The Second Half of the Monetary Easing Trade? Trading the Successor of the Federal Reserve

The Second Half of the Monetary Easing Trade? Trading the Successor of the Federal Reserve

Last week, Dolphin Research mentioned in the Strategy Weekly Report that "with the end of TGA rebuilding, the start of the rate-cutting cycle, high tariffs being lowered, tax and fee reduction policies in place, combined with a major AI infrastructure cycle... together, 2026 does not seem to present a recessionary outlook."

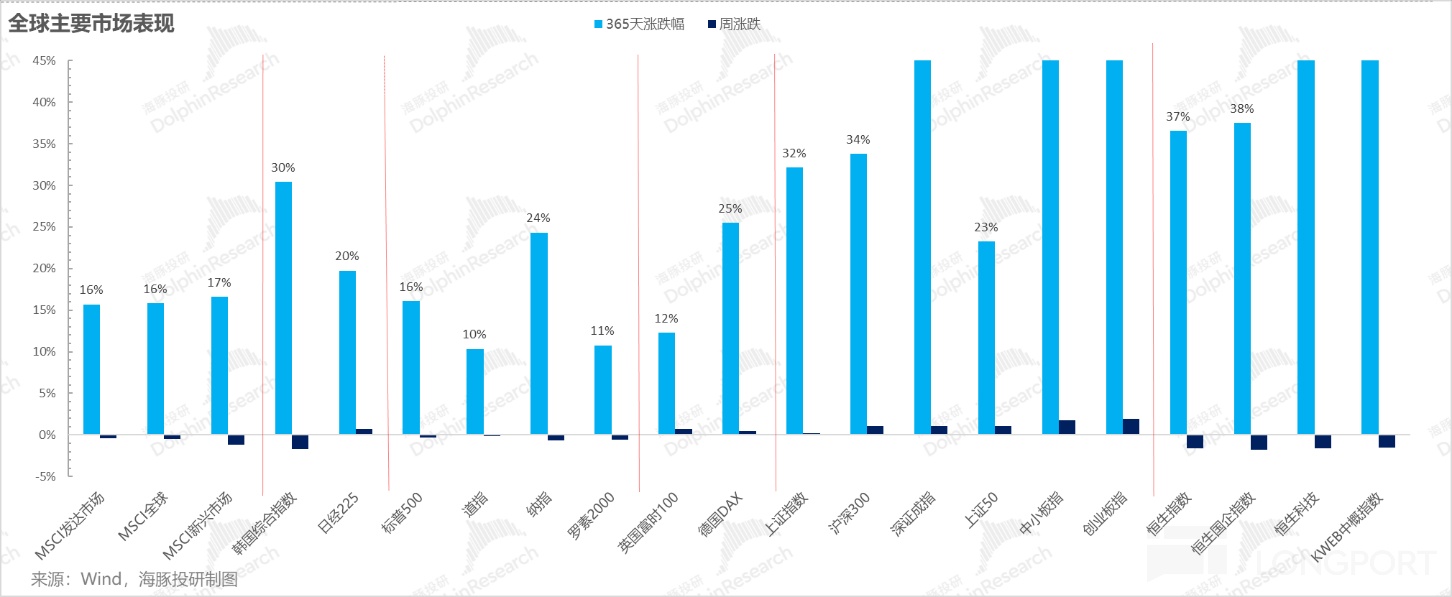

However, after the rate cut benefits materialized last week, most global markets declined, except for the continued revaluation of Chinese growth assets. Although the outlook for 2026 appears bright, how should we navigate the remaining time in 2025 from the current standpoint?

