Palantir: Expensive Valuation is Biting Back!

$Palantir Tech(PLTR.US) released its Q3 2025 earnings after the market closed on November 3rd, Eastern Time.

Overall, the Q2 results remain impressive, although guidance and operational indicators imply signs of slowing down. Considering the management's consistently conservative guidance style and short-term changes in the U.S. Department of Defense procurement process, the short-term disturbance is not a major issue. However, with a full valuation, the market will be more critical of Palantir.

Reviewing past performance vs. market reaction, it is not difficult to find that starting from this year, over three quarters, as valuations rise, the market has become increasingly "immune" to Palantir's performance:

In Q1, a minor flaw in the international commercial market led to a direct 12% drop post-earnings; Q2 saw record-breaking explosive results, but only a 5% increase after hours; and this time, Q3 still exceeded expectations in current performance, but due to the more critical "marginal slowdown in forward-looking indicators," the stock price directly turned downward.

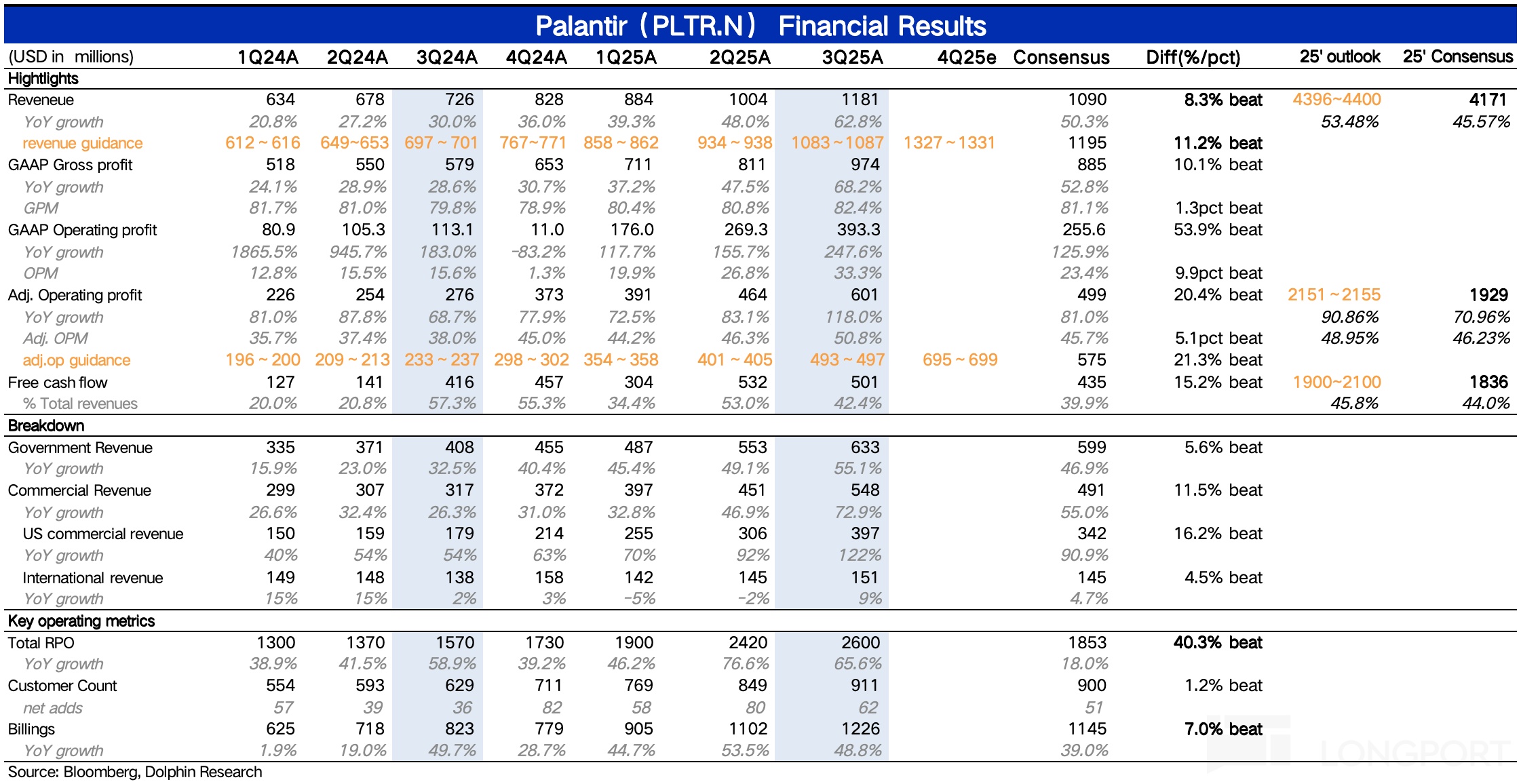

Specifically, the core information of the financial report:

