Google's Dramatic Turnaround: From AI 'Sacrifice' to AI 'Trendsetter'

After the market closed on October 29th Eastern Time, Alphabet, the parent company of $Alphabet(GOOGL.US) $Alphabet - C(GOOG.US), released its third-quarter financial report for 2025. Amid the spotlight on OpenAI and the logic of full-stack AI revaluation over the past two months, with limited room for direct recovery and the market urgently needing further reasons for an upward trend, Google delivered impressive results to continue its revaluation journey.

Key Information:

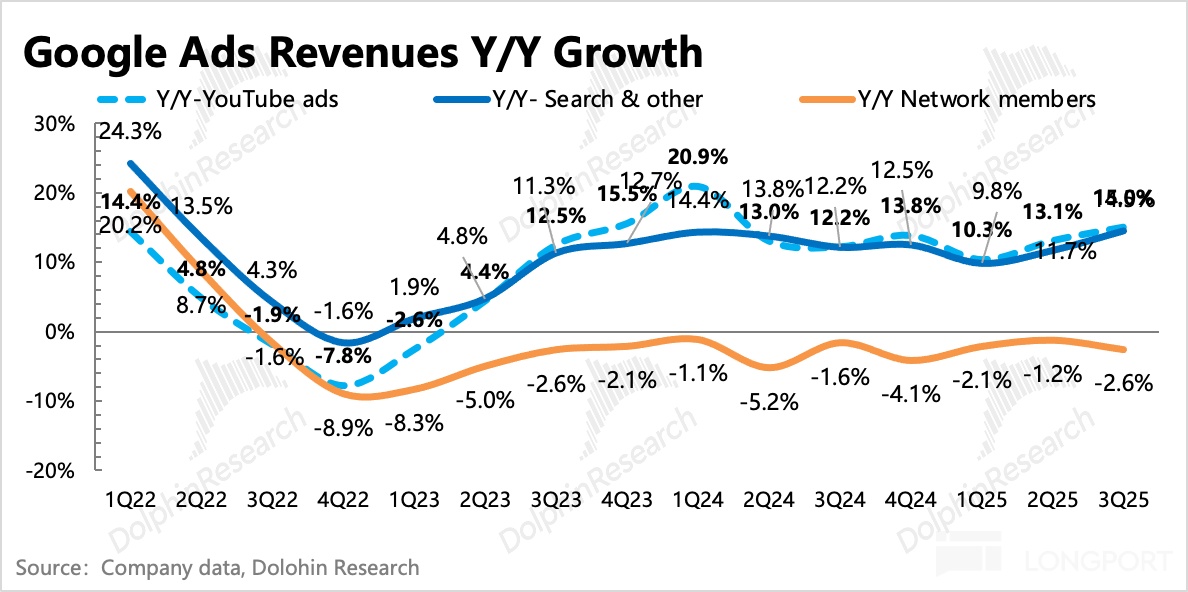

1. Explosive Advertising Performance: In the third quarter, both YouTube and search ads grew by 15%, exceeding market expectations.

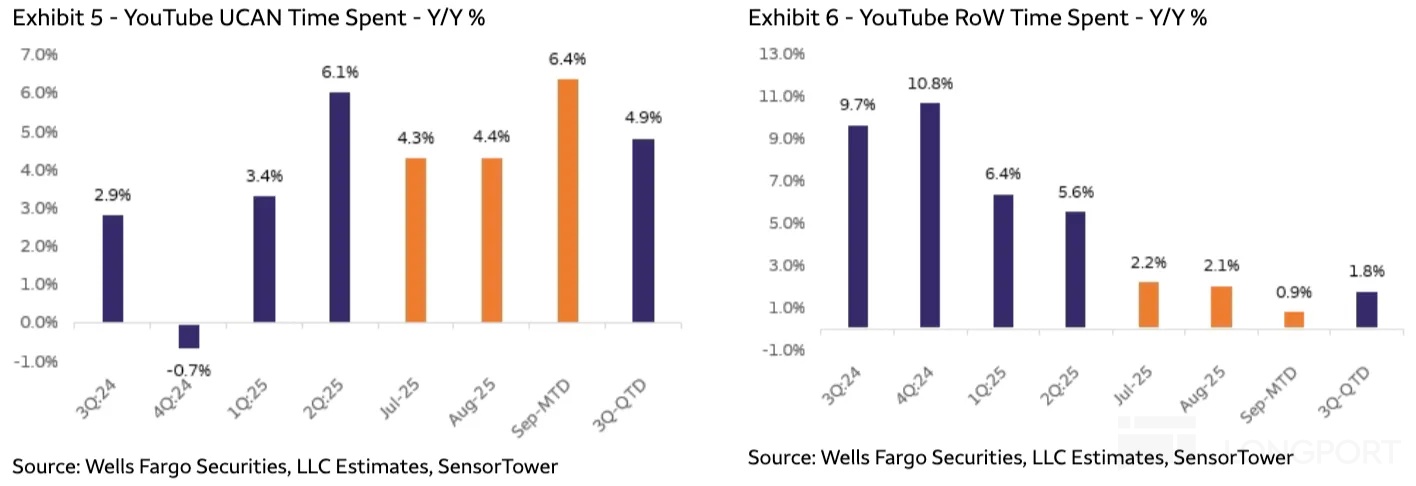

(1) Dolphin Research had some expectations for YouTube ads beating estimates. With user engagement leading the industry, the market only expected a 12% growth, which was indeed conservative. The growth was driven by Shorts ad load rate and AI tools (such as auto-generated ads) penetration.

(2) Surprisingly, search ads not only did not slow down on a high base but accelerated further, indicating no issue of AI erosion. According to research, the growth was mainly driven by AI Overviews and AI Mode increasing search query volume, thereby boosting display volume.

