All become 'money-eating beasts'! Can the giants of the US stock market still take the lead?

The U.S. federal government has been shut down since October 1st, and it has been over a month now. During this period, although there has been almost no release of federal-level macroeconomic data, the 'G2' meeting between China and the U.S. in Korea, the Federal Reserve's interest rate cut, and the resurgence of AI infrastructure investment by American tech giants during the earnings season have indeed created a small peak for the U.S. stock market.

However, the core issue the market now faces is whether the realization of positive factors also means that all the good news has been priced in, and whether the remaining time in 2025 is just 'junk' time?

I. Powell's 'hawkish' rate cut: Is there still room for rate cut trades this year?

At the FOMC meeting on October 29th, the Federal Reserve cut interest rates by 25 basis points as expected, bringing the federal funds rate down to between 3.75% and 4%. It also announced, as expected, that it would stop further reducing the Fed's balance sheet starting December 1st. These moves were anticipated after prior groundwork.

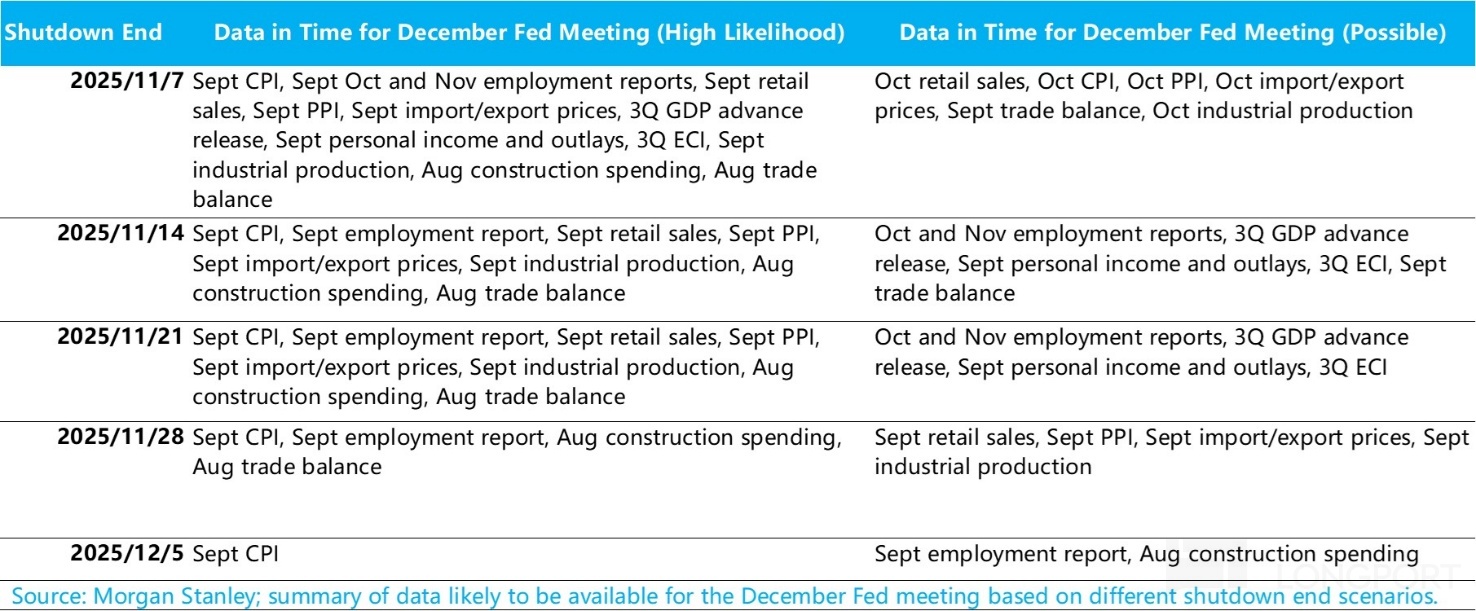

However, contrary to market expectations, Powell indicated that a rate cut at the next FOMC meeting on December 10th is not a foregone conclusion, as the current interest rate is near the neutral level. In the context of a federal government shutdown and a lack of macroeconomic data, assessing economic progress is like 'driving in fog,' raising questions about whether further rate cuts should be cautiously considered.

Before the meeting, the market had predicted a 100% probability of a rate cut in December. Therefore, after this 'hawkish' rate cut operation, U.S. stocks were instead hit, and the market's probability of a December rate cut has now fallen to around 65%.

The natural question then is, with AI becoming the absolute trading theme, is it really difficult to trade rate cuts going forward? Dolphin Research believes there should still be opportunities:

A. Federal Reserve personnel changes: The uncertainty about a December rate cut was pointed out by Powell, but Powell will step down from his position as chairman in May next year. His influence and authority will weaken. The selection of a new Federal Reserve chairman is fully managed by U.S. Treasury Secretary Bessent. According to him, the candidate pool has been narrowed down to five people, with a second round of selection before Thanksgiving, after which the final recommendation will be made to Trump, with the final candidate announced by the end of the year.

Since the Trump administration is very dissatisfied with Powell's current pace of rate cuts, a new Federal Reserve candidate strictly vetted by the Trump administration is likely to be more dovish. According to the current key timeline, there is a high probability that the market will have the opportunity to trade the 'rate cut magnitude' inclination of the new candidate during the Thanksgiving to Christmas period.