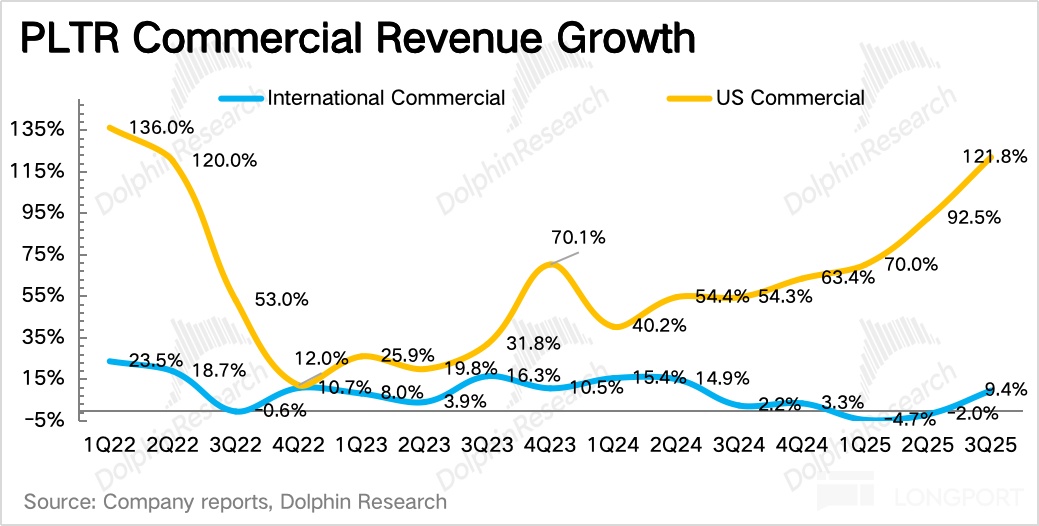

1. Demand from U.S. companies has not peaked: Government revenue is seen as Palantir's moat, but the high growth expectations corresponding to high valuations rely on U.S. commercial revenue. Overall commercial revenue continued to accelerate in the third quarter, and demand from U.S. local companies once again pushed the growth rate to 122%, with no signs of peaking.

Meanwhile, international corporate demand has warmed as expected, returning to positive growth. However, there is still uncertainty about how much the growth rate can recover, as Palantir's local protectionism and deep ties with the Department of Defense consistently affect European companies' willingness to sign contracts.

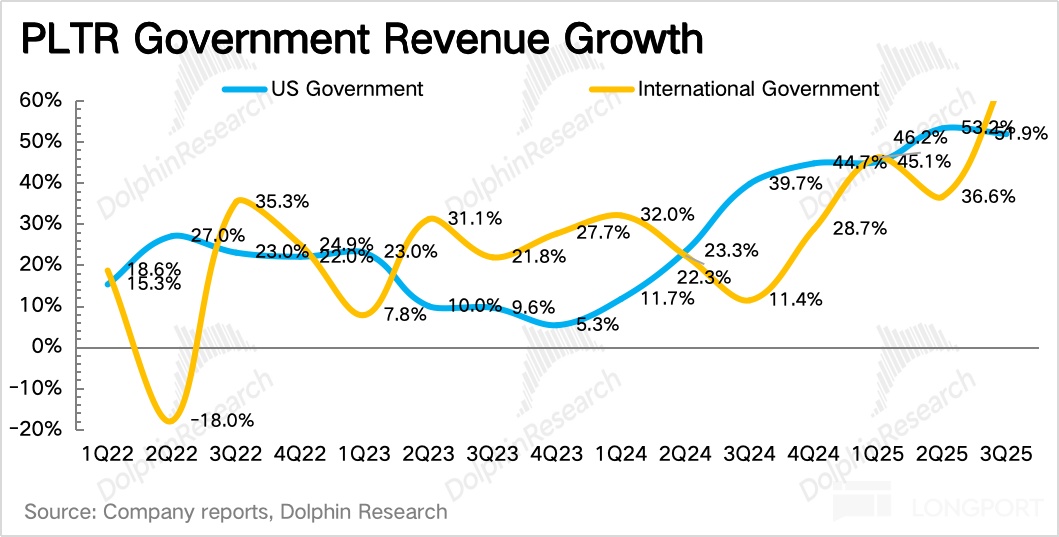

2. International government revenue accelerates: Government revenue grew 55% year-on-year in the third quarter, accelerating quarter-on-quarter. However, the growth rate of international government revenue exceeded that of the U.S. government, reflecting the gradual entry into the service cycle of contracts signed this year (NATO, UK, Germany, etc.).

