An in-depth analysis of Lemonade (NYSE: LMND) for long-term investment

Request for GPT-5 Pro Reasoned for 21m 1s

One-Sentence Conclusion $Lemonade(LMND.US)

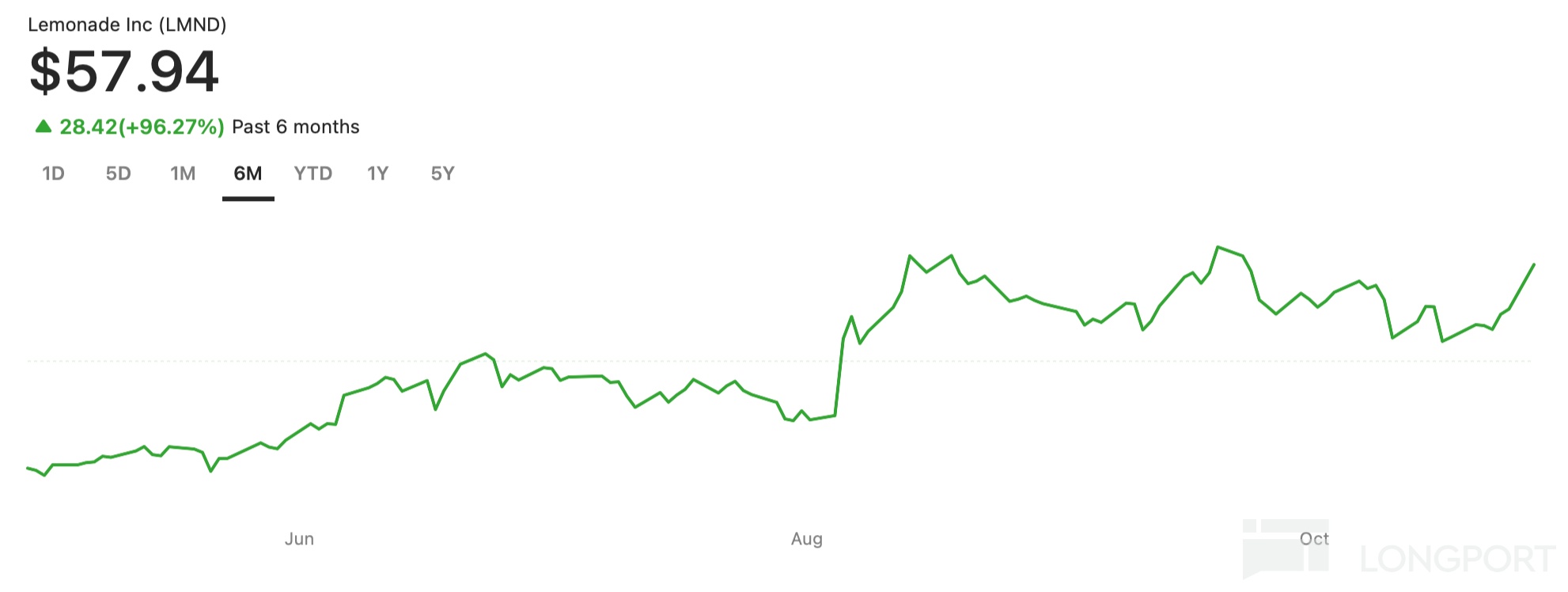

Lemonade is transitioning from a phase of "high growth but highly reinsurance-dependent" to one with "more retained risk and greater profit flexibility": core operational metrics (loss ratio, gross margin, cash flow) continue to improve, while the reinsurance cession ratio has dropped significantly from 55% to 20%, which will enhance revenue retention and medium-to-long-term profit leverage; however, this also implies greater earnings volatility, and the valuation already reflects certain expectations (approximately 4.5× 2025E sales/P/S, 3.23× EV/S). If you recognize its AI-driven long-term advantages and can tolerate volatility, it is more suitable to build a medium-to-long-term position via phased/dollar-cost averaging; if you prefer predictable current profits and low volatility, caution is advised. Price and market cap are shown in the chart above.