B. Government shutdown: It is difficult to determine when the federal government will restart, but one thing is certain: if the shutdown continues for a longer period, it is likely to start having a real impact on the real economy.

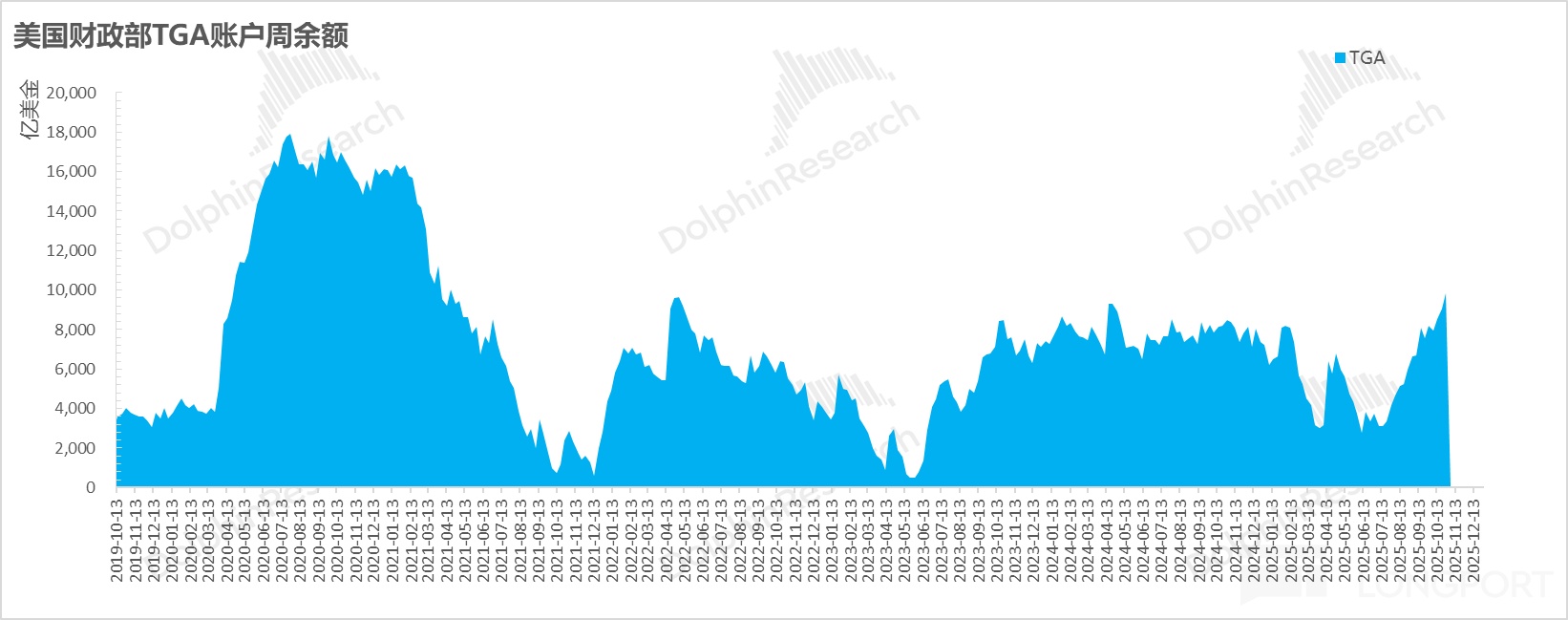

It can be seen that the U.S. Treasury's TGA account has surged significantly after the government shutdown. Originally at a level of $850 billion, it has risen to nearly $1 trillion.

However, the problem is that these funds, which should have been distributed to the real economy, such as the Supplemental Nutrition Assistance Program benefits that stopped on November 1st, affecting 42 million people, and funds for military salaries that are about to run out.

If the government remains closed, on one hand, these funds lying in the Fed's account effectively absorb liquidity, having a tightening effect; on the other hand, sectors and individuals in the real economy waiting for government aid will also be affected.

Dolphin Research tends to believe that the longer the shutdown lasts, as the economy and employment are gradually affected, even if there is no rate cut in December due to the Fed's 'cautious action,' the rate cut magnitude in 2026 will be higher. Currently, the market's key window expectations for the government to restart are between mid-November and early December. If negotiations deteriorate, it is not impossible for it to extend to the end of next year or early next year.

Therefore, Dolphin Research believes that even if the probability of a December rate cut decreases, after the market digests Powell's hawkish guidance, there is still room to trade the 'rate cut magnitude' imagination for 2026.

II. G2 game stabilizes, the key remains AI

Although Trump once again released a signature 'defensive essay,' it has been proven that these are all part of TACO's negotiation strategy. Ultimately, during the APEC meeting in Korea, a 'truce' agreement for one year was reached from a rational perspective, despite the basic consensus of confrontation between the two major economies.

The U.S. exchanged a 10% fentanyl tariff and non-tariff barriers for a temporary suspension of China's rare earth export controls and the resumption of agricultural product purchases. However, strategic competition areas such as semiconductor controls remain unchanged, indicating that after this agreement, competition is not over, but rather, after precisely exchanging chips, each side has a one-year buffer period. During this year, it is still a race to see who can fill the gaps faster, and when they return to the negotiating table the following year, whether the balance of negotiations will tilt based on changes in each side's situation over the year.

With the expectation of a more stable situation in the great power game within a year, the economic fundamentals become more important. Currently, the biggest individual stock fundamental in the U.S. economy is likely the AI investment cycle.

