Without the high-growth violent aesthetics, is Applovin still appealing?

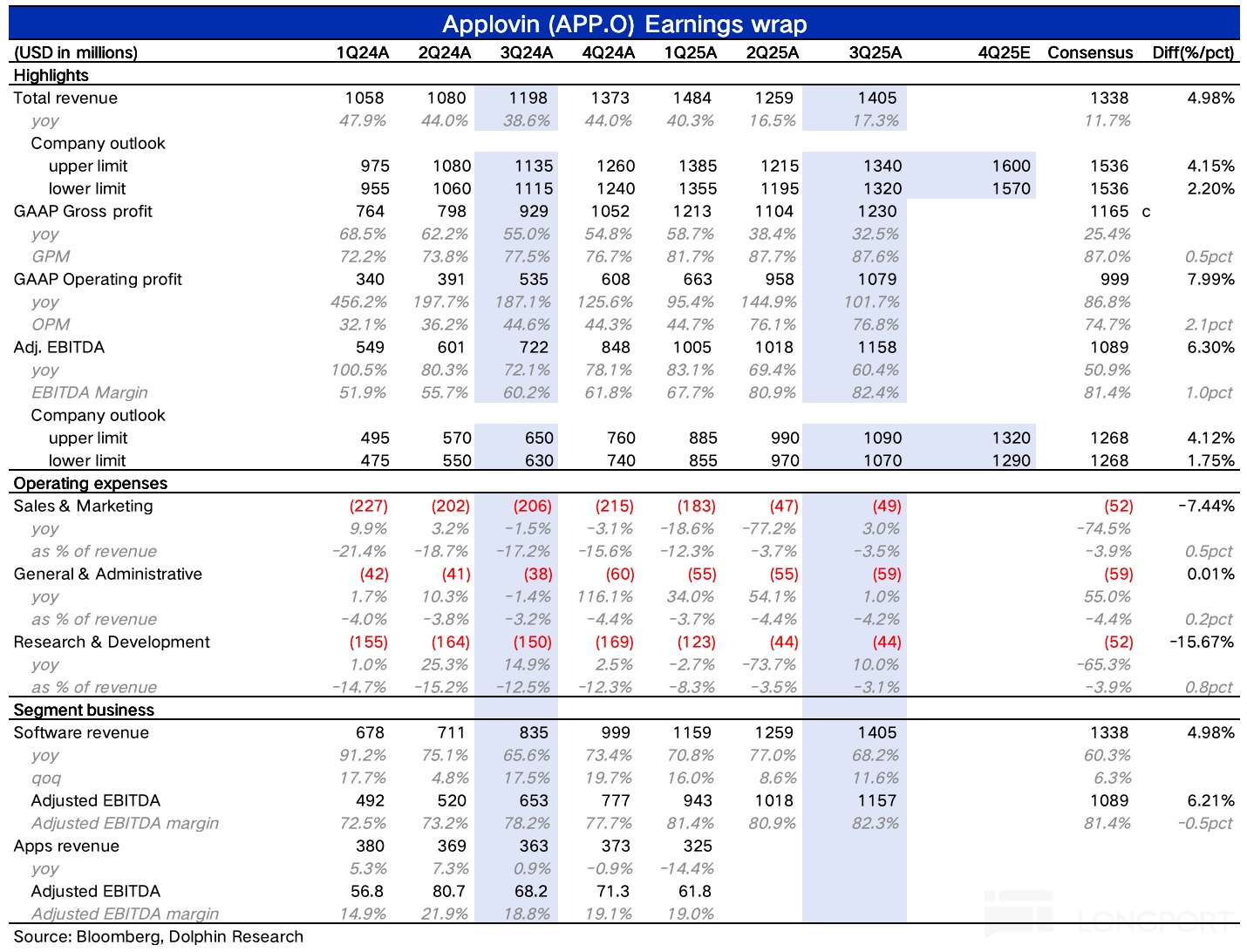

$AppLovin(APP.US) released its Q3 2025 financial report after the U.S. stock market closed on November 6th, Eastern Time. The results slightly exceeded consensus expectations, including current revenue growth and margin optimization, as well as guidance for Q4.

The Q4 guidance implies a slowdown in AppLovin's advertising growth, seemingly partially confirming the speculation that the initial response to the self-service advertising platform was mediocre. Dolphin Research believes that since the self-service advertising is still in the testing phase in specific regions, the Q4 guidance alone cannot fully demonstrate the driving effect of the self-service advertising. It is recommended to pay attention to the detailed discussion by management on the actual effects during the conference call.

