Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

The following is the minutes of the Q1 FY2026 earnings call for $Wolfspeed(WOLF.US). For an interpretation of the earnings report, please refer to "Post-Debt Wolfspeed: Layoffs and Cost Reductions Can...

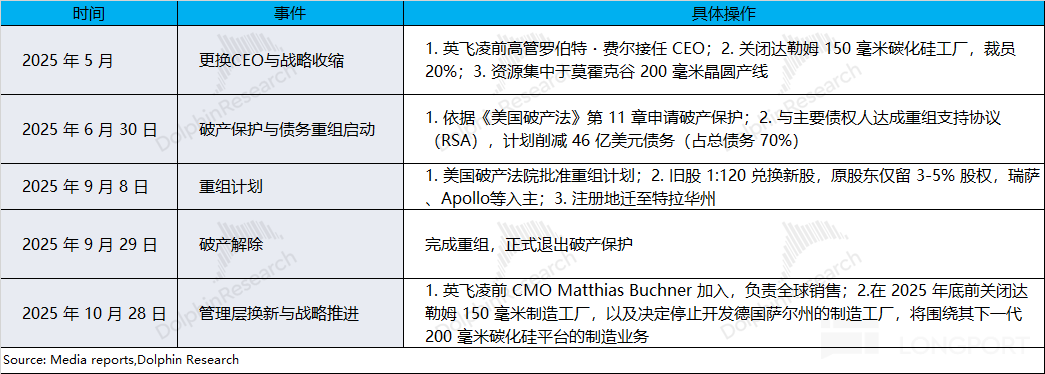

Wolfspeed after Debt Relief: Layoffs and Cost Reduction Can Mitigate Losses, Profitability Still Depends on Growth

