Meli: Profit miss? It might just be the 'growing pains' before victory.

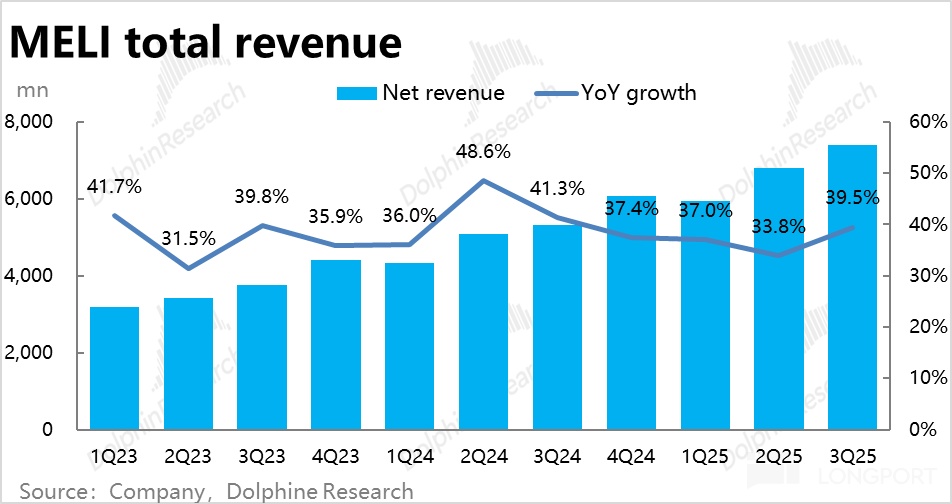

The Latin American version of "Alibaba"—$Mercadolibre(MELI.US) (hereinafter referred to as Meli) released its financial report for the third quarter of 2025 on October 30. Overall, the revenue side performed well, with accelerated growth quarter-on-quarter and slightly exceeding expectations. Conversely, due to increased logistics subsidies in the e-commerce segment and structural factors affecting the financial business, such as monetization/interest rates, profit margins declined, underperforming sell-side expectations.