Specifically:

1. Growth guidance slightly exceeds expectations: For AppLovin, as it is in a critical period of business expansion, guidance remains the most important indicator to watch.

The actual Q4 guidance slightly exceeded expectations, especially after the customer response to the self-service advertising platform was not as impressive as expected before the earnings report, preventing a "punishment" like last quarter due to the lack of explosive surprises.

Sequentially, both Q3 and Q4 showed acceleration (growing by 11.6% and 13.9%, respectively), which is also higher than the short to medium-term guidance of 5% sequential growth. This reflects the holiday season effect at the end of the year and also alleviates concerns about a rapid deceleration in growth next year.

2. The effect of the self-service advertising system has not been fully reflected: The self-service platform officially launched in October, but initially, it was mainly quantitatively tested in the U.S. region and will be gradually rolled out globally next year. Therefore, Q4 cannot fully reflect the effect of the self-service platform. Here, you can look at the relevant descriptions by management during the conference call, such as operational indicators like the scale of new customer access.

If we assume a 20% organic growth rate for game advertising as per the company's guidance, then of the $1.6 billion advertising revenue guidance for Q4, an estimated $400 million will come from non-gaming revenue. Annually, this means at least $1.6 billion in new non-gaming revenue. Coupled with the 20% organic growth of the gaming segment itself, it is roughly estimated that next year's revenue growth will be over 30%.

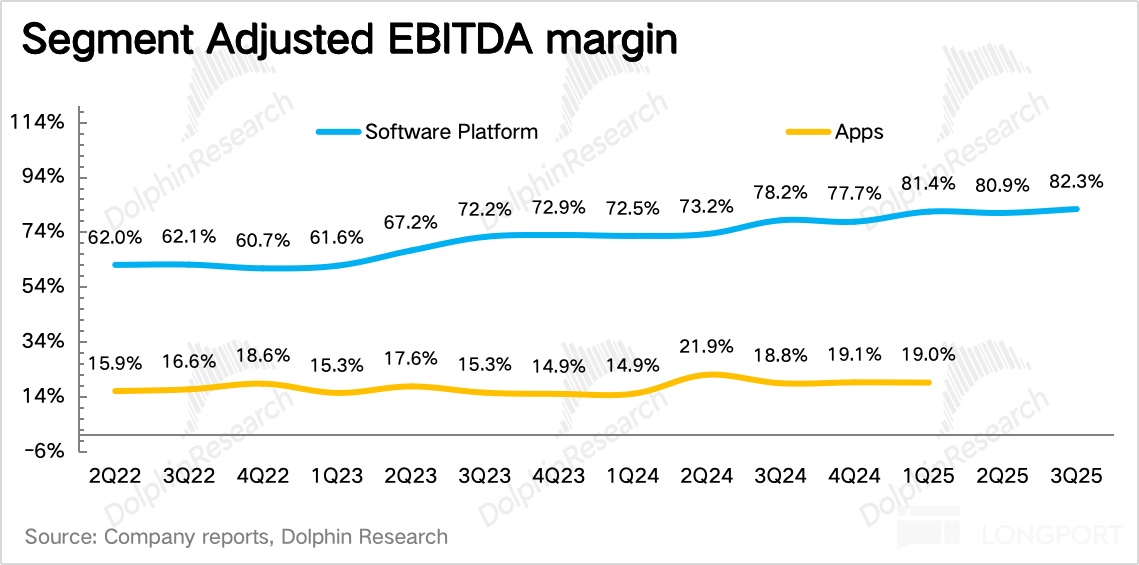

3. Profitability to the extreme, further improvement becomes more challenging: Although the operating profit margin reached 76% and adjusted EBITDA reached 81% after divesting the 1P gaming application business last quarter, the third quarter once again leveraged the cash cow advantage of pure advertising mediation, further increasing the operating profit margin to 76.8%, with the EBITDA margin increasing by 1.5 percentage points sequentially. With the subsequent cost recognition of the new platform and investment in new market expansion, especially the expenditure on expanding the sales team, the room for further improvement is relatively limited.