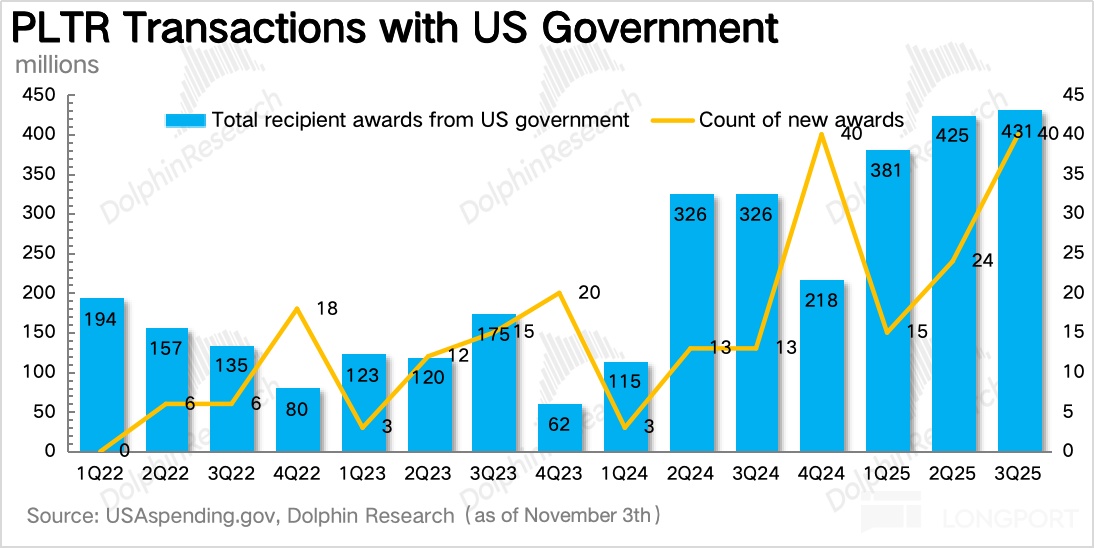

U.S. government revenue growth slightly slowed, but the actual contract signing scale remained high. The market may have some concerns about the impact of the Department of Defense procurement system reform, but the actual procurement process reform is beneficial to high-tech companies like Palantir, and short-term disturbances do not change the long-term trend.

3. Operational indicators remain healthy, but quarter-on-quarter slowdown may be the main reason for criticism:

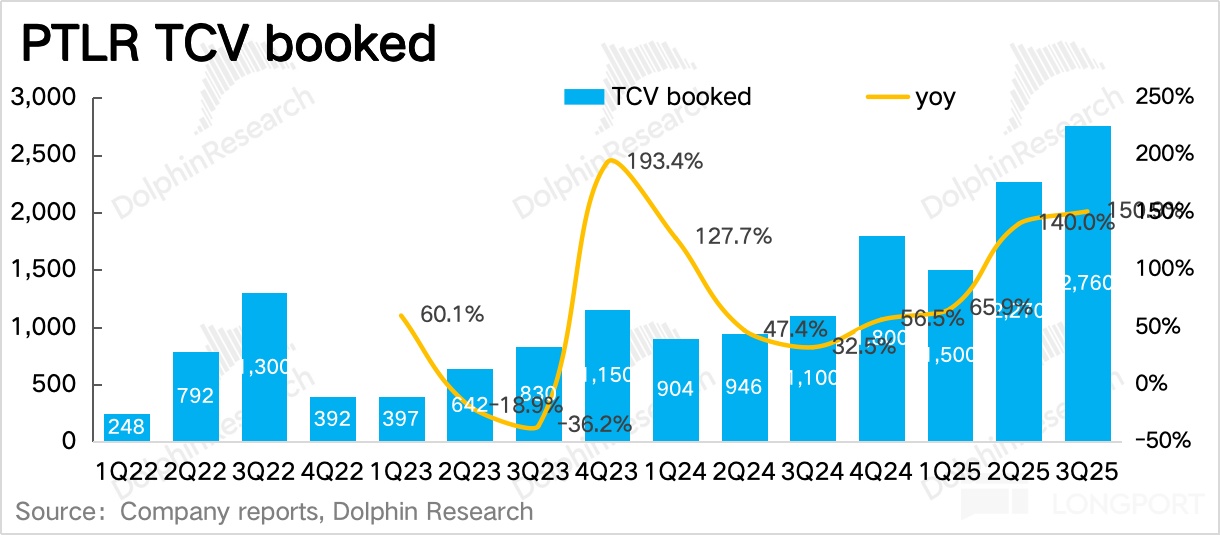

(1) Focus on TCV, RPO, and customer numbers from a medium to long-term perspective: In the third quarter, TCV (Total Contract Value) grew 150% year-on-year to $2.76 billion, with U.S. commercial orders growing 252% in the third quarter, being the main contributor to growth.

