Qualcomm: Shedding the 'Mobile Stock' Label, Is AI Computing Power the 'New Hope'?

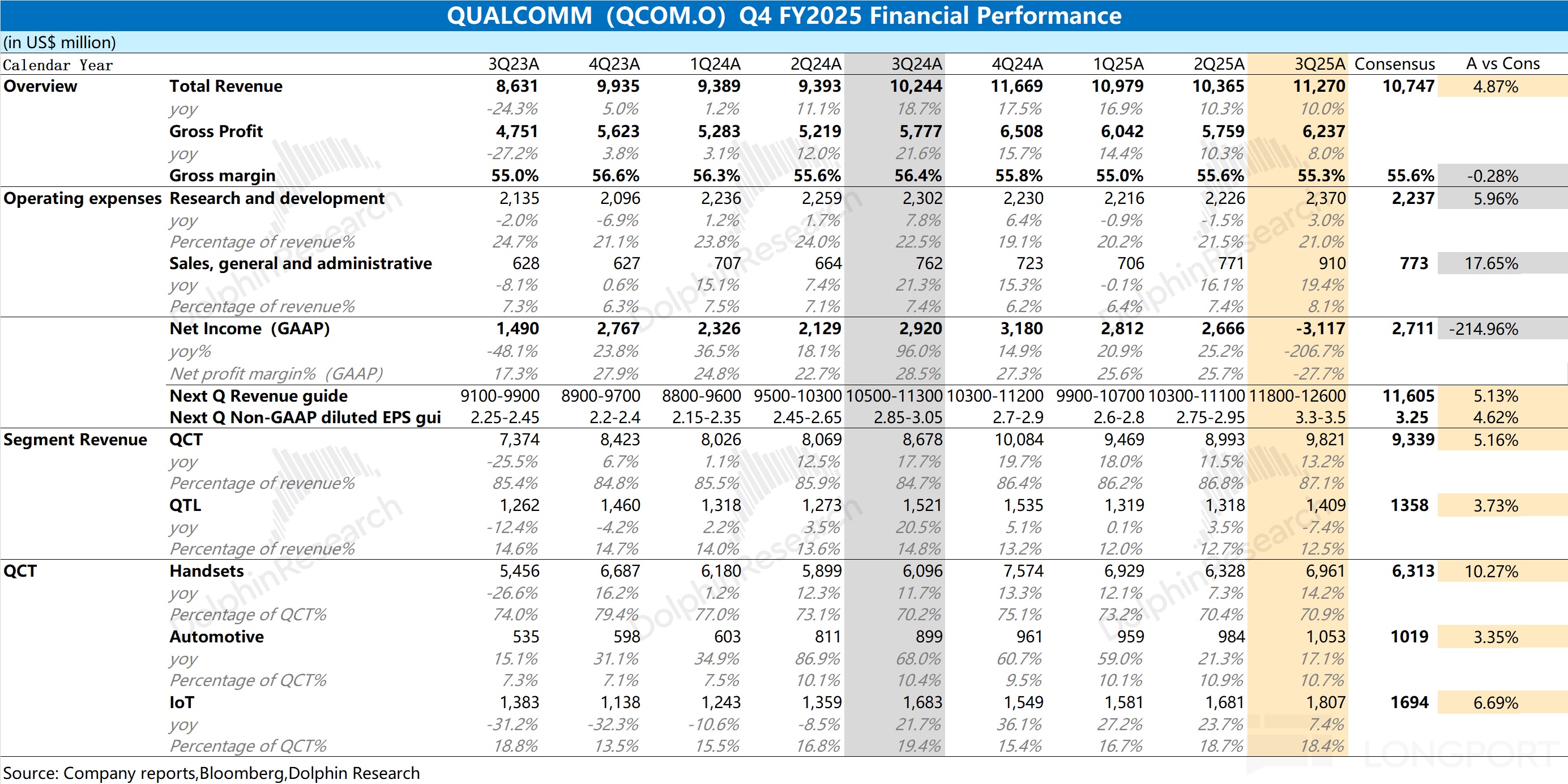

Qualcomm (QCOM.O) released its Q4 FY2025 earnings report (ending September 2025) after the U.S. stock market closed on the morning of November 6, 2025, Beijing time. Key points are as follows:

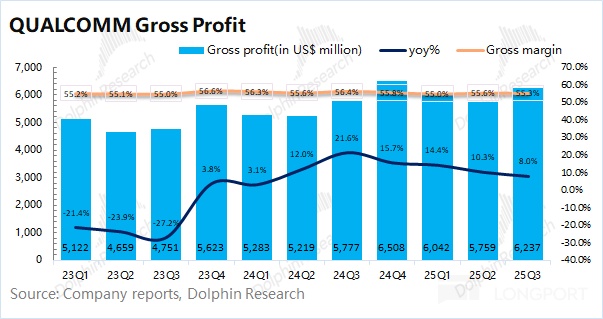

1. Core Data: Qualcomm's revenue for the quarter was $11.27 billion, up 10% year-on-year, better than market expectations ($10.75 billion). The company's mobile business accelerated growth driven by new products, while IoT and automotive business growth slowed. The company's gross margin for the quarter was 55.3%, down 1.1 percentage points year-on-year, slightly below market expectations (55.6%). Due to the relatively low gross margin of the company's hardware business (QCT), the increased proportion of hardware this quarter diluted the overall gross margin.

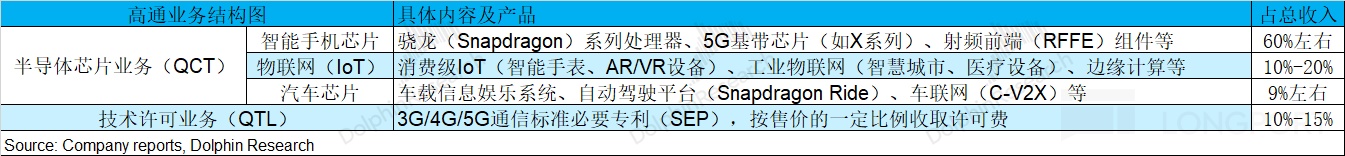

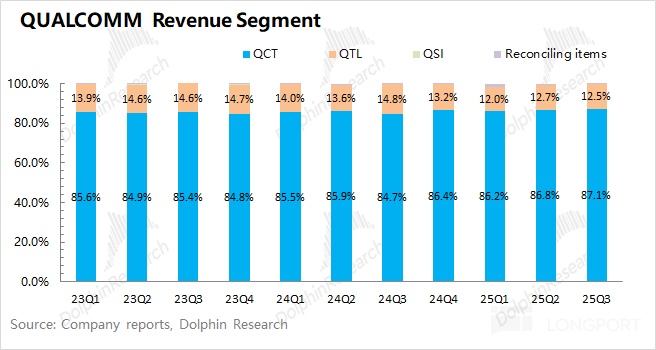

2. Specific Business Situation: $Qualcomm(QCOM.US) has two main business segments: semiconductor chip business (QCT) and technology licensing business (QTL), with semiconductor chip business being the largest revenue source, accounting for nearly 90%.

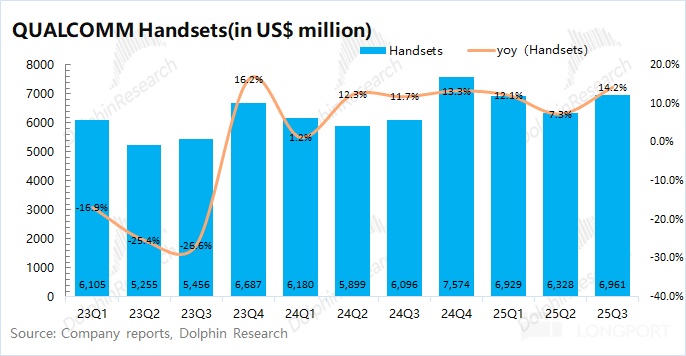

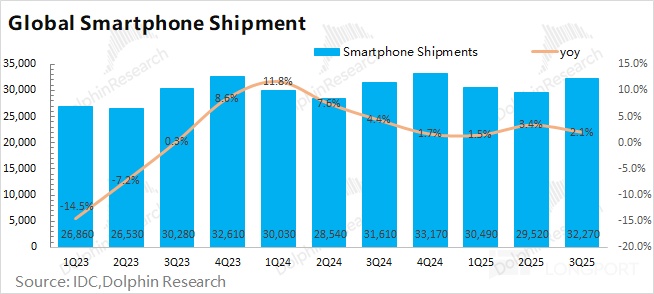

In the semiconductor chip business: ① Mobile business revenue for the quarter was $6.96 billion, up 14.2% year-on-year. Although the company's mobile business growth accelerated, this was mainly due to the demand brought forward by the early release of the company's flagship new product. From the global mobile phone shipment growth rate of low single digits, the demand in the mobile market remains weak;

