Has China Duty Free finally "bottomed out"?

A few days ago, China Duty Free released its Q3 2025 financial report. Due to previous scheduling conflicts with other financial reports, Dolphin Research is providing a brief commentary today:

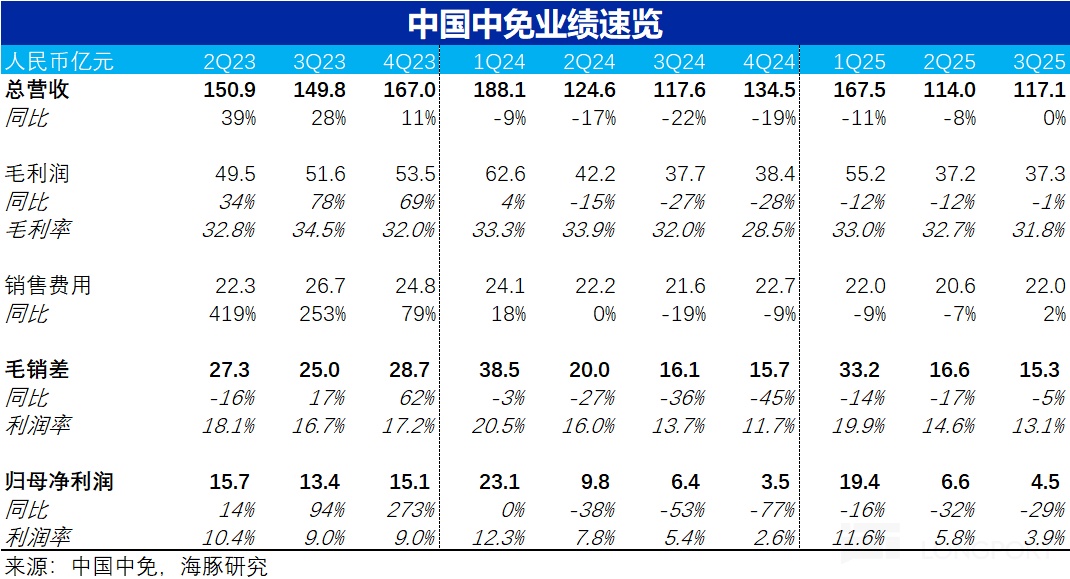

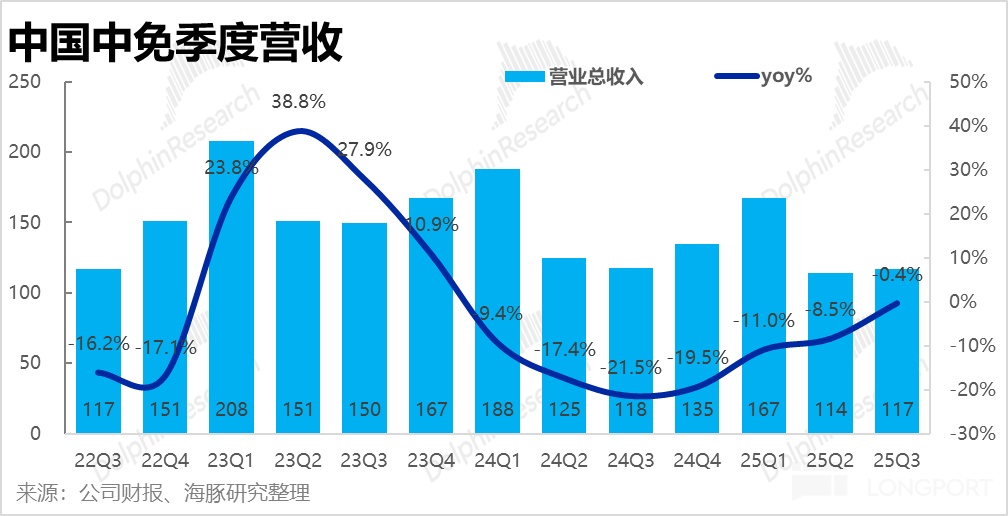

1. After a year and a half of decline, revenue growth finally stabilizes: In Q3 2025, the company's total revenue was approximately 11.7 billion yuan, roughly flat year-on-year (partly due to increasingly lower year-on-year base), finally announcing stabilization. Consistent with Dolphin Research's previous view, after six consecutive quarters of negative revenue growth, the worst period is likely over.