I. Is There Still Room for Rate Cut Trades? The Key to Easing Speculation Lies in the Fed's Choice

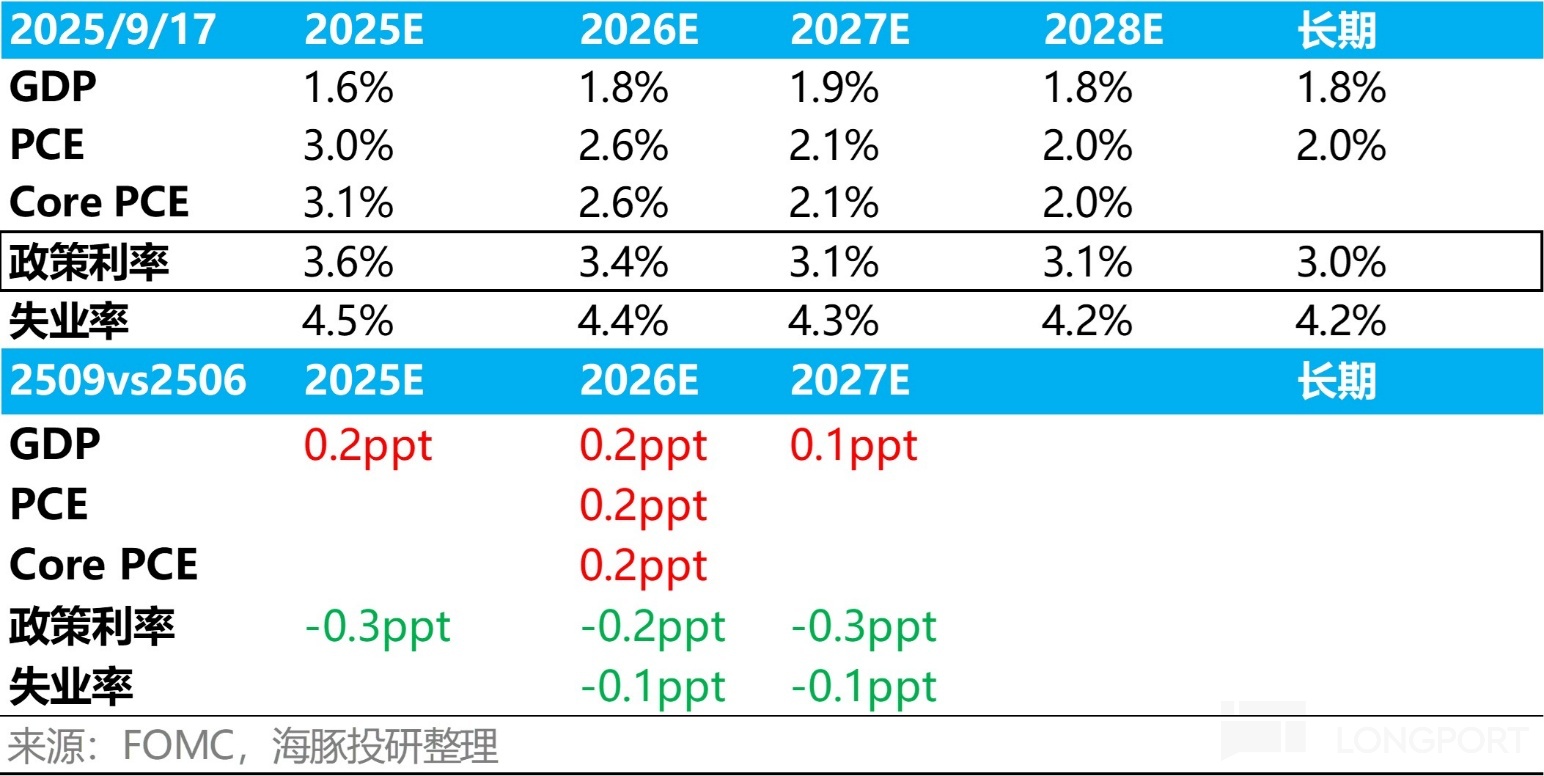

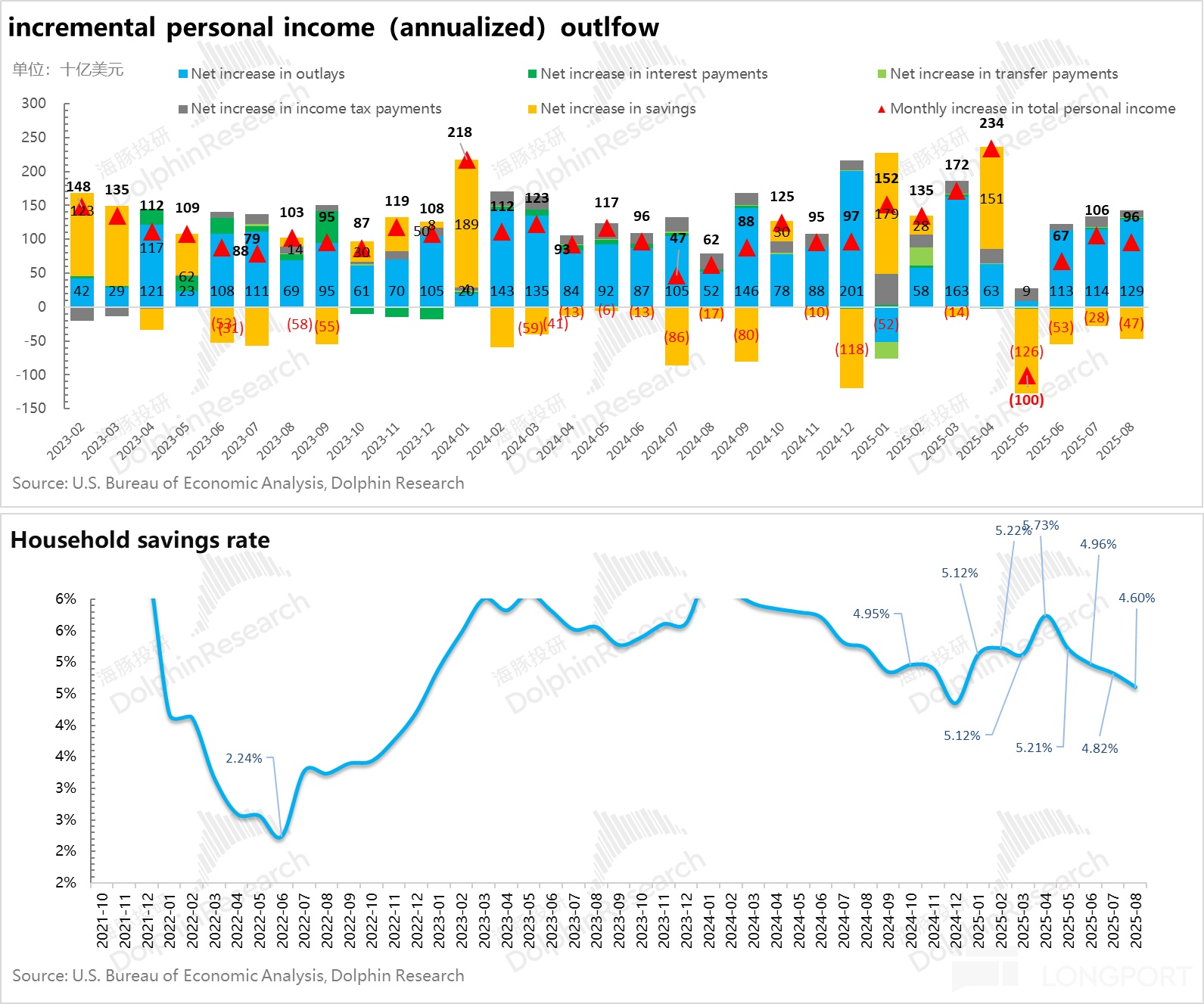

The current guidance from the Federal Reserve indicates two remaining rate cuts. This guidance is set against a backdrop where U.S. consumer spending remains resilient, and inflation is slightly strengthening. The main issue is that the labor market appears to have fewer job openings and less new employment, resulting in a low unemployment rate but limited job circulation and new employment, which is unfavorable for new entrants into the labor market, such as young college graduates.

The key report between now and the upcoming October rate cut is the non-farm payroll report released in early October. Even if the U.S. government fails to reach an agreement on a temporary funding bill and shuts down on October 1, preventing the timely release of this report, the current labor market dynamics suggest that an October rate cut still seems highly probable.

After the October rate cut, the scenario that precedes the December 10 FOMC meeting is actually the selection of a new Federal Reserve Chair. Jerome Powell's term as Chair will end in May 2026, and the President typically nominates a successor several months before the current Chair's term ends.

This means that if the rate cut occurs as scheduled on October 29, the focus should shift to the selection of the new Federal Reserve Chair and their stance. Based on this, the scale of easing expectations and the extent to which the Fed will relinquish its neutrality can be speculated.

II. AI Narrative: Will It Be Reenacted After the National Day?

So far this year, apart from China's Deep Seek moment, the U.S. AI narrative has primarily advanced through three dimensions: a. earnings season; b. new AI product launches; c. investment and acquisition events.

