Apple: iPhone maintains its central position, when will AI reveal its true form?

Apple (AAPL.O) released its Q4 FY2025 earnings report (ending September 2025) after the U.S. stock market closed on October 31, 2025, Beijing time. Key points are as follows:

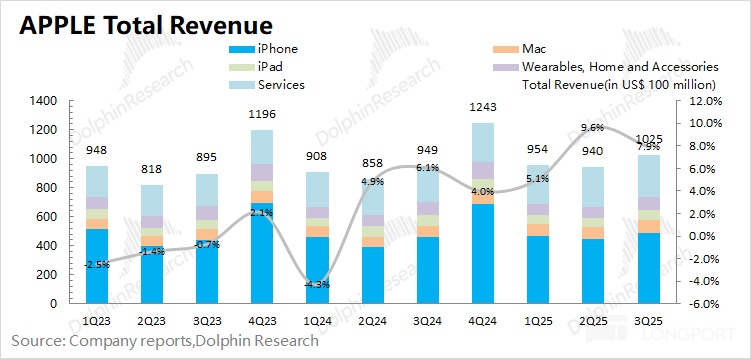

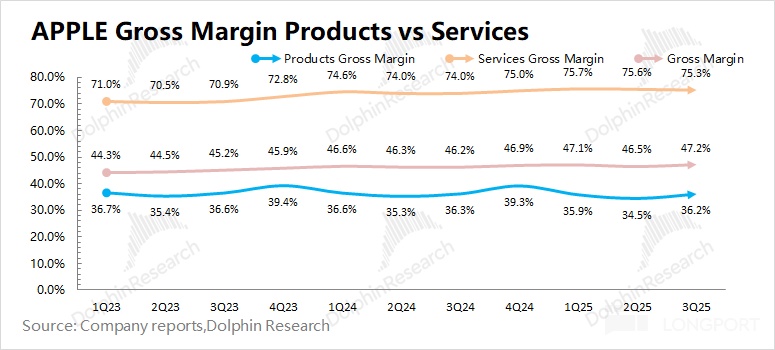

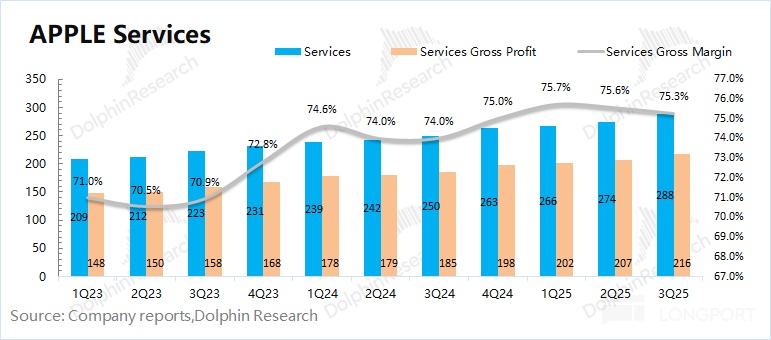

1. Overall Performance: This quarter, Apple achieved revenue of $102.5 billion, up 7.9% year-on-year, roughly in line with market expectations ($102 billion). The company's revenue growth this quarter was mainly driven by the growth of iPhone, Mac, and software services. Apple's gross margin was 47.2%, up 1 percentage point year-on-year, better than the market consensus (46.6%). The gross margin of software services increased to 75.3% year-on-year, while hardware gross margin remained at 36.2% year-on-year.