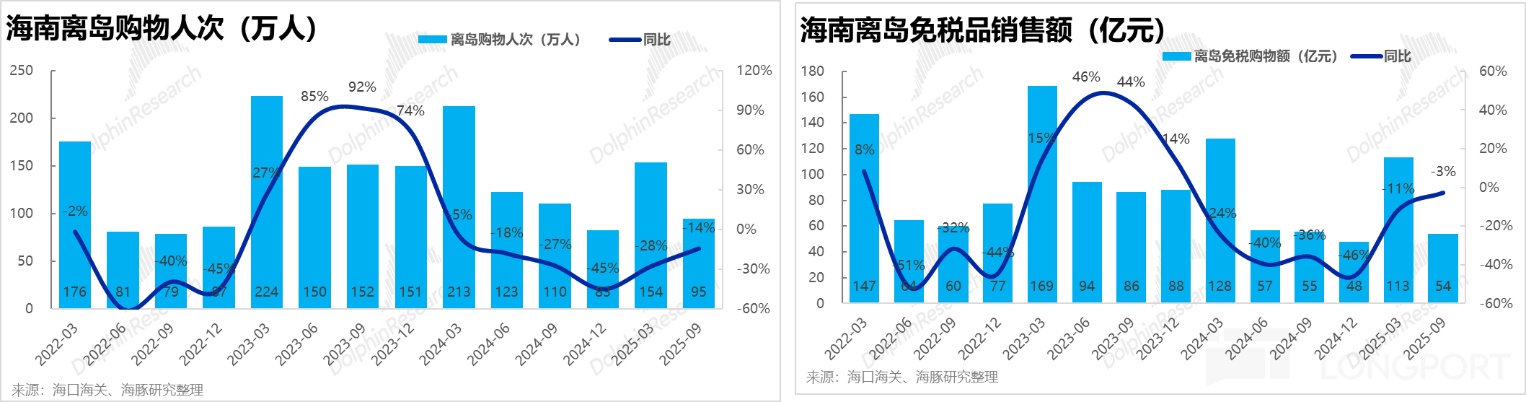

The overall performance of the offshore duty-free market is similar to the company, with overall offshore duty-free sales declining by 2.6% year-on-year this quarter, with the decline continuing to narrow, and stabilization and positive growth should not be far off. A major driver was the significant recovery in the number of tourists visiting Hainan this summer. This quarter, Hainan received approximately 20.29 million tourists, a 55% increase year-on-year, and roughly flat quarter-on-quarter.