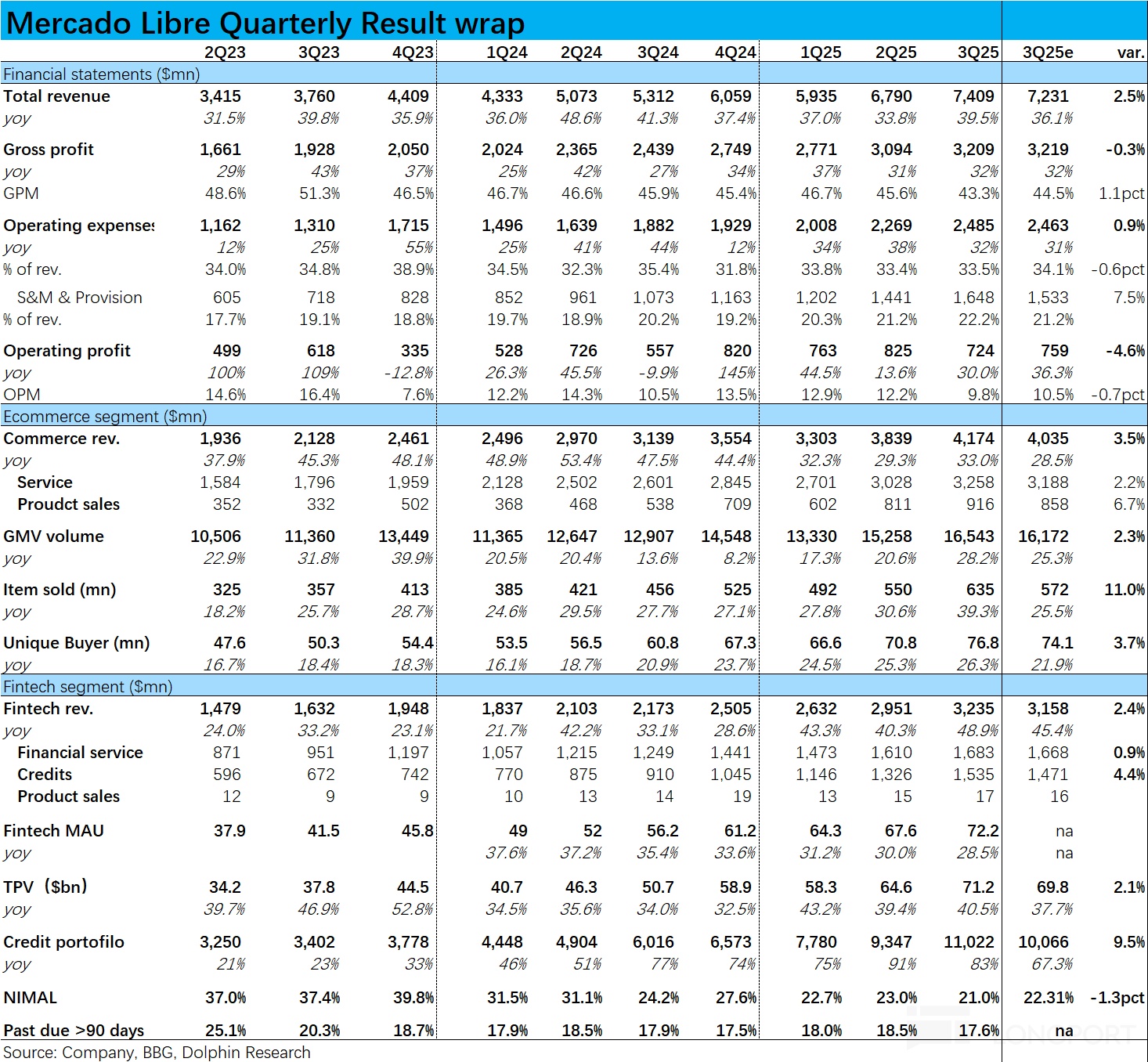

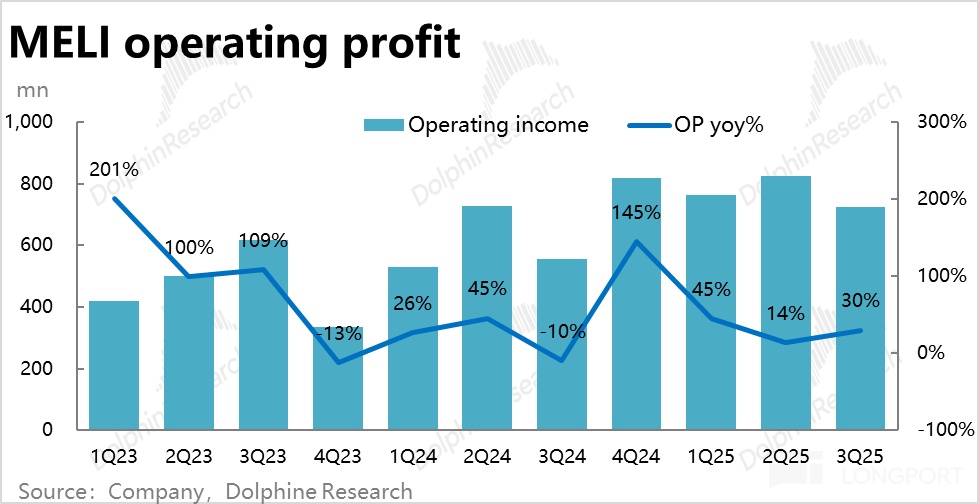

1. Growth Outperforms but Profits Underperform: Overall performance shows that Meli's total revenue for this quarter (in USD terms) grew by approximately 39.5% year-on-year, significantly accelerating from the previous quarter and exceeding market expectations by 2.5 percentage points. However, the cost was that this quarter's operating profit margin was 9.5%, narrowing both year-on-year and quarter-on-quarter, and below the market expectation of 10.5%. As a result, despite revenue outperforming, this quarter's operating profit of $720 million was about 4.6% lower than sell-side expectations.

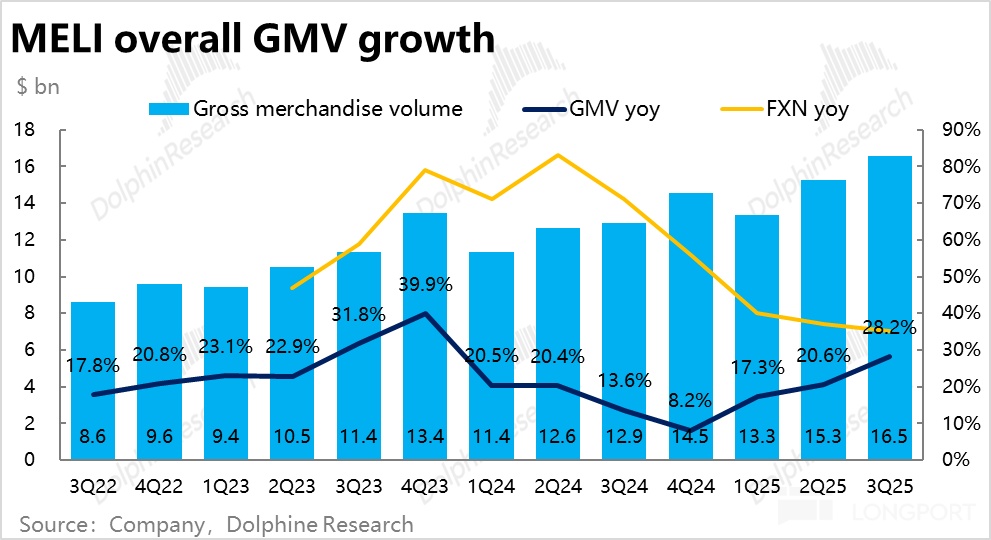

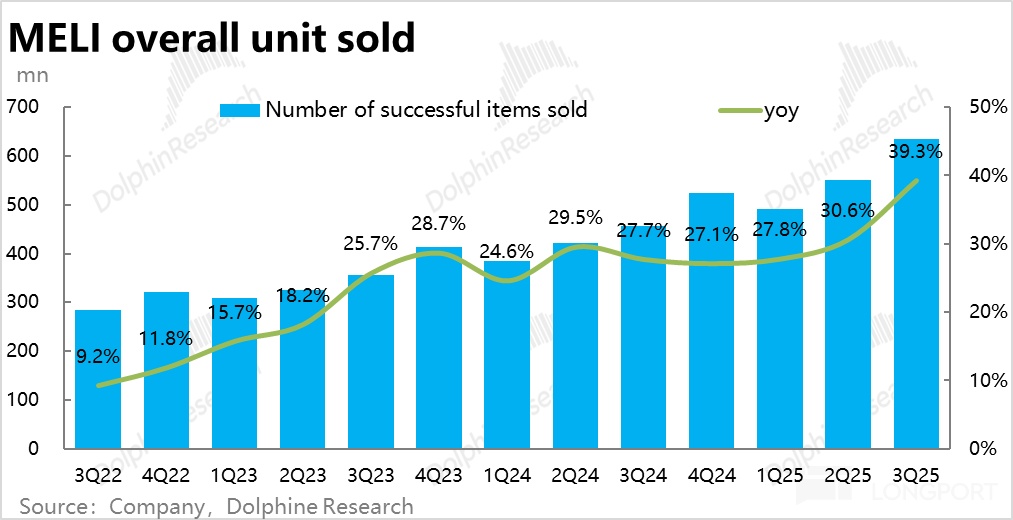

2. Accelerated Growth in E-commerce GMV Under Logistics Subsidies: The cornerstone e-commerce business saw GMV (in USD terms) grow by 28% year-on-year this quarter, significantly accelerating from the previous quarter (less than 21%), slightly exceeding the market expectation of 25.3%. Meanwhile, order volume grew by 39% year-on-year, accelerating by about 8.7 percentage points from the previous quarter, significantly exceeding market expectations.

Considering the price and volume situation, it can be seen that after Meli (and competitors) jointly lowered the free shipping threshold, there was indeed a significant boost to the penetration and growth of the e-commerce business.

