Posts

Posts Likes Received

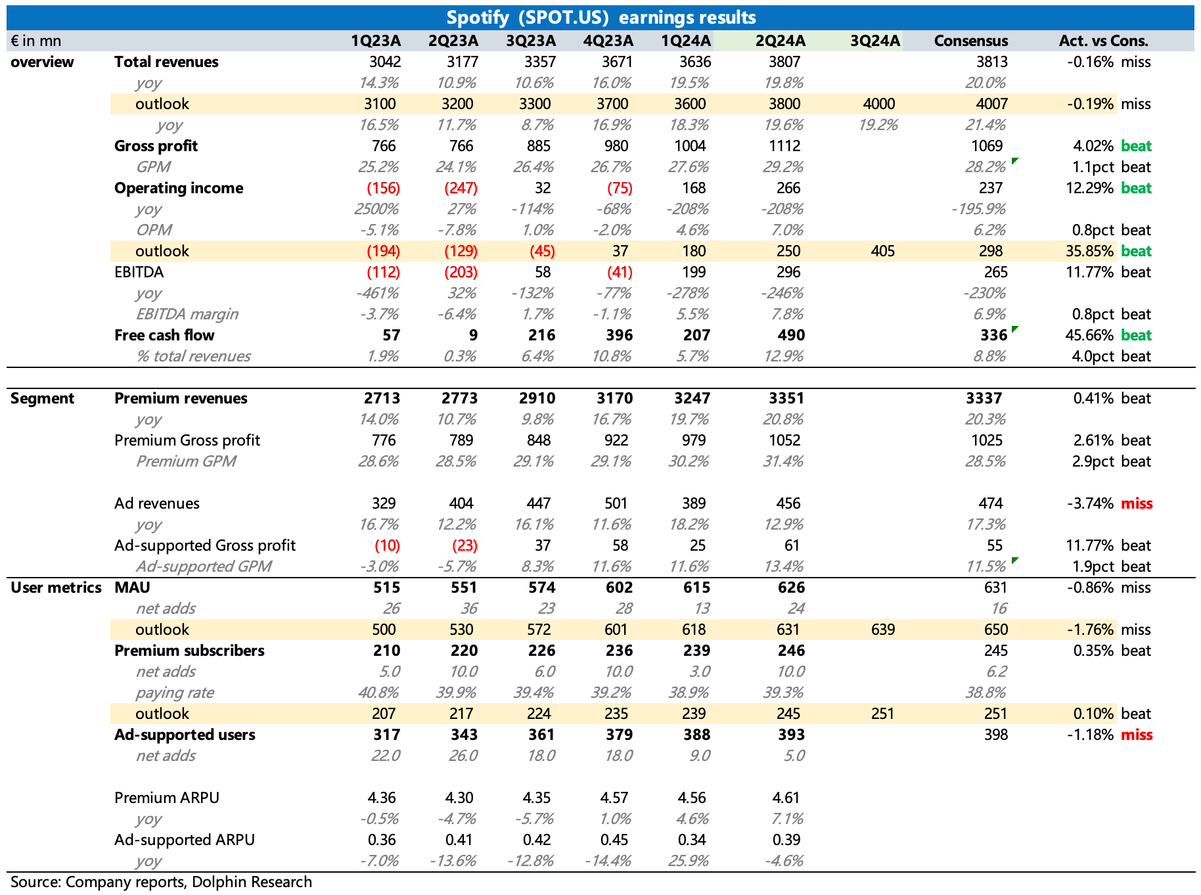

Likes Received$Spotify(SPOT.US)first take:Spotify's Q2 report is out, and the overall performance is in line with our expectations in the big picture—solid profits but mediocre user growth. However, there are some deviations in the details:

(1) User growth has indeed hit a bottleneck. Q2 monthly active users fell short of guidance and market expectations, and the Q3 guidance is also below expectations. However, third-party data had already reflected this, so it could be said that this has been partially priced in.

(2) But the company's profit performance significantly exceeded expectations, not just in the current quarter but also in the guidance for the next quarter. Since operating expenses generally don’t fluctuate much, Spotify's profit elasticity mainly comes from gross margins, and the variable factors affecting gross margins are primarily content costs. Therefore, the optimistic guidance for Q3 actually implies that management has high confidence in: 1) user feedback on the implicit price hike from the "music + audiobook" bundled package launched in June, and 2) the cost optimization effects.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.