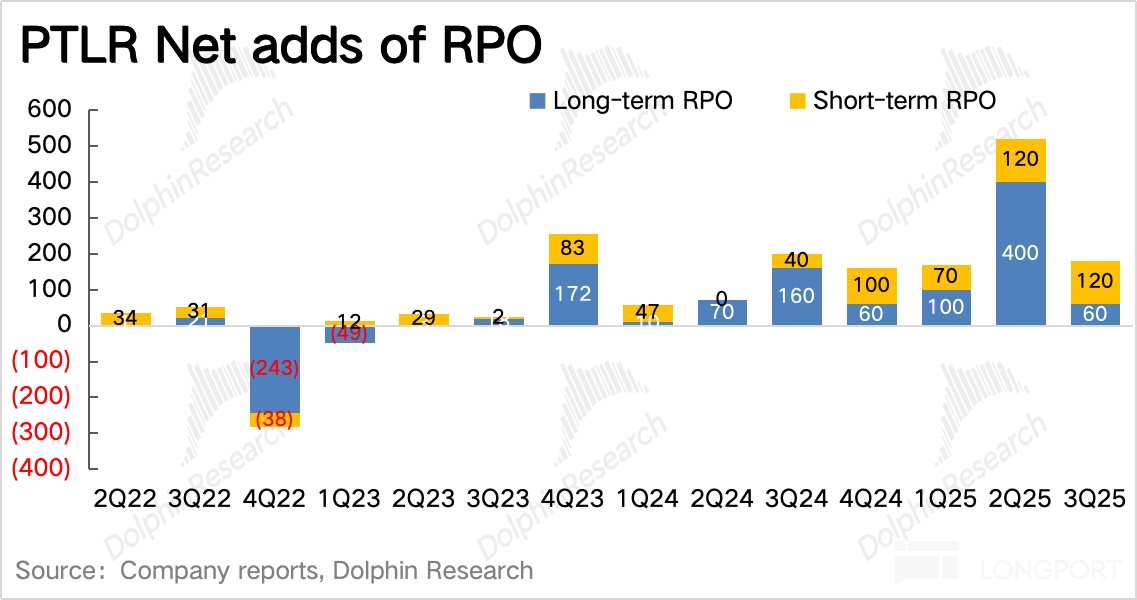

RPO indicates the amount of the remaining contracts that have been clearly locked (cannot be canceled), with a growth rate of 66%, slowing compared to the 77% growth rate in the second quarter.

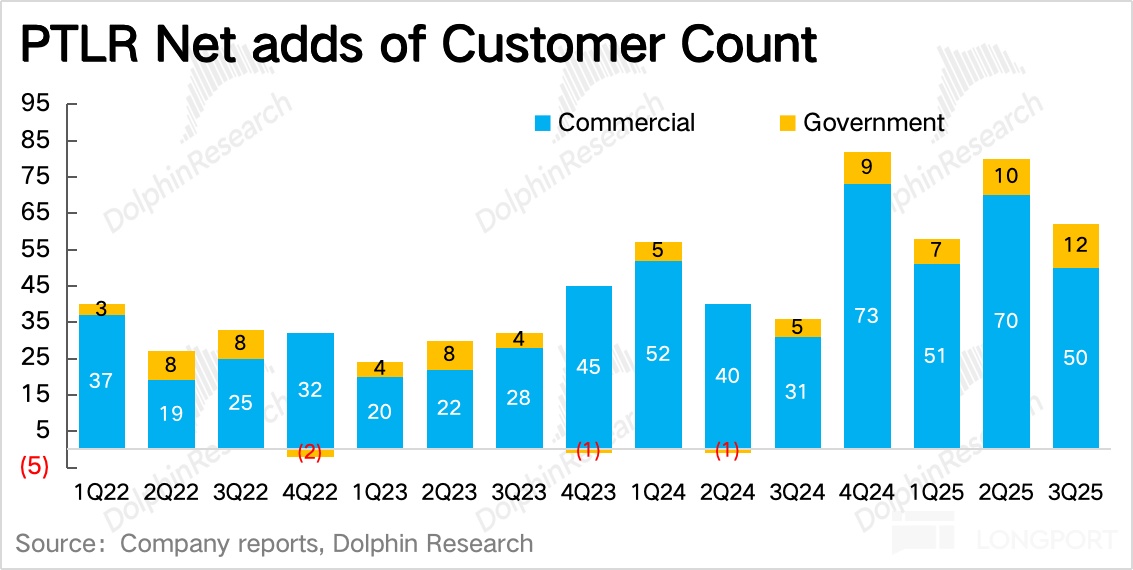

The overall net increase in customers was 62, with 12 new government (cooperation departments) and 50 new corporate customers, mainly from U.S. companies.

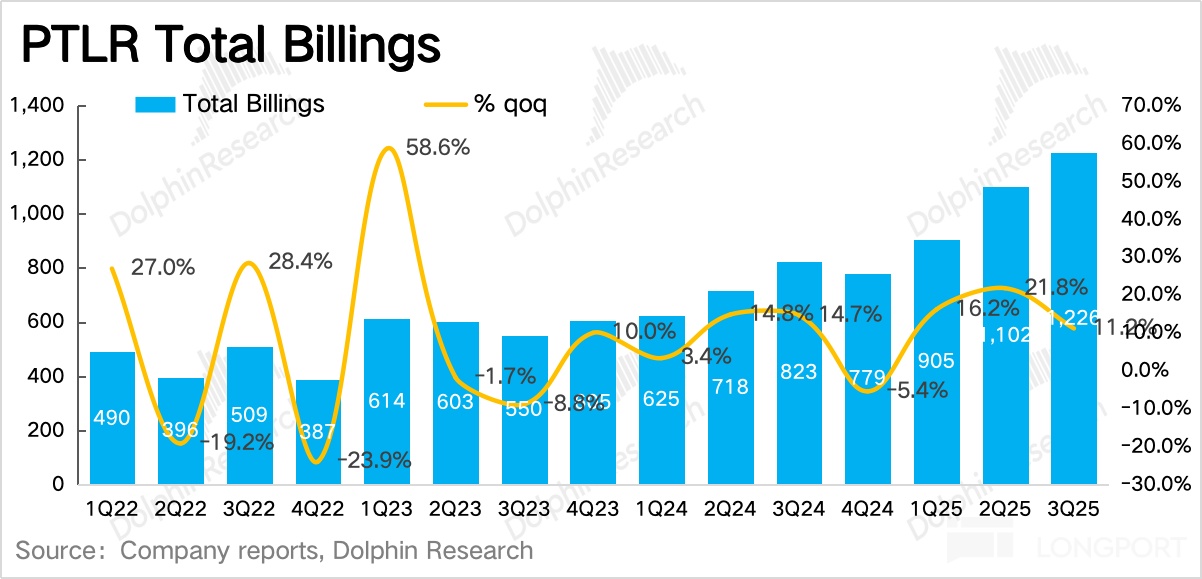

(2) In the short term, the market mainly focuses on Billings and NDR changes: Billings grew 49% year-on-year in the third quarter, with a slowdown compared to the previous quarter. Overall contract liabilities (including customer deposits) increased by nearly $50 million quarter-on-quarter, which is less than the second quarter. Revenue net expansion rate from old customers was 134%, continuing to increase quarter-on-quarter, reflecting the trend of old users upgrading their payments.