3. Narrowed Increase in E-commerce Monetization Rate Under Subsidies: The total revenue of the e-commerce segment this quarter was nearly $4.2 billion, growing by 33% year-on-year (unless otherwise specified, growth rates generally refer to USD terms), also accelerating by 4 percentage points from the previous quarter. However, upon closer inspection, the main driver was the high growth rate of self-operated revenue exceeding 70%; while 3P platform revenue only grew by about 25% year-on-year.

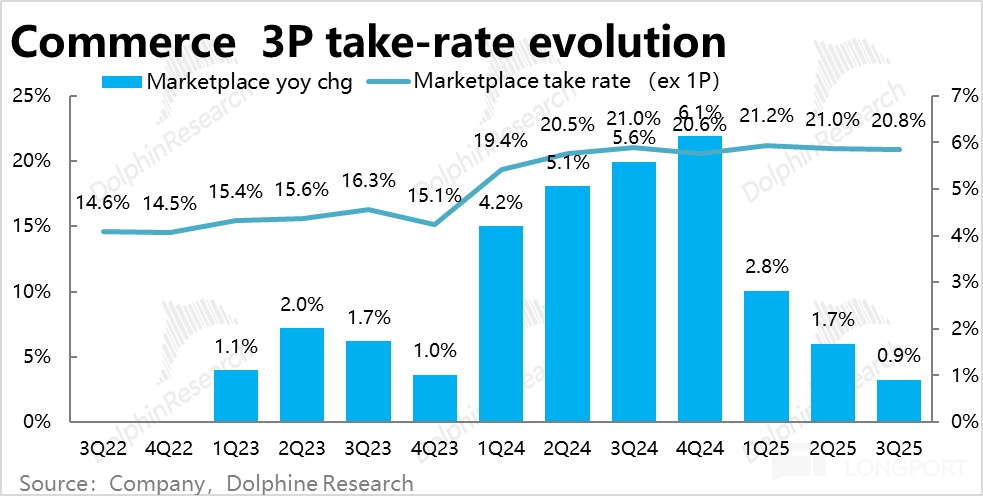

This reflects that the monetization rate of the e-commerce platform business did not improve much this quarter. According to Dolphin's estimates, it was 20.8% this quarter, slightly declining quarter-on-quarter, and the year-on-year increase was the lowest in nearly three years. The underlying reason is that the increase in advertising monetization was offset by the decline in logistics monetization.

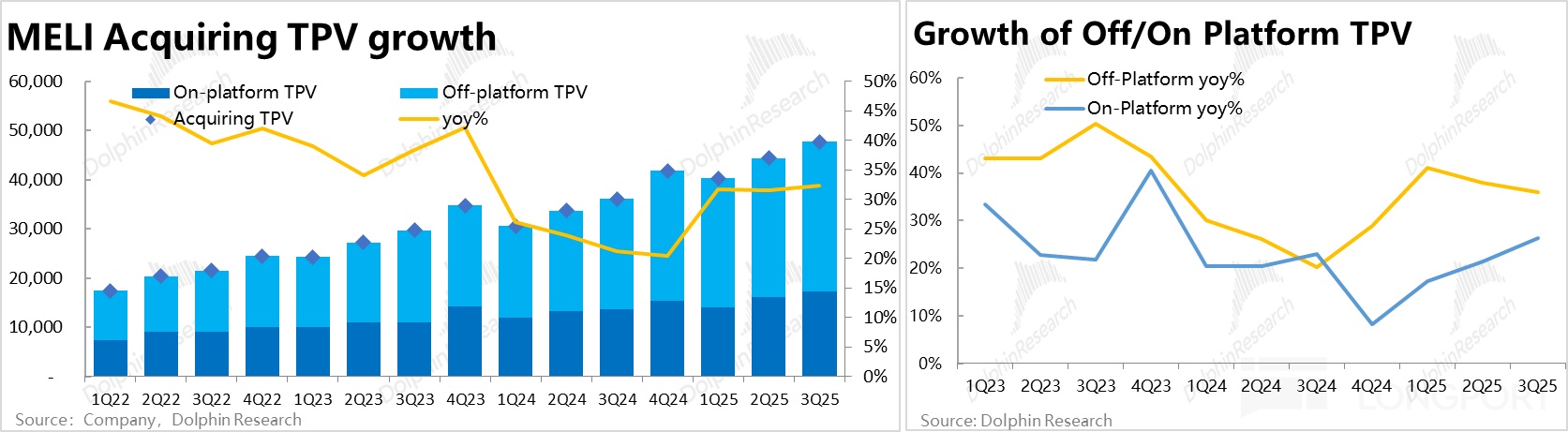

4. Steady Growth in Payment Business: The first part of the company's financial segment, the payment business, saw a total payment amount grow by 40.5% year-on-year this quarter, remaining generally stable with a slight increase from the previous quarter, also slightly exceeding market expectations. Among them, acquiring payment amounts grew more slowly at about 32%, remaining stable with a slight increase. More importantly, off-platform payment amounts grew by 36% year-on-year, still higher than the growth rate of on-platform payment amounts, but the trend decelerated by 2 percentage points quarter-on-quarter.

