Rivian (3Q25 Minutes): Still Confident in Achieving the Goal of Halving R2 Costs

The following are the minutes of the Q3 2025 earnings call for $Rivian Automotive(RIVN.US) organized by Dolphin Research. For an interpretation of the financial report, please refer to "Rivian: Narrowing Losses, R2 Mass Production Imminent, Is Rivian's Dawn Here?"

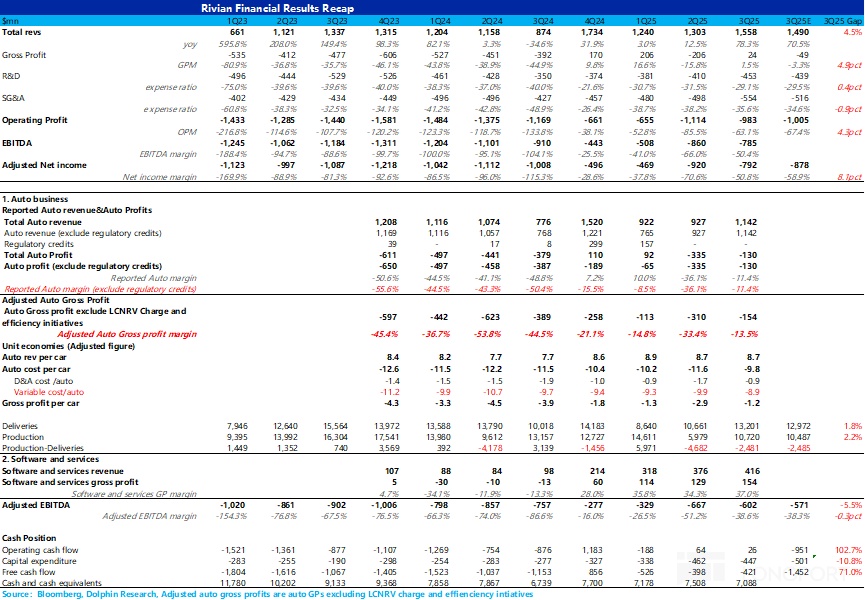

I. Review of Core Financial Information:

I. Management Remarks

(i) Remarks by Robert J. Scaringe (RJ)

1. Strategic Progress: Key strategic priorities continue to advance, including preparations for the R2 model launch, development of the technology roadmap (including autonomous driving technology and vertically integrated hardware and software).

2. Industry Trends: In the long term, the industry will achieve full electrification, autonomous driving, and software definition. Confidence in Rivian's future opportunities is enhanced, with plans to leverage technology and direct-to-customer brand experience to create a category-defining brand, covering a rich product portfolio in the US and European markets.

3. R2 Model Positioning: Consumer choice and price are key drivers for electric vehicle purchases. The average new car price in the US exceeds $50,000, with five-seat SUVs/crossovers being the most popular. The R2 is a mid-sized five-seat SUV with a starting price of $45,000, targeting the largest market opportunity.

4. R2 Development and Production Preparation: Drawing on the performance, utility, and style of the R1, the R2 is designed to be a smaller, more cost-effective SUV. The R&D team is executing efficiently, with continuous improvement in the quality and maturity of design validation prototypes, preparing for production validation prototypes after year-end production equipment commissioning.

Construction of a 1.1 million square foot R2 body shop and assembly plant, as well as a 1.2 million square foot supplier park and logistics center, has been completed. Equipment commissioning has begun in each workshop, with robot commissioning underway in the body shop. After upgrading the paint shop, the plant's annual capacity will increase to 215,000 vehicles.

5. R2 Product Experience: The R2 has been test-driven, continuing the brand's adventurous spirit, meeting consumer expectations, and providing an excellent daily driving experience suitable for multiple scenarios.

6. New Factory Planning: Plans to build a new manufacturing plant in Georgia, USA, adding 400,000 units of annual capacity for R2, R3, and derivative models. The groundbreaking ceremony was held in September 2025, expected to create 7,500 jobs and bring billions of dollars in economic benefits to the local area, expanding the US manufacturing and technology footprint.

7. Autonomous Driving and AI Layout: Continued investment in hardware, software, and autonomous driving platform development. An "Autonomous Driving and AI Day" will be held on December 11 to share the latest progress. In the long term, Rivian's differentiated advantage in autonomous driving will come from an end-to-end AI core technology path. The expanded user vehicle fleet after the R2 launch will collect real road data, complementing second-generation R1 data, to train large driving models and help quickly launch upgraded driving inference models.

