Can Spotify's new price hike cycle take off again?

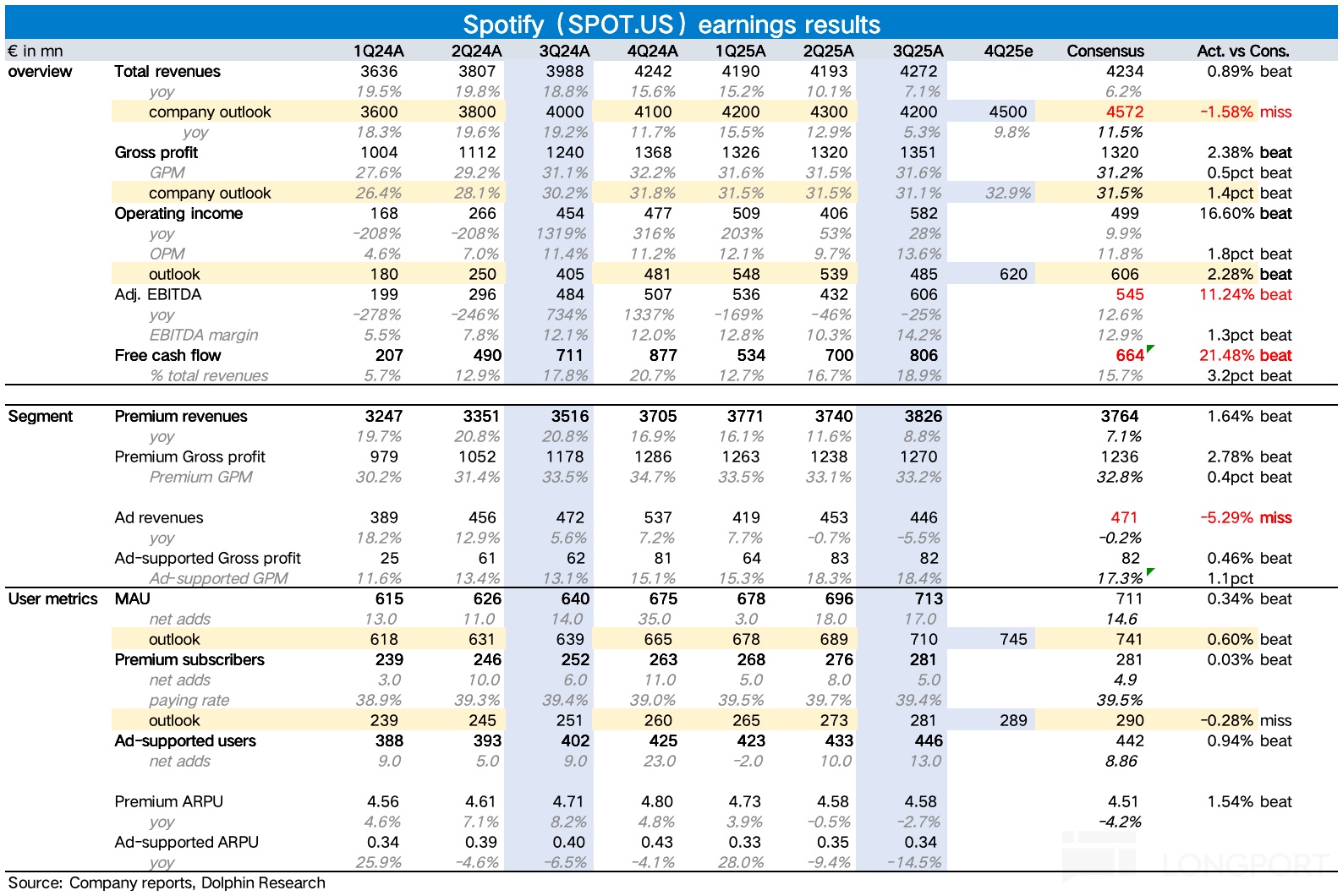

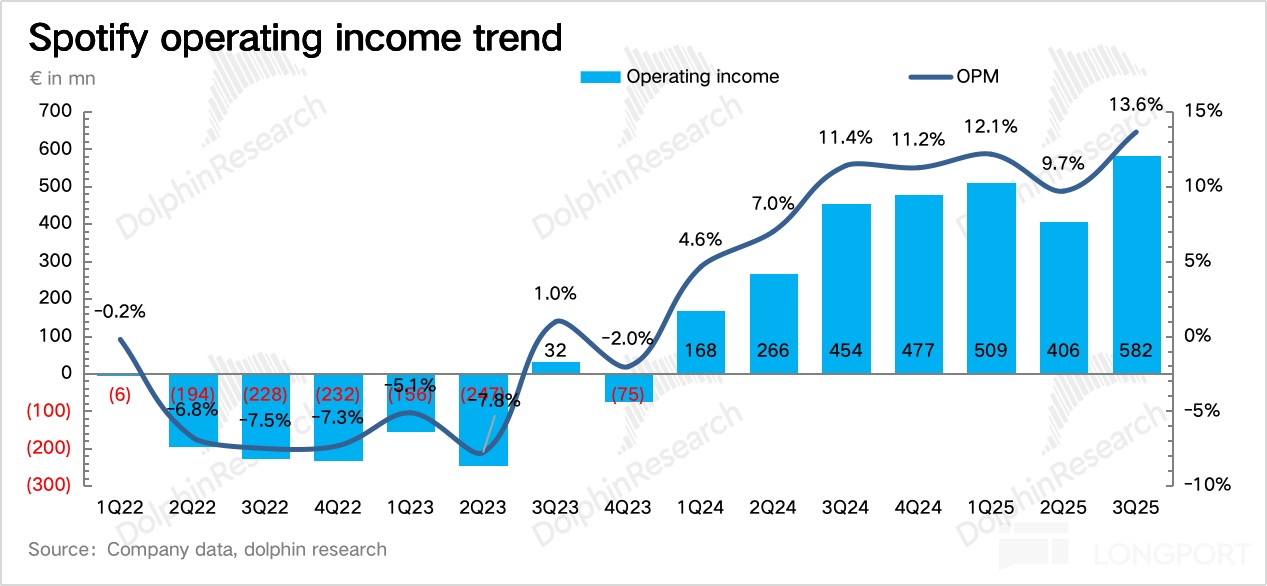

$Spotify(SPOT.US) The Q3 2025 report was released before the U.S. stock market opened on November 4th, showing mixed performance. However, the market's main concern—profit margin—actually exceeded expectations, leading to slightly positive market feedback.

Specifically:

1. Profit margin improvement exceeded expectations: Since the third quarter, Spotify has made numerous product changes (nearly 30 updates of various sizes), including lossless audio quality, playlist editing, messaging, personalized audio settings, and collaborations with Amazon Alexa and ChatGPT. Another significant change was allowing free users to switch from "shuffle play" to "on-demand listening for 1 hour." The goal is to enhance user experience, increase user engagement, and thereby improve paid conversion rates.