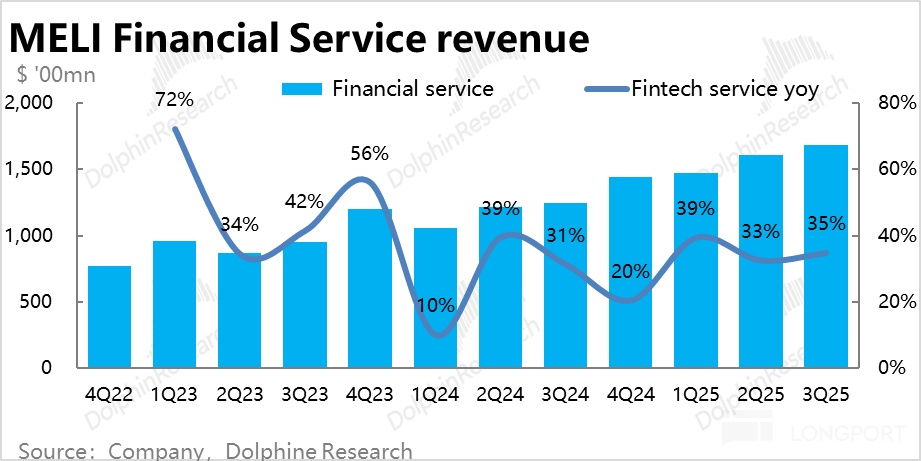

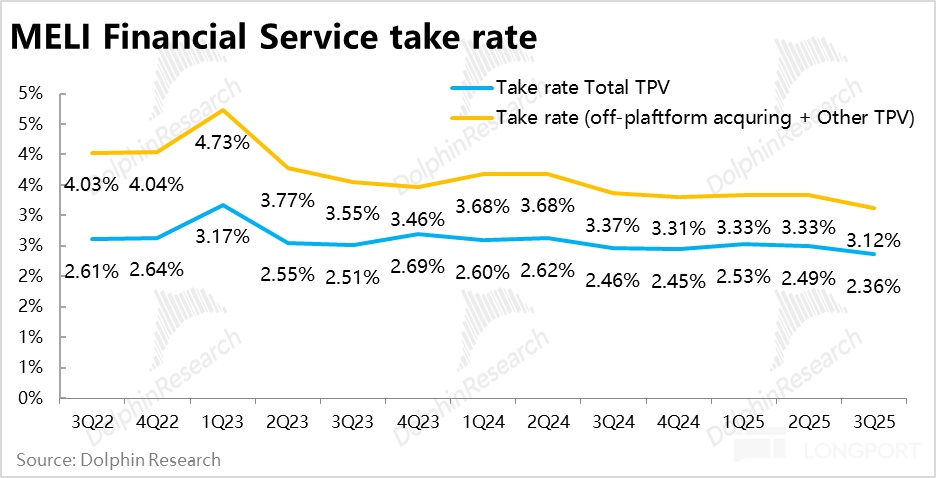

As we have mentioned multiple times, the monetization rate of the payment business has a long-term downward trend. Our calculated payment monetization rate decreased by 21 basis points quarter-on-quarter to 3.12% this quarter. Therefore, financial service income, mainly from payment fees, grew by 35% year-on-year this quarter, slightly underperforming the total TPV growth rate, but still better than market expectations.

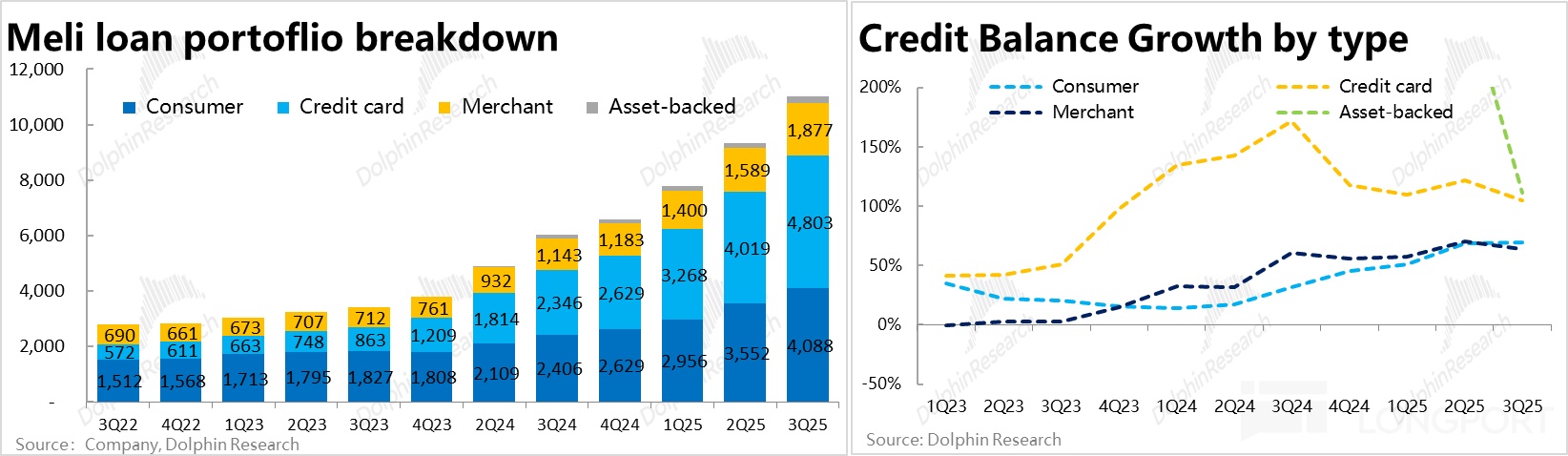

5. Continued High Growth in Credit Business Scale: In the more important credit business of the financial segment, the total credit balance reached $11 billion this quarter, growing by 83% year-on-year, although slightly declining from the previous quarter, it remains very high and outperformed Bloomberg consensus expectations.

According to the company's disclosure of four sub-types, credit card loans remain the fastest-growing and leading sub-item. Additionally, it is noteworthy that the growth rate of consumer loans has been increasing quarter-on-quarter since bottoming out in 1Q24, currently surpassing the growth rate of merchant loans, and is expected to become another major growth driver.

Breaking down price and volume factors, the average loan size grew by about 40% year-on-year this quarter, and the total number of loan accounts grew by 31% year-on-year. The contribution of price and volume factors is relatively balanced.

