[New Stock Hotspot] Auntie Shanghai is coming, starting with a 30x P/E ratio!

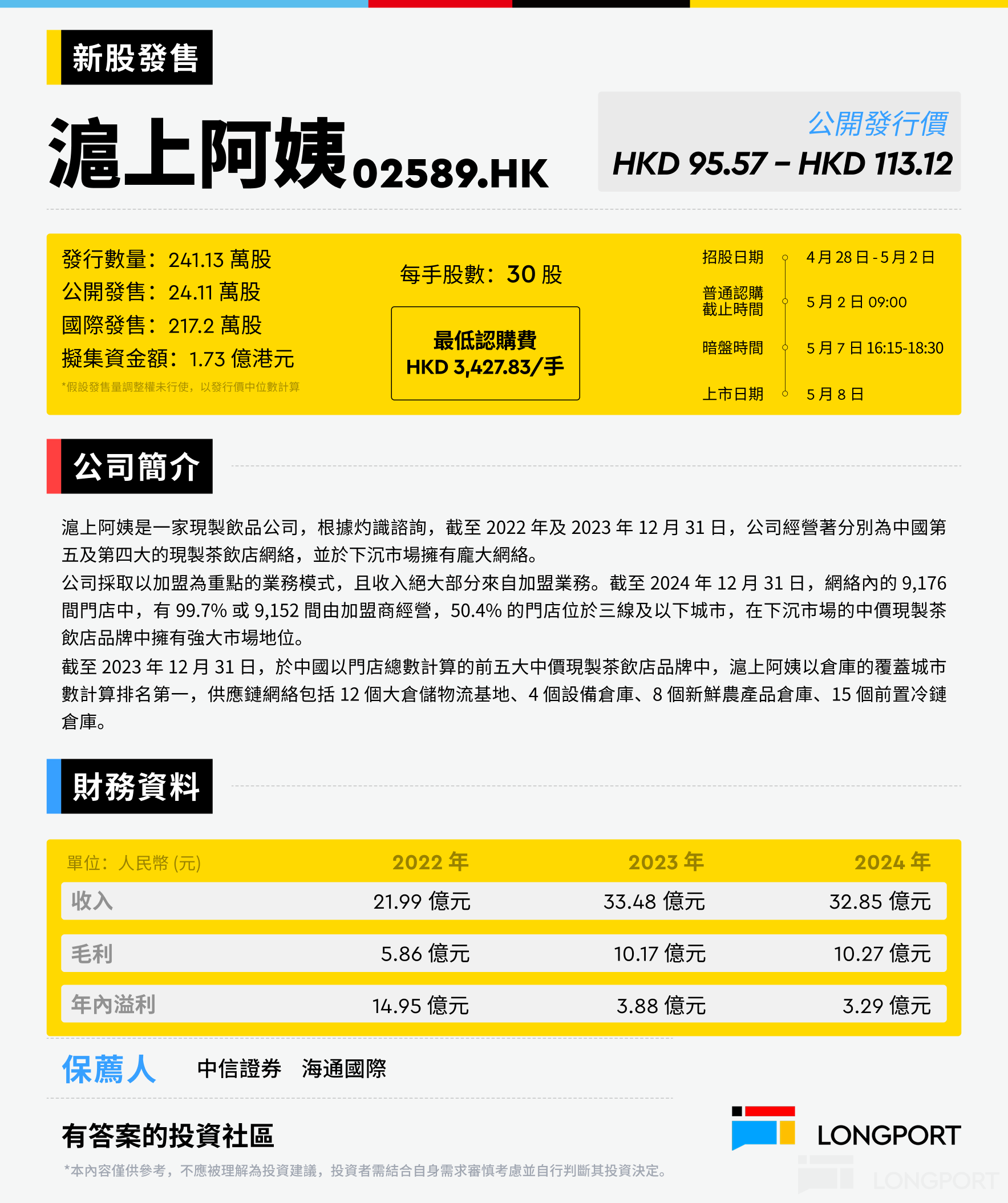

$AUNTEA JENNY(02589.HK) launched its Hong Kong IPO on April 28, planning to issue 2.41134 million H shares, with 10% for public offering in Hong Kong and 90% for international placement. The price range is set at HKD 95.57 to 113.12 per share, and it is expected to be listed on May 8.

