Unity: Patience is key, the metamorphosis is underway

Hello everyone, I am Dolphin Research!

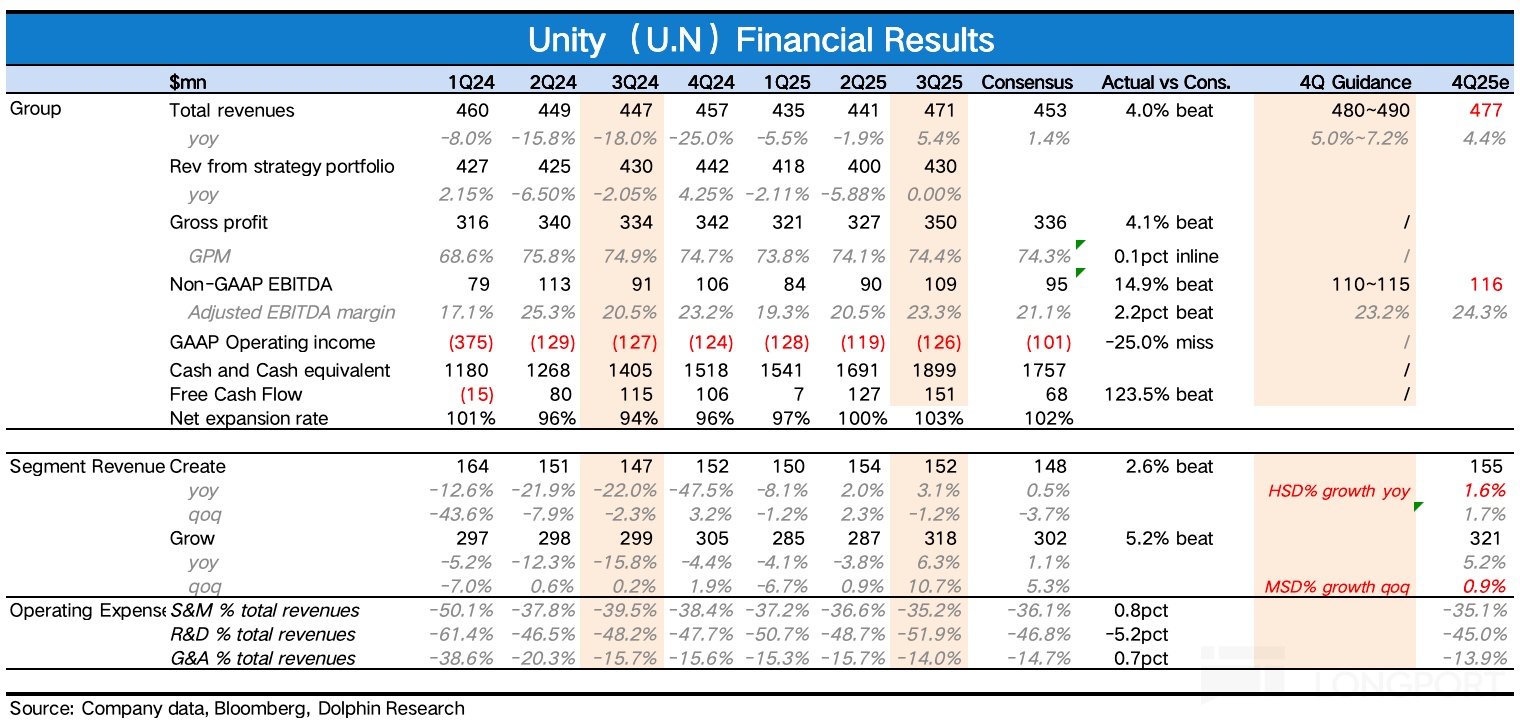

On November 5th, before the U.S. stock market opened, the leading game engine company $Unity Software(U.US) released its Q3 2025 financial report. The Q3 performance (including guidance) slightly exceeded the expectations of the sell-side, maintaining a trend of sequential improvement overall.

Although the speed of transformation compared to peers is still not fast enough, considering the management's consistently conservative style over the past year, it is expected that Q4 performance will be better than the guidance. Therefore, the market sentiment, which was previously suppressed due to average channel research results, can be alleviated.

What truly caught Dolphin Research's attention is the forward-looking nature of the mid-to-long-term operational indicators, which finally showed a good expansion trend this quarter.

1. Vector starts to take effect: Grow's revenue in Q3 increased by 6% year-on-year and 11% quarter-on-quarter, despite the drag from negative growth in non-advertising business, indicating a clear pull from Vector. Q4 guidance suggests a quarter-on-quarter growth rate of about 5%. Assuming the management's conservative downward adjustment of 4-5 percentage points each time, it would still be nearly 10% growth quarter-on-quarter. Although not as explosive as Applovin initially, it is better than pre-report expectations.

Previously, due to poor channel research data in September and October (after a 10-20% improvement in ROAS in August, Vector's algorithm optimization was insufficient, leading to a significant slowdown in ROAS improvement in September and October), market sentiment was relatively cautious.