8. Long-term Goals: Looking forward to 2026, Rivian aims to become a long-term market share leader.

9. Key Developments: R2 is progressing well in the verification and testing phase, looking forward to sharing the hardware and software roadmap and vision on "Autonomous Driving and AI Day" in December.

(ii) Overall Financial Data

1. Revenue and Gross Profit: Approximately $1.6 billion; consolidated gross profit of $24 million, including $125 million in depreciation expenses and $24 million in stock-based compensation expenses.

① Automotive Business:

Production and Delivery: Produced 10,720 vehicles and delivered 13,202 vehicles, marking the highest delivery quarter in 2025.

Revenue of $1.1 billion (driven by delivery volume); gross profit loss of $130 million due to planned shutdowns at the Normal plant for R2 production, resulting in insufficient fixed cost allocation. Unit economics improved significantly, with one of the best historical performances in cost of goods sold (COGS) per delivered unit (driven by improvements in raw material costs).

② Software and Services Business:

Revenue of $416 million, with a strong gross profit of $154 million.

About half of the revenue comes from a software and electronic hardware joint venture with Volkswagen Group; strong gross profit contributions also come from used car remarketing and vehicle maintenance services.

2. Adjusted EBITDA: Loss of $602 million.

3. Operating Expenses Increased Quarter-over-Quarter: Mainly due to increased prototype development investment for R2 production preparation and rising costs for autonomous driving platform training. Selling, general, and administrative expenses (SG&A) increased, related to the expansion of sales service infrastructure and teams, and included some non-recurring operating expenses (non-long-term cost structure).

4. Balance Sheet

a. Cash Reserves: Approximately $7.1 billion in cash, cash equivalents, and short-term investments at the end of the quarter.

b. Working Capital: Continues to improve due to strict control of raw material, work-in-progress, and finished goods inventory levels.

c. External Funding: Expected to receive up to $2.5 billion from the Volkswagen joint venture transaction, with $2 billion arriving in 2026; advancing a loan application with the US Department of Energy (DOE) for up to $6.6 billion (with advantageous funding costs), with updates to be provided in a timely manner.

5. 2025 Performance Guidance

a. Delivery Volume: 41,500 to 43,500 vehicles.

b. Adjusted EBITDA: Loss of $2 billion to $2.25 billion.

c. Capital Expenditure: $1.8 billion to $1.9 billion.

d. Gross Profit: Roughly breakeven for the year.

II. Q&A Session

Q: After the expiration of the IRA-related plan, electric vehicle sales declined in October. What has Rivian observed and what is your confidence in demand?

The expiration of the IRA led to demand being released in September, resulting in relatively weak demand in October, a phenomenon common across the industry.

I believe this situation exists across the industry, involving multiple manufacturers. However, from a longer-term perspective, one important point is that consumers ultimately decide based on "which product suits them best." I think we often focus too much on the performance of electric vehicle sales relative to other models.

Especially regarding the R2 model, our approach is to create the best possible model, offering consumers an excellent choice. For example, the R1 is currently the best-selling high-end electric SUV in the US market; in California, it is the sales champion among both electric and non-electric SUV categories. For the R2, we also hope to incorporate the core advantages of the R1—performance, configuration, and functionality—into a more cost-effective product, allowing this vehicle to compete with various models.

The R2 is positioned as a mid-sized five-seat SUV, belonging to the most popular segment, with a starting price of $45,000. The average new car price in the US market is about $50,000. Therefore, we are confident in the R2 and believe it will bring significant value to the company's business.

Q: What are your expectations for the demand for regulatory credits? I noticed you have no plans to sell additional regulatory credits this year. Do you have a general direction for 2026?

We do not expect regulatory credits to bring significant revenue to the company, so they have been excluded from the forecast. Considering the uncertainty of policy changes, we aim to keep the forecast conservative in this dimension.

Q: I understand that the cost per vehicle has dropped to about $96,000, even though the company arranged a shutdown to adapt the Normal plant for R2 production. Claire, you mentioned raw material costs as a key driver, but I would like to further understand your view on unit sales costs—especially when looking ahead to the R2 model, how much room do you think there is for cost reduction?