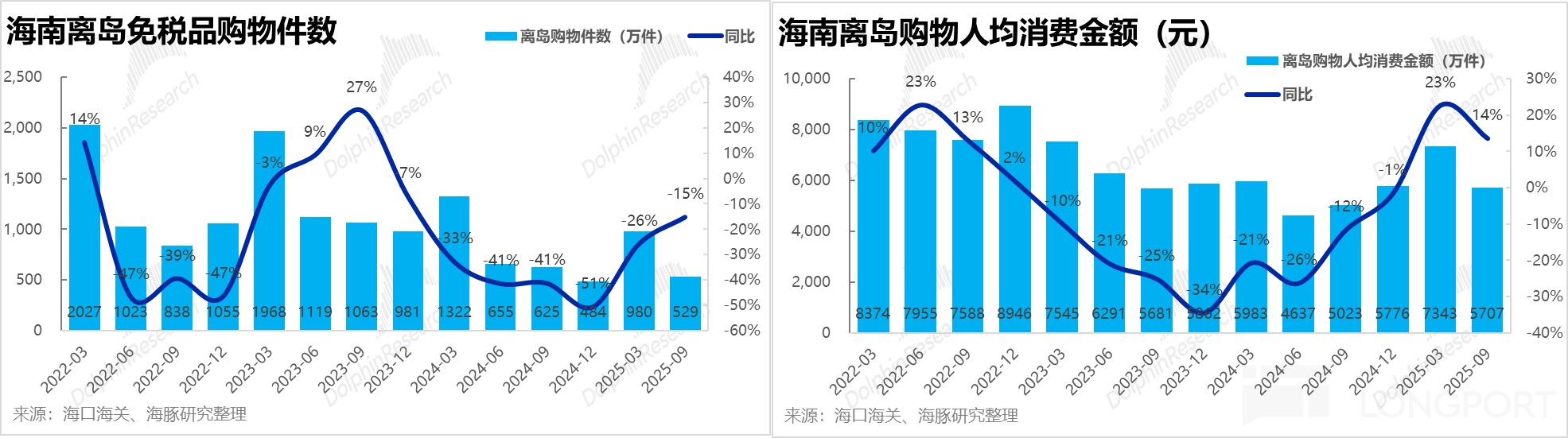

In terms of price and volume drivers, although the number of offshore shoppers still declined by 14% year-on-year, there was some improvement (the decline narrowed by about 8 percentage points quarter-on-quarter). Additionally, due to the 14% year-on-year increase in average transaction value, the overall growth rate of offshore duty-free sales has also stabilized. In other words, the company's performance is generally consistent with the overall industry trend.

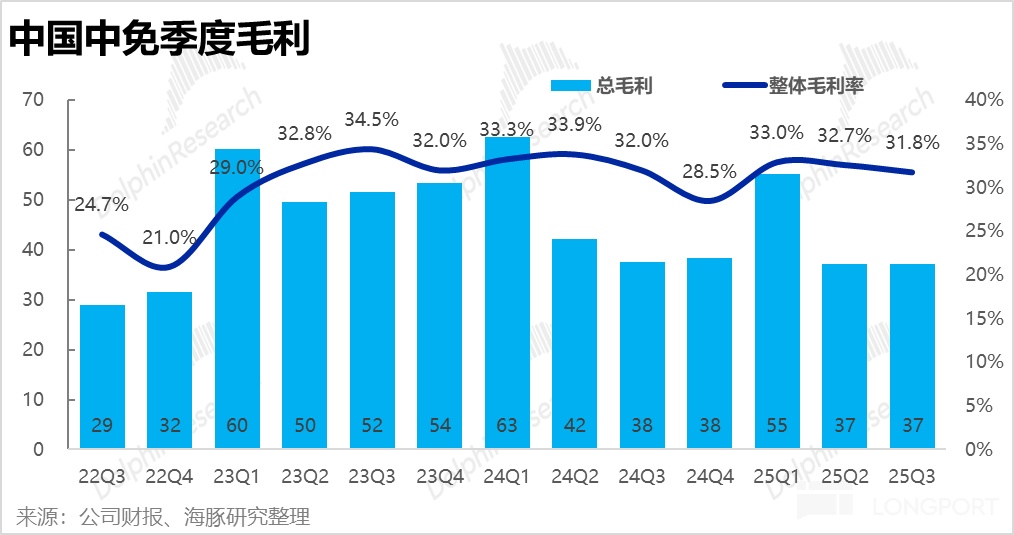

2. Gross sales margin continues to decline, competition/customer acquisition pressure remains high: As revenue growth nearly halts its decline and stabilizes, the company's gross margin continues to shrink, but the issue is improving this quarter. This quarter, the gross margin was 31.8%, down 0.2 percentage points year-on-year, further narrowing from the 0.3 percentage point decline last quarter.

Considering that the proportion of the company's taxable sales is relatively low, it should no longer significantly drag down the gross margin. Moreover, industry data shows that the current average transaction value of duty-free sales is rising. Therefore, the continued decline in gross margin reflects the current situation where, either to stimulate consumer shopping or due to competition among duty-free channels, the company still needs to offer relatively high discount rates to maintain competitiveness.

