Roblox (Minutes): Will prudently invest in AI and share profits with developers

The following are the minutes of the FY25Q3 earnings call for$Roblox(RBLX.US) compiled by Dolphin Research. For the earnings interpretation, please refer to 《Roblox: Record-breaking Ecosystem, Why is the Market Unimpressed?》

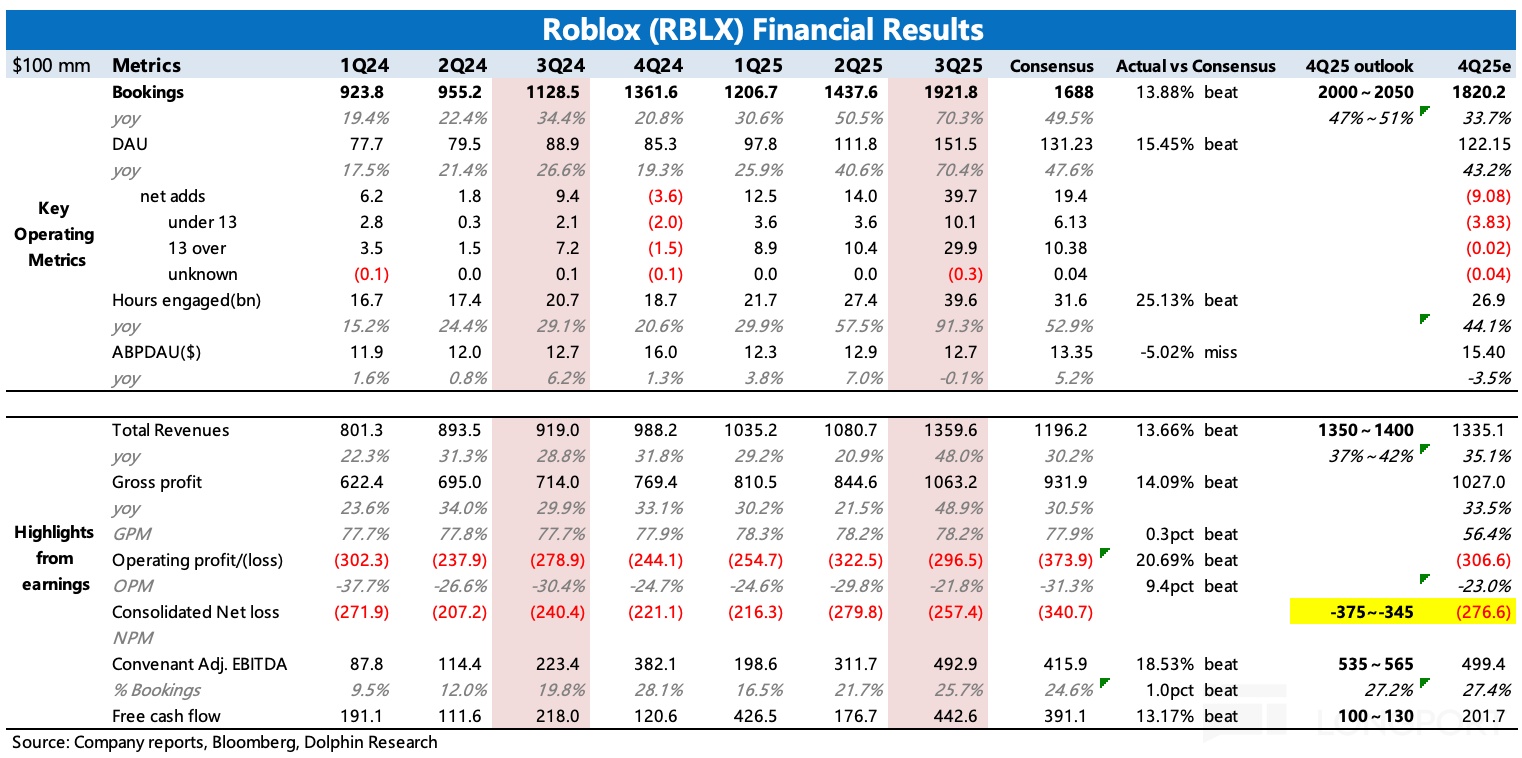

I. Review of Core Financial Information

1. Analysis of Ecosystem Health:

a. Diversification of Content Ecosystem ("Long Tail Effect" Significant): User engagement growth rate for games outside the top ten (long-tail content) accelerated from 47% in Q2 to 58% in Q3. Consumption growth rate for this content also remained above 40%. The platform's growth is not solely driven by top hits; the underlying ecosystem is vibrant.