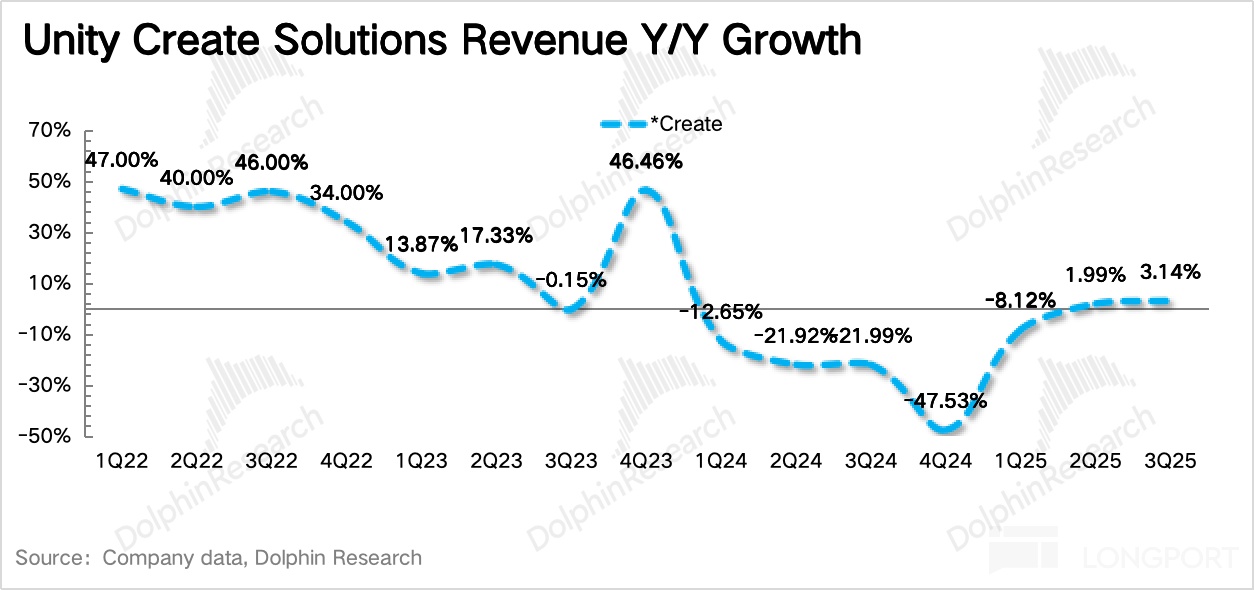

2. Unity 6 drives growth: Create's revenue in Q3 increased by 3% year-on-year but declined quarter-on-quarter. Last quarter, there was a large authorization fee of $12 million confirmed in advance (Tencent, Scopely). Excluding this special disturbance, the quarter-on-quarter growth was 7%, showing clear signs of improvement. Q4 guidance indicates high single-digit percentage growth, approximately 7-8%, with an 8% quarter-on-quarter growth.

Dolphin Research believes this is mainly driven by Unity 6 launched in October last year. Unity 6 engine features have been enriched and upgraded, with a higher comprehensive unit price. Therefore, even without new customers, the migration of existing customers alone is conducive to increasing engine revenue. According to institutional research, more than 50% of existing users have migrated to Unity 6, and according to previous expectations, there are still 20-30% of existing users planning subsequent migration.

3. Operational indicators: Combining indicators <1-4>, the warming trend is becoming increasingly evident.

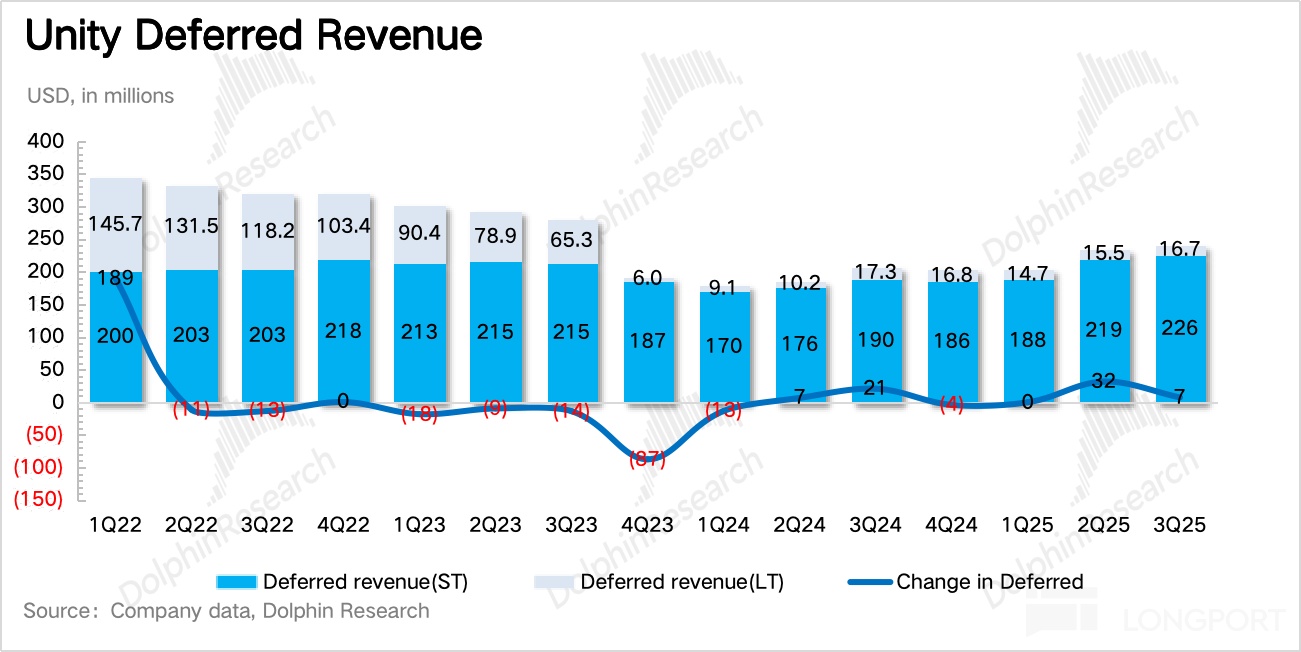

(1) Deferred revenue increased by $7.5 million quarter-on-quarter, less than last quarter due to several medium and large customers like Tencent and Scopely.