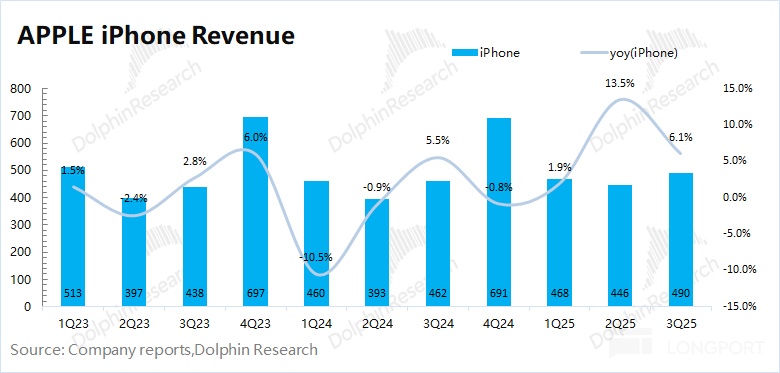

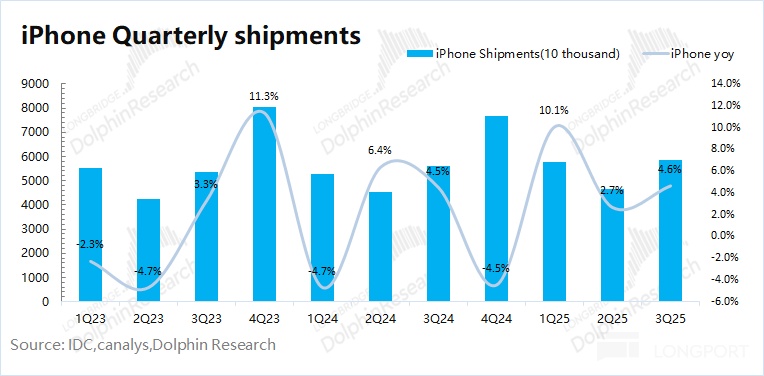

2. iPhone: This quarter,$Apple(AAPL.US) iPhone business achieved revenue of $49 billion, up 6.1% year-on-year, slightly below market expectations ($49.3 billion). The growth in the mobile business this quarter was driven by the launch of the iPhone 17 series. For this quarter, Dolphin Research estimates that the overall iPhone shipment volume increased by 4.6% year-on-year, with the average selling price rising by 1.4% year-on-year.

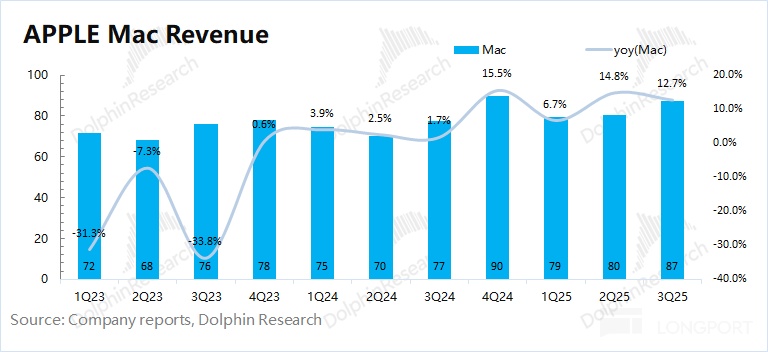

3. Other Hardware Beyond iPhone: The company's Mac business achieved a 12.7% year-on-year growth this quarter, mainly driven by the growth of MacBook Air, with growth in all regions globally, and double-digit growth in emerging markets; while iPad and other hardware businesses stopped declining this quarter but remained relatively weak, affected by the high base from last year's iPad Air/Pro launch.

4. Software Services: The company's software services revenue this quarter was still $28.8 billion, better than the market consensus ($28.2 billion). With a high gross margin of 75.3%, the company's software business, accounting for 28% of revenue, generated 45% of the company's gross profit.

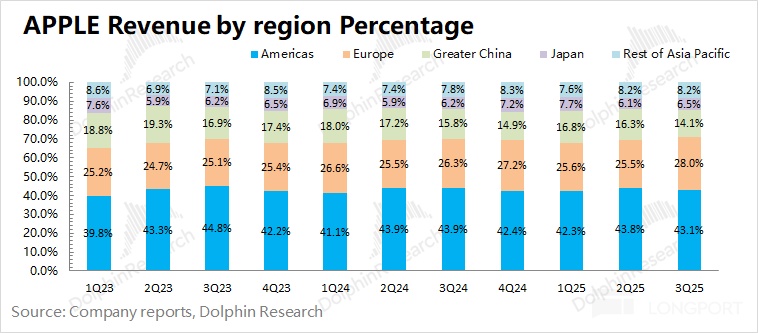

5. Revenue by Region: The Americas remained the company's core market, with a revenue share of 43%, achieving a 6.1% year-on-year growth this quarter; Greater China was the only region with a year-on-year decline in revenue this quarter, mainly due to the impact of state subsidies and the delayed launch of the iPhone Air.

Dolphin Research's Overall View: Performance was moderate, guidance boosts confidence.

