Roblox: Record-breaking Ecosystem Prosperity, Why is the Market Unimpressed?

Hello everyone, I am Dolphin Research!

$Roblox(RBLX.US) released its Q3 FY2025 earnings before the U.S. market opened on October 30th. The overall performance exceeded expectations, but the market might be dissatisfied with the larger-than-expected loss in Q4 and the implied growth trend (slowing too quickly).

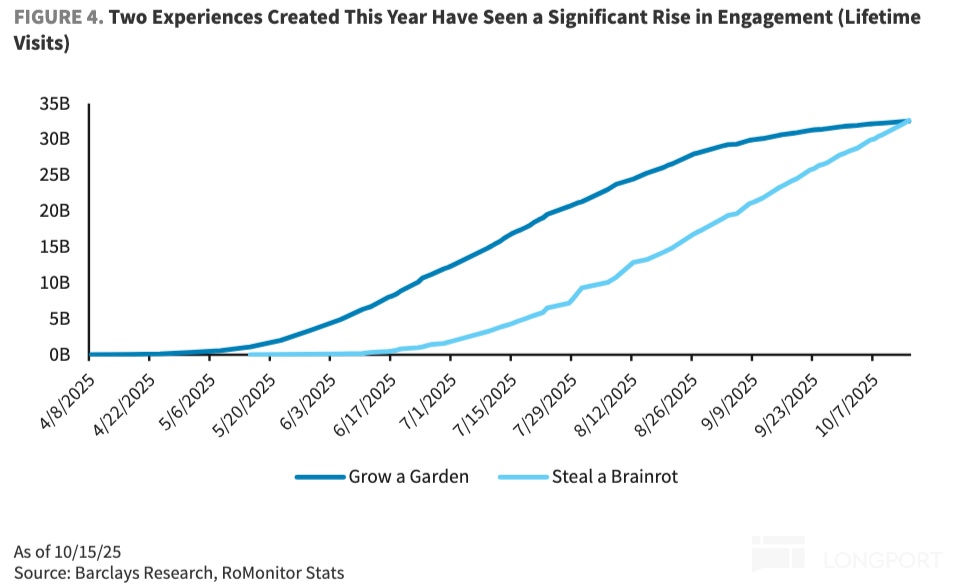

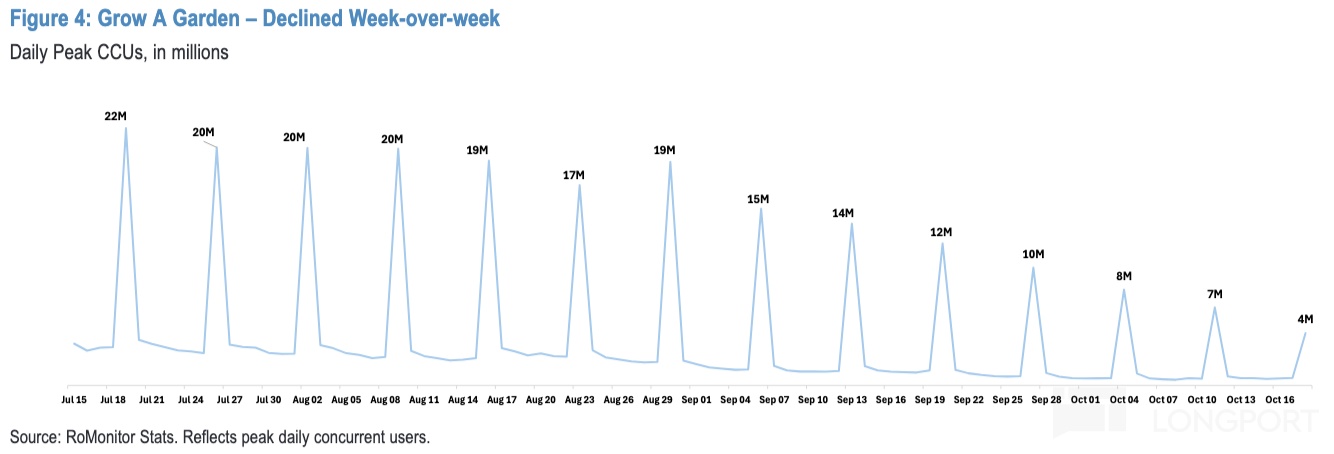

Dolphin Research believes that the underlying issue is still a fear of high valuations, which exacerbates concerns about the sustainability of high growth (especially considering the weakening user engagement of the hit game Grow a Garden in Q2), leading to profit-taking. However, in the long term, we remain optimistic about Roblox's platform ecosystem barriers and value expansion, and opportunities can be observed during short-term valuation corrections.

