Coinbase: Short-term recovery expected, long-term ecosystem still needs accelerated expansion

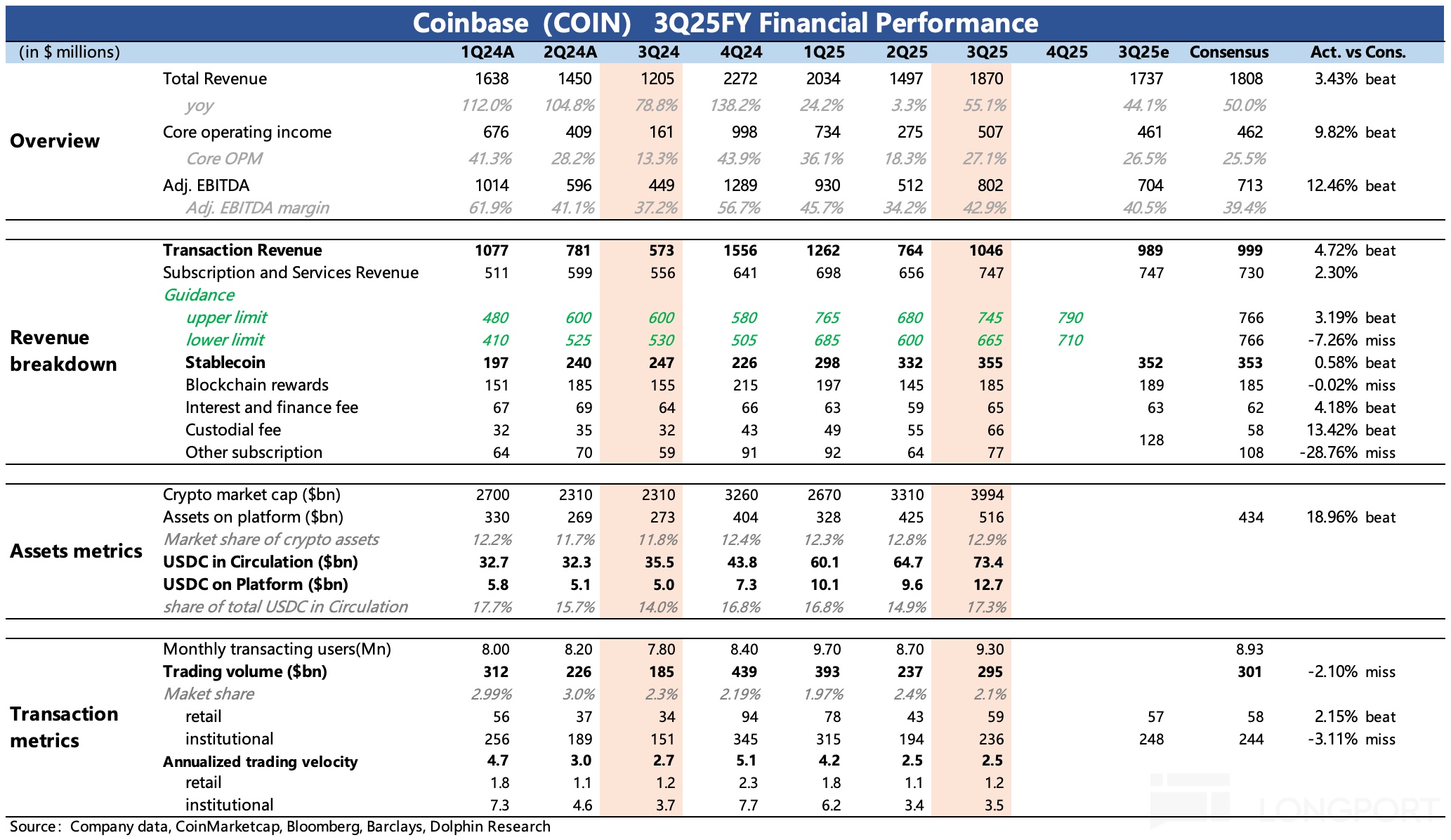

In the early hours of October 30th, Beijing time, after the U.S. stock market closed, $Coinbase(COIN.US) released its Q3 2025 financial report. Overall, the slight outperformance in trading revenue led to a noticeable recovery in both total revenue and profit.

The cryptocurrency market saw some recovery quarter-on-quarter in Q3, with Coinbase completing the consolidation of Deribit and launching perpetual futures for cryptocurrencies, which increased the market share of derivatives trading in Q3. During the conference call, management's outlook on launching banking payment services in Germany further stimulated trading sentiment for Coinbase. From the current market competition perspective, Coinbase's pace of ecosystem expansion still needs to accelerate.

Specifically:

1. Trading Recovery: The overall cryptocurrency market warmed up in Q3. According to CoinGecko statistics, the total market capitalization of crypto increased by 16.4% quarter-on-quarter to $4 trillion, with average daily trading volume surging by 44% quarter-on-quarter.

