Intel (Minutes): 18A is expected to contribute to profits by the end of 2026

The following is a summary of the $Intel(INTC.US) Q3 2025 earnings call minutes organized by Dolphin Research. For earnings interpretation, please refer to "Intel: Stopping Losses and Recovering! Can the 'American SMIC' Poach TSMC?"

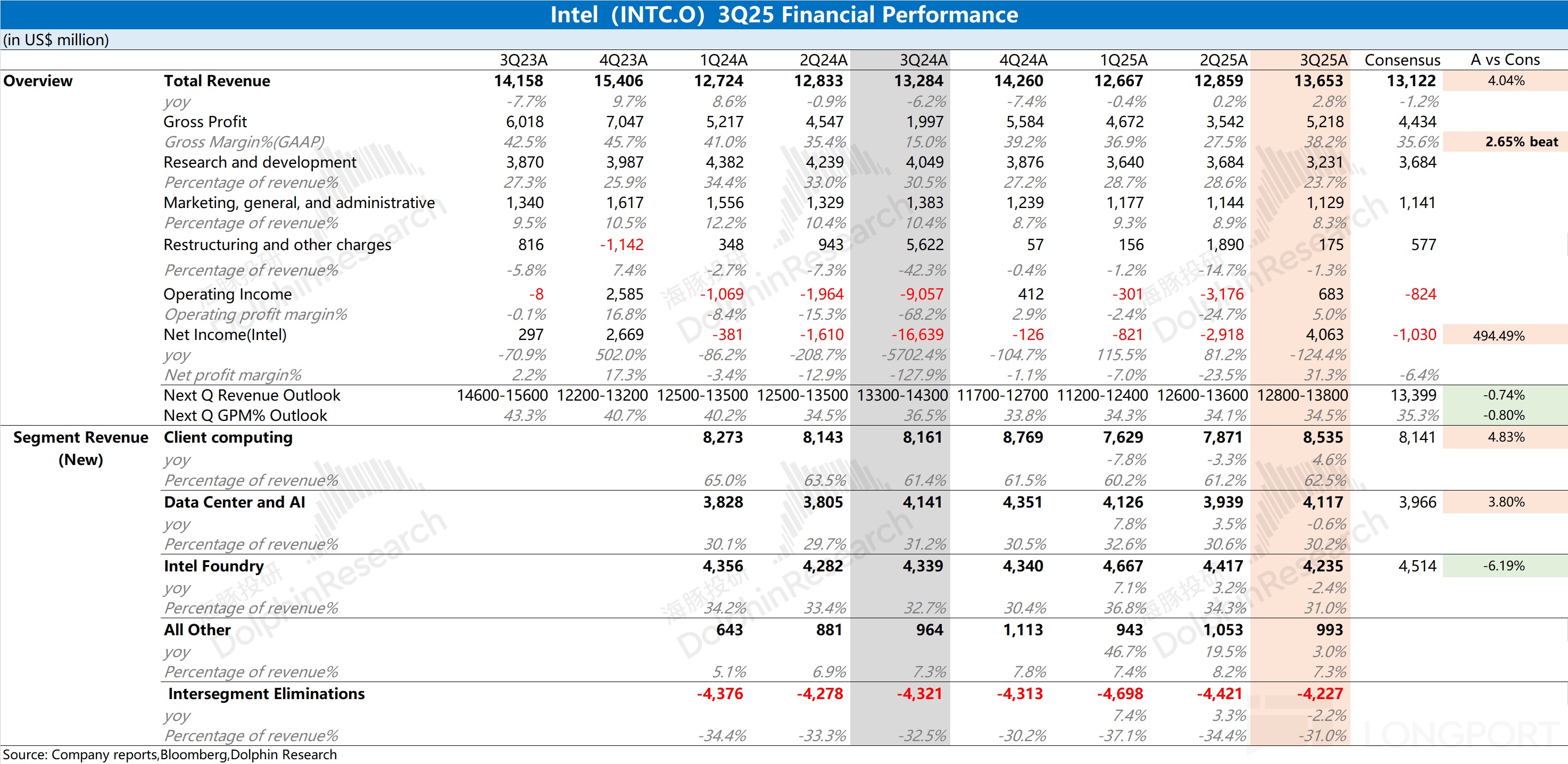

I. Core Financial Data of Intel's Earnings Report

Q3 Financial Data:

Revenue: $13.7 billion, exceeding the upper limit of the expected range, with a 6% quarter-over-quarter increase.

