GTC Conference: Next Year's Shipment 'Blockbuster', is NVIDIA‘s Limit Really “Sky”?

I. Key Points of the GTC Conference

1. Strategic Cooperation between NVIDIA and Nokia, with a $1 billion equity investment in Nokia. A new product series "NVIDIA ARC" was launched, which Nokia will use for future base stations to upgrade 6G and AI capabilities;

2. Release of NVQLink Interconnect Architecture and CUDAQ Platform, directly connecting GPU supercomputers with QPUs (Quantum Processing Units), laying the groundwork for quantum computing processors;

3.$NVIDIA(NVDA.US) is collaborating with the U.S. Department of Energy to build the largest AI supercomputer in the U.S. and has launched the Bluefield-4 DPU processor to support AI factories. NVIDIA's Blackwell GPU is now in full production in Arizona;

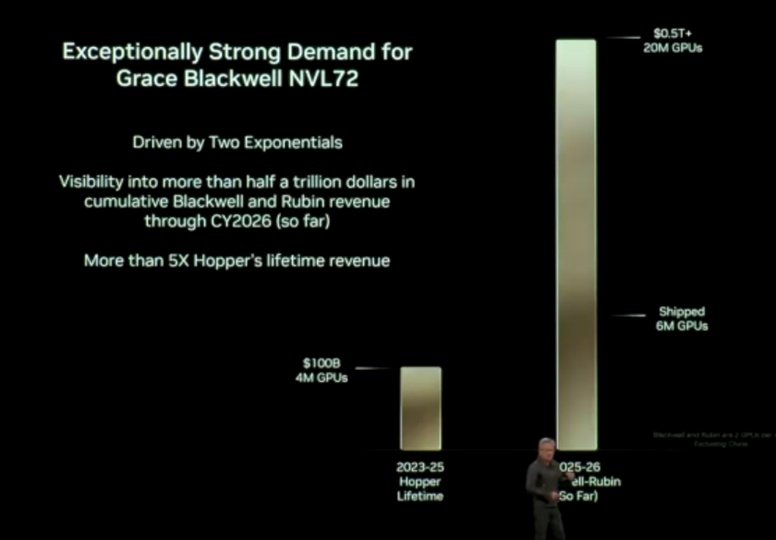

4. Focus Information: Blackwell has currently delivered 6 million units, and it is expected that Blackwell+Rubin will generate $500 billion in revenue and ship 20 million units over the next five quarters (by the end of 2026), which is five times the shipment of the Hopper lifecycle.

II. Dolphin Research's Overall View

The most "surprising" aspect of this GTC conference is that NVIDIA provided specific guidance for its data center GPU business.

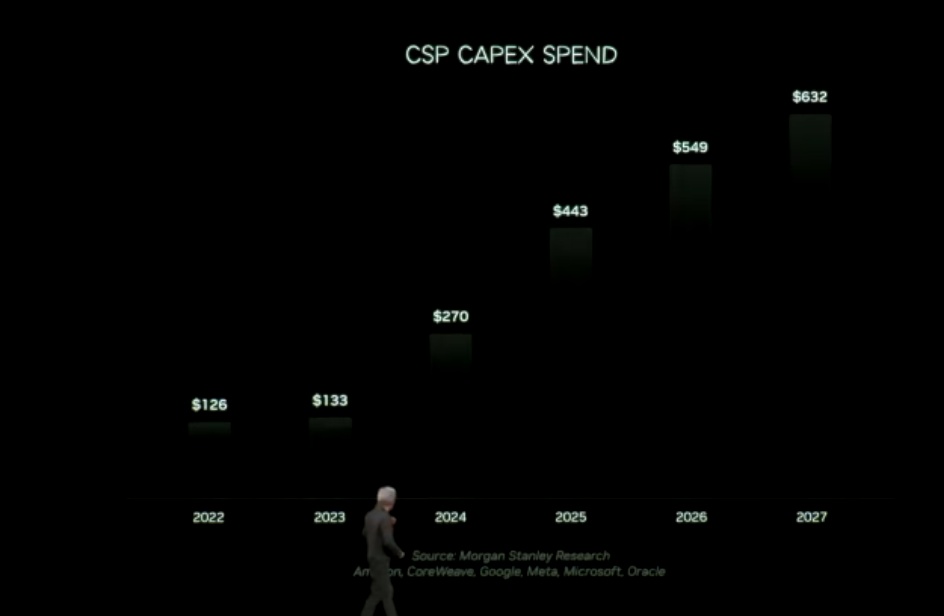

Compared to the "cautious attitude towards the 2026 market target" during NVIDIA's small-scale exchange in early September, the guidance this time has significantly improved, mainly due to Open AI's "boost" to the overall market AI Capex during this period.

