Reddit: Another unexpected surge, how to view the correction of expectation differences before and after the earnings report?

Discussion$Reddit(RDDT.US) on the third quarter report, which is actually similar to the second quarter situation, also involves a process of expectation correction:

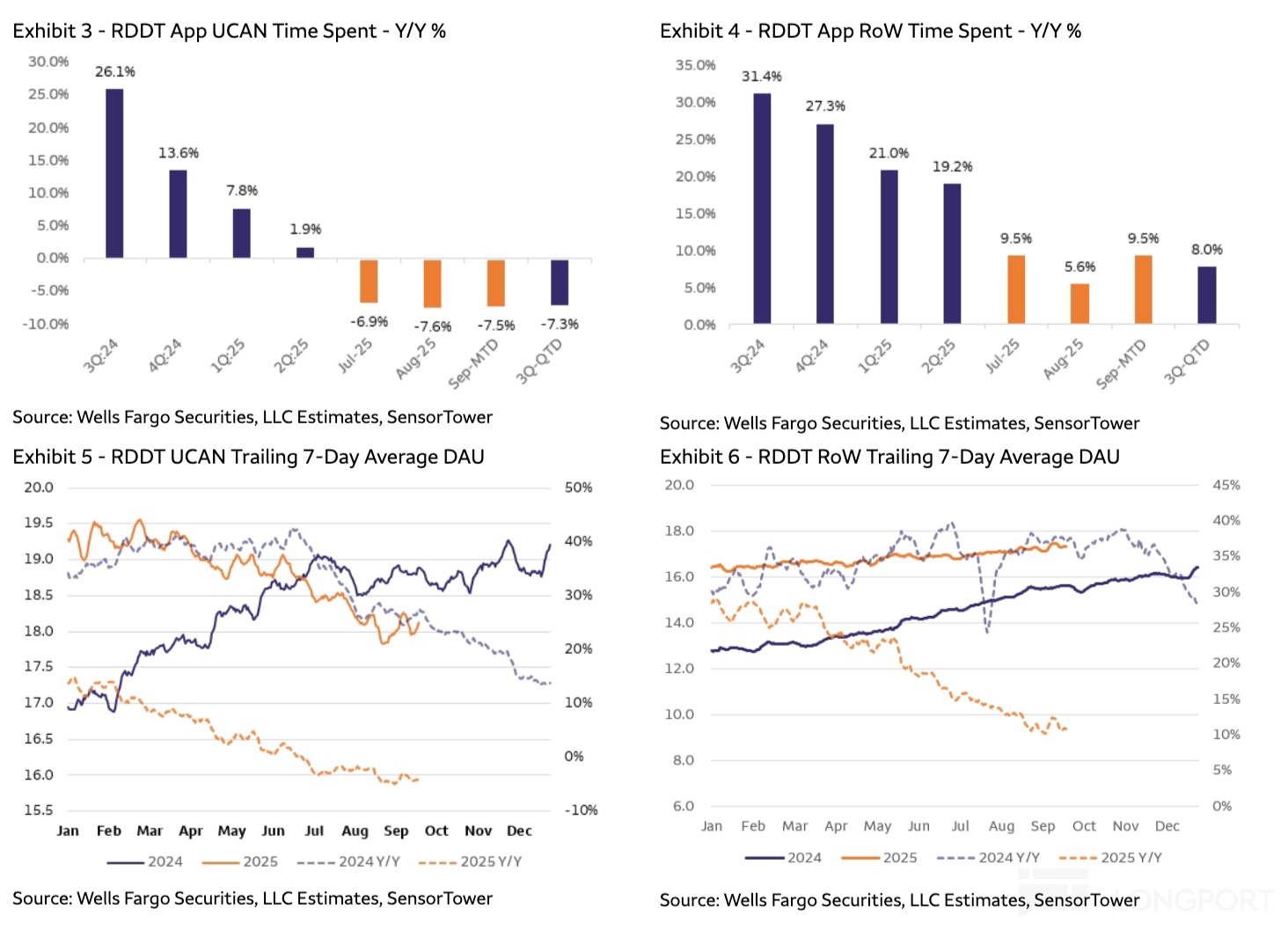

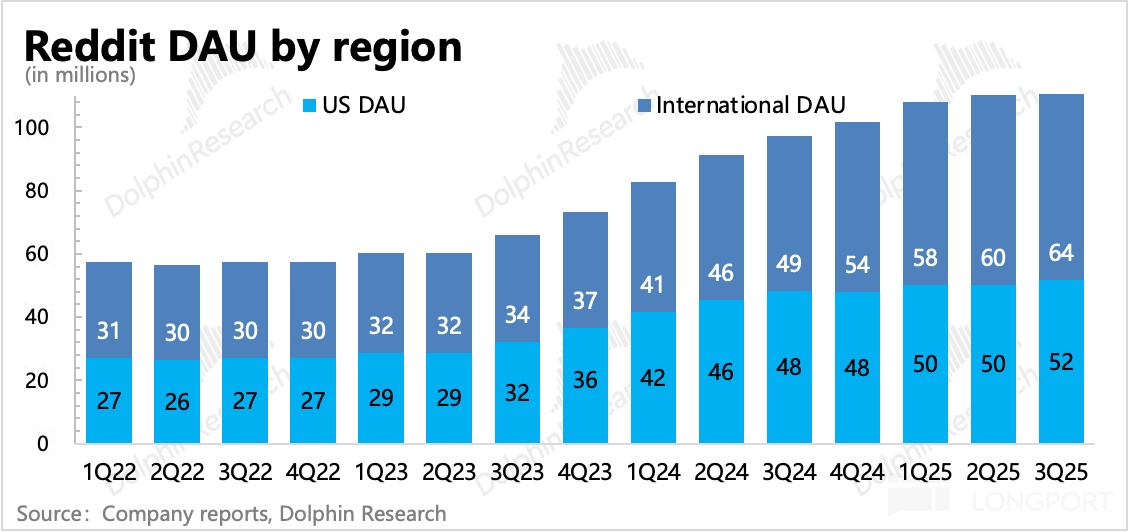