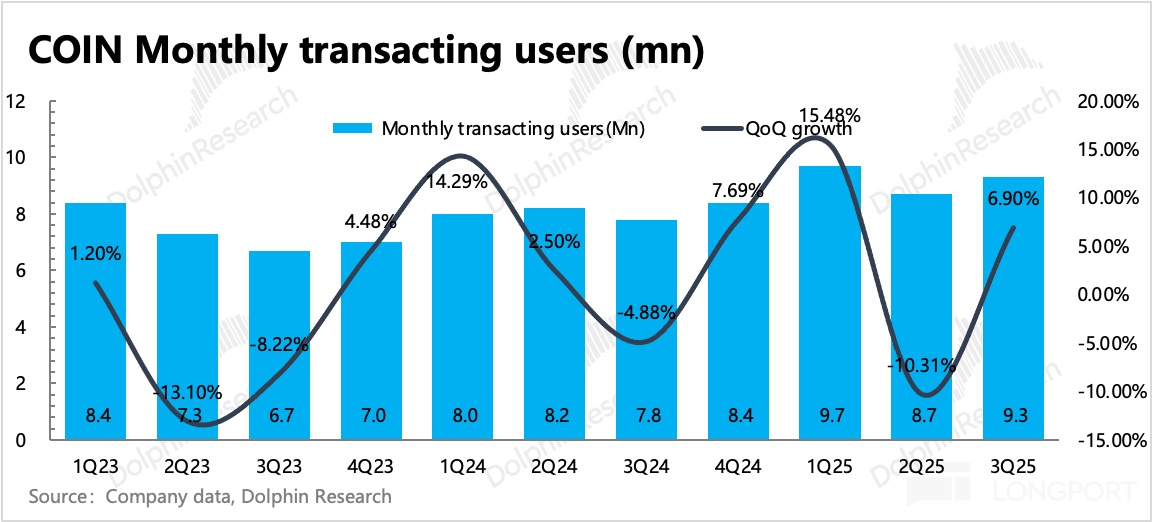

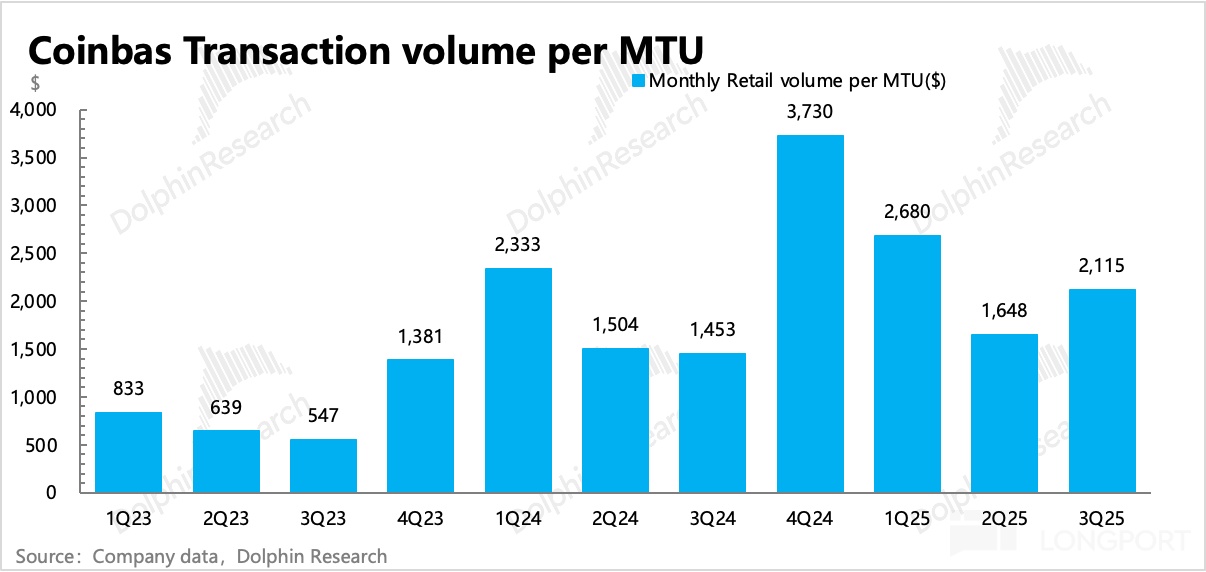

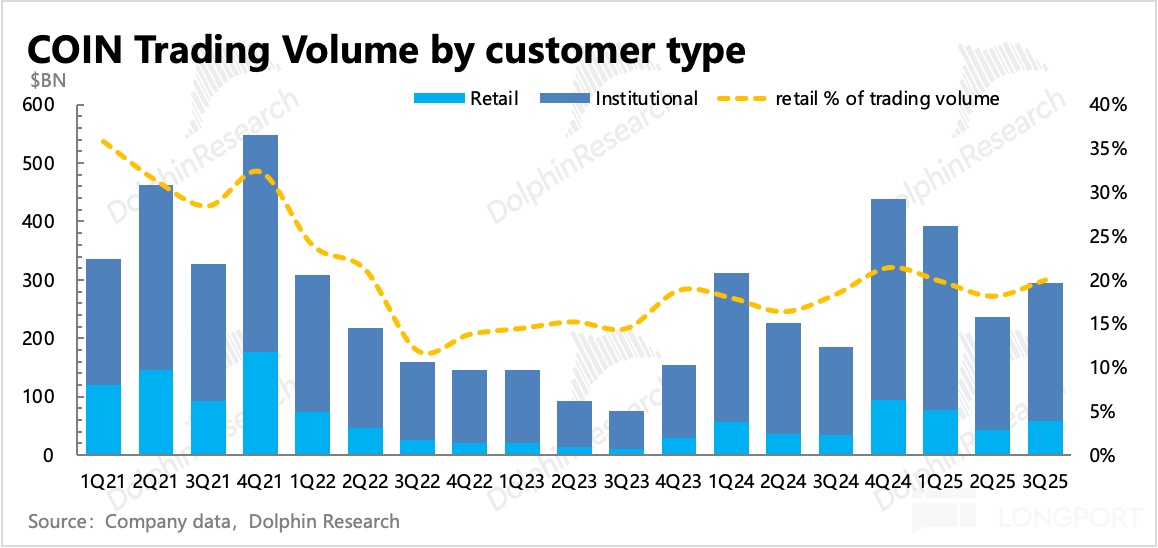

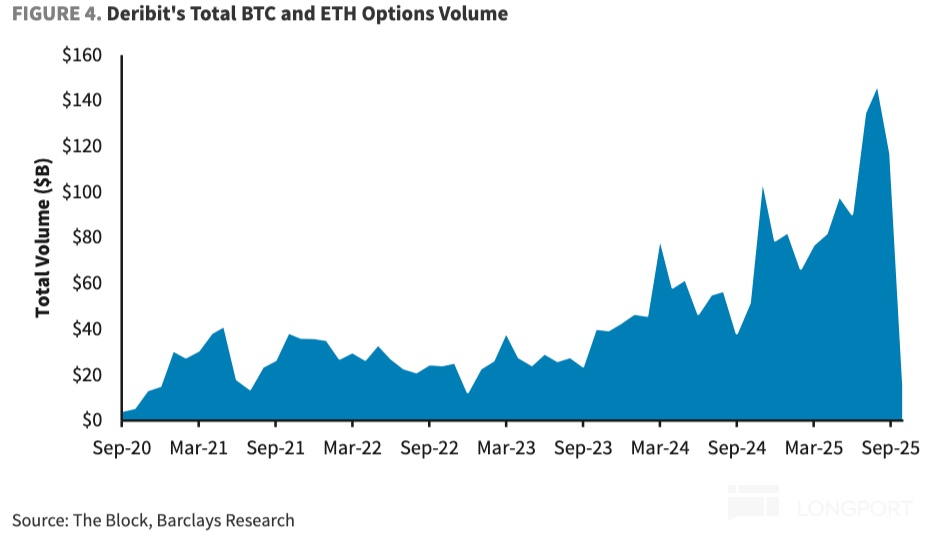

Coinbase still lags behind the overall industry. Although the average monthly trading users in Q3 increased by 600,000 quarter-on-quarter, the overall trading volume only grew by 25% quarter-on-quarter. The main reason is the decline in the trading share of the spot market (centralized exchanges' trading growth in Q3 was less than that of decentralized exchanges). However, the acquisition of Deribit, the largest crypto options platform, was completed this quarter, which increased the market share of derivatives, partially offsetting the decline in the spot market.

As derivatives trading further penetrates, Coinbase is expected to regain its trading market share.

2. Subscription Generally, Guidance Meets Expectations: Short-term trading revenue is subject to temporary fluctuations, so we consider the performance of subscription revenue, mainly from staking, custody, and stablecoins, as a reflection of Coinbase's business development capability.