b. Enhanced Monetization Capability: The growth rate of paying users (88%) significantly outpaced the overall user growth rate (70%), mainly due to the optimization of the economic system, particularly the regional pricing strategy launched in June, which effectively increased the payment penetration rate in markets like Southeast Asia.

c. Structural Interpretation of Key Metrics: Some metrics (such as per capita bookings in the Asia-Pacific region and overall per capita payment) showed a decline, but this does not indicate a weakening of the platform's monetization capability. The fundamental reason is the mixed change in user geographic structure—a large influx of new users from regions with lower average consumption levels, which lowered the average. This is a normal phenomenon during a period of rapid expansion.

2. Revenue Expectations: The business is expected to continue maintaining healthy double-digit bookings growth. Growth will be driven by new technologies to be launched at the end of Q1/beginning of Q2 2026 (aimed at expanding game categories).

3. Short-term Risks and Challenges:

a. High Base: The strong growth in 2025 will pose a challenging year-on-year comparison for 2026.

b. Impact of Safety Policies: New policies introduced to become the "gold standard of safety" may cause some friction or negative impact on user engagement and bookings in the short term, but in the long term, they are "amplifiers" of growth.

4. Investment and Margin Guidance:

a. The growth rate of bookings has exceeded the company's ability to deploy supporting investments.

b. Increased Investment: The company will "catch up" with investment progress in the coming quarters, focusing on developer exchange (DevEx), infrastructure, safety, and personnel.

c. Margin Expectations:

- Q4 2025 margins will not achieve year-on-year growth.

- Full year 2026: Due to higher DevEx rates, limited service cost optimization, and increased personnel expenses, margins are expected to slightly decline.

d. Capital Expenditure (CapEx): Will increase starting from Q4 2025 and remain at a high level in 2026.

II. Detailed Content of the Earnings Call

2.1 Key Information from Executive Statements

1. Performance:

| Metric | Q3 2025 Data | Year-on-Year Growth | Remarks |

| Global Market Share | 3.2% of global gaming revenue | 0.9% | Long-term goal is 10% |

| Daily Active Users (DAU) | 151.5 million | 70% | Asia-Pacific growth 108%, users over 13 years old grew 89% |

| Total User Hours | 39.6 billion hours | 91% | Asia-Pacific growth 127%, users over 13 years old grew 107% |

| Revenue | $1.36 billion | 48% | |

| Bookings | $1.92 billion | 70% | Asia-Pacific growth 110% (Indonesia growth 804%) |

| Monthly Paying Users | 35.8 million | 88% | |

| Developer Exchange (DevEx) | $427.9 million | 85% | Record high, over $1 billion in the first nine months of 2025 |

| Peak Concurrent Users | 45 million | Record set on a weekend in August |

2. Platform and Content Ecosystem:

a. Emergence of Popular Content: 7 games had DAUs exceeding 10 million during Q3, 5 of which were new games created in the past 12 months.

b. Healthy Content Ecosystem: New popular games continue to emerge (such as Fish It popular in Indonesia), evergreen games (such as Brookhaven, Blox Fruits), and last year's popular games maintain high popularity.

c. Empowering Creators: DevEx rate increased by 8.5%, and the collaboration process between IP owners (such as Mattel, Kodansha) and creators was simplified. Key metrics of the recommendation algorithm (such as clearance rate, 7-day game days, etc.) were made public to creators to help them optimize content. Roblox Moments was launched to provide new innovative content discovery channels.

d. Agent Framework: The Microsoft Agent framework was launched to help enterprises build and manage multi-agent systems, with clients like KPMG using it to improve audit processes. Azure's market share continued to grow this quarter.

3. Technology R&D:

a. Expansion of Game Types: Technologies such as server authority and custom matchmaking are being introduced to enhance the experience of competitive games like shooting and sports. Virtual avatar enhancement technology under development will achieve higher fidelity and more realistic character appearances.

b. Safety & Civility: AI facial age estimation will be launched by the end of the year to assess user age and manage social permissions, enhancing child safety. The International Age Rating Coalition (IARC) standards will be adopted, and the minimum age for restricted content will be raised to 18. Collaboration with the Attorney General Alliance aims to establish industry safety communication standards.

c. AI Applications: Over 400 AI systems are already running internally, applied in safety, discovery, and creation.

- Data Advantage: Over 30,000 years of human interaction data is captured daily under compliance for model training, which is unique and will not be leaked externally.

