Coca-Cola (Minutes): The bottling system restructuring strategy is nearing completion

$Coca Cola(KO.US) The following are the minutes of Coca-Cola's FY25 third-quarter earnings call organized by Dolphin Research. For earnings interpretation, please visitCoca-Cola: "Bulk Happy Water," Drinking to Steady Happiness?

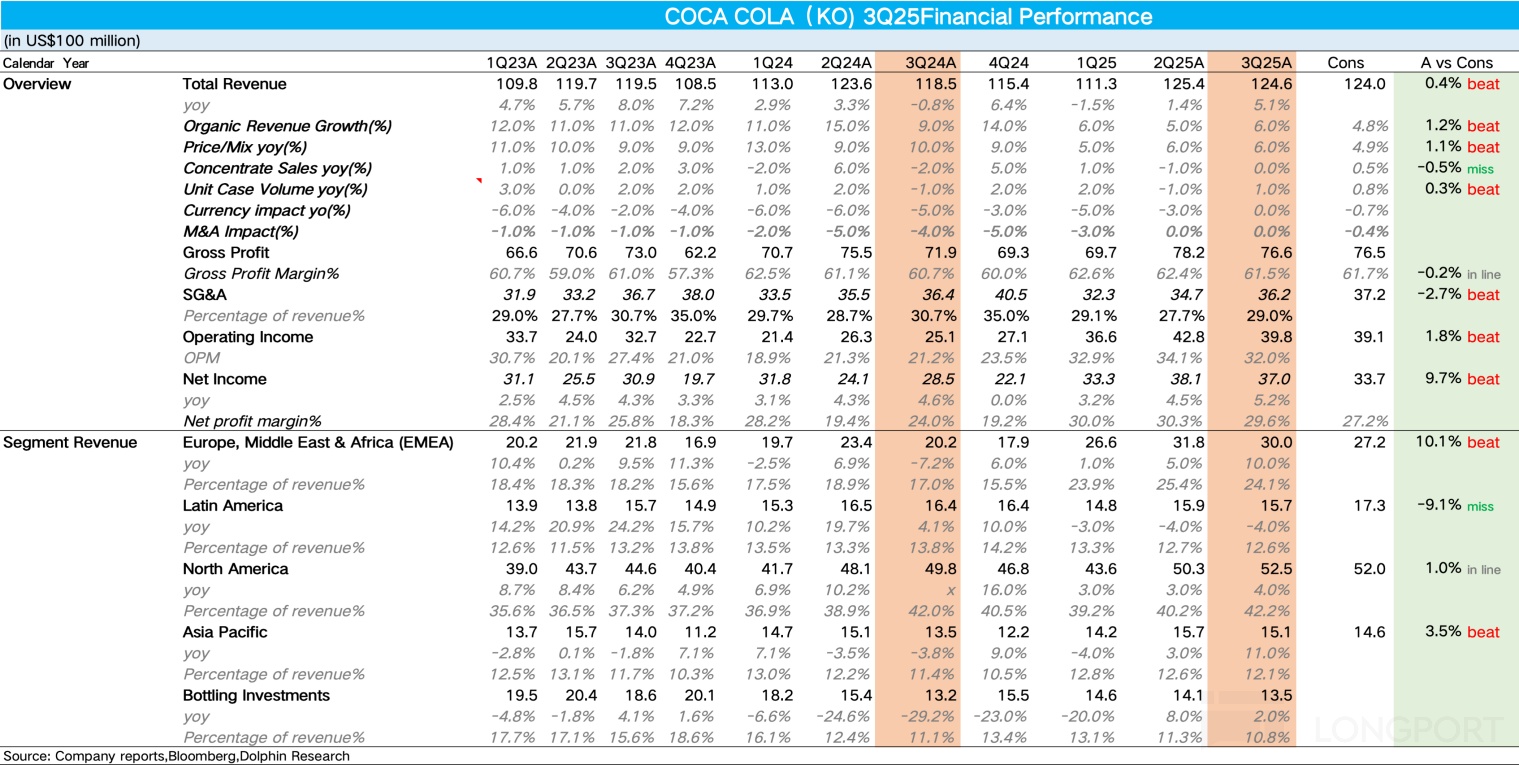

- Review of Core Financial Data

Key Operational and Financial Performance: The company's overall sales increased by 1% year-on-year, with organic revenue growth of 6%, primarily driven by pricing and product mix. Approximately 4 percentage points came from price increases, and 2 percentage points from product structure optimization. Adjusted earnings per share for the quarter were $0.82, exceeding market expectations of $0.78, with a margin of about 5.1%.