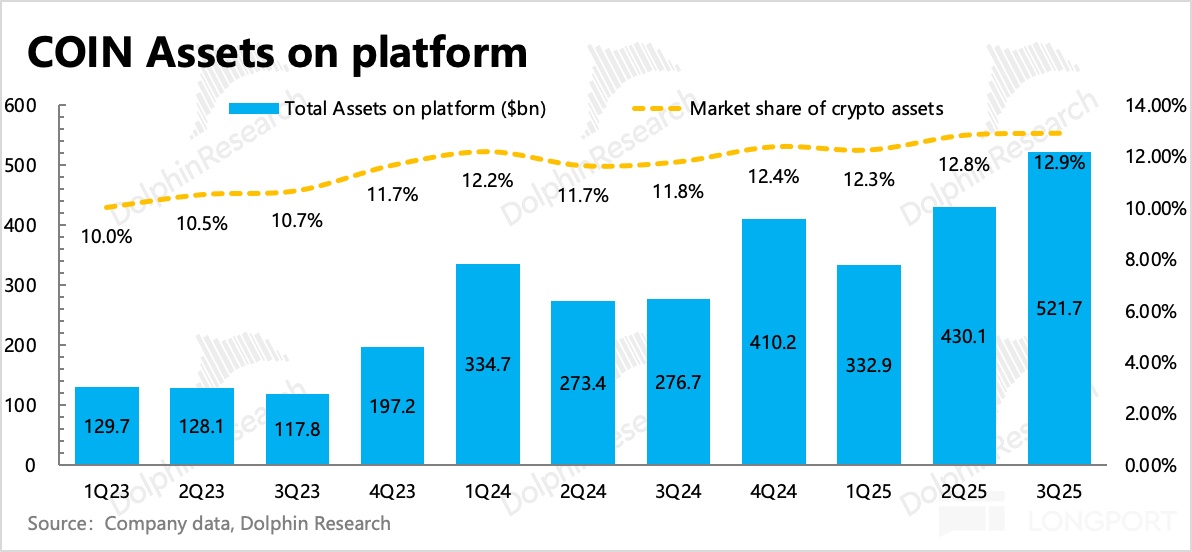

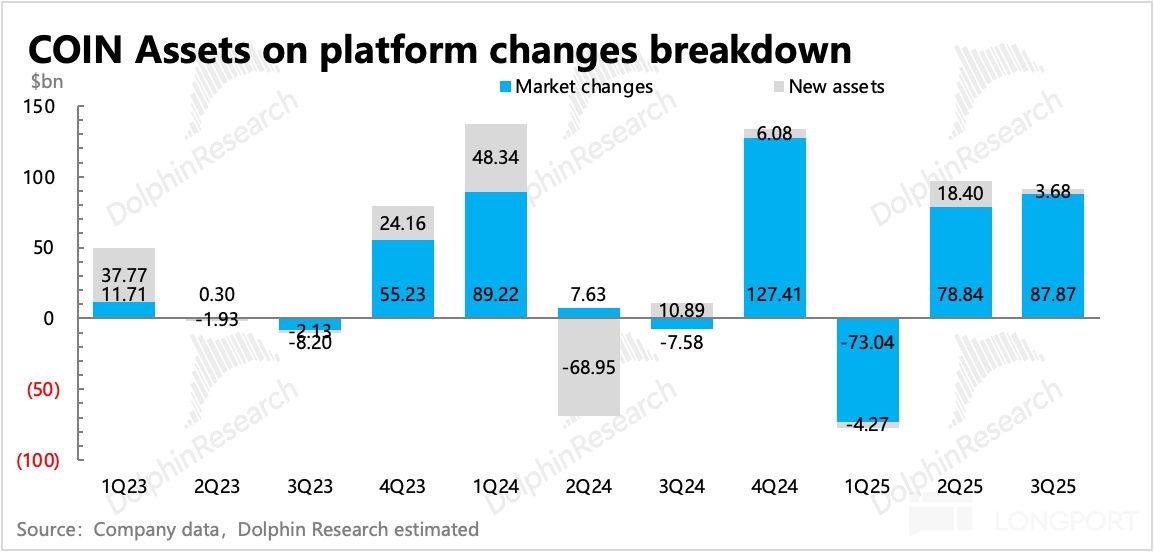

Overall, subscription revenue for the current and next quarter's guidance basically met expectations. Although the asset scale within the platform, AOP, continued to hit a new high of $521.7 billion (including fiat currency and segregated custody funds), increasing by 21% quarter-on-quarter, Dolphin Research's breakdown shows that the increase in asset scale mainly relied on market appreciation rather than new user deposits.