Gross Margin: (Non-GAAP) Gross margin was 40%, 4 percentage points above the performance guidance. This performance was driven by revenue growth, improved product mix, and reduced inventory write-downs, though partially offset by increased Lunar Lake production and early capacity ramp-up of Intel 18A process.

EPS: $0.23, significantly surpassing the breakeven expectation.

Cash and Short-term Investments: Reached $30.9 billion (as of the end of Q3).

Fundraising: Approximately $20 billion in cash, specifically including: $5.7 billion from U.S. government grants, $2 billion from SoftBank Group investment, $4.3 billion from Altera acquisition settlement, $900 million from Mobileye equity sale, $5 billion investment from NVIDIA (expected to complete by the end of Q4)

Simultaneously repaid $4.3 billion in debt.

Q3 operating cash flow was $2.5 billion; total capital expenditure was $3 billion, with adjusted free cash flow being a positive $900 million.

Segment Performance:

Product Revenue: $12.7 billion, a 7% quarter-over-quarter increase.

CCG Business Revenue: $8.5 billion, an 8% quarter-over-quarter increase.

PCAI Revenue: $4.1 billion, a 5% quarter-over-quarter increase.

Product Division Operating Profit: $3.7 billion, accounting for 29% of revenue.

Foundry Business: Revenue reached $4.2 billion, a 4% quarter-over-quarter decrease. Intel's foundry business operating loss was $2.3 billion, improving by $847 million quarter-over-quarter.

Other Business Income: Reached $1 billion, a 6% quarter-over-quarter decrease (mainly due to Altera being excluded from consolidated financial statements starting September 12), with Altera business contributing $386 million.

Future Performance Guidance:

Q4 revenue range is $12.8 billion to $13.8 billion (median forecast roughly flat compared to the previous quarter). Expected gross margin (non-GAAP) is approximately 36.5%. The tax rate is 4%. Earnings per share are $0.08 (based on non-GAAP).

Capital Expenditure: Net capital expenditure for 2025 (total capex minus disposed fixed assets, etc.) is approximately $18 billion. Plans to deploy over $27 billion in total capital expenditure in 2025 (a significant increase from $17 billion in 2024).

II. Intel Management's Views

Performance and Liquidity: Fourth consecutive quarter of performance improvement, with revenue, gross margin, and earnings per share all exceeding expectations. Cash position and liquidity significantly improved, benefiting from government funds, strategic investments, and asset monetization.

Government Support and Strategic Positioning: Gained trust and support from the U.S. government, highlighting its strategic position as the only U.S. semiconductor company with advanced logic chip R&D and manufacturing capabilities. Supports the government's vision to revitalize semiconductor production.

Operational Efficiency and Capacity Challenges: Completed company streamlining as planned, optimizing talent structure and management levels, with increased company vitality and collaboration efficiency after employees returned to work. Capacity for Intel 10 and Intel 7 processes did not fully meet Q3 demand.

AI Strategy and x86 Core: The AI revolution is still in its early stages, and Intel will play a more important role, with the core x86 business remaining crucial in the AI era, driving demand for new architectures and powering traditional computing. With the world's largest x86 installed base, it has advantages in compatibility, security, and flexibility, especially suitable for edge inference.

Partnerships and Engineering Execution: The collaboration with NVIDIA is exemplary, jointly creating cross-generational products to accelerate AI adoption. Established a central engineering group to integrate horizontal functions, enhancing collaboration efficiency in foundational IP development, test chip design, and other areas. Will expand ASIC and design services business to provide customized chip solutions for external customers.

Product Roadmap

Client: Plans to launch the first Panther Lake product by the end of the year; Arrow Lake shipments continue to grow; Nova Lake will enhance competitiveness. The PC market is expected to continue growing in 2025.

Server/AI: AI workloads drive device upgrades and capacity expansion; strong demand for Granite Rapids can significantly save total cost of ownership and power consumption. Committed to making Intel the preferred platform for AI inference, with plans to launch a new generation of inference-optimized GPUs annually.

Foundry Business:

Intel 18A process is progressing steadily, with Panther Lake products launching within the year; Fab52 mass production plant is fully operational; accelerating 18AP R&D; the 18A series will support at least the next three generations of products.