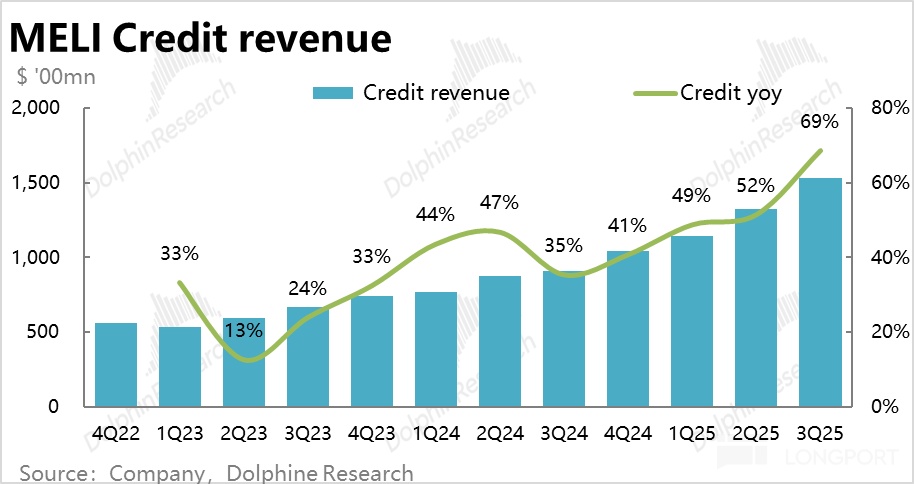

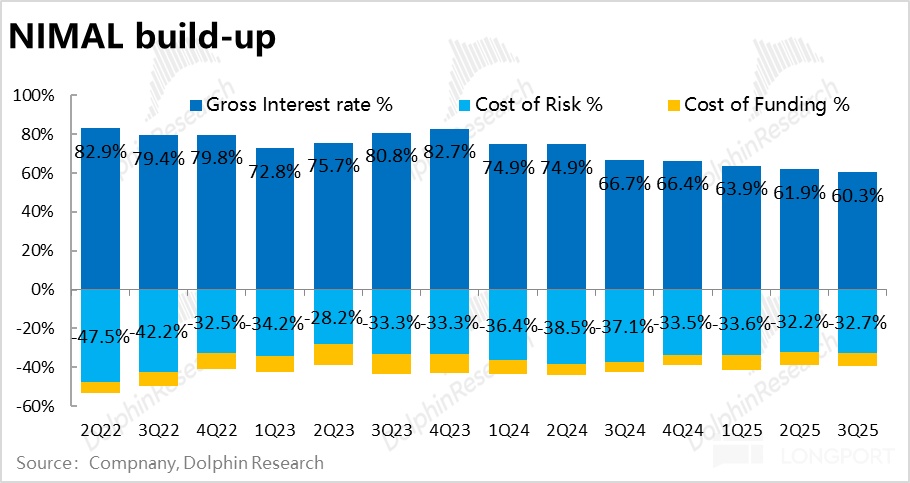

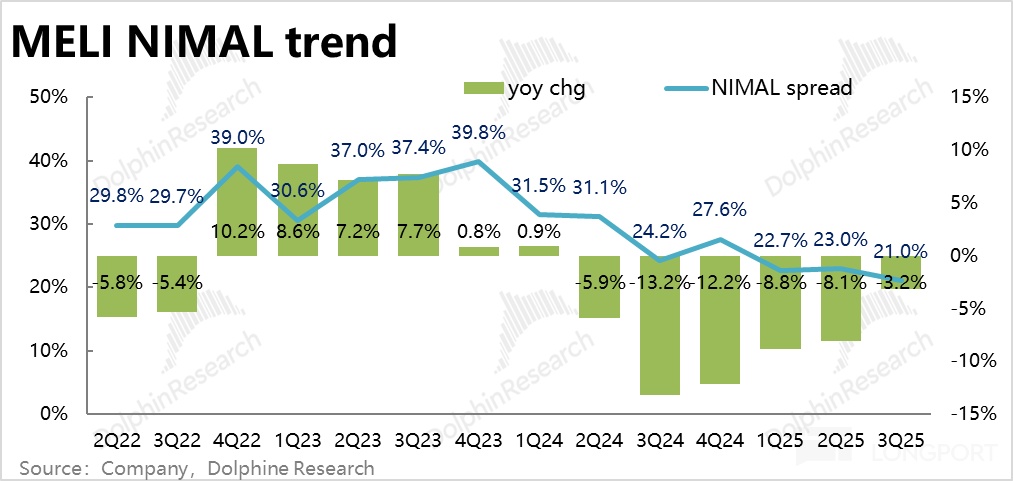

6. NIMAL Begins to Stabilize, Expected to Return to Profit Release Period: Credit income reached $1.54 billion this quarter, growing by 69% year-on-year, accelerating. The underlying reason and key signal is that the company's gross interest rate of the credit business, after rapidly declining from 70%~80% to just over 60%, has begun to stabilize. Subsequently, the scissors difference between the revenue growth rate of the credit business and the growth rate of the loan balance is expected to continue to decrease.

Another important component of NIMAL -- Cost of Risk (i.e., the proportion of bad debt provision losses to the average loan balance), was -32.7% this quarter, slightly increasing quarter-on-quarter. Considering the two main influencing factors mentioned above, this quarter's NIMAL (net interest margin after excluding bad debt losses, which reflects the profitability of the company's credit business) narrowed by about 2 percentage points quarter-on-quarter.

However, the marginal decline in NIMAL is expected (due to the increase in the proportion of credit card loans). Moreover, it seems that the rate of NIMAL decline has already begun to slow down.

NIMAL profit this quarter was approximately $540 million, growing by 62% year-on-year, the highest growth rate since 1Q23. It is evident that as the trend of NIMAL decline stabilizes, credit business profits have re-entered an accelerated release period.

7. Why Profit Margins Narrow from a Cost and Expense Perspective: Firstly, this quarter's gross margin was 43.3%, narrowing by about 3.3 percentage points year-on-year, and also declining by over 2 percentage points quarter-on-quarter. Combining the previous analysis, all three major segments should have an impact on the decline in gross margin.