4. Guidance growth did not accelerate, is it conservative or truly peaked?: Finally, looking at the guidance, fourth-quarter revenue is expected to grow 61%, slightly slowing compared to the third quarter, with an operating profit margin of 52%, increasing by 2 percentage points quarter-on-quarter.

Palantir's high valuation is built on future high growth expectations, so a key factor affecting the valuation limit, besides whether the current performance beats expectations, is the signal of predicted growth slowdown.

Firstly, the management itself has a conservative guidance style, which can be seen from past performance. However, what is different this time compared to the second quarter is that operational indicators also have some simultaneous slowdown, making it difficult to judge whether the short-term growth performance will continue to significantly beat expectations.

But short-term disturbances have not changed Palantir's long-term trend based on product competitiveness. The reason for being so picky about the short term is simply because the valuation is too high, and the motivation for capital belief to be discounted and for positive factors to be realized is very strong.

5. Overview of performance indicators

Dolphin Research's View

There is basically no doubt about Palantir's current prosperity, at least from the short-term operational indicators.

But the uncertainty about future growth makes capital focus more on short-term changes. Especially when Palantir's market value has reached $500 billion (up nearly 30% compared to the previous quarter's financial report), compared to the 2025 performance, EV/FCF and EV/Sales are 245x and 111x respectively. Even if the growth rate continues to be 50%+ next year, the forward-looking valuation is still 160x and 74x respectively.

Therefore, the "signs of growth slowdown" revealed by the third-quarter operational indicators are likely the market's main concern. But Dolphin Research believes that ultimately it is still a valuation issue. In fact, for customized software like Palantir, whose product service cycle is measured in years and requires heavy upfront deployment work, seasonal fluctuations are normal.

Whether the valuation is high or low depends on Palantir's future revenue growth rate, but the core controversy is actually the size of the market Palantir can reach.

To support a $500 billion Palantir, at least the original IPO company's given $120 billion TAM is clearly not enough. Last quarter, the management announced a five-year tenfold outlook for the U.S. market, meaning U.S. corporate revenue will reach over $10 billion by 2030. Dolphin Research does not doubt Palantir's ability to achieve this, but the problem is that the international market's customer relationship issues still exist. Even if U.S. corporate revenue reaches $10 billion by 2030, assuming international corporate revenue is $3 billion and government revenue is $10 billion, the valuation is still 20x EV/Sales, which is not considered low even among current software peers.

So, with Palantir's competitive advantage in the current field, can it support Palantir's business reach extending indefinitely into the optimistic view of a $1 trillion software market?

In the optimistic view, a $1 trillion TAM means treating Palantir's main platform as the new generation of enterprise Windows, and then continuously adding new applications within it to gain more revenue through increased customer usage. But from a qualitative perspective, this is very difficult, and perhaps Palantir can eventually achieve it, but the pace of realization needs to slow down. Therefore, although it may not affect the final valuation, it will affect the yield curve.

Not to mention that there are technical barriers in the subfields, the more critical point is that the ToB market is not entirely determined by the quality of the product for orders. Software services are not simply "paying money and delivering goods," nor are they "one-time deals." Deployment costs, training costs, and after-sales maintenance are all costs that enterprise customers need to consider when replacing or adding software systems.

At the same time, the upstream and downstream customer relationship is more complex (for example, software providers will establish good relationships with the IT executives of enterprise customers), making the cost of replacing enterprise software (especially with a long-term cooperation foundation) not low, thereby increasing the difficulty for new forces like Palantir, which uses AI to overtake on curves, to penetrate traditional software territories.

And for Palantir, the "end-to-end" customization model, and the business strategy that focuses more on product quality rather than building a partner ecosystem, may further limit Palantir's ability or "pace" of unlimited expansion—initially relying on top engineers FDEs to spend months (currently 3-6 months) on-site at companies to complete basic technical deployment, configuring cross-structural data and use cases from different departments to the Foundry/Gotham platform. Therefore, Palantir's expansion model, besides trying to penetrate new companies, mainly relies on increasing investment (charging by usage) after existing companies increase their platform stickiness to Palantir.

In this process, Palantir is not a one-time success either. Enterprise customers initially choose Palantir because they have a fundamental need for customized AI but currently lack the capability, thus giving up similar general components like Snowflake or Databricks. But if subsequent iterations of basic technology can meet basic needs, then there will also be a situation where new applications are added to the main platform, but prices cannot continue to rise. Of course, this is a future risk, but the high valuation forces the market to start worrying in advance.