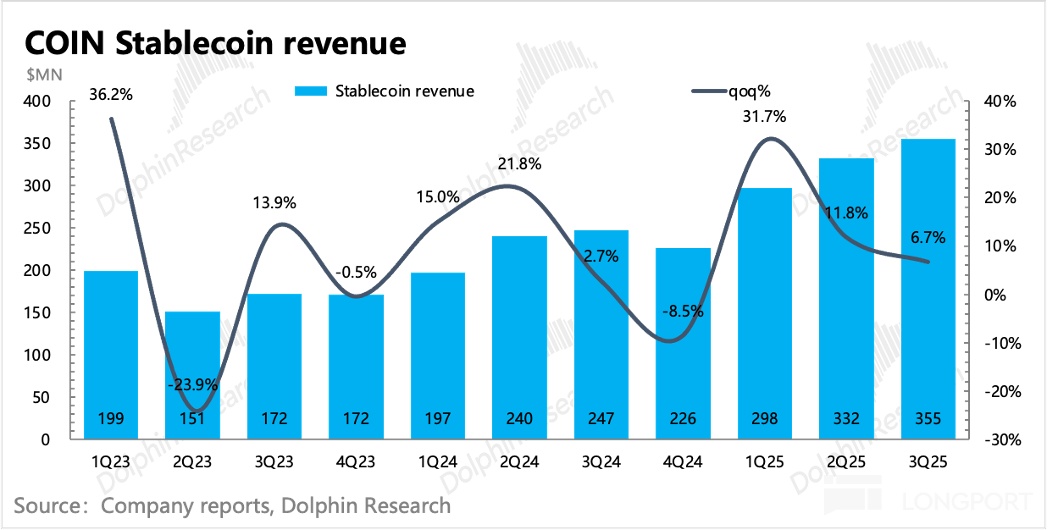

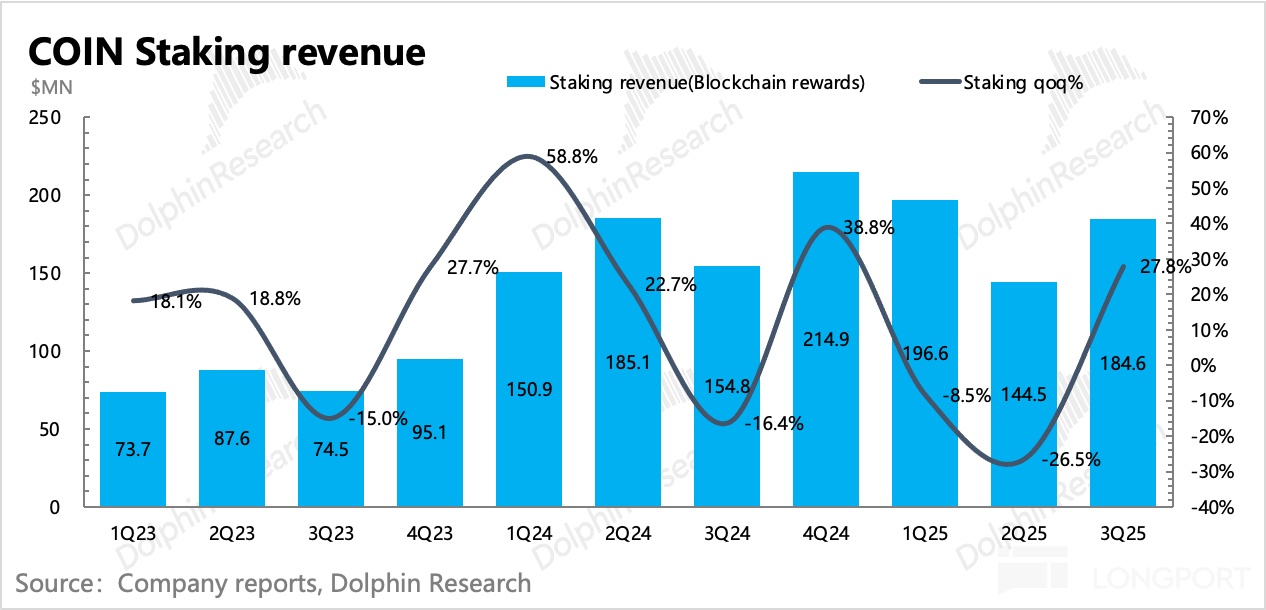

Therefore, subscription revenue grew by 14% quarter-on-quarter, lower than the asset scale growth rate. In detail, the main drag on growth was stablecoin revenue, where the yield decline due to interest rate cuts was the main reason. However, staking revenue increased as the average staking yield improved due to the significant rise in Ethereum (ETH) in Q3.

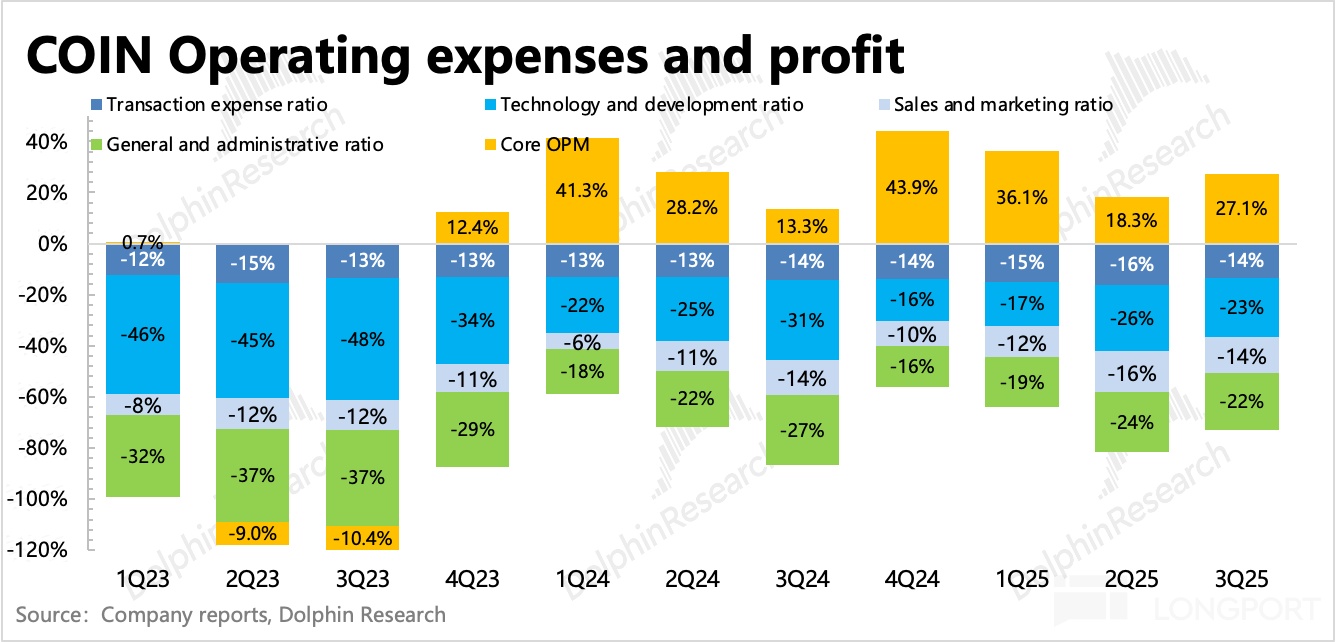

3. Rapid Profit Recovery: Generally, Coinbase's expenses mainly include transaction fees, personnel expenses, and basic operating costs, which are relatively rigid in scale, but the profit margin of trading segments is relatively high. Therefore, if trading is not poor, the profit margin can be somewhat guaranteed.

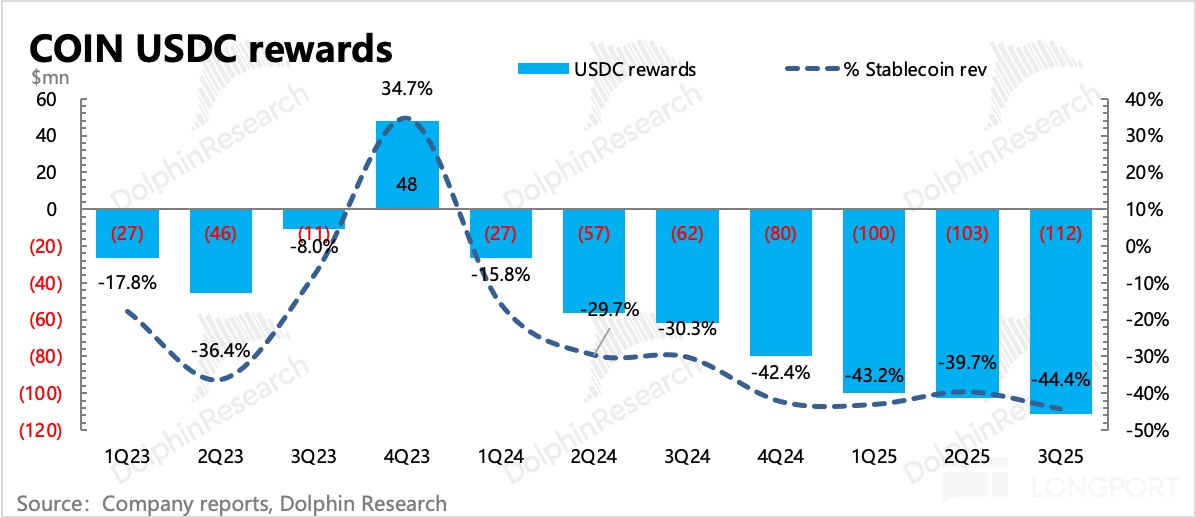

In Q3, although there were additional personnel costs from the acquisition of Deribit (approximately $30 million), and the proportion of USDC incentive subsidies given to users returned to 44%, the overall profitability still showed a quarter-on-quarter recovery, with an operating profit margin of 26%. Although there is still a gap compared to the peak of 45%, it has improved compared to the slight loss in the previous quarter.