As you mentioned, in the third quarter, the sales cost per delivered vehicle was about $96,300—even though the plant was shut down for several weeks, affecting fixed cost allocation. Looking ahead, the core driver of sales cost improvement in 2026 will be the sales growth brought by the ramp-up of R2 production capacity.

This will not only drive the R2 model to achieve positive gross profit and positive unit economics by the end of 2026, but the increase in sales will also have a positive impact on the R1 model and commercial van business, as the overall capacity utilization of the Normal plant will increase accordingly.

Q: Regarding Mind Robotics, you established the company in November and are introducing external financing. Could you elaborate on the business scope of Mind Robotics and what development opportunities you see for the company in the future?

The company has invested a lot of effort in this field, focusing on "what our manufacturing infrastructure and platform should look like in the long term." After in-depth research, we concluded that it is necessary to develop specialized products and robotic solutions to improve the operational efficiency of manufacturing plants.

These robotic solutions will be designed using data collected from our existing plants to train robots to adapt to manufacturing scenarios, especially for completing high-precision tasks. Ultimately, we raised $110 million in seed funding to spin off this business from Rivian and establish an independent company—though Rivian will remain a close partner and shareholder.

The company's solutions will not only be applied to Rivian's plants but will also cover a broader range of fields. In simple terms, we believe that AI-driven robots can add value in many industrial scenarios, which is the target market for this company.

Q: How is the collaboration with Volkswagen progressing?

The joint venture is approaching its first anniversary, with efficient and solid cooperation. The Volkswagen ID.1 (approximately $22,000 electric vehicle, based on Rivian's technology platform) has been released, marking the first project for both parties, with multiple projects planned for the future. The partnership is strong and positive.

Q: What role do you think Rivian will play in the robo-taxi market? Some peers collaborate with ride-hailing companies when developing electric vehicles. Do you have anything to share in this regard?

The industry has indeed invested a lot of attention in the robo-taxi field. However, I believe that regardless of whether the application scenario is private vehicles or robo-taxis, one crucial point is that autonomous driving technology will become a core component of the automotive ecosystem.

In our view, by the end of this decade, this technology will become an important consideration in consumer car-buying decisions—people will focus on whether the vehicle can achieve "hands-off, eyes-off" driving (hands off the steering wheel, eyes not fixed on the road), and more importantly, whether it can achieve this function on various roads. Theoretically, any drivable road should allow the vehicle to complete the journey with minimal driver intervention.

Currently, over 95% of the mileage on US roads comes from private vehicles, with the rest contributed by taxis, ride-hailing, and rental cars. We believe this ratio will not change significantly in the future—ride-hailing may see slight growth, but from the perspective of large-scale application of autonomous driving technology, solving the autonomous driving problem for private vehicles will bring the most significant transformation to the industry.

Of course, Rivian also has the opportunity to participate in the robo-taxi market—if we choose to collaborate with large ride-hailing operators, the market opportunity does exist. However, our core focus remains on technology development. As you mentioned, George, we will detail the technology roadmap on "Autonomous Driving and AI Day," including hardware, software, and the construction of the data flywheel. We will also demonstrate the functions these technologies can achieve when integrated. Through this event, everyone will see the potential application of this technology in different market scenarios—whether in private vehicles or the robo-taxi collaboration you mentioned.

Q: The CEO of Scout Motors recently revealed that 80% of their reservations come from extended-range electric vehicles (EREVs). BYD has both pure electric (BEV) and extended-range electric product lines. Even in the Chinese market, the growth rate of extended-range electric vehicles has been significantly faster in recent years. Clearly, there is market demand for this type of vehicle.

I think this powertrain might also be suitable for the truck products you plan to launch—of course, this is just my opinion, and I would like to hear your thoughts. I know you have always emphasized the vision of an "all-electric future," but my question is: Have you considered launching extended-range electric vehicles in the US or global market? If so, how difficult would it be to adapt the existing platform to accommodate an extended-range powertrain?

We currently have no plans to launch extended-range electric vehicles (or vehicles that are essentially series hybrids), as these vehicles require an engine to be installed in the car, so they are not in our product roadmap and are not a direction we are considering.

However, I think one point needs to be clarified: In the process of electrification transformation, providing consumers with choices is crucial. Therefore, different manufacturers will make different decisions—some will choose hybrid or extended-range routes, while others will stick to pure electric routes. But in our view, as I mentioned in my opening remarks, the industry will eventually move towards a future of "all-electric, all-software-defined, and high levels of autonomous driving."