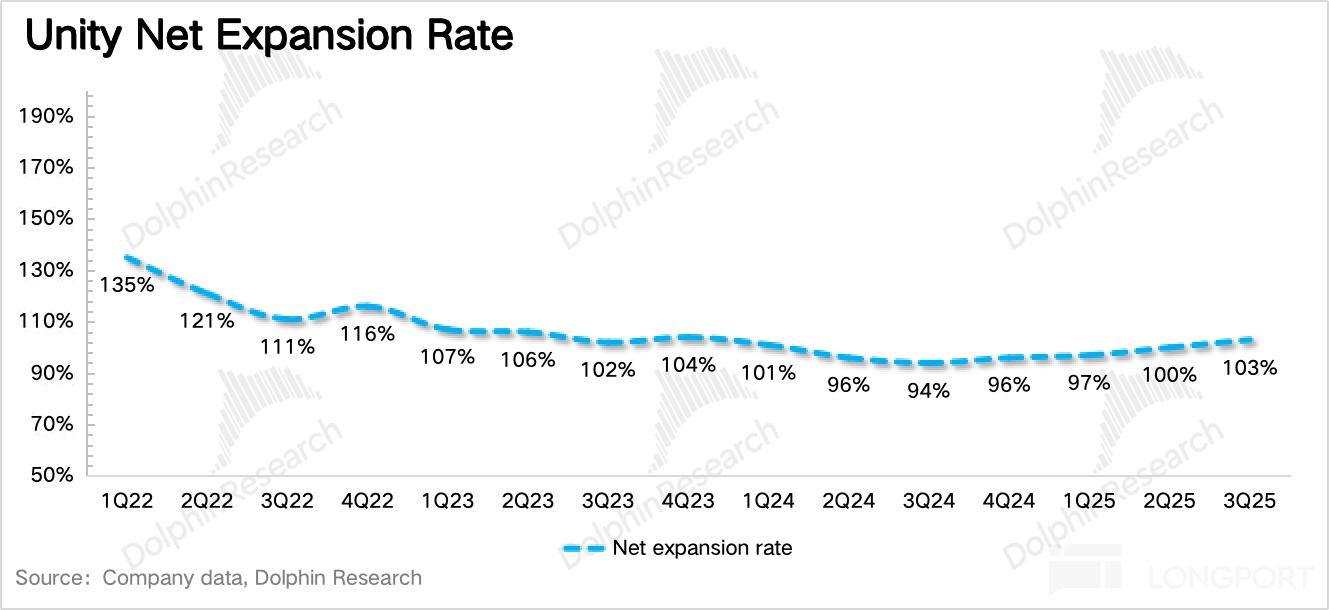

(2) Net expansion rate continued to warm up to 103%, finally reaching above the baseline of 100% after two years.