The funds raised will be used for digital upgrades, product R&D, and supply chain strengthening, with plans to expand into more tier-3 and below cities.

I. IPO Details

| Indicator | Details |

|---|---|

| Number of Shares | 2.41134 million H shares (10% Hong Kong, 90% international) |

| Price Range | HKD 95.57 - 113.12 |

| Fundraising Scale | HKD 230.5M - 272.8M |

| Minimum Investment | 30 shares per lot, HKD 3,427.83 |

| Use of Proceeds | Digital capabilities (25%), R&D (20%), supply chain (20%), store expansion (15%), marketing (10%), working capital (10%) |

| Timeline | Subscription period: April 28 - May 2, 2025; Listing date: May 8 |

II. Pricing Analysis

- Median Price: HKD 103.37, corresponding to a net fundraising amount of approximately HKD 172.7M.

- Valuation Reference: Based on the 2024 P/E ratio (calculated with 2024 net profit of CNY 329M), it is about 30x (at the median offering price), compared to the industry leader $MIXUE GROUP(02097.HK) with a current dynamic P/E of around 20x.

III. Industry Analysis

| Market Indicator | Data |

|---|---|

| China's Ready-to-Drink Tea Market Size | Market size of CNY 211.5B in 2023, mid-price tea accounting for 51.3% |

| Competitive Landscape | Low concentration of top five brands (2023 CR5≈22%), Auntea Jenny's market share at 4.6% (ranked fifth) |

| Lower-Tier Market Potential | Tier-3 and below cities are the main growth drivers (2023-2028 CAGR expected to exceed 15%), with Auntea Jenny's store share in these regions at 50.4%. |

| Risks | Declining GMV per store (2024 YoY -12.1%), intensified low-price competition in the industry |

IV. Fundamental Analysis

| Financial Indicator | 2022 | 2023 | 2024 | Trend |

|---|---|---|---|---|

| Revenue (CNY B) | 22.00 | 33.48 | 32.85 | ↓ 1.9% (slight decline in 2024) |

| Net Profit (CNY B) | 1.49 | 3.88 | 3.29 | ↓ 15.2% |

| Gross Margin | 26.7% | 30.4% | 31.3% | ↑ Cost control optimization |

| Number of Stores | 5,307 | 7,789 | 9,176 | ↑ 46.8% (2023), ↑17.8% (2024) |

Key Highlights:

- Franchise Model Dominance: 99.7% of stores are franchised, enabling light-asset rapid expansion.

- Lower-Tier Strategy Success: Over 50% of stores are in tier-3 and below cities, aligning with industry growth trends.

- New Brand Expansion: Sub-brand "Tea Waterfall" expanded to 304 stores in 9 months, capturing the low-price market.

Risk Warnings:

- Declining Store Efficiency: Daily GMV per store dropped to CNY 3,833 in 2024 (YoY -10.4%).

- Supply Chain Dependence: Reliance on third-party cold chain warehouses limits cost control capabilities.

V. Cornerstone Investors

| Institution | Background | Subscription Amount (USD M) | % of Offering |

|---|---|---|---|

| Infore Holdings | Industrial capital under He Jianfeng (home appliances/environment) | 6.44 | ~16.7% |

| Huazhi Trading | Wholly-owned subsidiary of Huabao International (300741.SZ) | 2.78 | ~7.2% |

| Total | 9.22 | 28.4% |

Analysis: Cornerstone investors locked nearly 30% of shares, coupled with a 6-month lock-up period, mitigating short-term selling pressure. Participation by Huabao International (flavor giant) affiliate signals potential supply chain synergy.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.