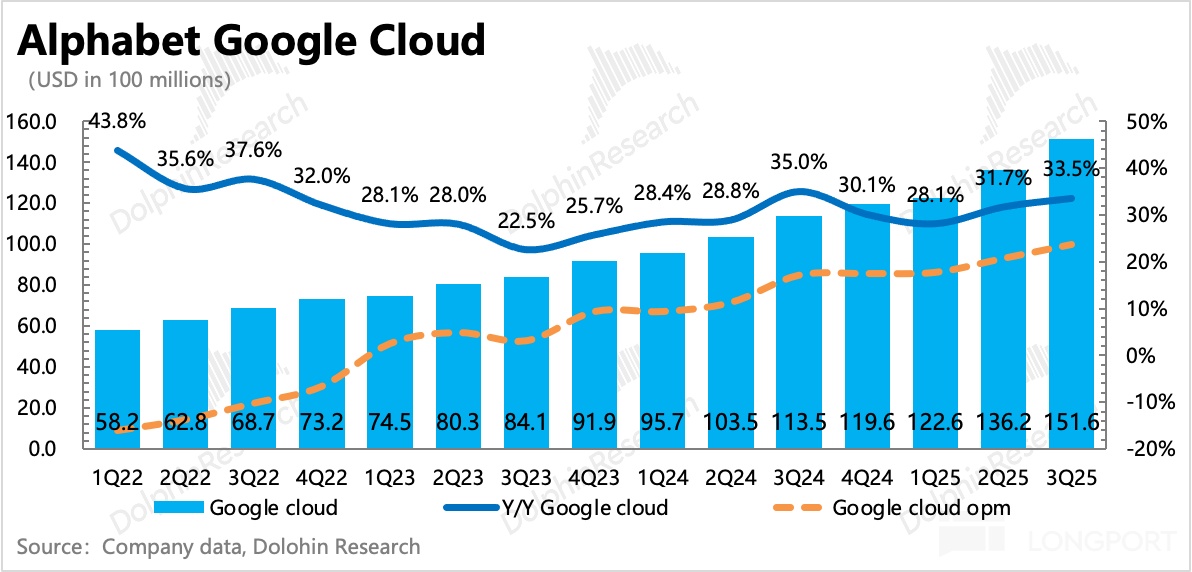

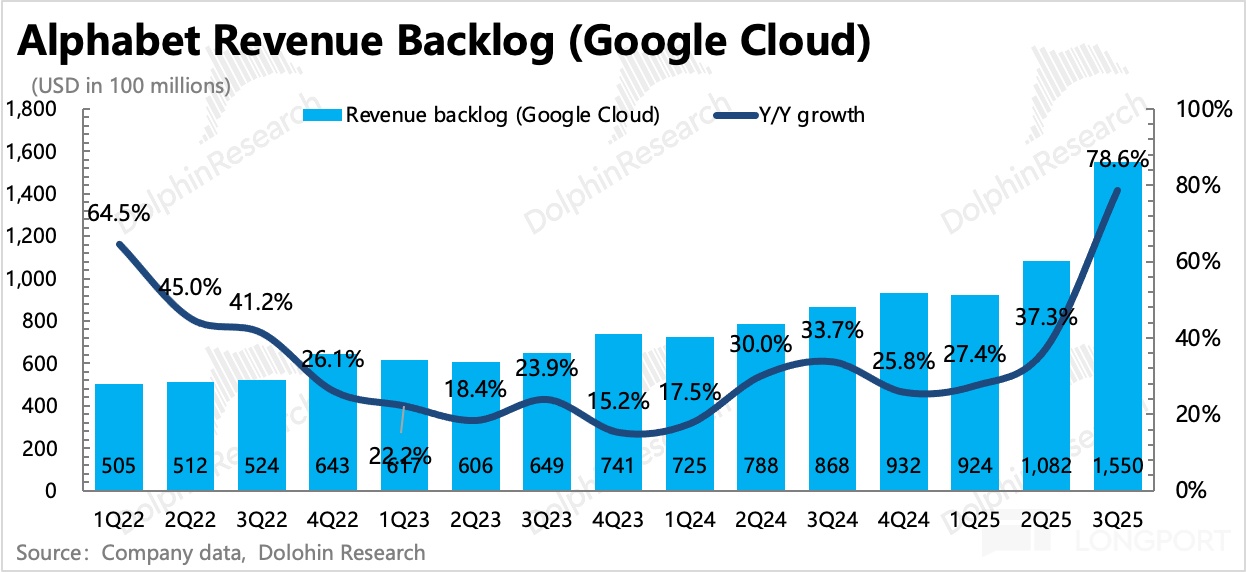

2. Continued Prosperity in Google Cloud: The cloud business now primarily focuses on accumulated unfulfilled orders (Revenue Backlog). As long as order accumulation maintains high growth, future cloud revenue growth can be sustained. As of the end of Q3, accumulated orders reached $155 billion, up 43% year-on-year, with a net increase of $47 billion quarter-on-quarter, excluding the recently revealed $20 billion order from Anthropic. With these order inventories, revenue growth can continue to exceed 30% for some time.

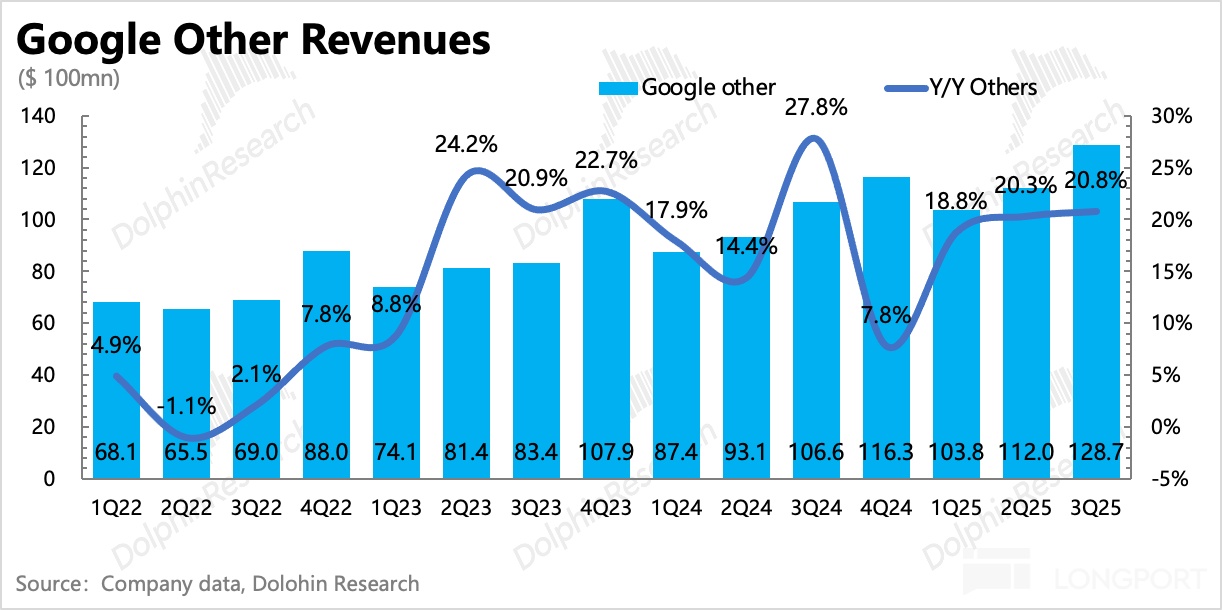

3. Subscription and Other Revenues Remain Stable: Other revenues, mainly from YouTube memberships, Google Play, and Pixel hardware, grew by 21% in the third quarter, not slowing as expected. The company disclosed that the scale of paid subscription users has exceeded 300 million.

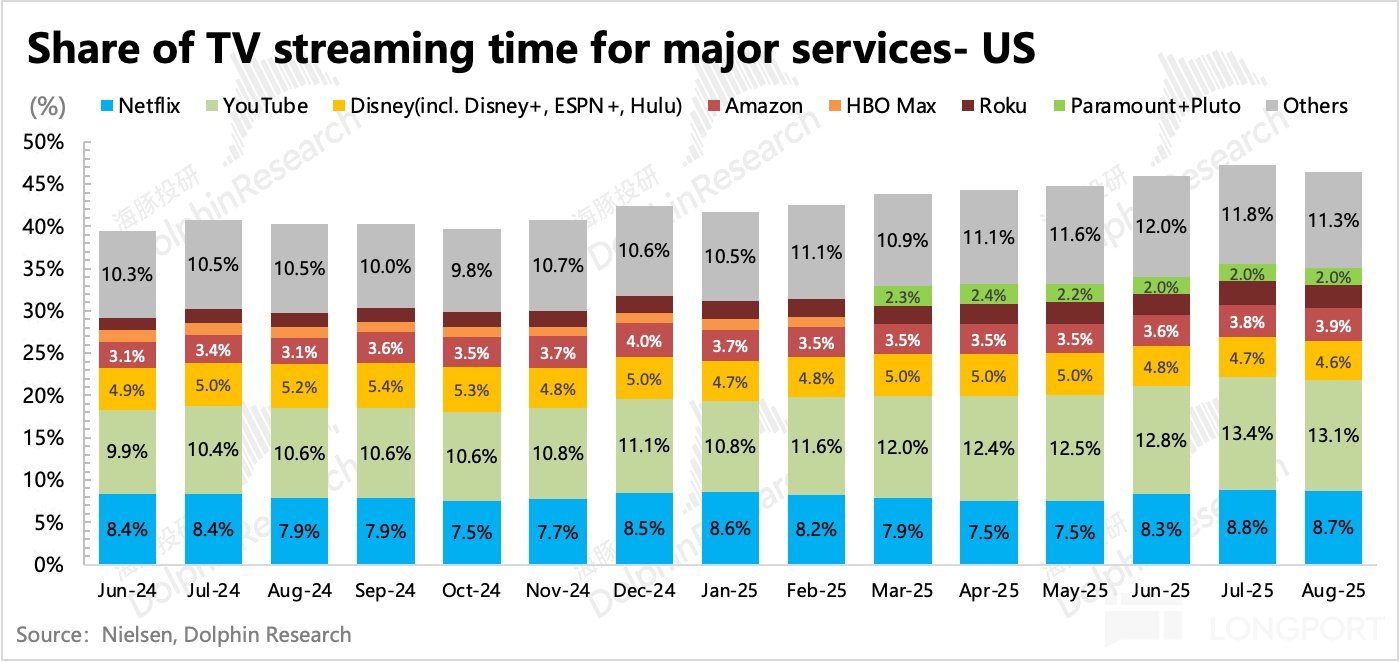

YouTube TV viewing time leads the industry, and market share continues to rise. Music and other content also help drive the expansion of paid memberships. According to institutional estimates, YouTube's paid subscription membership scale has reached 120 million, facing a base of over 2 billion active users, leaving room for improvement in the paid rate.