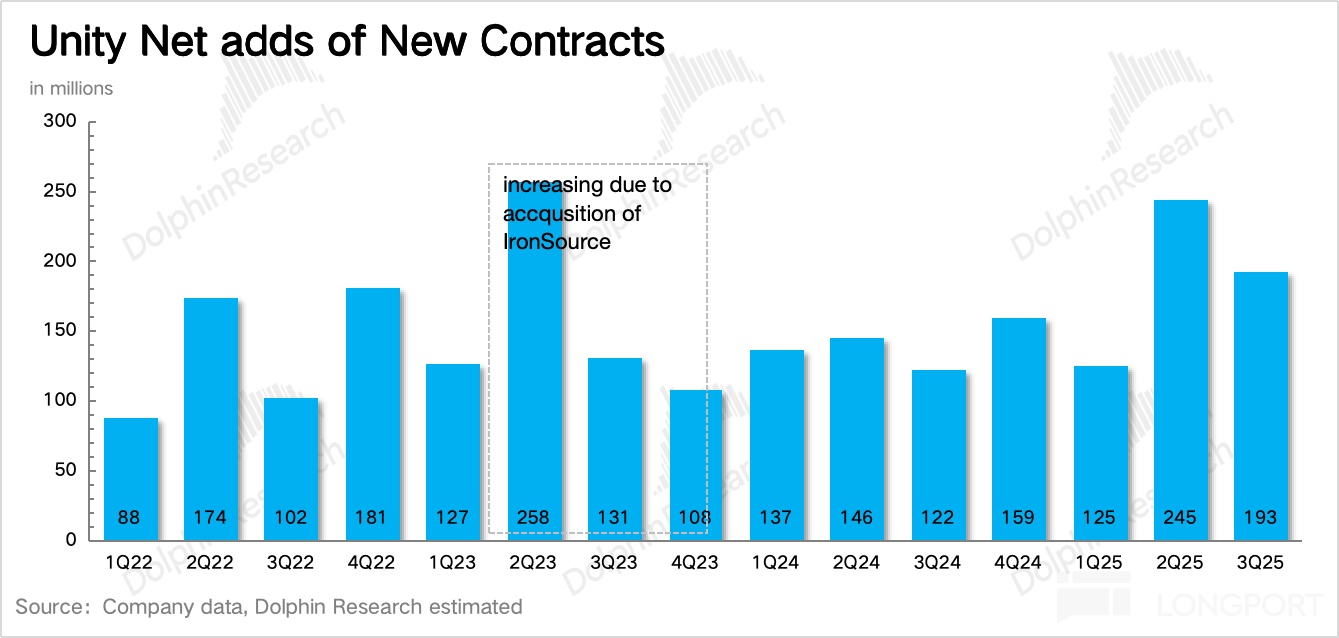

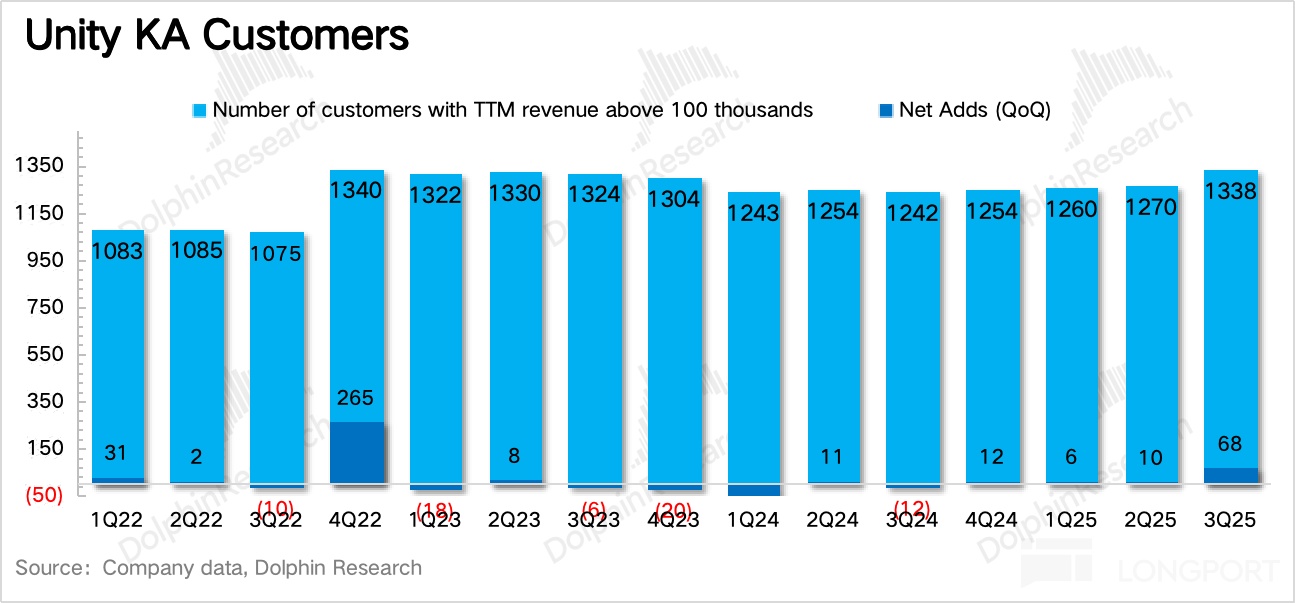

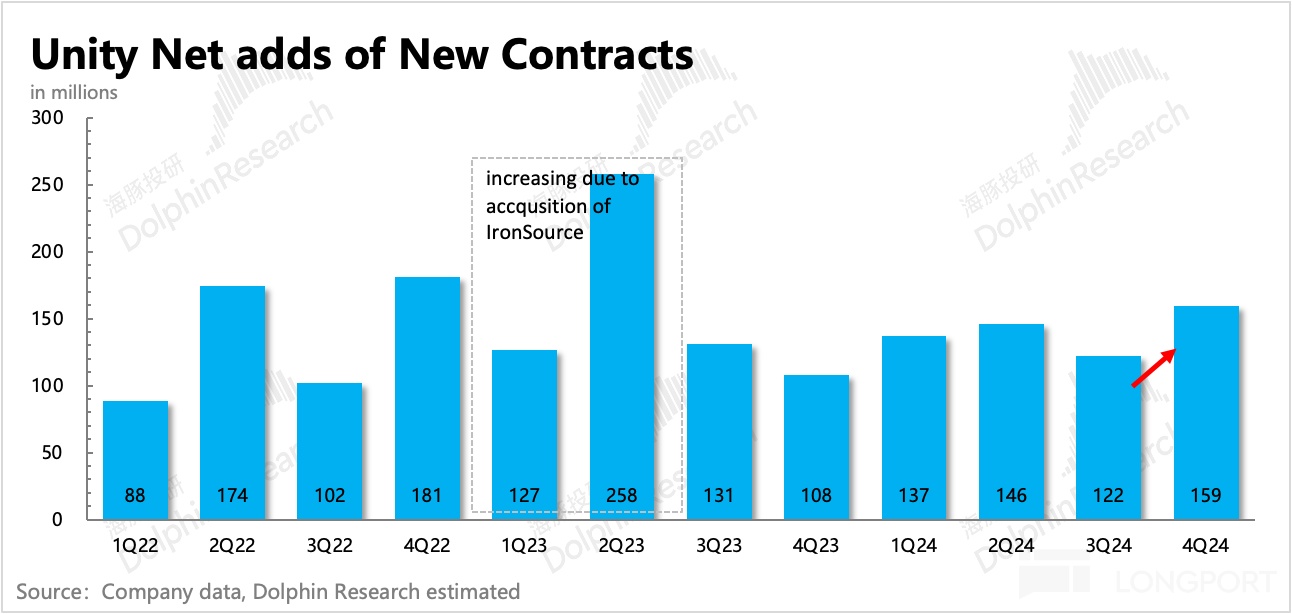

(3) Number of large customers increased by 68 quarter-on-quarter, significantly exceeding expectations. This net increase scale, excluding the new changes brought by the acquisition of Ironsource, dates back to Unity's glorious period in 2021. We estimate that besides the contract amount upgrade of Unity 6's existing customers, the main increment comes from advertising customers under Vector.

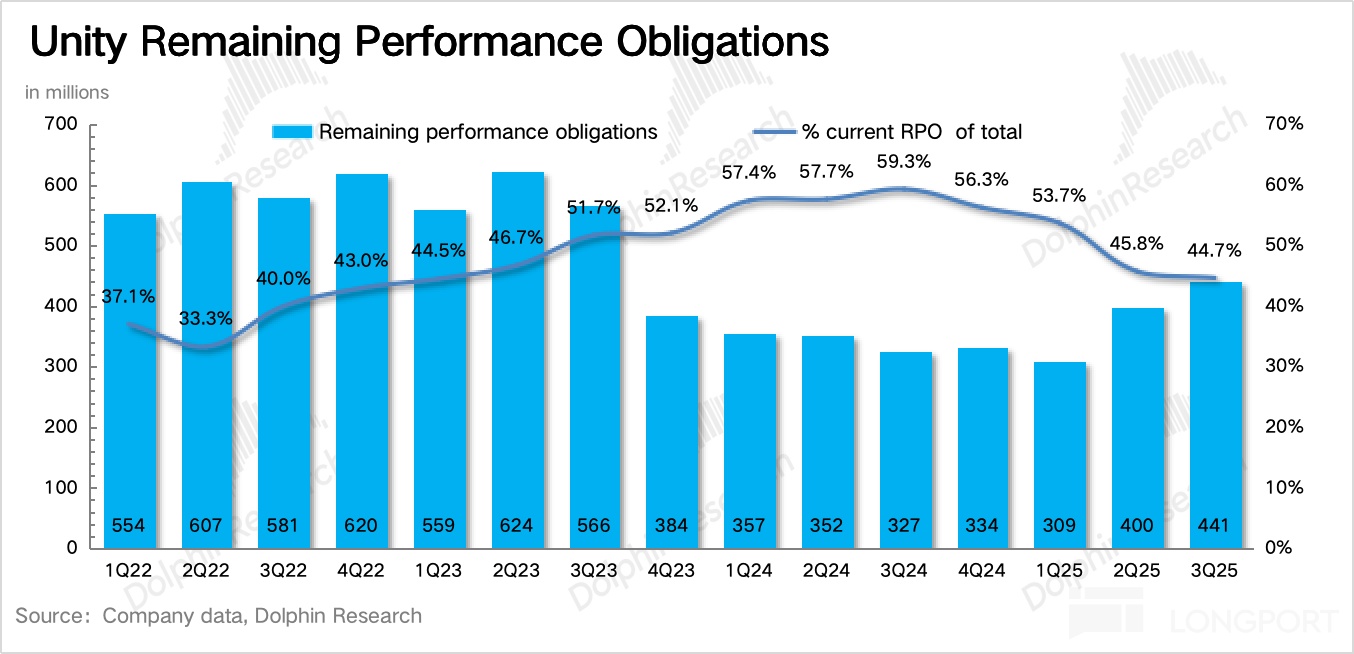

(4) Remaining contract amount increased significantly by $40 million quarter-on-quarter, although not as high as last quarter (Tencent), it is still a rare positive trend;