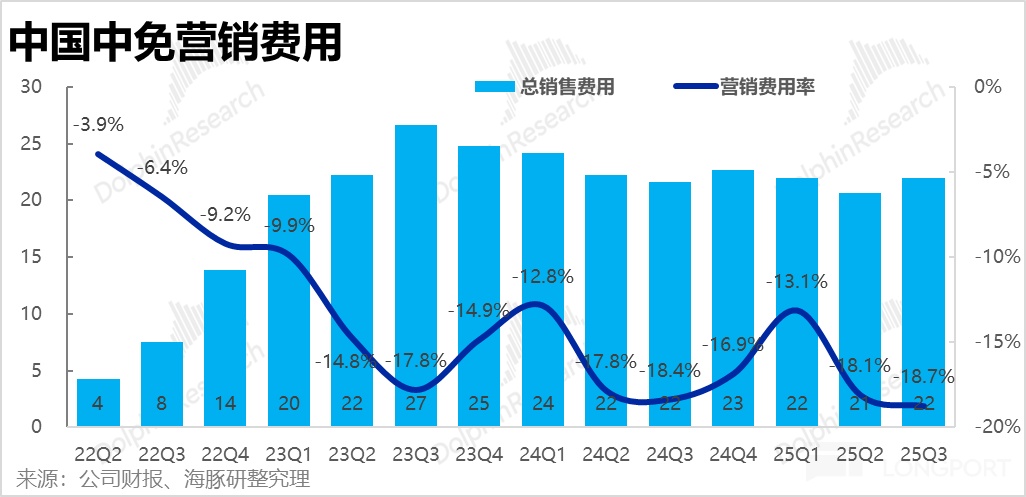

Additionally, the company's marketing expenses this quarter show similar signs. With the stabilization of revenue growth, marketing expenses have returned to positive growth (+1.7% year-on-year). Therefore, the proportion of marketing expenses to revenue has also expanded by 39 basis points.

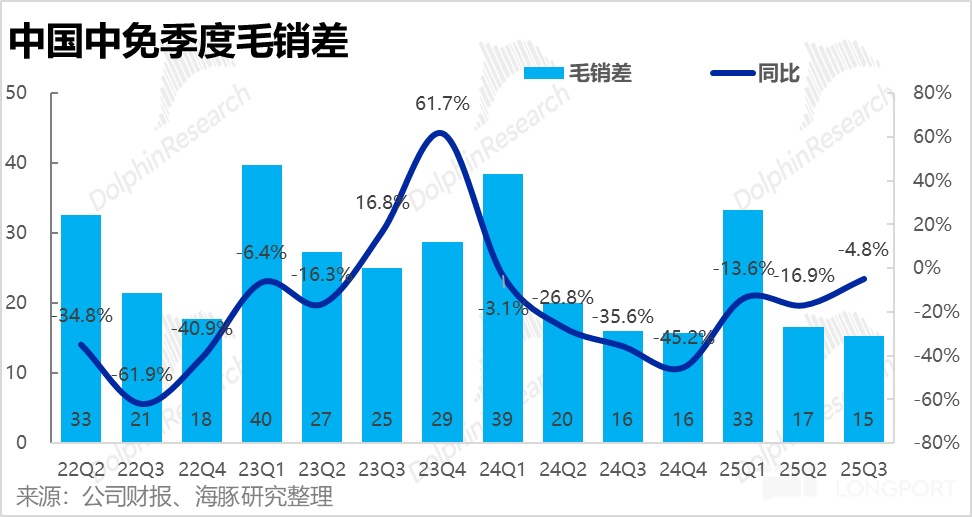

The slight decline in gross margin + slight increase in marketing expense ratio resulted in a nearly 5% year-on-year decrease in gross sales margin (gross profit minus marketing expenses) to 1.53 billion.

