Posts

Posts Likes Received

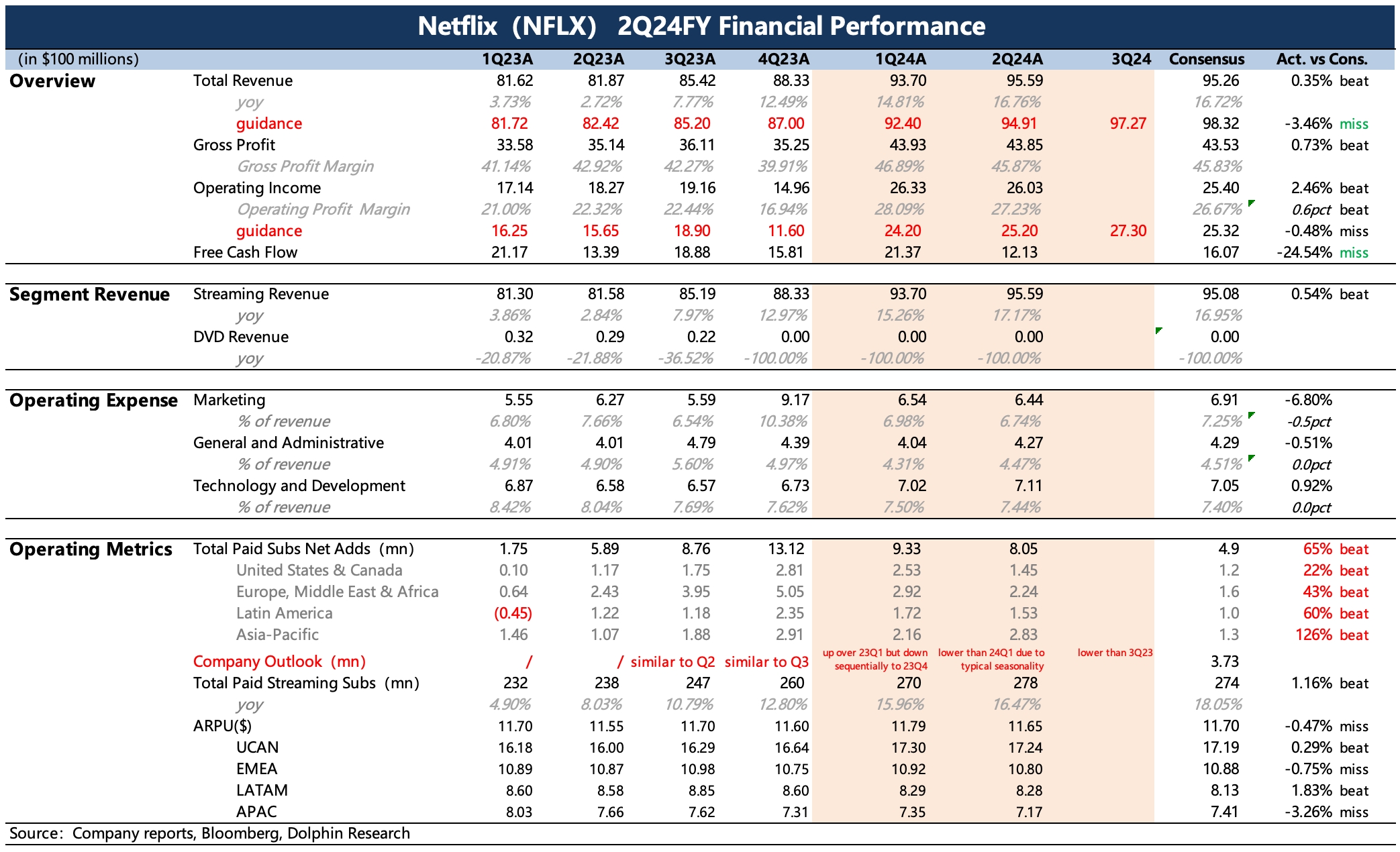

Likes Received$Netflix(NFLX.US) first take:At first glance, the Q2 performance was fine, with net user additions, revenue, and profits all exceeding company guidance and institutional expectations. However, it might have been slightly disappointing for more optimistic buyers.

For the Q3 revenue and profit guidance, the company's quantified guidance was slightly weaker than market expectations. Currently, Dolphin Research is more focused on "user growth." The company stated that Q3 user growth would be slightly lower than 3Q23 (last year's 3Q23 was the first full quarter benefiting from the crackdown on account sharing, resulting in a higher base). This is within market consensus, but some buyers might have expected more, such as significantly higher growth than 2Q24. More precise data can be found in the earnings call.

Dolphin Research believes that, compared to user growth, the short-term revenue miss is not a major issue. It’s likely due to lower ARPU from ad-tier users dragging down revenue and profits, as well as the restart of the investment cycle affecting free cash flow. For Netflix, which has high retention advantages, it’s more strategic to capitalize on the competitive window now, sacrificing short-term profits to accelerate user penetration, which would be more beneficial in the long run.

For the full-year performance guidance, the company slightly raised its revenue growth forecast (from 14% to 15%) and operating margin (from 25% to 26%). However, since market expectations were already high, this isn’t a material positive.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.