Posts

Posts Likes Received

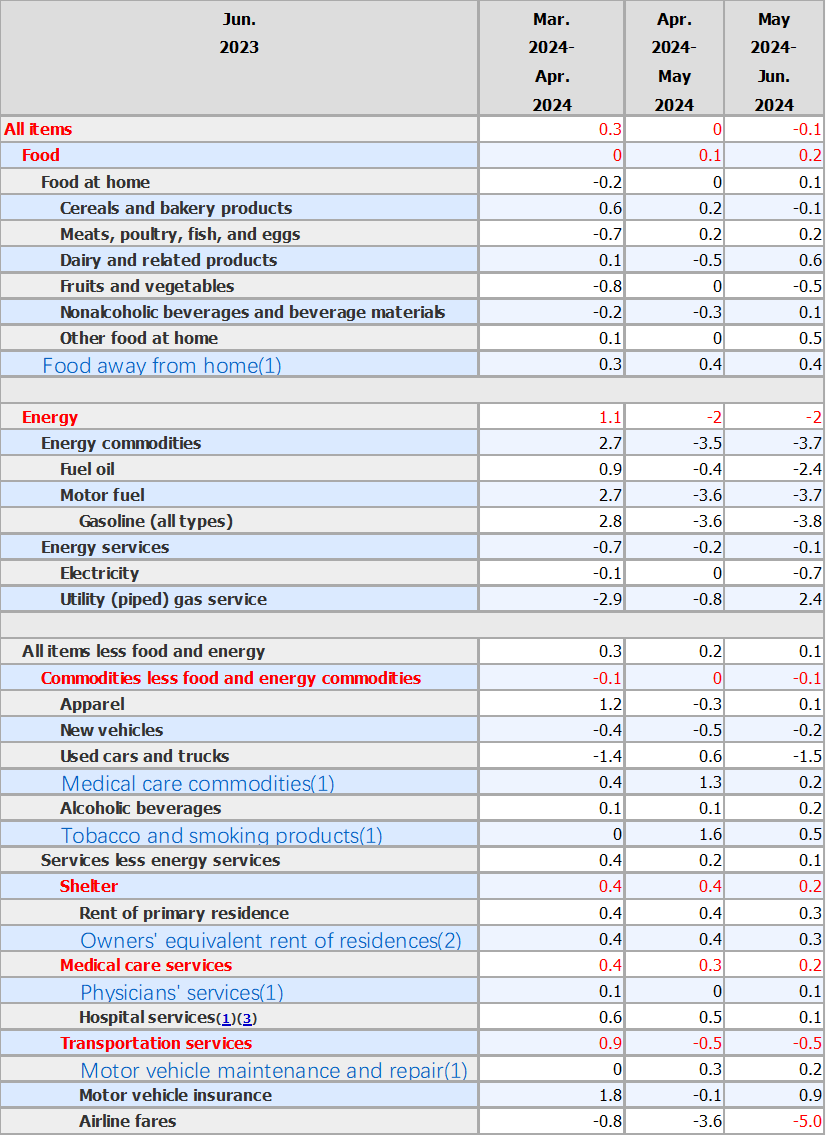

Likes ReceivedUS June CPI rose 3% year-on-year, falling to the lowest level since June last year.

The June CPI data in the US can almost be described as a comprehensive easing. Among the headline inflation, the two high-weight and high-volatility components—food and energy—rose 0.2% and fell 2% month-on-month, respectively, both contributing significantly to disinflation.

Meanwhile, the month-on-month growth rate of core inflation dropped sharply from 0.2% in the previous month to 0.06% in June, with the narrowing margin significantly exceeding expectations. Breaking down the core services, the highest-weighted component—housing costs—fell for the first time from 0.4% to 0.2% month-on-month.

However, after excluding this lagging factor, services excluding housing costs showed zero month-on-month growth for two consecutive months, and core CPI excluding housing also recorded zero growth for two months. Currently, among all subcategories, except for other personal services (such as haircuts and personal care), the June data suggests that disinflation has fully unfolded.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.