Therefore, we remain focused on leading the electrification development. Especially for the mid-sized SUV segment—with the launch of the R2 and subsequent R3 models, this market will become the main source of our sales—the pure electric architecture has a natural advantage in this market: we can offer excellent performance and range while keeping the price comparable to fuel or hybrid vehicles.

Q: I know you briefly mentioned Mind Robotics, and I would like to know two things: Have you already invested in this company, or do you have plans to invest? How should we view this investment—will there be continued investment in the future, or is this investment entirely borne by this external company, with you only as a shareholder?

Mind Robotics is an independent company from Rivian, with Rivian participating only as a shareholder. The $110 million I mentioned earlier was seed funding raised from external sources, not from Rivian. We are very excited about the company's development prospects.

I believe that just as AI has changed the way enterprises operate through large language models (LLMs), the potential for AI applications in the physical world is, to some extent, immeasurable. This understanding has influenced our thinking about the design of internal logistics and even the layout of factories.

Establishing this independent company is essentially a decision we made after careful consideration: we want to directly control and influence the design and development of advanced AI robots, and these robots will focus on industrial application scenarios. Therefore, Mind Robotics will develop robotic solutions optimized specifically for manufacturing and industrial environments.

Q: First, I would like you to update us on the impact of tariffs on this quarter's performance—I know you previously stockpiled batteries, and I'm wondering if this will have an impact?

As you mentioned, last week the government announced the extension of the 3.75% manufacturer's suggested retail price (MSRP) offset policy under Section 232 tariffs on automobiles until 2030, and also added categories of parts that can be included under Section 232 tariffs—this is particularly important for a highly vertically integrated company like Rivian.

Currently, when we produce subcomponents internally, we purchase a large amount of raw materials, but some of these raw materials were not previously included in the Section 232 classification. We are very grateful for the recent announcement of these new policies by the government.

As for the impact of tariffs this quarter: based on the products we have sold, the tariff impact per vehicle in the third quarter was slightly less than $2,000. Looking ahead, once the new policies are fully implemented, the unit tariff impact on newly produced vehicles will drop to a few hundred dollars. In the fourth quarter, our tariff pressure will ease, but there are still some vehicles or parts in inventory facing higher tariffs, which will have a short-term impact on the data—the overall trend is roughly as described.

Q: Additionally, there have been some changes in tariff policies recently, considering that the benefits related to the Inflation Reduction Act are no longer applicable, how will this change the battery procurement strategy for the R2 model? Will you consider sourcing lower-cost lithium iron phosphate (LFP) batteries from overseas?

Regarding the R2 project, we previously mentioned that the model will be equipped with 4695 cylindrical cells, which will be produced in Arizona, USA, starting in late 2026. We determined this procurement plan early on and have been working closely with cell supplier LG Group to advance development.

As you pointed out, we do have the opportunity to consider other cell sources—whether cells with different chemical systems or products from different suppliers. However, for the R2 production at the Normal plant, the current plan is to use cells produced by LG in Arizona.

Q: Although the final framework of regulatory policies is still gradually becoming clear, there is now a clearer direction. Considering that your expectations for tariffs and regulatory credits have changed from the initial assumptions when planning the R2—and the bill of materials (BOM) cost for the R2 is relatively fixed—what measures do you have to ensure the expected unit economics are achieved? I know you mentioned plans to reduce the BOM cost of the R2 by half compared to the R1 and achieve positive gross margins by the end of 2026. But how will you respond to these changes?

First, the BOM cost is contractually binding—when negotiating the BOM, we established a clear strategy for selecting component sources: prioritizing suppliers from the US or USMCA-compliant regions.

We made this decision because we had already foreseen the potential changes in recent policies. Importantly, the contracts we signed with suppliers for the BOM give us confidence in achieving cost targets and ultimately achieving positive unit economics for the R2 model by the end of 2026.

Another positive change is the expansion of the Section 232 framework and the extension of the 3.75% tariff offset policy—this is very beneficial for us. We previously estimated unit tariff costs at about $2,000, but now we expect them to drop to a few hundred dollars, which is a significant change for us.

Additionally, within the overall sales cost framework, the team is working hard to ensure the plant is ready for production. Of course, the team is also responsible for BOM management and supplier procurement—our procurement is based on "landed cost" contracts, so 100% of the costs are clear, and the current tariff environment is more favorable.