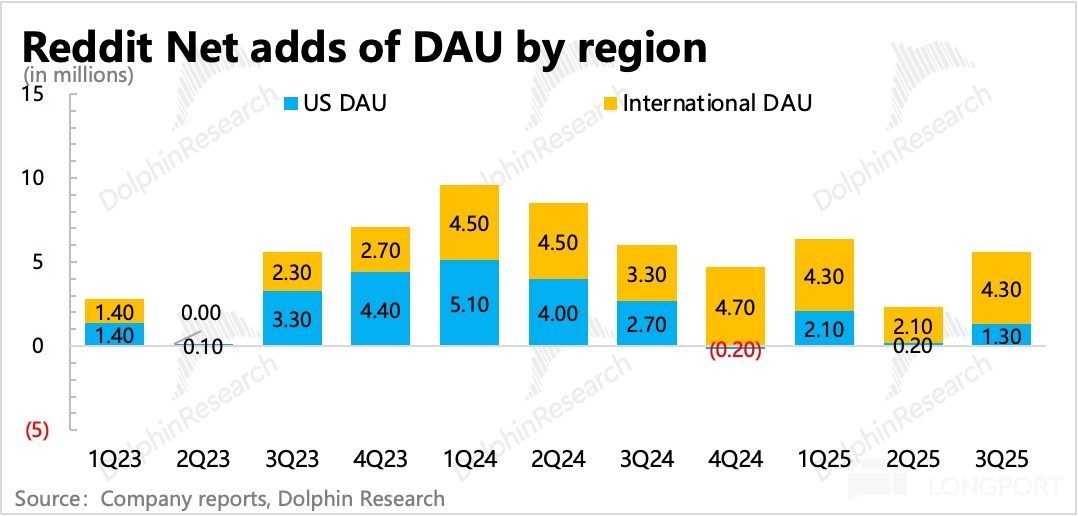

1. Before the earnings report, market tracking showed poor growth in North American user data (decline in duration, zero user growth). Considering that North American users are the main source of monetization, the lack of user growth raises doubts about growth potential, and high valuations (generally hovering around 40x-50x EV/EBITDA) naturally cannot be sustained.