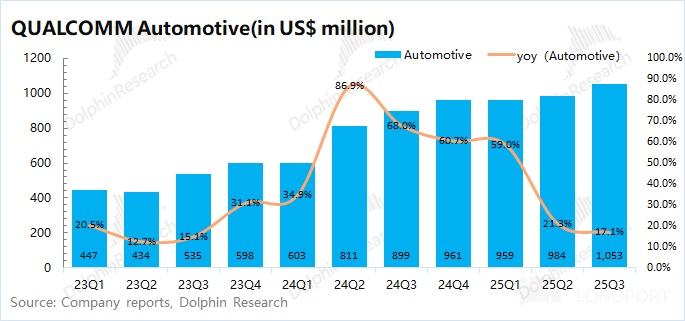

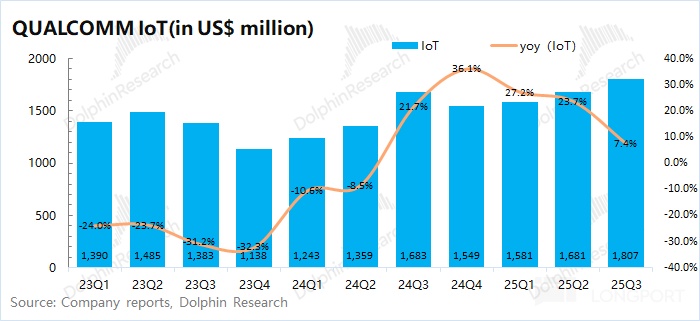

② Automotive business revenue for the quarter was $1.05 billion, up 17.1% year-on-year, driven by the growth in shipments of Snapdragon digital cockpit; ③ IoT business revenue for the quarter was $1.81 billion, up 7.4% year-on-year, growth driven by industrial WiFi 7 and smart glasses. Compared to the previous four quarters of 20%+ year-on-year growth, IoT revenue growth slowed significantly this quarter.

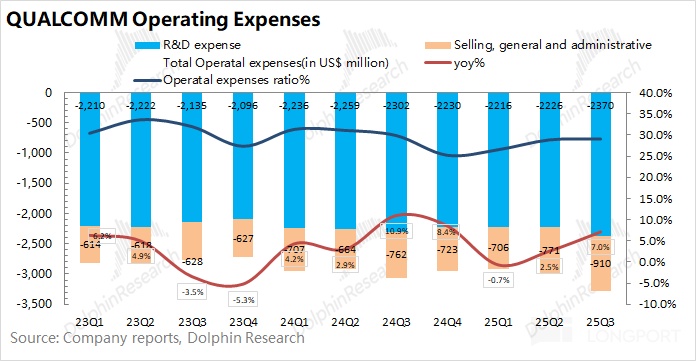

3. Operating Expenses: The company's operating expenses remained around $3.28 billion, with R&D expenses slightly increasing to around $2.37 billion, and quarterly sales expenses also growing to $910 million. The growth rate of operating expenses was similar to the revenue growth rate, maintaining an operating expense ratio of around 29%.

4. Next Quarter Guidance: Qualcomm expects Q1 FY2026 revenue to be $11.8-12.6 billion, market expectations ($11.6 billion). The midpoint of the range represents an 8% quarter-on-quarter growth, lower than the 13% in the same period last year. The company expects next quarter's Non-GAAP EPS to be $3.3-3.5, market expectations ($3.25). Due to the impact of the early release of new products, the company's seasonal demand performance was also brought forward.