As for other components of sales costs, we are actively optimizing conversion costs, logistics costs, and various processing costs within the plant. Currently, we are advancing large-scale lean transformation at the Normal plant, continuously improving daily operational efficiency—these experiences will be directly applied to R2 production operations.

Furthermore, the R2 production process design is more compact: it occupies less space, and maintenance costs and overhead consumption are also lower. Therefore, we are confident in achieving the "cost halving" goal, and internal data confirms that we are steadily moving in this direction.

Q: I would like to understand the future trend of operating expenses (OpEx)—you mentioned in the shareholder letter that operating expenses include spending related to autonomous driving training. How should we view the impact of autonomous driving training expenses on operating expenses in the future?

Our consistent philosophy and strategy are to self-fund through improved business efficiency to support strategically differentiated areas—autonomous driving training is one of them. This philosophy will remain unchanged in the future investment roadmap.

We are always committed to finding efficiency improvements and spending reduction opportunities within the organization to support business expansion—especially as the R2 model is launched next year, with sales expected to grow significantly.

Specifically for R&D spending: R&D spending will remain high before the R2 model is launched, mainly because we need to invest significant resources in developing prototypes (currently in the design validation prototype stage). As mentioned in our prepared remarks, production validation prototypes will be launched at the Normal plant by the end of the year. Once the R2 model is officially launched, this external spending will decrease. Therefore, although autonomous driving training spending will continue to increase in the long term, R&D spending for the entire year of 2026 will gradually return to normal levels.

Q: With the release of the R2 model next year, as orders gradually come in, can you introduce your expected production pace? For example, the distribution of production in the first and second halves of 2026?

Regarding the R2, as we mentioned earlier, we plan to start production and delivery of saleable models in the first half of 2026, but production will be relatively limited in the first half. In the second half of 2026, we will gradually increase capacity, and production will continue to rise. By 2027, the Normal plant's capacity will be maximized, reaching an annual capacity level of 215,000 vehicles.

Q: As I understand it, the Normal plant's capacity will reach 215,000 vehicles, and the Georgia plant will add an additional 400,000 capacity. But considering Emmanuel's previous mention of the demand environment and your stance of not planning to launch hybrid or extended-range models, how should we view the future capacity utilization of these two plants?

As you mentioned, the Normal plant's capacity is 215,000 vehicles, allocated to the R1, EDV, and R2 models, with R2's capacity being 155,000 vehicles. The Georgia plant will be built in two phases, ultimately reaching a capacity of 400,000 vehicles, mainly for producing R2, R3, and derivative versions of the two models.

I previously mentioned an important point, which I would like to emphasize again: understanding consumer demand for electric vehicles requires not only looking at overall electric vehicle sales but also focusing on the competitiveness of a particular model relative to other competitors. Ultimately, consumer decisions will depend on "vehicle price" and "value proposition"—the latter includes performance, functionality, and configuration.

Therefore, we are very optimistic about the market prospects of the R2. The internal positioning of the team is to create the "most worthwhile" model in this segment and price range. We hope that when consumers use the R2, they can clearly feel its advantages—especially when they compare the R2 with other models in the same price range, these advantages will be more apparent.

We also observe a trend: the adoption rate of electric vehicles is highly correlated with the "number of highly attractive models." Currently, in the $45,000 to $50,000 mass market price range, there is only one brand truly dominating, with only two products—Tesla's Model 3 and Model Y. They occupy about 50% of the market share, which is not a healthy market performance but reflects a severe lack of "consumer choice" in this market.

Rivian R2 is similar in size and price to the Model Y, but there are significant differences in product design and experience. Therefore, we believe the R2 will attract a wide range of consumers—not only those who are already considering electric vehicles but also those who "are not limited to electric vehicles and just want to buy a quality model for $45,000 to $50,000."

Based on the above factors, the product portfolio we have announced (R2, R3, R3X, and other derivative versions not yet announced) will be sufficient to support the capacity needs of the two plants—the capacity of the Georgia plant will also be fully utilized as a result.

Q: To achieve such a capacity scale, do you plan to export vehicles to other regions or countries? When do you expect to enter these overseas markets?

The R2 and R3 were designed with European market demand in mind and are preparing to enter the European market (Europe is a core part of the plan); the Georgia plant location was chosen to facilitate exports to Europe, but the European launch time has not been announced.