Apple's performance this quarter was basically in line with expectations, with revenue growth mainly driven by the growth of iPhone, Mac, and software services; while high profit growth was mainly due to the impact of a billion-dollar back tax from the EU in the same period last year. If the impact of the $10 billion back tax is added back, Apple's actual profit growth this quarter is about 10%.

After this "lukewarm" earnings data, Apple's stock price fell by 3% after hours. However, the company's management released guidance expectations for the next quarter, boosting market confidence and lifting Apple's stock price to around +3%.

For the next quarter, the company expects ① revenue to achieve a year-on-year growth of 10-12%, better than market expectations (6%), with iPhone business achieving double-digit growth as the main driver for the next quarter; ② gross margin of 47-48%, better than market expectations (46.6%), partly due to the adjustment of tariffs in China from 20% to 10% next quarter (the tariffs on products produced in China can benefit from the reduced rate when exported). Considering the guidance for the next quarter, Apple's iPhone 17 series is relatively good, driving the company's performance growth to accelerate, achieving double-digit growth again.

[Based on the Sino-U.S. negotiations: The U.S. plans to halve the existing "fentanyl tariff" on Chinese goods from 20% to 10%]

In addition, Dolphin Research mentioned two focus issues in the last quarter's earnings report (Google lawsuit and fall launch event), both of which had results in September:

a) Google Lawsuit: Better than expected. Although Google is prohibited from signing exclusive agreements with phone manufacturers for its products, it is not prohibited from agreeing to obtain default positions through revenue sharing. Similar to the past, Google pays Apple over $20 billion a year to secure the position of the default search engine on terminals;

b) Fall New Product Launch: The iPhone 17 series was released, with the main change being the "introduction of Air to replace Plus, doubling the storage of the basic version." Apple continues to maintain "minor tweaks," without bringing "highlights" in the AI direction.

Combining the two events with stock performance: On the day of the Google lawsuit result, Apple's stock price rose by 3%, while on the day of the fall launch event, the stock price fell by 3%. The former was the release of a negative factor suppressing the stock price, while the latter's stock performance also expressed the market's dissatisfaction with the launch event at that time.

Although this Apple launch event did not bring "surprises" in the AI aspect, the "more for less" operation on the basic version of the iPhone still reflects Apple's "sincerity." After all, the iPhone 17 256G is priced at 5,999 yuan, and with state subsidies, the final price is 5,499 yuan, making it a favorable response to competition from Android in the mid-to-high-end market.

Considering Apple's current market value ($4 trillion), corresponding to a PE of about 33 times for FY2026 net profit (assuming revenue growth of +9%, gross margin of 47.6%, tax rate of 15.7%). Referring to the company's historical valuation range, it is basically between 25x PE and 40x PE, with the current valuation near the midpoint of the range.

Dolphin Research believes that the main driving factors for Apple can be viewed from both short-term and long-term perspectives:

① Short-term: Mainly focusing on the shipment performance of the iPhone 17 series. Dolphin Research believes that the "more for less" operation will drive phone sales. The guidance given by the company for the next quarter also reflects the good performance of the iPhone 17 series, while the market's expectation for the full-year shipment volume was only about a 3% year-on-year increase;

② Long-term: Mainly focusing on Apple's progress in AI. The market had some expectations for the company's AI progress disclosure at this launch event, but the company did not explicitly mention it, and the stock price fell on the day. Compared to iPhone new products, AI can bring greater growth potential to the company. If the company can clearly provide breakthroughs in the AI field or integrate more AI functions in the next generation of new products, it will be the most anticipated by the market.

Overall, the risk of Apple's current software business has been realized, and this earnings report still delivered stable performance. The main focus of the company is the shipment volume of the iPhone 17 and AI progress. If the iPhone 17 shipment exceeds expectations (such as the guidance for the next quarter), it will be a short-term driver for the company's stock price, but the valuation is still difficult to break through the upper limit of the 40x PE range. Only when the company brings "eye-catching" performance in the AI field will the company as a whole achieve a substantial breakthrough, and the market still expects Apple to become a leader in edge AI. For more information, please follow Dolphin Research's subsequent management communication minutes and related content.