Dolphin Research's Overall View: Traditional business lacks highlights, still needs AI big orders to boost

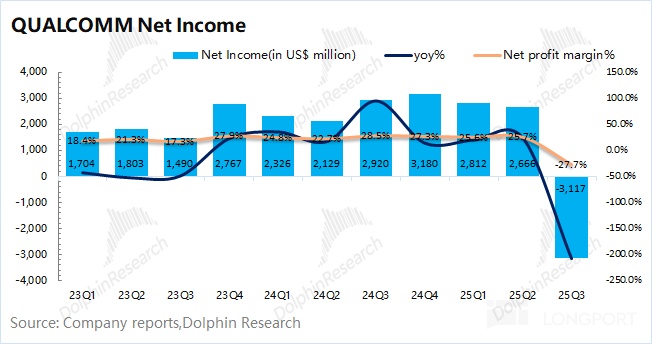

Qualcomm's performance this quarter was relatively flat, with revenue exceeding expectations mainly due to the early release of flagship new products. As for the decline in profits this quarter, it was mainly affected by the company's inclusion of a $5.7 billion deferred tax asset reserve. Excluding this impact, the company's net profit for the quarter was about $2.6 billion. The increase in R&D expenditure and sales and management expenses affected quarterly profits.

The company's current mobile business is still the largest source of revenue, accounting for 60% of total revenue. The acceleration in mobile business growth this quarter does not indicate an improvement in demand in the Android mobile market (global mobile market shipment growth in Q3 was only low single digits), but is mainly due to the company's early release of this year's flagship mobile SoC—Snapdragon 8 Elite Gen5, which was released nearly a month earlier than the previous generation Gen4, thus the downstream manufacturers' stocking demand was also brought forward.

Regarding the company's next quarter guidance, the company expects next quarter's revenue to be $11.8-12.6 billion, better than market expectations ($11.6 billion). However, if viewed from the midpoint of the range ($12.2 billion) with an 8% quarter-on-quarter increase, it is actually lower than the 13% increase in the same period last year, which also confirms the impact of demand being brought forward due to the release of new products.

Regarding Qualcomm's business, it can actually be divided into traditional business and AI layout:

a) Traditional business: is the main source of Qualcomm's current performance, mainly including mobile business and IoT business. Due to the company's mobile chip downstream customers being mainly Android brands, with Apple's lack of innovation and the support from China's state subsidies, the company's mobile chip business has warmed up.

However, the basic version of the iPhone's new product adopts a "more for less" cost-effective strategy, which will directly compete with the mid-to-high-end market of Android systems. On the other hand, China's state subsidy policy has tightened (many places have changed to a "lottery" method), which will also weaken the demand performance of the mobile and IoT markets, and Qualcomm's traditional business will face growth pressure in the next fiscal year.

b) AI layout (AI PC and data center): has little impact on performance in the short term but provides future growth highlights.

① AI PC: Qualcomm's AI PC products are centered around the Snapdragon X series, with partner manufacturers including Lenovo, Dell, HP, and other mainstream brands. The Snapdragon X2Elite released by the company in September this year is equipped with Hexagon NPU with 80TOPS computing power (previous generation computing power was 45TOPS).

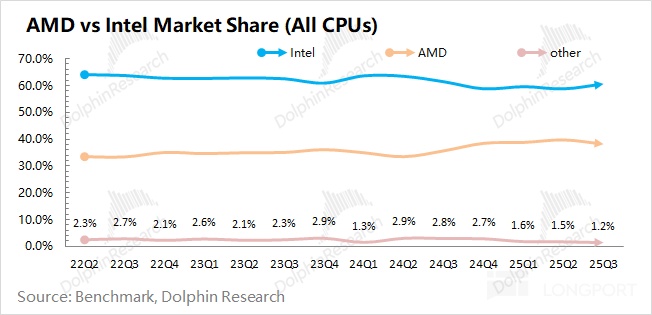

Qualcomm's key strategy for AI PC is "Copilot+ PC," currently the Snapdragon X series exclusively supports Microsoft's Copilot+, capable of running GPT-4o model locally. Although the company has already entered the PC market, the current market share is still less than 1%, making it difficult to compete with Intel and AMD.

Qualcomm once expected the AI PC business to grow to $4 billion by 2029, with a global share exceeding 10%. Since the current AI PC is expected to account for only a low single digit percentage of the company's total revenue, and at the same time, the company's AI PC products have not yet shown competitiveness, the current market has not priced the company's AI PC.