Considering the cluster of new features launched, the market had anticipated increased costs for the period. However, in reality, Q3 gross margin and operating profit margin both improved beyond expectations. Operating expenses significantly contracted, with a notable decrease in social charges (generally fluctuating with employee benefits, including stock-based compensation, as Spotify's stock price fell 10% compared to the end of Q2). The company effectively controlled marketing and personnel costs.

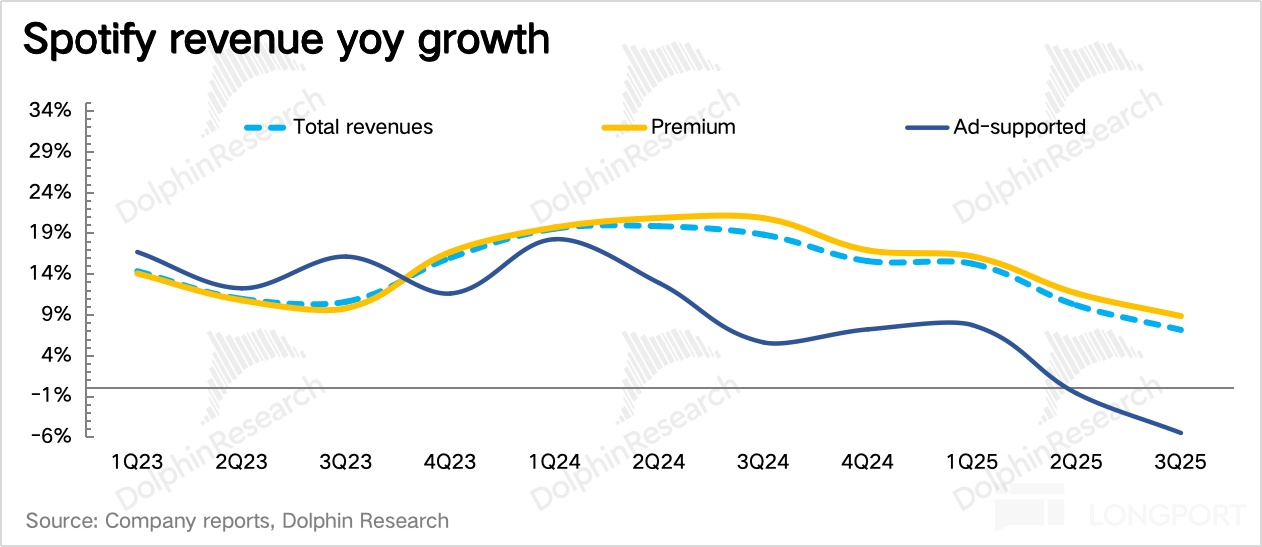

2. Revenue guidance remains weak: On the other hand, the revenue side performed poorly. Management guided Q4 revenue at 4.5 billion euros, a growth rate of 9.8%, slightly below the market's expected 11.5% year-over-year growth.