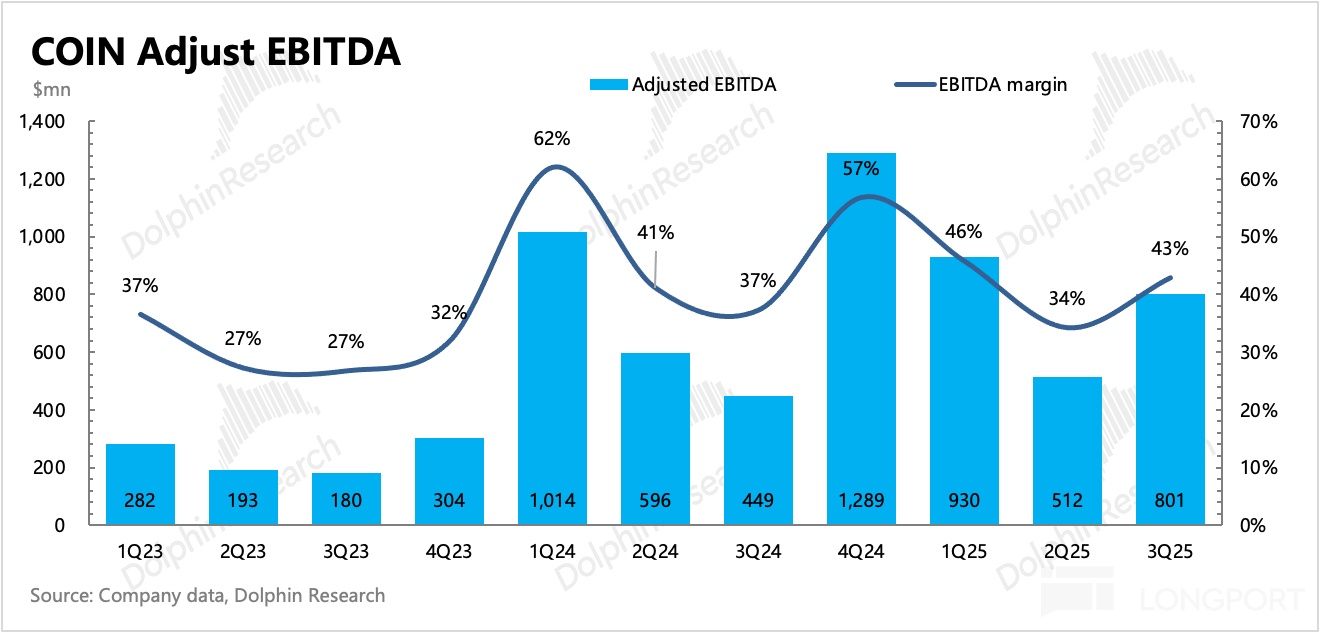

To smooth out the impact of depreciation and amortization cycles, the market focuses on changes in adjusted EBITDA. In Q3, adjusted EBITDA was $800 million, with a profit margin of 43%, up 80% year-on-year, driven by customer asset growth and stable expense spending.

4. Key Performance Indicators Overview

(The "3Q25e" column in the chart below represents the institutional expectations disclosed by Coinbase the day before the financial report)

Dolphin Research's View

The issue of declining spot trading market share that emerged last quarter has not been completely resolved, although it has slowed down with the recovery of the cryptocurrency market, the integration of Deribit, and the launch of perpetual futures in Q3. One reason for this is the competition from decentralized exchange shares.

To improve this trend, Coinbase can hedge the impact by continuing to expand its ecosystem. Recently, Coinbase initiated another acquisition, purchasing Echo Acquisition, an on-chain financing platform based on blockchain technology, for $375 million. The aim is to help early-stage startups and token projects raise funds from individual investors. Echo was founded in March 2024 and has helped approximately 300 companies raise over $200 million.

This scenario may be more effective than stock tokenization because on-chain technology can indeed solve current pain points rather than being redundant. Stock tokenization needs to replace the highly efficient and mature traditional securities market, which has high liquidity. Stock tokens cannot bridge the liquidity gap with just the advantages of 24-hour, cross-market operations. Moreover, the traditional stock market currently has a rich variety of pre-market, post-market, night trading, ETFs, and options derivatives products, which can basically meet the above-mentioned user needs.

Since the beginning of this year, Coinbase has shown a strong willingness to expand its ecosystem. On one hand, it has engaged in multi-faceted cooperation with existing banks, payment giants, and e-commerce platforms in the payment transaction field. On the other hand, it has also ventured into other niche areas through mergers and acquisitions. In addition to the aforementioned Deribit and Echo, Coinbase has initiated two small-scale acquisitions (such as Liquifi), absorbing token management functions and improving the digital currency ecosystem.

From a short-term perspective, Coinbase's valuation currently corresponds to 25/26 Adj. EBITDA multiples of 28x/23x (GAAP P/E of 40x, 30x). Although the cryptocurrency market fluctuates with interest rate cut expectations, there is still significant short-term volatility, but the long-term trend has not changed. Therefore, the current valuation basically falls within the reasonable range of 15x-25x for fintech companies.

From a long-term endgame perspective, compared to Dolphin Research's previous in-depth report expectations, we still do not make too many adjustments. For details, please refer back to "Stablecoins: Don't Doubt! Coinbase's iPhone Moment", "Coinbase vs Circle: The Symbiotic Stranglehold in the Stablecoin Circle, Who Will Prevail?".

