Robinhood: Quadruple in a Year, Is the King of U.S. Retail Investors Really That Impressive?

On November 6th, the American influencer retail brokerage stock $Robinhood(HOOD.US) released its earnings report before the U.S. stock market opened. After a nearly 300% surge over three quarters, the market's expectations are high. Can the actual results meet the capital market's enthusiastic expectations? Let's take a closer look:

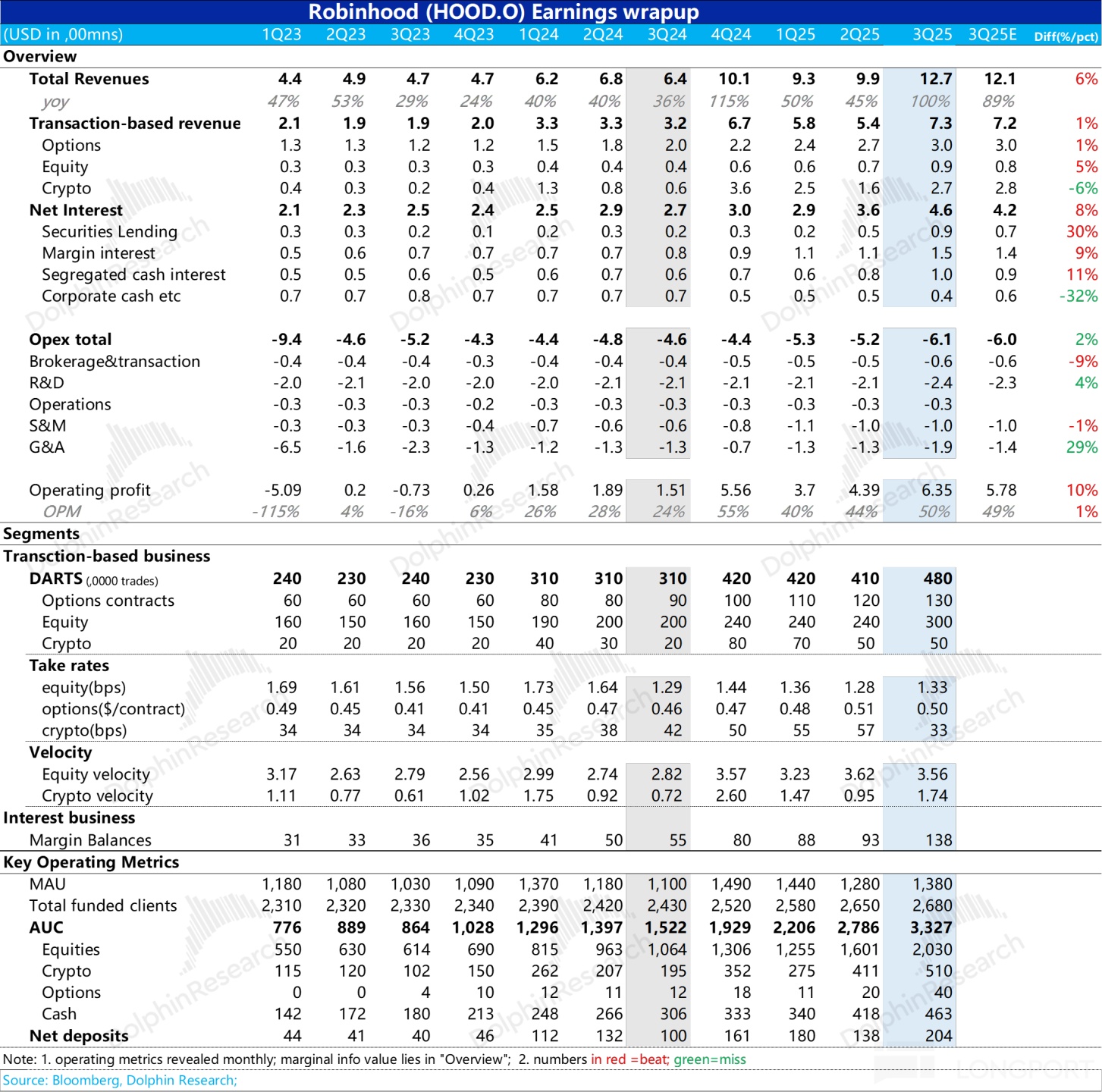

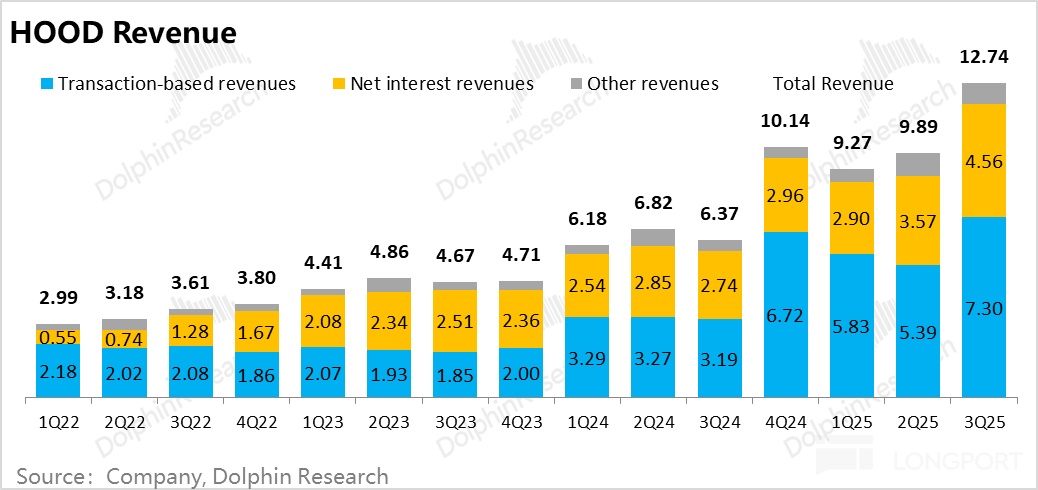

1. Total Revenue: $1.27 billion, a year-on-year increase of 100% and a quarter-on-quarter increase of 29%. This slightly exceeds Bloomberg's consensus estimate of $1.21 billion. However, since the company announced impressive operational data for September on September 29th, the real buy-side expectations have been elevated.

2. Monetization Rate Boosting Dividend Period: In terms of specific items, the most critical is the monetization rate of the Robinhood APP's virtual assets, which is 63 basis points. The market expectation was above 65 basis points, so it is slightly below expectations.