- Future Vision: Using AI to achieve "infinite creation," allowing ordinary users to create clothing, worlds, and games in real-time and interact with AI NPCs.

d. Infrastructure:

- An optimization strategy combining self-owned core data centers, edge data centers, and bare-metal GPUs with cloud service providers for traffic burst expansion.

- Edge data centers are being added in places like Brazil to reduce latency and enhance user experience.

2.2 Q&A

Q: You mentioned significant investments in infrastructure such as GPUs and data centers. How will these investments change the user experience and game content on Roblox? Specifically, what specific changes will AI technologies like Cube and your "real-time content generation" and "4D content creation" bring to Roblox's experience and user engagement in the coming years?

A: Our investments in AI and infrastructure are aimed at realizing a grand future vision: allowing creators to freely define any style from anime to photorealism and support large-scale real-time interactions from single-player to 100,000 players. Specifically, the upcoming Cube 4D technology will allow for the real-time generation of complex, interactive objects (such as vehicles and weapons) in multiplayer games, rather than just static props.

This AI-driven ability to modify the world in real-time will not only enhance the performance and experience of existing game types but, more importantly, it will give rise to entirely new gameplay and types that we cannot yet imagine, just as our past foundational technology innovations gave birth to "Dress to Impress."

Q: You mentioned increasing the DevEx rate, but competitive platforms like Fortnite are also using highly attractive revenue-sharing models to attract creators. How do you view the necessity of continuing to tilt economic benefits towards creators in the future to counter existing and potential platform competition?

A: Evaluating a platform's attractiveness cannot be based solely on the revenue-sharing ratio; creators are more concerned with the overall return. This return is the revenue-sharing ratio multiplied by the enormous opportunities our platform offers—including a large user base, powerful creation tools, and the possibility of rapid success for newcomers. Our strategy is not simply to compete on rates with competitors, but to continuously optimize internal costs (such as self-built infrastructure) and, while ensuring our own revenue and responsibility for safety, prudently return as much value as possible to the creator community. This is a long-term commitment, far more important than a single rate comparison.

Q: As the proportion of high-age users on the platform continues to expand, what key experiences and insights have you gained? Based on these insights, how will you adjust investment priorities to continue maintaining and promoting the growth of this user group in the coming years?

A: Our core experience in attracting high-age users is that creator-driven hit content (such as "Dress to Impress") can achieve viral growth through word of mouth, and these new gameplay styles are equally attractive to high-age users. Therefore, our investment strategy is to adjust the technology roadmap to support creators in exploring mainstream game types such as sports, racing, and RPGs. But we are not copying; instead, we empower creators to meet these market demands in our unique way by investing in more advanced virtual avatar systems, cross-platform technology (seamless experience from low-end mobile phones to high-end PCs), and deeply integrated AI tools, thereby naturally attracting and retaining a broader adult user base.

Q: At the 2023 Investor Day, you set a target of over 20% annual bookings growth for '25-'27. But in the latest shareholder letter, you mentioned "looking ahead to next year, our long-term goals have not changed." Does this imply that management expects the bookings growth rate in 2026 to be below 20%? The market seems to be concerned about this.

A: We will not provide specific growth guidance for 2026 at this time because it is too early. We want to emphasize that next year's growth will be influenced by two factors: on the one hand, the strong momentum of the current platform and the new technologies to be launched in the first half of next year will provide favorable momentum; on the other hand, the high base caused by this year's excellent performance and the upcoming new safety policies may also bring potential resistance. Although these factors will not change our long-term confidence in the business, we cannot provide specific numbers for 2026 until we achieve our 2025 goals.

Q: You did not include the advertising business when mentioning favorable factors for next year, which piques our curiosity. Could you share your early experiences with incentivized video ads? And, in 2026, to what extent do you plan to prioritize the advertising business?

A: We are very optimistic about the long-term opportunities in the advertising business, but we are cautious in the short term because ensuring "doing it right" is the top priority. Currently, we are testing incentivized video ads with over 140 creators on a limited scale, learning how to balance creator commercialization, user experience, and advertiser brand presentation. As a result, advertising will not be a major short-term growth contributor, but it is undoubtedly a key part of our business development in the coming years.

Q: The recommendation engine has been successful in discovering hit games, but it may also lead to content concentration in a few popular categories (such as certain game mechanics). How do you use tools like the recommendation engine to actively promote category diversity in the content ecosystem (such as sports, racing, etc.) to ensure users can discover a sufficiently rich new experience? Are you concerned about the risk of content concentration?

