Coinbase (Minutes): Driving comprehensive asset on-chain around 'Trading and Payment'

The following is a summary of the earnings call minutes for $Coinbase(COIN.US) organized by Dolphin Research. For a review of the third-quarter financial report, please refer to "Coinbase: Short-term Recovery Within Expectations, Long-term Ecosystem Still Needs Accelerated Expansion"

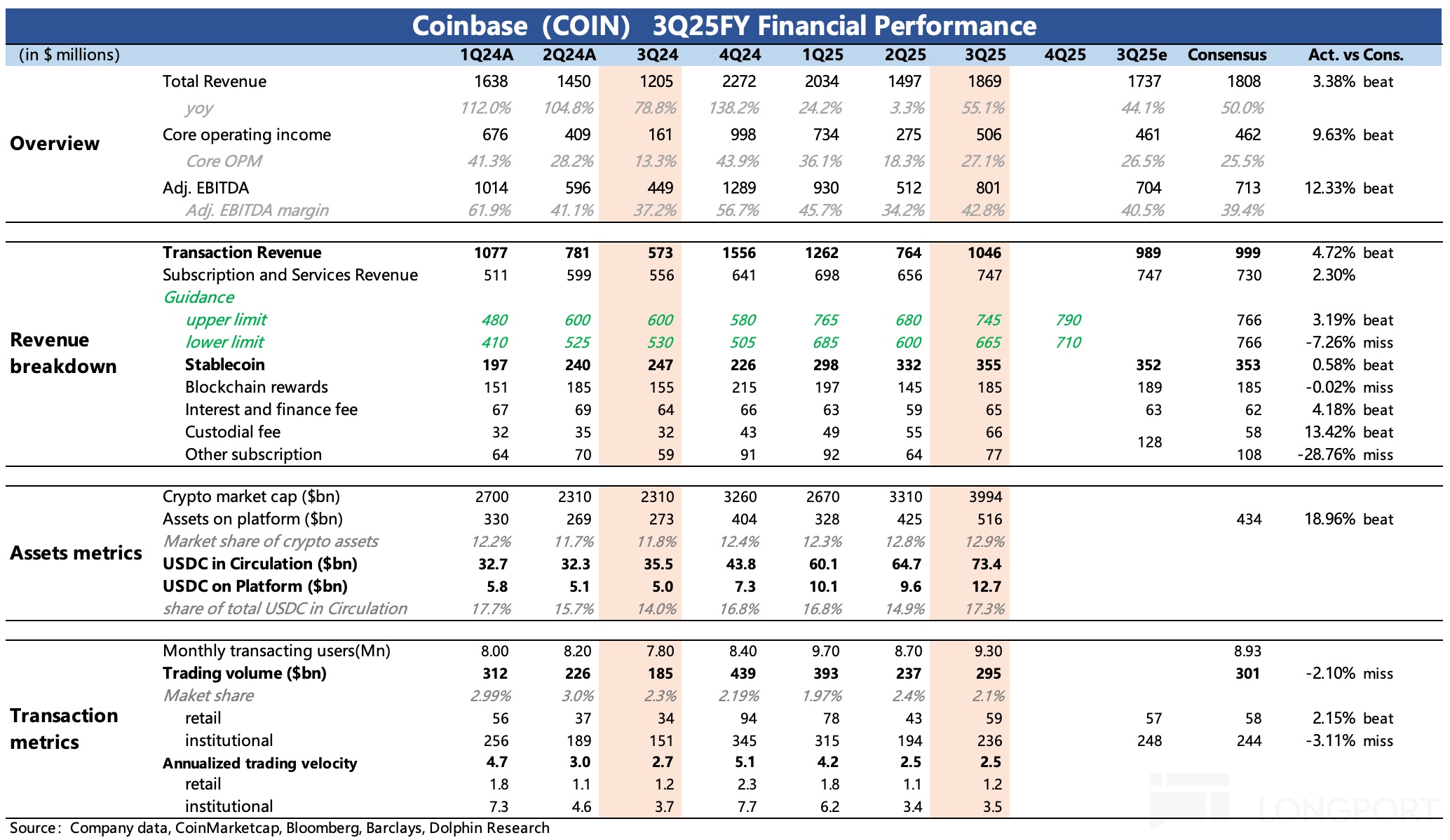

I. Review of Core Financial Information

1. Overall Performance: The company achieved total revenue of approximately $1.9 billion in the third quarter of fiscal year 2025. Adjusted EBITDA was $801 million. The company recorded a fair value revaluation gain of $424 million on its crypto investment portfolio, with other expenses including a $381 million charge mainly due to unrealized losses related to Circle investments. After accounting for these two items, net profit was $433 million; excluding these items, adjusted net profit was $421 million.

2. As of the end of the quarter, the company held $11.9 billion in USD resources and $2.6 billion in long-term crypto asset investments. The platform's total asset size reached $516 billion, with total operating expenses down 9% to $1.4 billion. Combined expenses for technology R&D, management, and sales marketing increased by 14% to $1.1 billion, mainly driven by employee growth and the USDC reward program.

3. Revenue from institutional trading was $135 million, up 122% year-over-year.The acquisition of Deribit contributed $52 million in revenue, mainly benefiting from the continued growth in options trading.Additionally, revenue from securities and services business grew 14% quarter-over-quarter to $747 million, mainly driven by increases in USDC balances, average institutional financing loan balances, and custodial assets.

4. Total operating expenses for the quarter were $1.4 billion, down 9% quarter-over-quarter.Deribit contributed $30 million in operating expenses in the third quarter, including $16 million in transaction-related amortization expenses, which were mainly accounted for in sales and marketing expenses.

5. Outlook:

A. October trading revenue is expected to reach approximately $385 million.Driven by rising average cryptocurrency prices and the continued growth of the Coinbase One user base, subscription and service revenue is expected to be in the range of $710 million to $790 million.