In the second-quarter earnings, Broadcom + Google/Oracle + Oracle have, to some extent, taken the baton in the AI relay race, pushing the AI narrative forward. The entire AI narrative has moved from model upgrades to soft and hard technology iterations, driving products to become more mature and usable, entering a stage of cost reduction in computing power and blossoming applications.

After the National Day, the U.S. stock market will soon enter the third-quarter earnings release period, with ASML and TSMC leading the way. Especially from ASML's sales guidance, efforts will be made to find any signals that AI storage demand might drive a rebound in traditional semiconductors.

According to the current progress, U.S. stock market giants are already beginning to plan their capital expenditure budgets for 2026 and formulate new procurement plans for the coming year. Therefore, NVIDIA's potential performance guidance for 2026 and the giants' capital expenditure plans for 2026.

With further macroeconomic financial easing, the economy, apart from employment, is not lacking in consumption and other aspects. Coupled with new capital expenditure plans and performance guidance stimulation, after consolidation, U.S. technology stocks still seem hopeful for further advancement. Additionally, once the rate cut trade is completed, if employment recovers, the market will further interpret towards economic recovery, and pro-cyclical asset sectors will also rise.

In this process, Dolphin Research believes that under an external easing environment, Chinese growth assets, along with the Chinese technology sector entering a semiconductor investment cycle, will continue to have opportunities. However, in the second half of the year, with the decline in consumption stimulus, the market remains a tale of two extremes, where the heat of technology is hard to warm the cold of consumption.