Additionally, Google One revenue drives other income growth. As Google integrates AI to launch more innovative features, it is expected to continue attracting user adoption.

4. Affiliate Advertising Continues to Decline Slightly: Affiliate advertising can be considered a casualty of the search AI transformation, but Google effectively controlled this impact within a certain range (decline within 5%), with a 2.6% year-on-year decline in the third quarter, thus avoiding damage to the advertising ecosystem.

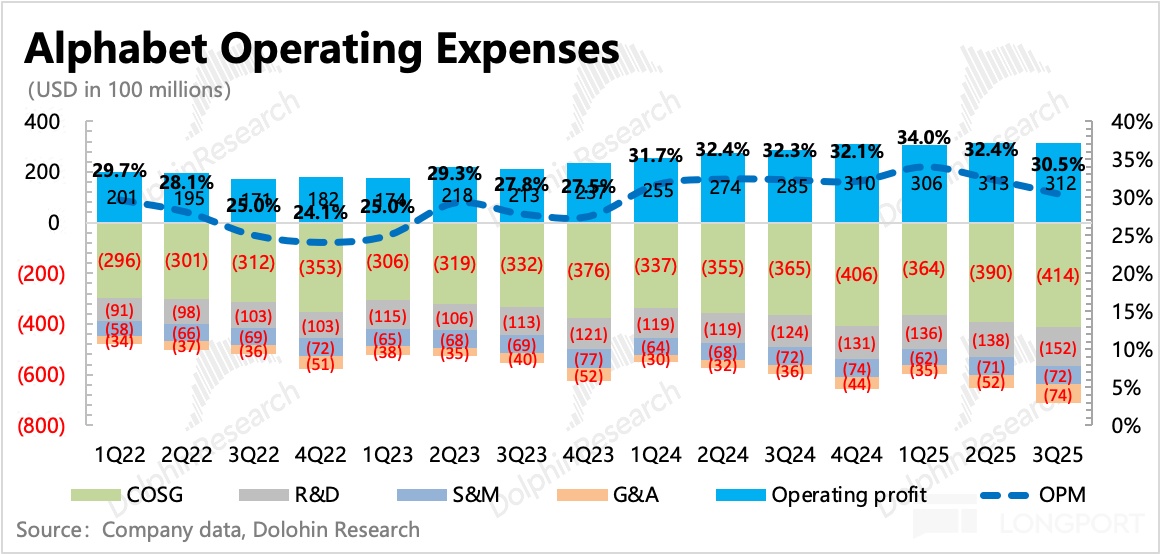

5. Improved Profit Efficiency Excluding Fines: This quarter, a $3.5 billion EU antitrust fine was confirmed, affecting the profit margin by 3 percentage points. Excluding this, the operating profit margin was 34%, with improvements both quarter-on-quarter and year-on-year. The improvement in operating efficiency mainly relied on faster revenue growth, while expenses such as sales and management costs either declined or grew slowly, and costs for R&D personnel and server depreciation continued to expand.

6. Short-term Slowdown in Buyback Efforts: In the third quarter, $11.5 billion was repurchased, a decrease of $2 billion quarter-on-quarter, with $2.5 billion in dividends actually distributed this quarter. Additionally, the company expects to distribute dividends of $0.2 per share based on third-quarter results, totaling approximately $2.4 billion. Following this trend, buybacks and dividends in the fourth quarter will total $15 billion, resulting in an annual shareholder return of only $62 billion, implying a yield of 2%.

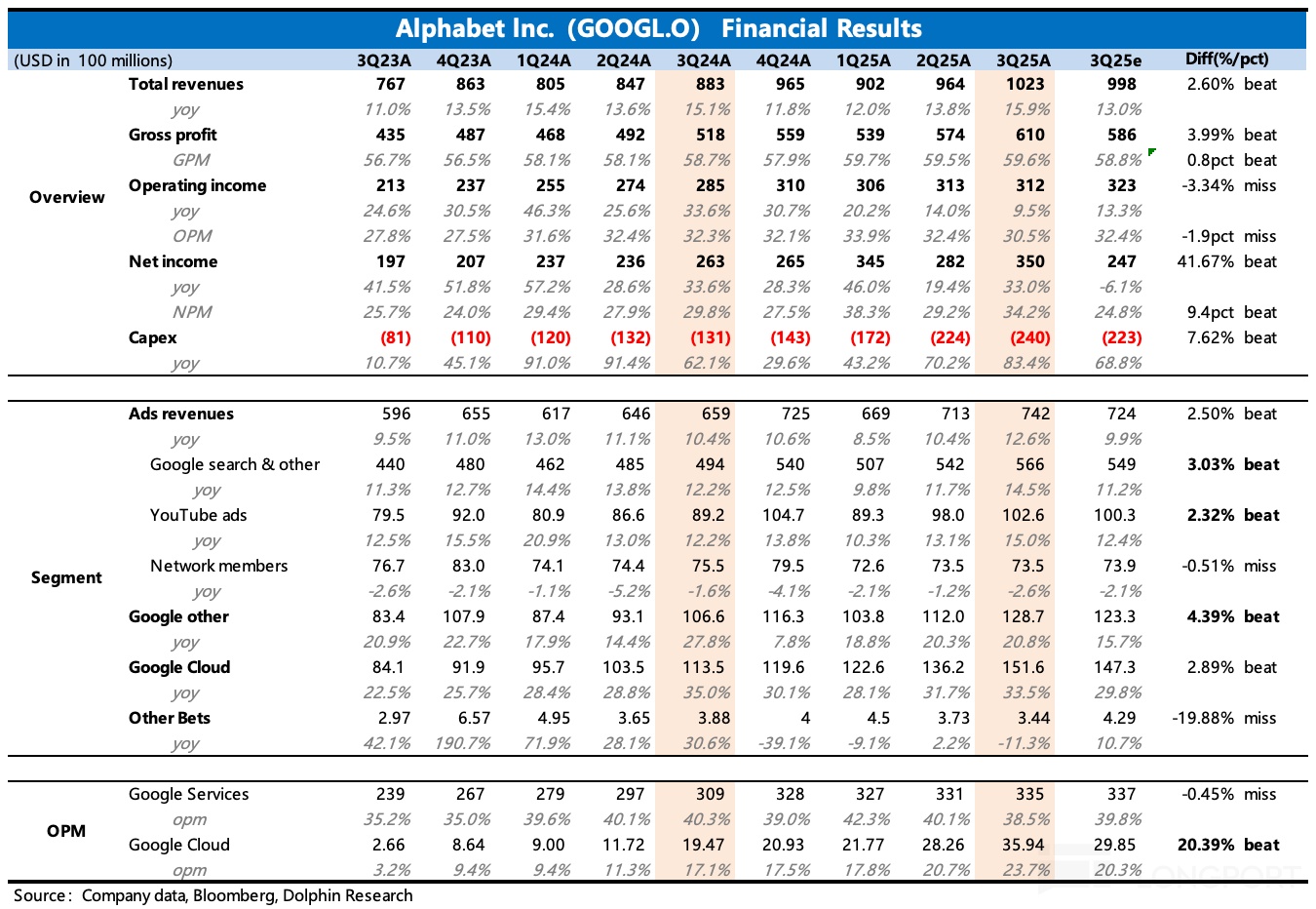

7. Key Indicators Compared to Expectations

Dolphin Research's View

With the release of antitrust risks and no regulatory concerns for now, Google has embarked on its AI revaluation journey. From a pure valuation multiple perspective (based on a 5% upward adjustment in performance expectations, the latest market value corresponds to a 24.5x P/E for 2026), Google's recovery journey is already more than halfway through. To continue upward, besides following the market in a rate-cut cycle to raise valuations, it requires achieving even better performance on an already decent fundamental basis, which is evidently challenging.

However, before OpenAI finds a commercial killer app and as management consciously begins to control next year's expenses, we believe Google can enjoy a moderate positive premium brought by AI-enabled business tailwinds for a while. The full-stack AI polygon warrior style also allows Google to benefit from the upstream infrastructure pull period, enjoying the supply chain dividends of insufficient computing power while reducing group costs through self-supply. The company's limited expansion of capital expenditures for 2026 vs. other platforms still needing to invest heavily, including the advantages brought by the long downstream vertical integration of self-developed ASIC chips and full-stack AI, can be seen.