B. Technology R&D and management administrative expenses are expected to be in the range of $925 million to $975 million, with the median increasing by approximately $100 million quarter-over-quarter. About half of the increase is due to recent acquisitions of Deribit and Echo, with the remainder mainly from employee expansion; fourth-quarter workforce growth is expected to slow significantly.

C. Sales and marketing expenses are expected to be in the range of $215 million to $315 million, depending on performance marketing spending opportunities, USDC balances, and the performance of Coinbase products driving USDC rewards.

D. Depreciation and amortization are expected to be approximately $70 million, mainly due to increased amortization of intangible assets from recent acquisitions.

E. Looking ahead to early 2026, the company believes the growth rate of operating expenses will slow, with a focus shifting to execution and integration.

II. Detailed Content of the Earnings Call

2.1 Core Information from Executive Statements:

1) The company achieved solid growth in the third quarter of fiscal year 2025, and Coinbase is fully advancing the "Everything Exchange" strategy.

2) During the quarter, the company completed the acquisition of Deribit, with post-merger derivatives trading volume exceeding $840 billion, driving market share to a record high. The 24/7 perpetual contracts approved by the US CFTC have officially launched, making Coinbase the first US platform to offer such contracts.

3) Coinbase users hold an average of $15 billion in USDC on the platform, helping USDC's total market capitalization rise to $74 billion. Management expects global payments to accelerate towards stablecoins in the future, as cross-border transfers can be completed in 1 second at a cost of less than $0.01.

4) As the world's most trusted crypto brand, the company will continue to expand institutional and corporate partnerships in the context of increasingly clear regulatory frameworks,including strategic cooperation with Citi in on-chain settlement.

5) By integrating decentralized exchange (DEX) functionality, the trading platform's performance has been significantly enhanced. This move has expanded the number of tradable assets in the US from about 300 to over 40,000. With the backend integrated DEX system, customers can participate in trading on the first day of new token issuance and simultaneously capture market opportunities.