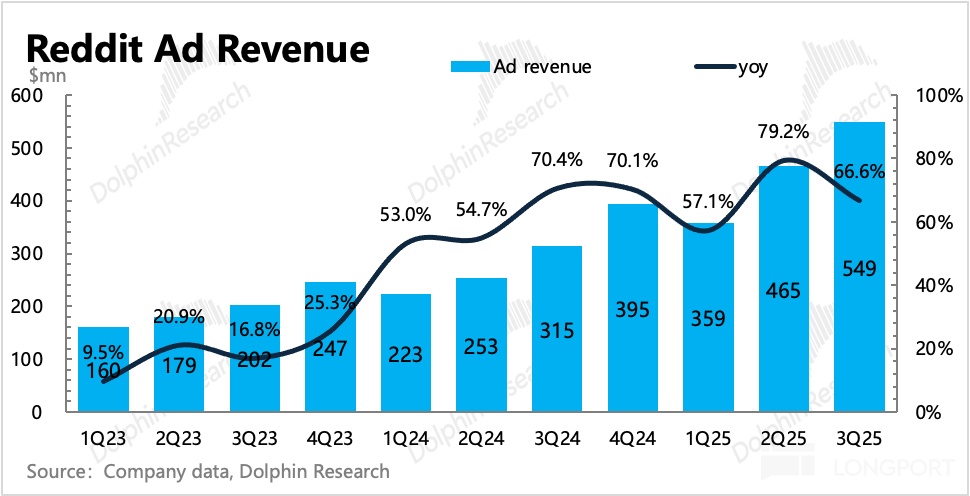

2. When the actual earnings report was released, North American user growth was not as bad as third-party data tracking indicated (negative growth), but it was not particularly good either, with a year-on-year growth rate of 10% and an increase of only 200,000 quarter-on-quarter. However, overall advertising revenue grew by 78% due to aggressive monetization (significantly exceeding market expectations of 60%), with the monetization rate per user in North America increasing by 69% year-on-year and 30% quarter-on-quarter.

Additionally, the guidance was also above expectations, with the company expecting a revenue growth rate of 55% in the fourth quarter.

3. How to understand the reversal of expectation differences for two consecutive quarters?

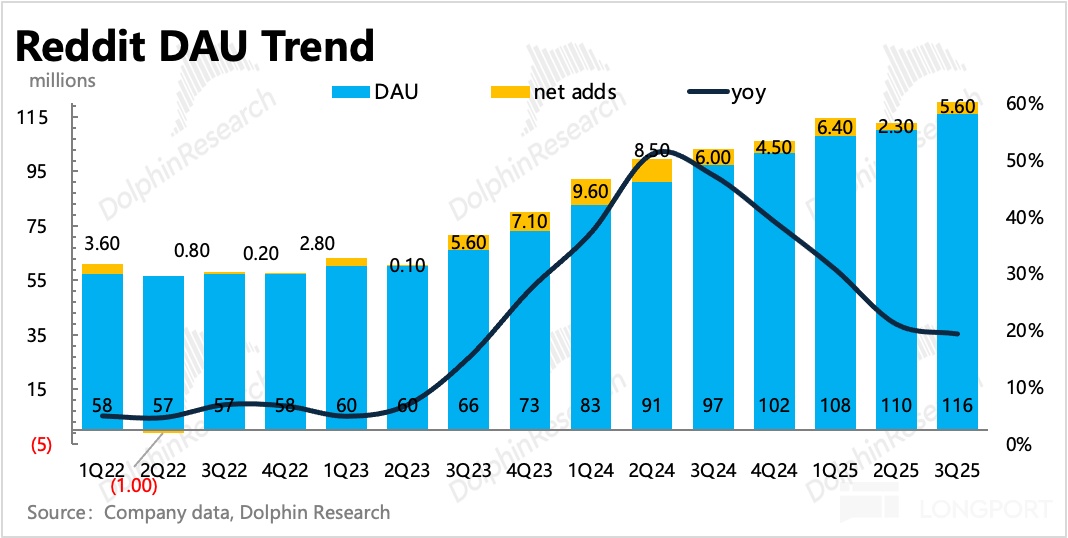

Firstly, user growth is indeed more challenging than before, with sales expenses growing too quickly (growth rates exceeding 70% in the last two quarters), indicating the need to advertise to acquire users.