III. Portfolio Returns

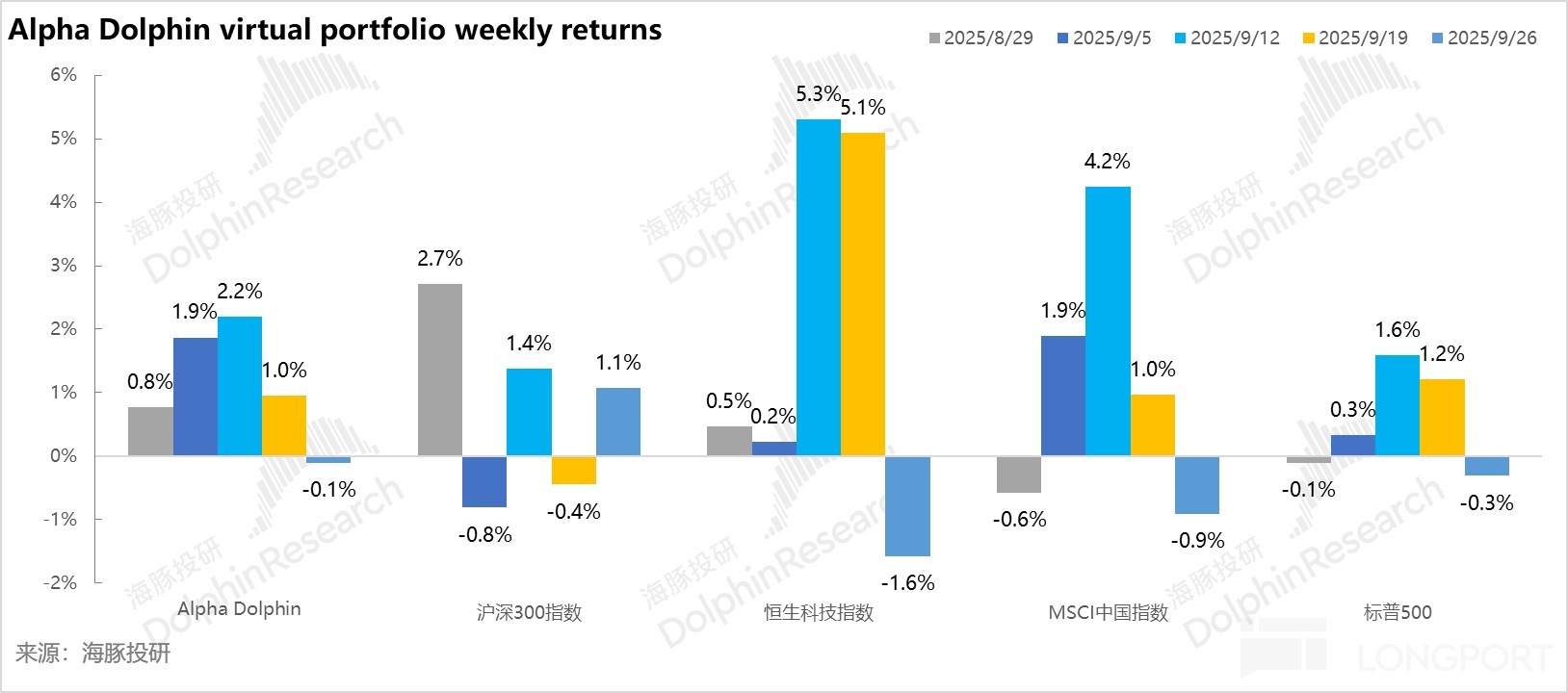

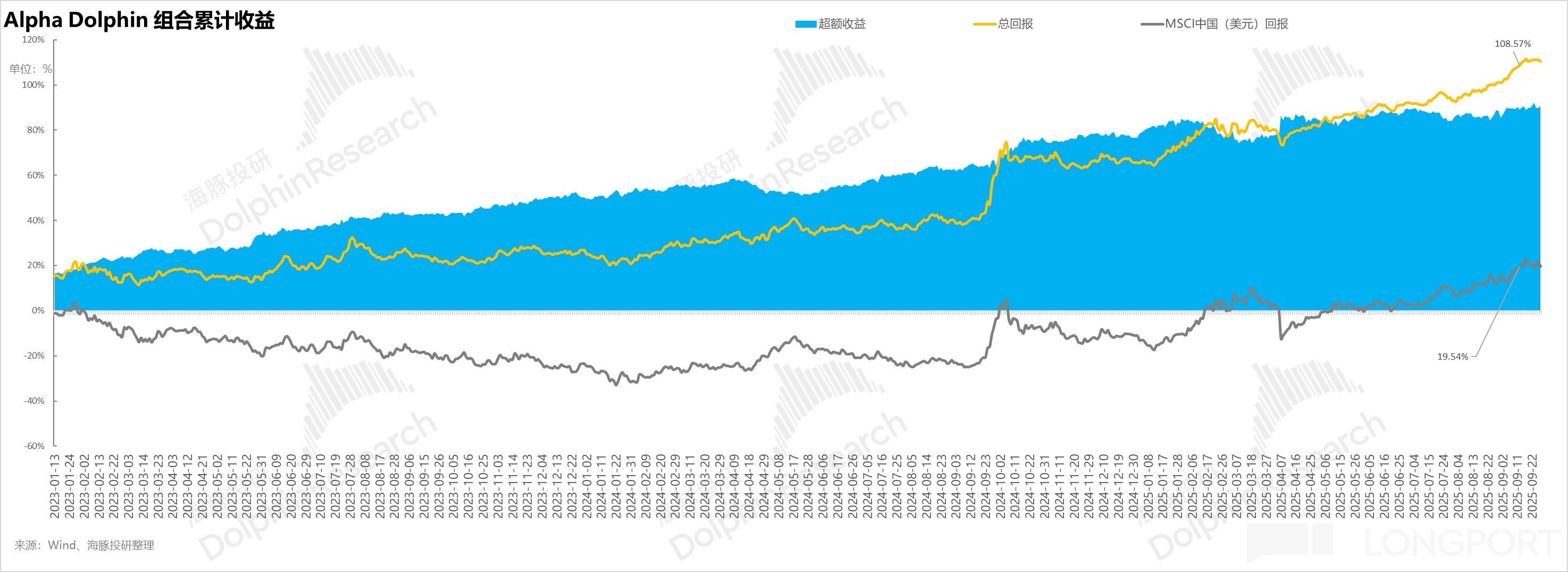

Last week, Dolphin Research's virtual portfolio Alpha Dolphin made no adjustments. It declined by 0.1% for the week, underperforming the CSI 300 (+1.1%) but outperforming the MSCI China Index (-0.9%), the Hang Seng Tech Index (-1.6%), and the S&P 500 Index (-0.3%).

Since the portfolio began testing (March 25, 2022) until last weekend, the portfolio's absolute return is 110%, with an excess return of 90.8% compared to the MSCI China. From an asset net value perspective, Dolphin Research's initial virtual asset of $100 million has exceeded $215 million as of last weekend.