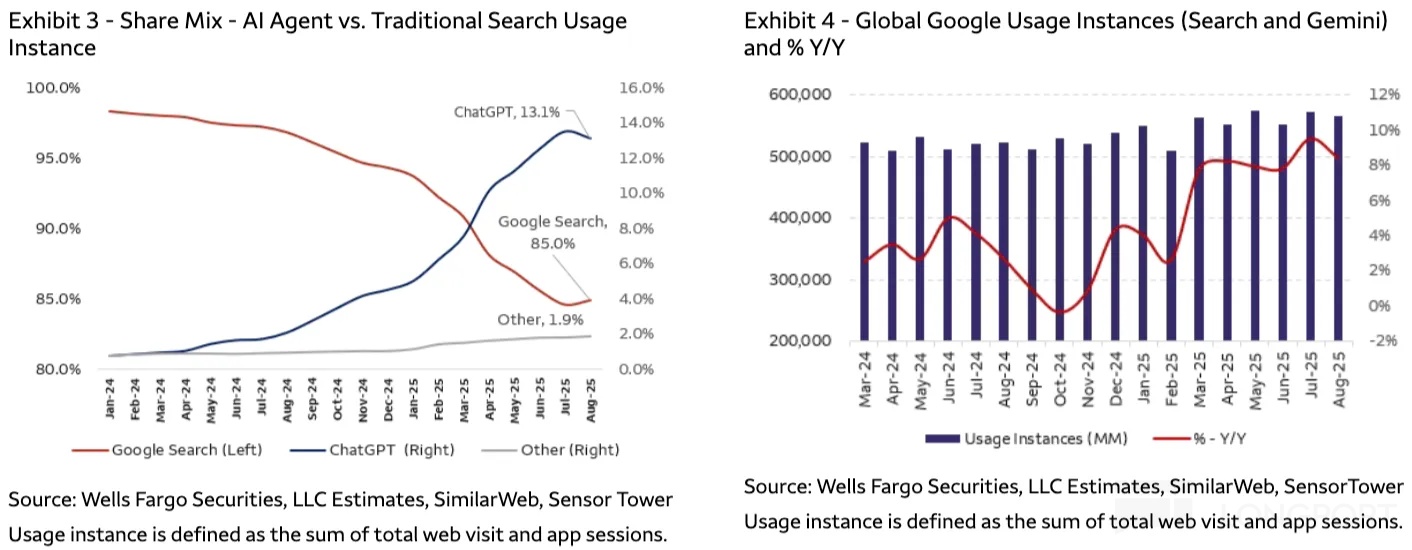

The reason why the expectation of search erosion has not materialized is essentially due to the lack of strong competitors and Google's strong ecosystem, allowing Google's transformation path to be relatively calm. Although Gemini has an inherent advantage gap with ChatGPT as an independent app, from an ecosystem perspective, the gap between Gemini's 650 million monthly active users vs. ChatGPT's 800 million weekly active users is not that large, and Gemini's overall processing volume has reached 70 billion tokens per minute, already surpassing ChatGPT's data of 60 billion tokens per minute at the beginning of the month (which may have improved now).

Additionally, the commercial ecosystem improvement that Dolphin Research has always mentioned is the biggest advantage of the existing advertising platform besides traffic, and it is a crucial step for new AI entrants to accumulate. The time window here also allows Google to remain a transitional transformation in search monetization—i.e., for clients in fields that contribute significantly to monetization, such as retail e-commerce, AI Overview has not led to a decline in display positions on their search results pages.

OpenAI and other AI competitors have strong model capabilities, but their product forms are not yet imaginative and disruptive enough, and the commercial ecosystem building still needs to be slowly polished. Recently, OpenAI launched an AI browser, which is not yet mature in terms of product disruption. If it only tries to imitate existing products and wrap ChatGPT, the entrance value will still exist in the hands of traditional giants who control the current scene (Atlas comments "Google: My fate is determined by me, not by OpenAI").

Of course, whether it's Google or OpenAI and others, they will continue to make moves, besides updating large models (GPT 6 and Gemini 3), the commercialization of leading AI products deserves close attention. Especially under the pressure of upstream interest binding, OpenAI will be more eager to promote commercialization in 2026 "All tied together, is OpenAI a spiritual pearl or a demon pill?" , so during this process, the impact on existing giants like Google may begin to show, thus worth close tracking. Dolphin Research will discuss the commercialization estimation and impact analysis of OpenAI later, so stay tuned.

Currently, OpenAI has already promoted the implementation of instant payment functions for e-commerce, based on actual transaction volume commission models, and Dolphin Research temporarily holds reservations (instant payment function review "OpenAI wants to scrape oil, who will lose a layer of skin?"). From the current feedback from advertisers, the commercialization effect of OpenAI is mostly curiosity, and some merchants may participate in testing, but it cannot yet become a must-have option for mainstream advertising budgets. Therefore, Dolphin Research believes there is no need to expect negative impacts on Google for now, but it does need continuous observation, especially whether there are new disruptive feature optimizations at the product level.

Below is a detailed interpretation of the financial report

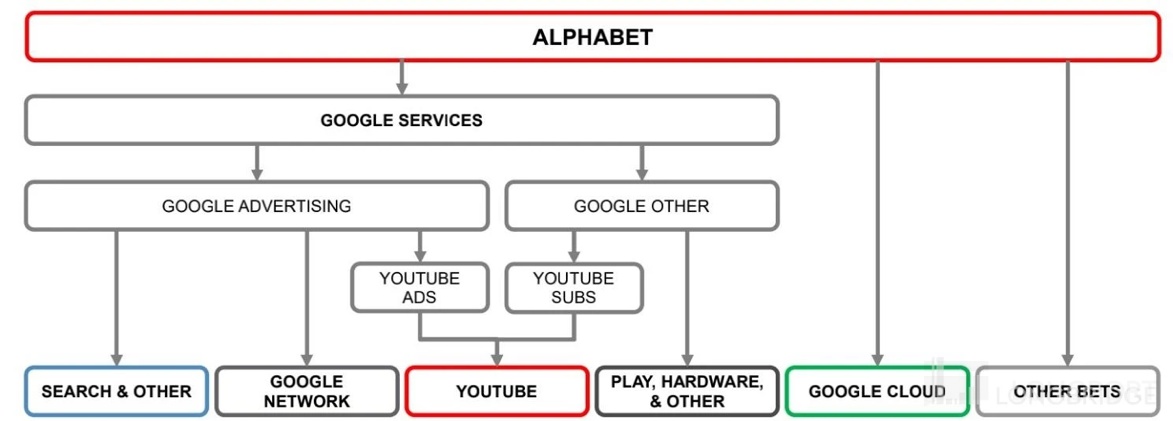

I. Basic Introduction to Google

Alphabet, Google's parent company, has a wide range of businesses, and the financial report structure has changed multiple times. Those unfamiliar with Alphabet can first look at its business architecture.

Briefly explain Google's long-term logic:

a. Advertising business is the main revenue driver, contributing the majority of the company's profits. Search ads face the long-term threat of erosion by information flow ads, with high-growth streaming media YouTube filling the gap.

b. Cloud business is the company's second growth curve, already profitable, with strong recent signing momentum over the past year. As advertising continues to be dragged down by weak consumption, the development of the cloud business is increasingly important for supporting the company's performance and valuation imagination.