Advancing Intel 14A process development. Advanced packaging business (such as EMIB) is progressing smoothly.

Investment strategy is prudent, focusing on capacity and scalability, only increasing capacity when external demand commitments are obtained.

Confident in long-term opportunities in the foundry market, with AI computing power growth driving demand.

III. Q&A

Q: This quarter you announced numerous partnerships and strengthened the balance sheet, and the tone on foundry progress in the opening remarks sounded more confident. Is this confidence derived from these partnerships and investments, or certain technological advantages?

A: Partnership announcements are one reason, such as SoftBank building AI infrastructure, which will require more capacity on the foundry side.

But more importantly, we have made solid progress on the technology front. 18A and 14A are progressing well, with yield performance becoming more predictable. For 14A, we are working with multiple customers based on milestones and have seen improvements in yield, performance, and reliability.

Additionally, advanced packaging has seen significant demand from key customers on the cloud service and enterprise side. Overall, we are building long-term trust with customers and focusing on recruiting top talent to drive process technology improvements.

Q: Can you outline some favorable and unfavorable factors affecting the 2026 gross margin? The biggest improvement seems to have to come from the foundry business's gross margin, is that the main driver? What specifically drives it? As foundry gross margin rises, will it have any impact on Intel's product division's gross margin?

A: First, please note that Altera will no longer be consolidated in the statements in 2026, and it contributed to the gross margin in 2025, which is expected to bring about a 1 percentage point headwind to the gross margin. Still believe in a 40% to 60% gross margin pass-through rate, but this range is large and largely influenced by the product mix. For example, Lunar Lake will be an important component in the first half of the year, but it is a profit-dilutive product for us.

Similarly, Panther Lake, while a great architecture in the long run, has higher initial costs due to the use of internal advanced processes, so it will also dilute profits in the first half, but will improve as the year progresses. Foundry business gross margin should indeed improve. Part of the reason is that economies of scale will bring benefits, and as we move to more advanced process combinations like 18A, and even Intel 3, these products have better pricing and cost structures, and their gross margins will be contributive. The extent of gross margin improvement will largely depend on the actual changes in the product mix throughout the year.

Q: Your company tends to invest only after obtaining customer commitments. Can you talk about the progress of these conversations? From the customer's perspective, when making commitments, do they expect capacity to be pre-built? Is there a "chicken or egg" problem with these investments? How do you conduct these conversations?

A: In the foundry area, we are engaging with multiple customers. This is a service industry, and you must have the right IP, which is why the company established the central engineering group, aiming to integrate the necessary IP to meet customer requirements. The best way is to demonstrate performance and yield, providing test chips for customers to verify, so they can start deploying their important production wafers and rely on us, thus driving success together. In terms of potential investments and collaborations, we are discussing based on different customers' different needs. Customers understand that it takes time from capital input to output. Therefore, we hope to obtain firm customer commitments in a timely manner to deploy capital and meet demand. Considering the capital expenditure investments we have already completed, we are currently in a relatively favorable position. We have a large amount of assets and "assets under construction" on our books, having made significant investments in capacity infrastructure.

Therefore, we do see a clear path to providing a considerable scale of supply to external foundry customers using existing resources. Frankly, by utilizing assets under construction and reusing existing equipment, we have flexibility. Obviously, if things progress well, we may consider making more investments faster, but we are confident in being able to handle various situations.

Q: Regarding server CPUs and other CPU supply constraints, we have seen this situation in the market. But your business only grew 5% year-over-year. I want to know, where exactly does the shortage come from? Is there higher demand that you cannot meet, or did some process transitions you managed lead to this situation? I do see market tension, so I'm not questioning, just curious about how you view the root of the shortage and how it will be resolved.

A: The shortage issue is almost across all our businesses. We are indeed very tight on capacity for Intel 10 and Intel 7 processes. Obviously, we do not intend to add more capacity to these processes. Therefore, as demand grows, we are constrained.

To some extent, we are consuming inventory to cope. At the same time, we are also trying to "shape demand," guiding customers to other products. Even aside from the specific challenges our foundry business faces, there are other shortage issues, such as the widely reported substrate shortage.

Clearly, I think on the demand side—at the beginning of the year, many industries were very cautious, but now it seems that this year's situation will be stronger, and this momentum is likely to continue into next year. I think everyone is working hard to cope with this situation.