6) The vision of "one-stop trading for all asset classes" proposed in Q2 was executed in Q3 by expanding spot coverage, growing derivatives supply, and laying the foundation for new asset classes.

7) The company will hold a product launch event on December 17 to update on the achievements of the second half of the year and the next phase of Everything Exchange, supporting broader asset trading and payment scenarios.

2.2 Q&A Session

Q: How does the company plan to enhance product innovation and iteration speed to expand market share? Is there consideration for launching prediction markets or tokenized stocks?

A: The company is accelerating the implementation of the "Everything Exchange" vision,by integrating decentralized exchanges to expand tradable assets from about 300 to 40,000, and has launched CFTC-regulated perpetual contracts first. The product is growing rapidly, and the company expects all asset classes to be on-chain in the future, with more progress to be disclosed at the December 17 product showcase. The long-term goal is to make Coinbase the premier global integrated financial application.

Q: Can you introduce the planning of Base network tokens and the way shareholders benefit? Can you talk about the monetization strategy of the base network and its future development path?

A: Base network tokens are still in the initial exploration stage, with the core goal of helping 1 billion people access blockchain and expanding the developer ecosystem. Governance structure or distribution model has not yet been determined. Monetization is mainly achieved through sequencer fees and ecosystem-driven USDC, custody, and other supporting services. Although still in the early stages, a revenue model similar to Coinbase's main application has been seen—including transaction fees, subscription fees, and various advertising charges, all of which will become the

profit channels for the application.

Q: How will the Echo platform help the company expand capital formation and fundraising business?

A: Coinbase believes the capital formation process will be fully on-chain, improving financing efficiency, reducing costs, and broadening participant scope.The acquisition of Echo aims to strengthen the layout in this field, combining the company's management of over $500 billion in assets and a large investor base to create a bilateral market that connects financing and trading. The Echo team has the ability to identify quality startup projects, which will drive vertical integration of the company's business.

Q: Compared to recent years, Coinbase's announced acquisition pace seems to be accelerating. How does the improvement in the US regulatory environment and political certainty affect the innovation process? Looking ahead, can we expect this innovation speed to drive Coinbase to act more aggressively in the acquisition field? Regarding current innovation trends, which core areas will your company focus on in the future?

A: The improvement in regulatory clarity makes acquisitions and investments more predictable. The company's current acquisition pace has significantly accelerated, focusing ontrading and paymentas the two core businesses. Coinbase will continue to flexibly choose among "acquisition, self-build, cooperation, investment" to strengthen long-term competitiveness.

Q: How does the company's operational infrastructure perform in the face of trading peaks and cloud service failures? How will system resilience be improved in the future?

A: The company stated that despite the temporary interruption of AWS, the multi-cloud architecture remained stable. Approximately 65% of customer interactions have been automated,with plans to launch an intelligent customer service system based on LLM in 2026.On the record trading day of October 10, the company's platform experienced no downtime or delays, thanks to load testing and system optimization investments over the past two years.

Q: Can you introduce the "white glove service" launched for high-value traders? What is the current retail competition situation?

A: This service is aimed at high-value customers, providing dedicated account managers and time-sensitive guarantees to ensure smooth and unobstructed transactions. Management noted that Coinbase's retail trading volume has surpassed the overall scale of the US spot market, and the company will continue to meet diversified trading needs through the "Everything Exchange" strategy.

Q: Please explain the latest progress in the company's payment and stablecoin business, especially the cooperation with institutions like Citi.

A: Management introduced thatthe Coinbase Developer Platform (CDP) has served 264 institutional clients, including JPMorgan, BlackRock, Citi, Stripe, and PayPal. The company is opening services to enterprise clients through the Base layer payment API, with over 1,000 enterprises already online and the waiting list continuing to grow, and has partnered with Shopify to provide USDC settlement solutions to enhance cross-border payment efficiency.