Q: How will working capital in the fourth quarter compare to the second and third quarters? I remember you mentioned earlier that capital expenditure (CapEx) will increase next year. Can you specify the scale of the increase?

In the fourth quarter, as implied by the performance guidance, we expect capital expenditure to increase. As for working capital, we have seen a strong positive trend in the first three quarters of this year, but this trend will reverse in the fourth quarter—we expect working capital to consume some cash.

Looking ahead to 2026, as we stockpile inventory for the R2 model, working capital for the year is expected to become a cash outflow. However, as R2 capacity gradually ramps up and reaches stable production levels, the working capital situation will return to normal—as Javier Varela mentioned, we are committed to achieving highly lean operations at the Normal plant, which will also have a positive impact on inventory management.

Regarding the specific scale of capital expenditure in 2026, we will provide more details in the fourth-quarter earnings call. But as RJ mentioned, part of the 2026 capital expenditure will be used for vertical construction at the Georgia plant—this expenditure will be reflected in next year's capital expenditure data.

Q: The next phase of Volkswagen Group's investment—$1 billion in equity financing, I understand this is related to the successful winter testing of the R2 model. Is the winter testing planned for this winter or the end of next year?

We are confident in obtaining $1 billion in equity financing from Volkswagen in 2026, but we do not plan to announce the specific timing of the R2 winter testing.

Q: You previously mentioned that the starting price of the R2 is $45,000. Can you introduce your pricing strategy? For example, Tesla's Model Y and other models usually launch high-end versions first and then gradually introduce lower-end versions as the market expands.

Considering that the current capacity of the Normal plant seems relatively limited, how did you determine the pricing of the R2? Will there be price reductions in the future? Additionally, how does this pricing strategy relate to the R2 production plan at the Georgia plant? After all, you have many pricing-related matters to advance in the short term, and I would like to understand your overall thinking.

In early 2026, we will hold a dedicated R2 event to introduce the full range of R2 products, including pricing for different configurations (trims) and powertrain versions.

As you pointed out, at the initial stage of the new model production line, we will limit the number of versions produced—the R2 will also launch a "launch edition." This is a typical challenge: thousands of consumers are eagerly awaiting the R2, some want the base version (lowest price version), some want the top version, and others prefer the middle configuration.

Therefore, we spent a lot of time thinking about "which version should be launched in the initial phase." Currently, it can be confirmed that the launch edition will be a dual-motor version—richly configured but not the top version. Our goal is to satisfy as many consumers as possible with this version.

After the production capacity of the launch edition gradually ramps up, we will introduce other configuration versions. We will provide detailed information about these configurations and their launch times at the event in early 2026.

Q: What role will advertising play in the promotion of the R2, and will marketing highlight product differentiation (some industry companies are reducing their electric vehicle business/turning to hybrids)?

The core is to enhance the awareness of the R2 and the brand, with some awareness coming from "natural exposure" (R2 on the road, lower price reaching a wider audience, similar to the word-of-mouth spread of the R1); at the same time, we will promote the R2 through temporary offline experience events (such as ski resorts, restaurant scenarios), cooperative activities, and digital marketing. Historically, we have not overly relied on paid advertising, and in the future, we will invest advertising funds in a "cautious and measurable" manner to ensure consumers understand the product's advantages.

Q: My question is: Regarding tariffs, you have clarified—although there is still a negative impact, it has eased compared to six months ago. However, one positive change is the weakening of the dollar, and US export tariffs to Europe will drop from 10% to 0%. I would like to know if this change has altered your view of the European market? I agree with your view that the R2 and R3 are very suitable for the European market. Does this mean you will accelerate your entry into the European market or expand your business scale in Europe?

Additionally, from a market potential perspective, are you currently planning to enter Europe through direct exports from the US, or will you consider adopting a "local distribution + dealership" model in Europe (different from the US business model)?

Yes, the reduction of export tariffs to 0% is indeed exciting, and we believe it deserves more attention. As you pointed out, although we have not announced the specific timing of exports to Europe, this policy has indeed influenced our decision—we need to weigh the "complexity of exporting to Europe" against the "strong domestic demand in the US." We want to first ensure that we meet the basic demand of the large US market, while also recognizing that the zero-tariff policy creates an opportunity for us to enter the European market earlier. These are factors we are currently considering, but the specific timing of entering the European market has not yet been determined.