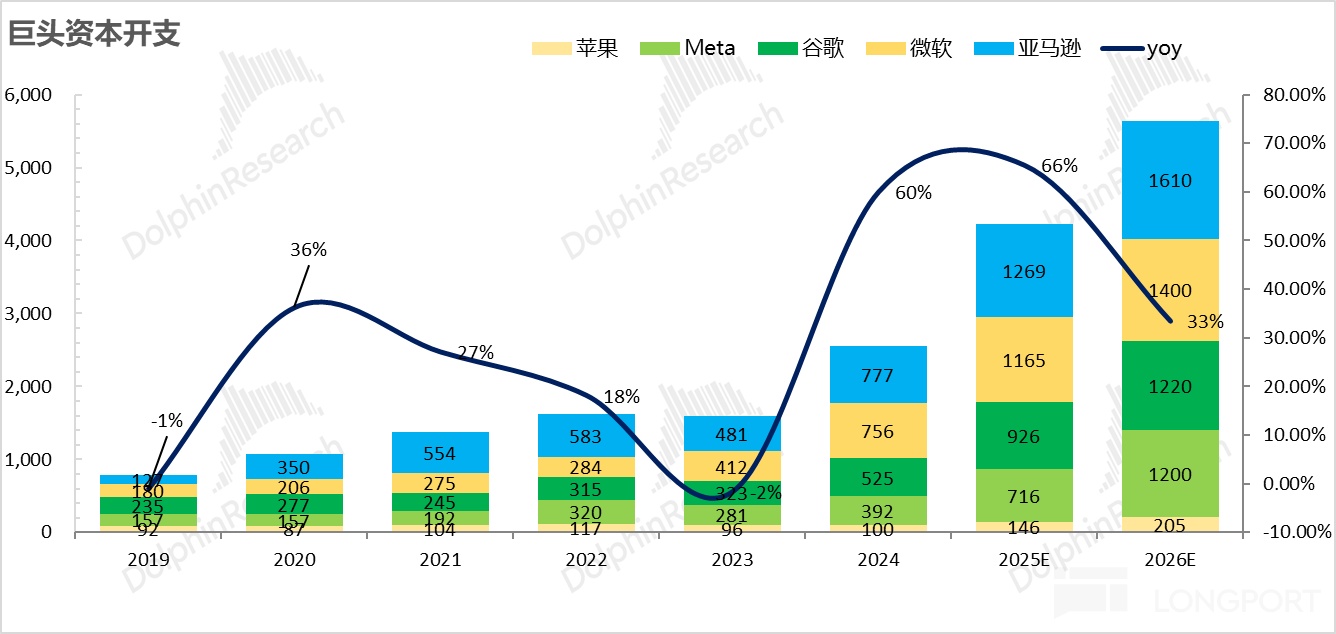

Currently, the capital expenditure of American giants has clearly become the core force of American industrial reconstruction. In addition to a series of giant investments in the U.S. negotiated by Trump, data center construction has begun to drive a batch of energy construction and surrounding facilities.

However, although the giants announced wave after wave of huge capital expenditures in this earnings season, it seems that they have not effectively driven the production material stocks needed for AI infrastructure, such as Nvidia, to reach new highs. Of course, one reason is that Jensen Huang has already outlined his 2026 performance growth range at the GTC conference.