Below is a detailed analysis

I. High local growth, international acceleration recovery

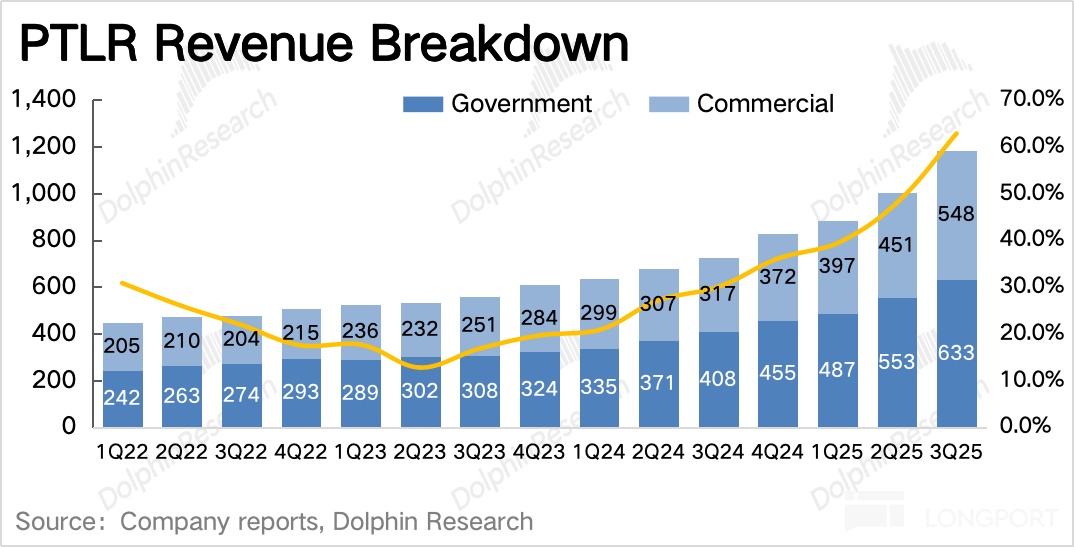

In the third quarter, total revenue reached $1.18 billion, a year-on-year increase of 63%, exceeding market expectations (~$1.09 billion), with growth continuing to rise quarter-on-quarter.

Palantir mainly provides customized software services to customers, so revenue is relatively predictable in the short term, and the company's guidance range is relatively narrow, implying high revenue certainty. However, exceeding the upper limit of guidance for several consecutive quarters still reflects strong customer demand for AIP and Foundry, as well as the management's relatively conservative guidance style.

1. Business segment situation

(1) Government customer revenue: domestic and foreign both accelerate

Government customer revenue grew 55% year-on-year in the third quarter, with local government still being the main growth driver, but international government accelerated significantly this quarter, with growth even surpassing the U.S., reflecting the gradual entry into the service cycle of contracts signed this year (NATO, UK, Germany, etc.).

From the official budget details, Palantir's contract volume with the U.S. government remained full in the third quarter, including a $385 million contract signed with the Department of Veterans Affairs.

International government growth this quarter mainly added (1) a high-value agreement with the UK Ministry of Defense worth £750 million, focusing on using AI technology to enhance battlefield decision-making, intelligence gathering, and target positioning capabilities. This agreement surpasses the original agreement reached by both parties in 2022 in terms of scale and scope, including Palantir's investment in the UK (employment positions, etc.). This cooperation marks Palantir's first billion-dollar transaction outside the U.S. (2) A cooperation agreement with the Polish Ministry of Defense to modernize the defense system.

Regarding the overall procurement process reform of the U.S. Department of Defense, it may temporarily affect Palantir's short-term contract signing due to the suspension of new project procurement. But overall, this reform is more beneficial to high-tech companies like Palantir (unfavorable to traditional solution providers).

(2) Commercial market: U.S. company demand is booming, international market recovery as expected

Commercial revenue grew 73% year-on-year in the third quarter, significantly accelerating. Among them:

U.S. local corporate revenue was very impressive, with growth increasing to 122%, not only due to the penetration of new customers but also due to the increased usage stickiness of old customers (Palantir charges based on usage), with a net expansion rate of 134% (implying a 34% increase in payments from old users over the past 12 months).

International companies finally resumed growth under the pull of a low base, but the growth rate was only 9%, with 5 new customers added. For the significantly weaker situation in international regions compared to the U.S. local market, Palantir's management explained that many non-U.S. companies have not fully recognized Palantir's advantages in data analysis and AI, and the U.S. market itself is very prosperous, so Palantir intentionally prioritizes limited resources for business development in the U.S. market.

Through institutional research, besides the demand factors themselves (under economic pressure, European companies do not have sufficient budgets for innovative technology), European companies also have doubts and concerns about Palantir's deep ties with the U.S. Department of Defense. Therefore, the future growth space of the international commercial market still has high uncertainty.

II. Contract indicator situation: healthy but with quarter-on-quarter slowdown

For software companies, future growth is the core of valuation. But the revenue confirmed each quarter is a relatively lagging indicator, so we recommend focusing on the acquisition of new contracts, mainly reflected in contract situations (RPO, TCV), current billing flow (Billings), and the increase in customer numbers.

Overall, both long-term and short-term indicators have some slowdown. This could be viewed normally last year, but at the current valuation level, it's no wonder the market is picky.

(1) Remaining irrevocable unfulfilled contracts (RPO): medium to long-term contract additions slow down

Palantir's remaining contract amount in the third quarter was $2.6 billion, with a net increase of only $180 million quarter-on-quarter, significantly weaker than the previous quarter.

