Expanding production capacity comprehensively! Has Ning Wang finally made it?

On the evening of October 20, 2025, $CATL(300750.SZ) announced its third-quarter results for 2025. Here are the highlights:

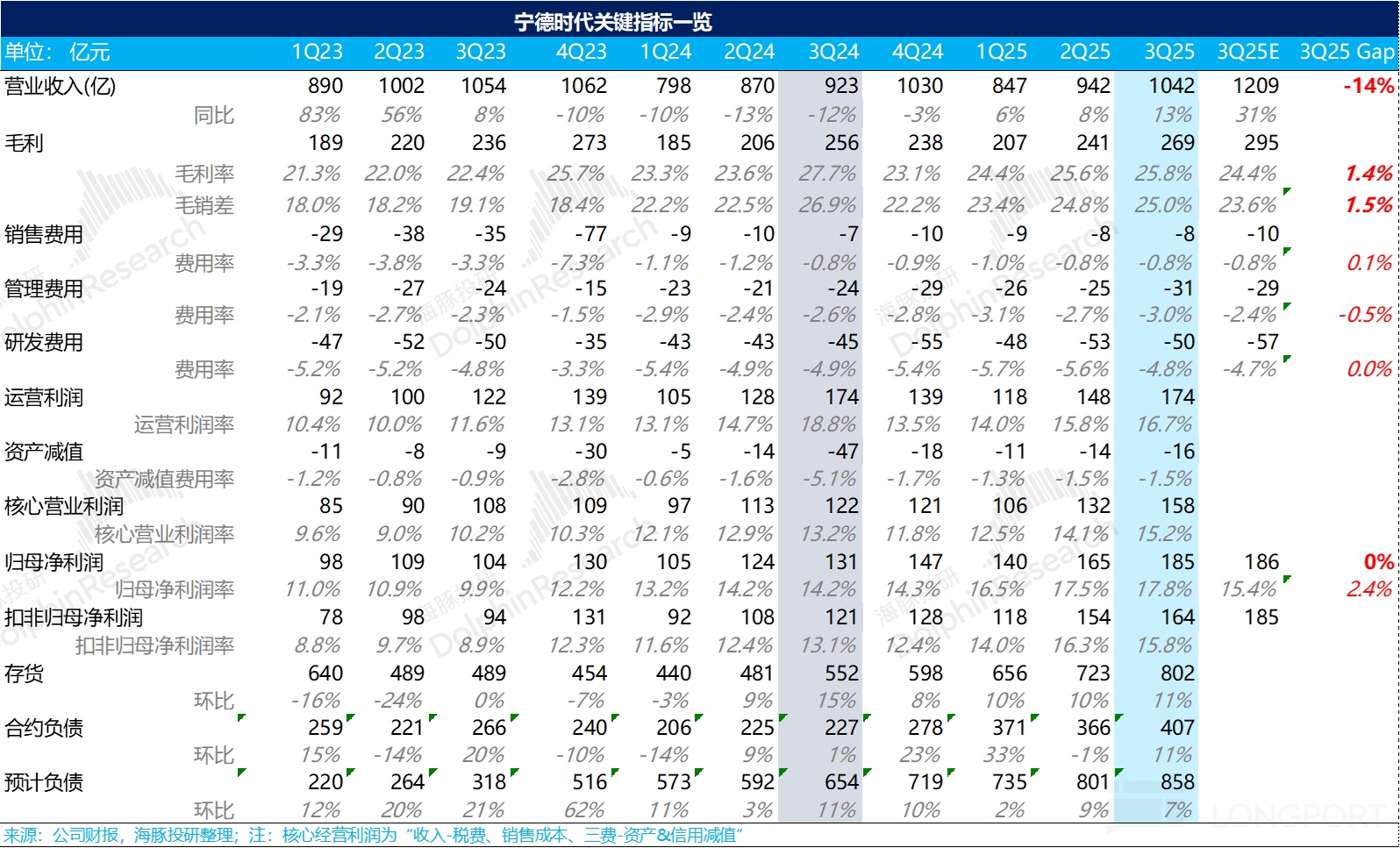

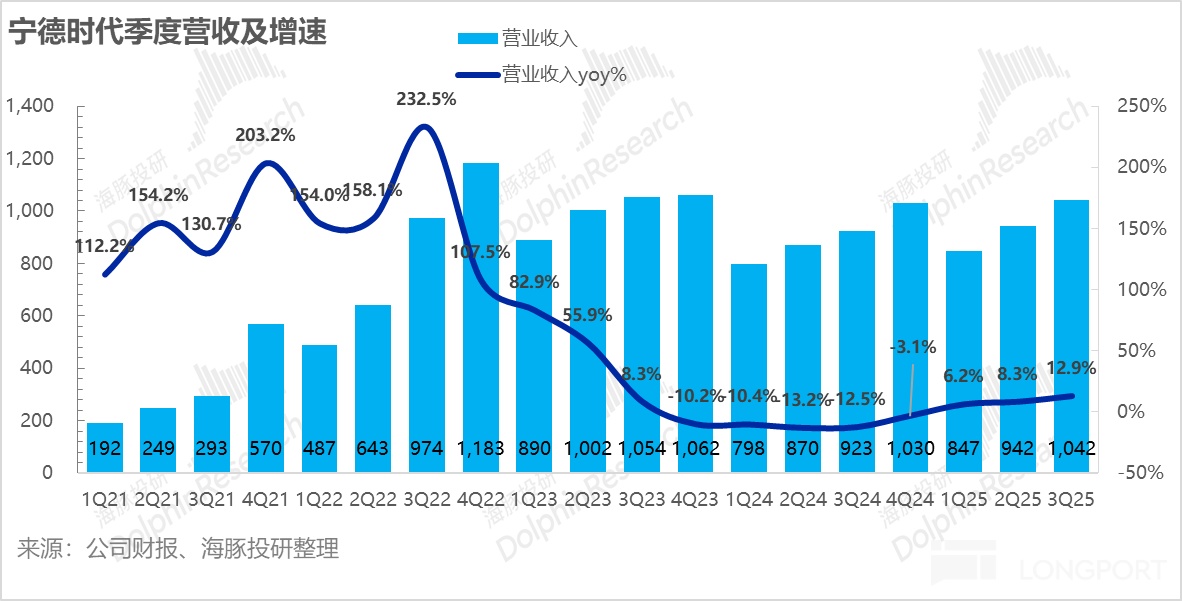

1) Revenue seems significantly below expectations? In the third quarter, $CATL(03750.HK) reported operating revenue of 104.2 billion, while the market consensus on Bloomberg was over 120 billion, with actual revenue falling more than 10% short of market expectations.

However, according to Dolphin Research's calculations, one reason might be that Ningde's products did not increase in price along with the rise in raw materials like lithium carbonate. Another reason could be that as the proportion of energy storage in shipments increases, the discrepancy between the company's recognized revenue shipments and the shipped volume is growing.

This is mainly because energy storage products are increasingly delivered as system-level solutions (including cabinets, AC/DC, etc.) rather than just selling battery cells. The cycle is mostly around 180 days, and invoicing requires project completion for full revenue recognition.