II. Explosive Advertising, Cloud Meeting High Expectations

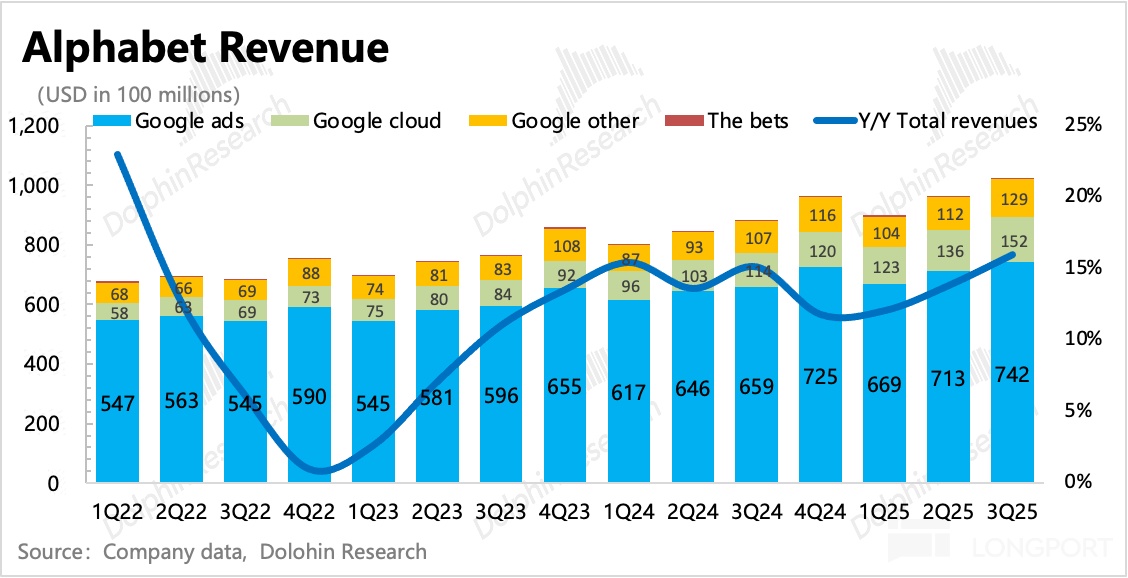

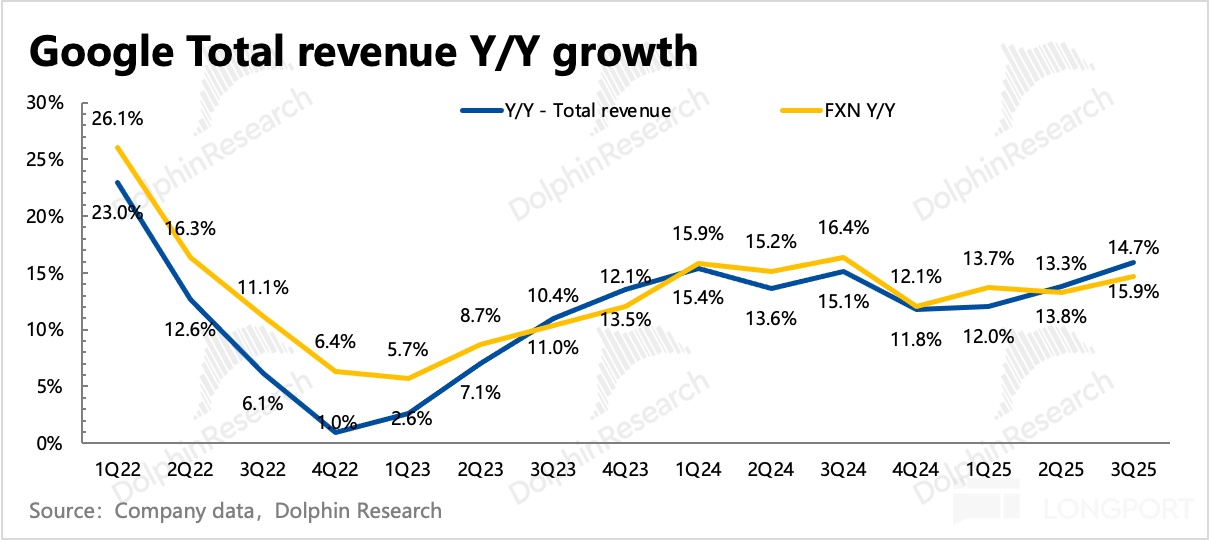

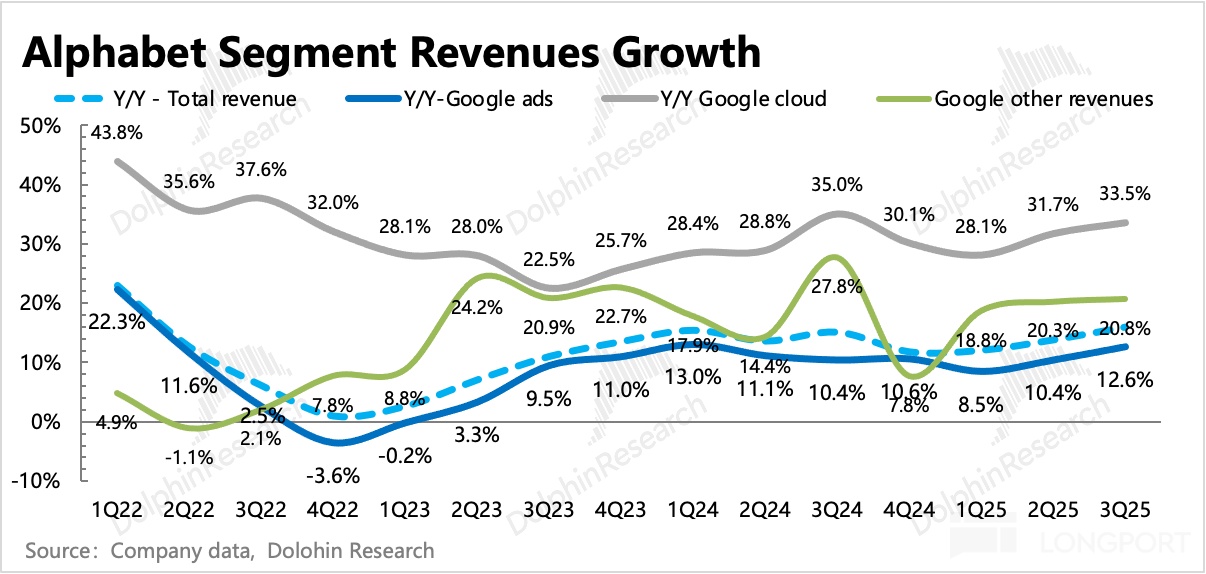

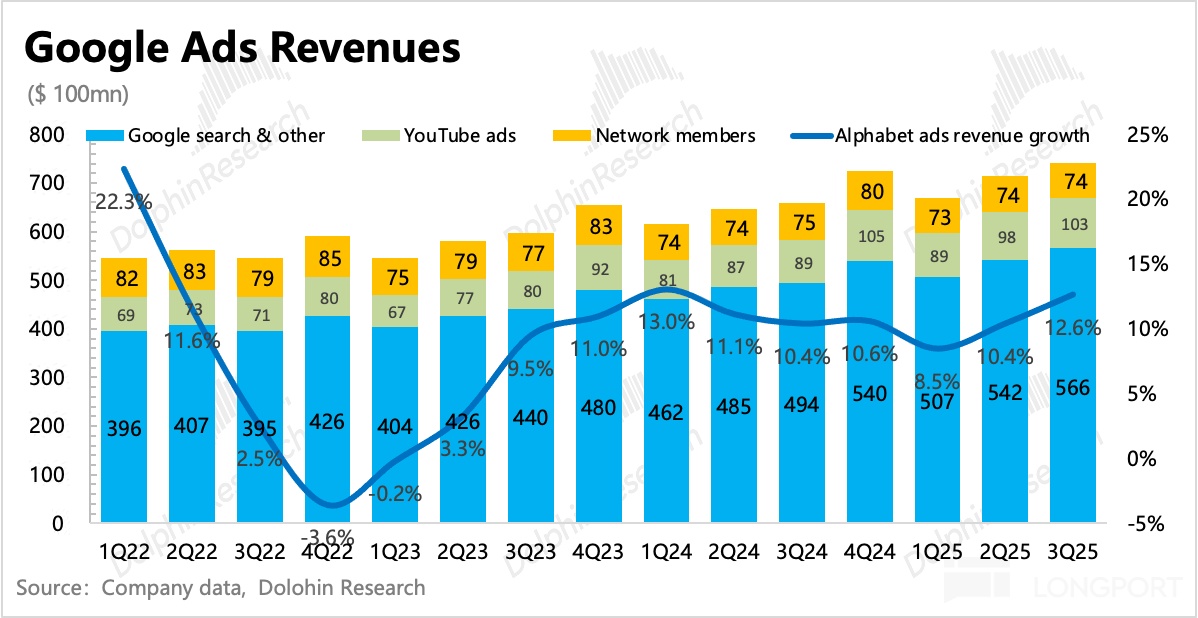

In the third quarter, Google's overall revenue was $102.3 billion, up 15.9% year-on-year, exceeding expectations. Among them, the core pillar, accounting for 73% of advertising business, grew by 12.6% year-on-year, accelerating quarter-on-quarter. In addition to favorable exchange rates (bringing 1 percentage point), endogenous growth was also good, with a year-on-year increase of 14.7%.