② AI data center: Qualcomm announced the launch of two new AI chips—AI200 and AI250 at the end of October, marking the company's strategic shift towards the data center market. The company announced that Saudi Arabia's AI startup Humain has become the company's first customer, planning to deploy 200 megawatts of computing power based on AI200 chips starting in 2026 (Dolphin Research estimates it could bring about $3 billion in revenue opportunities).

The computing power of the two products has not yet been disclosed, from the current information: 1) AI200 is a rack-level solution, with "high memory capacity + low total cost of ownership (TCO)" as the core, specifically optimized for large language models (LLM) and multimodal model inference scenarios; 2) AI250 adopts a near-memory computing architecture, with the core advantage of "effective memory bandwidth increased by more than 10 times + lower power consumption," focusing on inference scenarios with extremely high memory bandwidth requirements.

Dolphin Research believes Qualcomm plans to avoid the "AI training" field dominated by Nvidia and choose the high-demand niche of AI inference. By combining "AI200 (low-cost scale) + AI250 (high-performance scenarios)," it aims to meet different customers' inference needs.

Overall (a+b), Qualcomm has always wanted to break away from the "mobile chip" single market dependency to find new growth points in AI and other fields. The company first entered the AI PC field, but in the mature market divided by Intel and AMD, the company still finds it difficult to quickly gain market share. Under the influence of the hot AI Capex, Qualcomm has also turned its attention to the computing power chip field, hoping to "get a share" in the AI chip field and transform into a "multi-scenario AI hardware manufacturer."

Considering Qualcomm's current market value ($193.9 billion), it corresponds to about 15x PE of the company's net profit for FY2026 (assuming revenue grows 5% year-on-year, gross margin 55.5%, tax rate 10%). Referring to the historical valuation range (10-20x PE), the company's current valuation is roughly in the middle of the range.

Overall, Qualcomm's performance and guidance this quarter are relatively flat, with both mobile and IoT businesses affected by the tightening of state subsidy policies, and the company's traditional business is unlikely to have highlights in the short term or next fiscal year.

It is very clear that the company's stock price has always been flat, basically maintaining a range of $150-170, which also expresses the market's view that the company's "mobile business" is not attractive. When the company announced its entry into the data center market at the end of October, the company's stock price rose by double digits on the day, breaking through $200. Subsequently, the company did not continue to provide progress in the AI field, and the stock price fell back again.

Considering the company's situation and current valuation, Dolphin Research believes that the current valuation of about 15x PE mainly includes "pricing of the company's mobile business" and "a little enthusiasm for data center and AI." This is also because the company's AI PC business has not yet shown obvious competitiveness, and the data center business has just announced its entry and a future order of about $3 billion.

This series of operations shows the company's determination to shift from "mobile chip manufacturer" to "AI hardware manufacturer," but the market remains cautious about how much success can be achieved, and has not yet priced the company.

In the current situation, the performance of the company's traditional business is not important, if the market is more looking forward to the company's breakthrough in the AI field. If the company can show AI PC competitiveness performance, "big orders" from the data center, it is expected to allow the market to re-price AI PC or data center, and the company's valuation can truly improve.

For investing in Qualcomm, if viewed as a "mobile chip stock," then the current 15x PE for single-digit growth performance does not have "cost-effectiveness." As for the layout of AI PC and computing power chips, it is more like an "upward" option for the company. The final realization degree requires the company to provide "orders" or "performance" to give confidence in growth. If the company only talks about "planning" without substantial breakthrough performance, it will still return to the "mobile stock" state.

The following is Dolphin Research's specific content on Qualcomm's earnings report:

I. Overall Performance: Early release of new products drives demand forward

1.1 Revenue

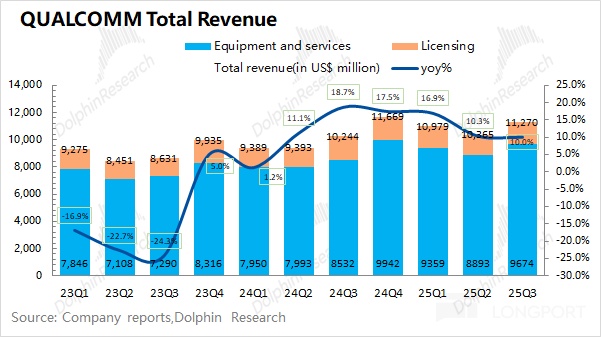

Qualcomm achieved revenue of $11.27 billion in Q4 FY2025 (i.e., 25Q3), up 10% year-on-year, better than market expectations ($10.75 billion). Growth in QCT (semiconductor chip business) in smartphones, automotive, and IoT drove the increase, while QTL (technology licensing business) declined year-on-year.