IV. Contribution to Individual Stock Gains and Losses

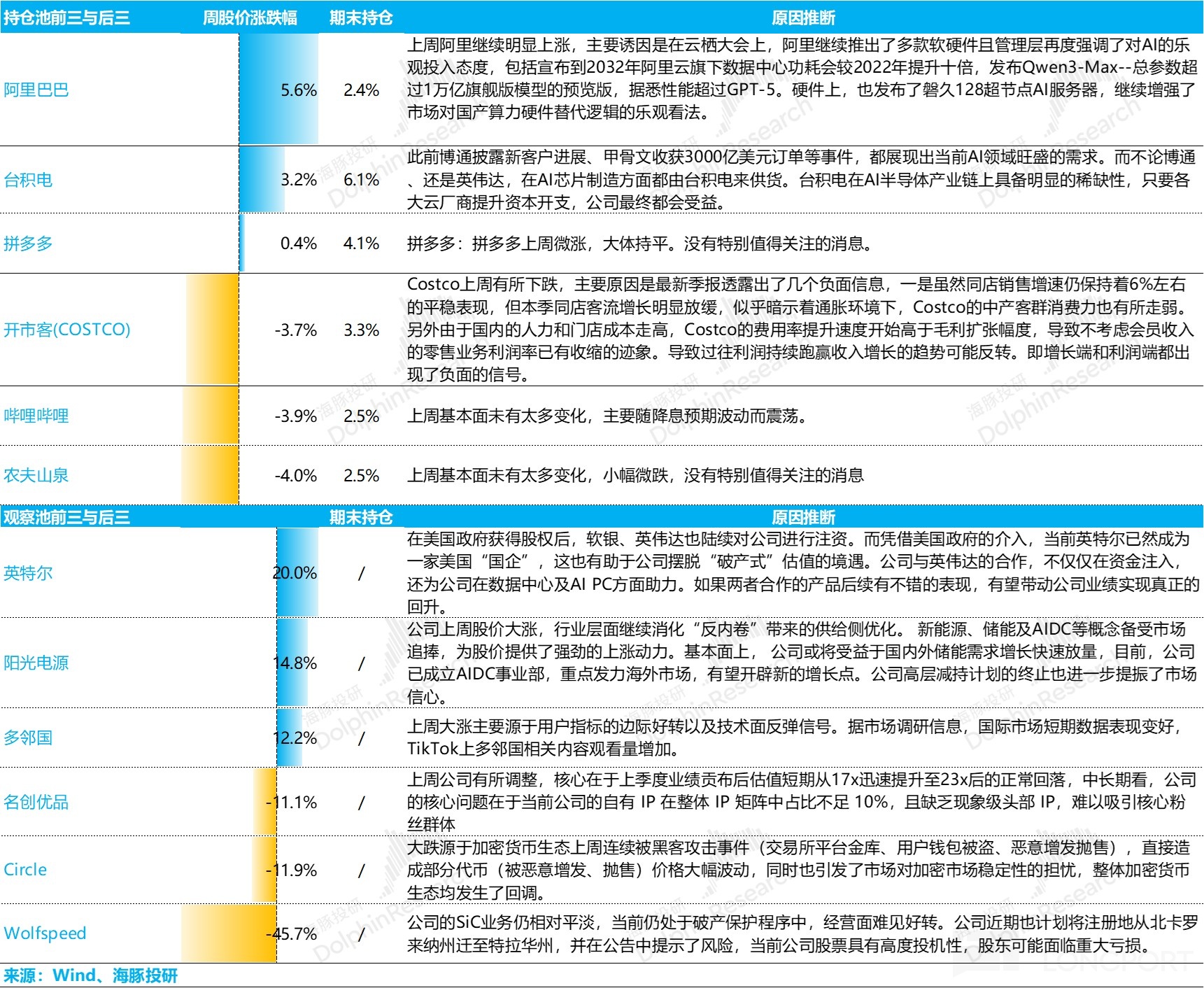

Last week, Dolphin Research's virtual portfolio Alpha Dolphin declined mainly due to the pullback of Chinese concept stocks like NetEase and Bilibili, while U.S. stocks like Costco weakened due to performance, dragging down equity asset performance. However, the gold weighting in the portfolio rose due to the risk of a U.S. government shutdown, offsetting the equity asset pullback.