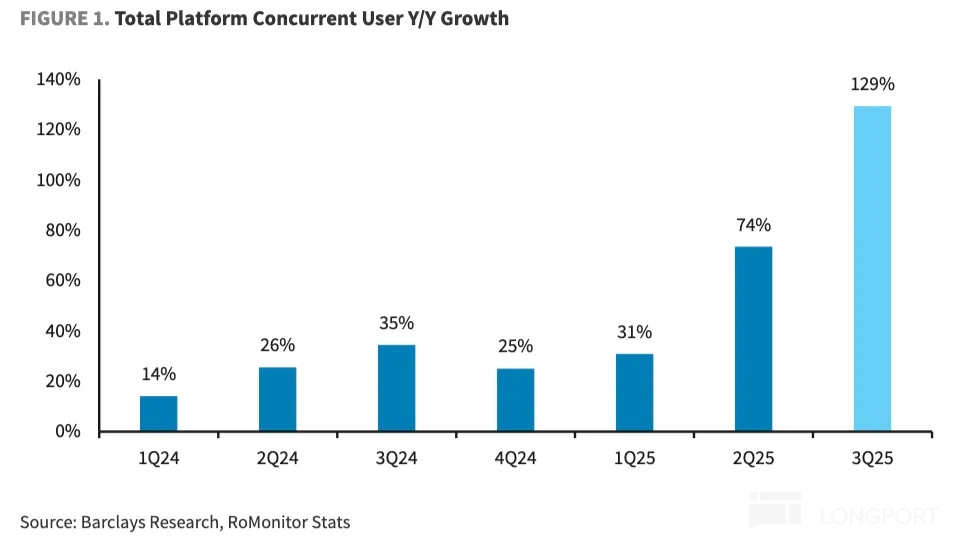

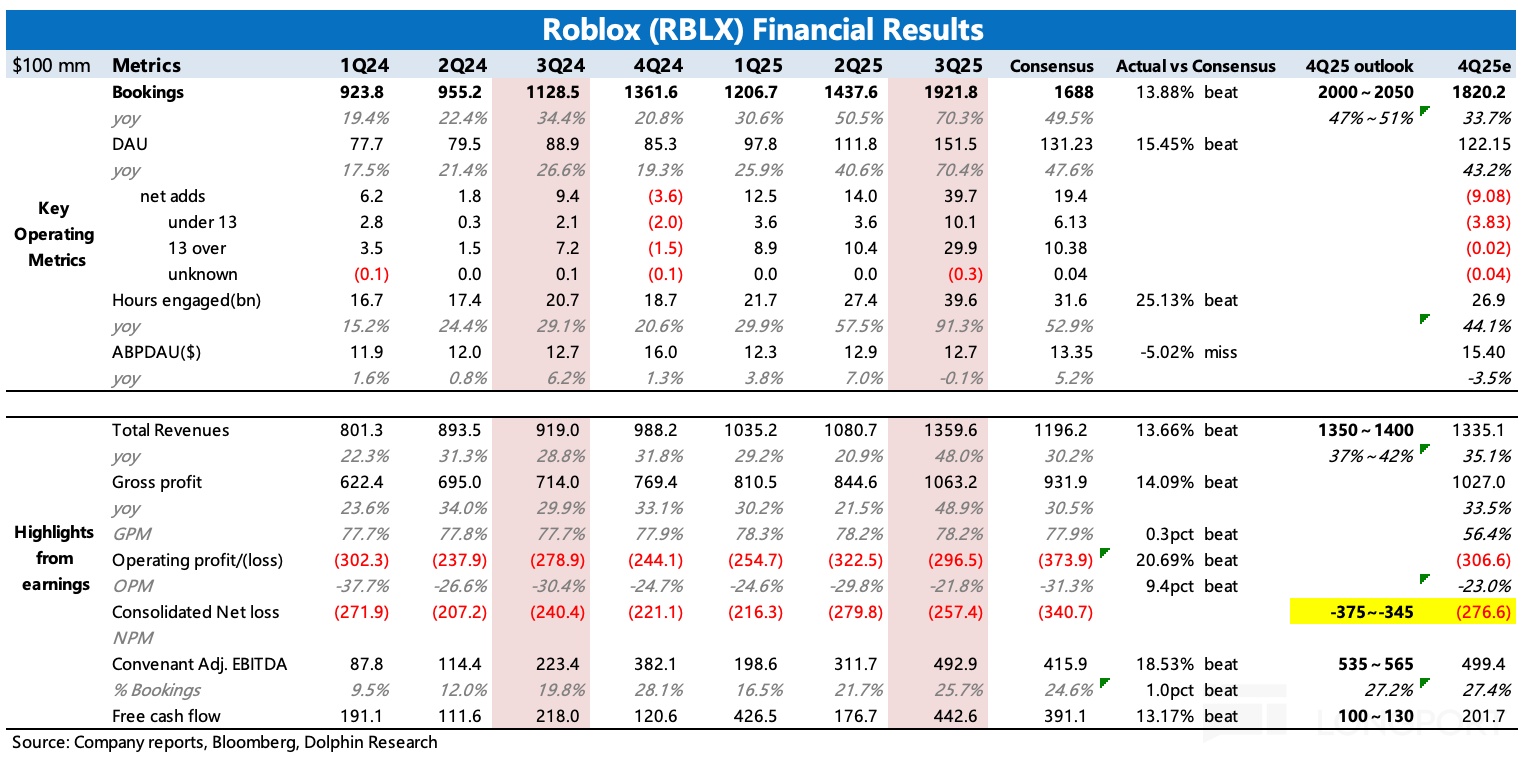

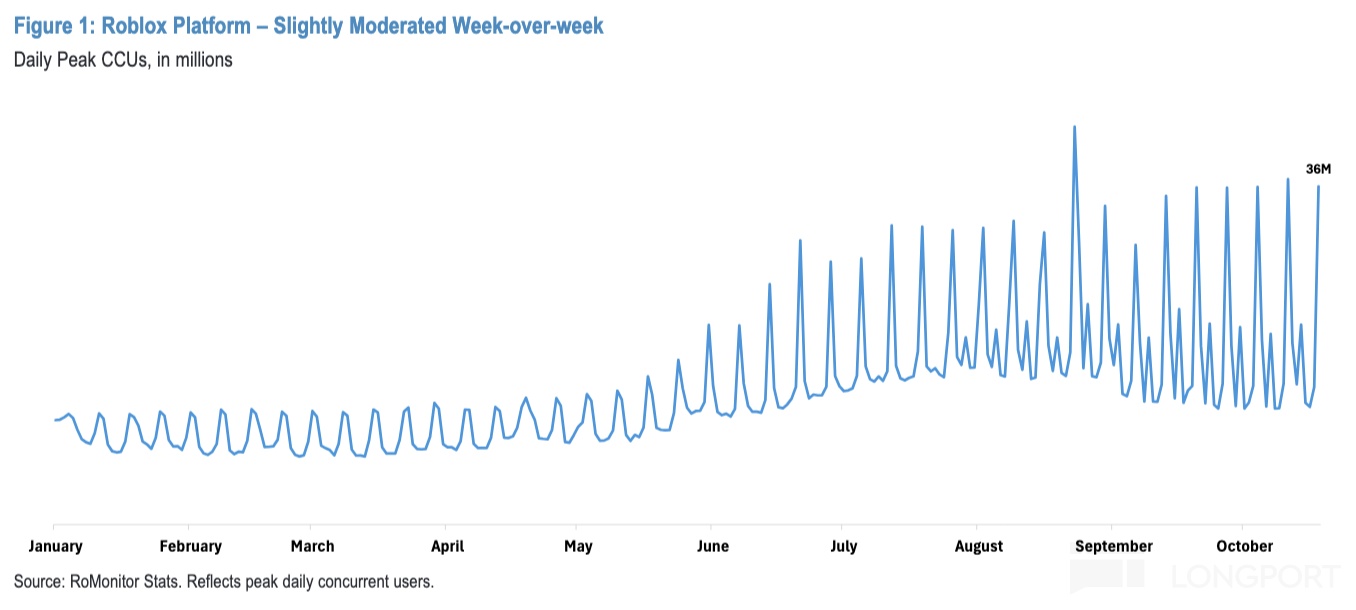

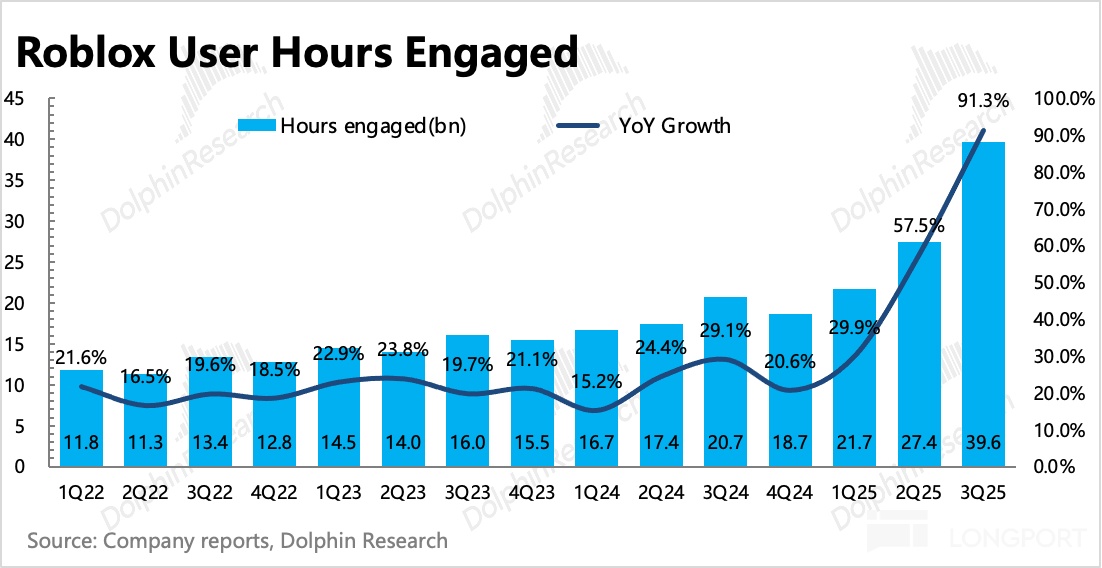

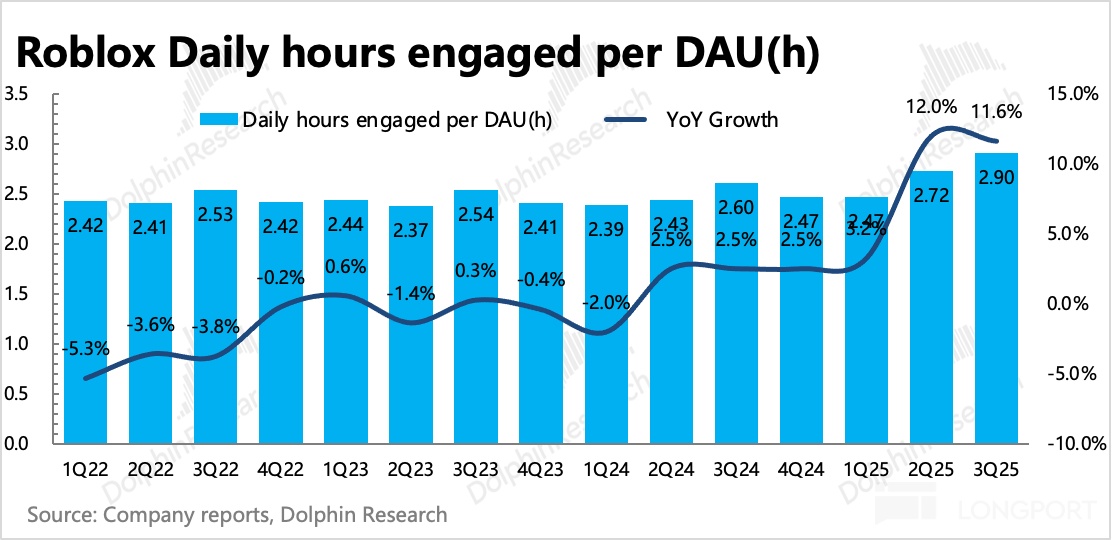

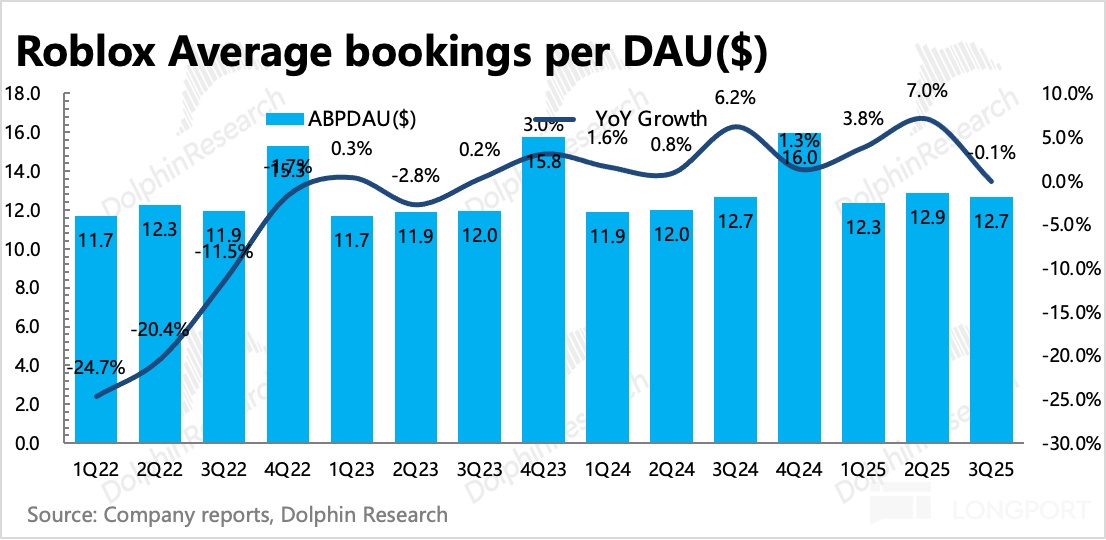

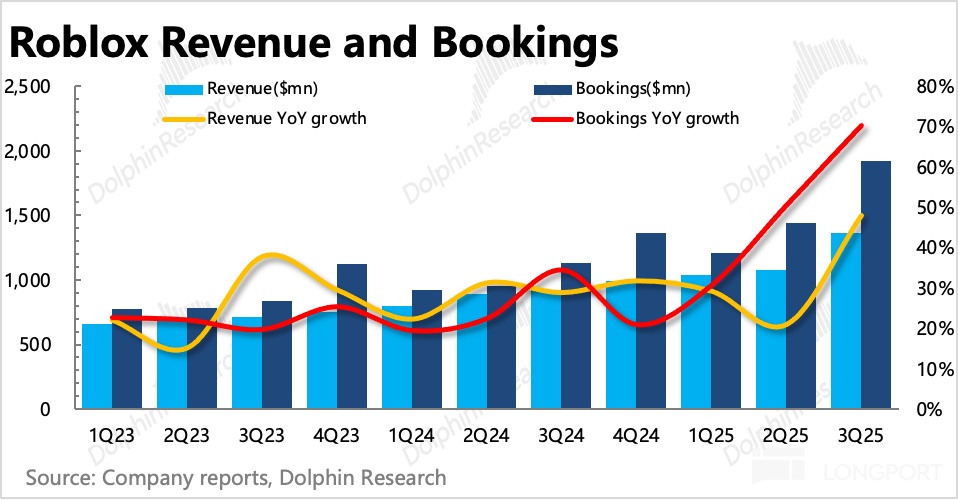

1. Benefiting from popular games, the platform's revenue and DAU in Q3 both grew by 70% year-on-year, significantly exceeding the company's conservative guidance. Although the actual performance also surpassed the consensus expectations of the sell-side, considering the 130% year-on-year increase in concurrent users on the platform in Q3, and the trend of changes in concurrent users and bookings, the probability of greatly exceeding guidance (+40%) is very high. Therefore, Dolphin Research judges that the buy-side sentiment will be much more positive than the consensus expectations.

2. Q4 guidance implies a rapid slowdown in growth: After a 70% leap in Q3, the Q4 guidance for revenue growth quickly slows to 50% to reach 2 billion, implying only a 4% quarter-on-quarter increase, with an annualized growth rate of 17% for the next year, below the long-term target of 20%. Meanwhile, in absolute terms, although the guidance of 2 billion is higher than the consensus expectation of 1.85 billion, according to the market's original expectations, the quarter-on-quarter growth rate in Q4 was expected to be 8%, with an annualized growth rate of 36%. Only an endogenous growth rate above 36% can match the current P/E level of over 50x.