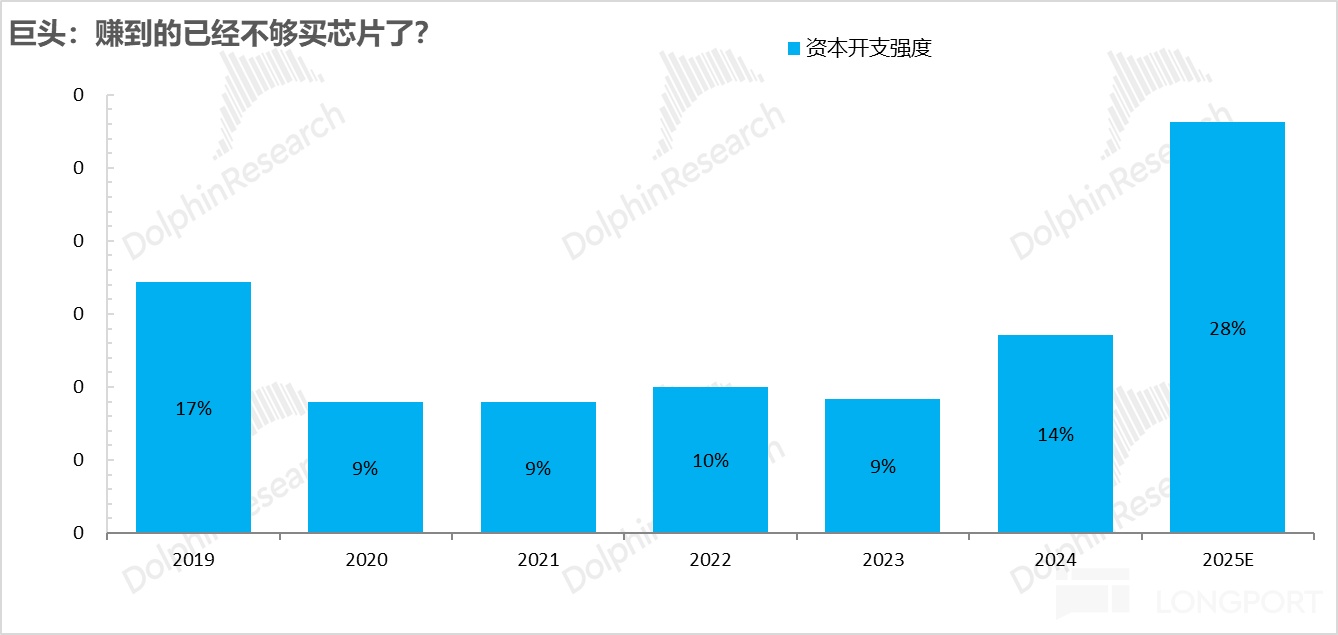

But a bigger issue, Dolphin Research believes, comes from the uncertainty of future growth, especially as the capital expenditure intensity (capital expenditure/revenue) used to measure capital expenditure levels is rapidly rising in the AI era. According to the latest capital expenditure levels guided by the current earnings reports, the capital expenditure density of giants in 2026 is likely to be between 30-45%.

There are two obvious problems here:

1) The operating cash flow of some giants in the year can no longer support infrastructure investment. Currently, Meta has announced large bond financing, and Google has also announced billions of dollars in bond financing. However, the current benchmark interest rate of 3.87% is obviously high compared to historical financing rates.

2) The continuous increase in capital expenditure intensity clearly lacks proportional revenue growth to dilute these capital expenditures. If the capital expenditure ratio remains high, the market will begin to worry whether these U.S. stock giants, proud of their light asset model, are becoming heavy asset companies.

3) Heavy assetization will kill valuations, but the trigger for killing valuations is still the decline in profit margins. Microsoft was the first company to invest in capital expenditures, and now, with the new high capital expenditures entering the depreciation phase, the depreciation expense growth rate of 70-80% year-on-year has begun to affect the financial statements.

However, Microsoft is strong in its ability to raise prices through its market monopoly position with products like Office, and by cutting costs through layoffs, using Opex to replace Capex, it has maintained its overall profit margin target. But obviously, not all U.S. stock giants have this operational capability. In 2026, it is not ruled out that several aggressively investing U.S. stock giants will begin to see a decline in profit margins.

Clearly, the combined result of valuation and performance, in 2026, it is not ruled out that giants will have full valuations but declining operating profit margins. Therefore, from this quarter, Dolphin Research will be more cautious and conservative in judging individual stocks that bear a large amount of heavy asset AI infrastructure in the AI era.

Combining and , Dolphin Research believes that 2026 will still be a policy combination of certain monetary and fiscal easing. This policy combination + AI major industry cycle will most likely still be the 'comfort zone' for growth stocks.

In 2026, Dolphin Research will focus more research efforts on individual stocks related to AI landing scenarios, whether it is a company like Coca-Cola striving to achieve 'de-averaging' operations using AI, a pure AI stock like Figma, or progress in specific intelligent tracks.