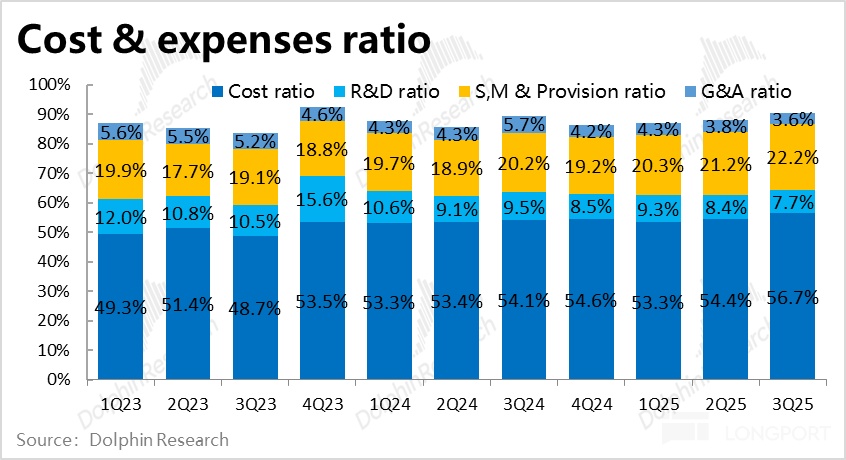

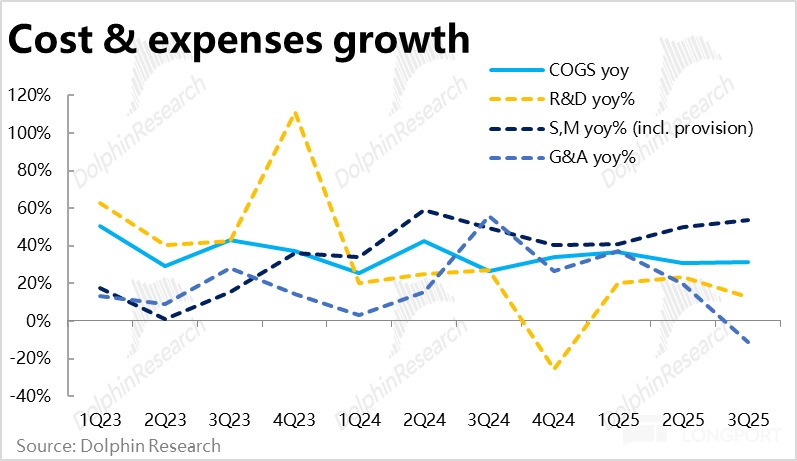

From an expense perspective, the total of the four operating expenses grew by 32% year-on-year, lower than the revenue growth rate. Therefore, the expense ratio (as a proportion of revenue) actually shrank by 1.9 percentage points this quarter. Among them, marketing and bad debt losses, which are directly related to business growth, grew by 44% and 64% year-on-year, respectively, higher than the revenue growth rate. However, due to the significantly lower growth in management and R&D expenses, the overall expense growth rate was reduced.

Therefore, overall, facing the pressure on gross margins brought by business development and the necessary customer acquisition and bad debt provision expenses, Meli has relatively mitigated the impact through efforts in other areas of cost control.

8. Overview of Key Indicators

Dolphin Research's View:

Overall, Meli's performance this time continues the previous logic – the company is willing to sacrifice short- to medium-term profits for longer-term growth potential and to counter competition.

However, beyond the "expected" underperformance in operating profit, Dolphin believes that the signals revealed by the company's performance this quarter are more optimistic. On one hand, the main purpose behind the company's increased shipping subsidies is to counter competition and to promote the growth of the e-commerce business through a better fulfillment experience. Therefore, the accelerated growth in GMV and order volume this quarter undoubtedly validates the above logic. In other words, the investment in logistics is not wasted but is yielding returns.

On another note, as the credit scale grows, its NIMAL will marginally decline, which is a logic we have clearly stated in our coverage report. In this regard, the performance this quarter indicates that the gross interest rate and NIMAL seem to have passed the rapid decline stage and show signs of stabilization. Meanwhile, the credit business scale maintains a good high growth rate. Although this does not necessarily mean that the NIMAL of the company's credit business has definitively lowered to a new stable level, it at least indicates that subsequent revenue and profit growth in the credit business will be somewhat restored, aligning with the growth rate of the loan scale.

Summarizing the above two logics, the logic that the company sacrifices short- to medium-term profits for long-term growth is established and has been initially validated. It is expected that the current concessions in profits will promote the growth of the company's business or stabilize its market share.

Of course, according to recent reports, Shopee and Amazon Brazil are still increasing their investment in the Brazilian market, so in the medium to long term, the competition Meli faces in the e-commerce business in Brazil and even the entire South American market is still unclear. Dolphin does not recommend being overly optimistic about this. However, Dolphin still holds the previous view that even if the company's market position in Latin American e-commerce may slightly decline, the impact of the industry's incremental space will be greater than the marginal slight decline in market position. Moreover, the potential of the financial business is far from being fully realized.

In terms of valuation, according to Dolphin's test in the in-depth report, the company's current market value corresponds to about 20 times the profit of 30 years. This is a relatively reasonable range, but it is based on the relatively conservative assumption of subsequent growth in the Latin American e-commerce industry. Therefore, as reflected in this quarter's performance, if the Latin American e-commerce industry experiences explosive growth under logistics improvement, then the company still has upward potential under the current relatively neutral valuation.

Detailed Comments as Follows:

I. Mercado's Business Composition

As one of the largest internet companies in Latin America, MercadoLibre has two major segments: e-commerce and financial payments. Below, we will sort out the company's main business composition according to the disclosure in the financial report to better understand the company's overview and the analysis below:

1) E-commerce Segment

The company's disclosed e-commerce business revenue is divided into two sub-items—e-commerce service revenue and product sales revenue. Among them, product sales refer to the company's self-operated e-commerce business, while e-commerce services reflect the e-commerce platform business revenue, including commissions, fulfillment, advertising, and payment service fees charged to merchants.

2) Financial Segment

The company's financial income is divided into three sub-items—financial service income, credit income, and product sales income. Among them, the financial product sales income is very small, mainly generated from the company's sales of POS hardware. Financial service income mainly reflects the payment services and digital wallet business provided by the company, with payment fee income based on payment amounts as the main source of revenue.

The credit business generates interest income from various loans provided to consumers and merchants, currently mainly consisting of merchant operating loans, consumer loans, and credit card loans.