The main explanations for the specific stock price movements are as follows:

V. Asset Portfolio Distribution

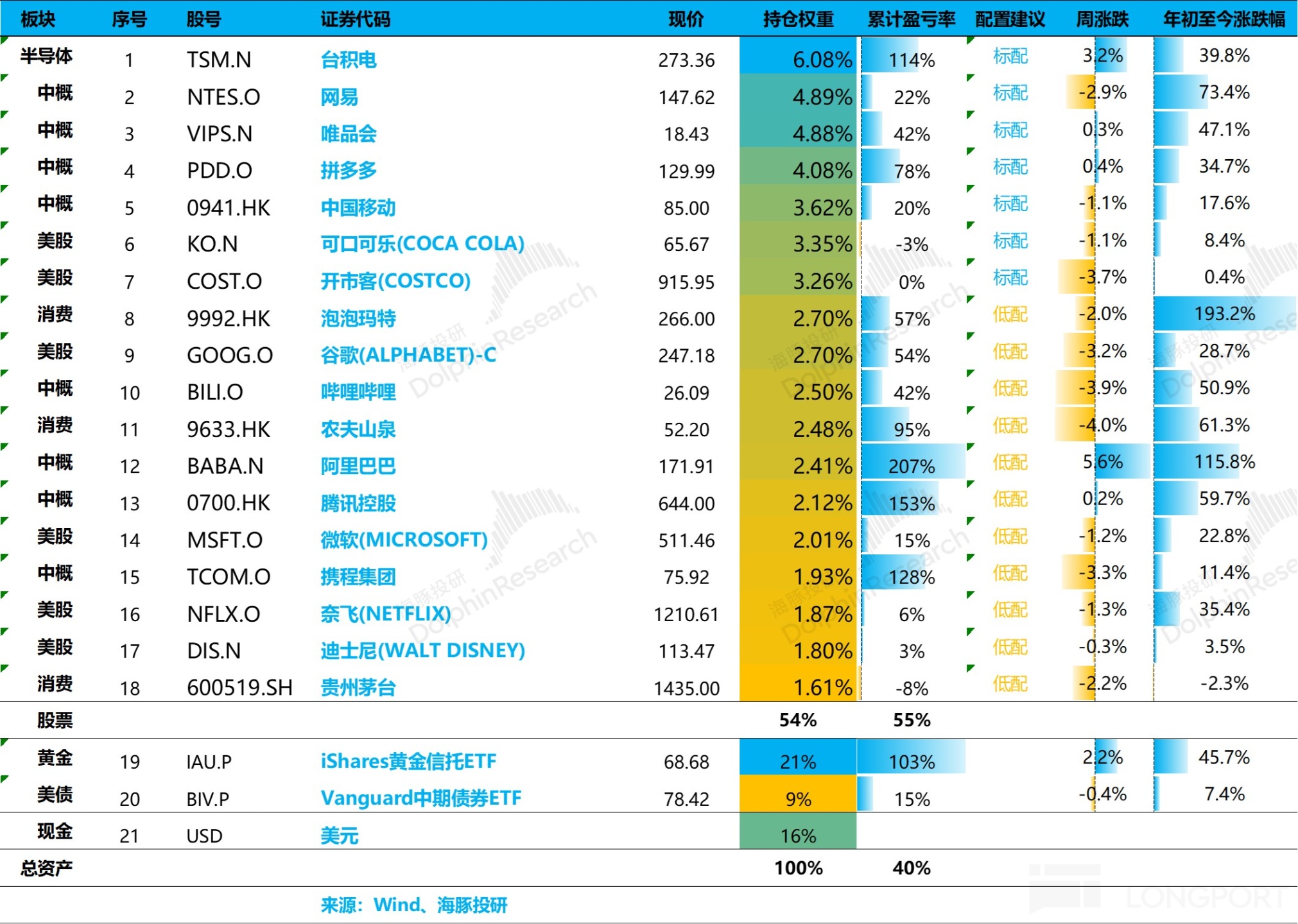

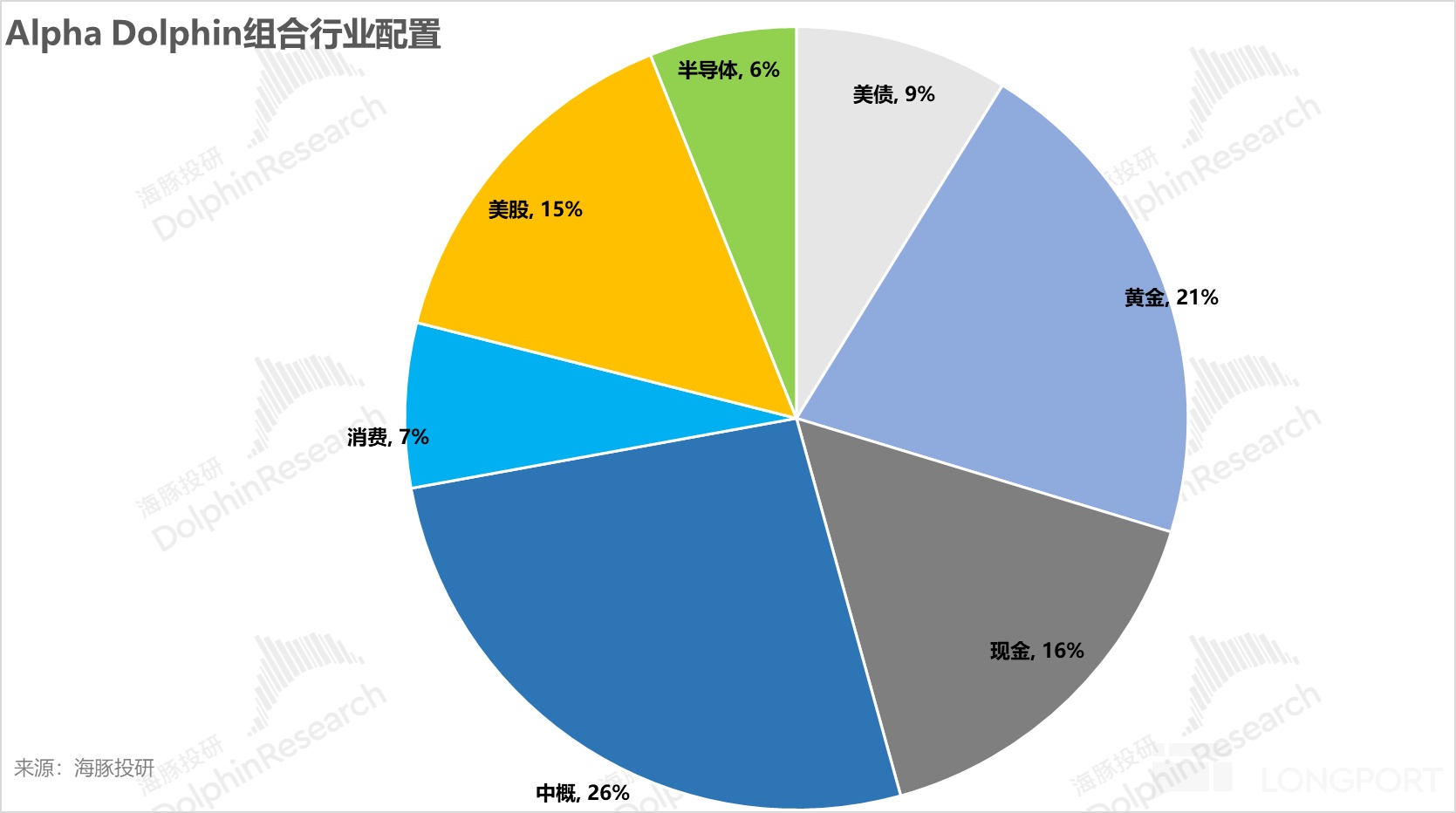

The Alpha Dolphin virtual portfolio holds a total of 18 stocks and equity ETFs, with 7 standard allocations and the rest underweight. Assets outside of equities are mainly distributed in gold, U.S. Treasuries, and U.S. dollar cash, with the current ratio between equity assets and defensive assets like gold/U.S. Treasuries/cash being approximately 55:45.

As of last weekend, the Alpha Dolphin asset allocation distribution and equity asset holding weights are as follows:

<End of Text>

Risk Disclosure and Statement of This Article:Dolphin Research Disclaimer and General Disclosure

For recent articles on Dolphin Research's portfolio weekly report, please refer to:

"A Tumultuous Struggle Like a Tiger, Trump Ultimately Can't Escape 'Inflationary Debt'?"

"This is the Most Down-to-Earth, Dolphin Investment Portfolio Takes Off"

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.