4. Increase in repurchase quota: The repurchase effort increased in the third quarter, spending $570 million to repurchase 1.3 million shares at an average repurchase price of $440 per share. This time, it also announced an increase in the repurchase quota by $3.2 billion, with the remaining repurchase quota close to $3.3 billion as of the end of October. However, compared to a market value of over $200 billion, this repurchase scale is not enough to be singled out as shareholder returns, but at least the attitude is shown.

5. Overview of important financial indicators

Dolphin Research's View

Overall, there is no issue with AppLovin's Q3 performance, but more elaboration from management on the current state of the self-service platform, especially the real feedback from existing customers, needs attention.

Entering the third quarter, as AppLovin's market value surged past $250 billion before the launch of the advertising self-service platform, market views on AppLovin began to diverge.

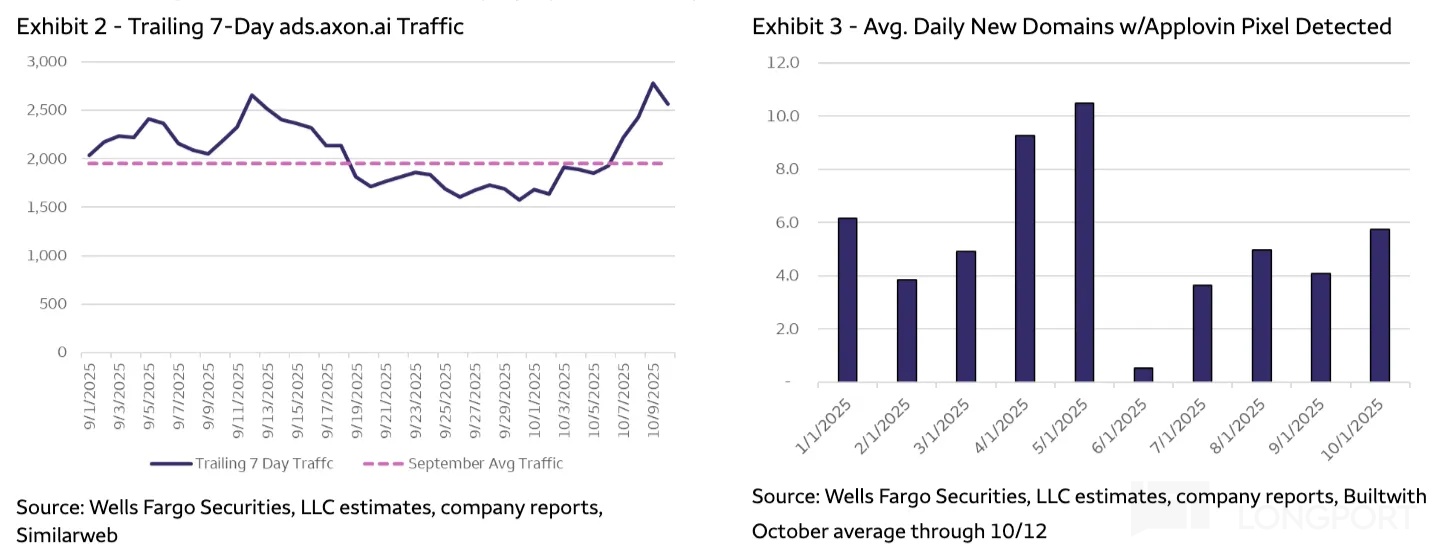

One key factor is that the effect of the self-service platform does not seem to be as "astonishing" as expected (as shown in the figure below, the peak traffic on the AXON website at the beginning of October when the self-service platform was launched is not much different from the peak in September). AppLovin's advertising self-service platform (Axon Ad Manager) is a one-stop traffic tool specifically designed for numerous small and medium-sized businesses, mainly to facilitate AppLovin's expansion and penetration into the larger non-gaming market.

However, in the early stages of launch, the self-service advertising platform is still being tested by invitation in specific regions and is planned to be rolled out globally next year. Therefore, the effect of the self-service advertising platform implied by the Q4 guidance is not comprehensive, which is one of the main reasons why the market's valuation sentiment has been continuously suppressed due to the lack of impressive feedback from the self-service advertising platform in the past month.

Another factor is the SEC's investigation into AppLovin for alleged data collection violations and user data privacy infringements, which caused the stock price to plummet on the day of the announcement. The investigation results are not yet available, and the company has not issued any official risk warning announcements regarding this investigation. However, if we assume a worst-case scenario, based on previous fines for Meta and Google, it is expected that AppLovin could face a fine of up to 5% of its annual revenue. Based on 2025 calculations, this would be less than $300 million, which would have a significant impact on the EPS for that year.