Dolphin Research believes that the expectation gap, aside from the advertising business, may be due to overly optimistic expectations for subscription payment rates and ARPU bottoming out.

(1) Advertising: This has been a relatively unsuccessful business for Spotify this year, with poor ad conversion rates compounded by a year of weak brand advertising. The former head of advertising has already left, and there is no news of a new leader taking over. In Q3, Spotify announced a collaboration with Yahoo's advertising system, but Dolphin Research remains cautious about the short-term effects.

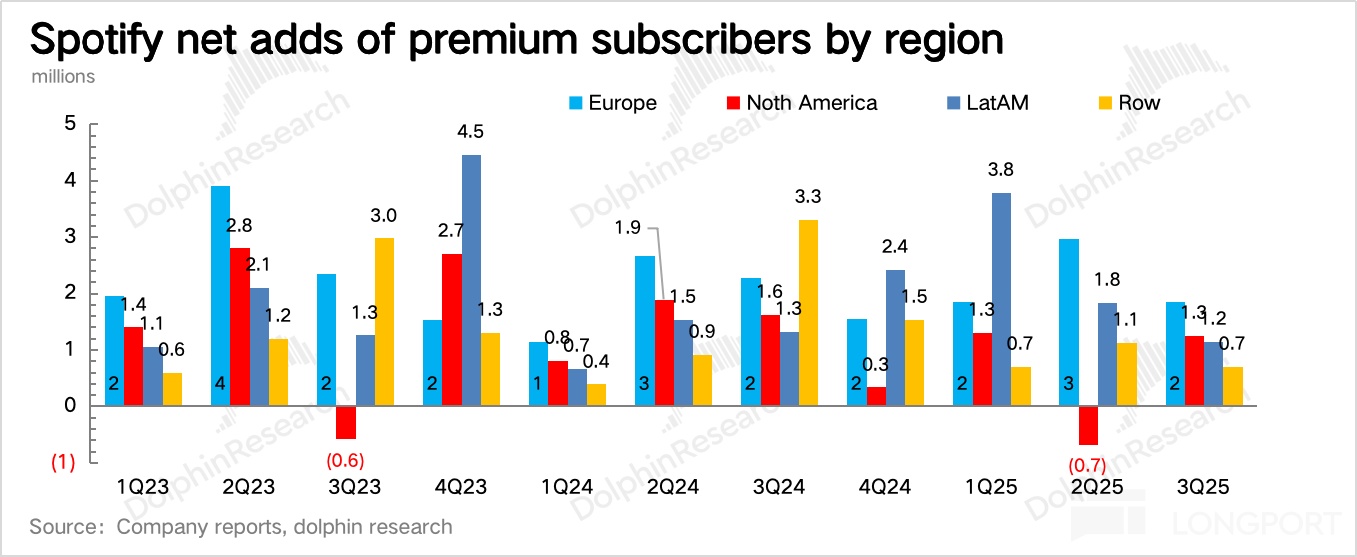

(2) Subscription: This year, the improvement in paid conversion has been relatively slow. Although there has been a focus on promoting audiobook content, the pull effect of audiobooks is generally limited (with low overlap with music users), and the promotion pace is slow, currently only launched in a few core regions, thus showing little effect.