3. Operating Profit: Operating profit of $635 million with a profit margin of 50%, which is basically in line with the expectations seen by Dolphin Research. However, in the expense items, there is a management fee due to the rise in stock prices, triggering executive stock incentives and salary tax, which Dolphin Research estimates led to the company paying significantly more in taxes.

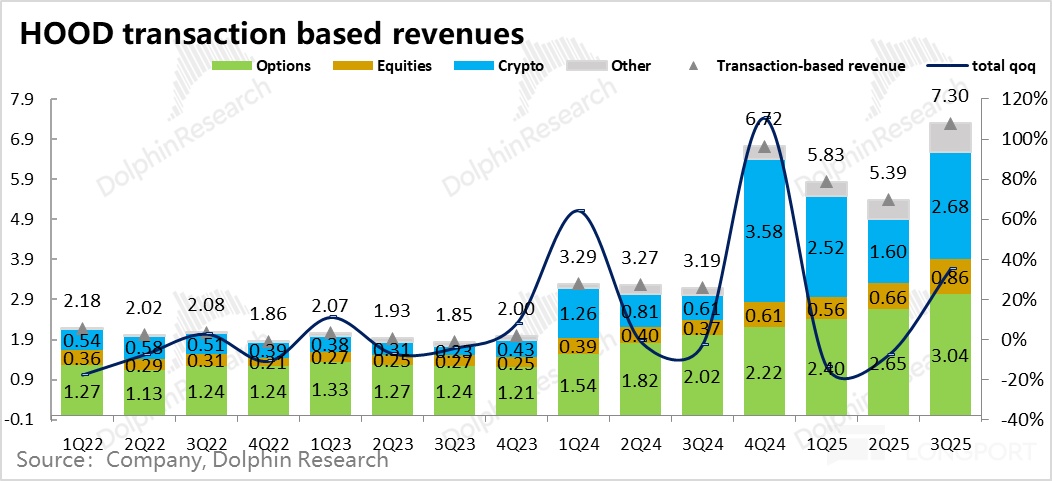

4. Trading Revenue: Virtual asset trading revenue benefited from both increased monetization rates and rising trading volumes, reaching a quarterly revenue level of 2.7, almost on par with options revenue. Options revenue, with previously disclosed trading volumes and stable monetization rates, was completely in line with expectations. Stock trading revenue slightly exceeded expectations due to a slight increase in monetization rates from a very low level.

5. Interest-bearing Revenue: The rapid growth of margin and securities lending businesses highlights Robinhood's super Alpha capability in a Beta bull market (see the main text for detailed analysis).