II. Subsidizing for Growth, with Notable Results

1. More Shipping Subsidies, Driving Accelerated GMV Growth

In the company's cornerstone e-commerce business, Meli's overall GMV in USD terms grew by 28% year-on-year this quarter, significantly accelerating from the previous quarter (less than 21%), slightly exceeding the market expectation of 25.3%. In local currency terms, the company's overall GMV growth rate was 35%, but compared to the previous quarter, it actually decelerated by nearly 2 percentage points. Meanwhile, order volume grew by 39% year-on-year this quarter, accelerating by about 8.7 percentage points from the previous quarter, significantly exceeding market expectations.

Considering the price and volume situation, the real growth of the company's e-commerce business this quarter has significantly accelerated compared to the previous quarter, reflecting that after the company (and competitors) jointly lowered the free shipping threshold, it indeed significantly promoted the penetration and growth of local e-commerce consumption.

Meanwhile, due to subsidies, in local currency terms, the company's average order value decreased by about 3%, further compounded by the depreciation of the local currency against the USD. In USD terms, the average order value decreased by 8% year-on-year.

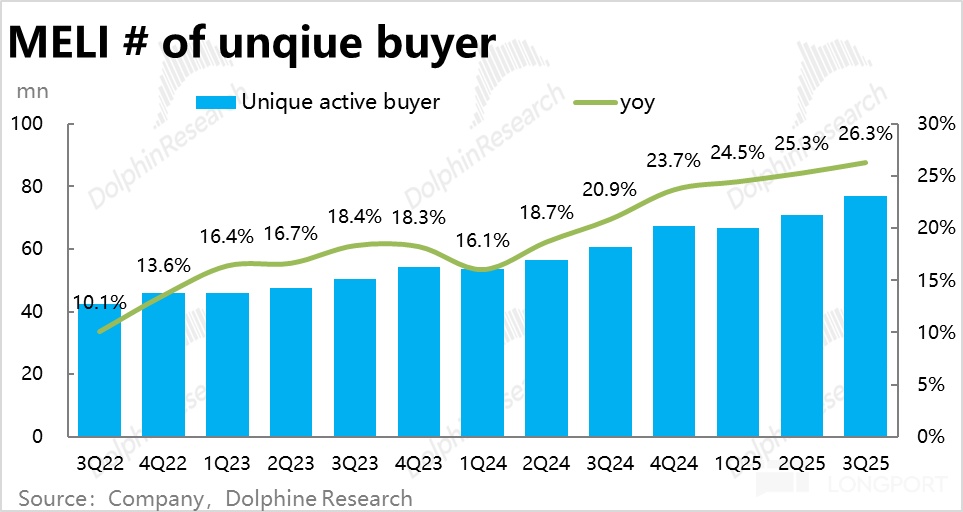

Additionally, the number of active buyers this quarter grew by 26.3% year-on-year, marking the seventh consecutive quarter of continuous quarter-on-quarter improvement in user growth since 1Q24. The average number of purchases per active buyer within the quarter grew by 10.3% year-on-year, also a historical high since 2022.

In other words, Meli's e-commerce business penetration rate and user stickiness are both rising. This also indicates that higher subsidies, although (temporarily) harming the company's short- to medium-term profits, have a significant positive impact on the growth of the company's e-commerce business.

2. High Growth in Self-operated Business, Limited Increase in Overall Monetization Rate Under Logistics Subsidies

In terms of revenue, the total revenue of the e-commerce segment this quarter was nearly $4.2 billion, growing by 33% year-on-year (unless otherwise specified, growth rates generally refer to USD terms), also accelerating by 4 percentage points from the previous quarter.

Upon closer inspection, self-operated e-commerce revenue (product sales) grew by over 70% year-on-year this quarter, remaining stable with a slight decline; while 3P platform revenue (service) grew by about 25% year-on-year. It is evident that the company's self-operated business remains the main growth direction, with its share gradually increasing (although it currently accounts for only about 5%).

From the not-so-high growth rate of e-commerce service revenue, it can also be seen that the monetization rate of Meli's e-commerce platform business did not improve much this quarter. According to Dolphin's estimates, it was 20.8% this quarter, slightly declining quarter-on-quarter, and the year-on-year increase was only 0.9 percentage points, the lowest level in nearly three years. This reflects the decline in logistics monetization rate.

III. Accelerated Growth in Financial Business, Indeed a New Growth Engine

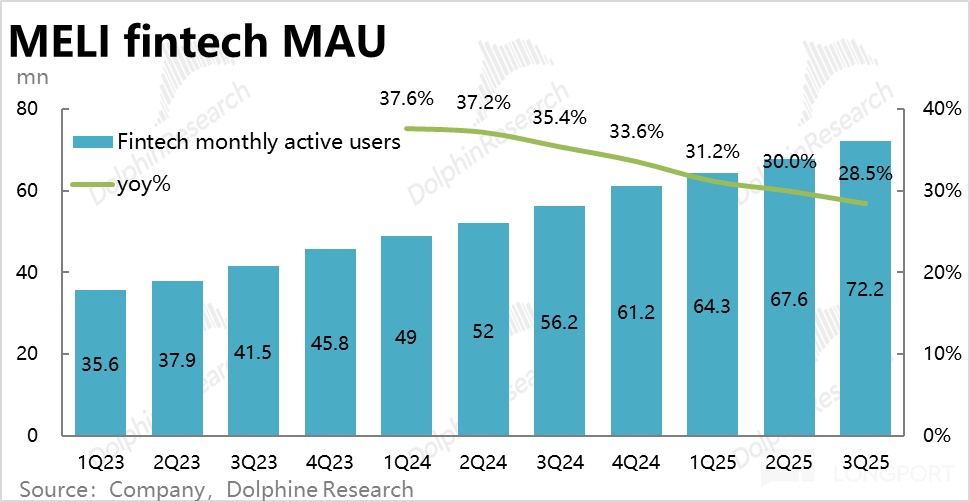

The first indicator of Meli's financial segment, the number of monthly active financial users reached 72.2 million this quarter, growing by 28.5% year-on-year, compared to the previous few quarters, it has slowed down steadily. The strong increase in user volume and stickiness in the financial segment does not seem to have translated into user growth in the financial segment.