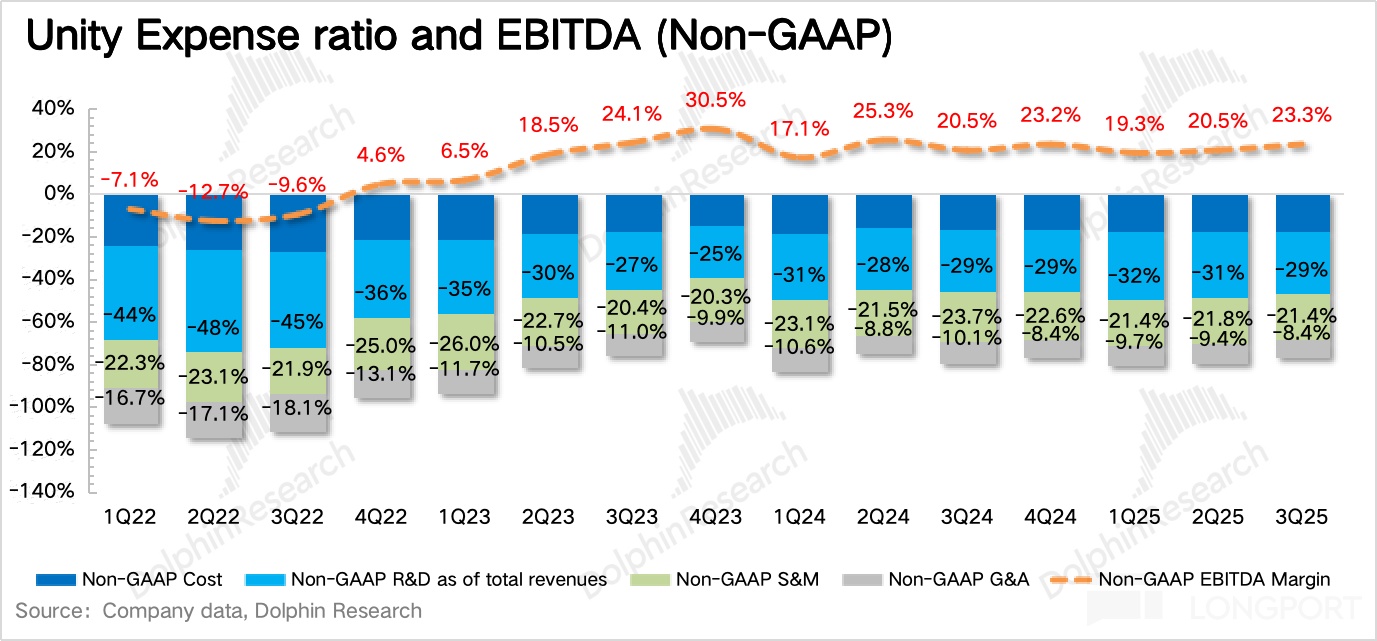

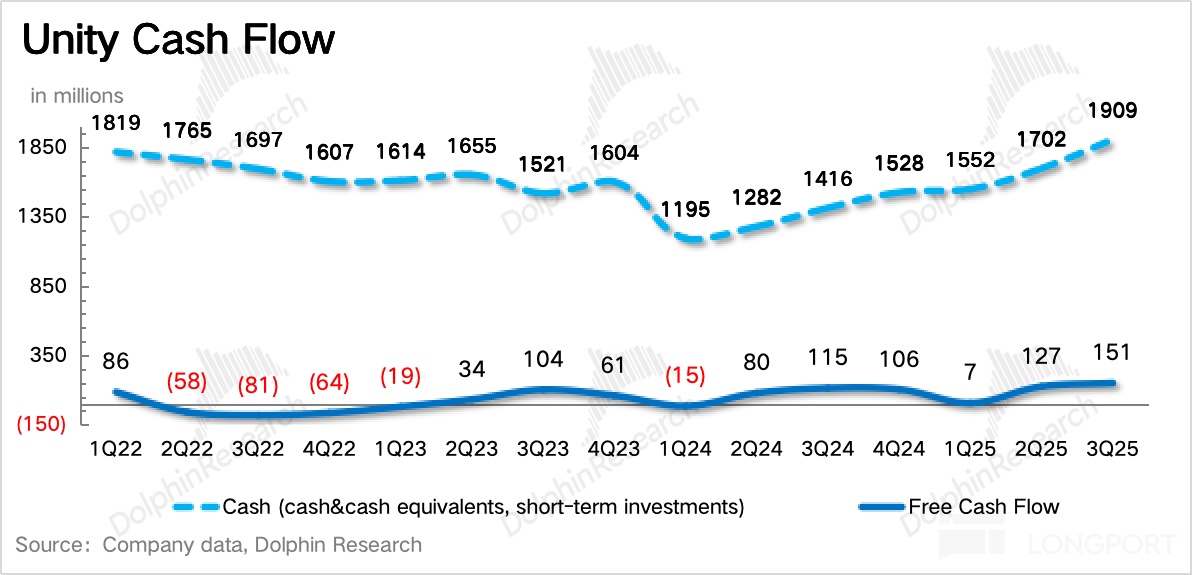

4. Change in amortization period of intangible assets: Although currently in a critical transition period, profit requirements can be less stringent. However, if the loss reduction and profit targets can be exceeded, it would certainly be better. In Q3, Unity was in this situation, with Non-GAAP EBITDA profit margin increasing by 3 percentage points quarter-on-quarter, mainly due to expense optimization. Additionally, benefiting from the improvement of the main business, free cash flow reached $150 million, the highest free cash flow scale in the company's history.