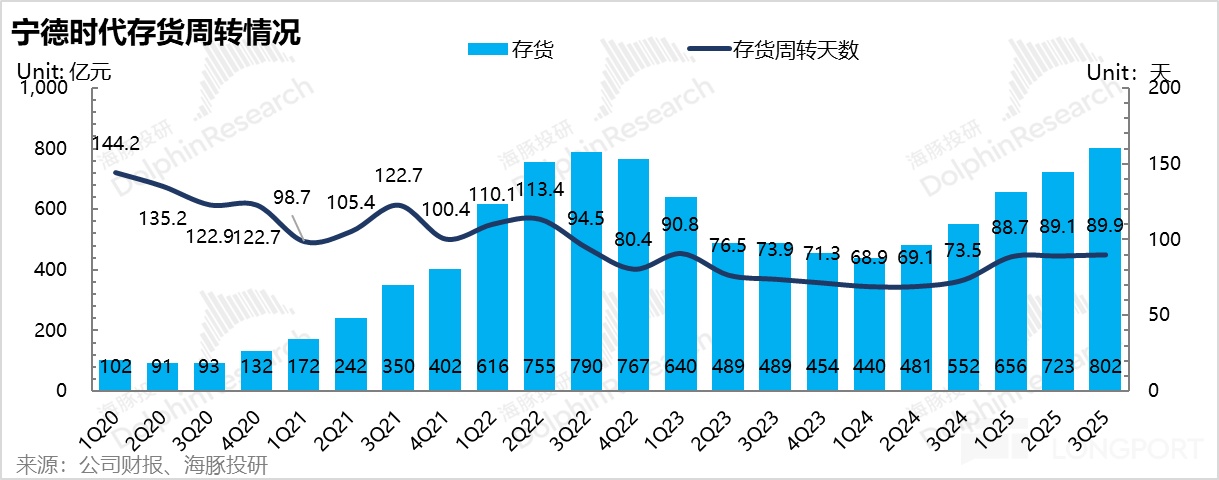

This trend change is also consistent with changes in inventory, with inventory rising directly from 72.3 billion in the previous quarter to over 80 billion in the third quarter. Given the company's current high proportion of in-transit and finished goods, this also indicates that there are indeed many goods that have been shipped but not yet recognized as revenue.

This may lead to some discrepancies between market expectations and the company's actual recognized revenue. Therefore, in this situation, Dolphin Research believes the key is to look at the progress of profit release.

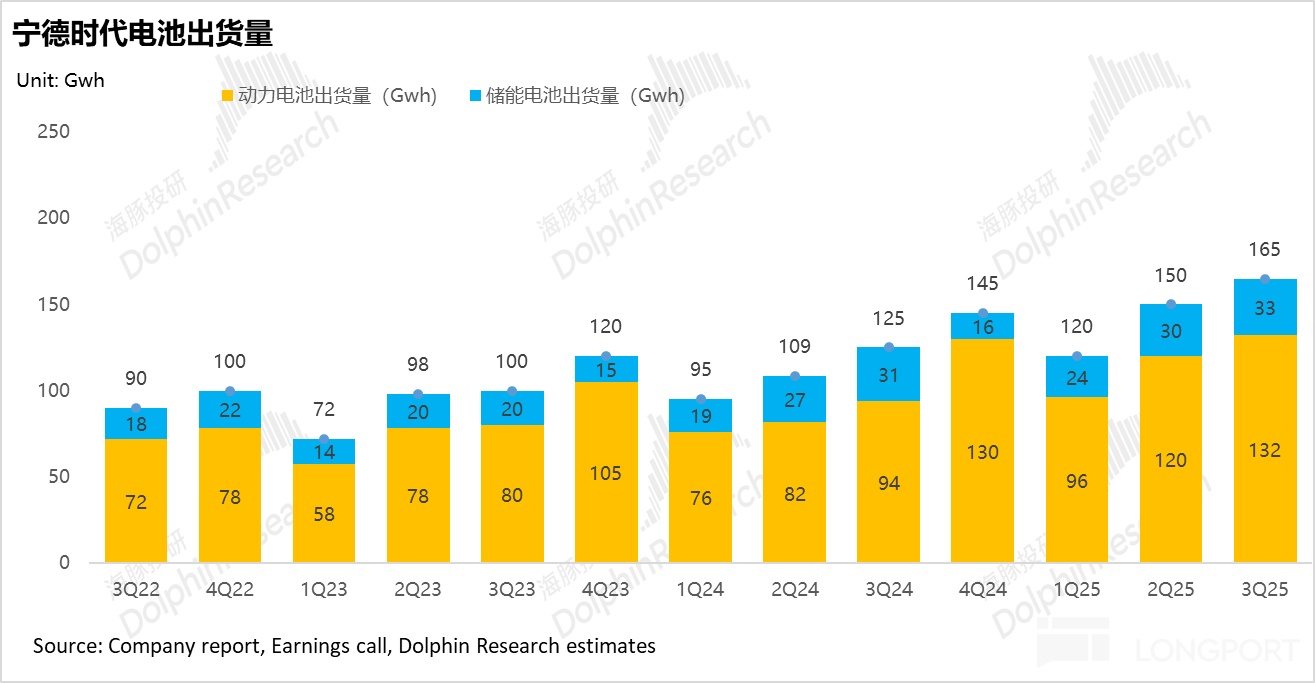

2) Shipment volume: According to company communication, the third-quarter shipment volume was 180 GWh, with recognized revenue volume at 165 GWh. This aligns with Dolphin Research's current full-year market expectations, where the market generally expects invoiced shipment volume to be around 610 GWh, roughly distributed over the remaining two quarters (165 in Q3, around 185 in Q4), with little deviation, keeping shipment volume within expectations.

