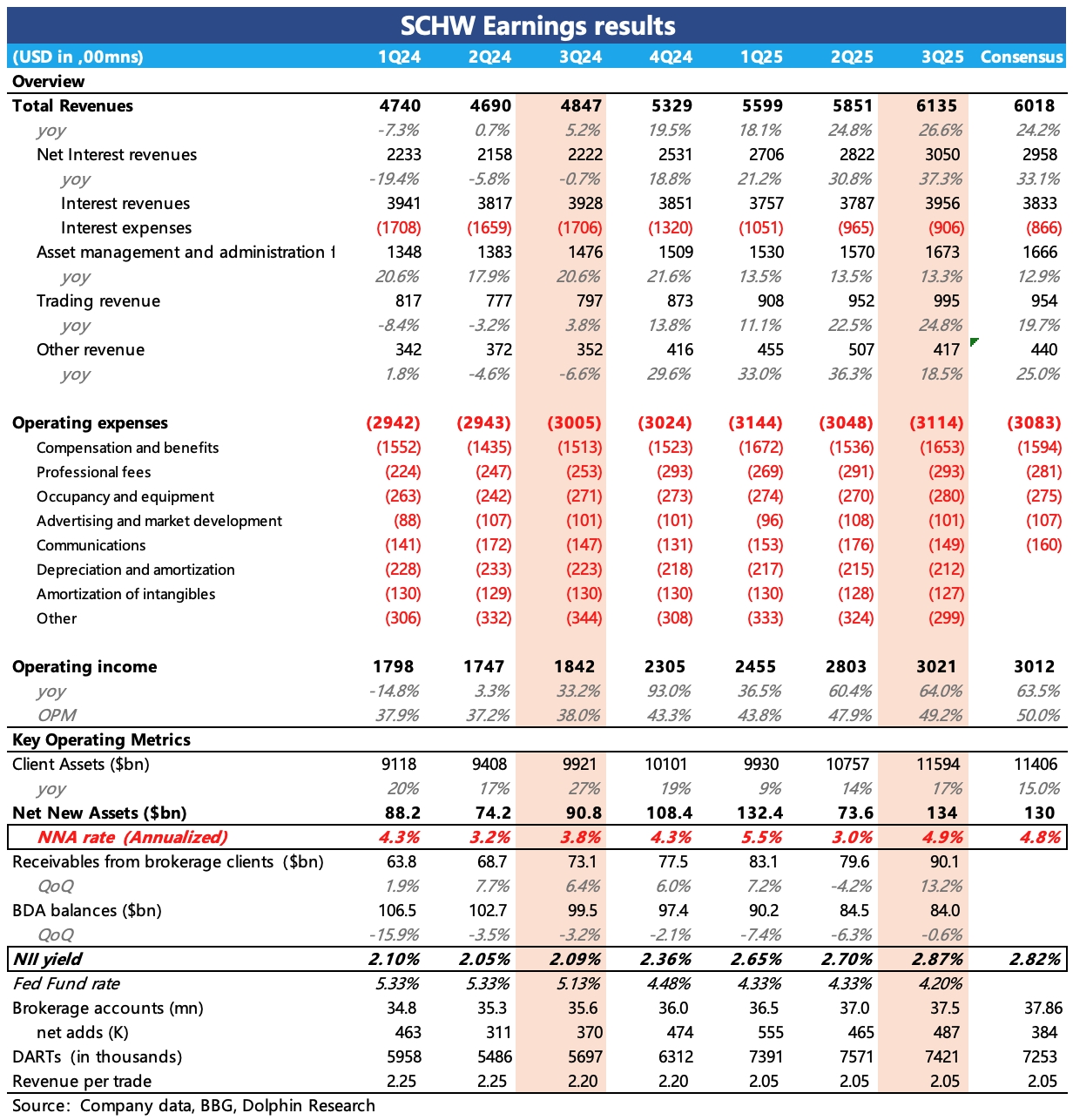

Charles Schwab 3Q25 Quick Interpretation: Charles Schwab's third-quarter performance slightly exceeded expectations, with highlights in interest and trading income. The core logic still stems from the Q3 U.S. stock market dynamics and effective cash management. Overall, endogenous growth is gradually recovering as expected.

(1) First, let's look at the two key indicators driving endogenous growth—Net New Assets (NNA) and Net Interest Margin (NIM):

NNA for the third quarter was $134 billion, with an annualized growth rate of 4.9%, aligning with market expectations and gradually approaching the lower end of the long-term guidance range of 5%-7%. Whether it can continue to return to the median level of 6% and above is crucial for driving long-term value enhancement.

NIM for the third quarter was 2.87%, exceeding the market expectation of 2.82%. Although in a rate-cutting cycle, the first rate cut of 25 basis points was only announced in September, having limited impact on Q3. Additionally, the active capital markets in Q3 significantly increased high-interest financing transactions, causing the income-side interest rates to continue rising.

Meanwhile, Charles Schwab's short-term debt decreased by $2.7 billion quarter-on-quarter, reducing interest expenses. Therefore, with one increase and one decrease, the net interest margin further expanded.

(2) In trading income, Daily Average Revenue Trades (DARTs) increased by 30% year-on-year, supported by a stable 6% growth in user account numbers and a 10% increase in per capita assets, along with market dynamics. DARTs slightly declined quarter-on-quarter, but the penetration rate of derivative trades reached 22% in Q3, up by 2 percentage points from the previous quarter.

This led to an increase in average revenue per trade, and with two additional trading days in Q3, trading income was significantly higher than in Q2.

(3) Net interest income grew by 37% year-on-year, further accelerating compared to the previous quarter. The core driver is the aforementioned increase in NIM, with the scale of interest-bearing assets remaining flat year-on-year.

(4) Asset management business growth was driven by scale, with both 1P fund management fees and 3P fund commissions seeing a downward trend in comprehensive rates.

Due to the impact of rate-cutting expectations, users invested more idle funds into money market funds or mutual funds, and funds from users receiving advisory services also increased significantly in the third quarter.

(5) On cost expenses, the third quarter mainly reflected an increase in employee expenses, while marketing and basic operating expenses remained restrained. Ultimately, operating profit reached $3 billion, achieving a 64% growth despite a higher base. The profit margin was 49.2%, up by more than 1 point quarter-on-quarter and 11 percentage points year-on-year. $Charles Schwab(SCHW.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.