This scenario is reminiscent of several occurrences in Roblox's historical earnings seasons. Dolphin Research believes that due to the cyclical nature of games and specific disturbances such as back-to-school days, seasonal fluctuations are unavoidable. Moreover, in games, a massive surge in the current period followed by significant attrition in the next quarter is normal. In the long view, short-term disturbances do not change the long-term expansion trend.

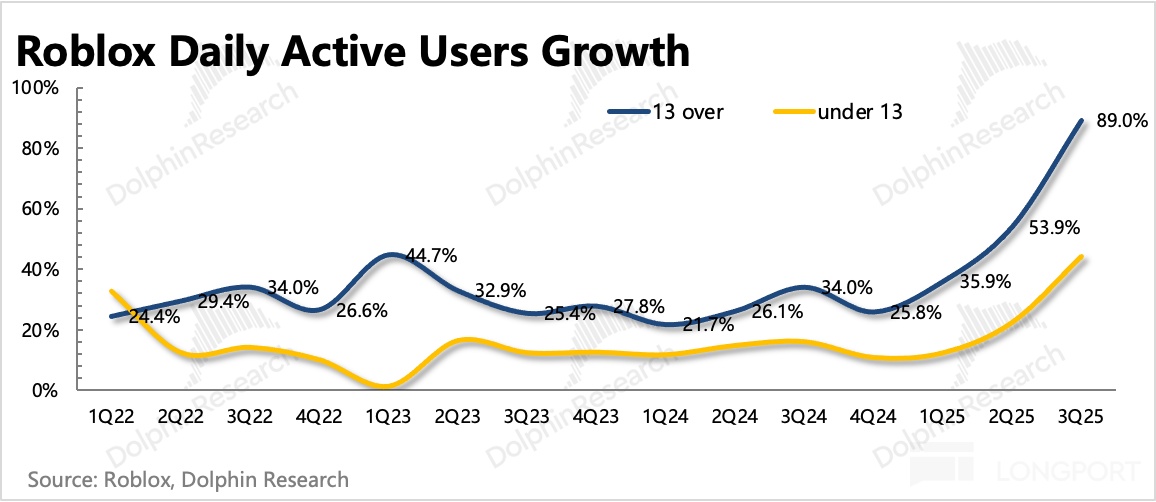

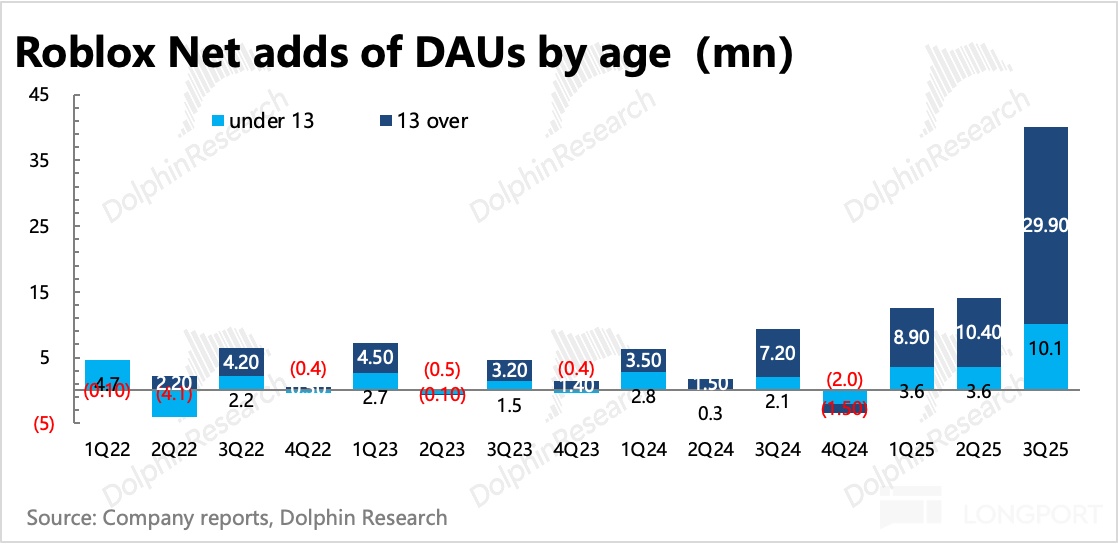

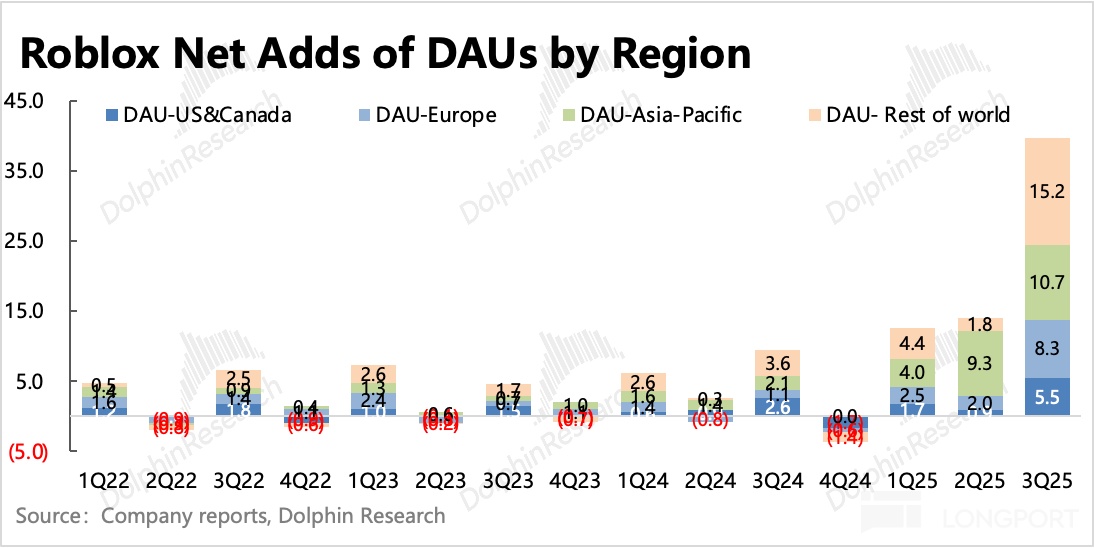

3. The most growth in the Asia-Pacific region and users over 13 years old: Q3 DAU reached 150 million, and according to the general DAU/MAU stickiness comparison of games, the overall user scale should have exceeded 400 million, nearly halfway to the 1 billion target.

In detail, different regions have record-breaking quarterly net growth scales, with the Asia-Pacific and other regions having the most user growth, accounting for 60% of the total net increase in users, mainly due to the effect of regional pricing strategies stimulating users' willingness to purchase, with Indonesia contributing the most new users.

In terms of age, users over 13 years old continued to grow more in Q3, not only due to the gradual improvement in platform content quality but also due to the impact of the back-to-school season in September, which lowered the activity of younger users.