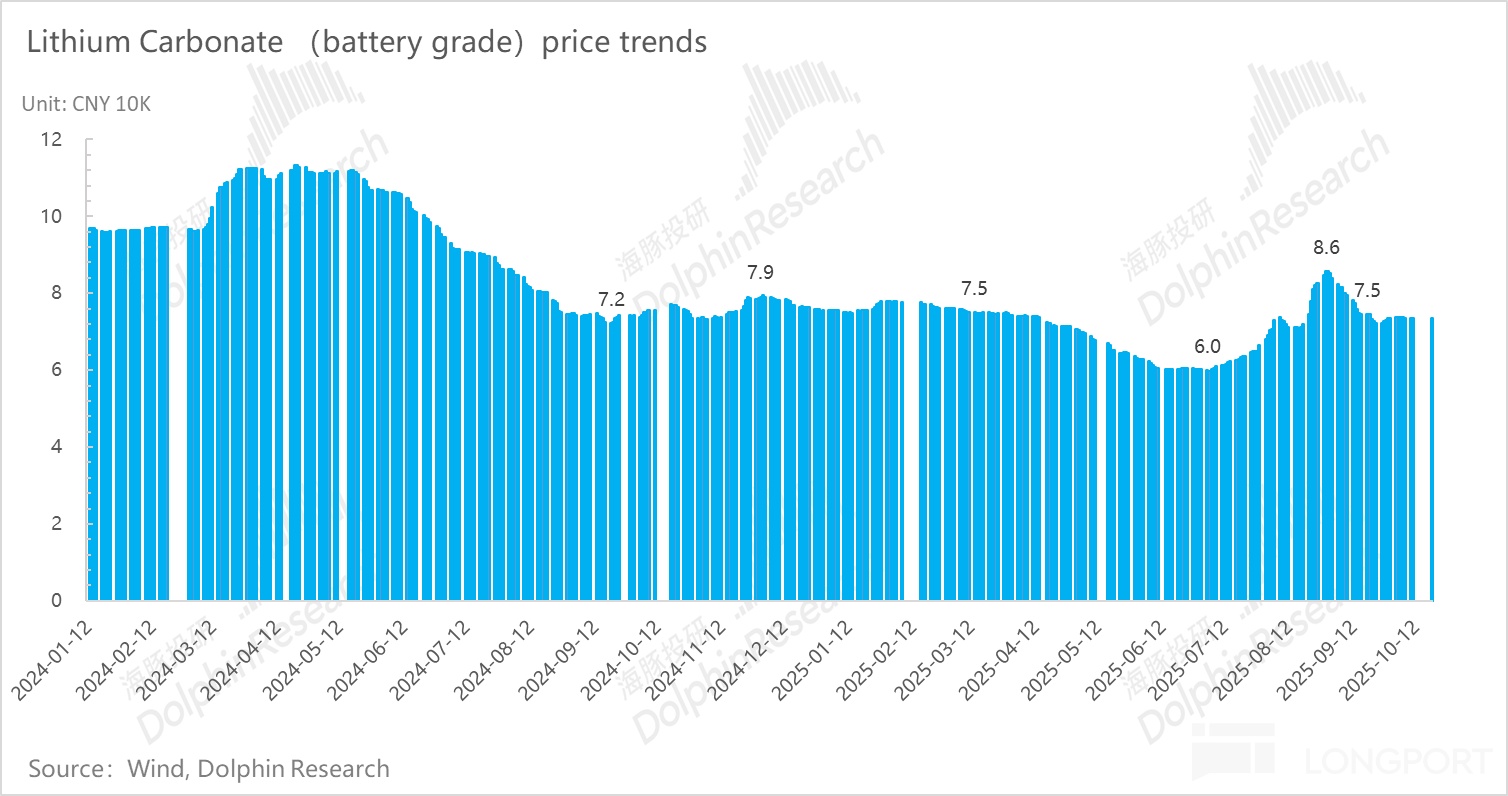

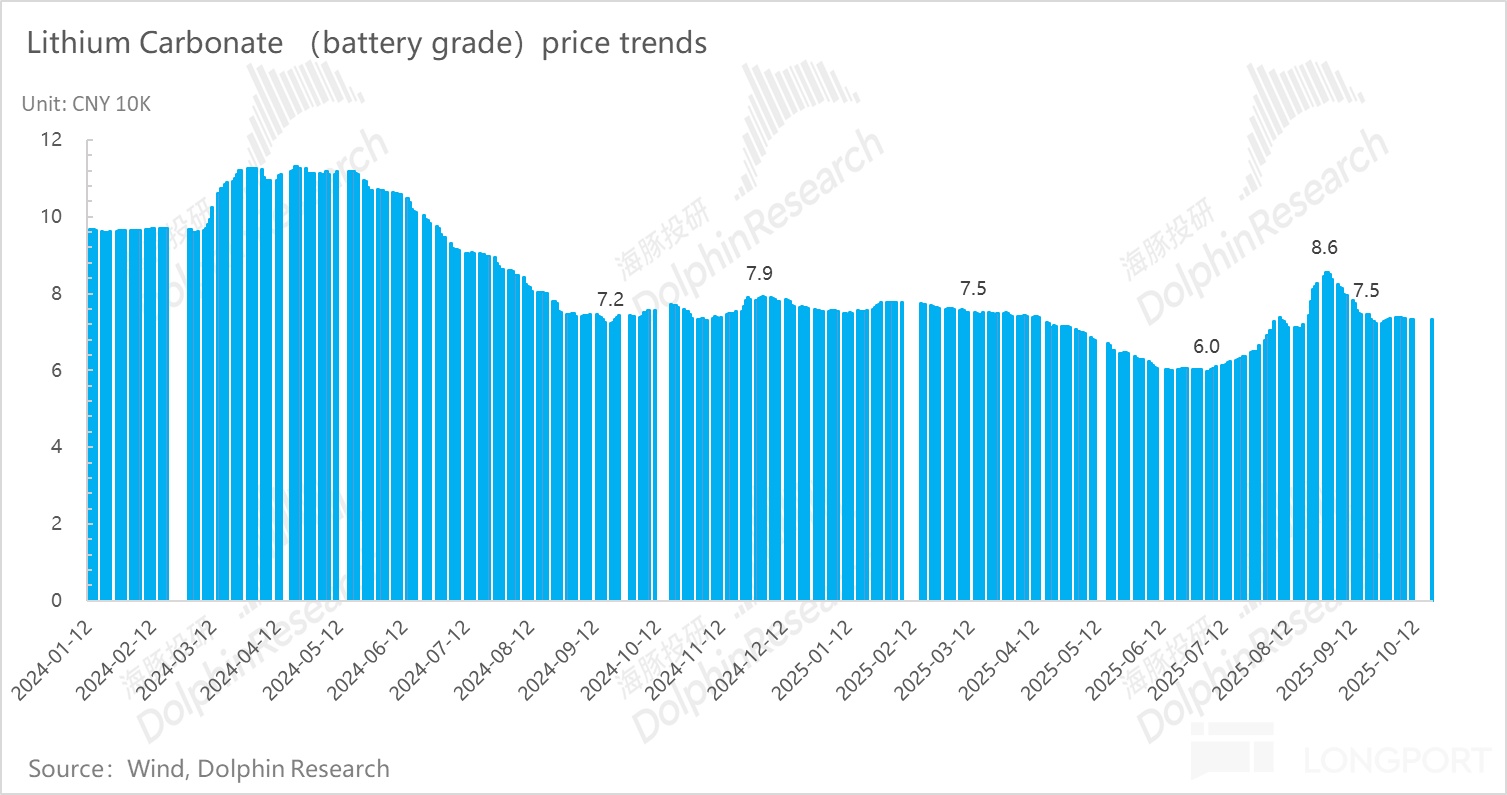

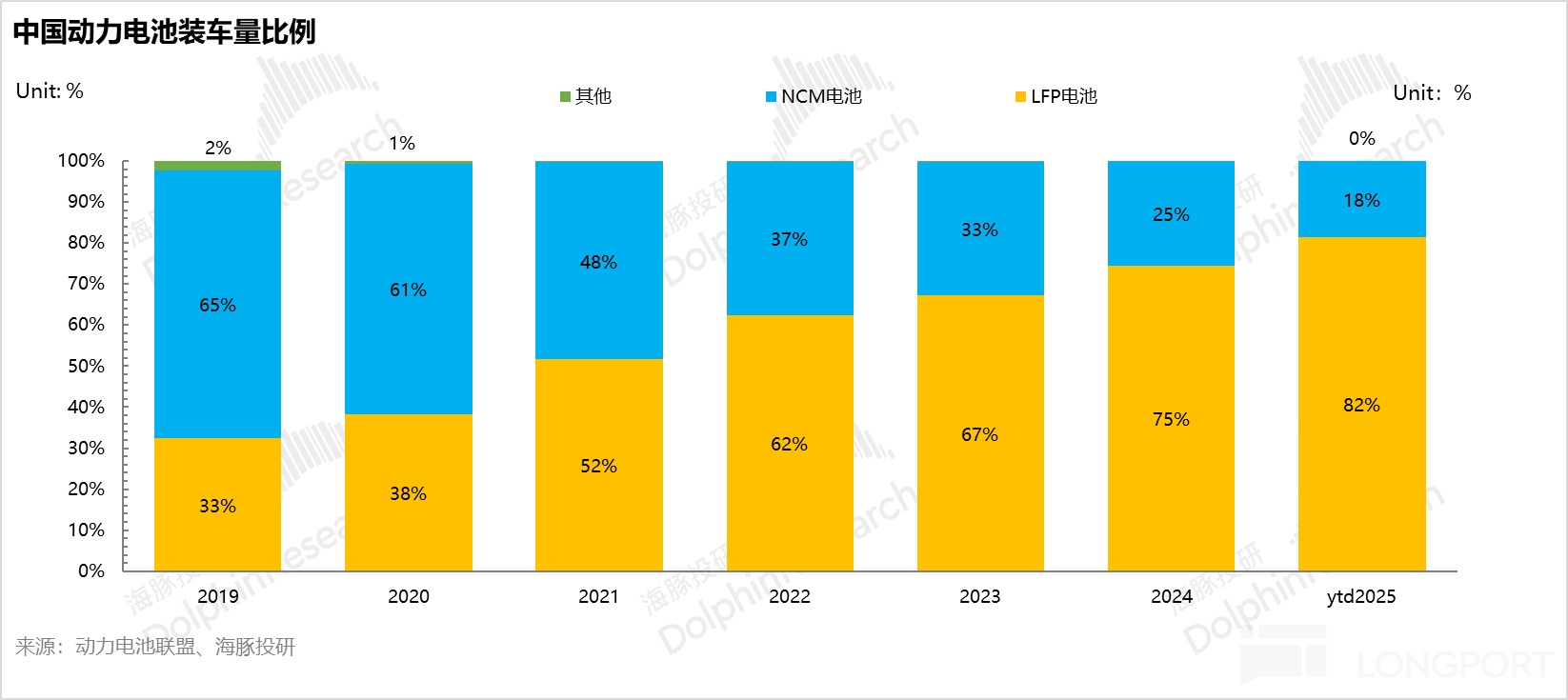

2) Battery unit price stabilized quarter-on-quarter: In terms of battery unit price, the third-quarter battery unit price should have remained unchanged from the second quarter, still around 0.56 yuan; however, during the same period, the price of lithium carbonate per ton actually rose from over 60,000 to 70,000-80,000, possibly due to the continued increase in the proportion of lower-priced iron-lithium batteries in the product structure. Fortunately, the profit per watt has stabilized or even slightly increased as capacity utilization has been maximized.