The revenue exceeding expectations this quarter was mainly due to the impact of demand being brought forward by the early release of new products.

1.2 Gross Margin

Qualcomm achieved a gross profit of $6.24 billion in Q4 FY2025 (i.e., 25Q3), up 8% year-on-year.

The company's gross margin for the quarter was 55.3%, down 1.1 percentage points year-on-year, lower than market expectations (55.6%). The impact of the increased proportion of QCT business with relatively low gross margin diluted the overall gross margin.

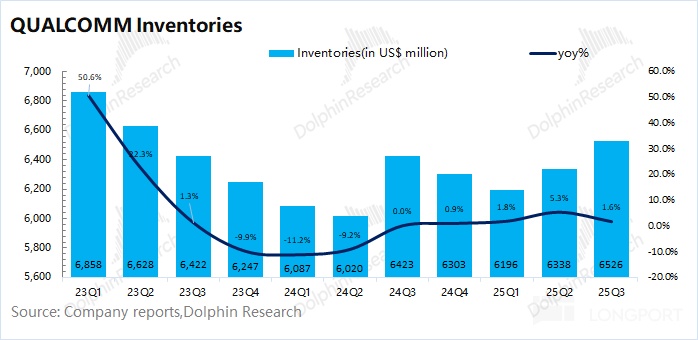

Qualcomm's inventory in Q4 FY2025 (i.e., 25Q3) was $6.53 billion, up 1.6% year-on-year. Typically, the second half of the year is the peak season for electronic products, and the company needs to stock up to meet customer demand. The current inventory situation is relatively reasonable.

1.3 Operating Expenses

Qualcomm's operating expenses in Q4 FY2025 (i.e., 25Q3) were $3.28 billion, up 7% year-on-year. The growth rate of operating expenses was similar to the revenue growth rate, and the company's operating expense ratio for the quarter remained at 29.1%.

Among them, 1) R&D expenses: the company's R&D expenses for the quarter were $2.37 billion, up 3% year-on-year, still the largest investment; 2) Sales and management expenses: the company's sales and management expenses for the quarter were $910 million, up 19% year-on-year, in the context of weak mobile market demand, the company increased corresponding expenses.

1.4 Net Profit

Qualcomm's net profit in Q4 FY2025 (i.e., 25Q3) was -$3.1 billion, mainly due to the company's inclusion of a $5.7 billion deferred tax asset reserve this quarter.

Excluding this impact, the company's net profit for the quarter would return to around $2.6 billion, slightly below market expectations ($2.7 billion), mainly affected by the increase in operating expenses.

II. Business Segments: Traditional business lacks highlights, still needs to rely on AI

From Qualcomm's business segment situation, QCT (CDMA business) remains the company's largest revenue source this quarter, accounting for 87%, mainly including revenue from the chip semiconductor part; the rest of the revenue mainly comes from QTL (technology licensing) business, accounting for about 12%.

The main growth for Qualcomm this quarter still came from the QCT business, with different degrees of growth in mobile, automotive, and IoT businesses, while QTL business revenue declined year-on-year.

QCT business is the most important part of the company, specifically subdivided:

2.1 Mobile Business

Qualcomm's mobile business achieved revenue of $6.96 billion in Q4 FY2025 (i.e., 25Q3), up 14.2% year-on-year, better than market expectations ($6.31 billion). The mobile business exceeded expectations mainly due to the impact of the early release of the company's flagship new product—Snapdragon 8 Elite Gen5.

Last year's Snapdragon 8 Elite Gen4 was released in late October, while this year's Snapdragon 8 Elite Gen5 was released in late September, nearly a month earlier. Due to downstream customers needing to stock up in advance, it actually brought forward some order demand for the next quarter.