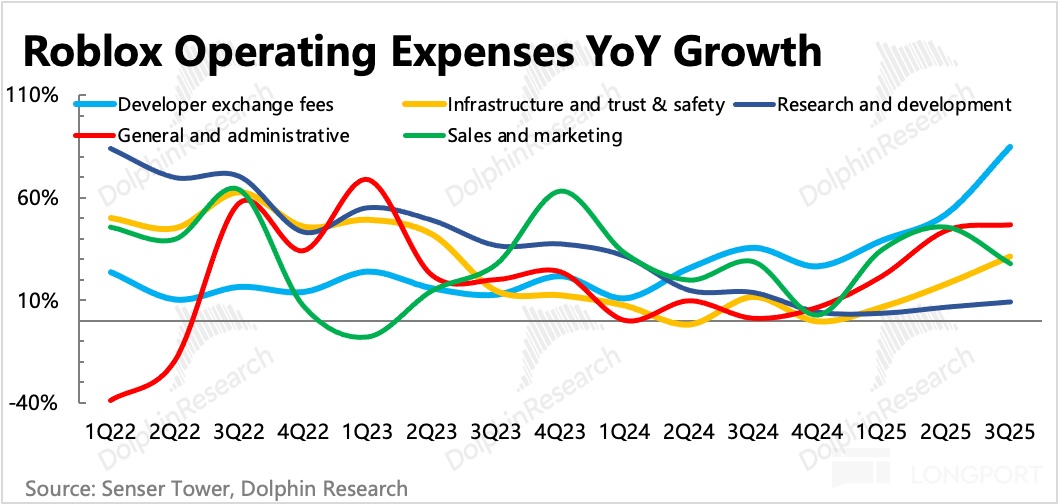

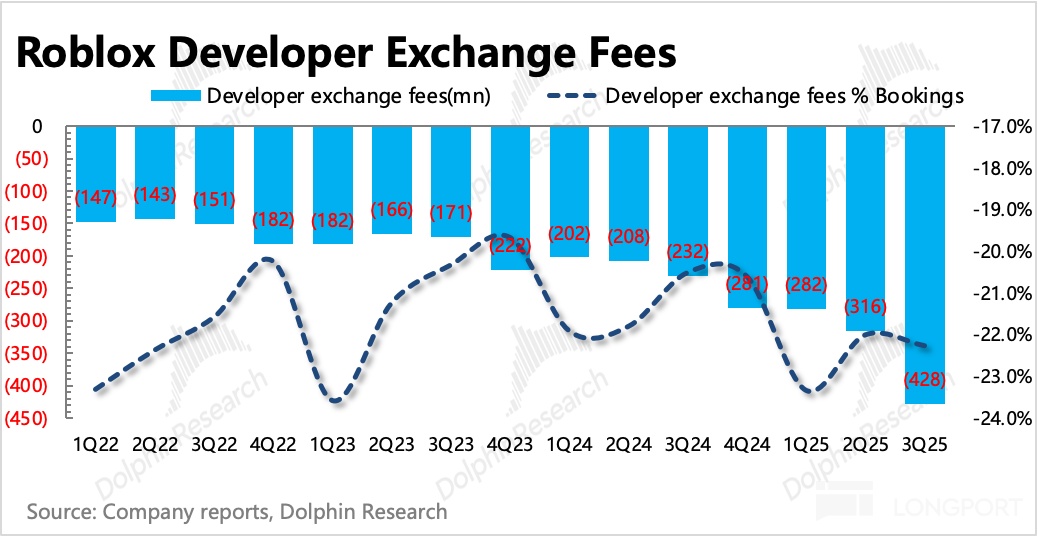

4. Continue to increase developer revenue share: Dolphin Research has mentioned that a key change that keeps us confident in Roblox in the long term is the company's conscious effort to increase the revenue share for developers. In the short term, increasing the developer revenue share will somewhat impact profit release.

However, in the long run, for Roblox to break out of the small product cycle logic and continue on the platform expansion logic, it needs to create a healthy ecosystem, where quality content developers play a very important role. Therefore, establishing a good incentive mechanism is key to the overall ecosystem's development. This is evidenced by the continuous emergence of hit games since last year, driving the platform to achieve true endogenous growth without relying on non-objective factors (such as the pandemic dividend three years ago), proving the effectiveness of this strategy.

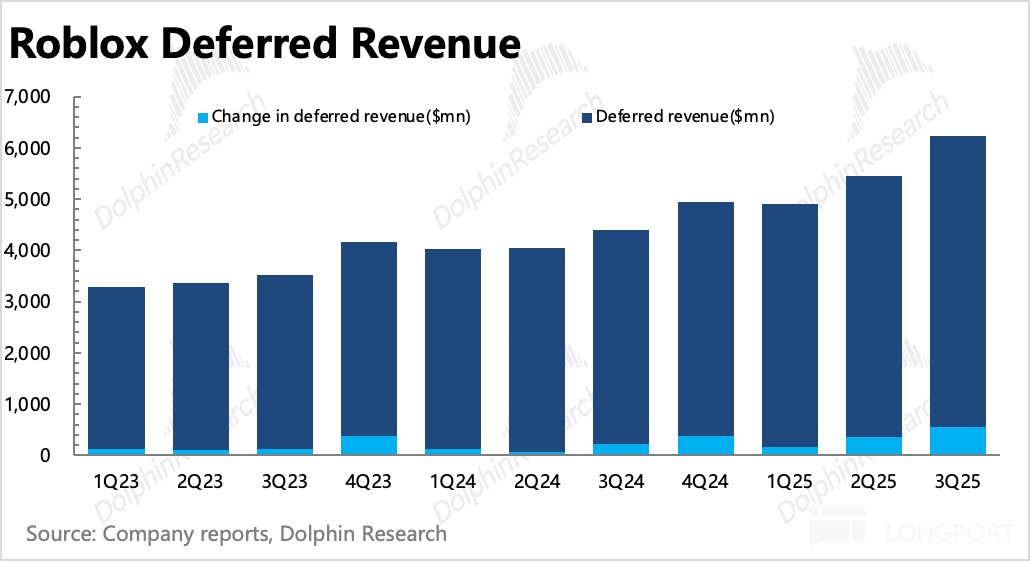

Although the developer revenue share ratio (as a percentage of revenue) only slightly increased quarter-on-quarter in Q3, it increased by 2 percentage points year-on-year. Meanwhile, it continues to rise compared to the income ratio. This indicates that as the number of quality games increases, the average lifecycle of platform games extends, and the deferral indeed lengthens, but it still maintains normal revenue sharing with developers based on actual revenue receipt.

From the RDC conference, it was learned that in Q4, the company adjusted the exchange rate of developer Robux to real dollars, "appreciating" compared to before (1 Robux can be exchanged for $0.0038, up 8.5% from before). Although this may impact Q4 profits, it is also an important long-term positive measure for the ecosystem.