Q: Can you reveal when the R3 model is expected to be launched after the R2 is released? Is the time interval between the two 12 months, 18 months, or 24 months? I would like to understand your timeline planning.

We have not yet announced the specific launch time of the R3, but it can be confirmed that the R3 will only be produced at the Georgia plant and will not be produced at the Normal plant. The Georgia plant is planned to start production at the end of 2028, so the R3 launch time will not be earlier than the plant's production start time.

Q: Currently, the deployment speed of autonomous vehicles (including passenger and commercial vehicles) is rapidly increasing. I would like to understand Rivian's vision and strategy in this field.

I know that more details may be announced on "Autonomous Driving Day" in December, but I still want to ask: Is Rivian more likely to collaborate with suppliers to develop robo-taxi businesses in the future, or will it promote the application of autonomous driving technology in commercial vehicles (such as electric delivery vans, EDVs)? Can you share some thoughts?

Thank you for mentioning "Autonomous Driving Day" on December 11—we are very much looking forward to it, and we will share many details, including some that have not been disclosed, while unveiling the core technologies we have focused on developing in this field over the past few years.

At the core level, autonomous driving technology is a key area of the company's business, one of the largest technology directions we have invested in, and the main focus of the R&D team. As you mentioned, this field also fills our entire team (including myself) with enthusiasm.

However, as I mentioned earlier, the application scenarios of autonomous driving technology are very broad, and it will become an important driver of vehicle sales. For example, our upcoming R2 and R3 have a highly versatile form factor—suitable for both private use and various ride-hailing services; they can be adapted to both the US and European markets.

Therefore, on top of this "already highly attractive" model (form factor, configuration, and price all have advantages), adding "advanced autonomous driving capabilities"—from "hands-off driving" gradually upgrading to "eyes-off driving" (hands off the steering wheel, eyes not fixed on the road), and then to "parking-to-parking" full autonomous navigation—we believe this will become a key factor driving demand, even attracting those "who were not originally considering Rivian or electric vehicles": "I not only like this car but also value that it can save me time—allowing me to handle affairs on my phone while riding, truly reclaiming my own time." This is our core goal.

Of course, we cannot achieve this ultimate goal overnight. On December 11, we will detail the technology roadmap: first expanding the "hands-off driving" road coverage, then adding "address-to-address" navigation functionality, followed by achieving "eyes-off driving" in specific scenarios, and finally gradually expanding the applicable areas and scenarios for "eyes-off driving."

This is the core focus of our business—doing this well will create more opportunities for our commercial vehicle business (which we are also very excited about) and open up space for robo-taxi collaboration. However, it should be clear that the largest revenue opportunity currently still comes from privately owned vehicles—over 95% of the mileage on US roads comes from private vehicles, and the situation in the European market is roughly the same.

Therefore, our initial core focus is on the private vehicle market, but we also clearly recognize that the application scenarios of this technology have strong extensibility.

Q: Regarding the US Department of Energy (DOE) loan, can you review or update your expectations for the drawdown pace next year and in the future?

The DOE loan is a "project financing loan," and drawdowns can only occur after the vertical construction of the Georgia plant is initiated and the conditions for the first drawdown are met; the Georgia plant is planned to start vertical construction in 2026, with the first batch of vehicles rolling off the line by the end of 2028.

Q: Observing the midpoint of the performance guidance, it can be seen that adjusted EBITDA is expected to improve in the fourth quarter, but the midpoint of the delivery volume guidance has decreased. What factors will drive profit improvement in the case of declining delivery volume?

From the trajectory of fourth-quarter performance, we expect the sales of electric delivery vans (EDVs) to remain stable—and EDVs have historically had a relatively low cost base, which is a key factor.

Another factor is that as we achieve key milestones in the joint venture project, "foundational IP revenue" from Volkswagen Group will continue to grow. Compared to the second quarter, the gross profit of the software and services business has improved in the third quarter, and this trend may continue in the fourth quarter—the software and services business will contribute incremental gross profit.

Additionally, as mentioned in our prepared remarks, selling, general, and administrative expenses (SG&A) are expected to decrease slightly in the fourth quarter.

Q: Is there regulatory credit revenue from multi-year contracts in 2026, and should future assumptions exclude the impact of regulatory credits on performance?

Due to the uncertainty of the policy environment, regulatory credits have been excluded from the forecast, and future assumptions do not assume their impact on performance.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.