Combining industry data, global smartphone shipments in Q3 2025 were 323 million units, up 2.1% year-on-year. Industry growth remains in low single digits. Under Apple's new basic version "more for less" strategy and the tightening trend of China's state subsidies, the performance of the company and Android in the next fiscal year will face pressure.

2.2 Automotive Business

Qualcomm's automotive business achieved revenue of $1.05 billion in Q4 FY2025 (i.e., 25Q3), up 17% year-on-year, slightly better than market expectations ($1.02 billion), mainly driven by increased shipments of Snapdragon digital chassis.

With downstream demand growth starting to slow, the company's automotive business growth also showed a significant slowdown, and the company expects to maintain stable or steady growth next quarter.

2.3 IoT Business

Qualcomm's IoT business achieved revenue of $1.8 billion in Q4 FY2025 (i.e., 25Q3), up 7.4% year-on-year, better than market expectations ($1.7 billion). After experiencing double-digit growth for four consecutive quarters, IoT business fell back to single digits this quarter.

In Qualcomm's IoT business, it mainly includes consumer electronics, edge network, and industrial products. The company's IoT business this quarter was mainly driven by growth in industrial WiFi 7 access points, 5G fixed wireless, smart glasses (Meta Ray-Ban Meta second generation, etc.).

As for the AI PC business that the market is concerned about, the company currently categorizes it under IoT business, mainly because the company's AI PC business is still relatively small in scale. The company recently launched the Snapdragon X2 product, with AI computing power increased to 80TOPS (previous generation was 45TOPS).

The company hopes AI PC can become a new growth point for the company, but currently the company's market share in the PC market is still very low, less than 1%, making it difficult to form competition with Intel and AMD.

<End of this article>

Dolphin Research on Qualcomm

Earnings Season

July 31, 2025, Conference Call "Qualcomm (Minutes): Growth opportunities in automotive and IoT far exceed revenue from Apple"

July 31, 2025, Earnings Review "Qualcomm: Mobile risks lurking, when can AI "fill the hunger"?"

May 1, 2025, Conference Call "Qualcomm (Minutes): This year's iPhone new machine share will drop to 70%"

May 1, 2025, Earnings Review "Qualcomm: Samsung "blood transfusion" difficult to sustain, Apple's "undermining" hides dark thunder"

February 6, 2025, Conference Call "Qualcomm: Achieving non-mobile business revenue of $22 billion by 2029 (1QFY25 Conference Call)"

February 6, 2025, Earnings Review ""Hot" Qualcomm, Apple's baseband to "disrupt"?"

November 7, 2024, Conference Call "Qualcomm: Already entered the $700 PC market (FY24Q4 Interpretation Minutes)"

November 7, 2024, Earnings Review "AI PC shows "signs," Qualcomm's second spring is coming soon?"

August 1, 2024, Earnings Review "Qualcomm: Mobile calm, AI carries new hope"

May 2, 2024, Earnings Review "Qualcomm: "Lukewarm" mobile, relying on AI to lead?"

February 1, 2024, Conference Call "Mobile revenue, will have double-digit recovery (Qualcomm FY23Q4 Conference Call)"

February 1, 2024, Earnings Review "Qualcomm: Without the leader, how far can mobile recovery go?"

November 2, 2023, Conference Call "Mobile revenue, will have double-digit recovery (Qualcomm FY23Q4 Conference Call)"

November 2, 2023, Earnings Review "Qualcomm: Android leader's "hibernation period" is finally ending?"

August 3, 2023, Conference Call "No significant recovery seen, continue to promote cost control (Qualcomm FY23Q3 Conference Call) "

August 3, 2023, Earnings Review "Qualcomm's winter, still needs to "endure a bit more""

May 4, 2023, Conference Call "Qualcomm: Inventory reduction is the current primary task (Qualcomm Q2FY23 Conference Call)"

May 4, 2023, Earnings Review "Qualcomm: Chip "giant" hides big thunder, winter needs to last longer"

In-depth

December 20, 2022 "Qualcomm: Earning billions a year, is the chip king only worth 10x PE?"

December 8, 2022 "Qualcomm (Part 1): The "big boss" behind Android phones"

Risk Disclosure and Statement:Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.