Q: How will the supply shortage develop? Will we see improvement in the first quarter of next year?

A: The shortage situation is expected to peak in the first quarter. This is because we can still rely on some inventory support in the third and fourth quarters and fully utilize factory capacity. After entering the first quarter, we will no longer have this buffer advantage. Given that supply will be very tight, we may find it difficult to reverse the normal seasonal trend. We are managing by adjusting the capacity of small core markets and client products to more broadly meet the needs of clients, especially in the server field. After the first quarter, we expect the situation to begin to improve and gradually resolve the shortage issue in the following period. Regarding the details of the first quarter, we expect to provide more specific explanations in January.

Q: Considering that investments from the U.S. government and NVIDIA have improved the cash position, how have your thoughts on capital expenditure or product business investment changed?

A: Our current financial position is good. For cash use, our top priority is deleveraging. This quarter we have repaid billions of dollars in debt and will continue to address debt maturing next year. In terms of capital expenditure, this provides us with flexibility, but we will maintain high discipline. We will strictly decide based on demand, needing to see clear and credible customer demand signals. If demand does exist, we will certainly increase capital expenditure accordingly.

In terms of operating expenses, we still consider $16 billion to be a reasonable level for next year. However, we are continuously optimizing the specific allocation of this $16 billion to drive the best growth and investor returns and will adjust accordingly.

In addition, we will maintain discipline in the ratio of operating expenses to revenue to enhance operating leverage. But we also see investment opportunities that can bring substantial returns, and we will decisively make such investments.

Q: Regarding the gross margin trend of the 18A process, you mentioned that yield is in good condition and improving. How does the current yield level of 18A compare to historically successful process nodes? How should we consider its contribution in the first half of the year?

A: Frankly, 18A is a whole new area for us. The current yield is sufficient to meet supply demand, but it has not yet reached the ideal profit margin level. We expect to reach this level by the end of next year and are confident in reaching industry-recognized yield levels the year after.

It should be added that the start of the 14A process is very smooth. When compared at the same maturity stage as 18A, 14A performs better in terms of performance and yield. We have had a better start on 14A and need to continue to maintain this progress.

Q: Regarding supply constraints, AI has driven demand for servers and PCs, but customers seem to prefer older products rather than your new AI products. How do you encourage customers to switch to new products? Considering you even cut the capacity of old products.

A: Saying AI products are underperforming is a misunderstanding. Our AI business achieved double-digit growth quarter-over-quarter, and AI PC shipments are expected to reach the target range of about 100 million units by the end of this year, progressing well. Of course, demand for products from older process nodes is indeed strong, which may exceed expectations. We need to continue working with independent software developers to mature the AI application ecosystem on the PC side, which takes time. Meanwhile, the demand for device upgrades brought by Windows system updates is stronger than expected, not just driven by AI PCs, but products like Raptor Lake are also benefiting, and we see growth momentum in this part of the market as well.

Q: Regarding 18A, I heard two statements: one is that yield will not be ideal until at least the end of next year, and the other is that there will be no significant increase in 18A capacity next year. How can the latter be true if you are to mass-produce Panther Lake? Did I hear wrong?

A: Regarding capacity, my statement is relative to the capital expenditure plan—we will not add additional capacity for 18A next year. But of course, we will gradually increase the output of 18A throughout next year.

Regarding yield, I did not say that the yield situation of 18A is bad. They are currently meeting our set annual targets. But to fully achieve profit contribution from 18A in the cost structure, we still need to further improve yield—this is a process that every process technology goes through. I think it will indeed take the whole of next year to achieve the goal.

Q: In your prepared remarks, you mentioned fixed-function computing and possibly supporting more ASICs. Can you provide more background information? Is this aimed at potential foundry customers, or is it about products? If it's about products, what types of applications do you expect to support with custom chips?

A: First, the central engineering group I mentioned is driving ASIC design, which will be a good opportunity to enhance and expand the influence of our core x86 IP. We will develop specific-purpose chips for some system manufacturers, cloud service providers, and customers. Meanwhile, our foundry and advanced packaging business will also assist in meeting customer needs. Overall, artificial intelligence will drive significant growth, especially in deepening the application of Moore's Law. This will strongly enhance our x86 business, and our building of complete ASIC design capabilities is to seize opportunities and meet customers' specific needs.