It is worth mentioning that under GAAP, R&D expenses increased significantly, mainly due to accelerated amortization of technical assets acquired during the acquisition of Weta (already divested). The amortization period was shortened from the original 4-7 years to 1-3 years, resulting in high expenses for the current quarter. However, the company and the market are still focusing on Non-GAAP EBITDA for Unity, so it does not affect actual expectations.

5. Overview of performance indicators

Dolphin Research's View

The overall performance of the Q3 report is quite good. Although the financial indicators slightly exceeded expectations, it may still be considered inline for optimistic funds. Dolphin Research is mainly satisfied with several forward-looking operational indicators, especially the scale of large customers and the expansion of unfulfilled contract amounts, which are more of a mid-to-long-term business inflection point.

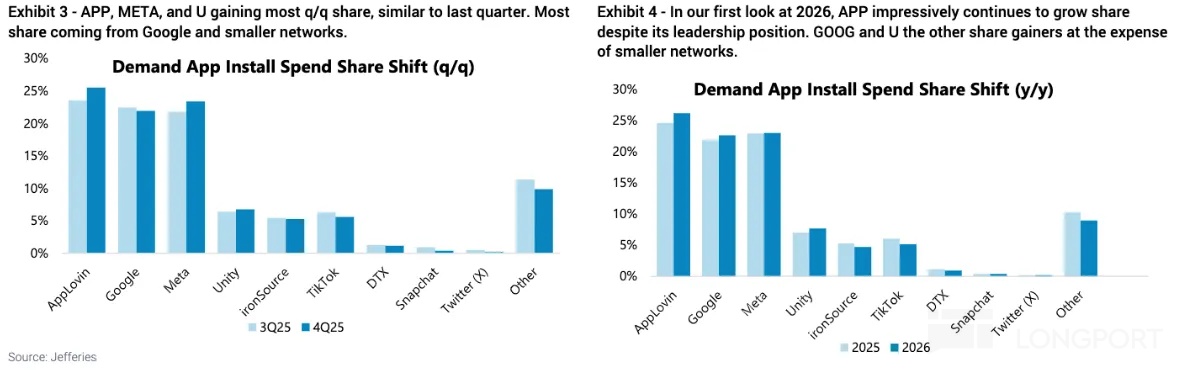

Additionally, the market is most concerned about Unity's Grow business. Although there is still a continuous drag from ironSource, the Vector part should be quite good, at least maintaining a positive trend and not as worrying as the research situation. In fact, the industry itself was generally average in Q3, which further highlights the outstanding effect of Vector. The overall performance of the game application advertising market in Q3 was generally average, due to the continuous increase in advertising quotes over the past year, game developers are undergoing a long-term trend of transitioning from pure advertising monetization (IAA model) to a hybrid model (advertising IAA + paid IAP).

In this process, small and medium platforms with poor conversion effects are likely to further lose market share. In Q3, ironSource's market share also showed a slight decline. Meanwhile, based on the current situation of ironSource, advertisers surveyed are willing to continue reducing their budget allocation to ironSource in 2026.

Is there an impact of Vector advertising system cannibalization? Although in the last quarter's conference call, management mentioned that internal cannibalization is not serious, less than 10%. But theoretically, if Vector is really effective, existing advertisers have no reason not to try it. It seemed not serious in Q2, possibly because Vector was launched at the end of May not long ago. Therefore, Dolphin Research believes as Vector gradually optimizes, this internal cannibalization process should further deepen.

Besides internal cannibalization, ironSource itself has issues. Since being acquired by Unity, the integration between the two has not been smooth. Coupled with the departure of original ironSource executives and the exit of original Unity management responsible for acquisition matters, it further affects the integration pace and effect, and this turbulent process also reduces the willingness of original ironSource customers to cooperate.

However, the key variable affecting Unity's valuation at present is still Vector.Since May, Vector's conversion effect has actually been continuously optimized, although the process has been somewhat tortuous. For example, management claimed a 10-20% improvement in ROAS at the beginning of Q3, but when channel research feedback showed average data in September and October, the stock price immediately adjusted.

Dolphin Research believes that the reason Vector did not upgrade as smoothly as Axon initially is due to the lack of user data. Another missing trump card—a complete ecological industry chain, is currently mainly connected to mainstream DSP through the integration of ironSource bidding platform, although it does not achieve the full industry chain layout effect of Applovin, it is not the biggest problem at present, and the requirements will be higher in the subsequent advanced period.

Unity will mainly use engine data to optimize Vector recommendation algorithms, Unity 6 integrates the Developer Data Framework,which will be used starting from Unity 6.2.This means that more in-app user behavior data will be systematically automatically collected through the engine and then transmitted to the backend cloud platform for storage or used for Vector algorithm optimization (with customer authorization).

Currently, the progress of existing customers switching to Unity 6 engine has exceeded half, and previous research showed that 70-80% of existing customers expressed their intention to switch to Unity 6. Therefore, in 2026, we will see the effect of price increase brought by the higher unit price of Unity 6, the focus of attention will be on the penetration of Unity 6.2, which is related to the future optimization pace of Vector.

In the last quarter's review, Dolphin Research discussed how engine data can improve advertising recommendations and targeting (refer to《Crazy Roller Coaster, Does Unity Have a 'U' Turning Point?》). Simply put, the use of engine data can ensure normal commercialization while reducing negative interference from ads to users, appearing at more "appropriate" times, dynamically pushing different types of incentive ads based on players' performance and preferences in the game.This helps advertisers increase user stickiness due to improved product experience, while also potentially increasing ad conversion by placing ads when players' attention is most focused.

This process requires time to accumulate data and train models, so it is difficult to quickly reflect on performance in the short term, but it is also gradually iterating and progressing. From another perspective, looking at the long term,Unity's competitive advantage in deeply integrating into customer development processes, at the end of October, a cross-platform payment management system (including payment, product pricing, promotional operations, data statistics) was released and integrated into the Unity engine, helping game developers bypass app stores to build payment external links, thus potentially laying out a more complete industry chain, increasing competitive barriers while also achieving higher monetization.