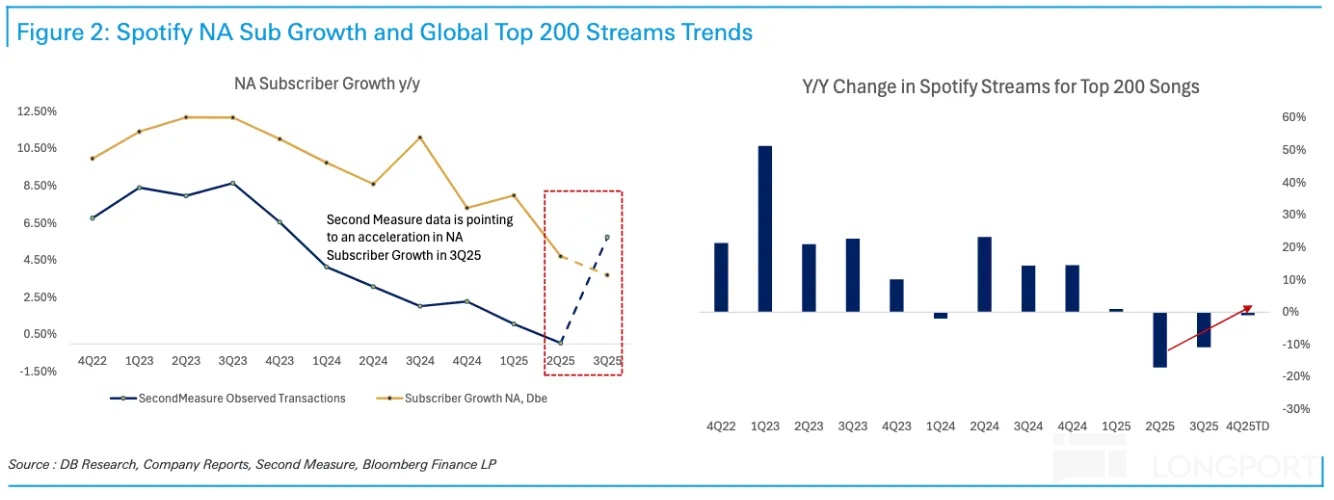

However, according to third-party data, in North America, Spotify benefited from the Epic vs. Apple lawsuit, improving paid conversion through direct in-app promotion. However, the depreciation of the dollar has a significant impact, and per capita ARPPU continues to decline year-over-year due to exchange rate effects.

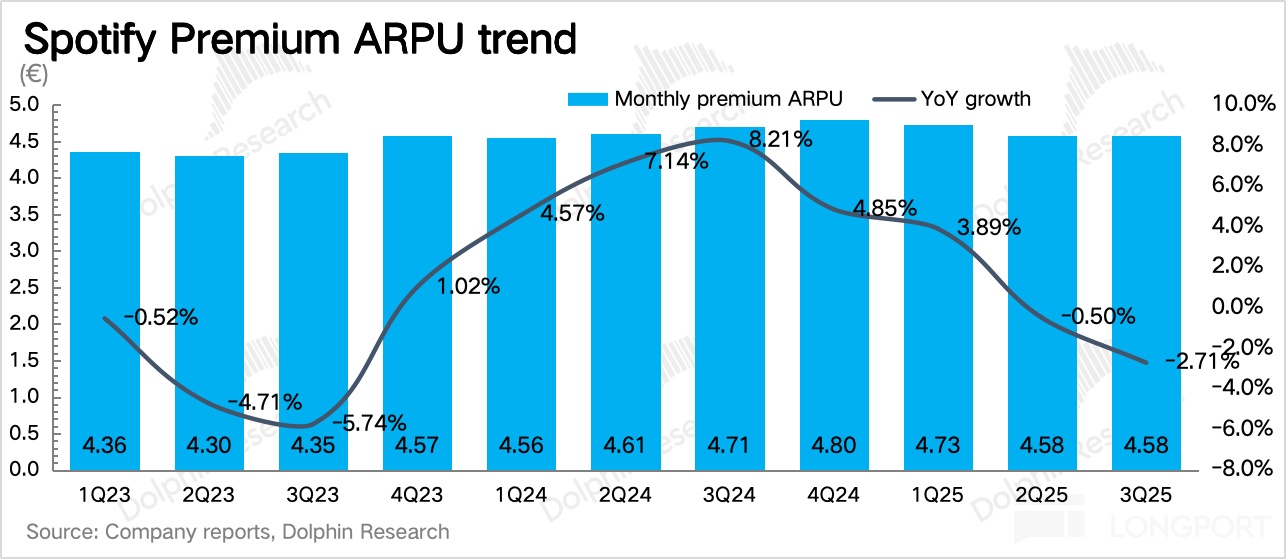

Although there was a large-scale price increase in Q3, the price increase mainly occurred after mid-August, making it difficult to quickly reflect within the quarter; additionally, the second-largest market, North America, did not simultaneously increase prices, making it difficult to offset the impact of dollar depreciation.

However, the product function updates targeting pure music users in Q3 give Dolphin Research hope for a new round of subscription growth. If Spotify continues to innovate and optimize products in this direction, it can drive long-term paid conversion and high-level monetization for core music users. Combining this with the price increase cycle will be a key growth point for Spotify next year.