Detailed Analysis Below

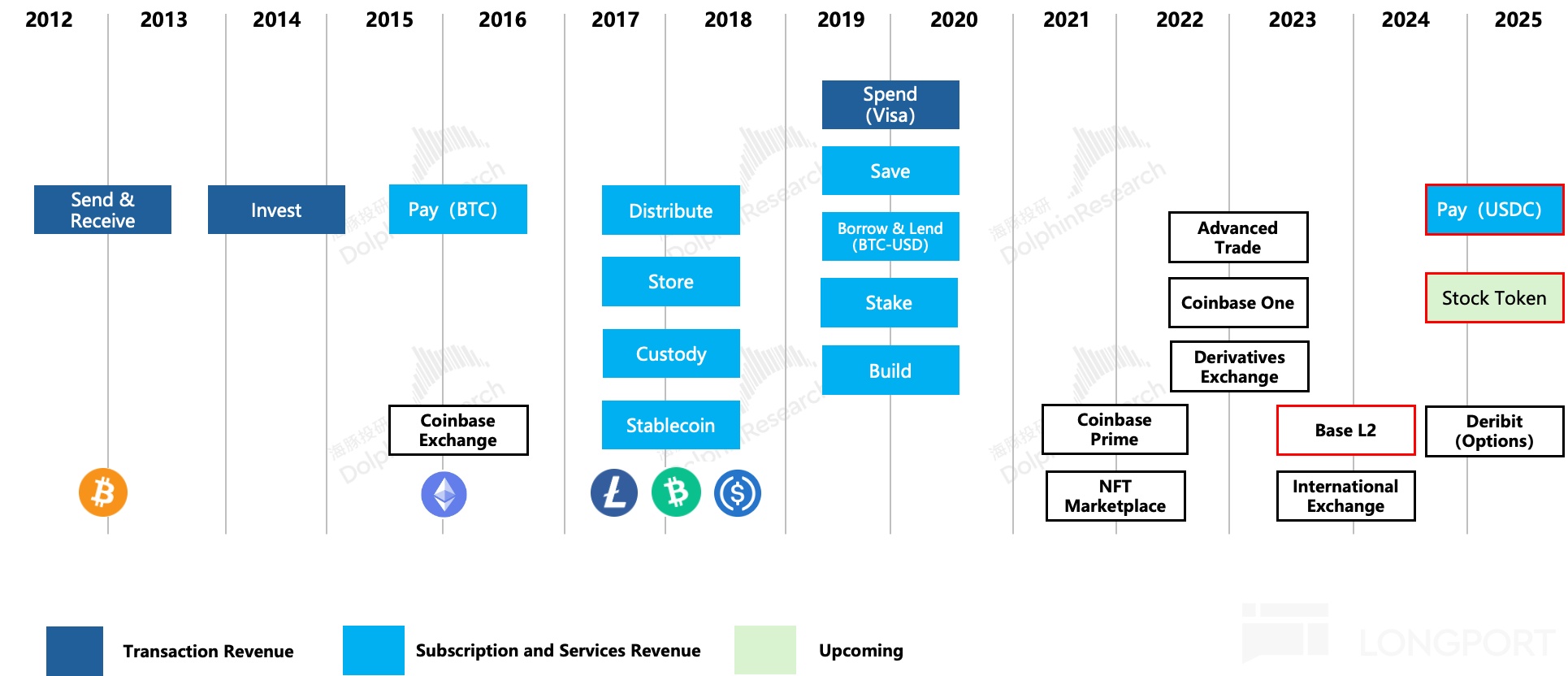

I. Introduction to Coinbase's Main Business

Coinbase is a platform that revolves around virtual assets, emerging from an exchange to create an on-chain comprehensive financial scenario. Compared to its peers, its biggest advantage is compliance friendliness. This is expected to give it a head start as regulators actively recognize and promote the virtual asset market.

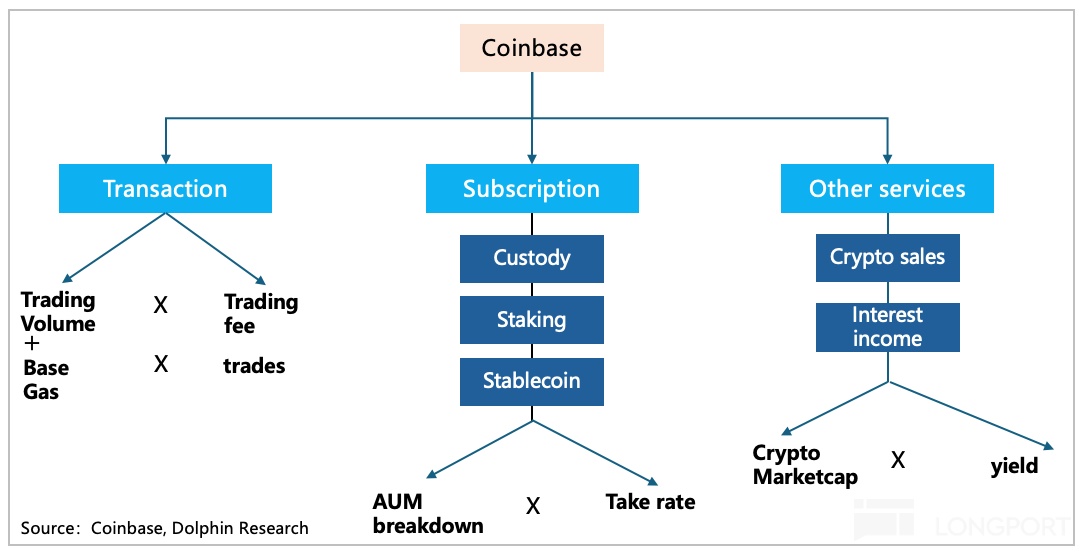

In terms of major revenue contributions, Coinbase has three main sources of revenue: trading revenue, subscription revenue, and others.

Trading revenue is highly susceptible to market conditions but remains the main revenue driver for Coinbase, accounting for over 50%. Subscription revenue and others (including custody settlement, staking, stablecoins, data/cloud, and corporate investment income) act more like lubricants, as their relatively stable growth can slightly smooth out the volatility of trading revenue.

However, a clear trend is emerging: as the scenario broadens, competition intensifies, and the structure of incremental funding sources changes, Coinbase's future reliance on trading revenue will decrease.

By attracting users with low fees and expanding added value through comprehensive financial services, Coinbase aims to establish a business model. Currently, it leverages its compliance advantage to offer fee discounts to institutional users.

As stablecoins penetrate cross-border B2B transactions and RWA on-chain scenarios, riding the wave of virtual asset scale expansion, Coinbase is poised to become the "water seller" during the gold rush.

II. Benefiting from Cryptocurrency Market Sentiment, Ecosystem Expands Gradually

Let's first look at the changes in Coinbase's user ecosystem.

In Q3, trading users increased by 600,000, recovering to 9.3 million, but this is only a slight recovery. Although the market value of crypto assets hit a new high in Q3, Coinbase's active trading users have not yet returned to Q1 levels, and the average trading volume per user is still lagging.

In terms of asset scale, the customer asset scale on the platform continued to hit a new high in Q3, reaching $522 billion, including segregated custody funds, with a 21% quarter-on-quarter growth. However, Dolphin Research's simple calculation shows that the increase in asset scale mainly relied on the appreciation of existing assets (Ethereum outperformed Bitcoin this quarter, with the highest increase), with only 10% of the increment coming from new external deposits.

III. Trading Recovery, Market Share Still Needs to Be Restored

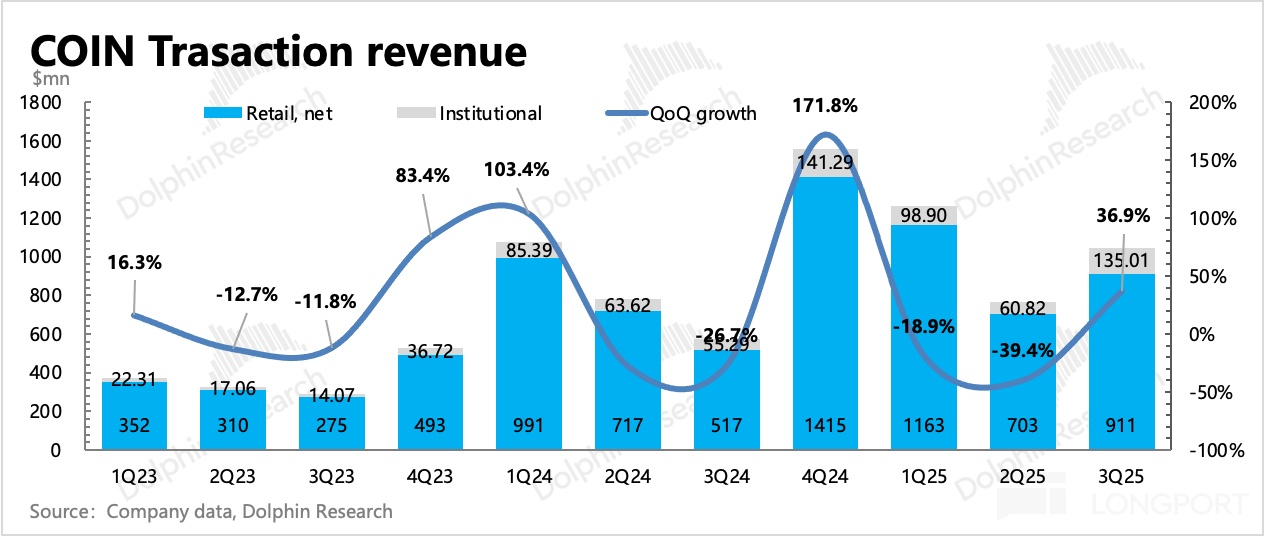

Coinbase's short-term fundamentals are still heavily reliant on trading revenue. Therefore, any fluctuation in trading sentiment has a significant impact on short-term performance.