However, AppLovin's valuation should currently focus more on revenue growth. Assuming normal game advertising growth and annualized Q4 non-gaming advertising increments, Dolphin Research estimates that AppLovin can maintain at least 30% growth next year. With a closing market value of $208 billion on the day, the valuation for next year corresponds to an EV/EBITDA of 34x, which is basically in line with the current growth rate. If the SEC investigation results in the highest possible fine and market sentiment weakens, it is worth watching whether this will bring a high safety margin correction opportunity.

Detailed Analysis Below

I. Growth Guidance Slightly Exceeds Expectations

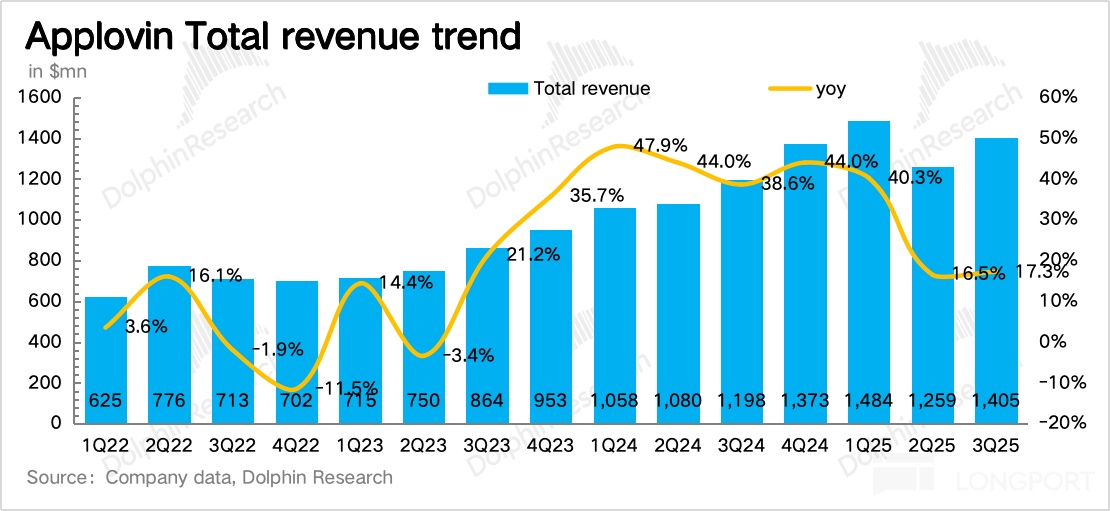

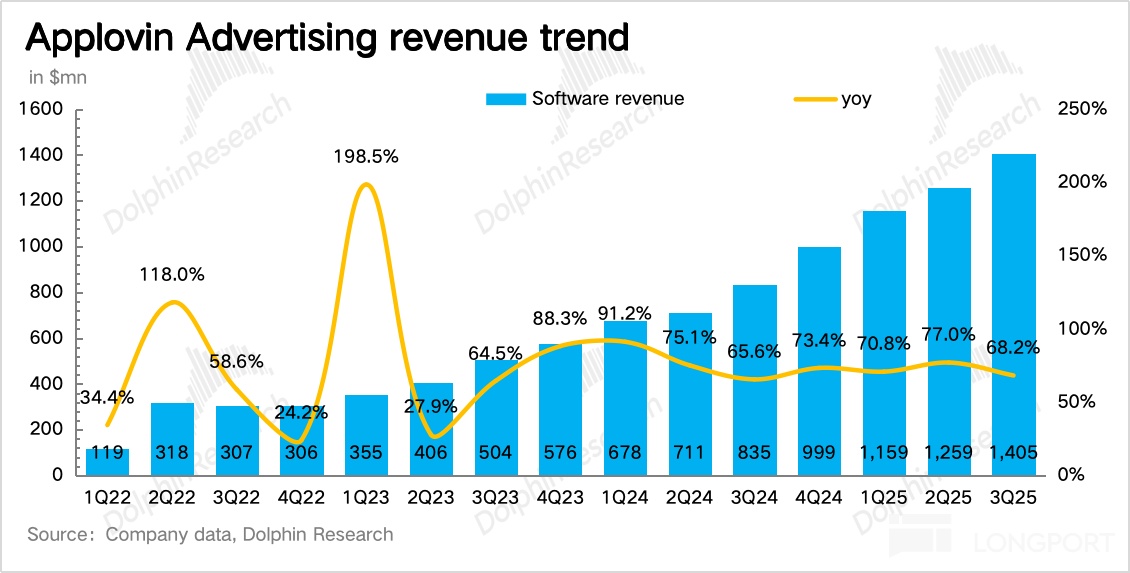