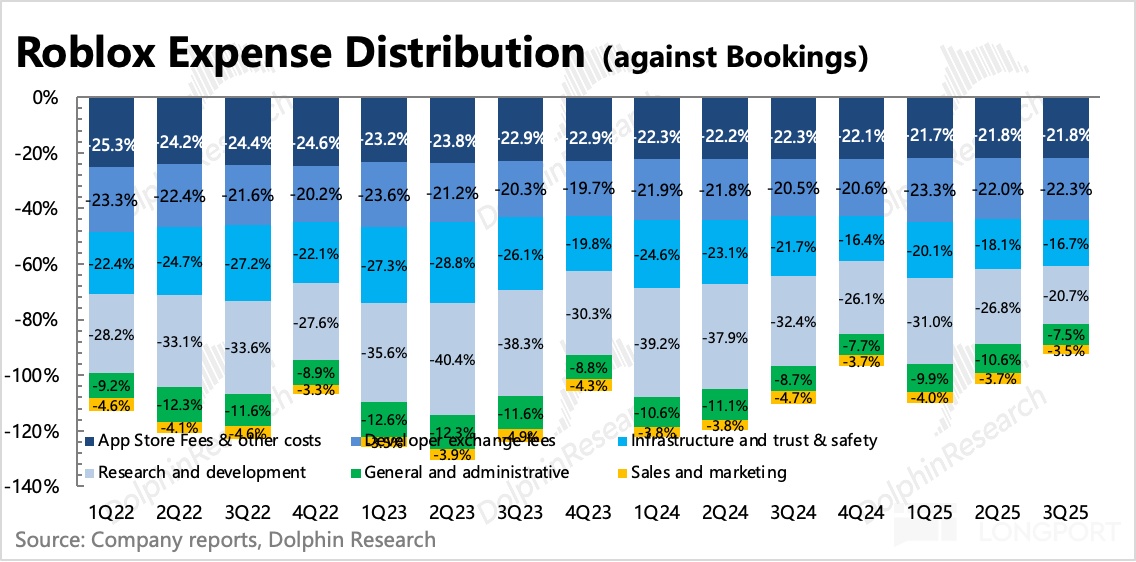

5. Guidance for increased losses: Despite sharing more with developers, developers can bring more quality games, thereby attracting the platform to break through and increase user payments, ultimately leading to revenue expansion, which is more likely to drive profit improvement. For Roblox, besides advancing the advertising business and developing more AI tools, which may generate some additional R&D and sales expenses, other than developer revenue sharing, the overall fee rate is relatively stable. Therefore, as long as revenue expands, operational efficiency can naturally improve.

As shown in the figure below, the Roblox Cube model launched in March facilitates automatic content generation for developers:

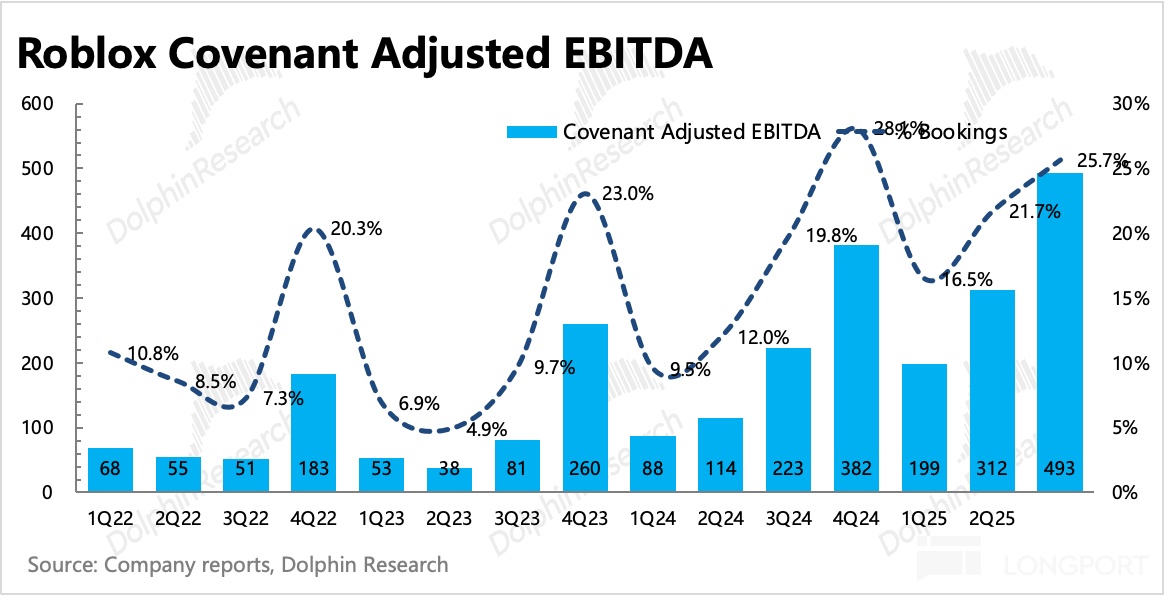

In reality, Q3 GAAP operating loss was nearly 300 million, with the loss rate narrowing to 22%. Excluding SBC, interest, and depreciation amortization, Non-GAAP EBITDA was 46 million, with a profit margin of 2.4%. However, due to the high deferred revenue awaiting confirmation by Roblox, considering this part of the revenue, the Covenant Adj. EBITDA profit margin increased by 4 percentage points quarter-on-quarter to 26%, better reflecting the true operating situation.

Management's guidance for Q4 losses again exceeds 300 million, with the loss magnitude higher than market expectations, possibly due to increased developer revenue sharing (Robux exchange rate adjustment) and basic operational costs such as security. The median adjusted EBITDA guidance is 27%, with quarter-on-quarter improvement slowing. Dolphin Research believes that besides the back-to-school season possibly affecting revenue, the aforementioned preferential exchange rate for developers will also have some impact on short-term profits.