In Q3, the market value of cryptocurrencies hit a new high again, and trading volume saw a quarter-on-quarter recovery. The industry's average daily trading volume grew by 44% quarter-on-quarter, but Coinbase only grew by 25% quarter-on-quarter.

This means Coinbase's trading market share further declined. The main reasons are twofold: one is that the spot market underperformed derivatives, and the other is that centralized exchanges overall underperformed the industry, with a 32% quarter-on-quarter growth in Q3. Coinbase happens to be one of the representatives of centralized exchanges with a high proportion of spot trading.

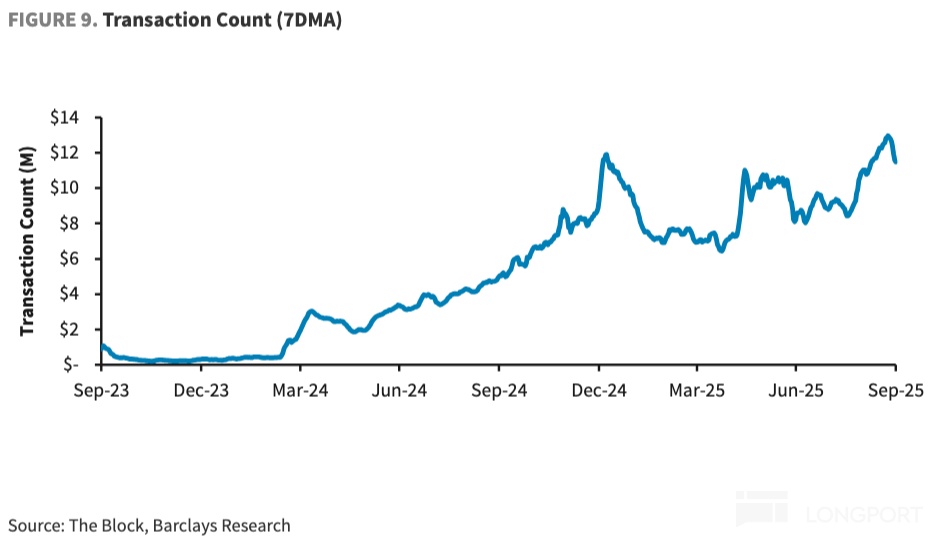

However, with the formal integration of Deribit, Coinbase is expected to fill this natural gap through derivatives trading, driving market share recovery. As shown in the chart below, the scale of derivatives trading in August and September was already significantly higher than before.

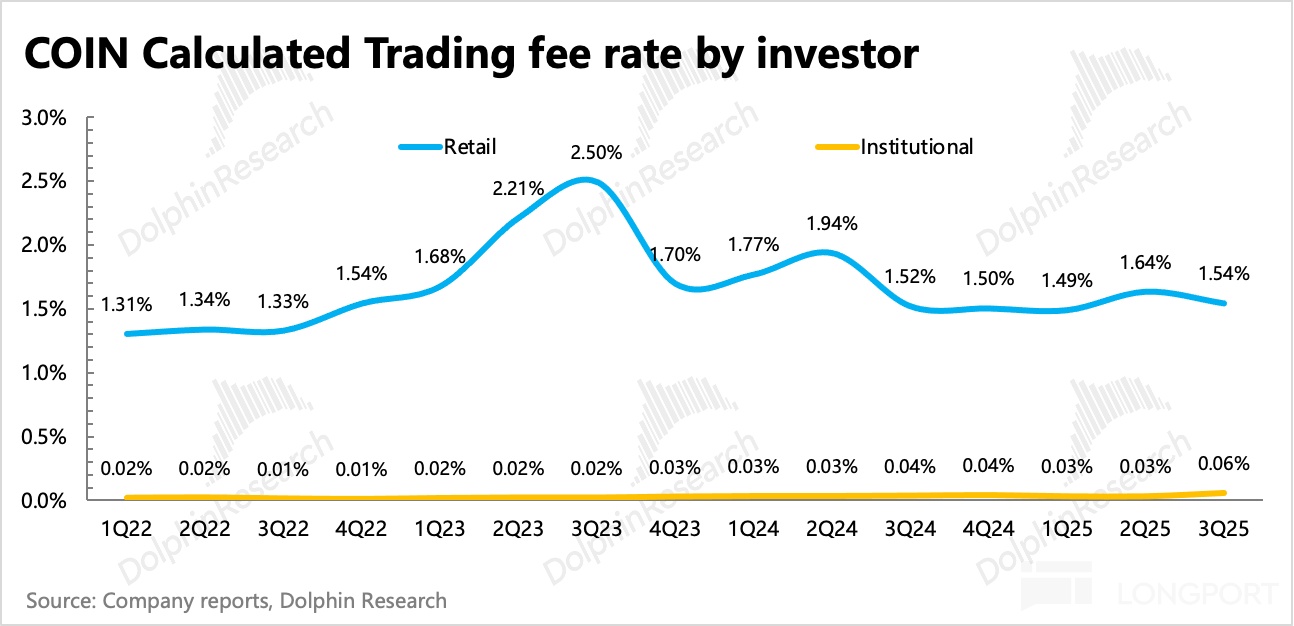

As the future penetration of derivatives gradually increases, it can also hedge the downward trend of comprehensive rates. In Q3, there was no temporary surge in trading demand as in Q2, i.e., high-rate Simple channel trading decreased, and retail rates returned downward. Institutional rates rose, possibly due to the use of a large number of derivatives trades.

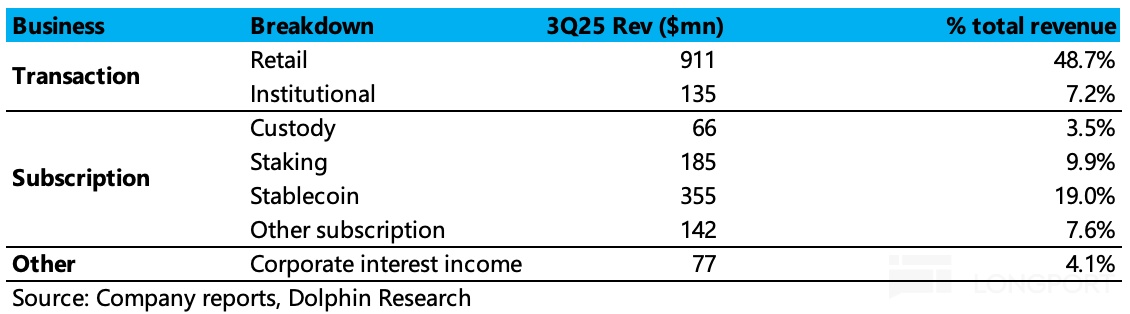

But ultimately, trading revenue is mainly driven by scale and trading volatility, and it will continue to be so in the future. In Q3, trading revenue was $1.05 billion, up 83% year-on-year and 37% quarter-on-quarter, slightly exceeding market expectations.