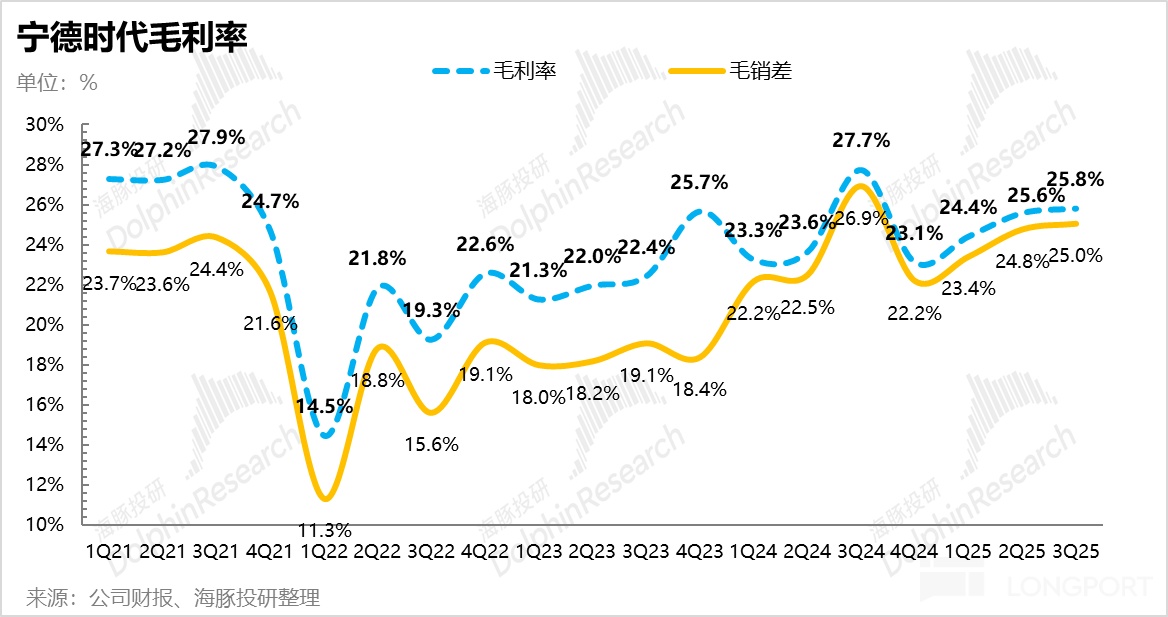

3) Overall gross margin performed well, slightly up quarter-on-quarter: The improvement in profit per watt corresponds to a slight improvement in Ningde's gross margin in the third quarter. Last quarter's 25.6% increased to 25.8%, with Ningde's gross margin gradually rising during the upward cycle.

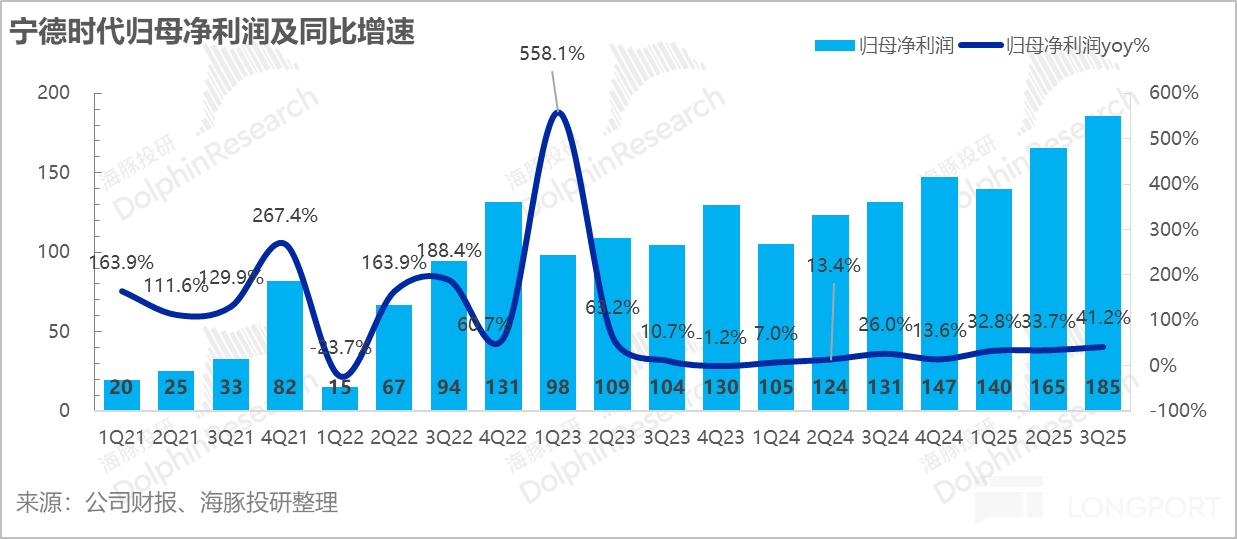

4) Net profit met market expectations: The company's net profit attributable to shareholders was 18.55 billion, almost completely in line with market expectations, partly due to Ningde's extensive market communication, with a year-on-year growth of 42%.