III. Portfolio Returns

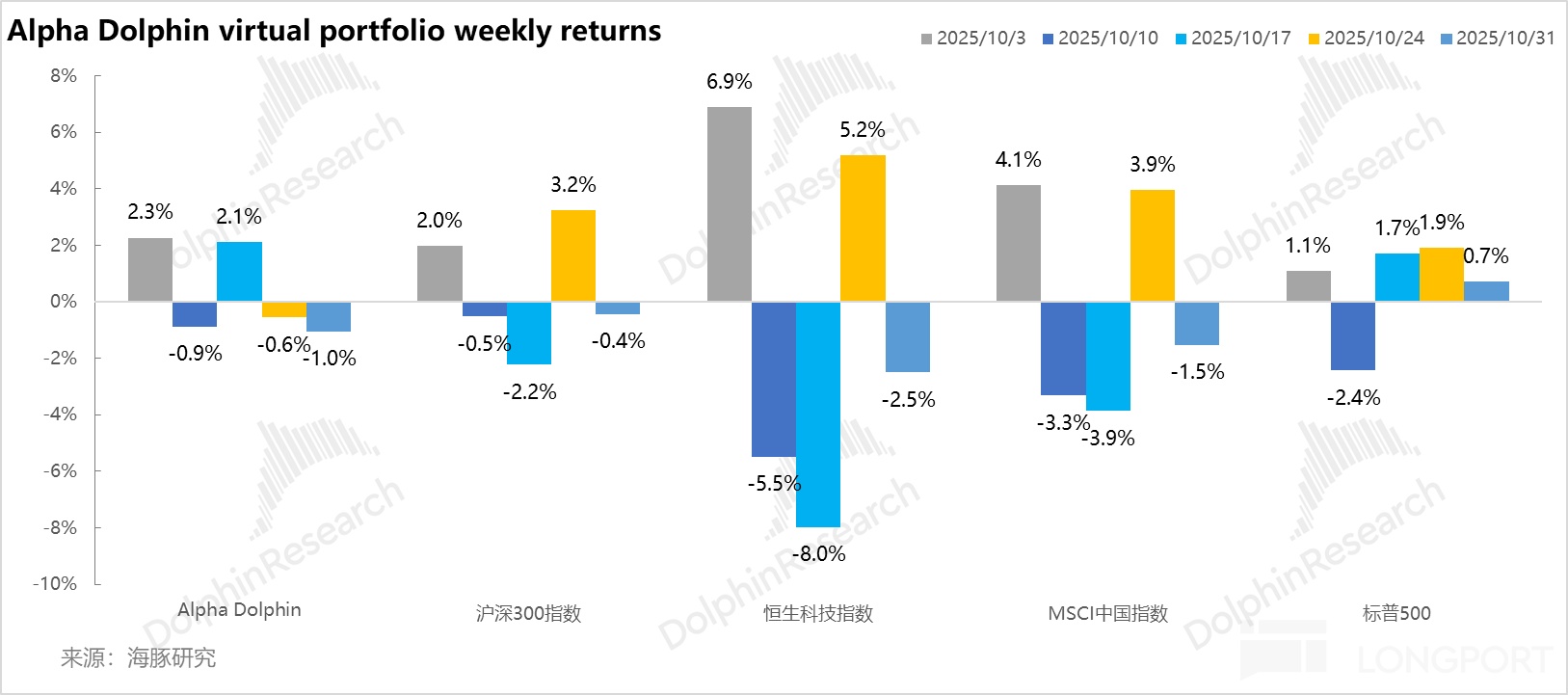

Last week, Dolphin Research's virtual portfolio Alpha Dolphin did not adjust its positions. It fell by 1% during the week, underperforming the CSI 300 (-0.4%) and the S&P 500 Index (+0.7%), but outperforming the MSCI China Index (-1.5%) and the Hang Seng Tech Index (-2.5%). This was partly due to the high gold holdings in the virtual portfolio and partly due to the strong dollar dragging down Chinese concept stocks.

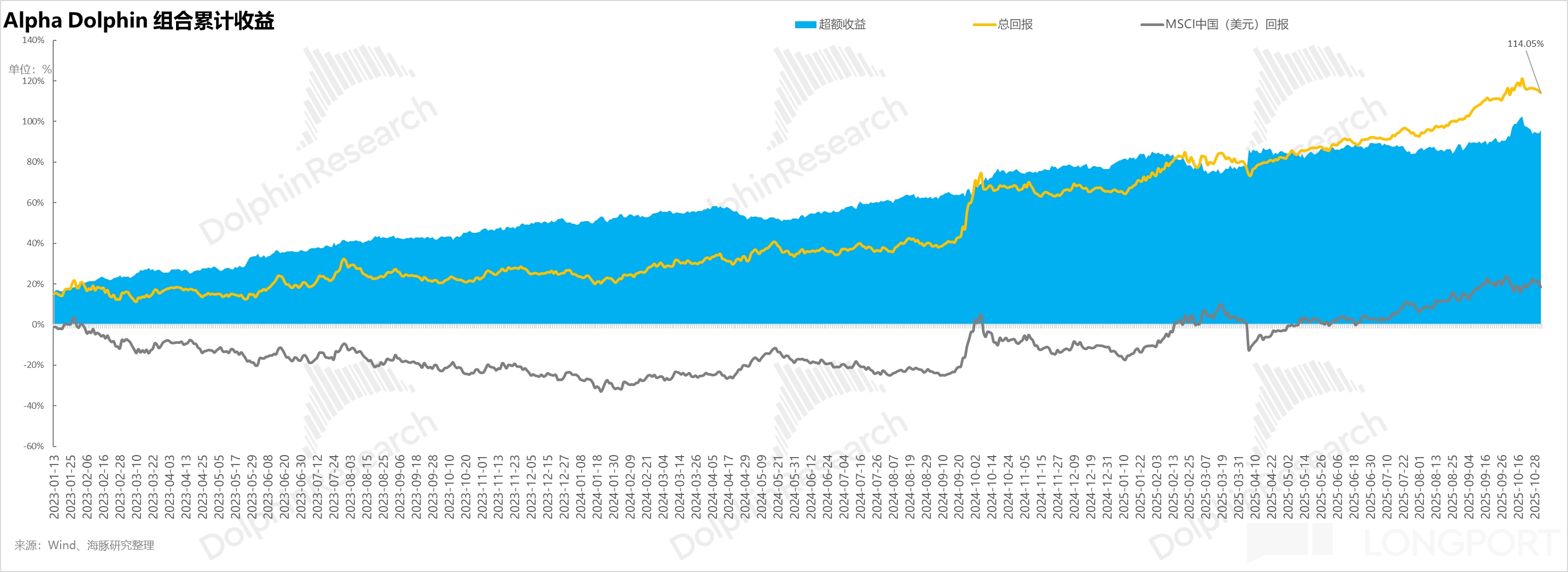

Since the portfolio began testing (March 25, 2022) until last weekend, the portfolio's absolute return is 113%, with an excess return of 92.6% compared to MSCI China. From an asset net value perspective, Dolphin Research's initial virtual asset of $100 million has exceeded $217 million as of last weekend.