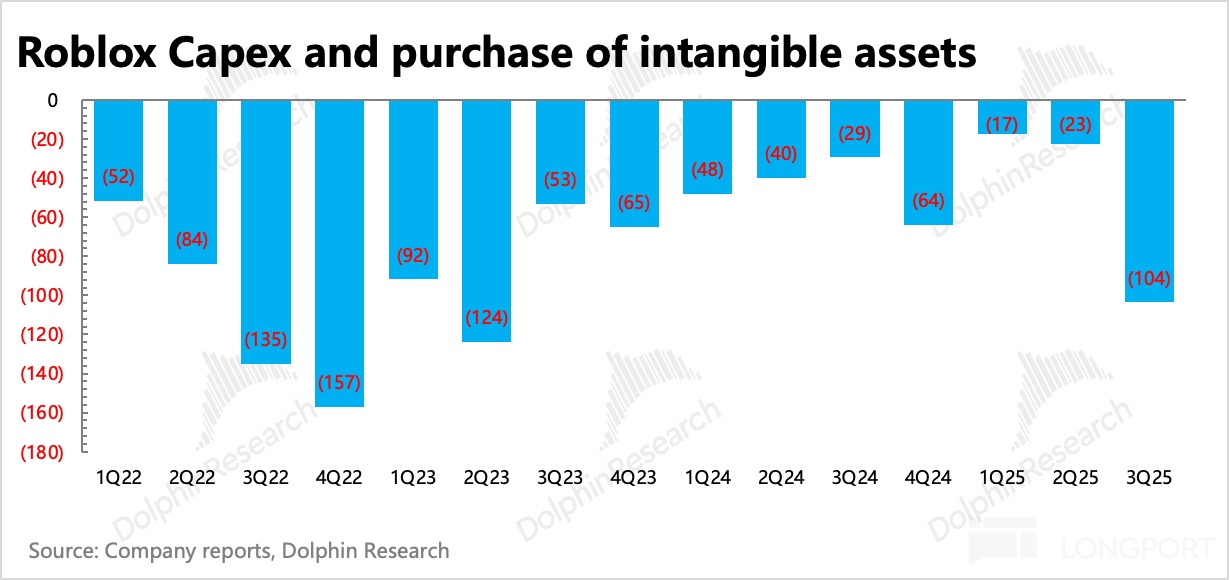

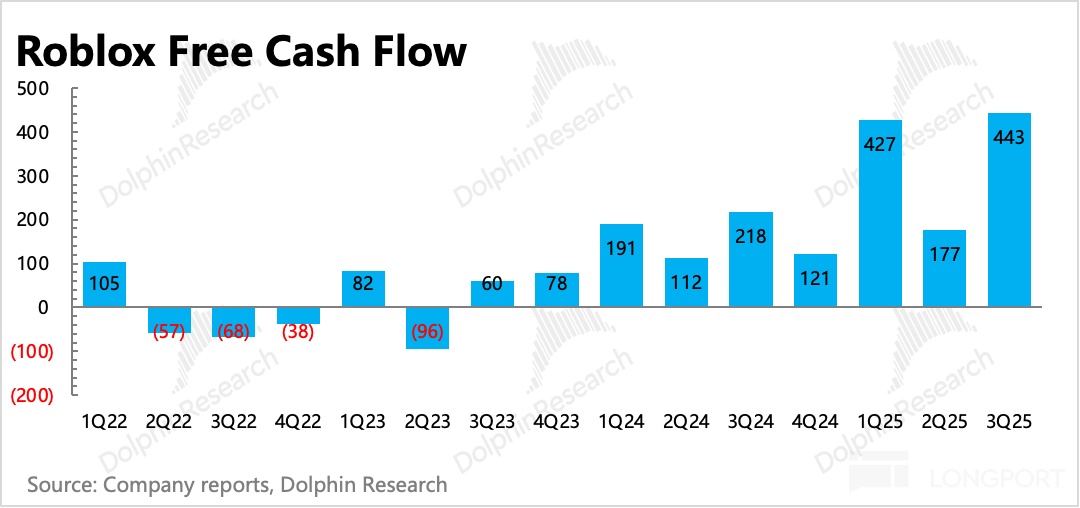

Free cash flow in Q3 doubled year-on-year to 440 million, accounting for 23% of current bookings.

6. Overview of Financial Indicators

(Note: The following BBG consensus expectations are relatively outdated and do not fully reflect market expectation adjustments before the earnings report and more optimistic buy-side expectations (pricing side), so the actual beat margin is not that large.)

Dolphin Research Viewpoint

Overall, the Q3 performance was decent. The market's negative feedback, besides the higher-than-expected loss in Q4 due to increased developer revenue sharing, is mainly due to dissatisfaction with the implied rapid slowdown in growth trend. If the main reason for the higher-than-expected loss is sharing more with developers, Dolphin Research believes it can be viewed positively from a long-term perspective. If it's a growth issue, as mentioned earlier, this is not the first time in Roblox's history. It can only be said that under the pressure of high valuations, some funds inevitably consider cashing in on the good news.

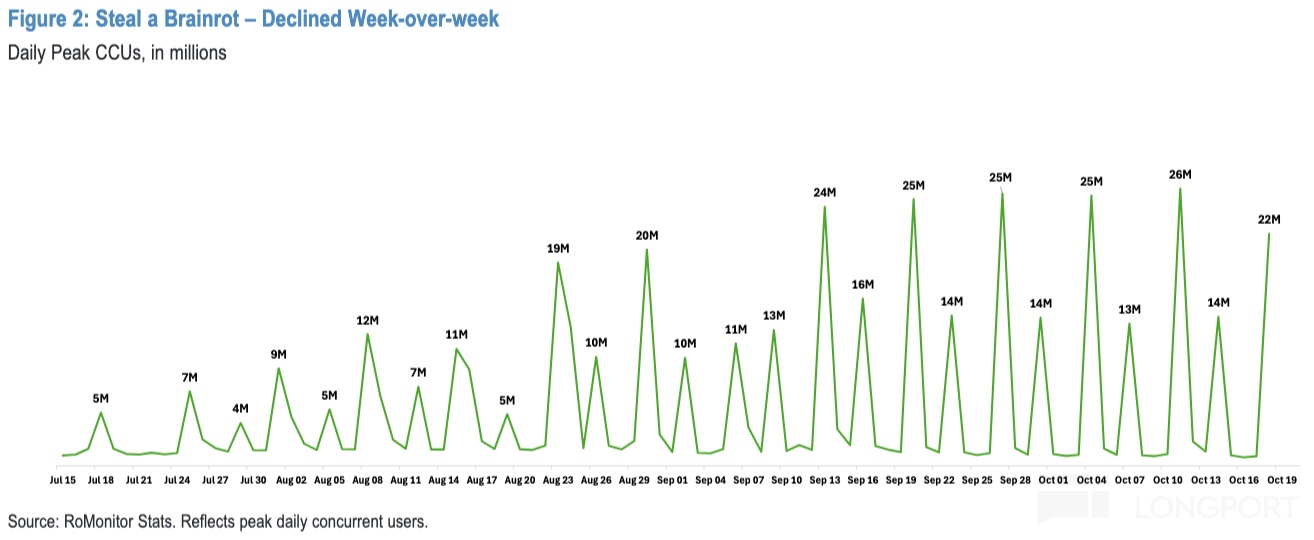

Since the release of the better-than-expected Q2 performance, Roblox's stock price has not increased much. The main influencing factor is that the hit game "Grow a Garden" in Q2 saw a significant slowdown in user engagement after entering August, leading to a 15% correction in Roblox. When another new hit "Steal a Brainrot" quickly took over "Grow a Garden"'s user traffic, the stock price recovered.

Tracking product cycles is a consistent practice for game companies. However, because games themselves are lighter and easier to switch to new games on Roblox, even a big DAU hit game on Roblox should have a relatively shorter average lifecycle than a standalone app with strong retention. This increases the cost of tracking the pipeline for us.

But as Dolphin Research stated last quarter: Roblox is not suitable to be viewed as a traditional game company but rather as a platform. Roblox's biggest advantage is the abundance of content supply, effectively nurturing a large group of developers who are constantly producing content and creating hits. For Roblox, there is no need to bear the risk of betting on hits. This is similar to the logic of YouTube and Bilibili. As long as the economic ecosystem is balanced, a positive cycle of mutual promotion between creators and users can be formed, and good content will always emerge.