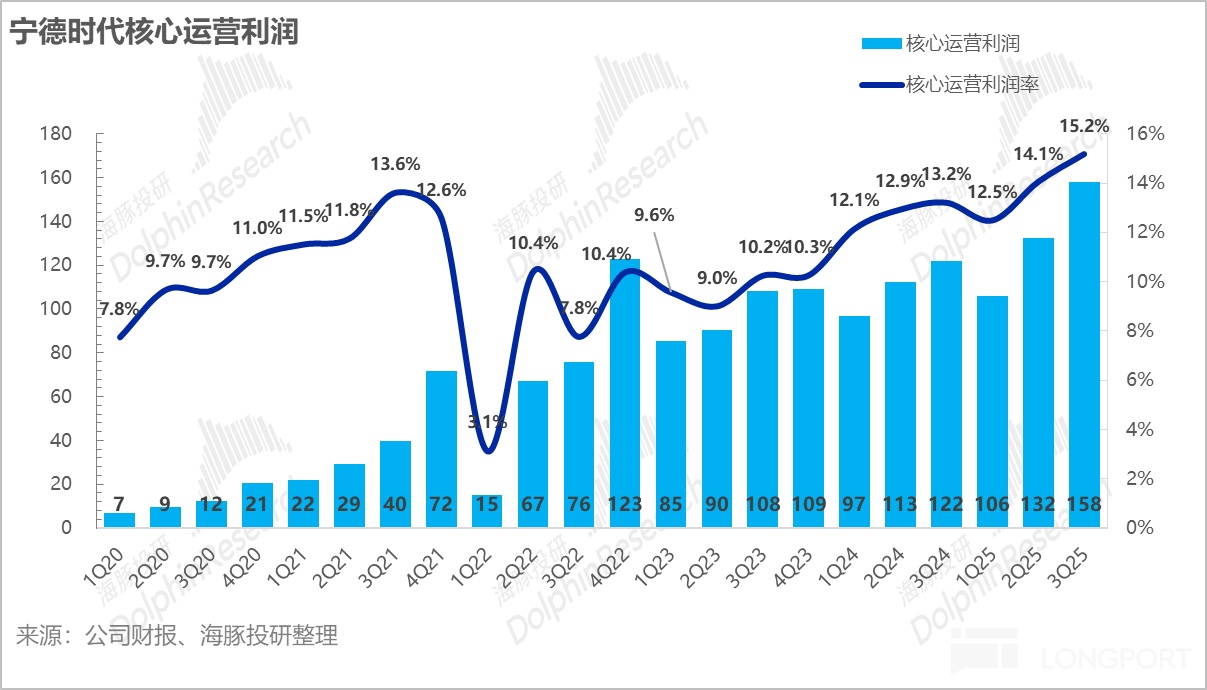

Of course, this profit includes a lot of interest income (due to Ningde's large cash reserves), investment income, subsidies, and other income with low relevance to main operations. Dolphin Research separately extracted a core main business profit (gross profit minus three expenses, asset credit impairment) that can truly reflect the main business's profit creation ability.

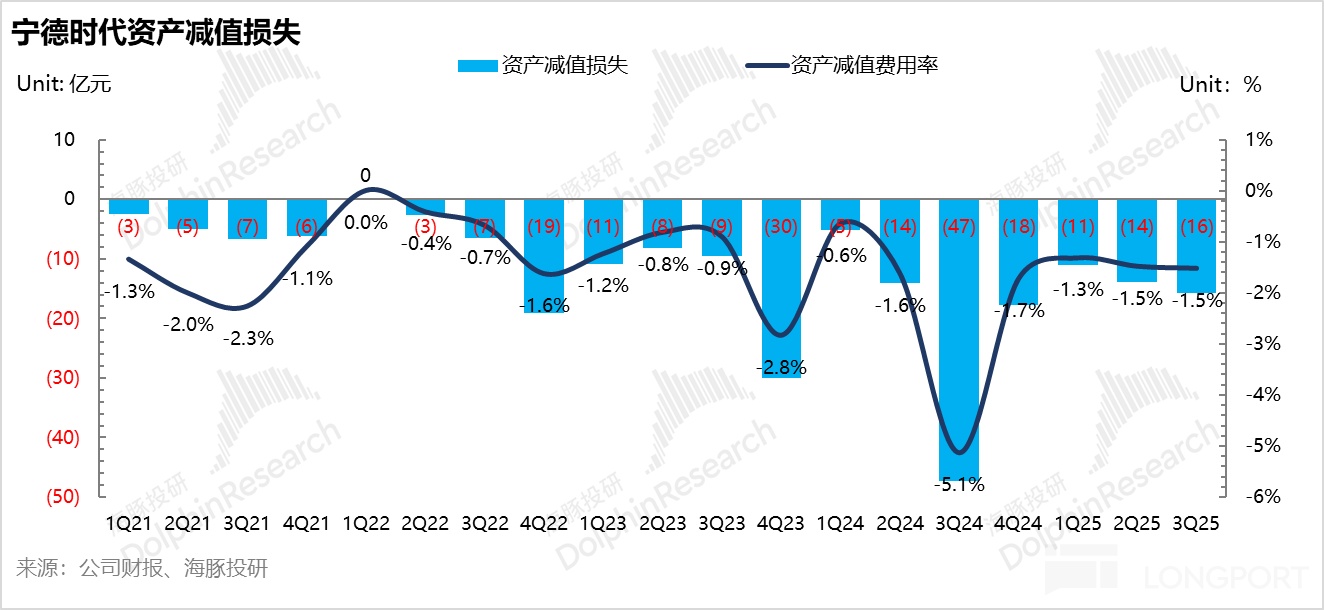

This profit grew by 30% year-on-year, mainly due to the large asset impairment in the same period last year. Excluding the impact of asset impairment, the core operating profit was basically flat year-on-year.

At this point, considering both revenue and core profit, the company's third quarter did not fundamentally exceed expectations significantly. In this case, Dolphin Research is more focused on the operational trend going forward.

5) Key point! Full production: This information was actually revealed in a call, where the company disclosed that current capacity utilization is extremely high, almost at full capacity, and to meet new demand, major domestic capacity bases have begun significant expansion! Meanwhile, overseas capacity is also rapidly advancing.

6) Inventory at a record high: In the context of full production, September inventory directly reached 80.2 billion. This inventory seems more like seasonal stockpiling for the fourth quarter peak season and a large amount of goods already shipped but not yet recognized as revenue. Coupled with the growth in contract liabilities, it indicates that the current inventory is not a risk but rather revenue that can be confirmed.

Dolphin Research's overall view:

Since August, with energy storage demand exceeding expectations, domestic industry anti-involution, and rumors of Ningde's 2026 production plan exceeding 1 TWh, Ningde's stock price has risen by 30%. After sufficient information brewing, Ningde's third-quarter report, in terms of performance itself, did not provide significantly incremental information beyond expectations in terms of revenue or profit.

Therefore, the more important information is to comprehensively look at the operational trend from various angles of the entire financial report. The three core pieces of information from the conference call—full capacity operation + comprehensive domestic expansion + inventory increase—actually indicate that Ningde has basically emerged from a more than two-year-long downturn.

In this new upward cycle, a new feature for Ningde is that the unit price per watt may not rise (structural increase in iron-lithium shipments), and Ningde does not rely on raising unit prices to make money, but rather through expanding quality capacity and achieving increased shipment volume without raising unit prices, resulting in a larger total profit pool through scale effects.

At the same time, after emerging from the downturn, other factors dragging down profits, such as sales rebates and asset impairments, will naturally fade away. During the upward cycle, Ningde's past history has proven that it can effectively pass on price inflation during material price increases driven by inflation.

