Posts

Posts Likes Received

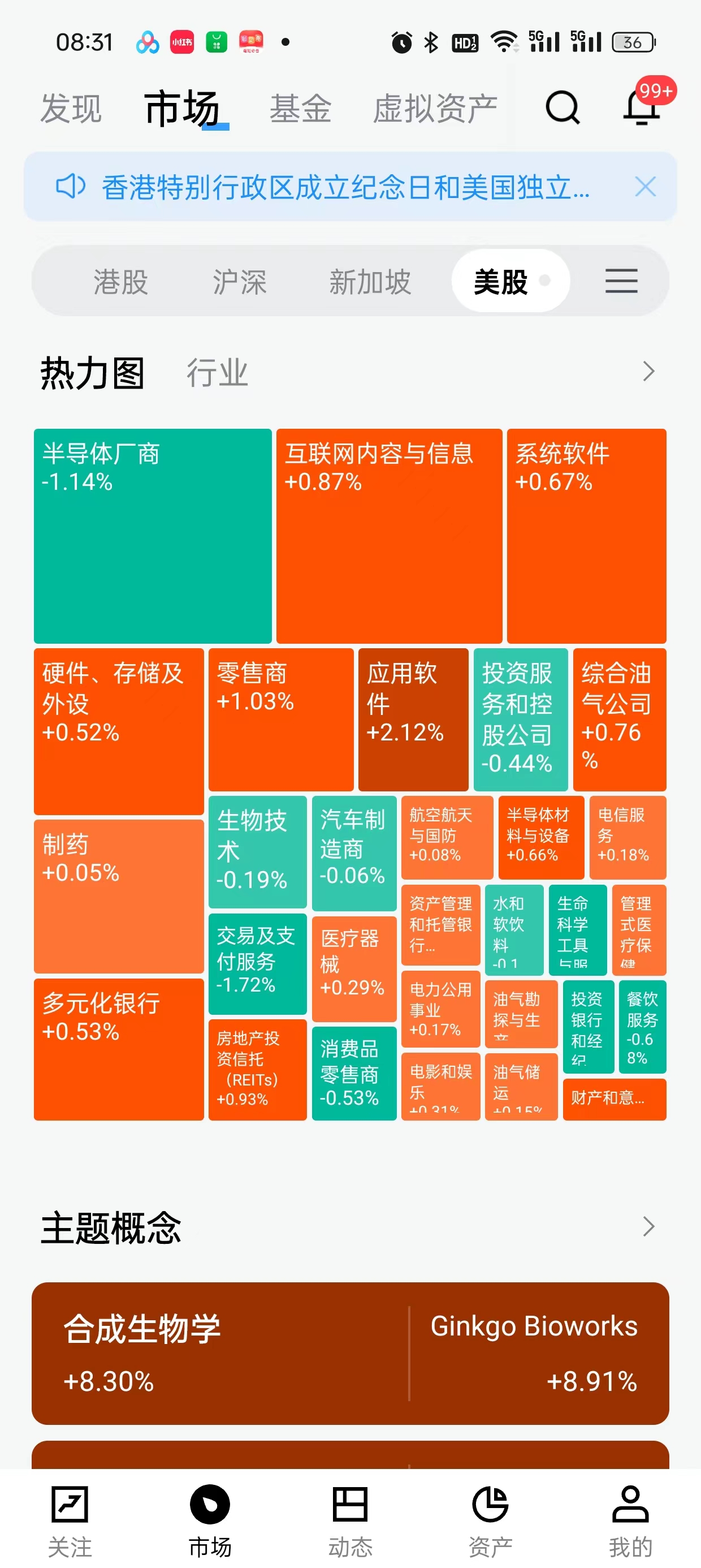

Likes ReceivedThe newly released economic data in the past two days—from slightly lower-than-expected continuing jobless claims to persistently sluggish existing home sales—all imply a continued cooling of the economy. Under ample liquidity support, the market continues to trade on expectations of a soft landing.

So even though last night, $Micron Tech(MU.US) dragged down the semiconductor big three—Nvidia, TSMC, and Broadcom—due to weaker-than-expected guidance, leading to a sector-wide pullback. However, in terms of market structure, capital seems to be shifting downstream.

Whether it's the continued rise of internet information and content or application software, in a favorable macro and liquidity environment, capital is rotating rather than simply locking in profits.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.