Dolphin Research's specific analysis of Apple's earnings report is detailed below:

I. Overall Performance: Moderate

1.1 Revenue: In Q4 FY2025 (i.e., 3Q25), Apple achieved revenue of $102.5 billion, up 7.9% year-on-year, in line with the market consensus ($102 billion). The company's revenue growth this quarter was mainly driven by the growth of iPhone, Mac, and software services, while iPad and wearables and other hardware businesses remained relatively weak.

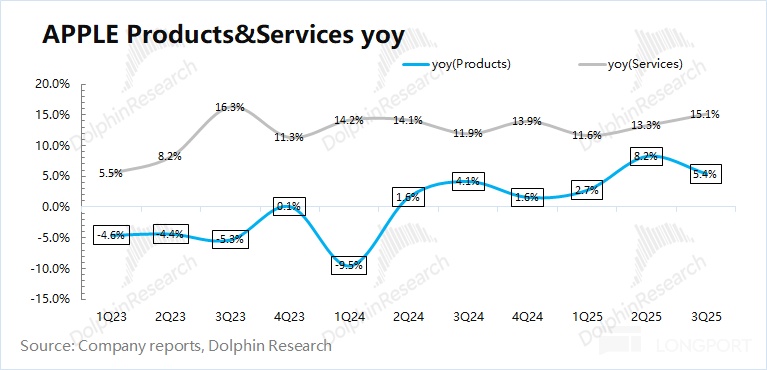

From both hardware and software perspectives:

① The growth rate of Apple's hardware business this quarter was 5.4%, continuing to maintain positive growth. The hardware business continued to grow this quarter, mainly driven by the growth of the company's main hardware products (iPhone and Mac), while iPad and wearables businesses basically stopped the "downward trend" this quarter;

② The growth rate of Apple's software business this quarter was 15.1%, accelerating. The resolution of the Google lawsuit this quarter directly released the risk of the company's software business.

From each region: Revenue increased year-on-year to varying degrees. The Americas, Europe, and Greater China are the company's three main sources of revenue. Specifically, the Americas accounted for 43.1% of revenue, growing 6.1% this quarter; Europe's growth rate increased to 15.2% this quarter. Due to factors such as the delayed launch of the iPhone Air, Greater China's revenue declined by 3.6% year-on-year this quarter, the only region to decline, with the company expecting growth to resume next quarter.

1.2 Gross Margin: In Q4 FY2025 (i.e., 3Q25), Apple's gross margin was 47.2%, up 1 percentage point year-on-year, in line with the market consensus (46.6%). The improvement in the company's gross margin was mainly driven by the increase in software business gross margin and structural factors.

Dolphin Research breaks down the gross margin of software and hardware:

Apple's software gross margin this quarter remained at a relatively high level of 75.3%, which was the main source of the company's gross margin improvement this quarter. The hardware gross margin remained at 36.2%, with tariff-related costs impacting approximately $1.1 billion this quarter. Excluding this impact, the company's hardware gross margin this quarter would be about 37.7%, actually up 1.4 percentage points year-on-year.

As the company expects Chinese tariffs to adjust from 20% to 10%, this will improve the company's hardware gross margin next quarter.

1.3 Operating Profit: In Q4 FY2025 (i.e., 3Q25), Apple's operating profit was $32.4 billion, up 9.6% year-on-year. The growth in Apple's operating profit this quarter was driven by both revenue growth and gross margin improvement.

The operating expense ratio for Apple this quarter was 15.5%, down 0.4 percentage points year-on-year. The company's sales and administrative expenses remained stable, with the additional spending this quarter mainly reflected in R&D expenses.

Considering the current capital expenditure situation, the company's capital expenditure for this fiscal year reached $12.7 billion, up 34.5% year-on-year. The increase in R&D expenses and capital expenditure also indicates that the company has increased its investment in AI and other innovative businesses. Although the company has not provided more progress in the AI field, the market still has expectations for the company in the edge AI field.

II. iPhone: Volume and Price Increase

In Q4 FY2025 (i.e., 3Q25), iPhone business revenue was $49 billion, up 6.1% year-on-year, slightly below market expectations ($49.3 billion). The growth in the company's iPhone business this quarter was mainly driven by the launch of the iPhone 17 series and the growth in demand from emerging markets.