In upstream price increases driven by supply-demand contradictions, it can also control price risks through industrial chain investment and mergers. For example, high-pressure solid-state lithium iron phosphate cathode materials require high purity of raw materials and secondary and tertiary sintering, resulting in high energy density and fast charging performance, with only a few companies having mass production technology. After Ningde increased its stake in Jiangxi Shenghua, it can also ensure the supply of core materials.

Overall, as long as it is not a period of severe supply-demand imbalance or severe oversupply, it is basically Ningde's "comfort zone" for performance, and this is the state going forward.

Since the company has already provided a 1 TWh production plan for 2026, the market currently generally expects a shipment volume of 850-900 GWh, with about 850 GWh of recognized shipment volume. Based on a net profit of 0.11 per watt, the profit is expected to be around 90-95 billion in 2026. With a 25x PE during the lithium battery upward cycle, this corresponds to an estimated valuation of about 2-2.5 trillion RMB, which is basically the current fluctuation range of H-shares.

Of course, one thing to note here is that since the company says it does not rely on price increases to drive growth, the market has not raised the net profit per watt. However, during a normal supply-demand tight balance upward cycle, the net profit per watt can generally recover, so if the net profit per watt can still rise, there is hope for the stock price to rise.

And a signal for this to start is the rebound in lithium carbonate prices, which are currently stable at around 75,000 yuan.

Overall, since the third-quarter report did not provide truly additional incremental positive information, it is more of a confirmation of the previous upward logic, and it is not ruled out that some funds may take profits after the confirmation of positive performance news (including conference call content).

In the short term, since the fourth quarter of this year will enter a peak shipment period for power batteries (due to the early purchase of new energy vehicles before the subsidy phase-out), and Ningde is already at full production, fourth-quarter net profit may reach 20 billion, with full-year net profit attributable to shareholders reaching 69 billion, meeting the current optimistic market expectations.

In this context, coupled with external interest rate cuts, there is still hope for Ningde to rebound after a pullback. However, after the fourth quarter, 2026 may face some uncertainty due to the phase-out of the purchase tax policy and the high base from last year.

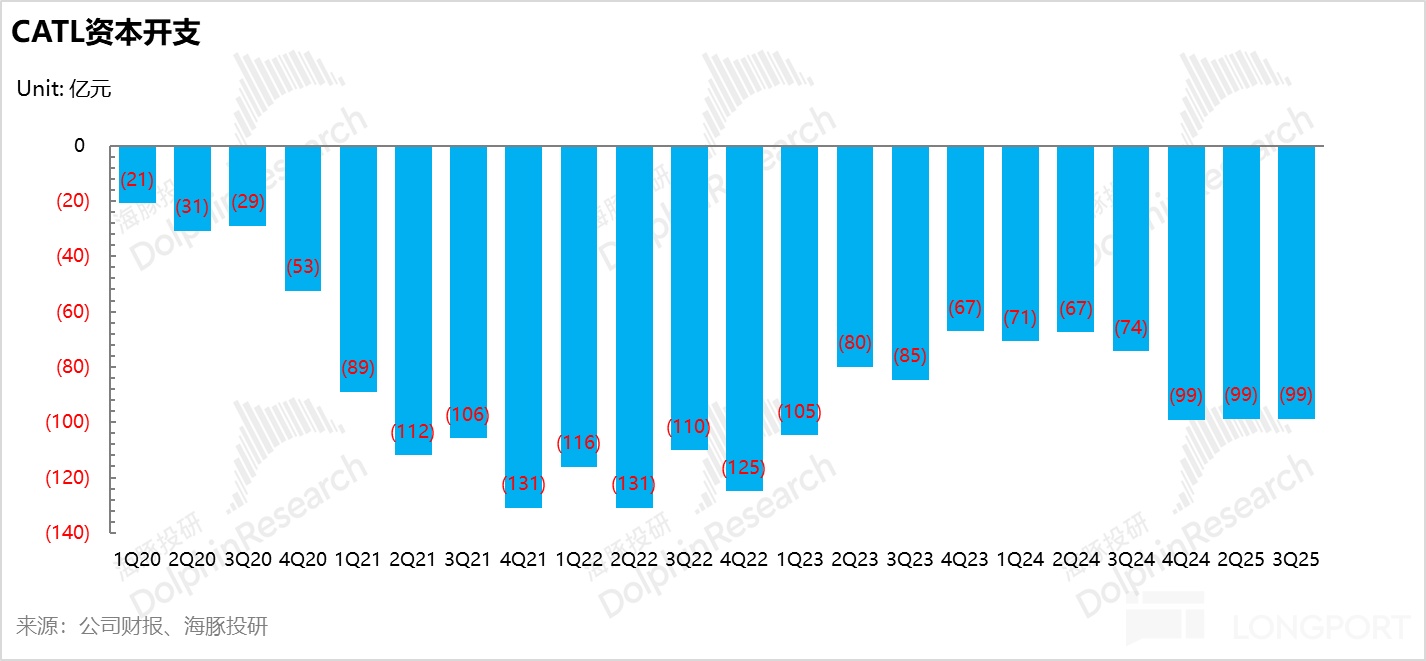

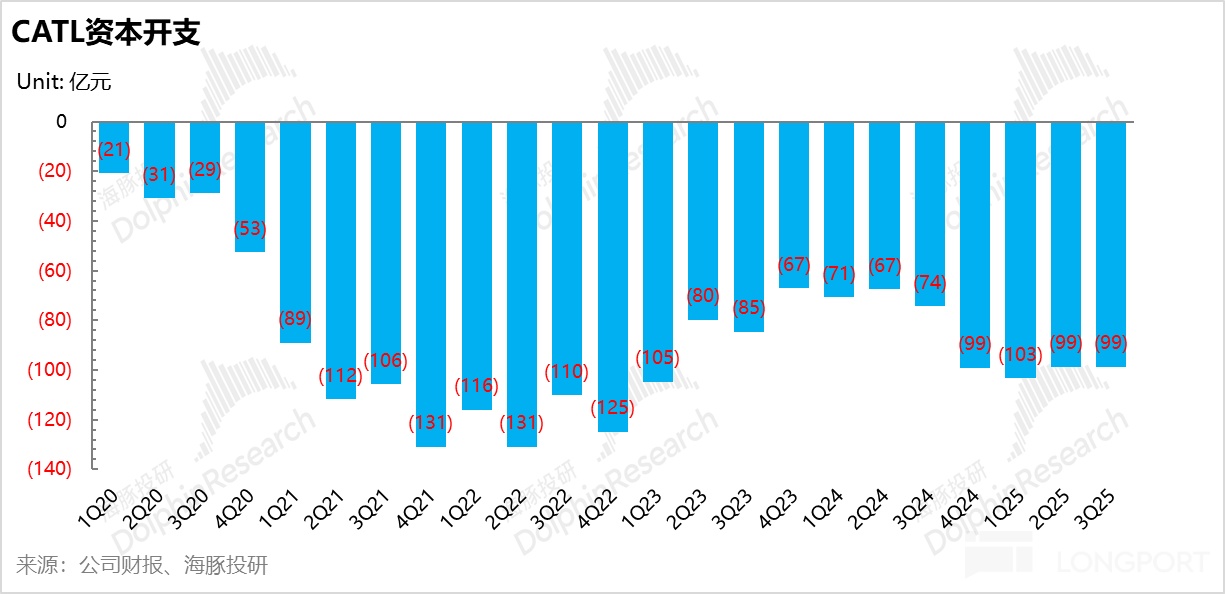

But looking beyond the ultra-short-term game and extending the perspective: domestic expansion, overseas production, energy storage volume increase, Ningde's capital expenditure is about to re-enter an expansion cycle, and Ningde has already emerged from its "lying flat" period of capacity and is entering a new operating cycle.