Full-Year Guidance (2025): Management reiterated the full-year guidance, maintaining growth expectations. The company expects organic revenue growth of 5%–6%, with comparable earnings per share growth of approximately 8% at constant currency.

2026 Outlook and Operational Considerations: The focus of overall growth will be on driving balanced growth through volume, with pricing strategies gradually returning to normal in the context of easing inflation. The company also emphasized flexible responses to market demand, balancing affordability and premiumization. Based on current exchange rates and hedging positions, it is expected that exchange rate factors will provide a slight tailwind to revenue and earnings per share for the full year 2026.

II. Core Management Statements

Execution Improvement and System Strengthening Measures:

1. Overall Strategy and Execution

The company is executing an "all-weather" strategy in a dynamic environment, driving growth through more precise execution and investment. Facing challenges such as consumer segmentation, the company is allocating more resources to the front line to respond more agilely to different market demands. The decade-long bottling system restructuring strategy is nearing completion, with key transactions in India and Africa introducing strong local partners to these markets, unlocking long-term growth potential. The company can now focus more on brand building and innovation, while achieving complementarity through collaborative execution with bottling partners.

2. Brand Portfolio and Product Innovation

The company boasts a strong brand portfolio, with approximately 30 brands valued at $1 billion each, about twice the number of its closest competitor. Innovation is a key driver of growth, contributing significantly to revenue growth in the first three quarters. Specific cases include: launching Sprite Plus Tea in North America, Bacardi mixed cola in Mexico and Europe, and adding spring flavors to Powerade in South Africa. Meanwhile, Diet Coke attracted a new generation of consumers through marketing activities such as "No Design," achieving strong sales growth and reintroducing retro cherry and lime flavors in the U.S.

3. Marketing Transformation and Market Execution

The company's marketing transformation aims to establish deep connections with consumers through digital interaction, personalized experiences, and cultural associations. Fanta collaborated with Universal Pictures to activate Halloween marketing campaigns in about 50 markets, featuring iconic characters on packaging, launching limited-time flavors, and creating immersive retail and digital experiences. The partnership with the Premier League linked Coca-Cola, smartwater, and Powerade with football passion, successfully attracting high-frequency consumers through packaging displays and exclusive fan events.

4. Profitability and Cost Management

Comparable operating profit margin increased by approximately 120 basis points, mainly due to ongoing productivity improvements. The company optimized supply chain efficiency, improved advertising spending effectiveness, and prudently controlled the expense base. Despite facing cost inflation, the overall impact is manageable. Currently, digital platforms are helping connect all system links, enhancing consumer and customer experience.

5. Performance in Various Regional Markets

North American Market: Sales were flat but improved sequentially for the second consecutive quarter, gaining value share. Through a combination strategy of high-end brands (such as Topo Chico, Smart Water, and Fairlife) and affordable packaging (such as mini cans), the company effectively addressed consumption segmentation among different income groups. The mini can product line has become a $1 billion brand.

Latin America: Sales were flat but gained value share. Brazil continued to grow, with strong performance from Zero Sugar. The Mexican market faced challenges due to softening macroeconomic conditions, and the company has taken measures to address this, but full recovery is expected to take time. Santa Clara has become the value share leader in high-value-added dairy products in Mexico.

EMEA Region: In Eurasia, the Middle East, and Africa, despite macroeconomic volatility, the company achieved sales growth and drove business through localized marketing activities (such as collaboration with the Springbok rugby team in South Africa) and innovative products (such as Turkey's "Cape Bubble").

Asia-Pacific Region: Due to weak consumer spending, poor industry performance, and adverse weather in markets such as India and the Philippines, sales in all business units declined. However, the company focused on refined channel execution plans, adjusted brand pricing structures to enhance affordability, and continued to invest in growth, still gaining value share and achieving revenue and profit growth in this segment.

III. Q&A

Q: Momentum at the beginning of the third quarter was below expectations, but improvement was seen in September. Was this acceleration due to improved market trends or proactive measures by the company? What impact does this have on the fourth quarter and 2026 planning?