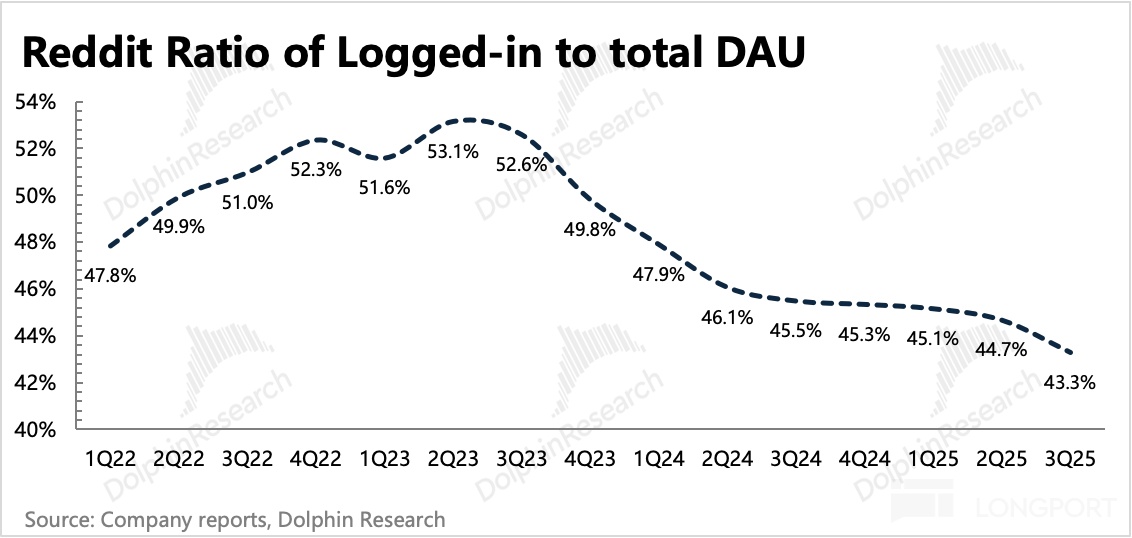

Secondly, high advertising growth can continue in the short term. The core reason is that Reddit is still in the early stages of commercialization, with annual revenue/DAU in North America at only $30. So even if Reddit's ad conversion rate may not be high, because the overall user base is still growing (accelerated internationalization through AI translation), it can still attract some spillover demand from major advertisers.

During this period, the pace of inventory release basically depends on how the company adjusts the flow. As long as inventory is released, short-term growth can easily be boosted from a low base.