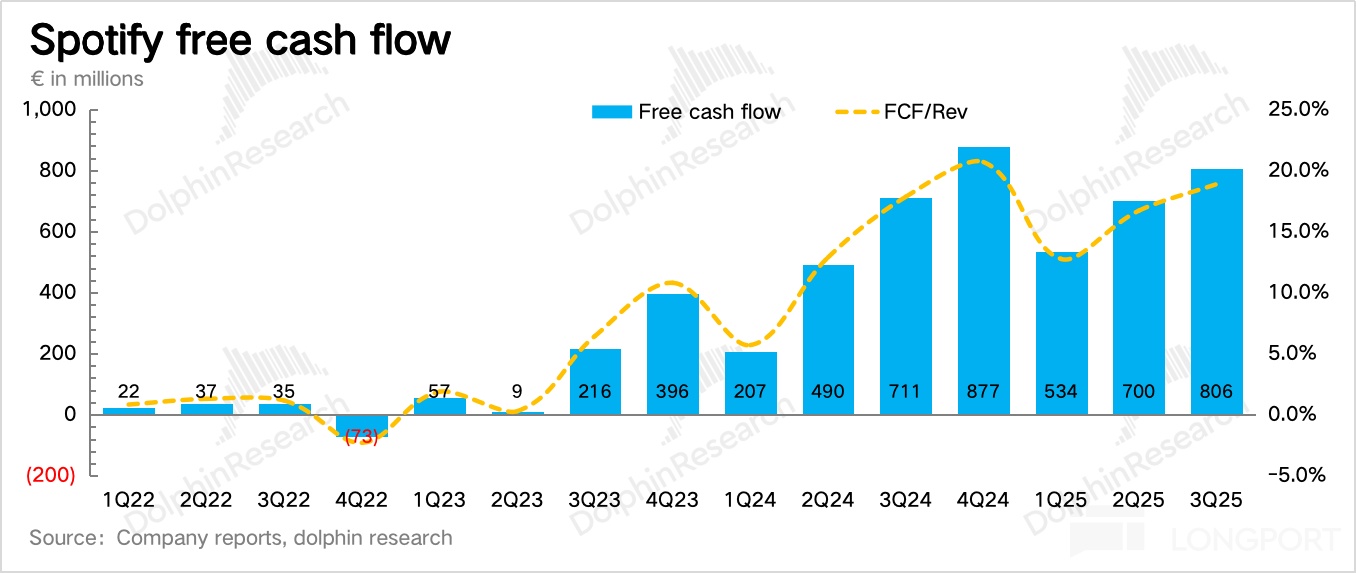

3. Cash flow improves accordingly: With profitability recovering, despite increased capital expenditure (overall scale is not large), Q3 free cash flow still rose to 800 million euros, accounting for 19% of revenue.

As of the end of Q3, the company had accumulated cash and short-term investments of nearly 9.1 billion euros, with Q3 buybacks costing $77 million. As of November 3rd, nearly $410 million worth of stock had been repurchased this year. However, relative to a market cap of over 130 billion, less than 0.5% shareholder return is still more of a statement.

4. Performance overview

Dolphin Research's View

Overall, Q3 performance was average, but the market reacted positively due to excessive pre-report concerns about profit margins. However, weak guidance remains an issue, especially for Spotify, which is not low in valuation. Although a price increase cycle is imminent, management also needs to have a clearer expectation for the ARPPU bottoming out.

Last quarter, the market's initial reaction to Q2 performance was not good, aside from the impact of exchange rates, SBC, and social security taxes, there was dissatisfaction with Spotify's slow price increase actions. However, a week later, Spotify announced price increases in multiple markets (mainly non-audiobook markets), which boosted the stock price.

Q3 did not fully reflect the effects of the price increase, but Q4 should be more apparent. However, two regions are worth noting: the U.S. market and Australia.

(1) In this large-scale price increase, the U.S. market, which accounts for 1/4 of users and 1/3 of revenue contribution, did not adjust prices. Therefore, a price increase in the U.S. is also a point of market expectation for Spotify to drive growth next year.