Dolphin Research specifically looks at the relationship between volume and price to see the main sources of iPhone business growth this quarter:

1) iPhone Shipment Volume: According to IDC data, the global smartphone market grew by 2% year-on-year in Q3 2025. Apple's global shipment volume grew by about 4.6% year-on-year this quarter, with the company's shipment volume performance slightly better than the overall market.

The company's shipment volume growth this quarter was mainly driven by the iPhone 17 series and emerging markets. In addition, the delayed launch of the iPhone Air in China also affected shipment volume this quarter, with actual demand likely better than the 4.6% performance.

2) iPhone Average Selling Price: Based on the revenue and shipment volume of the iPhone business, the average selling price of iPhones this quarter was about $837, up 1.4% year-on-year, with the average selling price this quarter affected by demand from emerging markets and increased shipments of the basic version.

III. Other Hardware Beyond iPhone: Mac Shines, iPad and Other Products Stabilize

3.1 Mac Business

In Q4 FY2025 (i.e., 3Q25), Mac business revenue was $8.7 billion, up 12.7% year-on-year, slightly better than market expectations ($8.5 billion).

According to IDC's report, the global PC market shipment volume grew by 10.3% year-on-year this quarter, while Apple's PC shipment volume grew by 28.3% year-on-year, with the company's performance significantly better than the overall market, mainly driven by the growth of MacBook Air products. Based on company and industry data, Dolphin Research estimates that the average selling price of the company's Mac this quarter was $1,283, down 12.2% year-on-year.

3.2 iPad Business

In Q4 FY2025 (i.e., 3Q25), iPad business revenue was $7 billion, flat year-on-year, in line with market consensus ($7 billion), due to the high base from last year's iPad Air/Pro launch.

In addition, the state subsidy policy in China has little impact on the company's iPad business. Although some iPad products also fall within the relatively favorable range of state subsidies, growth has not been achieved in the past two quarters.

3.3 Wearables and Other Hardware

In Q4 FY2025 (i.e., 3Q25), wearables and other hardware business revenue was $9 billion, down 0.3% year-on-year, better than market expectations ($8.64 billion). Wearables and other businesses basically stopped the decline that had lasted for nine consecutive quarters this quarter.

Specifically: The growth of Apple Watch and AirPods was dragged down by the accessories business. Last year, the launch of new iPad products drove high sales of accessories (such as cases and chargers), and this year, the growth rate of the accessories business fell back, offsetting the growth contribution of Watch and AirPods.

IV. Software Services: Risk Release, Accelerated Growth

In Q4 FY2025 (i.e., 3Q25), software services revenue was $28.8 billion, up 15.1% year-on-year, in line with market consensus ($28.2 billion). Even with the U.S. App Store allowing external links, Apple's software services revenue growth still accelerated, reflecting the barriers of Apple's software ecosystem.

On the other hand, the resolution of the Google lawsuit this quarter also released the risk for Apple's software business. Although Google is prohibited from signing exclusive agreements with phone manufacturers for its products, it is not prohibited from agreeing to obtain default positions through revenue sharing. This shows that with a large user base and ecosystem stickiness, Apple as a hardware terminal still has a significant moat.

In this quarter, the software services gross margin continued to remain at a relatively high level of 75.3%, standing above 75% for four consecutive quarters. With a high gross margin, the company's software business accounted for 28% of revenue this quarter, generating 45% of the company's gross profit.

Dolphin Research's Historical Articles on Apple:

Earnings Season

September 10, 2025, Launch Event Review "Apple: iPhone "Small Tweaks" to Hold the Fort, AI Big Move Still in the Works?"

August 1, 2025, Conference Call "Apple (Minutes): Capital Expenditure Growth Mainly from AI-Related Investments"

August 1, 2025, Earnings Review "Apple: AI Difficult to Deliver, Still Relying on iPhone to Save the Day"

May 2, 2025, Conference Call "Apple (Minutes): $500 Billion Investment to Leverage Third-Party Resources"

May 2, 2025, Earnings Review "Apple: "Lying Flat" is Easy, Running is Hard"

January 31, 2025, Conference Call "Apple (Minutes): Continue to Use Hybrid Models to Optimize Costs and Performance"

January 31, 2025, Earnings Review "Apple: Large Model "Slimming Down," Hardware Becomes the Final Winner?"