In the third quarter, AppLovin achieved total revenue of $1.405 billion, a year-on-year increase of 17%, exceeding consensus expectations. Excluding the impact of the divestiture of the 1P gaming application, the advertising year-on-year growth rate was 68%, showing a natural slowdown compared to 77% in the previous quarter.

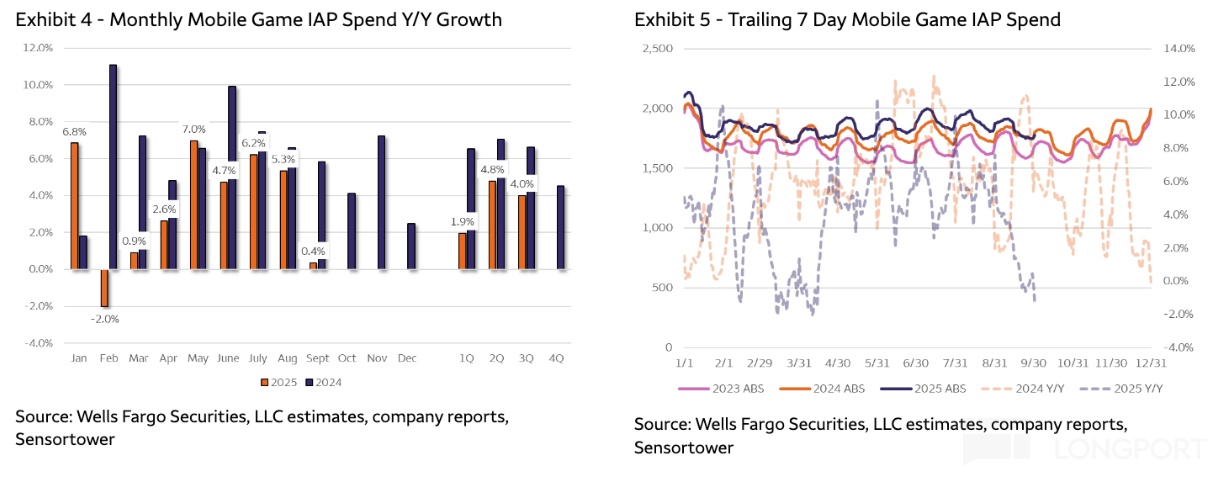

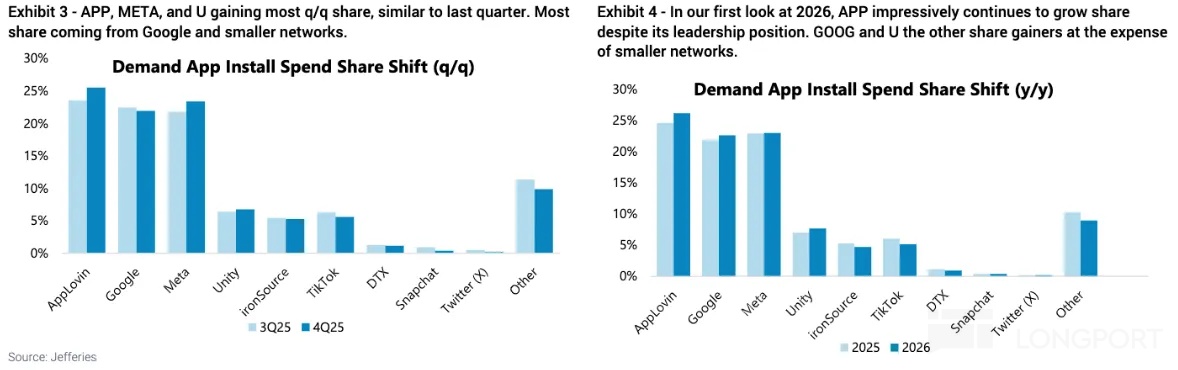

The Q4 revenue guidance is $1.57-1.6 billion, implying a growth rate close to 60% (excluding the divestiture impact), further slowing down. Although from a sequential perspective, both the third and fourth quarters show healthy acceleration. This includes the seasonal effect and the still strong gaming advertising (AppLovin further increased its market share in the gaming application advertising market in the third quarter).

