Posts

Posts Likes Received

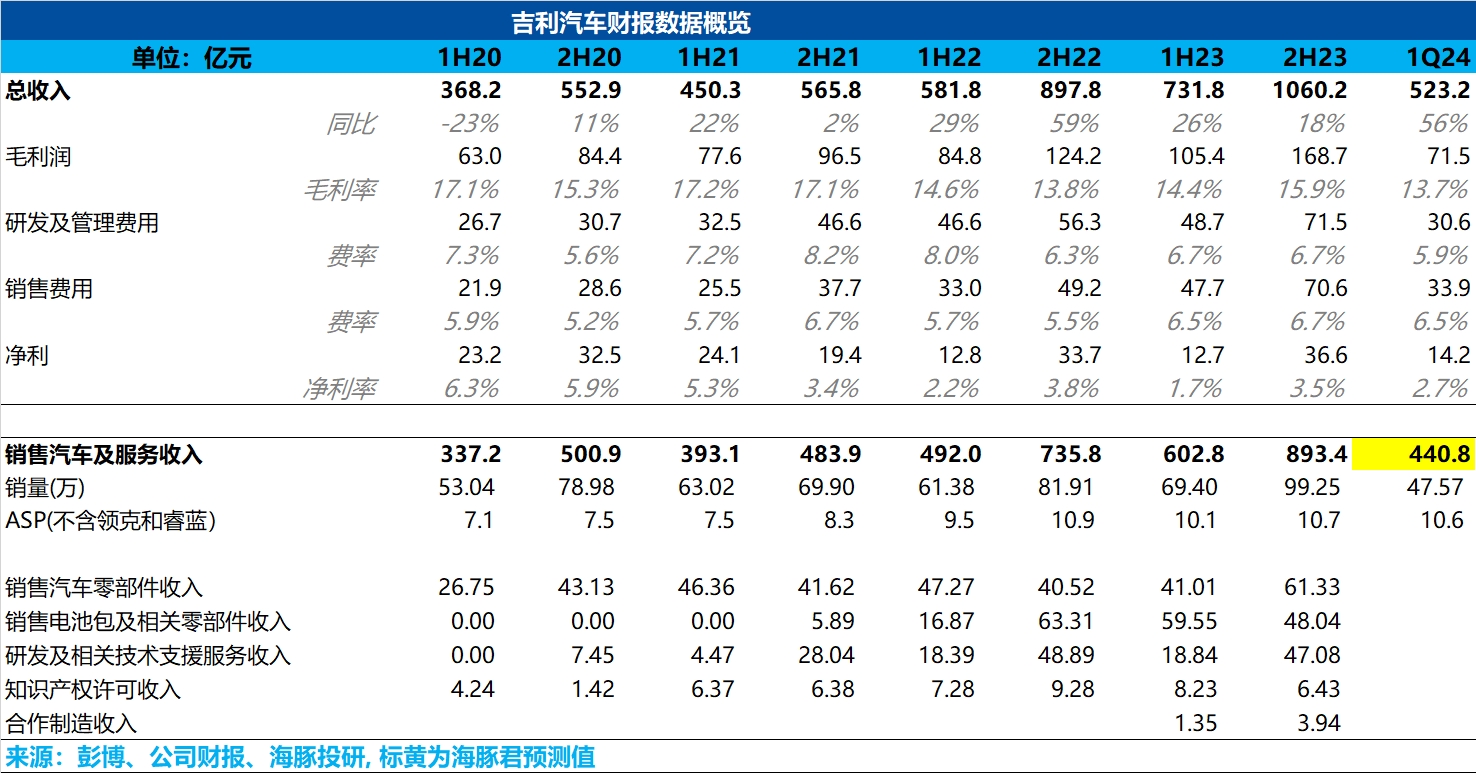

Likes ReceivedFrom the first quarter results of $GEELY AUTO(00175.HK), the revenue side basically met Dolphin Research's expectations, but the gross margin was lower than expected.

Geely's revenue increased by 56% year-on-year in the first quarter. Since the sales volume was already known, the most important marginal information was Geely's per-vehicle revenue. According to Dolphin Research's estimates, Geely's per-vehicle revenue in the first quarter was approximately 106,000 yuan, basically flat with the second half of 2023.

By brand, Geely's sub-brand ZEEKR saw intensified competition. The new ZEEKR 001 was launched at a price 31,000-57,000 yuan lower than the old model, and the proportion of the high-priced ZEEKR 009 declined. As a result, ZEEKR's ASP dropped from 273,000 yuan in the second half of 2023 to 247,000 yuan this quarter.

However, the ASP of Geely's main brand (including Geometry, Galaxy, and Geely) increased by approximately 3,400 yuan compared to the second half of 2023 to 94,000 yuan (according to Dolphin Research's calculations), exceeding expectations. Dolphin Research believes this was mainly due to the strong sales of Geely's relatively high-priced China Star fuel vehicles and the increase in overseas share, offsetting the negative impact of Galaxy's price cuts (Geely's new energy brand Galaxy reduced prices by 10,000-20,000 yuan for the Galaxy Longteng edition in March due to the launch of BYD's Honor edition).

However, the gross margin in the first quarter was only 13.7%, down approximately 2.3% compared to the second half of 2023. Dolphin Research speculates this may be due to the decline in gross margin of Geely's new energy brands. ZEEKR's gross margin in the first quarter was only 12%, down 3% from 15.2% in the second half of 2023. Galaxy's gross margin is also expected to decline quarter-on-quarter due to the Longteng edition price cuts.

Geely's net profit in the first quarter was 1.42 billion yuan, basically in line with Dolphin Research's expectations. Sales expenses were relatively rigid, with marketing expenses mainly used for the successive launches of new vehicles under Geely's new energy brands. R&D and administrative expenses were relatively restrained, but the net profit margin declined to 2.7% due to the significant drop in gross margin. Overall, since investors are most concerned about the progress of Geely's new energy brands, the first-quarter results suggest that both the unit price and gross margin of Geely's new energy brands have declined.

In terms of sales volume, Geely's new energy brand sales from January to May 2024 reached only 254,000 units, achieving only 31% of the annual target of 810,000 units. The main models, Galaxy L7 and Lynk & Co 08, have only recovered to around 6,000 units per month compared to last year's monthly sales of over 10,000 units, indicating that the pace of new energy transformation still falls short of expectations.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.