Q: Given the significantly improved balance sheet situation compared to three months ago, is there any change in the decision to possibly abandon the 14A process?

A: Since the last quarter, our collaboration with customers on the 14A project has significantly increased. We are in-depth communication with customers to better serve them. Customers clearly see the huge market demand and believe that Intel must maintain strong capabilities in the 14A process. Meanwhile, we are also attracting some key process technology talents, which will strongly drive success. These developments give me greater confidence in advancing the 14A project.

Q: Can you provide the latest progress on the collaboration with NVIDIA, including the product timeline? Have you received feedback from customers about the importance and timeline of the collaboration, or any other information?

A: This is a very important collaboration with NVIDIA. It is a multi-generational deep engineering collaboration, combining Intel's leadership in CPU and x86 with NVIDIA's strengths in AI, accelerated computing, and its NVLink technology, aiming to jointly create a new generation of AI-optimized products in the data center and PC fields. We are excited about this incremental opportunity to expand the total addressable market. This collaboration is particularly special for us because it is not about competing for the existing market, but an incremental opportunity to expand the total addressable market. This is a great opportunity for us.

Q: You mentioned that Intel's AI strategy will focus on exploring the inference market and see room for development in Intel solutions. Is this strategy more focused on collaboration? Is there specific Intel IP? Or is it a more neutral collaboration model to jointly explore the market with existing manufacturers?

A: AI indeed drives huge growth, and we are determined to participate. This market is still in its early stages, providing us with significant opportunities.

Our strategic focus is on revitalizing the x86 architecture, developing customized CPUs and GPUs for new AI workloads, particularly focusing on high-efficiency intelligent system management. This will form a new computing platform choice and be applied at the system and software levels.

In terms of implementation path, we will establish extensive partnerships with traditional enterprises and emerging companies driving these changes.

Q: In a high fixed-cost business facing supply constraints, it is uncommon for gross margins to be below 40%. If Intel 10 and 7 high-cost processes are no longer used in the future, and the yield issue of 18A is resolved, how will gross margins normalize?

A: Gross margins are affected by two key dynamics. First is the process cost structure: we have very high costs on old processes (like Intel 10 and 7), with the foundry business even in a negative gross margin state; while new processes (like Intel 3, 18A, and 14A) have better cost structures, transitioning to these processes will significantly drive gross margin improvement.

Secondly is product competitiveness: in the client field, our product performance and competitiveness are acceptable, but the cost base still needs optimization. In the data center field, not only is our cost structure not ideal, but performance competitiveness is also lacking, resulting in not being able to obtain the expected profit margins from customers. This is a process that requires years of effort to improve.

Additionally, the intensive launch of multiple new process nodes has brought huge startup costs, which have compounded the current gross margin. As the future process R&D pace (especially after entering 14A) normalizes, this cost pressure will gradually ease. Overall, with improved product competitiveness, process mix migration to more advanced nodes, and reduced startup costs, gross margins are expected to achieve substantial improvement.

Q: You did not update the release time of Diamond Rapids last time, and the entire roadmap is under review. But you seem quite optimistic about Coral Rapids, can you update us on the data center roadmap?

A: Regarding the data center roadmap, Diamond Rapids has received stronger positive feedback from hyperscale customers. Meanwhile, we are focusing on the new product Coral Rapids, which will include SMT (Simultaneous Multithreading) and modular processing functions to drive higher performance. We are currently in the definition stage, after which we will formulate and execute a specific roadmap.

Q: Besides the NVLink integration strategy, recent reports mentioned the possibility of using Gaudi in the NVIDIA technology stack to handle specific inference workloads. Is this just a starting point? Will there be more integration beyond NVLink in the future?

A: NVLink is the core technology hub connecting x86 and GPU. At the AI strategy level, we are defining the previously mentioned Crescent Island architecture while planning a new product line focused on generative AI, physical AI, and inference fields. Please stay tuned, we will continue to update progress.

Q: Can you update us on the expectations for non-controlling interest (NCI) spending, especially when looking ahead to 2026?

A: For 2026, we expect non-controlling interest spending to be around $1.2 billion to $1.4 billion, which is a reasonable estimate range. We are focusing on this expenditure and will strive to minimize it as much as possible.

Risk Disclosure and Statement of this Article: Dolphin Research Disclaimer and General Disclosure