(2) Current billing flow (Billings) & deferred revenue: healthy, but also with slowdown

Billing flow in the third quarter was $1.23 billion, with a 49% year-on-year growth, also slowing quarter-on-quarter. Overall contract liabilities (including customer deposits) increased quarter-on-quarter, with the scale of payment expansion from old customers at 134%, continuing to increase quarter-on-quarter, reflecting the strengthening of old customer stickiness and the trend of upgrading payments.

(3) Total contract value (TCV): seasonal fluctuations, continued healthy growth

The total contract value recorded in the third quarter was $2.76 billion, a year-on-year increase of 151%, with a quarter-on-quarter increase of $490 million, mainly contributed by the new order from the UK Ministry of Defense.

(4) Customer increment: growth relies entirely on U.S. companies

From the most intuitive customer number, which is also a medium to long-term indicator, there was a net increase of 62 customers quarter-on-quarter, with 50 from commercial customers, among which U.S. corporate customers increased by 45.

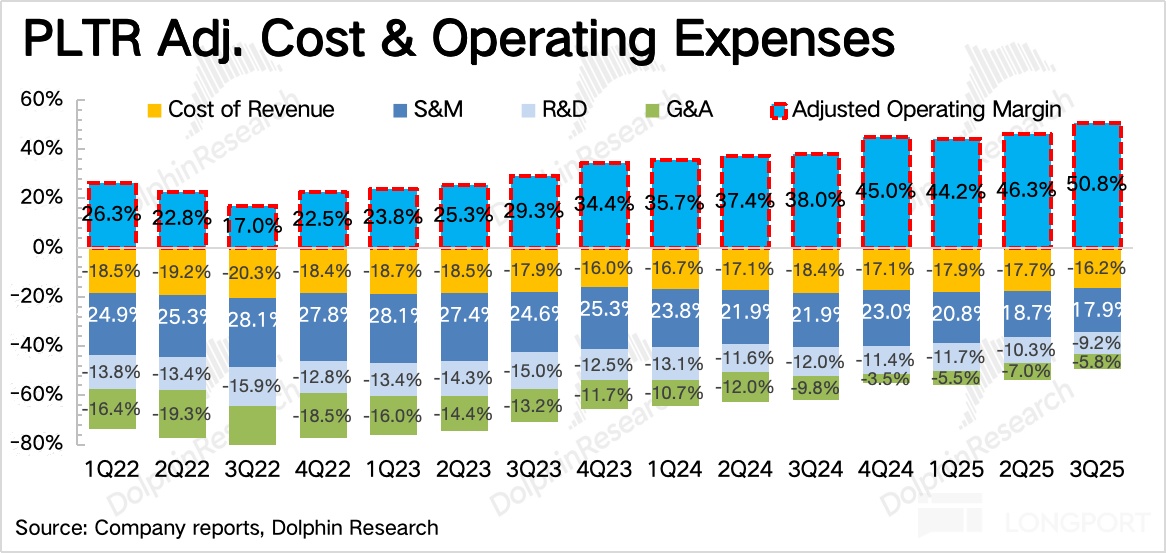

III. Slowing pace of profitability improvement

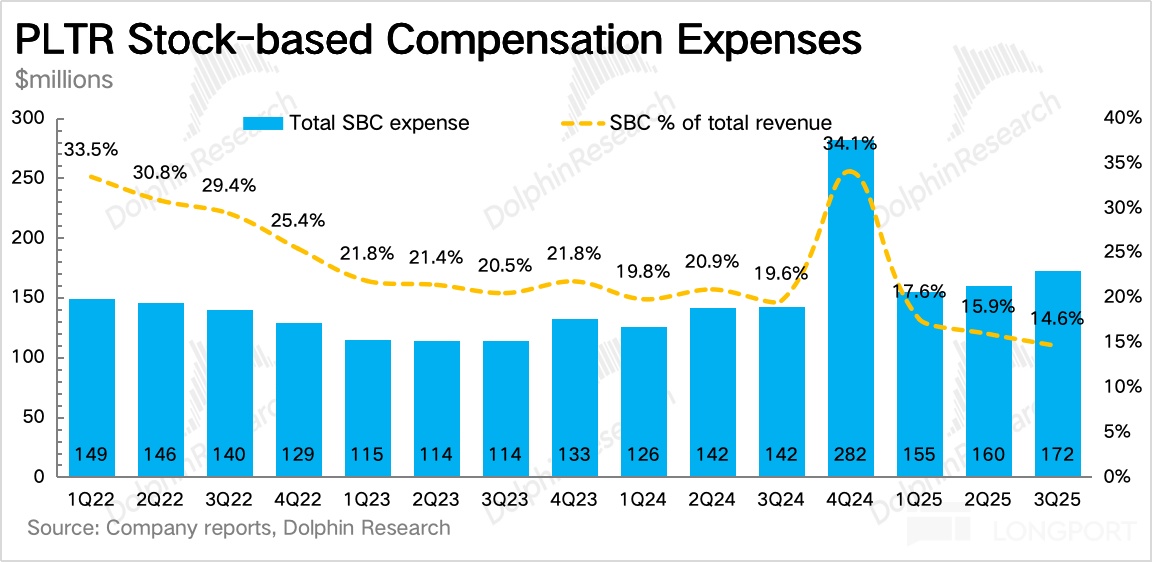

Palantir achieved GAAP operating profit of $393 million in the third quarter, with three operating expenses continuing to maintain a year-on-year growth of around 20%, lower than the revenue growth rate, thus improving the profit margin. SBC growth was not high, but its proportion compared to revenue continued to decline. Considering the market value increased by 30% during the same period, it may be synchronously optimizing employees.