A: The improvement mainly came from proactive company actions rather than changes in the external environment. The team increased marketing and innovation investments, strengthened collaboration with bottlers, and focused more on price management and terminal execution, leading to the recovery in September. The overall market environment remains complex, and the company will maintain investment intensity in the fourth quarter, requiring high-intensity execution. Looking ahead to 2026, the company expects inflation and pricing to stabilize, continuing to pursue a long-term growth model balancing volume and price.

Q: In an environment of rising consumer pressure, have you seen increased competition from local brands? How do you respond?

A: Indeed, more regional and local brand competition has emerged in various markets, but this is not just a price issue; it also reflects a trend towards "localization" in consumption. The company is increasing frontline resource allocation and enhancing regional responsiveness to flexibly address different market characteristics. The goal is to maintain the scale advantage of global brands while being closer to local consumers, achieving differentiated competition.

Q: You mentioned that global consumers are generally under pressure. Can you further explain the specific situation in Latin America? This region is closely linked to the U.S. economy and is also affected by U.S. policy adjustments. Please share the latest dynamics in Mexico and Brazil in recent months, and how these changes in the consumption environment affect your future performance. Additionally, has the local strategic direction been adjusted accordingly?

A: Latin America remains a structurally strong market overall, with a solid foundation after years of growth. In recent quarters, the company has continuously improved performance in the region, with overall stability this quarter but key markets remaining robust. Brazil, Colombia, and Chile achieved growth, showing strong performance; Mexico is gradually improving but has not yet fully reached expected targets. The local macroeconomic environment remains challenging, and the company has advanced targeted adjustment plans and achieved phased progress.

Overall, Latin America has not yet fully escaped macro pressures, but growth momentum is consolidating. Some markets have shown positive signs, while the region as a whole still needs more time to return to a stable growth trajectory.

Q: Can you update on the latest progress in franchising? Today's announcement regarding the CBA (Coca-Cola Beverages Africa) transaction is an important step towards achieving the global asset-light goal. After this transaction is completed, what other franchising opportunities remain to be advanced in other regions? Additionally, the company previously mentioned an operating profit margin target of around 35%; has this target been largely achieved after the transaction?

A: The company has announced two important transactions with India's Jubilant Bhartia Group and Bhartia Group, marking the final stage of the global franchising restructuring strategy initiated in 2015. Through these transactions, the company will collaborate with local partners who have long-term investment capabilities and are willing to continue investing, enhancing system efficiency and profitability. With the completion of transactions in India and Africa, the company has essentially completed the global franchising transformation, with only a few regions (such as Malaysia and Singapore) still pending.

From a financial perspective, after the restructuring is completed, the company is very close to the established operating profit margin target of 30% to 35%. In the future, management will focus on improving capital efficiency and cost control capabilities to ensure continued improvement in profit margins and support long-term growth.

Q: Can you restate your latest thoughts on the coffee strategy? Why has the recent recovery been somewhat difficult? What factors are driving recent improvements? How do you view the future prospects of this category? Additionally, regarding the zero-sugar product line, after slowing growth in 2023, it has achieved strong accelerated growth over the past two years. Can you discuss the growth potential of this business?

A: Coffee remains a high-potential category, with Costa's business returning to growth, driven by the expansion of UK stores and the automatic coffee machine network, boosting revenue. Both retail and ready-to-drink channels have returned to growth but are still in the early stages of expansion. Zero-sugar and Diet products together account for about 15% of sparkling drinks, both continuing to grow, with Diet Coke returning to positive growth in major markets, forming a dual growth engine with Coke Zero.

Q: The consumer goods industry is under pressure; what is the actual business situation of your company?

A: The beverage industry has maintained long-term growth, with Coca-Cola driving revenue through marketing, innovation, and execution. At the same time, productivity improvements are continuously promoted in cost, marketing, and management areas. In the future, AI and automation will be used to enhance efficiency, and moderate organizational optimization is planned for 2026 to release resources to support growth.

Q: Asia market revenue grew by 7%, accelerating sequentially. Is this high growth sustainable?

A: The growth rate is mainly driven by structural portfolio effects, with increased weight in mature markets (Japan, Australia), while growth in India and Southeast Asia slowed due to weather and weak consumption. In the long term, Asia remains a major growth engine, but quarterly performance will fluctuate due to regional rhythms.