On the revenue side, both advertising and cloud performed well, benefiting from the AI industry wave, with upstream and downstream development dividends. In addition, YouTube and Google One subscriptions also remained bright.

Specifically:

(1) Advertising: No AI Erosion Impact Seen Yet

Third-quarter advertising revenue was $74.2 billion, with overall growth of 9.9%. Core search and YouTube both achieved 15% growth, including favorable winds from the depreciation of the dollar in the European market. The third quarter temporarily emerged from the shadow of tariffs, continuing to recover demand for advertising.

However, for Google, the market's originally cautious optimism mainly stemmed from Amazon's consideration of withdrawing from Google Shopping ad placements and the impact of last year's high base. At the end of July, Amazon suddenly removed Google Shopping ad placements in key regions such as the US, UK, Germany, and Japan, with its ad display share in the US, UK, and Germany dropping from 60%, 55%, and 38% to 0%, respectively.

The main conflict between the two parties lies in Amazon's dissatisfaction with the continuously rising CPC of Google ads, which is 30%-50% higher than Amazon's internal ads, causing ROI to decline year by year. Meanwhile, Amazon's internal ROI improved through optimization of its own AI recommendation system. In addition, in the comprehensive AI era, data is a key competitive element. After the removal of ad placements, Amazon also cut off Google's AI shopping assistant and other AI agents from accessing product information to obtain data.

However, after the removal, it was more detrimental to Amazon itself—competitors took the opportunity to seize Amazon's original ad positions, threatening e-commerce transactions. Therefore, it later resumed Google Shopping ad placements in regions other than the US. In the US, because Amazon's brand awareness is wide enough, it believes there is no need to rely too much on Google and other external leading ad platforms.

In fact, Google's better-than-expected performance is mainly driven by AI empowerment:

On one hand, AI Overview and AI Mode in search raised user engagement, bringing Google back from a share below 90% in the second quarter. Meanwhile, Google further activated the Gemini ecosystem's activity through the new product Nano Banana.

Additionally, the high penetration of Pmax in Google Shopping ads (institutional research shows nearly 90%) means almost all merchants will experience the recommendation conversion improvement brought by Pmax.

On the other hand, the increased penetration rate of YouTube Shorts drove user time growth, resulting in more ad display volume. Advertisers also benefited from Gen-AI's generated ads reducing costs and driving comprehensive ROI improvement.

(2) Cloud: Significant Growth in Accumulated Unfulfilled Orders

The cloud business is a key support in Google's AI revaluation, but important large order collaborations are often directly disclosed in the news, so the benefits are immediately reflected in the stock price, such as the recent $20 billion collaboration between Anthropic and Google, even if it should be included in next quarter's unfulfilled orders, it has already been factored into expectations on the day.

This quarter is no exception, with cloud business revenue growing by 33%, accumulated orders growing by 43% year-on-year (calculated as a new contract amount of $62 billion), aligning with relatively optimistic market expectations. With a net increase of 40%, short-term cloud revenue growth of over 30% can still be maintained.

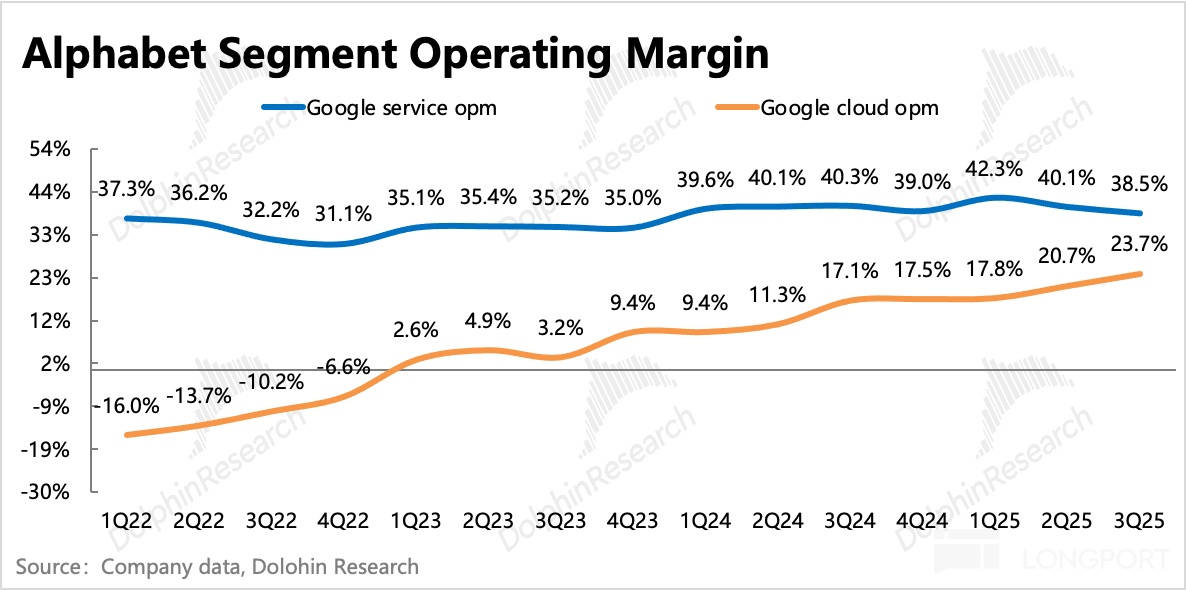

Additionally, the operating profit margin of the cloud business continued to improve in the third quarter, reaching 23%, also exceeding market expectations.

(3) Other Businesses: Driven by CTV & Google One, Growth Remains Strong

This part of the revenue mainly consists of YouTube subscriptions (TV, music, etc.), Google Play, Google One, hardware (Pixel phones and smart home appliances Nest), etc.

In the third quarter, other revenue reached $12.9 billion, growing by 21% year-on-year, with growth remaining strong, mainly driven by YouTube memberships and Google One empowered by AI. The company revealed that as of the end of the third quarter, the overall subscription user scale reached 300 million, with market estimates for YouTube Premium at 120 million and YouTube TV at less than 30 million, so the remaining over 150 million comes from Google One.

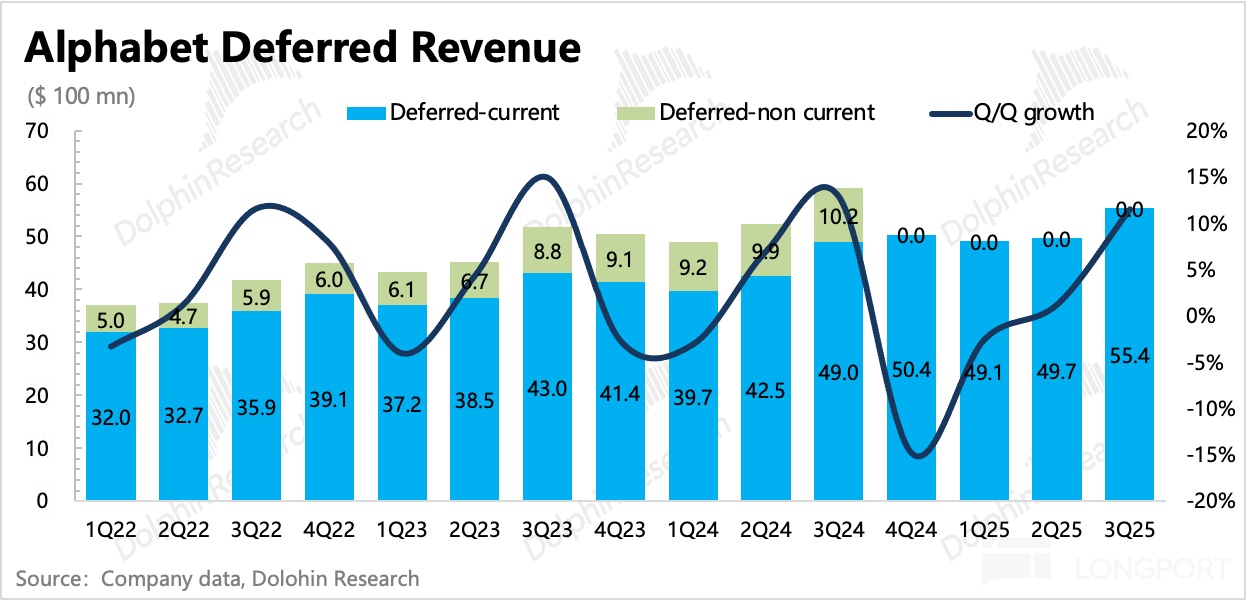

Nielsen data shows that YouTube CTV and Google One subscription revenue growth contributed the main momentum. The deferred revenue situation also shows that subscription-type pre-revenue has increased significantly.