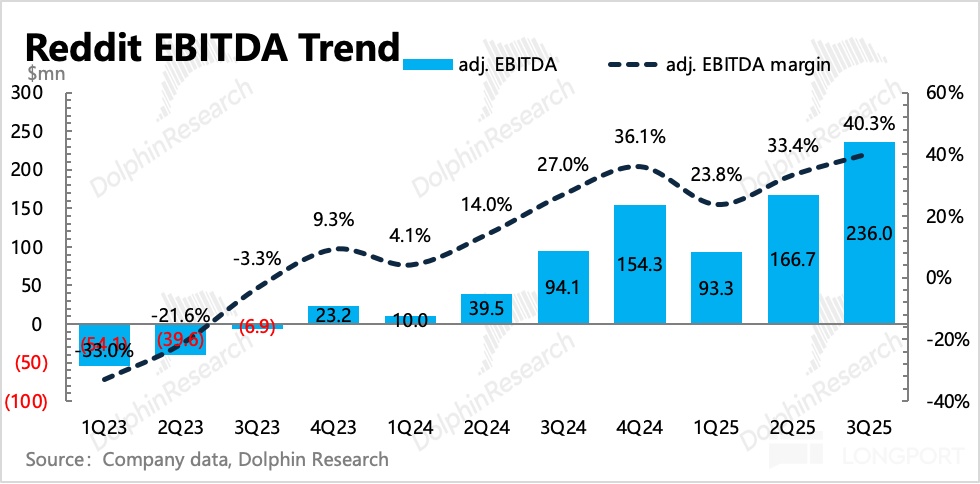

4. How to view valuation: Long-term value remains to be observed (relying on Google for traffic, rapid monetization's impact on community ecology). However, in a rate-cut environment, there is short-term room, but participation is challenging, especially now that the positive earnings report has been released and valuations have risen again. A safer approach is to wait for another correction when third-party monitoring data shows weak North American user growth. Based on next year's adjusted EBITDA of 800 million, assuming a growth rate of 50% next year (revenue growth of 40%), corresponding to 1.2 billion EBITDA, with a reasonable valuation of 25-30x = 300-360 range, and participate after applying a discount according to your risk preference.

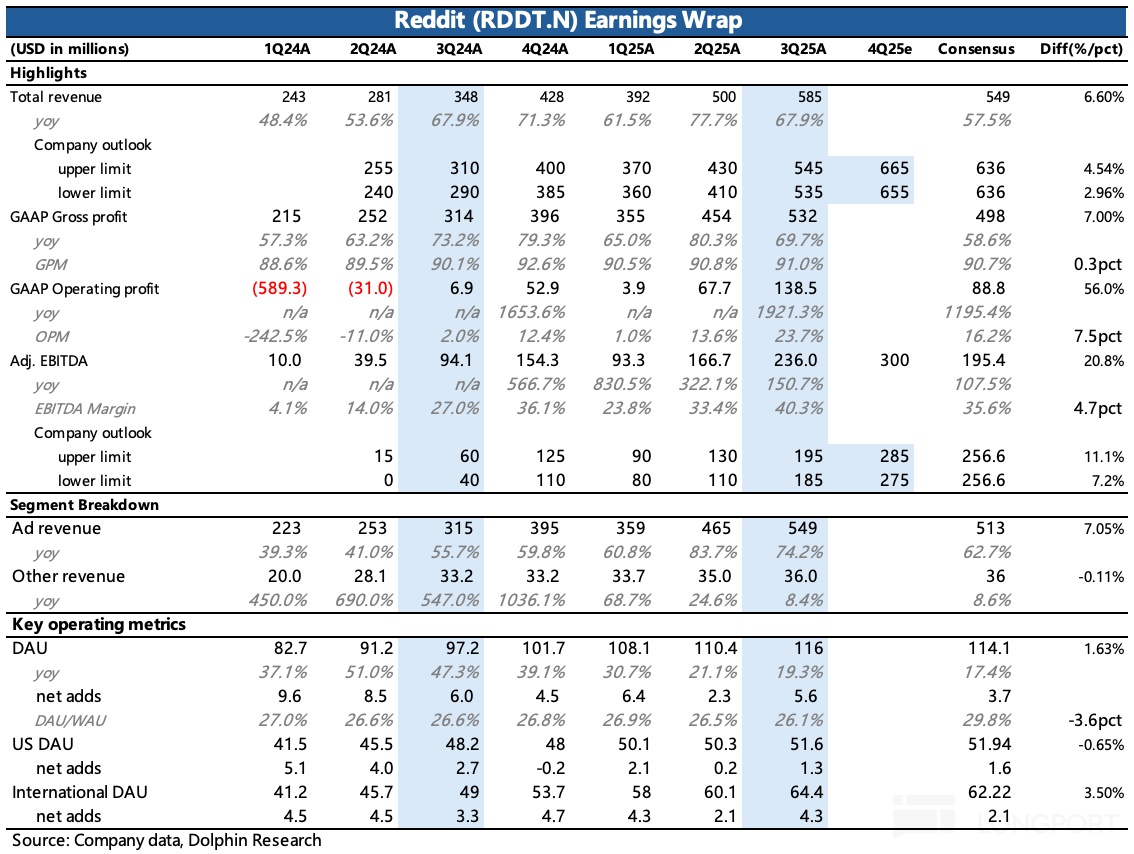

5. Key financial indicators at a glance

6. Detailed charts

(1) User metrics (external tracking metrics in North America continue to weaken)