IV. Subscription Revenue is Mediocre

In Q3, subscription revenue was $747 million, with a year-on-year growth rate of 34% and a quarter-on-quarter growth rate of 14%. The median guidance for the next quarter is $750 million, with a year-on-year growth rate of 35%, all in line with market expectations.

Although the asset scale within the platform, AOP, continued to hit a new high of $521.7 billion (including fiat currency and segregated custody funds), increasing by 21% quarter-on-quarter, Dolphin Research's breakdown shows that the increase in asset scale mainly relied on market appreciation rather than new user deposits.

Therefore, subscription revenue grew by 14% quarter-on-quarter, lower than the asset scale growth rate. In detail:

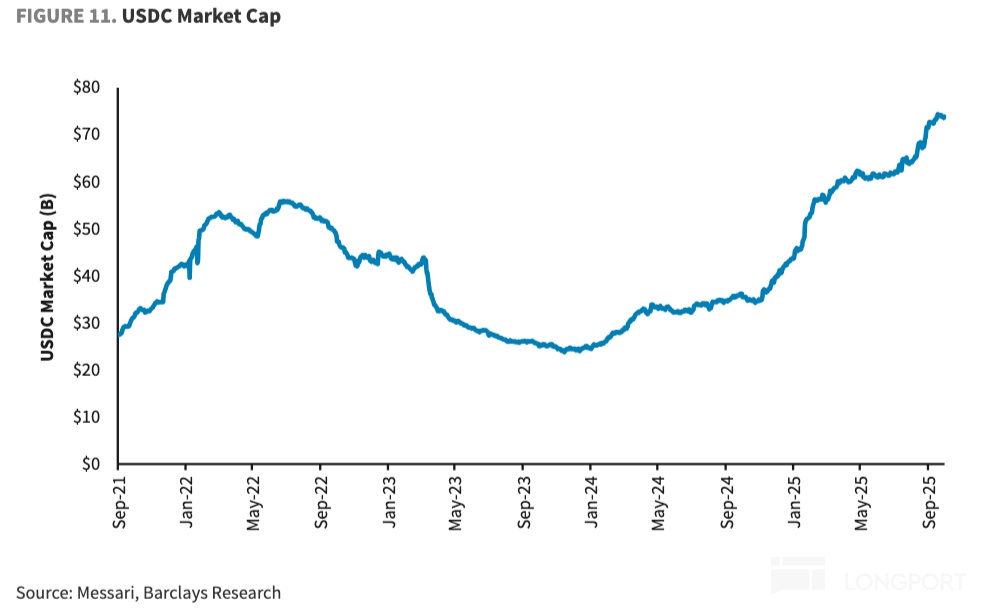

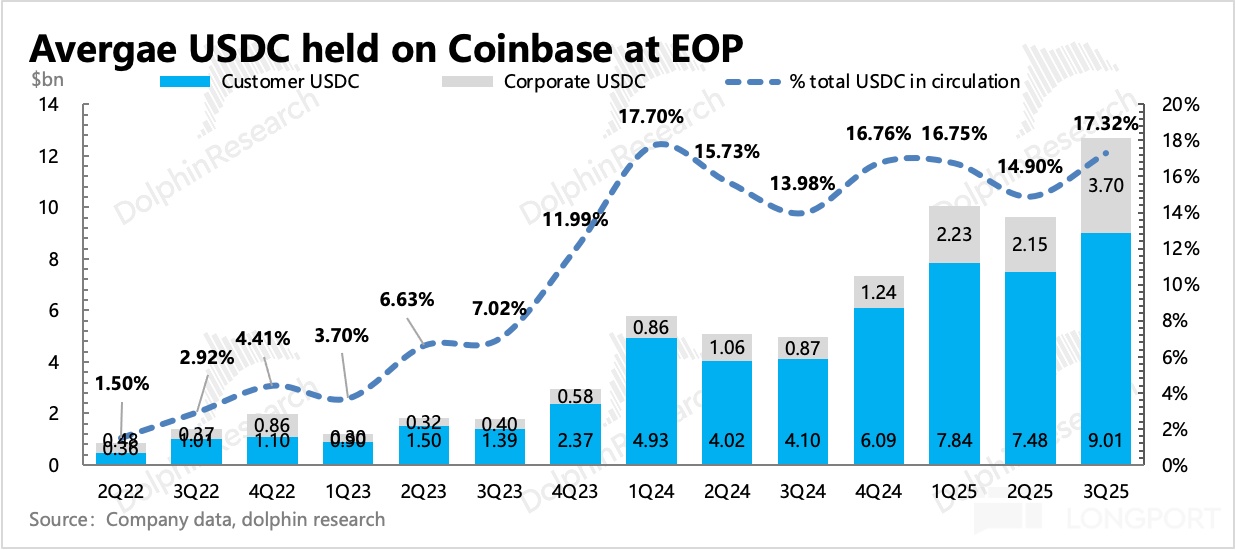

(1) The main drag on growth was stablecoin revenue, where the yield decline due to interest rate cuts was the main reason. The total USDC in circulation at the end of the period reached $74 billion, with Coinbase's platform holding (customers + company) at the end of Q3 being $12.7 billion, accounting for 17%, with a net increase of $3 billion quarter-on-quarter. The proportion of USDC incentives given to users by Coinbase in Q3 also increased.

(2) Staking revenue increased as the average staking yield improved due to the significant rise in Ethereum (ETH) in Q3.

(3) Other revenue mainly includes custody fees (consolidated in Q1 2025), Base sequencer fees, and other small parts of payment-related revenue. In Q3, other subscription revenue was $140 million, with a year-on-year growth rate of 31%.

According to data from The Block, Base revenue allocated to Coinbase rose to approximately $14 million in Q3 (with a trading volume of 900 million transactions), compared to $12 million in the previous quarter (quarter-on-quarter growth rate of 17%). The company stated that it is exploring more possibilities for issuing native tokens for Base.

V. Trading Drives Profit Improvement

In Q3, although there were additional personnel costs from the acquisition of Deribit (approximately $30 million), and the proportion of USDC incentive subsidies given to users returned to 44%, the overall profitability still showed a quarter-on-quarter recovery, with an operating profit margin of 26%. Although there is still a gap compared to the peak of 45%, it has improved compared to the slight loss in the previous quarter.

To smooth out the impact of depreciation and amortization cycles, the market focuses on changes in adjusted EBITDA. In Q3, adjusted EBITDA was $800 million, with a profit margin of 43%, up 80% year-on-year, driven by customer asset growth and stable expense spending.

<End Here>

Dolphin Research "Coinbase" Historical Articles:

August 1, 2025 Minutes "Coinbase (Minutes): New Business Blossoms on Multiple Fronts—Payments, DEX, CAS..."

August 1, 2025 Earnings Review "Coinbase: Dismal Performance, Hard to Extinguish the "On-Chain Fire""

July 3, 2025 Initial Coverage Part 3 "Coinbase vs Circle: The Symbiotic Stranglehold in the Stablecoin Circle, Who Will Prevail?"

July 2, 2025 Initial Coverage Part 2 "Stablecoins: Don't Doubt! Coinbase's iPhone Moment"

July 1, 2025 Initial Coverage Part 1 "Coinbase: On-Chain Fire, Can the "Water Seller" Really Win by Lying Down?"

Risk Disclosure and Statement of This Article:Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.