III. Profitability: Outlook for Capex Investment Returning to Normal Growth Rate

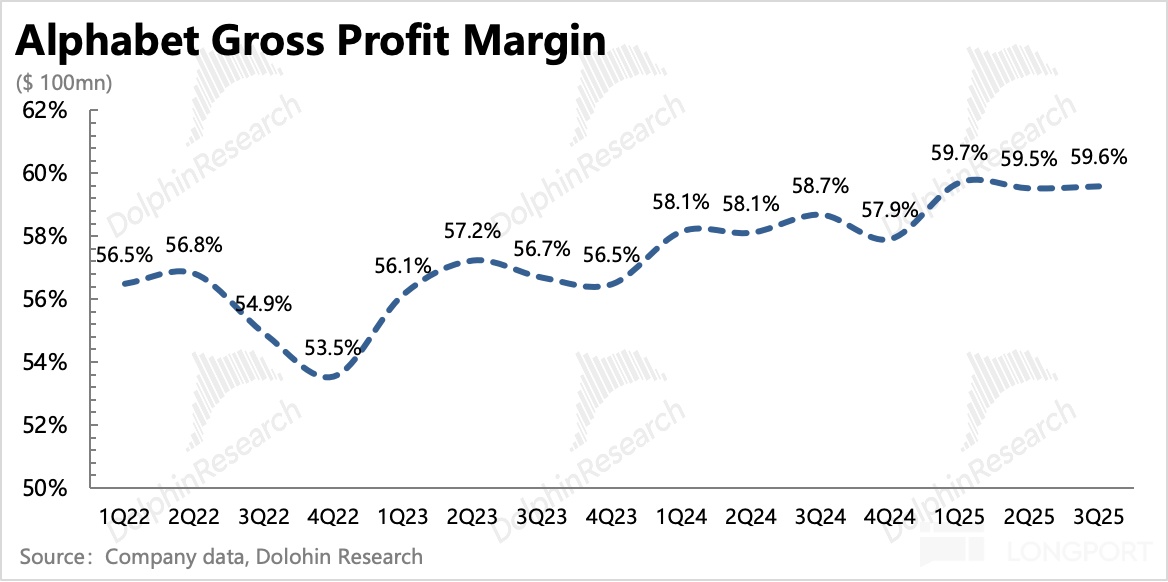

In the third quarter, the core main business operating profit was $31.2 billion, excluding the $3.5 billion EU antitrust fine (affecting the profit margin by 3 percentage points), the actual business-level profit was $34.7 billion, growing by 21.6% year-on-year, with a profit margin of 34%, improving both year-on-year and quarter-on-quarter.

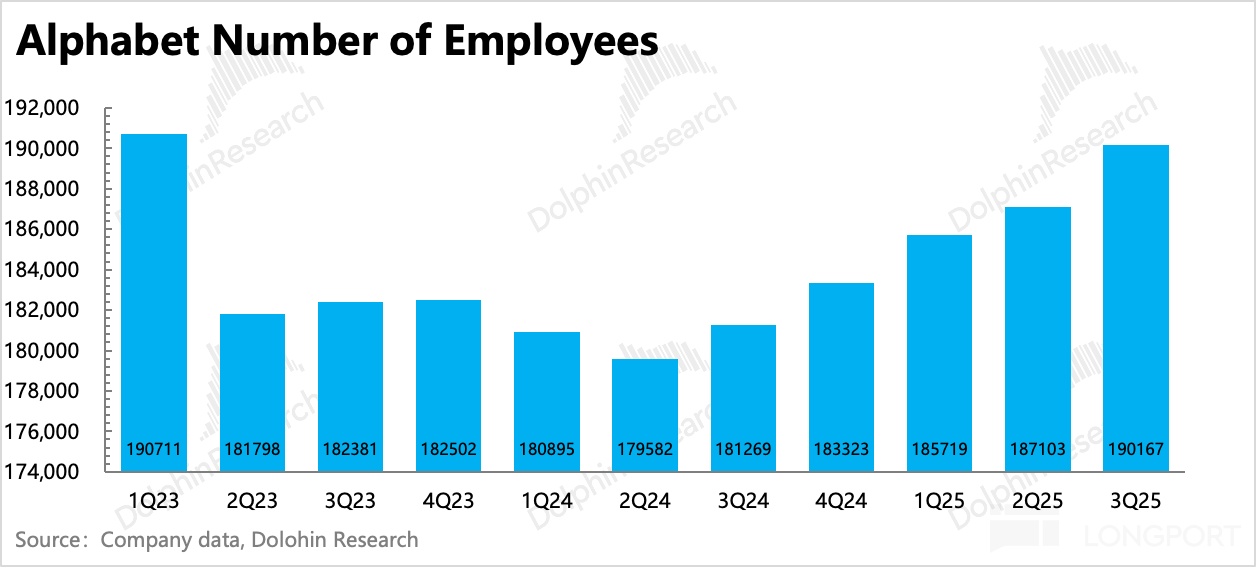

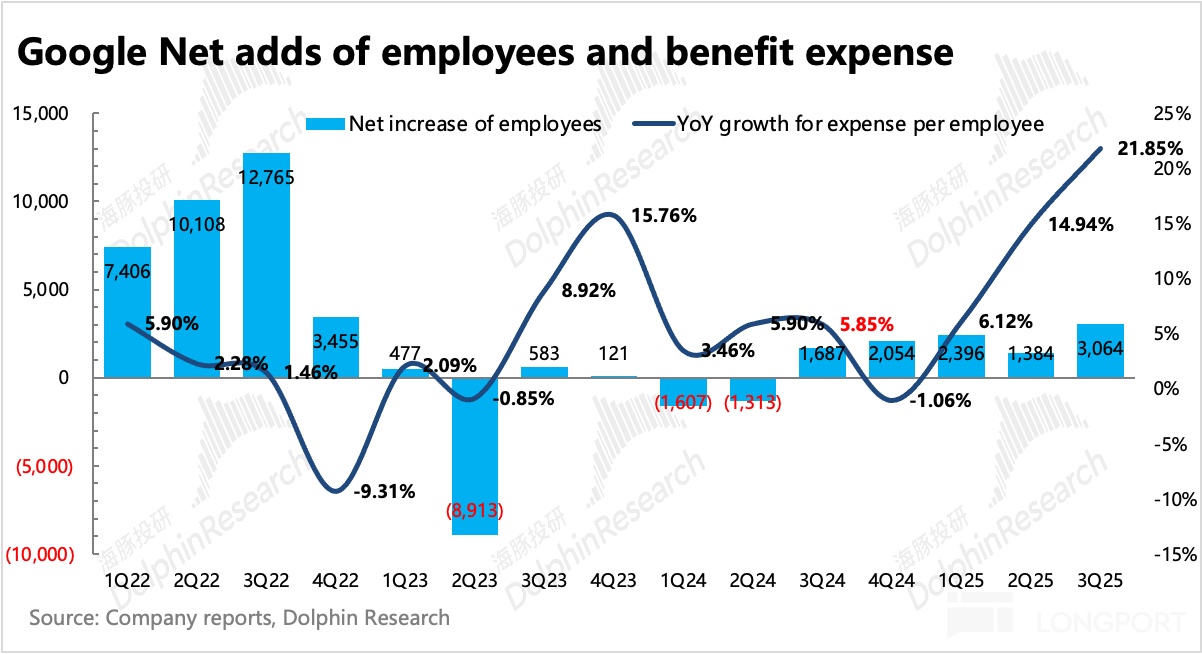

However, the optimization of profitability mainly relies on revenue expansion. In terms of actual expenditure, the absolute value is still growing. Among them, sales expenses showed negative growth, and management expenses excluding fines were flat year-on-year, with the main increase coming from R&D expenses. In the third quarter, the group added a net 3,064 employees, but subsequent large companies will still focus on optimizing traditional business layoffs. At the beginning of the year, Google issued a voluntary resignation plan, and subsequent trends should still maintain a stable entry and exit range (optimizing traditional business, adding new AI business), rather than trend expansion.