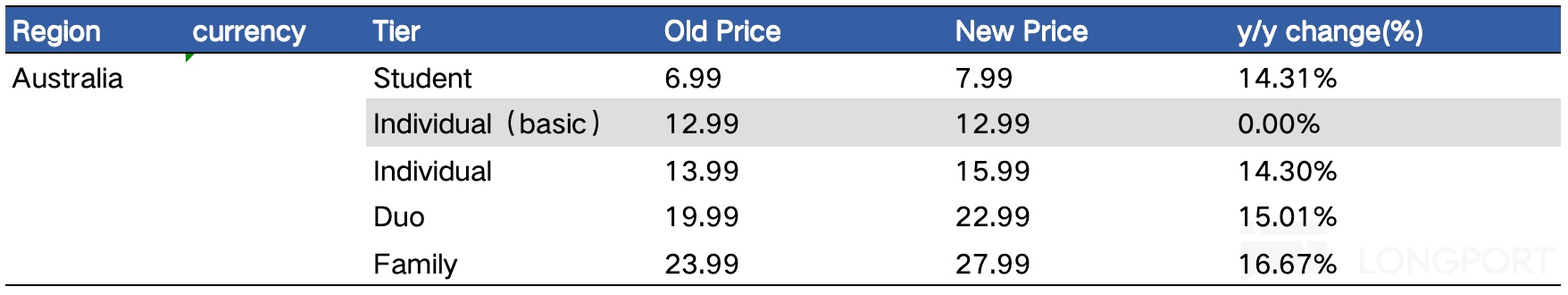

(2) Spotify's price increase in Australia is the only region where audiobook business has been expanded. Meanwhile, the price increase is not for pure music packages but for audiobook bundled packages. The logic here is that by increasing the price of audiobook bundled packages, it covers the content cost of audiobooks and indirectly adjusts the royalty sharing ratio.

Since there is no price increase for pure music packages, the price increase is considered by Spotify as an independent cost for "audiobooks," thus not allowing major labels to benefit from the package price increase, ultimately improving Spotify's gross margin. The market expects that Spotify's experiment in Australia, if successful, is likely to be promoted in North America, the UK, France, and other core regions.

However, it is worth mentioning that major labels are not completely without benefits, as the minimum guarantee fee that follows the change in subscription numbers also has a fixed growth rate. Generally, it is 5% to 6%, which is significantly lower than Spotify's price increase margin of about 15%. The final effect is what Dolphin Research has always emphasized: the long-term trend of changes in the distribution pattern of industry chain interests under the enhanced platform discourse power. Although the process is tugging and tortuous (last year, Spotify was pressured by the royalty association, and finally compromised by launching a pure music package and signing a new contract to increase the minimum guarantee fee by MSD to HSD%).

Therefore, from this perspective, starting from Q4 to next year, Spotify will begin to benefit from a new round of price increase cycles, which is also the logic most loved by institutions for streaming media. However, this effect on Spotify's profitability level is slowly reflected, because in the short term, due to exchange rate headwinds, the cost confirmation of multiple new features, and the increase in social security taxes, the price increase's boost to profitability will be offset in the short term.

Driven by the two favorable logics of price increase and Apple store rectification, although short-term profit improvement will be dragged down by new investments, Spotify's fundamental changes are overall marginally upward. Currently, with a market cap of 130 billion (compared to the Q2 report point, a nearly 20% pullback), compared to 2026, there is still a 40x EV/EBITDA (corresponding to about 45x P/E), considering a 35% CAGR growth rate over the next three years, it has gradually returned to a reasonable valuation range. But to allow for a safety margin, it is still worth paying attention to opportunities during market pullbacks.

Below are detailed charts

I. User penetration progresses steadily

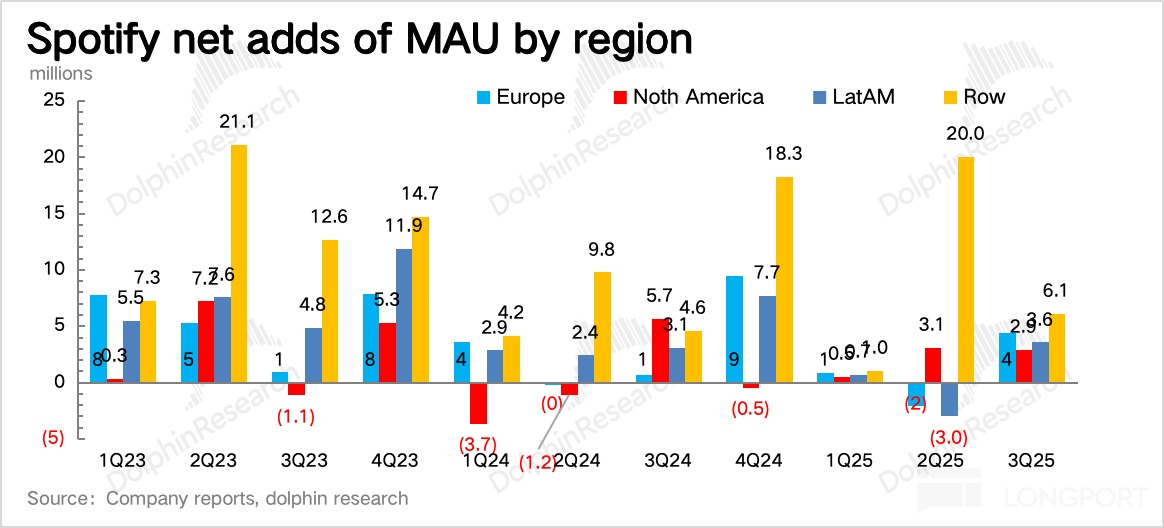

Q3 user metrics basically met expectations, but objectively speaking, the performance was impressive. Monthly active users increased by 17 million to 713 million, with higher growth in Europe and other regions this quarter. Paid subscription users increased by 5 million, relatively evenly across regions, with Europe slightly outperforming.