If we assume a 20% organic growth rate for game advertising as per the company's guidance (as shown in the figure below, the overall gaming market remained stable in the third quarter, while AppLovin's market share in gaming advertising increased):

Then, of the $1.6 billion advertising revenue guidance for Q4, an estimated $400 million will come from non-gaming advertising revenue. Compared to the $200-300 million in the previous quarter, this continues to expand. However, it also seems to confirm that the pull from the self-service advertising platform in October may still be relatively limited, falling short of previous high expectations.

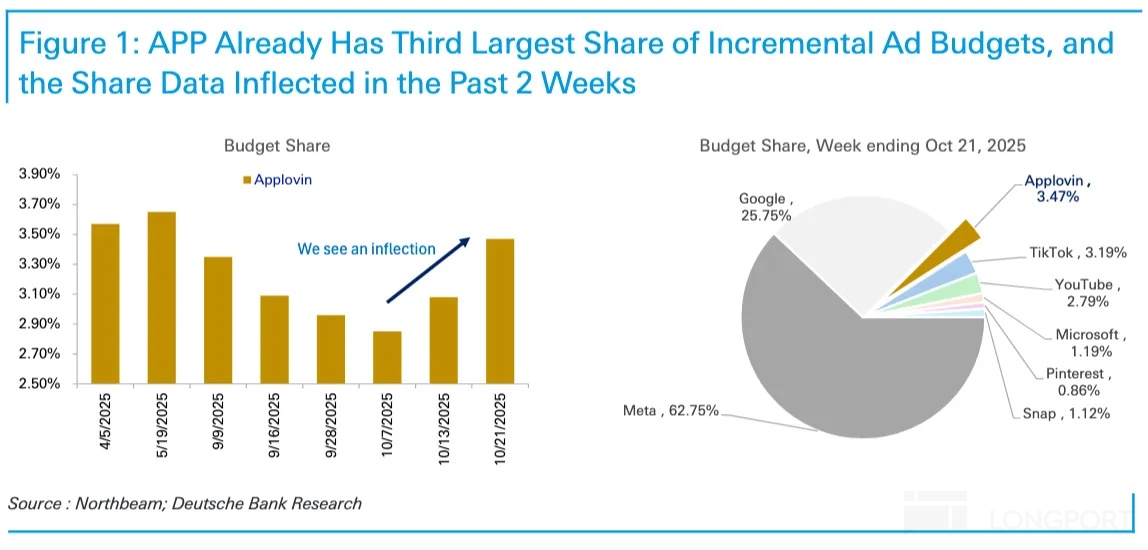

Of course, this may be related to the current scope of promotional testing, and the fourth quarter cannot fully reflect the effect of the self-service platform. According to third-party data (Northbeam), AppLovin's share in new e-commerce advertising placements only began to recover in mid-October, surpassing TikTok to become the third-largest advertising channel after Meta and Google. Of course, it is also best to pay attention to more detailed descriptions from management during the conference call about the self-service platform, especially feedback from small and medium-sized businesses.