At this GTC conference, the company directly provided guidance that "Blackwell+Rubin" will ship a total of 20 million units by the end of 2026, bringing in $500 billion in revenue. As of now, Blackwell has shipped 6 million units, leading to the projection that 14 million units will be shipped over the next five quarters, generating nearly $350 billion in revenue.

NVIDIA's guidance of 20 million units shipped by the end of 2026 for Blackwell+Rubin is significantly better than the market expectation of 15 million units, roughly beating it by 30%.

Since the current revenue from the company's data center GPU is primarily from Blackwell, with a small amount of the H series mainly supplied to the Chinese market, assuming zero revenue from the Chinese market, NVIDIA's Blackwell+Rubin essentially represents the future revenue of the company's data center GPU.

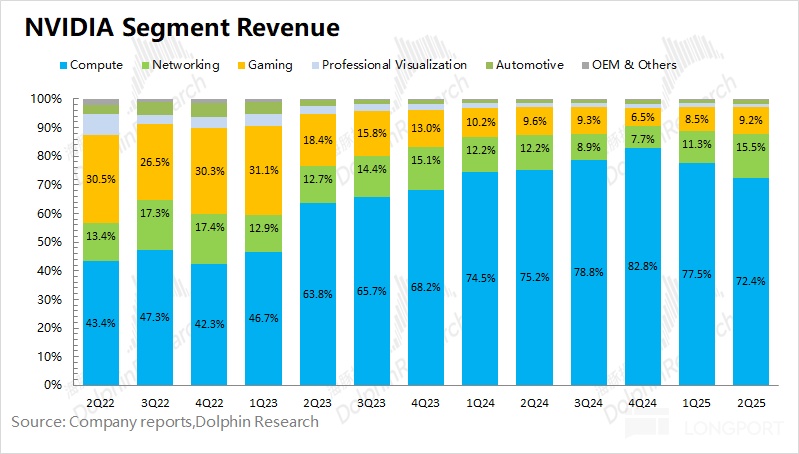

From NVIDIA's business perspective, the data center business has become the company's largest revenue source, accounting for nearly 90%. The data center business can be further divided into computing revenue and networking revenue. The aforementioned $350 billion in data center GPU revenue falls under computing revenue. By analyzing the ratio between computing revenue and networking revenue, it can be inferred that the company's data center revenue over the next five quarters will exceed $420 billion.

Driven by AI demand, the weight of the data center business in the company's performance has risen to over 90%. The company has also provided guidance on GPU shipment expectations, essentially offering a performance outlook for the future.

NVIDIA's current market value ($4.88 trillion) roughly corresponds to a PE ratio of 22 times the company's net profit for the 2027 fiscal year (assuming revenue +76%, gross margin of 75.6%, and tax rate of 15.3%). The current valuation level roughly corresponds to the expectation of a slowdown in the company's performance growth in the 2028 fiscal year. If the company and the industry's AI Capex release another "major positive," it will be beneficial to enhance the company's future performance growth and valuation level.