November 1, 2024, Conference Call "Apple: Apple Intelligence to Expand in More Countries and Languages (FY24Q4 Conference Call Minutes)"

November 1, 2024, Earnings Review "Apple: Billion-Dollar Bleeding, Can It Hold On?"

August 2, 2024, Conference Call "Apple: ChatGPT to Complete Integration by Year-End (FY24Q3 Conference Call Minutes)"

August 2, 2024, Earnings Review "Apple: The Pillar of U.S. Stocks Remains Steady"

May 3, 2024, Earnings Review "Apple: iPhone Sales Stagnate, Unleashes Buyback Weapon"

February 2, 2024, Conference Call "Hardware Gross Margin Steadily Increases, Advances into AI (Apple FY24Q1 Conference Call)"

February 2, 2024, Earnings Review ""Lying Flat" Apple, Why Enjoy a 30x PE?"

November 3, 2023, Conference Call "Apple: No Highlights for Next Quarter (FY23Q4 Conference Call)"

November 3, 2023, Earnings Review "Apple: Zero Growth "Cash Cow," Worth a 30x PE?"

August 4, 2023, Earnings Review "Apple: Barely Holding On, Relying on India to Save the Day?"

August 4, 2023, Conference Call "Indian Market Sets New Record (Apple FY23Q3 Conference Call)"

May 5, 2023, Earnings Review "Apple: Turning the Tide Against the Wind, Truly the "King of Machines""

May 5, 2023, Conference Call "Apple's Turnaround Against the Wind, All Relying on Emerging Markets Like India? (Apple FY2023Q2 Conference Call)"

February 3, 2023, Earnings Review "Apple: The Thunder Entangled Finally Emerges"

February 6, 2023, Conference Call "Limited Demand Shock, Guidance Continues to Boost Confidence (Apple FY2023Q1 Conference Call)"

October 28, 2022, Conference Call "Apple: Not Busy in Peak Season, Even the "King of Competition" Can't Escape Recession (FY2022Q4 Conference Call)"

October 28, 2022, Earnings Review "Apple: The Only Giant Still Standing, How Long Can It Last?"

July 29, 2022, Conference Call "Only iPhone Business to Cover Up, How Will Management Explain (Apple Conference Call)"

July 29, 2022, Earnings Review "Slightly Increased iPhone, Becoming Apple's Last "Cover-Up""

April 29, 2022, Conference Call "Multiple Factors Troubling, Apple Gives Weak Guidance (Conference Call Minutes)"

April 28, 2022, Earnings Review "Apple Making Money Like Crazy, Should It Worry About Growth? | Earnings Season"

January 28, 2022, Conference Call "Apple: Supply Crisis Eases, Innovation Ignites True Technology (Conference Call Minutes)"

January 28, 2022, Earnings Review "Apple's Hard Power, Sweet and Fragrant | Read the Earnings Report"

October 29, 2021, Conference Call "What Did Apple Management Discuss After Missing Performance Expectations?"

October 29, 2021, Earnings Review "Expectations Missed, Apple's Report Card Was Awkward"

July 28, 2021, Conference Call "Apple's Five-Event Exceeds Expectations, Management's Interpretation (Full Q&A Included)"

July 28, 2021, Earnings Review "Apple: The Definition of Excellence, Five-Event Exceeds Expectations"

April 29, 2021, Conference Call "Apple 2021Q2 Earnings Call Minutes"

April 29, 2021, Earnings Review "Excellent Companies Always Exceed Expectations, Apple's New Fiscal Quarter Is Strong!"

April 25, 2021, Earnings Preview "After a Dominant Q1 Report, Will Apple's New Earnings Report Continue to Explode?"

In-Depth

December 29, 2022, "Semiconductor Avalanche? Only After the Most Severe Decline Will There Be True Resilience"

November 11, 2022, "Even with Good Performance, Apple Still Falls, Is It Really Sweet?"

June 17, 2022, "Consumer Electronics "Ripe," Apple Stands Firm, Xiaomi Struggles"

June 6, 2022, "U.S. Stock Market Turmoil, Were Apple, Tesla, and NVIDIA Wrongly Killed?"

February 28, 2022, "Apple: Passing on Cost Pressure, I Salute You!"

December 6, 2021, "Apple: Dual-Engine Drive Shows Fatigue, "Lame" Hardware Urgently Needs a Big Product to Continue"

This article's risk disclosure and statement: Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.