Posts

Posts Likes Received

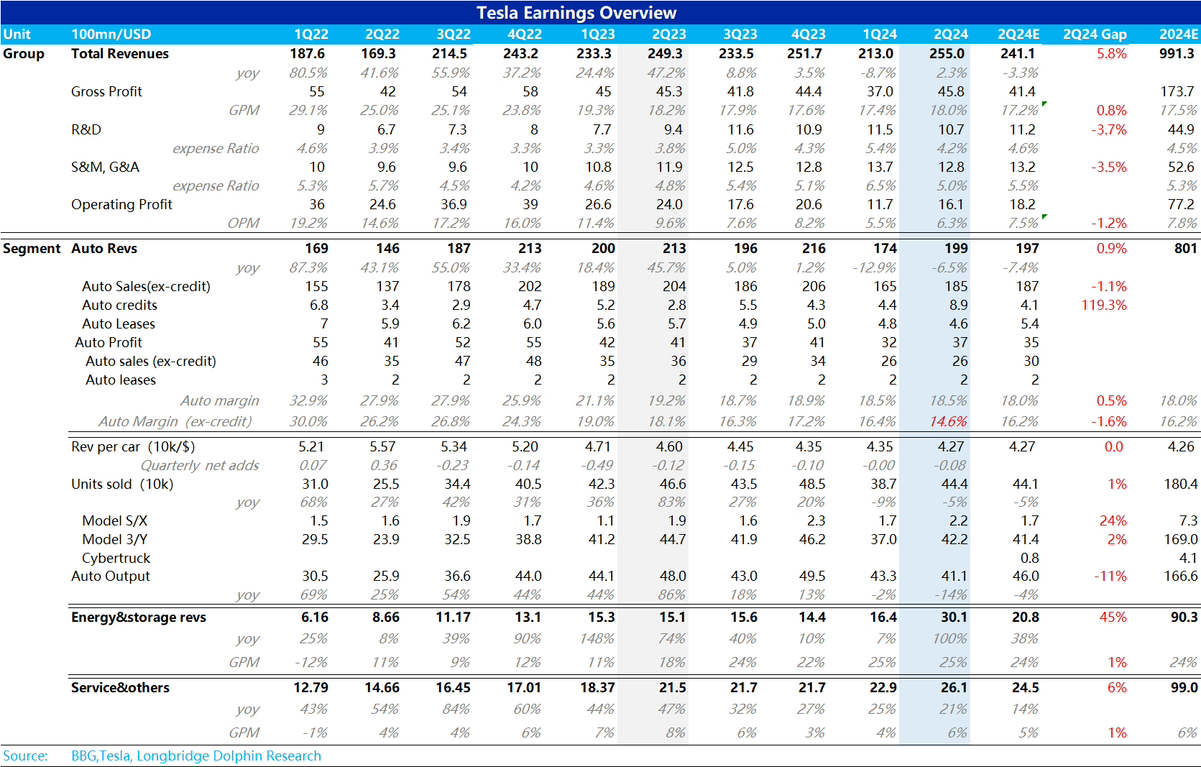

Likes Received$Tesla(TSLA.US)First take: No matter how glamorous the story is, it must face the reality check. And Tesla's recent reality check feels more like pouring cold water on a group of overenthusiastic investors: Automotive revenue (including car sales, leases, and regulatory credits) seems to have slightly exceeded expectations, but the excess comes entirely from regulatory credits, which have no long-term prospects.

The real core is the automotive business excluding credits. And here, Tesla's performance is particularly disappointing—especially the automotive gross margin excluding credits, which has dropped to 14.6%, far below the market expectation of 16.2%. The impact of promotions in Q2 was much worse than expected.

Two smaller segments, energy and automotive services, performed well—especially energy, with a 160% YoY increase in energy installations (so impressive that it was pre-disclosed in the quarterly shipment report) and 100% revenue growth, which is remarkable.

However, the automotive business, accounting for 80% of revenue, remains the unshakable core. Tesla provided no updates in its earnings report on the next-gen vehicle or the recently delayed robotaxi. With the stock price completely detached from the fundamentals of car manufacturing, it may eventually have to return to reality.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.