Company & Business Snapshot (Key Points)

Products/Regions: Offers renters, homeowners, pet, auto, and term life insurance in the U.S.; operates in Germany, France, the Netherlands, and the UK in Europe. European IFP (in-force premium) grew >200% YoY in Q2 to $43 million, with a gross loss ratio in the "low 80%" range, and management highlights the rate-filing-exempt environment in Europe as conducive to rapid pricing/underwriting iterations.

AI & Automation: Long represented by "Maya" (customer acquisition) and "Jim" (claims); industry reports indicate Lemonade has automated ~55% of claims processes, with 95% of claims filed digitally.

Auto Insurance Progress: Q2 marked the second consecutive quarter of IFP growth (+12% QoQ) in auto insurance, with telematics data introduced earlier driving ~60% conversion rate improvement (vs. Q4 baseline). The auto gross loss ratio has improved to ~82%.

Financial Health Check (Q2 2025 & Full-Year Guidance)

Scale & Growth:

IFP: $1.083 billion, +29% YoY; Customer Count 2.69 million, +24% YoY; Premium per Customer $402, +4% YoY.

Revenue: $164.1 million, +35% YoY; Gross Profit $64.3 million, +109% YoY; Gross Margin 39%.

Underwriting Quality:

Consolidated (Key Disclosed Metric): Gross Loss Ratio (GLR) 67% (79% YoY); Net Loss Ratio (NLR) 69%; TTM GLR 70%. By segment: homeowners ~60%, pets 70%, auto 82%, Europe 83%.

Profit Trajectory & Cash Flow:

Net Loss $43.9 million (narrowed YoY); Adjusted EBITDA loss $40.9 million; Adjusted Free Cash Flow +$25 million (positive for the quarter). The company expects full-year 2025 adjusted FCF to be positive and maintains its path to achieve adjusted EBITDA breakeven by end-2026.

Balance Sheet & Equity:

Cash, Equivalents & Investments ~$1.03 billion (as of June 30); ~$277 million is regulated surplus. Debt (Synthetic Agents/CAC Financing) $123.5 million; Outstanding Shares 73.82 million; Shareholders’ Equity $527 million.

Net Cash ~$907 million (= $1.03 billion cash & investments − $123.5 million debt), ~$12.28 per share.

Equity Incentives/Dilution: 2025 SBC estimated at ~$61 million; the equity plan includes an annual 5% evergreen provision. The company terminated unvested Chewy warrants on 2025-04-04, mitigating potential dilution.

Reinsurance Structure & Major Changes (Impact on Profit Flexibility Over Next Two Years)

Major Adjustment: Effective 2025-07-01, the quota share (QS) cession ratio was reduced from ~55% to ~20% (with comparable terms). As QS is a risk-attaching contract, the cession ratio will "linearly" transition from 55% to 20% over several quarters; the company expects the ceded GEP ratio to remain ~45% (aggregate) in 2H 2025. This implies revenue growth will temporarily "outpace IFP" (due to higher retention).

Risk Shields: Beyond QS, the company uses excess-of-loss (XOL) and per-risk structures for catastrophes and large individual claims: XOL covers losses above $50 million per event, up to $80 million; per-risk cedes 100% of losses >$750k to $2.25 million. Note: QS has exclusions/limits for hurricane losses, so catastrophe seasons (e.g., California wildfires, hurricanes) may still cause quarterly volatility.

Interpretation: Reducing QS cession is operationally positive (boosting revenue retention, gross margin leverage, long-term ROE potential) but increases volatility; Lemonade’s confidence in this shift stems from multi-quarter improvements in loss ratios. For long-term investors, this is akin to a **"rite of passage from conservatism to self-sufficiency"**.

Valuation & Comps (As of Today’s Intraday)

Market Cap ~$3.21 billion;

2025 Revenue Guidance midpoint $712.5 million ⇒ P/S ≈ 4.50×;

Enterprise Value (EV) ≈ $2.303 billion ⇒ EV/S ≈ 3.23× (based on guidance and latest price);

Book Valuation: P/B ≈ 6.09× (shareholders’ equity $527 million).