Currently, Dolphin Research's view has not changed much compared to last quarter:Unity is suitable for enjoying corporate growth from a mid-to-long-term perspective. However, due to the uncertainty of algorithm optimization pace and effect, and the presence of very strong competitors at the same time, it requires a cautious valuation relying on short-term performance to find low-cost entry opportunities.In terms of pace:

(1) Before the requirement for Vector to be reflected in performance, valuation is mainly driven by short-term sentiment. Market sentiment will be influenced by management guidance (earnings conference call), channel research (especially changes in advertisers' budget allocation to U), and other factors. Dolphin Research does not make significant adjustments to the reasonable valuation previously expected in Q2, only raising the latest guidance by 5%, with a neutral to optimistic expectation of $16.8 billion to $19.5 billion.

(2) Approaching the Q4 earnings period, if the valuation is high, caution is needed to prevent the 2026 guidance from not reflecting the strong high growth trend priced by the valuation.

Below is the detailed analysis

I. Basic Introduction to Unity's Business

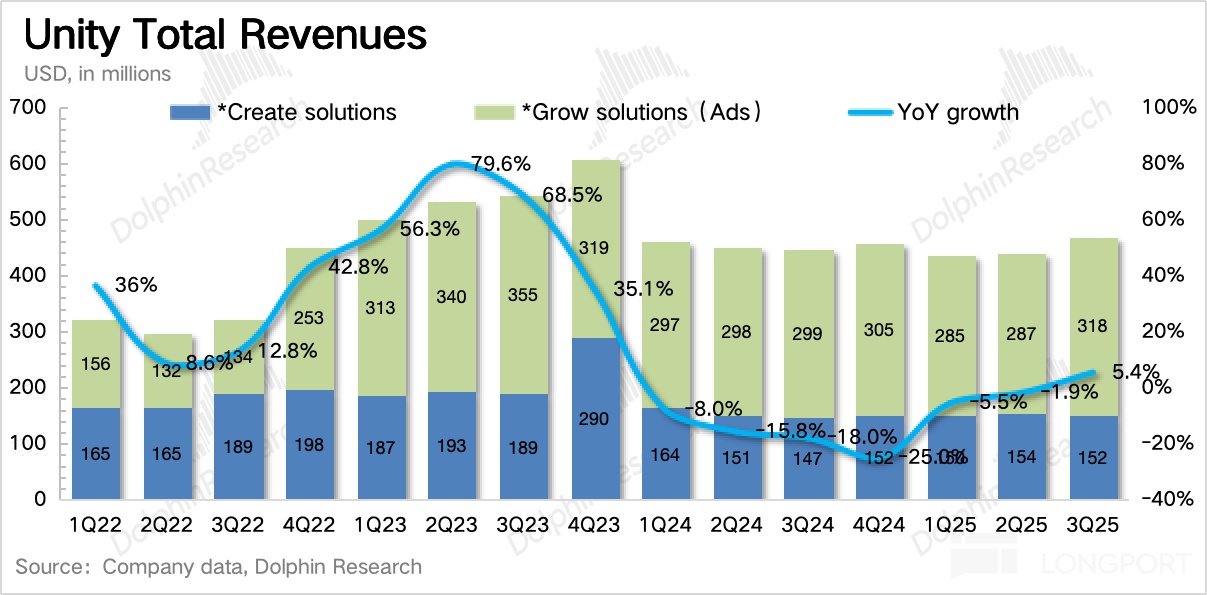

In Q1 2023, Unity incorporated IronSource's operating conditions and adjusted the scope of segmented business. Under the new disclosure structure, the segment business was condensed from the original three (Create, Operate, Strategy) into two (Create, Grow).

The new Create solution includes the original Create products (main game engine) and also incorporates UGS revenue (Unity Game Service: a full-chain solution for game companies, helping solve game development, distribution, and customer acquisition operations), and the original Strategy revenue, but gradually closing Professional service, Weta, and other product services starting from 2023;

The Grow solution includes the advertising business from the original Operate, as well as the merged IronSource marketing (mainly Aura, Luna will close in Q1 2024) and game distribution services (Supersonic). Revenue contribution comes from the seat subscription revenue of the main game engine and the advertising platform revenue responsible for bidding and game distribution revenue.

II. Further Confirmation of Positive Operating Trend

Unity achieved total revenue of $470 million in Q3, up 5% year-on-year, slightly exceeding company guidance and market expectations. Last quarter, we said Unity's operating inflection point was established, and Q3 further confirmed the positive trend.

Looking at the segmented business:

1. In the Create business, the core engine subscription revenue maintained double-digit year-on-year growth, stable compared to the situation in the past year. Although there was no quarter-on-quarter growth, it was mainly due to the long-term engine contracts of large customers last quarter, requiring one-time confirmation of authorization fee revenue in the current period. Excluding this part of the revenue, the quarter-on-quarter growth was 7%.

On October 22nd, the company released a cross-platform payment management system (including payment, product pricing, promotional operations, data statistics) integrated into the Unity engine, allowing developers to no longer jump to various third-party platforms for operations, while also helping game developers bypass app store payments, saving some channel taxes (mainly saving those outside of Apple's app store). This is aimed at the $120 billion in-app payment IAP market, although integrated into Unity 6, Unity may additionally take a certain take rate from the payment flow. Specific attention can be paid to how the conference call forecasts the development of this business.

2. Grow: Q3 grew by 3.8% year-on-year, mainly benefiting from Vector. Q4 guidance suggests a quarter-on-quarter growth rate of about 5%. Assuming the management's conservative downward adjustment of 4-5 percentage points each time, it would still be nearly 10% growth quarter-on-quarter. Although not as explosive as Applovin initially, it is better than pre-report expectations.

3. All forward-looking indicators show continued warming and improvement

(1) Deferred revenue increased by $7.5 million quarter-on-quarter, less than last quarter due to several medium and large customers like Tencent and Scopely.

(2) Net expansion rate continued to warm up to 103%, finally reaching above the baseline of 100% after two years.

(3) Number of large customers increased by 68 quarter-on-quarter, significantly exceeding expectations. This net increase scale, excluding the new changes brought by the acquisition of Ironsource, dates back to Unity's glorious period in 2021. We estimate that besides the contract amount upgrade of Unity 6's existing customers, the main increment comes from advertising customers under Vector.