Regarding Q4 guidance—monthly active users are expected to increase by 35 million, and subscription users by 8 million, implying a normal trend of user scale penetration and expansion.

II. Revenue remains weak, price increase effects still pending

Q2 revenue grew by 7%, with exchange rate headwinds impacting 5 percentage points. Subscription revenue growth was 8%, while advertising declined by 5% year-over-year.

Management guided Q4 revenue at 4.5 billion euros, a growth rate of 9.8%, slightly below the market's expected 11.5% year-over-year growth. Dolphin Research believes that the expectation gap, aside from the advertising business, may be due to overly optimistic expectations for subscription payment rates and ARPU bottoming out.

However, according to third-party data, in North America, Spotify benefited from the Epic vs. Apple lawsuit (specific discussion can be found in the Q2 report commentary at the end of the article), improving paid conversion through direct in-app promotion. However, the depreciation of the dollar has a significant impact, and per capita ARPPU continues to decline year-over-year due to exchange rate effects.

Although many regions (non-audiobook covered areas) implemented price increases in Q3, Dolphin Research estimates that Q4 ARPPU will still decline by nearly 2% year-over-year, with the trend slowing down.

Regarding Australia's special price increase, it is likely to be next year's price increase plan for North America and other core regions, mainly aimed at covering audio content costs and slightly weakening the comprehensive royalty sharing ratio.