1. Slight Increase in Payment Amount Growth, Monetization Rate Slows as Expected

In the first part of the company's financial segment, the payment business, the total payment amount grew by 40.5% year-on-year this quarter, remaining generally stable with a slight increase from the previous quarter, also slightly exceeding market expectations. Among them, non-acquiring payment amounts completed through digital wallets grew faster, reaching 60.5%; while acquiring payment amounts reached $47.7 billion, growing more slowly at about 32%, also remaining generally stable with a slight increase.

Among them, more importantly, off-platform payment amounts grew by 36% year-on-year, still higher than the growth rate of on-platform payment amounts, but the trend decelerated by 2 percentage points quarter-on-quarter.

In terms of revenue, financial service income, mainly from payment fees, grew by 35% year-on-year this quarter, better than market expectations, slightly underperforming the total TPV growth rate. As we have mentioned multiple times, the monetization rate of the payment business has a long-term downward trend. According to the calculation of financial service income/(off-platform payment amount + digital wallet payment amount), the payment monetization rate continued to decline by 21 basis points quarter-on-quarter to 3.12% this quarter.

Overall, the performance of the payment business is stable with a slight increase, good but not particularly outstanding.

2. Continued High Growth in Credit Business, NIMAL Marginally Declines as Expected

In the more important credit business of the financial segment, the underlying indicator—the total credit balance reached $11 billion this quarter, growing by 83% year-on-year, although slightly decelerating from the previous quarter, it remains at a very high absolute growth rate, also significantly outperforming Bloomberg consensus expectations.

According to the company's disclosure of four sub-types, credit card loans remain the fastest-growing and leading sub-item. Additionally, it is noteworthy that the growth rate of consumer loans has been continuously recovering quarter-on-quarter since bottoming out in 1Q24, currently surpassing the growth rate of merchant loans, and is expected to become another growth engine for credit scale.

Breaking down price and volume factors, without considering the sub-structure, overall, the average loan size grew by about 40% year-on-year this quarter, and the total number of loan accounts grew by 31% year-on-year. The contribution of price and volume factors is relatively balanced.

In terms of revenue, credit-related income reached $1.54 billion this quarter, growing by 69% year-on-year, despite a slight deceleration in loan balance growth quarter-on-quarter, credit income growth instead increased against the trend. The underlying reason is that the company's average gross interest rate of the credit business, after rapidly declining from 70%~80% to just over 60%, has begun to stabilize and no longer decline rapidly. (In the past three quarters, it has only decreased from 64% to about 60%) In other words, subsequently, the scissors difference between the revenue growth rate of the credit business and the growth rate of the loan balance will continue to decrease.

Another important component of NIMAL -- Cost of Risk, i.e., the proportion of bad debt provision losses to the average loan balance, was -32.7% this quarter, slightly increasing quarter-on-quarter, but still at a low level in nearly three years.

Considering the slight quarter-on-quarter decline of about 1.6 percentage points in the loan gross interest rate, and the quarter-on-quarter increase of about 0.5 percentage points in the bad debt provision rate, ultimately, this quarter's NIMAL (net interest margin after excluding bad debt losses, which reflects the profitability of the company's credit business) narrowed by about 2 percentage points quarter-on-quarter.

However, as we mentioned in the company's coverage report, due to the significantly lower initial NIMAL of credit card loans, and credit cards being the fastest-growing sub-type, the marginal decline in NIMAL due to structural changes is expected. Moreover, from the current trend, the rate of NIMAL decline has already begun to slow down significantly.

Furthermore, according to the calculated NIMAL profit this quarter was approximately $540 million, growing by 62% year-on-year, the highest growth rate since 1Q23. It is evident that as the trend of NIMAL decline stabilizes, credit business profits have entered an accelerated release period.

IV. Overall Performance: Growth Outperforms, Profit is the "Expected" Underperformance

Due to the stimulation of lower logistics costs in the e-commerce segment, GMV and revenue accelerated growth; the payment segment in the financial segment also remained stable with a slight increase, and the credit business growth was even stronger, therefore, Meli's overall revenue grew by nearly 40% to $7.41 billion this quarter, accelerating by nearly 6 percentage points quarter-on-quarter, better than Bloomberg consensus expectations. The performance on the growth side can be said to be quite impressive.

However, as we mentioned in the previous text and in-depth coverage report, the cost of the above impressive growth (especially in the e-commerce business) is the company's significantly lowered free shipping threshold and continuous investment in logistics construction, while the NIMAL of the credit business and the monetization rate of the payment business are both declining quarter-on-quarter. With one increase and one decrease, one of the main issues the company faces in the medium term is the pressure on profit margins.

In actual performance, the company's operating profit margin this quarter was 9.8%, declining both year-on-year and quarter-on-quarter, also below Bloomberg consensus expectations of 10.5%. As a result, despite revenue slightly exceeding expectations, this quarter's operating profit instead underperformed market expectations by nearly 5%.

From a cost and expense perspective, the factors influencing the year-on-year contraction of profit margins and being below expectations. Firstly, this quarter's gross margin was 43.3%, narrowing by about 3.3 percentage points year-on-year, and also declining by over 2 percentage points quarter-on-quarter. Although the company does not disclose the gross margin situation of each segment, combining the analysis above, the decline in logistics monetization rate in the e-commerce business, the decline in monetization rate in payments, and the decline in interest rate after excluding funding costs in the credit business all have an impact on the decline in gross margin.

From an expense perspective, the total of the four operating expenses grew by 32% year-on-year, lower than the revenue growth rate of about 40%, and roughly in line with the growth rate of gross profit. Therefore, the expense ratio (as a proportion of revenue) actually shrank by about 1.9 percentage points year-on-year.

Specifically, marketing and bad debt losses, which are directly related to business growth, grew by 44% and 64% year-on-year, respectively, higher than the revenue growth rate. However, due to the significantly lower growth in management and R&D expenses, the former even experiencing negative growth, the overall expense growth rate was reduced.

Therefore, overall, facing the pressure on gross margins brought by business development and the necessary customer acquisition and bad debt provision expenses, Meli has relatively mitigated the impact through efforts in other areas of cost control.

<End of Text>

Risk Disclosure and Statement of This Article:Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.