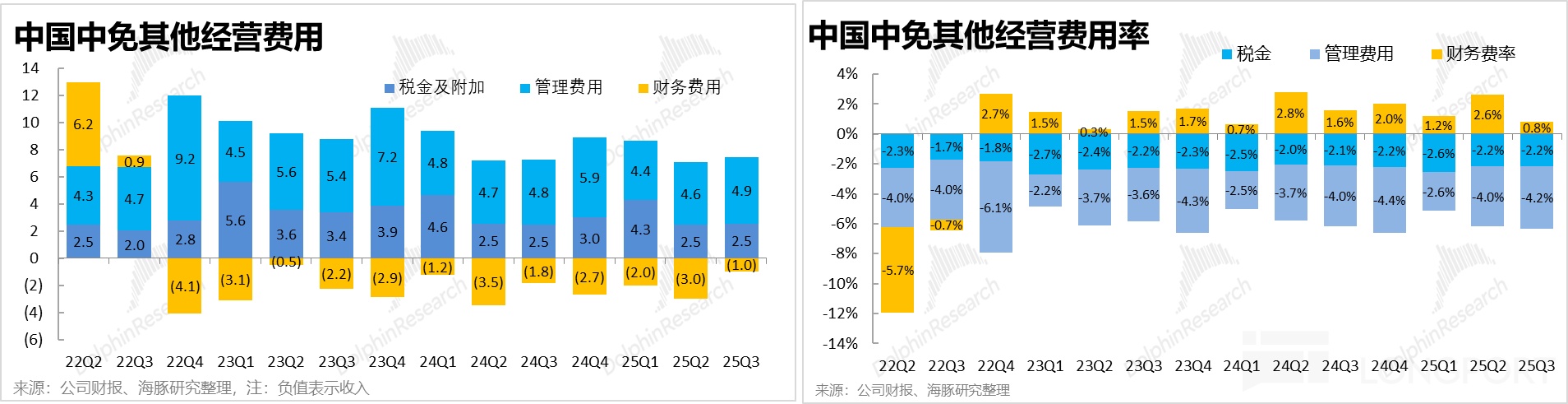

3. Expenses return to expansion, profit stabilization not yet achieved: Similarly, other expenses including business taxes, management expenses, and R&D expenses have also returned to growth as revenue roughly stabilizes, although the increase is limited (low single-digit percentage year-on-year), but the proportion of expenses to revenue has still expanded. Meanwhile, one of the previously "important" profit sources, net financial profit, also decreased by about 80 million year-on-year this quarter.

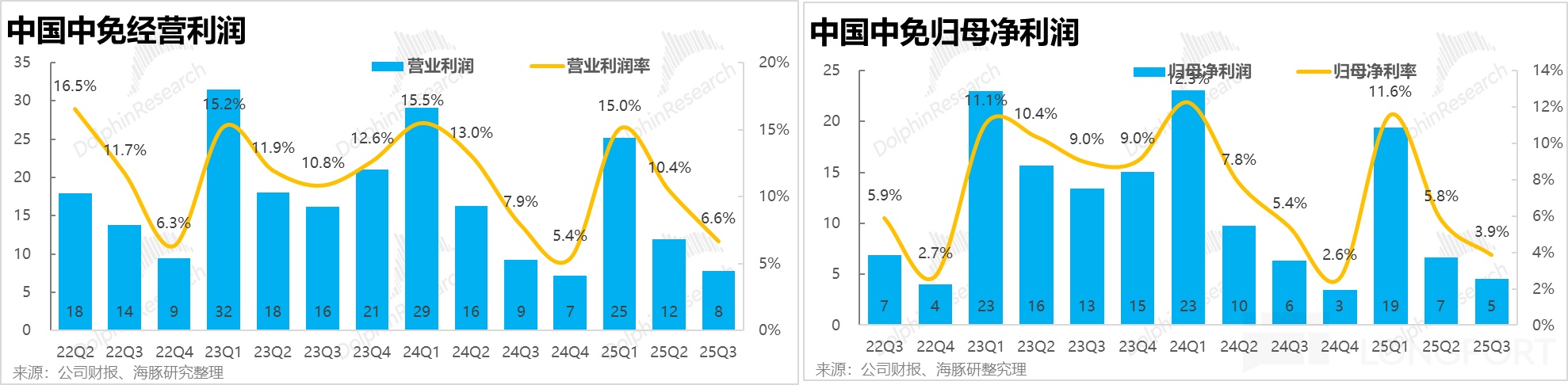

As a result, the company's operating profit was 770 million, and after deducting taxes and fees, the net profit attributable to the parent company was 450 million, still down nearly 29% year-on-year, although the decline has narrowed compared to the previous quarter, it is clearly still some distance from bottoming out and stabilizing.