This is actually a very rare aspect. Palantir's model determines that business expansion requires simultaneous expansion of the personnel team, but it actually shrinks instead of growing. Even from the guidance, Q4 operating profit margin is implied to continue to increase by 2% quarter-on-quarter, showing Palantir's extreme operational efficiency.

But on the other hand, does this affect Palantir's further pace of customer penetration? This is worth paying attention to, and it can be seen if there is any relevant discussion in the conference call.

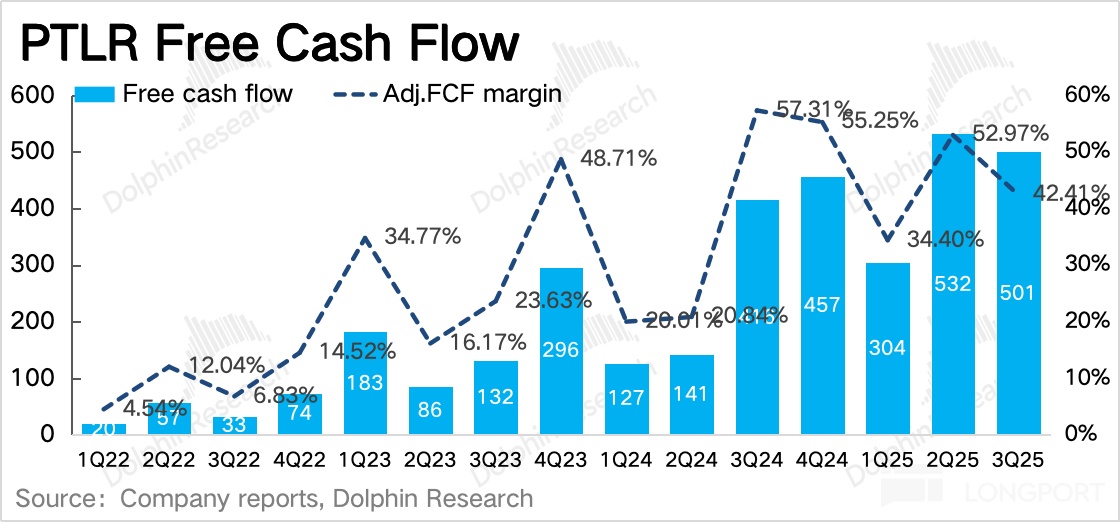

Palantir's cash flow is related to contract payments, so there will be seasonal fluctuations. Although many new contracts were added in the third quarter, accounts receivable increased significantly, affecting the actual cash inflow for the period. Management's full-year guidance for cash flow is $1.9-2.1 billion, assuming a 50% growth rate in cash flow next year, the current EV/FCF=160x valuation is still high, implying too many positive expectations—sustained high growth + maintaining extreme operational efficiency.

<End here>

Dolphin Research "Palantir" Historical Research:

Financial Report

August 5, 2025 Conference Call "Palantir (Minutes): Looking forward to tenfold growth in U.S. revenue over the next 5 years"

August 5, 2025 Financial Report Commentary "Palantir: Worthy of being the leader in AI applications, guidance flaws are not a problem"

May 6, 2025 Conference Call "Palantir (Minutes): Welcome DOGE, government efficiency focus is beneficial to us"

May 6, 2025 Financial Report Commentary "Palantir: "DOGE+ Tariffs" double-edged sword, will AI faith fall from the altar?"

February 4, 2025 Conference Call "Palantir (Minutes): Hope to become the cornerstone company of this AI revolution"

February 4, 2025 Financial Report Commentary "Palantir: Beating shorts, the "AI faith" that is high and unattainable"

November 5, 2024 Conference Call "Capturing more allies, what makes Palantir's AI different? (3Q24 Conference Call)"

November 5, 2024 Financial Report Commentary "Palantir: AI faith ticket comes to deliver hope again"

August 6, 2024 Conference Call "Palantir: Our success lies in building AI products that fit real needs (2Q24 Minutes)"

August 6, 2024 Financial Report Commentary "Palantir: Raising guidance, proving the AI growth story"

May 7, 2024 Conference Call "Palantir: In the U.S., we have no direct competitors (1Q24 Conference Call)"

May 7, 2024 Financial Report Commentary "Palantir: Exceeding expectations but plummeting? The market is more picky under high valuation"

February 6, 2024 Conference Call "The core driver of growth is the business model of entering through training and the continuous investment in product strength (Palantir 4Q23 Conference Call)"

February 6, 2024 Financial Report Commentary "AI has triggered a new growth cycle for Palantir"

November 3, 2023 Financial Report Commentary "Palantir: Growth rate warms up against the trend, is AI the hero again?"

In-depth

October 13, 2023 "Palantir: What justifies the high valuation?"

September 26, 2023 "Palantir: The "mysterious" military weapon activated by AI"

Risk Disclosure and Statement of this Article:Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.