By business, not only did Google's service business rise quarter-on-quarter (excluding fines), but the cloud business profit margin also further increased to 23%.

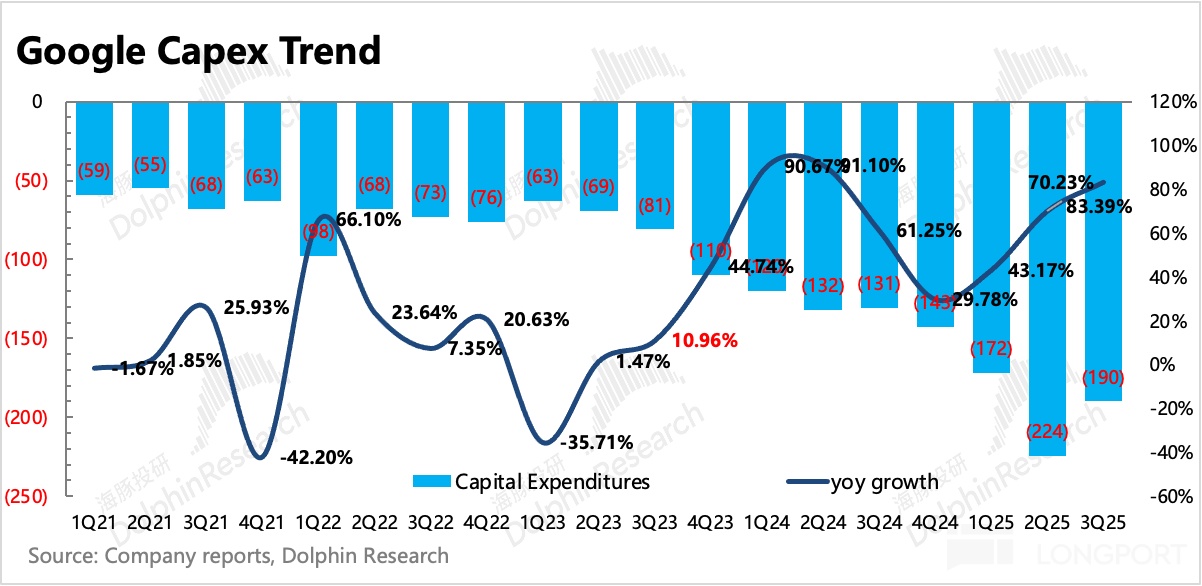

Third-quarter capital expenditure was $24 billion, higher than market expectations. However, the company forecasts next year's capital expenditure to be in the range of $91-93 billion, less than the market expectation of $95 billion, showing a trend of normal growth of less than 10%. This not only reflects Google's full-stack AI advantages but also requires looking at whether Google's outlook implies an attitude towards upstream investment trends in the industry chain next year. It is recommended to pay attention to the content of the conference call.

However, Google's current revenue expansion and expenditure-saving style is the AI tech stock performance trend that the market likes at present.

<End here>

Dolphin Research "Google" Historical Collection:

Earnings Season

October 30, 2025, Conference Call "Google (Minutes): Cloud Business Big Orders Double, Computing Power Shortage Will Continue Until Next Year"

October 30, 2025, Earnings Review "Google: AI Wolf Didn't Come, Advertising King Steadily Sits on the Fishing Platform"

April 24, 2025, Conference Call "Google (Minutes): It's Too Early to Set the Tone for Second Quarter Performance"

April 24, 2025, Earnings Review "Google: Tariff Stick Keeps Swinging, Can the Advertising King Really Be Steady as a Mountain?"

February 5, 2025, Conference Call "Google (Minutes): Cloud Slowdown Due to Insufficient Investment, More Investment Needed!"

February 5, 2025, Earnings Review "Google: $75 Billion Crazy Investment in AI, Big Brother Goes Crazy Beyond Meta"

October 30, 2024, Conference Call "Google: Efficiency and Investment, Simultaneously Promoting (3Q24 Conference Call Minutes)"

October 30, 2024, Earnings Review "Google: Haunted by Little Ghosts? AI Solves Thousands of Sorrows"

July 24, 2024, Conference Call "Google: Rather Overinvest Than Underinvest (2Q24 Conference Call)"

July 24, 2024, Earnings Review "360-Degree No Dead Angle Stare, Is Google Really That Stable?"

April 26, 2024, Conference Call "Google: Outlook for Profit Margin Expansion, Quarterly Capital Expenditure Higher Than Q1 (1Q24 Conference Call Minutes)"

April 26, 2024, Earnings Review "Google Soars? Learning from Meta, Competing to Be a Good Student"

January 31, 2024, Conference Call "AI Operational Efficiency, AI Product Innovation, AI Expenditure Investment... (Google 4Q23 Conference Call Minutes)"

January 31, 2024, Earnings Review "Google: Expectations Too Feverish, King Pours Cold Water"

October 25, 2023, Conference Call "Google: Cloud Slowdown Due to Enterprise Customer Capex Optimization, Signs of Stabilization Seen (3Q23 Earnings Conference Call Minutes)"

October 25, 2023, Earnings Review "Google: Advertising Still the King, Cloud Slowdown Due to "AI Not Working"?"

July 26, 2023, Conference Call "Google: Investing in AI, Benefiting from AI (2Q23 Earnings Conference Call Minutes)"

July 26, 2023, Earnings Review "Google: Breaking Doubts, Advertising King Wants to Turn Around?"

April 26, 2023, Conference Call "AI Competition Never Stops, Landlord Looks at Search and Cloud (Google 1Q23 Conference Call Minutes)"

April 26, 2023, Earnings Review "Google: Exceeding Expectations Against the Trend? Joy Comes with Worries"

February 3, 2023, Earnings Review "More Focus on Revenue Growth Than Simply Cutting Expenditure (Google 4Q22 Conference Call Minutes)"

February 3, 2023, Earnings Review "Short-term Pressure Is Not Small, Google Needs to Learn from Meta"

October 26, 2022, Conference Call "Short-term Resource Optimization, Opportunities Still Look at Search and YouTube (Google 3Q22 Conference Call Minutes)"

October 26, 2022, Earnings Review "Google: Recession Approaching, Advertising King Has Already Fallen"

July 27, 2022, Conference Call "Google: High "Uncertainty" in the Economy in the Second Half of the Year, Concentrated Investment in Areas with Better Long-term Prospects (Conference Call Minutes)"

July 27, 2022, Earnings Review "Google: "Hard Work" Under Bombshell Expectations"

April 27, 2022, Conference Call "Management Avoids Talking About TikTok, but the Emphasis on Shorts Still Reflects Intensified Competition (Google Conference Call Minutes)"

April 27, 2022, Earnings Review "Google: Constant Headwinds, Even Big Brother Struggles"

February 2, 2022, Conference Call "Increasing Investment, Accelerating Recruitment, Google Actively Seeks Expansion (Conference Call Minutes)"

February 2, 2022, Earnings Review "Dazzling Performance, Rare Stock Split, Google Is About to Soar Again"

In-depth

December 20, 2023 "Google: Gemini Can't Solve "Little Ghost" Haunting, Next Year Won't Be Easy"

June 14, 2023 "In-depth Long Article: Is ChatGPT the "Thanos Snap" to Rob Google?"

February 21, 2023 "US Stock Advertising: After TikTok, Will ChatGPT Start a New "Revolution"?"

July 1, 2022 "TikTok Wants to Teach "Big Brothers" How to Do Things, Google and Meta Are About to Change"

February 17, 2022 "Internet Advertising Overview—Google: Watching the Storm Rise"

February 22, 2021 "Dolphin Research | Detailed Analysis of Google: Has the Advertising Leader's Recovery Rally Ended?"

November 23, 2021 "Google: Performance and Stock Price Fly Together, Strong Recovery Is the Main Theme This Year"

Risk Disclosure and Statement of This Article:Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.