A: We are actively promoting content diversity rather than just optimizing short-term metrics. Our content discovery system is committed to achieving the long-term health of the ecosystem, which means we will actively support new categories (such as RPGs, racing, sports, etc.) and new creators, rather than sticking to historically popular content. Specifically, we achieve this goal through a three-pronged approach: 1) algorithm-based natural recommendations; 2) creator-paid "sponsored slots"; 3) official manual "curated" curation. This combination ensures that we can constantly look forward and discover new experiences for the platform's future. I believe the current discovery system is more effective than ever and will continue to improve.

Q: As more and more games have daily active users exceeding ten million, the user behavior data you accumulate is also becoming more extensive. Does this mean your recommendation algorithm will become increasingly intelligent, thereby forming a true "data moat" in the field of content discovery?

A: First, we strictly comply with privacy and security regulations and will never leak any data outside the platform. Under this premise, our data moat is indeed very strong. Our advantage data is far more than just click behavior; it is a vast amount of real-time 3D virtual avatar interaction data—such as specific user behaviors in experiences, where they linger longer, etc. We use these unique 3D and immersive duration signals to gain a deeper understanding of "what makes an experience fun" and incorporate it into the recommendation algorithm. In short, the answer is yes, we are continuously optimizing the content discovery mechanism using this unique dataset.

Q: In the past few quarters, we have observed a gap between user time growth and booking revenue growth. Can you explain the reason? Is it because user growth is more from games or regions with lower monetization capabilities? And how should the relationship between these two indicators evolve in the future?

A: Your judgment is correct. The core reason for the difference between user time growth and revenue growth is the change in the geographic mix of user growth. Specifically, our user time growth is more from emerging market regions with inherently lower monetization levels. Although the monetization capabilities of each region are still growing healthily year-on-year, the increased proportion of users from these low-monetization regions has lowered the overall average monetization data, resulting in the gap you see.

Q: Roblox has doubled in size over the past two years, with significant changes. Considering the potential severe year-on-year growth pressure in 2026, and Roblox has historically never used advertising to attract users, mainly relying on the natural spread of hit games. Why not consider using advertising to acquire new users in 2026, a "slow growth year," to smooth out user growth fluctuations?

A: First, we are very optimistic about future growth potential because we currently only account for 3% of the global gaming market, which has enormous potential. Regarding advertising, you may not know that we have always been doing paid user acquisition, but as a supplement to viral growth, and we do it very prudently. One of our important future directions is to collaborate with creators on the platform for joint paid promotion.

By sharing costs and benefits with creators, we can incentivize them to buy more actively, thereby increasing the overall scale of paid user acquisition. So, this is indeed one of our key directions, and we will expand our investment in a financially prudent manner to ensure the return on advertising spend (ROAS).

I would like to add that our current spending on marketing and promotion is actually very low. The main driver of our growth is still the platform's powerful natural growth engine, which is working very well, with nearly 40 million new users added in the last quarter alone. Of course, as mentioned earlier, we are very much looking forward to working with developers to promote new content through paid means, which will especially help us achieve content and category diversity, and we will continue to explore and experiment in this area.

Q: In the last two quarters, the platform's user numbers (DAU) have grown significantly. Has the growth in the number of developers (dev) kept pace with user growth? We don't know much about the growth of the developer ecosystem and want to know if it is as strong as user growth.

A: Regarding the developer ecosystem, we continue to observe healthy growth in the income and user engagement of the top 10, top 100, and even top 1000 developer groups. More importantly, the "long tail curve" of income distribution is becoming increasingly flat, meaning that more and more creators at different levels can earn substantial income on the platform, and the entire ecosystem is very healthy and continues to grow. At the same time, our migration to self-owned data centers in infrastructure is also key to improving efficiency.

Q: Continuing from the previous question, if the number of developers is indeed growing in sync, considering the company is currently in a new investment cycle centered on AI, do we have reason to believe that the returns from this investment (especially in AI) will be faster and more direct than previous investment cycles? Has this expected return speed been reflected in your comments on 2026?

A: Regarding the investment return cycle, we need to look at it differently: some investments, especially AI applications that have already been made (such as content discovery, economic systems, etc.), are quickly generating returns and are short-term effective. Others are more long-term, such as building self-owned data centers to deploy and train AI models, which takes more time. Overall, we have benefited from existing investments and expect more significant results in 2025, with continued expansion in 2026 and beyond.

Risk Disclosure and Statement of this Article:Dolphin Research Disclaimer and General Disclosure