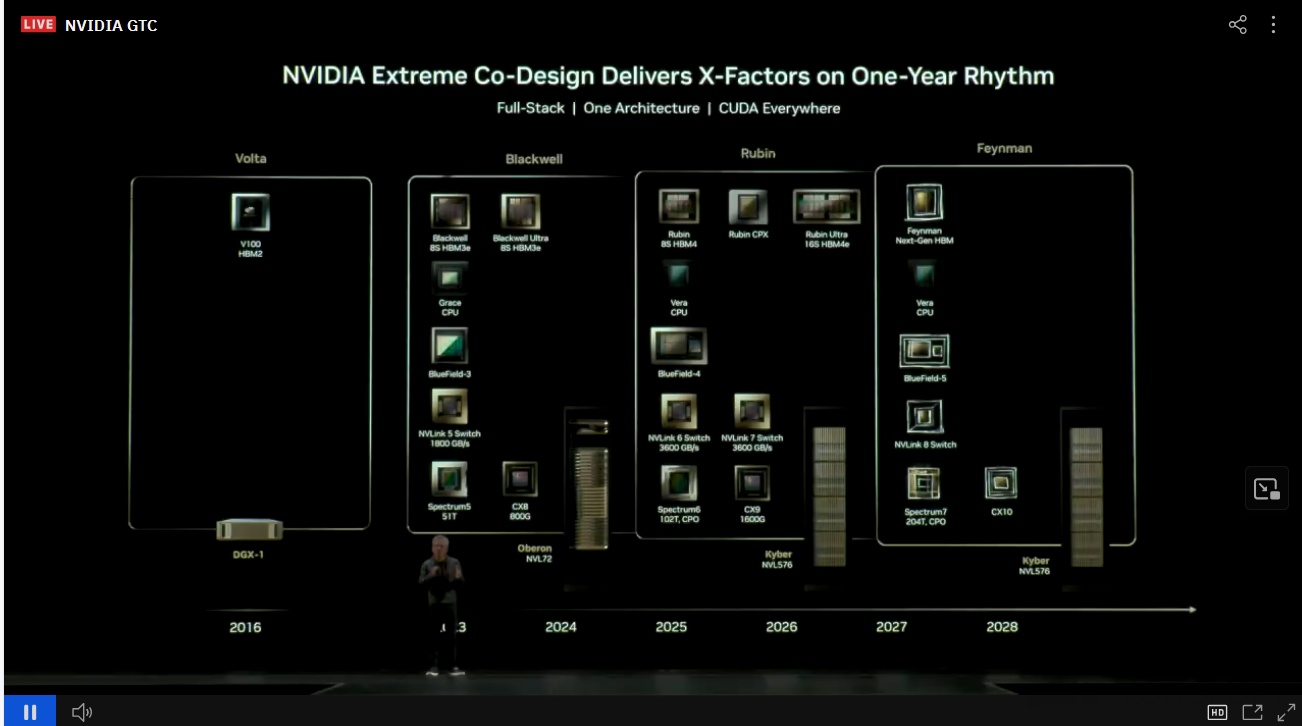

NVIDIA remains a strong leader in the AI chip field. The company has once again provided a future roadmap, with "Blackwell-Rubin-Feynman" roughly forming the main framework of the company's AI chips for the next 3-4 years, demonstrating the company's product iteration capability. The company's Rubin chip will begin mass production in early 2026, forming the main source of the company's revenue next year along with Blackwell.

In fact, before this GTC conference, Open AI recently finalized cooperation with a series of companies, directly raising market expectations for AI Capex, including NVIDIA (10GW), AMD (6GW), Broadcom (10GW), Oracle (4.5GW), and others, totaling 30GW in order demand. [For detailed content on Open AI, you can read All in the Same Boat, Is OpenAI a Gem or a Curse?]

In this GTC conference, NVIDIA directly provided shipment expectations for the next five quarters (14 million units corresponding to $350 billion in AI GPU revenue) and a roadmap for the next 3-4 years. Compared to market concerns about Open AI's payment capability, NVIDIA directly provided guidance expectations for next year, more like giving the market a "reassurance pill". Now, NVIDIA, Open AI, and major CSPs are already on the main track of the AI industry. If AI Capex is further expanded, it will drive overall performance and valuation improvement.

<End Here>

Dolphin Research NVIDIA Historical Articles Retrospective:

Hot Topics

October 27, 2025, Open AI's AI Capex "All in the Same Boat, Is OpenAI a Gem or a Curse?"

September 19, 2025, Intel and NVIDIA Cooperation "Intel: Embracing NVIDIA's "Big Leg", Who is the Real Winner?"

September 10, 2025, CPX Conference "NVIDIA: Rubin CPX Debuts! Ready to Compete with Broadcom ASIC"

Earnings Season

September 1, 2025, NVIDIA Small Meeting "NVIDIA (Small Meeting): 2026 Target Relatively Cautious, Market to Reach 3-4 Trillion by 2030"

August 28, 2025, NVIDIA Conference Call "NVIDIA (Minutes): GB300 Already Shipped, Rubin to Mass Produce as Planned Next Year"

August 28, 2025, NVIDIA Earnings Report "NVIDIA: The Universe's Top Stock, Not Explosive Enough is a Sin?"

Risk Disclosure and Statement of this Article: Dolphin Research Disclaimer and General Disclosure