Q: Regarding the popularity of GLP-1 weight loss drugs, you should have some data by now. What impact has this drug had on beverage consumption behavior? Have you seen increased demand for protein drinks, energy drinks, and hydration products? Also, please update on your protein drink business capacity and strategy in the face of new competitors.

A: We are indeed continuously tracking changes in consumption among GLP-1 users. Although it is still in the early stages, some clear trends can be seen: these consumers are adjusting their overall diet structure, with decreased consumption of sugary soft drinks, while consumption of zero-sugar drinks, diet drinks, hydration products, coffee, and protein drinks has significantly increased.

In the protein drink sector, Fairlife and Core Power have consistently performed well over the past few years, continuing strong growth in the third quarter. The capacity construction of the new factory in New York is progressing smoothly, expected to start production in early 2026, and will gradually release capacity throughout the year, enabling the company to have stronger supply capabilities to meet demand. Despite new competitors entering the protein drink track, we have leading brands and quality products and continue to increase innovation investment. In the coming years, the company will further expand capacity, launch new products, and consolidate its leading position in the high-protein drink field, which will become a medium- to long-term growth engine.

Q: Considering resource allocation and innovation pace, how do you view 2026? Will progress accelerate in the second half of the year? Additionally, from a long-term perspective, do you think establishing protein production bases in Santa Clara, Mexico, and other places is feasible? Is this part of the long-term supply chain layout?

A: Once the New York factory is operating at full capacity, capacity will increase by about 30%, expected to achieve significant growth in 2026 and gradually move away from quota supply to retail partners. This factory is one of the largest dairy processing facilities in the United States, helping the company break through current bottlenecks and enhance market supply capabilities.

Regarding international expansion, the company is evaluating relevant plans. Currently, the global dairy industry has high barriers, complexity, and strict regulation. The company is focusing on how to apply the experience gained in the U.S. market with Fairlife to the Mexican market, driving Santa Clara brand growth. In the third quarter of 2025, Santa Clara's sales in the Mexican market increased by 13% year-on-year, continuing to consolidate its leading position in the high-value-added dairy field.

Since acquiring Santa Clara ten years ago, the company has continuously expanded its market scale, proving that under the right platform, brand concepts and product innovation can create synergy. The company will continue to explore how to translate the core product concepts of Fairlife and Santa Clara into global innovation solutions.

Q: The North American market performed well, but you mentioned income level differences and channel segmentation; can you elaborate?

A: High-income consumer spending in North America is stable, while middle- and low-income groups are under pressure. The company responds with a dual strategy: on one hand, developing high-end brands (such as Smartwater, Fairlife, Topo Chico) to bring portfolio enhancement; on the other hand, strengthening affordable products, such as mini cans, to meet broader consumer demand.

Q: The improvement in third-quarter sales mainly came from enhanced execution; can this trend continue into the fourth quarter?

A: The improvement mainly stems from internal marketing, innovation, and execution enhancements rather than external demand rebound. Entering the fourth quarter, the company will continue to maintain investment, aiming to sustain positive growth despite a high base.

Q: What is the trend for profit margins next year? Will the impact of exchange rates weaken?

A: Exchange rates are expected to have a slight positive impact in 2026. Profit improvement in 2025 partly comes from increased marketing efficiency and digital spending optimization. Future profit margins will continue to expand steadily, but growth pace will return to normal levels.

Q: North American competitors are undergoing restructuring; what does this mean for Coca-Cola?

A: The company focuses on its own growth and execution, continuing to strengthen brand, marketing, and system efficiency. Competitors' internal adjustments present market opportunities for Coca-Cola, and the company will leverage its leading advantage to accelerate investment and expansion.

Q: What is the actual situation of sales in Europe, and what are the reasons? How has market share changed?

A: European consumption is polarized, with stable spending among high-income groups and a tendency towards value-for-money products among low-income groups. Although favorable weather in some regions, it is insufficient to offset macro pressures. Overall market share remains stable, and the company will continue to optimize product portfolio and channel layout.

Q: Has there been further improvement in the governance mechanism of bottlers in emerging markets?

A: The selection of new franchising partners focuses more on capability, willingness, and capital strength, continuing the common governance model in Latin America. New cooperation areas, including India, Africa, and the Philippines, adopt common KPIs and collaborative investment mechanisms to drive synchronized revenue and return growth.