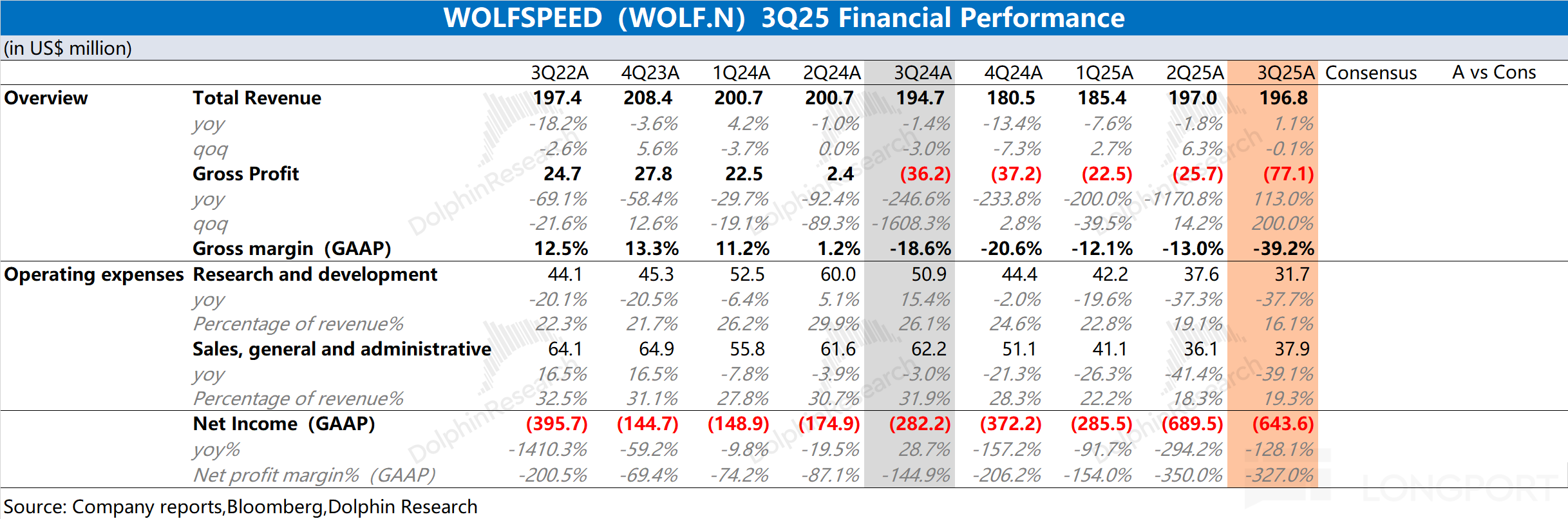

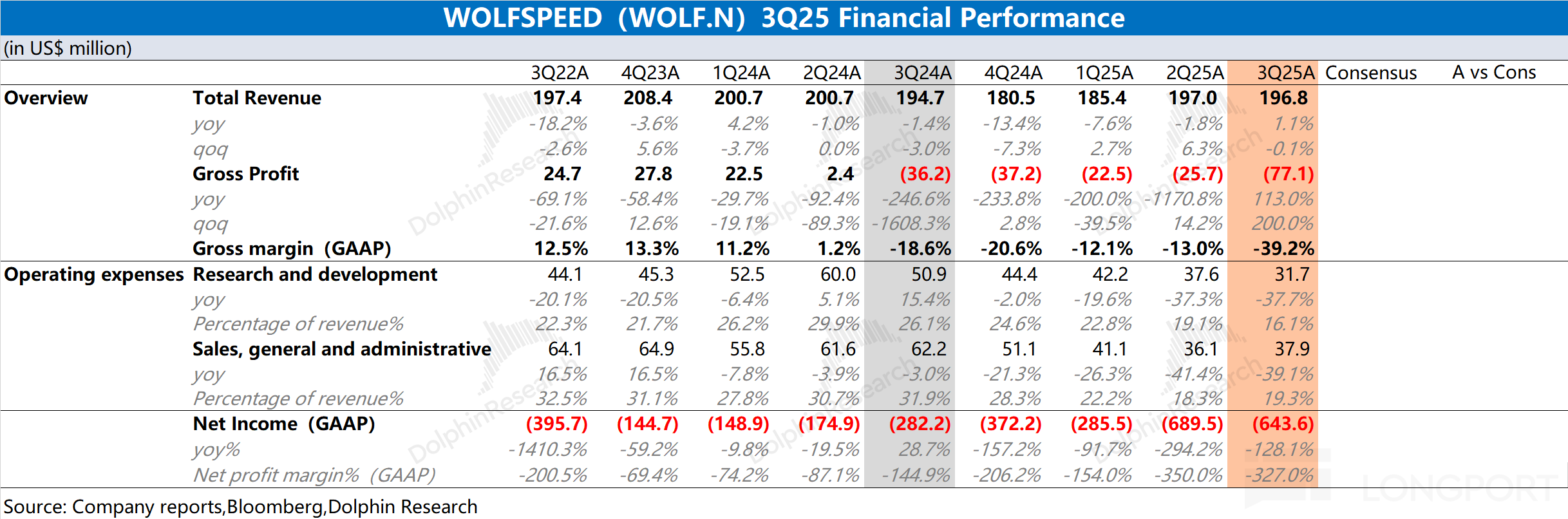

Wolfspeed (WOLF.N) released its financial report for the first quarter of fiscal year 2026 (ending September 2025) after the U.S. stock market closed on October 30, 2025, Beijing time. The key points ...

$Wolfspeed(WOLF.US)Now is good chance to enter market

Trade War Uncertainty Lingers; Yuewen Bets on Collectible Toys for Growth Reinvention|Today's Important News Review

0708|Dolphin Research Focus: 🐬 Macro/Industry 1. Trump signed an executive order to postpone the "reciprocal tariffs" grace period from July 9 to August 1. Meanwhile, he announced that starting Augus......

0521 | Dolphin Research Key Focus: 🐬 Macro/Industry 1. Last Friday, Moody's downgraded the U.S. credit rating from Aaa to Aa1, triggering a wave of dollar selling. The U.S. dollar index fell below th...