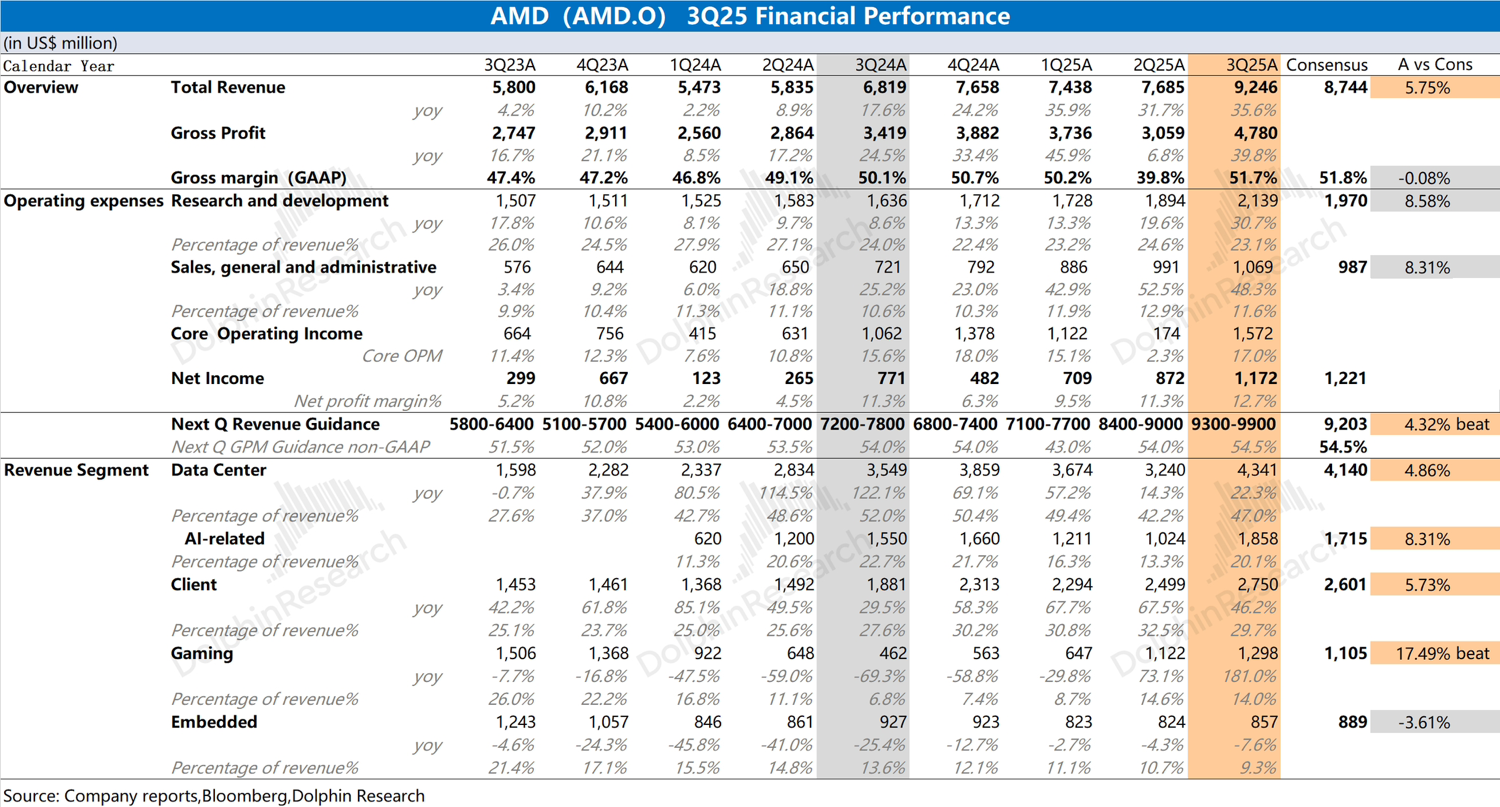

AMD Quick Interpretation: The company's revenue and gross margin for this quarter exceeded previous guidance expectations, primarily driven by growth in the data center, client, and gaming businesses.

With the recovery of the PC market, the company's client business reached a new high, and the gaming business has clearly rebounded from the bottom.

The most watched data center business achieved revenue of $4.34 billion this quarter, an increase of $1.1 billion quarter-on-quarter, better than market expectations ($4.14 billion). This was mainly driven by the increased production of the MI355 series, with Dolphin Research estimating that AI GPUs contributed approximately $800 million of the incremental revenue.

Regarding the company's guidance, it expects next quarter's revenue to be between $9.3 billion and $9.9 billion, with the midpoint ($9.6 billion) representing a 3.8% quarter-on-quarter growth, still mainly driven by the MI355. The company's non-GAAP gross margin for the next quarter is expected to be around 54.5%.

As Open AI signed a major contract with the company, market focus has completely shifted from gaining CPU market share to the data center field.

Meanwhile, the company's stock price has surged from around $150 to over $200, primarily catalyzed by Open AI.

Open AI's 6GW major contract is expected to bring the company approximately $100 billion in revenue, providing support for the company's sustained growth in the future.

On the other hand, with the help of Open AI, the market is also looking forward to the subsequent MI450 series products and the enhancement of competitiveness in the AI chip market, and the current high valuation has already factored in the expectation of high growth over the next 2-3 years.

For this earnings report, the market is more focused on progress in the data center field, such as the status of new orders and the progress of the MI450, which are more attractive than the next quarter's guidance. For more information, please follow Dolphin Research's subsequent detailed commentary and management minutes. $AMD(AMD.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.