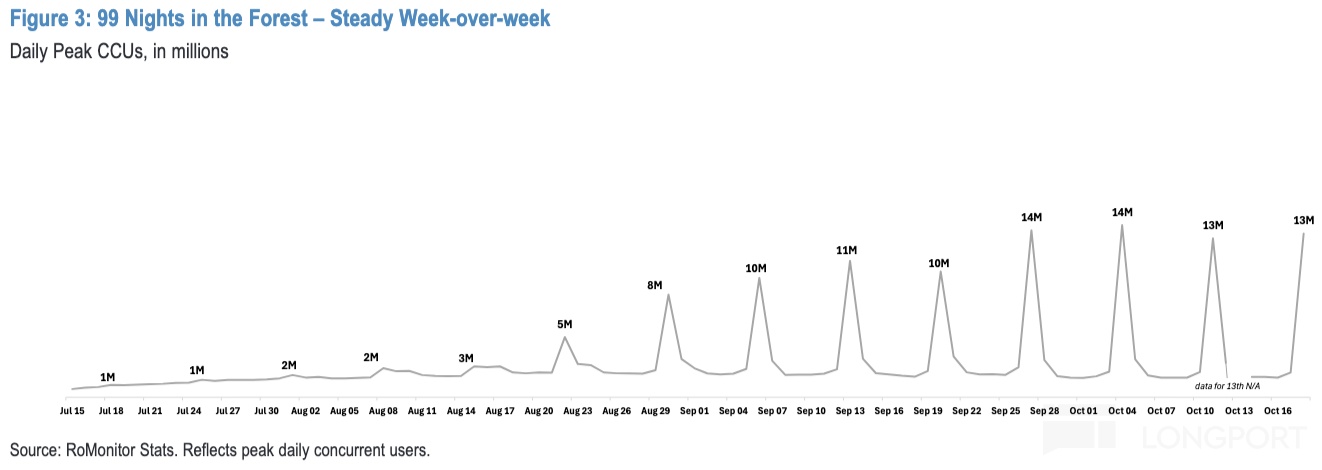

Therefore, after "Grow a Garden" came "Steal a Brainrot", and before "Steal a Brainrot" fully declined, "99 Nights in the Forest" and then "Plants Vs. Brainrots" followed. Although the latter two are not as explosive as "Steal a Brainrot", this relay trend confirms that Roblox's internal circulation ecosystem is gradually stabilizing—this means that even though games rise and fall, the platform as a whole is in an expansion trend.

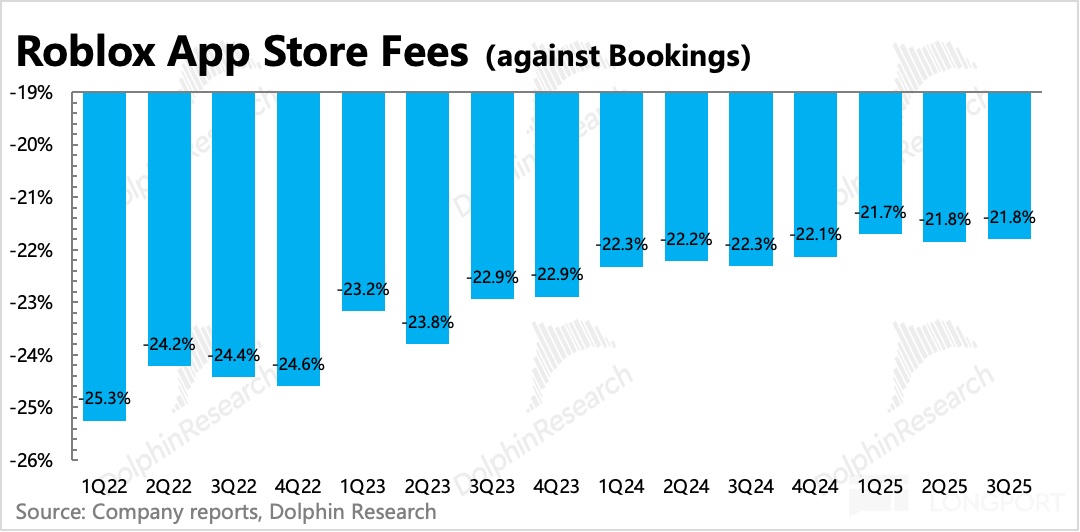

Besides endogenous growth within the platform, long-term growth drivers also include advertising and Apple tax reform stories. Therefore, Dolphin Research remains optimistic about Roblox's long-term prospects, but it is still a matter of a good company vs. a good price.

Assuming a 25% bookings growth rate can be maintained over the next two years (higher than the company's long-term target of 20% set three years ago), with a slight improvement in profit margin next year (+2 percentage points), achieving an Adj. EBITDA of 2.2 billion, with a two-year CAGR of 30%. Based on the current market value, there is still a 38x EV/EBITDA, which is clearly not safe enough. But if a premium is given for the profit inflection point, a correction to below 35x (77 billion, compared to last quarter's valuation) can be actively monitored.

Below are Roblox's key indicator charts:

Similarly, the adjusted EBITDA indicator, excluding SBC expenses, when restored to the original calculation method (i.e., adding net deferred revenue to Adj. EBITDA, which is deferred revenue minus deferred costs), Covenant Adj. EBITDA in Q3 grew by 121% year-on-year, with a profit margin (%Bookings) of 25.7%, an increase of nearly 6 points year-on-year.

<End here>

Dolphin Research "Roblox" Historical Articles:

Earnings Reports

July 31, 2025, Conference Call Minutes "Roblox (Minutes): Incentive Video Ads Launched, Adoption Rate Continues to Grow"

July 31, 2025, Earnings Report Commentary "Roblox: Hit Game Assists, Returning to Ecosystem Breakthrough"

May 2, 2025, Earnings Report Commentary "Roblox: Turning the Metaverse, a True Fortress of Risk Aversion?"

February 9, 2025, Conference Call Minutes "Roblox (Minutes): Sharing with Developers, Expanding the Ecosystem."

February 9, 2025, Earnings Report Commentary ""Sliding Kneel" Roblox: Even the Ultimate Metaverse Flag Bearer Must Fall?"

3Q24 Conference Call Minutes "Roblox: Marching Towards the Long-term Goal of 10% Game Revenue Market Share! (3Q24 Conference Call Minutes)"

3Q24 Earnings Report Commentary "Roblox's Growth Achilles' Heel is "Breaking the Circle""

August 2, 2Q24 Conference Call Minutes "Roblox: Cautious Guidance, Leaving Room (2Q24 Conference Call)"

August 2, 2Q24 Earnings Report Commentary "Roblox: Guidance Raised, Why is the Market Still Dissatisfied?"

May 11, 1Q24 Conference Call Minutes "Roblox: Revenue Guidance Lowered for Caution, Growth Recovered in Early April (1Q24 Conference Call Minutes)"

May 10, 1Q24 Earnings Report Commentary "Roblox: Key Indicators Falter, Growth Doubts Arise Again"

February 8, 4Q23 Conference Call Minutes "Roblox: Positive Growth Guidance Stems from Good User Data Performance (4Q23 Conference Call)"

February 8, 4Q23 Earnings Report Commentary "Roblox: Growth and Loss Reduction, Not Wanting to Miss Either"

November 8, 3Q23 Earnings Report Commentary "Roblox: Taking Advantage of the Peak Season to "Clear the Shame""

August 11, 2Q23 Conference Call Minutes "Roblox: User Experience First, Maintaining Ecosystem Expansion (2Q23 Conference Call Minutes)"

August 9, 2Q23 Earnings Report Commentary "Roblox: Profit Bomb, Breaking Through High Valuation"

In-depth

July 18, 2023 "Betting on the Metaverse with Roblox, Is It Worth It?"

July 13, 2023 "Roblox: Unable to Swallow the "Big Pie" of the Metaverse"

This article's risk disclosure and statement: Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.