Q: How is the integration of Deribit progressing? Are there more opportunities for product synergy in the future?

A: The acquisition was completed in August, with 100 employees joining in September. Deribit has performed strongly in the options market, with trading volume reaching new highs. Coinbase is advancing the integration of spot, perpetual contracts, futures, and options businesses into a unified platform, and has launched cross-margin functionality for spot and derivatives in the US, significantly enhancing capital efficiency.

Q: What are the key timelines for the "Everything Exchange" project?

A: The company stated that some functions have been launched, including decentralized exchange integration and American perpetual contracts.A product launch event will be held on December 17 to disclose more project progress.

Q: What impact did the October 10 crypto clearing event have on the market and the company? Is there a foreseeable mid-term chain reaction? Are there any lessons learned to optimize future market operations?

Market Operations?

A: The event led to some deleveraging, but the platform remained stable with no major clearings. The company emphasized that transparent risk control and asset-liability disclosure help reduce systemic risk. The market has achieved good recovery, with no observed sustained losses.

Q: How is the commercialization of stablecoins progressing? What role does the company play in cross-border payments?

A: Stablecoins are the key application for the next stage of the crypto industry.Global cross-border payment annual transaction volume is about $40 trillion, with inter-company payments accounting for 75%, which is the main application scenario for stablecoins.Coinbase's enterprise payment products have been connected to about 1,000 customers and plan to integrate into retail and Base applications. The company has launched the X402 protocol and Agent Kit toolkit to promote the implementation of stablecoins in AI agents and internet payments.

Q: Can you quantify the impact of expanding battery production scale and adjusting derivative incentive mechanisms on profit margins, and is it expected that this will help expand profit margins in the fourth quarter and 2026?

A: The company confirmed that some derivative incentives have been reduced, with overall pricing structure changes being limited. The integration of Deribit and international derivatives business has enhanced liquidity and open interest scale, bringing higher profitability growth to this segment.

Q: How does the company manage the profit contribution of a multi-product portfolio?

A: The company focuses on overall customer relationships rather than single product profitability. Most institutional clients use three or more services simultaneously, with the goal of driving overall adjusted EBITDA growth, without setting profit margin targets for individual products.

Q: What is the outlook for the take rate in the next few quarters?

A: The company does not provide specific forecasts. Coinbase continues to optimize retail pricing structure, with strong growth in Coinbase One subscriptions and Card products. The company is gradually reducing reliance on transaction fees, shifting towards diversified revenue sources.

Q: What are the main reasons for the increase in expenses in the fourth quarter? Will the team continue to expand?

A: Fourth-quarter technology R&D and management expenses increased by approximately $100 million quarter-over-quarter, with about half coming from Deribit and Echo acquisitions, and the other half from personnel expansion. The company will continue to moderately increase staff by the end of the year, but the growth rate will be lower than in the third quarter.

Q: How do you incentivize merchants and users to adopt the payment platform during promotion?

A: Management pointed out that the payment business has strong network effects. Coinbase, relying on approximately $500 billion in assets and a large user base, will first launch promotions in high-demand scenarios such as cross-border B2B and micropayments, and will gradually expand to more fields in the future.

Q: What additional market share can Deribit bring in the options business?

A: Deribit's options market share in non-US markets has exceeded 75%. The US market still has long-term growth potential, and related products will be launched once regulatory approval is obtained. The unified trading platform will enhance overall trading volume and customer asset retention.

Q: Was the competitive environment between September and October due to systemic competitive pressure? For example, did peers engage in more aggressive price competition in promotions and incentives, leading to customer loss?

A: Competition always exists, and the company will continue to focus on providing the most trusted and easy-to-use product experience. The market fluctuations in October are normal phenomena, and the company will consolidate long-term market share through product and service innovation.

<End here>

Risk Disclosure and Statement of this Article:Dolphin Research Disclaimer and General Disclosure