It can be seen that China Duty Free's expense elasticity has always been relatively low. Even with significant fluctuations in revenue size, the quarterly expenditure of various expenses mostly fluctuates by no more than 200-300 million. Therefore, as long as the revenue size recovers, the scale effect returns, and the profit elasticity is also relatively considerable.

Dolphin Research's View:

Overall, Q3 continued the marginal improvement and trend of performance bottoming out that began last quarter. Revenue has basically stopped declining, but profit is still some distance from stopping its decline.

Of course, part of the improvement in revenue growth is following the overall industry stabilization, and another part is due to the continuously declining base, with a natural tendency for year-on-year growth to return.

However, in any case, the probability of the company's revenue returning to positive growth in the future is relatively high. And with the return of revenue scale effects, as long as expense growth does not accelerate too quickly, profit margins are likely to stabilize and even enter a recovery trend after a few quarters.

Additionally, on the policy and news front, several stimulus policies have been introduced recently, including:

1) In October, the Ministry of Finance and two other departments jointly issued the "Announcement on Adjusting the Duty-Free Shopping Policy for Hainan Offshore Travelers," expanding the range of goods covered by the offshore duty-free policy and the groups eligible for the policy;

2) At the end of October, a statement was made to "improve duty-free store policy support to boost consumption," encouraging the development of various channels such as offshore duty-free and indoor duty-free;

3) Starting December 18, Hainan will be fully closed off and become a free trade zone.

Although it is not yet possible to accurately determine the extent to which the above policies or statements will benefit the duty-free industry, or whether the closure of Hainan will be beneficial or detrimental to licensed duty-free operators like China Duty Free,

at the very least, it will increase market and consumer attention to duty-free shopping. Combined with the trend of gradually bottoming out performance, China Duty Free may have a recovery window in the medium term.

However, from a long-term perspective, as mentioned in previous financial report commentaries, including ① increased consumer recognition of domestic beauty brands, which may reduce the attractiveness of imported duty-free goods to consumers; ② continued recovery of inbound and outbound travel, leading to diversion of domestic duty-free consumption to overseas channels; ③ with Hainan about to be fully closed off and turned into a free port, it is currently unclear whether the exclusive operating barriers of licensed duty-free operators like China Duty Free will benefit or suffer. Therefore, Dolphin Research still lacks significant confidence in the long-term value and potential of China Duty Free.

In terms of valuation, the market's expectations for the company's net profit attributable to the parent company in 2025 and 2026 are approximately 3.6 billion and 5.5 billion, respectively (implying a revenue growth of about 13% in 2026, but a net profit margin returning to over 9%, similar to the level in 2023). Therefore, based on the company's Hong Kong stock market value, the PE ratios for 2025 and 2026 are 35.6x and 23x, respectively.

This means that the current price has already partially priced in the recovery within 2026, and if it can indeed be delivered, it would be a relatively neutral and reasonable valuation.

The following are the core charts:

1. Revenue has basically stopped declining

2. Gross margin pressure still exists

3. Profit is still declining

<End of text>

Dolphin Research's Past Research on China Duty Free:

March 28, 2025, Financial Report Commentary "China Duty Free: Falling Off a Cliff with No Bottom, Can It Start Over Again?"

October 30, 2024, Financial Report Commentary "The More It Falls, the More Expensive It Gets, Is There No Bottom for China Duty Free?"

August 30, 2024, Financial Report Commentary "Falling Again and Again, China Duty Free Has Become a 'Bottomless Pit'"

April 23, 2024, Financial Report Commentary "China Duty Free: Tough Times, 'Double Kill' Brutal"

March 27, 2024, Financial Report Commentary "China Duty Free: Duty-Free Lying Flat with No Improvement, When Will It Turn Around?"

October 27, 2023, Financial Report Commentary "Weak Revenue and Profit, Is Duty-Free Sales Recovery Hopeless?"

August 26, 2023, Financial Report Commentary "China Duty Free: Just Browsing, Not Buying, Duty-Free Consumption Is Hurt"

April 28, 2023, Financial Report Commentary "Travel Boom, Is China Duty Free's Spring Coming Soon?"

March 30, 2023, Financial Report Commentary "China Duty Free Survives the Retrograde, Just Short of a Comeback?"

Risk Disclosure and Statement of This Article:Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.