III. Profit exceeds expectations

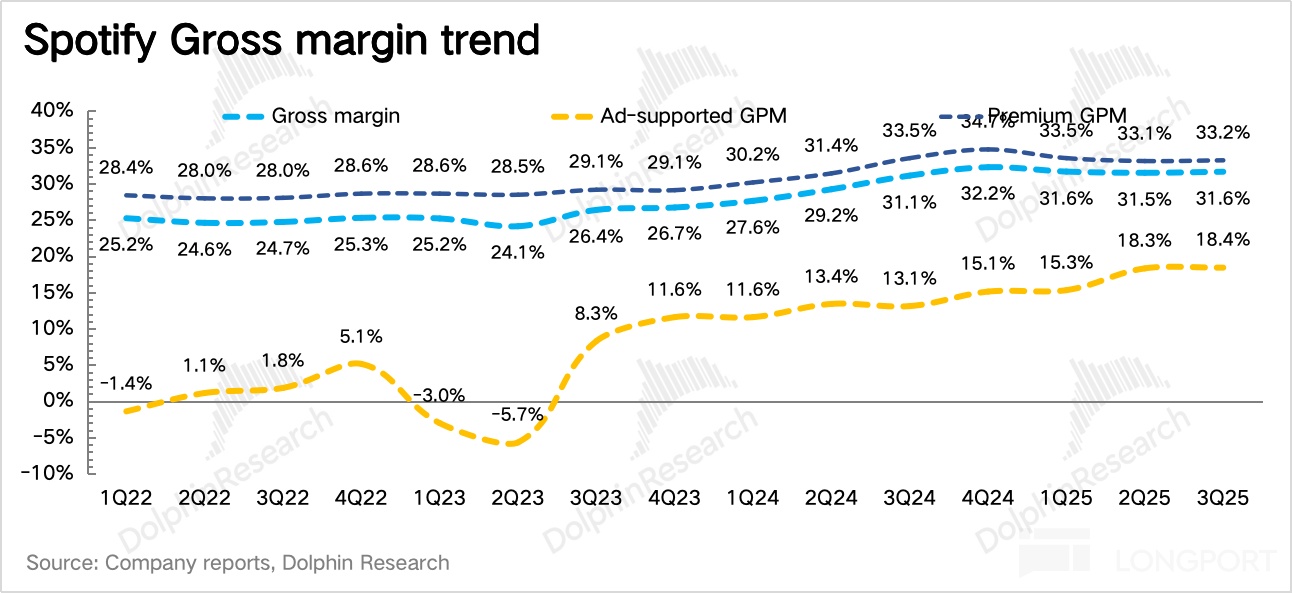

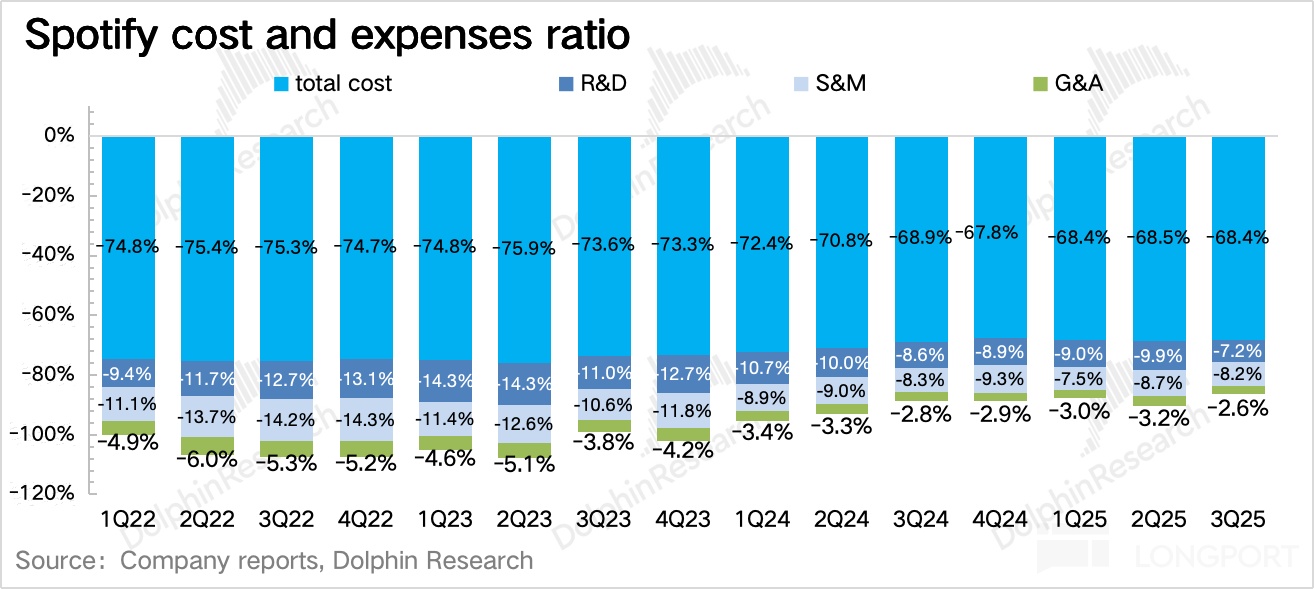

Q3 profitability exceeded expectations, which is the main point of market praise. Despite the launch of many new features in Q3, the market had fully anticipated increased investment.

However, in reality, gross margin and operating profit margin both improved beyond expectations. Operating expenses significantly contracted, with a notable decrease in social charges (generally fluctuating with employee benefits, including stock-based compensation, as Spotify's stock price fell 10% compared to the end of Q2, with approximately 37 million euros of expense contraction). The company effectively controlled marketing promotion (North America may benefit from the Apple Epic lawsuit, allowing direct in-app paid promotion, saving marketing expenses) and personnel costs.

<End here>

Dolphin Research "Spotify" Articles:

1. Financial Reports

July 29, 2025, 2Q25 Earnings Call Minutes "Spotify (Minutes): Developing Non-linear, More Focused on Lifecycle Value"

July 29, 2025, 2Q25 Financial Report Commentary "Spotify: Price Increase Failure, Can High Valuation Still Hold?"

April 30, 2025, 1Q25 Earnings Call Minutes "Spotify (Minutes): Non-linear Business Growth, Not Rushing into the Next Price Increase"

April 30, 2025, 1Q25 Financial Report Commentary "Minor Flaws Don't Change Major Trends, High Valuation Faces Sentiment Kill"

November 13, 2024, 3Q24 Earnings Call Minutes "Spotify: Partnering with TTD, Gradually Shifting from Brand Advertising to Performance Advertising (3Q24 Call Minutes)"

November 13, 2024, 3Q24 Financial Report Commentary "Spotify: Positive Feedback from Leading Price Increase"

July 23, 2024, 2Q24 Earnings Call Minutes "Spotify: User Attrition Rate Better Than Expected After Bundled Package Price Increase (2Q24 Call)"

July 23, 2024, 2Q24 Financial Report Commentary "Spotify: Another Surge? Music Giant Provides Standard Answer"

2. In-depth

June 25, 2024 "Detailed Analysis of Spotify: Worth How Many Tencent Musics?"

June 13, 2024 "Price Increase More Expensive Than Apple Music, Where Does Spotify's Confidence Come From?"

Risk Disclosure and Statement of This Article:Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.