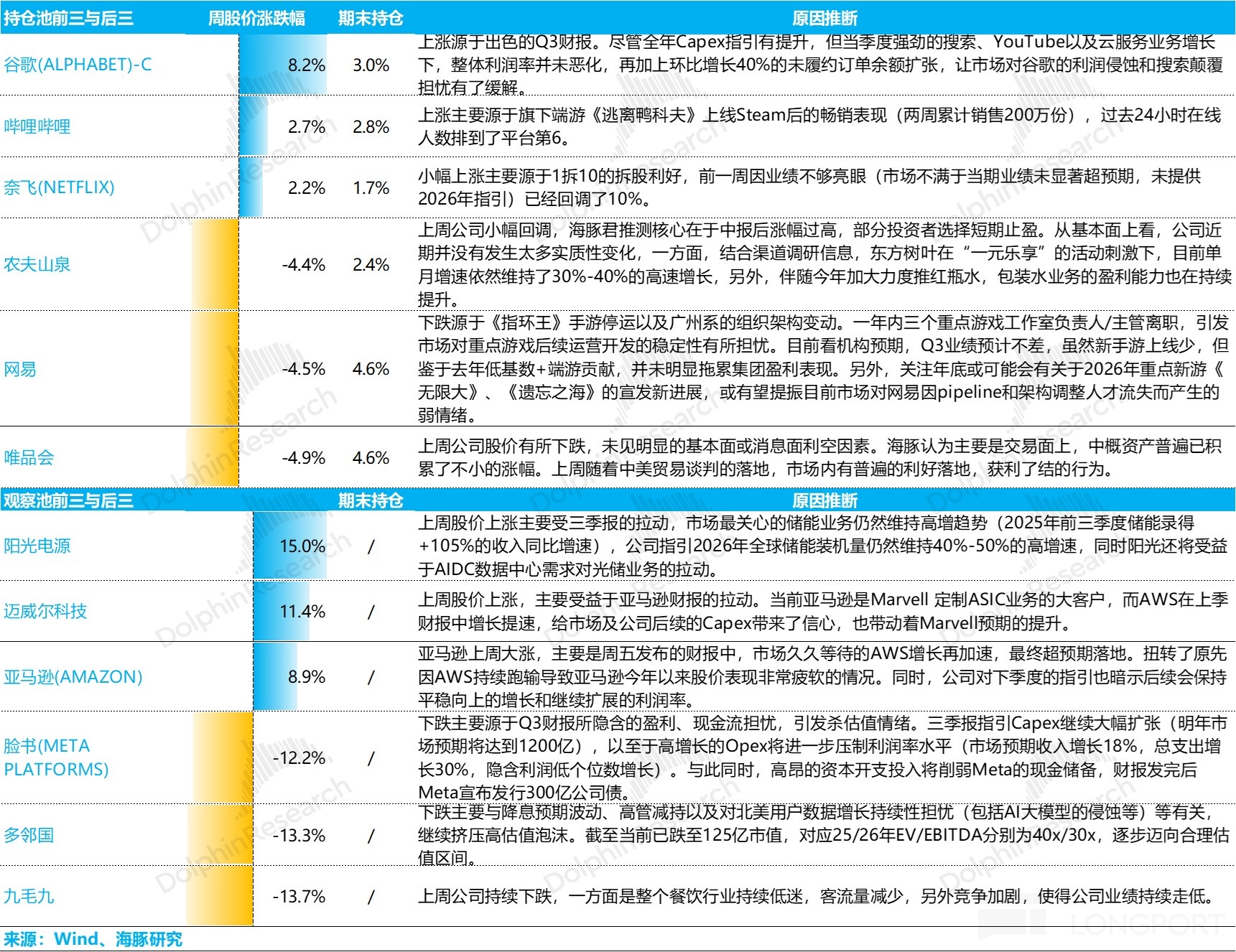

IV. Individual Stock Profit and Loss Contribution

Last week, Dolphin Research's virtual portfolio Alpha Dolphin fell mainly due to the pullback of gold assets after a sustained surge and the decline of Chinese concept assets. The specific individual stock gains and losses are explained as follows:

V. Asset Portfolio Distribution

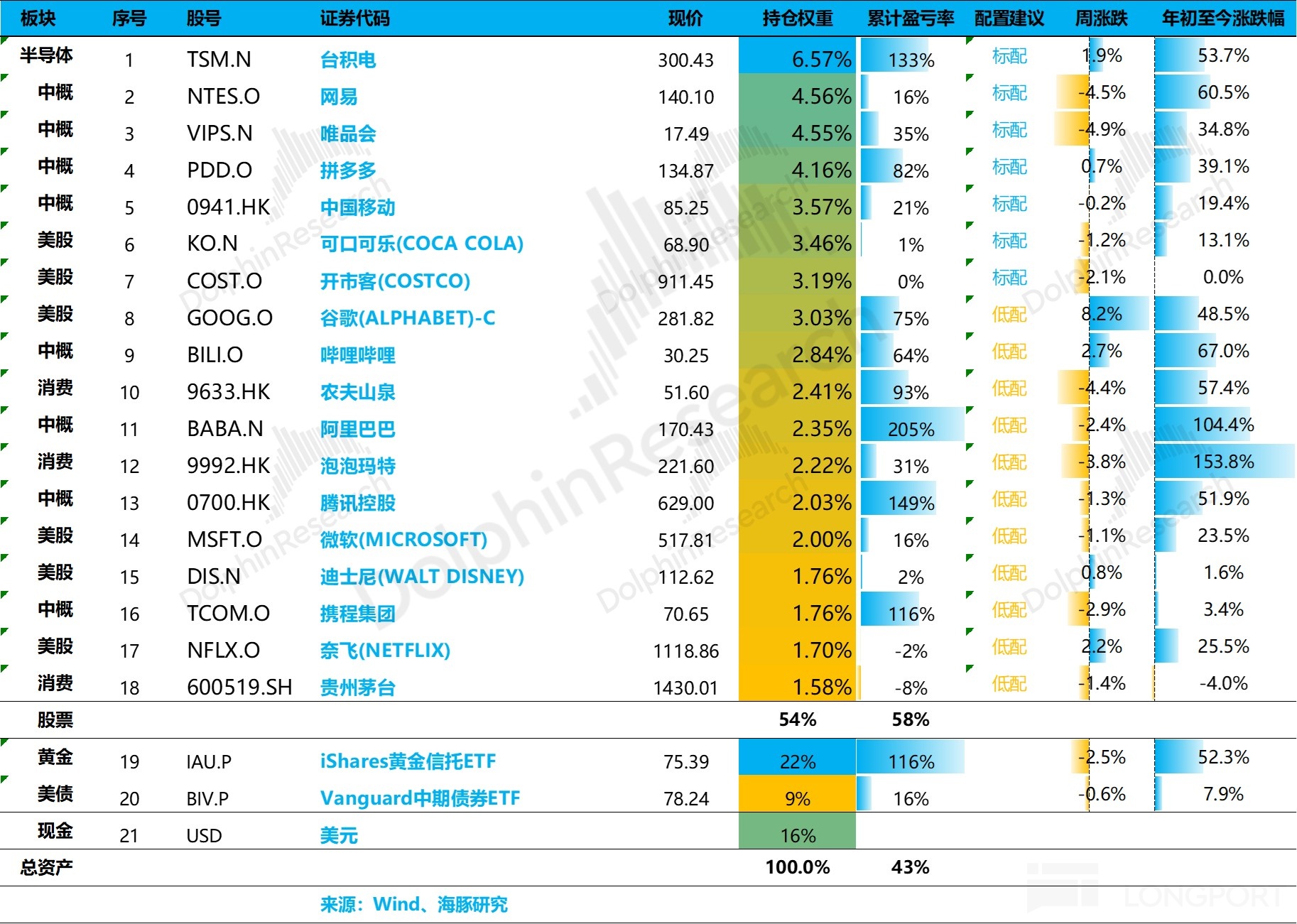

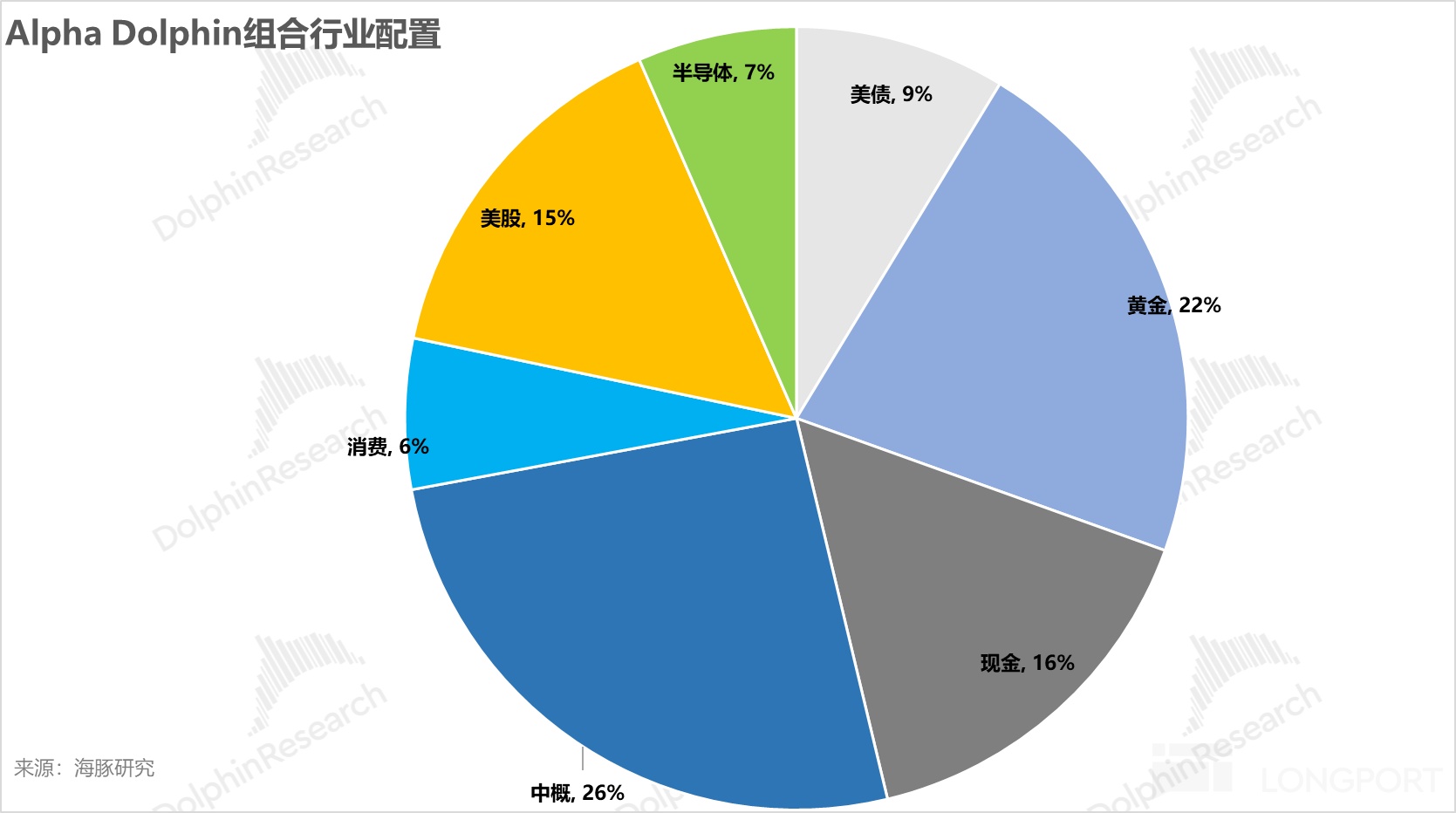

The Alpha Dolphin virtual portfolio holds a total of 18 individual stocks and equity ETFs, with 7 standard allocations and the rest underweight. Assets outside of equities are mainly distributed in gold, U.S. Treasuries, and U.S. dollar cash, with a current equity to gold/Treasuries/cash defensive asset ratio of approximately 55:45.