If successful, the normal stock price cycle should first see a rise in valuation (already completed), then verify performance (to be completed), and then the stock price rises to ensure at least a 25x PE target during the upward cycle.

Here are the details:

I. Revenue is quite average

1. Revenue is mediocre

This quarter, Ningde's operating revenue reached 104.2 billion yuan, although it grew by 13% year-on-year, it actually did not reach the level of the same period in 2023, with a quarter-on-quarter growth of 11%.

As for the reasons, Dolphin Research has already explained earlier that a large part is due to the increase in the proportion of energy storage shipments, leading to a discrepancy between the revenue recognition and shipment volume. Another reason is that with the rise in lithium carbonate prices, the market may have expected a certain degree of increase in unit price per watt, but it did not actually rise quarter-on-quarter.

According to company communication, the third-quarter battery shipment volume was 180 GWh; power accounted for 80%, and energy storage accounted for 20%; the recognized revenue volume was 165 GWh, performing basically within expectations.

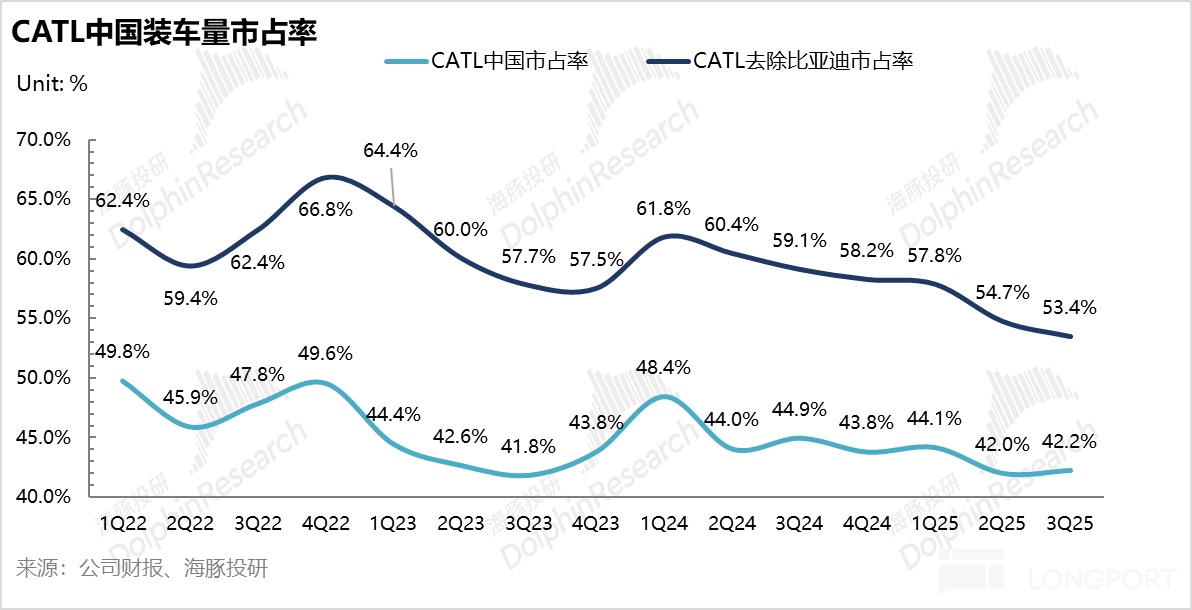

Of course, from the current domestic trend, due to the continuous increase in the proportion of iron-lithium battery shipments in the industry, some car companies are developing their own batteries (mainly iron-lithium), leading to a continuous decline in Ningde's domestic market share in vehicle installations.

Especially, in the context of growth in new energy vehicle sales and recovery in single-vehicle battery capacity, the domestic power battery installation volume has been growing at a high rate this year, even reaching a growth rate of 36% in the third quarter, but Ningde's domestic power battery shipments have always been below the industry average.

This also means that with the current domestic revenue contribution still accounting for 70%, Ningde cannot fully release the domestic growth dividend in the context of declining market share.

Structurally, the current proportion of energy storage is still 20%, but the key issue is that after overseas enters the AI infrastructure cycle, there is a trend of energy tension, and in this situation, overseas energy storage demand is recovering. At the same time, Ningde now uses system-level energy storage solutions, has overseas brand trust, and has many orders.

Currently, energy storage in data centers is mainly used for two purposes: the first is as a backup power solution, mainly using lead-acid batteries, with fewer iron-lithium batteries; the second is for energy storage, using wind and solar energy and storage to generate electricity when traditional energy is insufficient. The second type of demand has a bright future.

The 587 Ah large-capacity energy storage cell solution has been mass-produced, and the new energy storage market has expanded to high-margin markets such as the UAE and Saudi Arabia in the Middle East; at the same time, domestic energy storage demand has been further stimulated by the cancellation of the 136 policy, which previously worried about the cancellation of storage allocation (after the benchmark electricity price moves towards marketization, the price difference between peak and valley prices is large, and energy storage can arbitrage by charging low and discharging high).

With the resonance of scenario demand (global wind and solar new energy installations rising, requiring grid stability adjustment, global AI data center expansion, with light storage systems as efficient green power supply solutions), Ningde's energy storage capacity is insufficient, so the company plans to increase the single energy storage capacity in Shandong by 100 GWh in 2026, mainly producing 587 Ah large cells, with the capacity tension expected to ease within half a year.