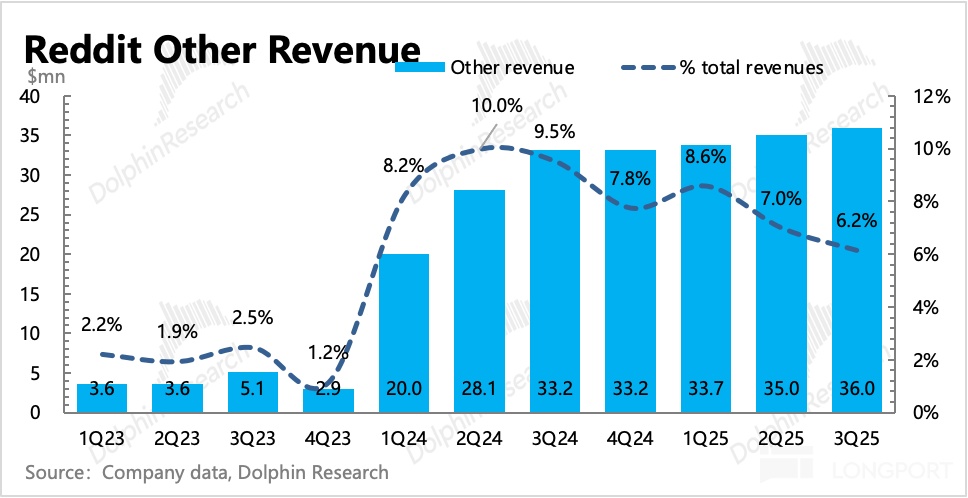

(2) Revenue

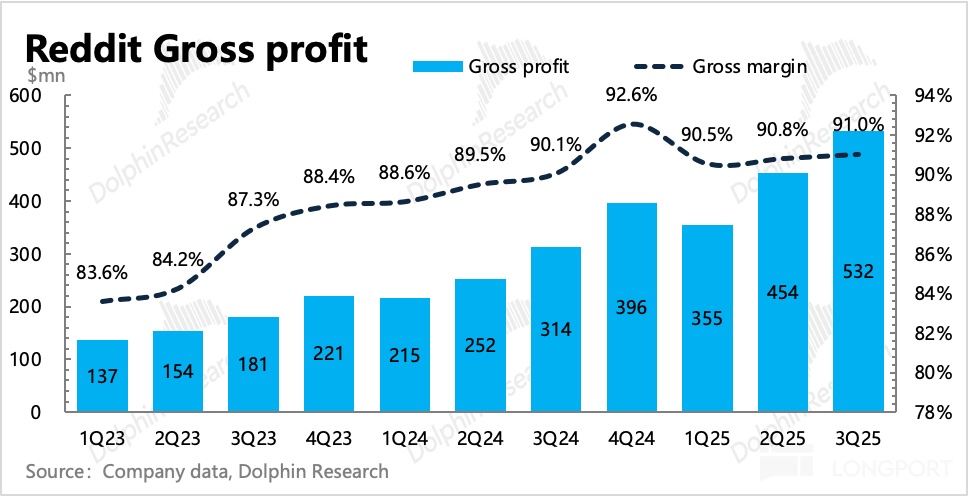

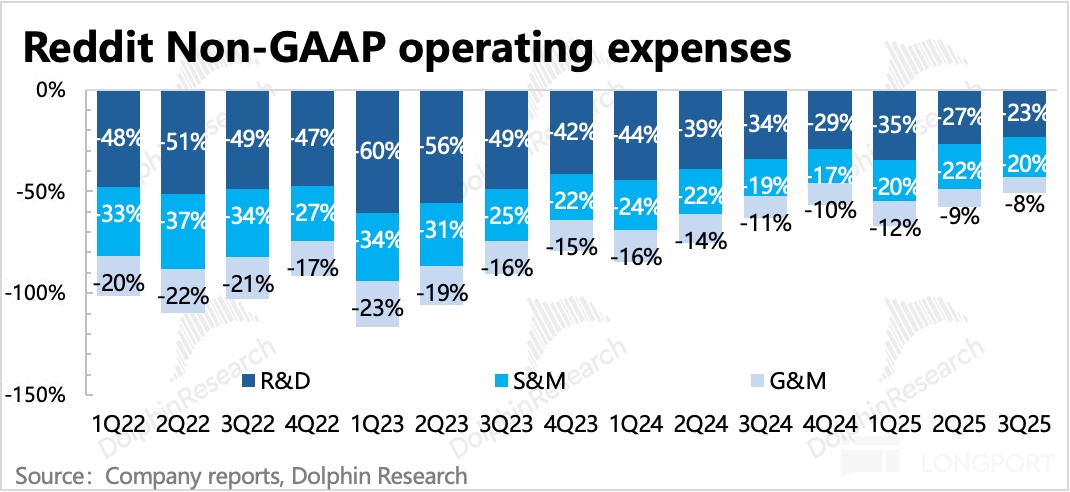

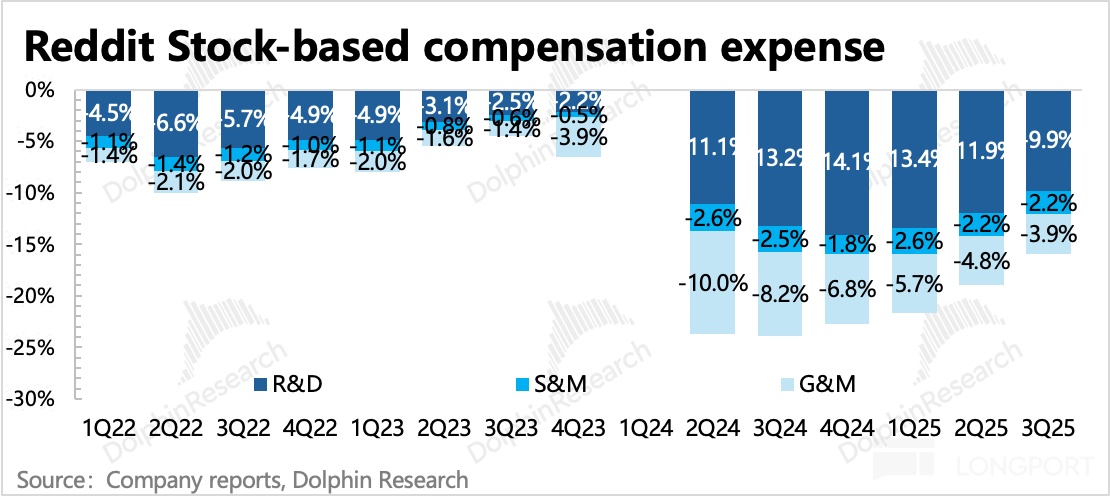

(3) Profit situation

<End here>

Dolphin Research on "Reddit" Historical Studies

Earnings Report

August 1, 2025, "Reddit (Minutes): Core search weekly users have reached 70 million"

August 1, 2025, earnings report commentary "Holding tightly to Google's leg, Reddit is racing down the commercialization road"

February 12, 2025, Minutes "Reddit (Minutes): The user mindset for professional search is forming"

February 12, 2025, earnings report commentary "Reddit: Growth depends on the big brother's face? High valuation is the 'sword over the head'"

In-depth

December 24, 2024, initial coverage "Reddit: The American version of 'Zhihu + Tieba', why can the old tree sprout new buds?"

Risk disclosure and statement of this article:Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.