As of last weekend, the Alpha Dolphin asset allocation distribution and equity asset holding weights are as follows:

VI. Key Events Next Week

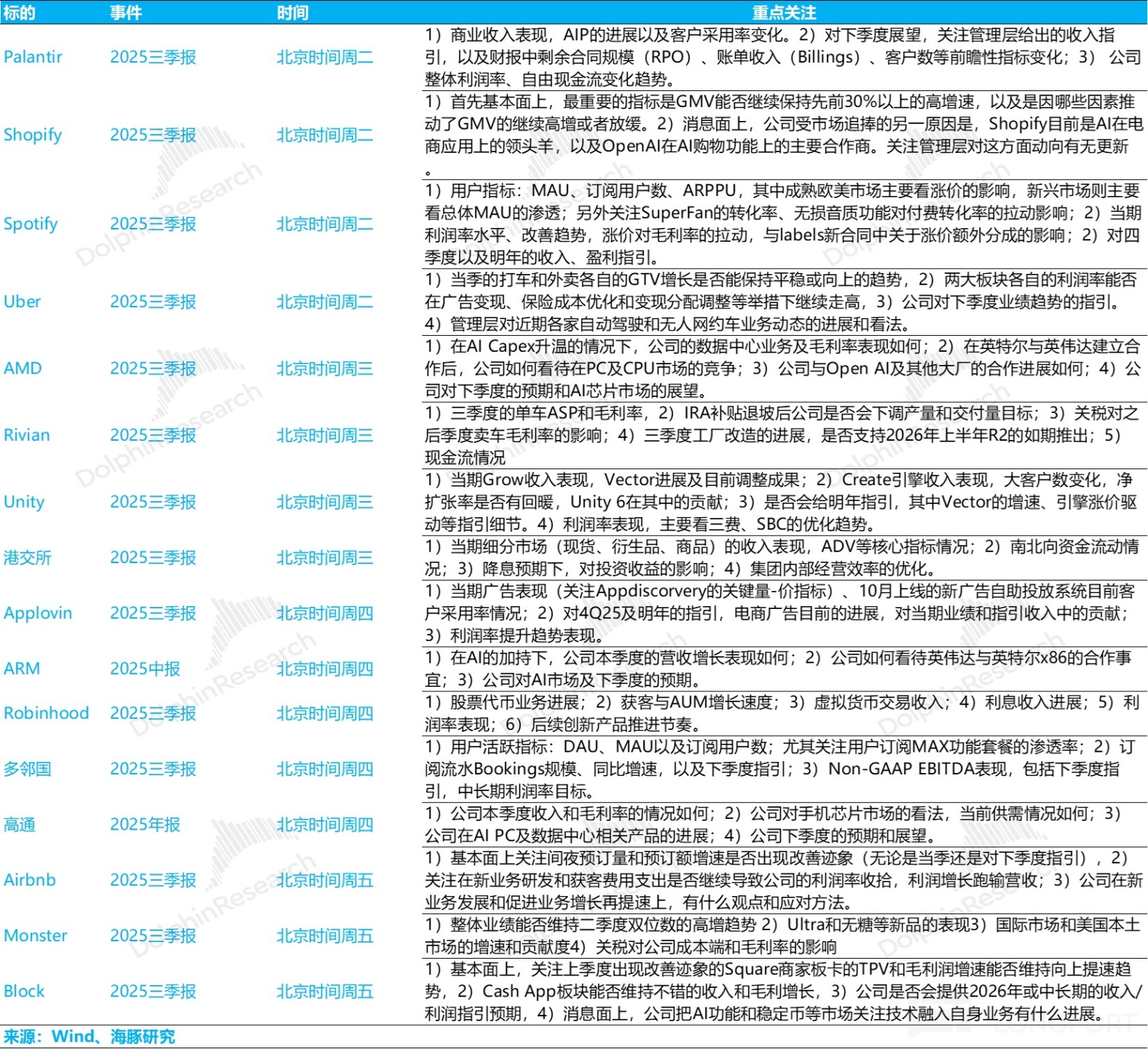

Starting this week, U.S. stocks enter the earnings season for small giants. From companies like Palantir (no longer considered a small giant, as it is now among the top three software stocks by market cap) and Shopify, the progress of AI can be observed. There are many specific companies, and Dolphin Research has organized them for you as follows:

<End of Text>

Risk Disclosure and Statement of this Article:Dolphin Research Disclaimer and General Disclosure

For recent articles on Dolphin Research's portfolio weekly report, please refer to:

"A Tumultuous Toss, Trump Ultimately Can't Escape 'Inflation Debt'?"

"This is the Most Down-to-Earth, Dolphin Investment Portfolio Starts Running"

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.