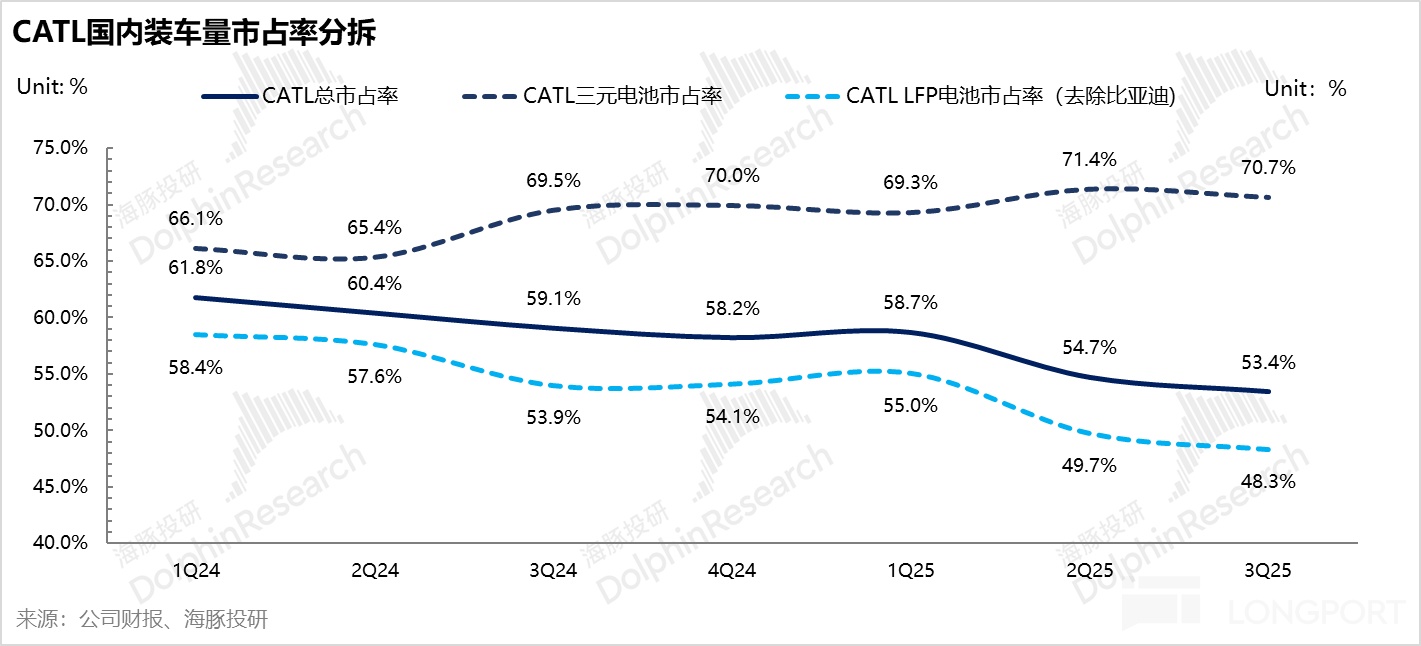

In addition, in terms of battery unit price: Dolphin Research estimates that the battery unit price should be around 0.56 yuan/Wh, with no change from the previous quarter. Generally, Ningde's battery unit price is directly linked to the upstream raw material lithium carbonate price, and this quarter, the lithium carbonate price per ton increased by 10,000-20,000 compared to the previous quarter, but Ningde's price did not change, which can only indicate that the proportion of lithium iron phosphate batteries in its shipment structure has increased again.

In fact, due to the continuous high price of cobalt in ternary lithium, the price gap between ternary lithium batteries and lithium iron phosphate batteries is widening, even as the energy density gap narrows, leading to a structural trend of increasing iron-lithium proportion.

2. Gross margin slowly recovers

Although the unit price did not rise, Ningde's gross margin still slightly improved quarter-on-quarter. According to company disclosures, new products like Shenxing and Qilin batteries will account for 60% of shipments this year, and the optimization of the product structure is conducive to improving the gross margin, even without an increase in unit price per watt.

From the perspective of gross sales margin (gross margin - sales expense ratio, without warranty adjustment interference), the gross sales margin this quarter is around 25%, with a slight quarter-on-quarter improvement.

Reflecting the company's true main business profitability, the core operating profit (gross profit - taxes - three expenses - asset, credit impairment) saw a one percentage point increase in profit margin in the third quarter, mainly due to scale effects, with revenue growth naturally reducing the expense ratio.

As for the market's main concern, the net profit attributable to shareholders, the company achieved 18.55 billion in the third quarter as expected, but this includes government subsidies, interest income (due to the company's large cash reserves), and investment income totaling nearly 6 billion. These non-main business incomes may continue, but they are not part of the main business, so compared to the 18.5 billion net profit attributable to shareholders, Dolphin Research is more concerned with the aforementioned core main business profit trend that better reflects profit quality.

II. Inventory surge? Good news under full production and expansion

1) Inventory surge: "Shipped but pending confirmation"

This quarter, inventory directly reached 80.2 billion, with a quarter-on-quarter increase of nearly 8 billion, and inventory turnover days directly increased to 90 days. Clearly, with the fourth quarter peak season approaching, regular stockpiling will also raise inventory levels.

However, the irregular and more important aspect here is that energy storage and other products have long project cycles, and with more overseas long-distance markets (in addition to Europe, there are more in the Middle East), there are more goods in transit. But actually, many of these are "pending confirmation revenue" that have been shipped and are awaiting invoicing.

2) Asset impairment warning lifted

In the third quarter of 2025, asset impairment was 1.6 billion, with a slight increase from 1.4 billion in the previous quarter. Ningde's asset impairment mainly includes:

① Inventory write-downs: This is straightforward, meaning the market value of inventory is already below cost or cannot recover the cost;

② Long-term asset impairment: Assets related to mineral resources.

This quarter, the proportion of asset impairment relative to revenue remained at 1.5%, and with full production again and battery material prices recovering, this risk has been greatly reduced.

IV. Accelerated expansion, new cycle set sail

1) Capital expenditure accelerates again, high-profile expansion begins:

From the capital expenditure cycle perspective, although Ningde has passed the intensive capacity investment period (2021-2022), subsequent market competition saturation and capacity surplus led to a downward cycle in capital expenditure since the fourth quarter of 2022, reaching a phase low of 6.7 billion in the fourth quarter of 2023.

However, starting from the third quarter of 2024, Ningde began to increase capital expenditure, reaching around 10 billion in 2025. Going forward, Dolphin Research estimates that expansion will accelerate:

The company revealed in a conference call that in the domestic market, bases in Jining, Shandong; Ruiqing, Guangdong; Yichun, Jiangsu; Xiamen, Fujian; Qinghai; and Ningde, Fujian are all undergoing significant expansion;

In the overseas market, the German factory (14 GWh) was put into production in 2024 and can achieve stable profitability. The first phase of the Hungarian (100 GWh) factory's cell production line equipment has been installed and is expected to be completed by the end of 2025; the Spanish (60 GWh) factory has completed preliminary approval procedures, and a joint venture company has been officially established, with factory construction about to begin; the Indonesian battery industry chain project is expected to be put into production in the first half of 2026.

From the production rhythm, the opportunity for overseas market volume increase in 2026 is higher.

2) Contract liabilities: Order harvest

Since Ningde is mainly a B2B business, there will be situations where prepayments from downstream B-end customers are received but not yet delivered, so contract liabilities can be seen as a rough indicator of changes in Ningde's order volume.

From Ningde's third-quarter contract liabilities, which increased again year-on-year, contract liabilities reached 40.7 billion, with a quarter-on-quarter increase of 4 billion, continuing to improve marginally, indicating that short-term order volume is still at a good level.

<End here>

Past in-depth research:

July 5, 2025, "Ningde: H-share premium over 20%, is the lithium battery leader coming for a value revaluation?"

January 23, 2025, company in-depth "Looking at Ningde through TSMC: The inescapable cycle fate"

July 14, 2021, company in-depth "Ningde Times (Part 2): Is faith building a "rigid bubble"?"

July 7, 2021, company in-depth "Ningde Times (Part 1): Where is the confidence in a trillion market value?"

Financial report tracking:

July 31, 2025, minutes "Ningde Times (2Q25 Minutes): European new energy vehicle growth continues, domestic capacity gradually released"

July 31, 2025, commentary "Ningde Times: Price battle, Ningde also finds it hard to escape the involution dilemma?"

April 14, 2025, minutes "Ningde (1Q25 Minutes): Tariff impact relatively limited, actively negotiating solutions with customers"

April 14, 2025, commentary "Ningde Times: Tariff "robber" strike, Ningde's difficult crossing"

March 16, 2025, minutes "Ningde (4Q24 Minutes): Shenxing Qilin's share is expected to increase to 60%-70% in 2025"

March 16, 2025, commentary "Ningde Times: Another deep squat! Is it really that scary this time?"

October 21, 2024, financial report commentary ""Trillion" Ningde is really going to rise this time?"

October 21, 2025, financial report commentary "Ningde Times 3Q24 Performance Meeting Minutes"

Risk disclosure and statement of this article:Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.