These multiples are significantly higher than traditional P&C insurers on a static basis, but given Lemonade’s transition from outsourced risk to retained profits and AI-driven expense ratio improvements, they align closer to an "insurtech platform" framework. Risks: if seasonal catastrophes or auto inflation resurge, short-term profits may disappoint, compressing valuations.

Bull & Bear Cases

Bull Case

Underwriting Inflection: TTM GLR has declined to 70%; Q2 standalone 67%, with broad-based product improvements, and further room in auto & Europe.

AI & Automation-Driven Operating Leverage: Gross profit +109% YoY, with public case studies showing highly automated claims/acquisition; telematics drives front-end conversion and back-end pricing precision.

Europe’s High Growth, Low-Catastrophe Profile: Q2 Europe IFP >200% YoY, with a rate-filing-exempt regime enabling rapid pricing/model iterations.

Cash & Funding Flexibility: ~$1.03 billion cash & investments + "Synthetic Agents" CAC financing (~80% coverage), with 2025 full-year adjusted FCF expected positive, buffering expansion and transition losses.

Reinsurance Reduction Boosts Profit Leverage: QS drop from 55% → 20% lifts retained revenue and margins (gradually).

Bear Case/Risks

Amplified Volatility: Post-QS reduction, catastrophe quarters or single-line deviations hit the P&L more directly; QS exclusions for hurricanes require reliance on XOL layers for extreme events.

Auto Inflation & Severity/Frequency Uncertainty: Despite telematics gains, auto GLR remains ~82%; repair/medical cost rebounds could slow improvements.

Policy Retention (ADR) Pressure: Q2 ADR 84% (−4pct YoY), attributed to risk-based non-renewals; recovery to 86%+ needs monitoring.

Dilution & Equity Incentives: 2025 SBC ~$61 million; plan includes **up to 5% annual** dilution.

Rich Valuation: P/S, P/B exceed most insurance peers; slower profit delivery may pressure multiples.

Key Tracking Checklist (Next 12–18 Months)

Underwriting Quality:

TTM GLR ≤ 70% and stable;

Auto GLR ≤ 80%; Europe GLR ≤ 80%.

Growth & Retention: **IFP ≥ $1.21–1.22 billion (2025 year-end guidance)** and ADR recovery to ≥ 86%.

Profit & Cash: 2025 full-year adjusted FCF positive, adjusted EBITDA on track for 2026 breakeven; net cash remains ample.

Reinsurance Transition: Monitor QS cession as % of GEP trending toward ~20% by 2026 and its revenue/margin impact.

Equity & Dilution: Track share count changes, SBC, and Synthetic Agents renewal terms/costs.

Valuation & Position-Building Approach (For Reference, Not Advice)

At current market cap and 2025 revenue guidance, LMND trades at ~4.5× P/S, 3.23× EV/S, 6.09× P/B. Under an "execution bet" framework, anchor on underwriting quality/cash flow over GAAP profits.

Approach:

If bullish long-term and tolerant of volatility: phased/DCA (scaling in as KPIs like GLR and FCF improve).

If cautious: await post-QS transition volatility and auto/Europe loss ratio validation before allocating.

Ideal Investors: Those confident in AI-driven efficiency gains and insurtech adoption, with higher risk tolerance.

Near-Term Catalysts

Q3 2025 Earnings: Expected 2025-11-05 (ET morning call). This will be a key window to assess the new reinsurance framework’s (first full quarter) real-world impact.

Key Sources & Further Reading

Q2 2025 Shareholder Letter (IFP/revenue/loss ratios/guidance, reinsurance transition, Europe & auto breakdowns).

2025-06-30 10-Q (cash & investments, debt, equity, reinsurance/XOL details, equity plan, Chewy warrants).

Reinsurance Renewal Notice: QS cession 55% → 20%, with comparable terms.

Synthetic Agents (CAC Financing): ~80% CAC coverage, extended with higher capacity.

AI/Automation: Claims automation and digital filing penetration.

Disclaimer: This research is for informational purposes only and not investment advice. Share your risk appetite, horizon, and target allocation, and I can turn the "Key Tracking Checklist" into a scorecard for quarterly reviews.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.