II. Profitability Continues to Optimize, but Future Space May Be Limited

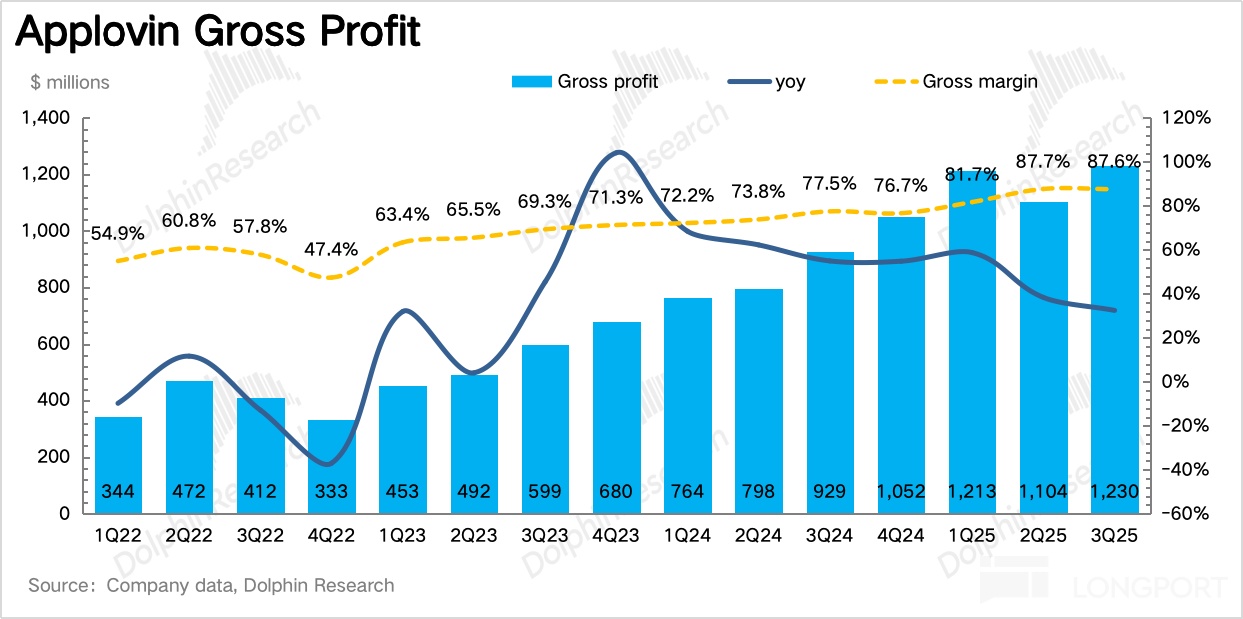

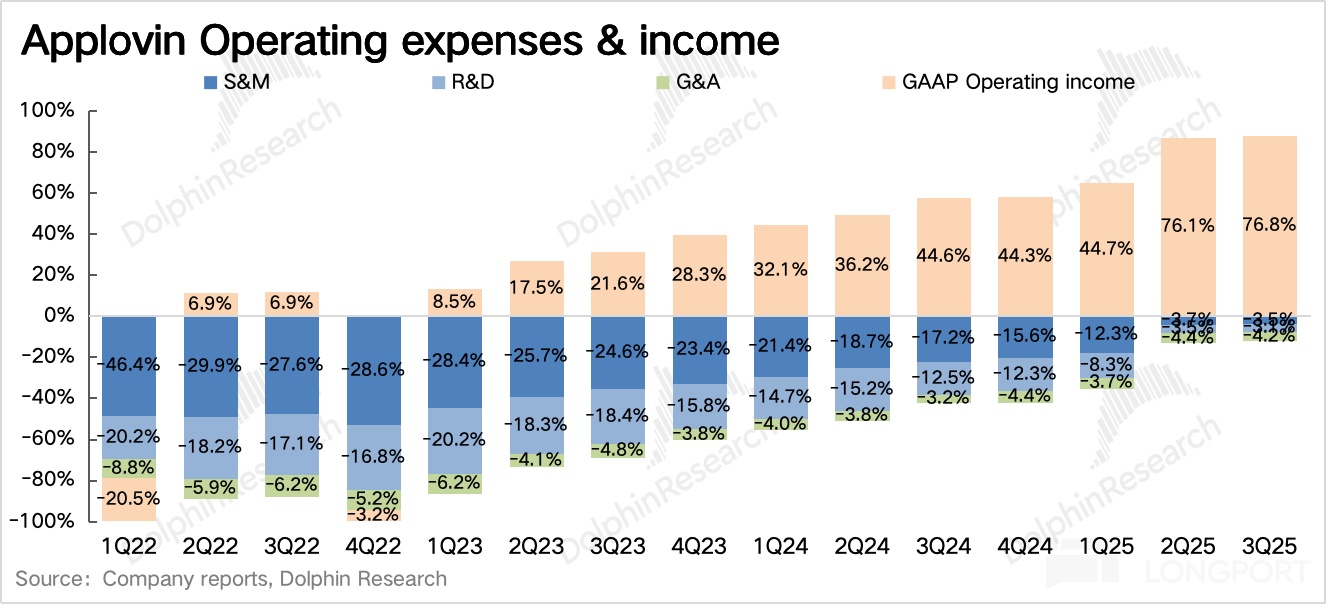

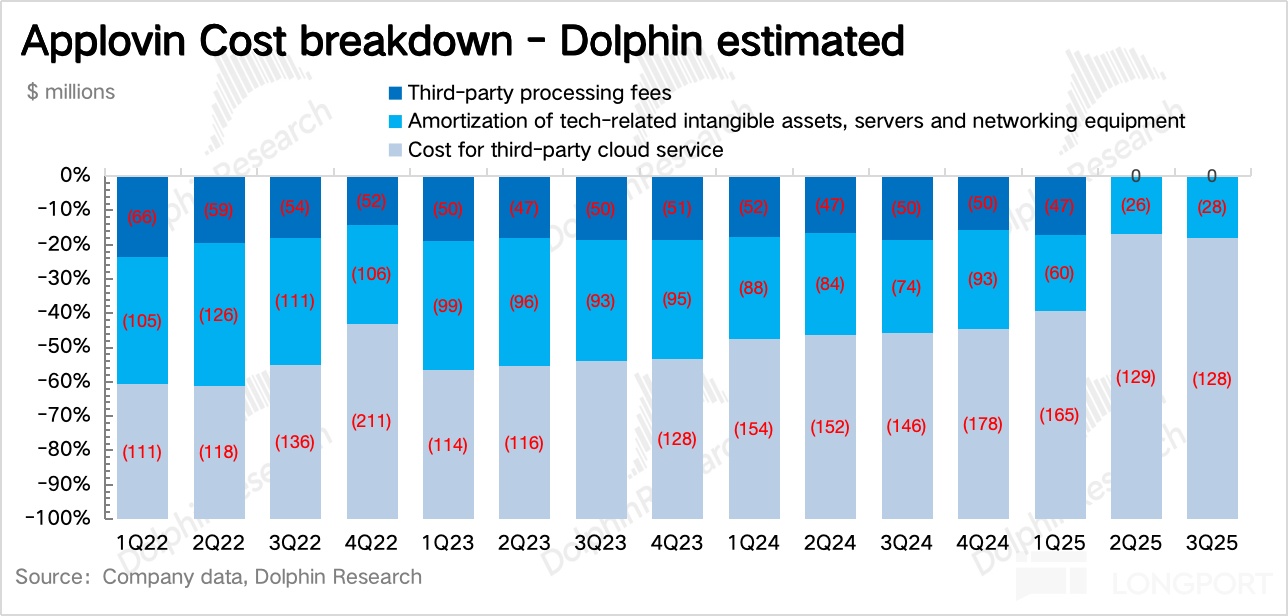

In the third quarter, the company achieved an EBITDA margin of 82%, continuing to increase by 1.5 percentage points sequentially. Compared to the cost and expense of the previous quarter, the optimization mainly came from strict control of operating expenses.

Sales expenses and administrative expenses in the third quarter only increased by 3.6% and 6.9% sequentially, while R&D expenses directly shrank in absolute terms. From the SBC perspective, it decreased by $800,000 sequentially in the third quarter, but the market value more than doubled during the same period, indicating continued optimization of team size in the third quarter.

However, the current profit margin level of 82% is already relatively extreme, and with the subsequent cost recognition of the self-service platform and investment in new market expansion, especially the expenditure on expanding the sales team, the room for further improvement is relatively limited.

<End Here>

Dolphin Research's Historical Study on "AppLovin"

Financial Reports

August 7, 2025, Conference Call "AppLovin (Minutes): The self-service advertising platform will be launched in October this year"

August 7, 2025, Financial Report Review "AppLovin: All tricks exhausted, what will the advertising overlord use to amaze the audience?"

May 7, 2025, Conference Call "AppLovin (Minutes), customers are queuing to join"

May 7, 2025, Financial Report Review "AppLovin: Short sellers take turns, but can't beat the strong performance"

February 12, 2025, Conference Call Minutes "AppLovin (Minutes): Can technology really meet cross-market demand?"

February 12, 2025, Financial Report Review "Surge 30%! How did AppLovin beat the shorts?"

Hot Reviews

March 30, 2025, Short Report Review "Muddy Waters also hammered! Is AppLovin really a 'flawed egg'?"

February 28, 2025, Short Report Review "Six-fold bloodbath, is AppLovin guilty to this extent?"

In-depth

January 10, 2025, Initial Coverage Part II "Copying the gourd, can Unity replicate AppLovin's 'money-making ability'?"

January 3, 2025, Initial Coverage Part I "'Cool Article' AppLovin Big Reveal: A Five-Year Winning Plan"

Risk Disclosure and Statement of This Article:Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.