(4) Remaining contract amount increased significantly by $40 million quarter-on-quarter, although not as high as last quarter (Tencent), it is still a rare positive trend;

Regarding management's guidance on short-term performance:

Q4 revenue and adjusted profit basically meet expectations—revenue guidance is expected to be between $480 million and $490 million, a year-on-year increase of 5%-7%, slightly exceeding expectations; adjusted EBITDA is expected to be between $110 million and $115 million, meeting expectations.

Considering the new management's guidance style tends to be cautious, the actual performance should be better, but the previous optimistic expectations of the buy-side were not low, only suppressed by channel research sentiment in the past month.

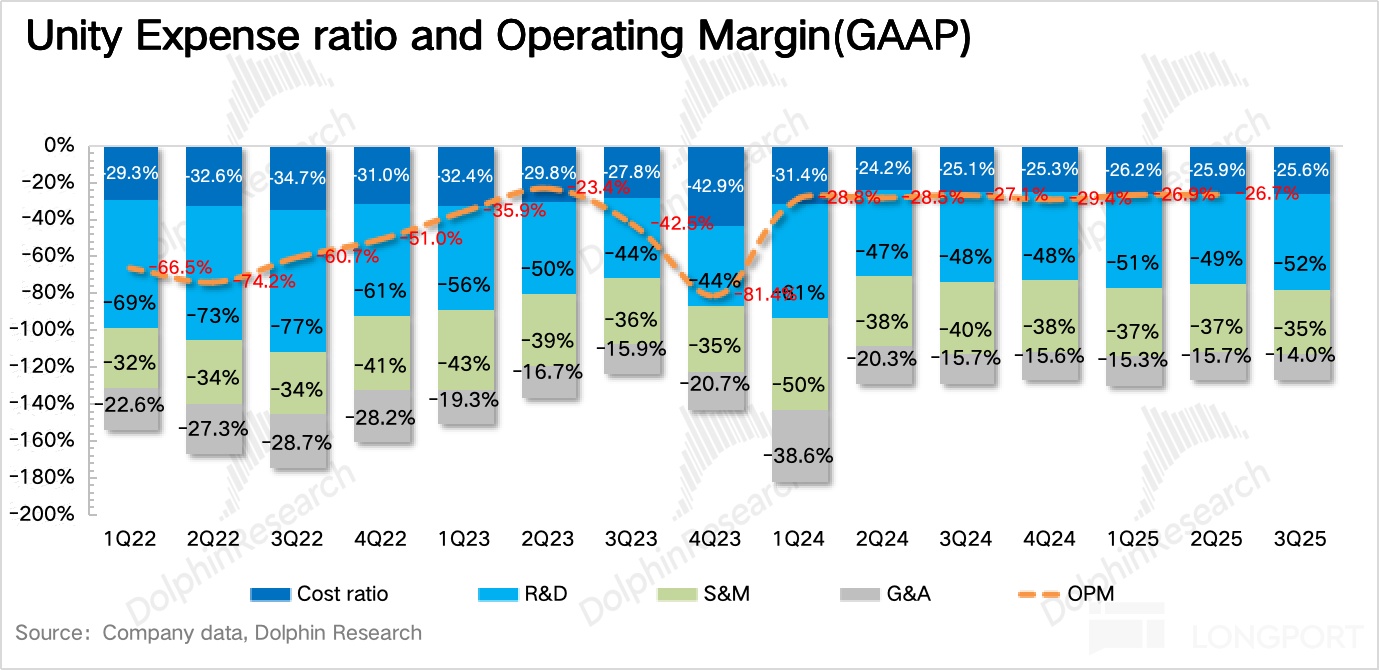

III. Besides a change in intangible asset amortization, short-term expenses continue to be optimized

Q3 Non-GAAP EBITDA profit margin increased by 3 percentage points quarter-on-quarter, mainly due to expense optimization. Additionally, benefiting from the improvement of the main business, free cash flow reached $150 million, the highest free cash flow scale in the company's history.

It is worth mentioning that under GAAP, R&D expenses increased significantly, mainly due to accelerated amortization of technical assets acquired during the acquisition of Weta (already divested). The amortization period was shortened from the original 4-7 years to 1-3 years, resulting in high expenses for the current quarter. However, the company and the market are still focusing on Non-GAAP EBITDA for Unity, so it does not affect actual expectations.

<End here>

Dolphin Research "Unity" Related Reading:

Earnings Season (Past Year)

August 6, 2025 Conference Call《Unity (Minutes): Vector is still in its early stages, it's a continuous gradual process》

August 6, 2025 Earnings Review《Crazy Roller Coaster, Does Unity Have a "U" Turning Point?》

May 7, 2025 Conference Call《Unity: Vector has driven customers to increase ad budgets》

May 7, 2025 Earnings Review《Unity: Can the bubble still be blown bigger?》

February 21, 2025 Conference Call《Unity (Minutes): "Briefing" on the new model》

February 21, 2025 Earnings Review《Pressed by Applovin for too long? Unity hasn't started yet!》

November 9, 2024 Conference Call《Unity: Customer relationships, product quality, and execution (3Q24 earnings call)》

November 9, 2024 Earnings Review《Soul searching, has Unity's "bottom" been worn out?》

August 10, 2024 Conference Call《Unity: It's too early to talk about goals, execution is the top priority (2Q24 conference call minutes)》

August 10, 2024 Earnings Review《Unreasonable surge, but "new" Unity is promising》

May 10, 2024 Conference Call《Unity: Customer communication has improved, business improvement in the second half (1Q24 conference call minutes)》

May 10, 2024 Earnings Review《Unity: Near the end of bone scraping therapy?》

Hot Comments

July 17, 2025《Unity's surge review》

In-depth

January 10, 2025《Can Unity replicate Applovin's "money-making ability"?》

October 12, 2022《The winter of games has arrived, where is the warm spring?》

April 1, 2022《 Several interesting points in "Unity 2022 Global Game Report"》

March 17, 2022《Using "Metaverse" imagination to boost valuation? Unity says it can be done》

March 9, 2022《The unclear metaverse, the clear Unity》

Risk Disclosure and Statement of this Article:Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.