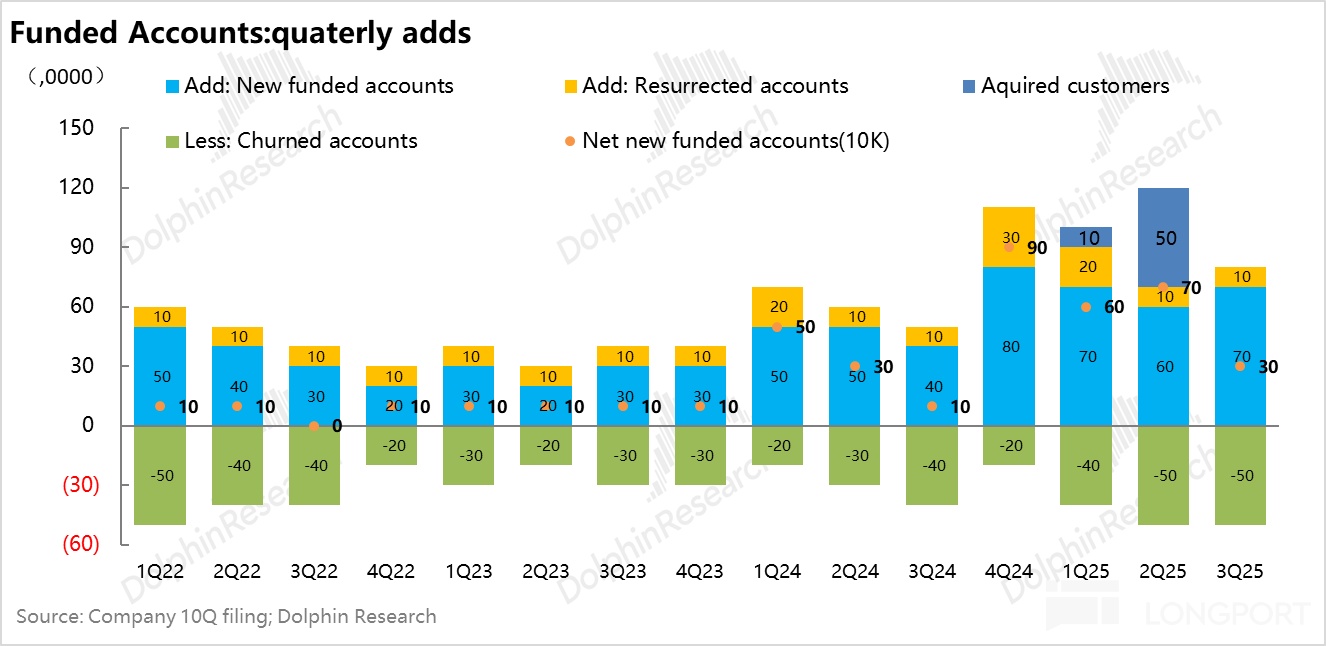

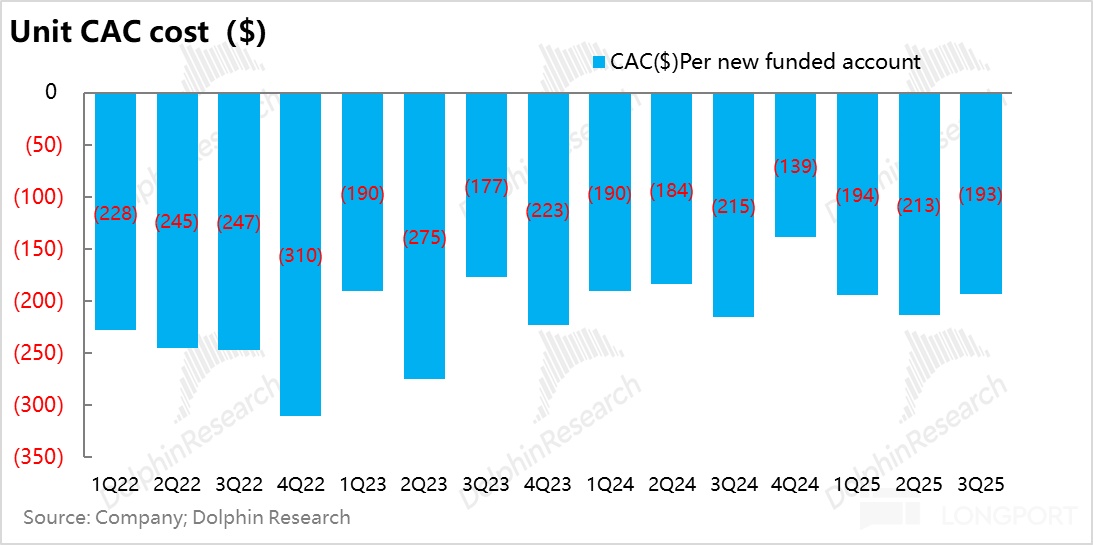

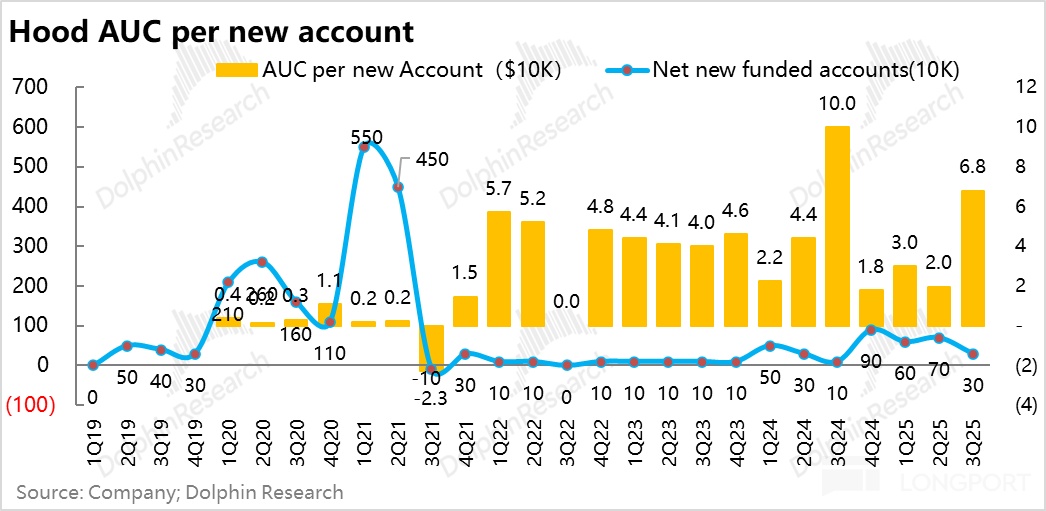

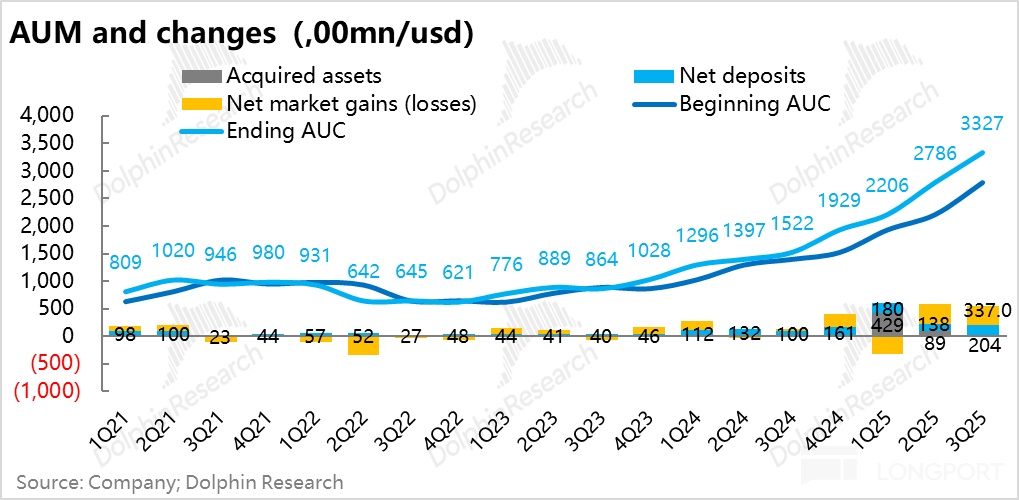

6. Excellent Customer Acquisition: In the third quarter, the number of asset users increased by 30 billion, and the cost of acquiring a single customer (relative to sales expenses) decreased slightly, while the deposit amount for new customers significantly increased to $68,000.

With more active platform trading, Robinhood is gradually expanding its customer base from users with a few thousand to 10,000 assets to those with 50,000 to 100,000 assets, showing clear signs of breaking through.

7. Performance Overview:

Dolphin Research's View

To talk about the big bull stock of 2025, the American retail king is definitely one of the brightest stars of 2025: the stock price was less than $40 at the beginning of the year, and now it has exceeded $140, with a nearly 300% increase.

At the beginning of the year, it relied on Trump's relaxation of regulations on virtual currency assets; in the middle of the year, it relied on a stock token conference on June 30th, which doubled the stock price in the short term. In the third and fourth quarters, although the actual progress of stock tokens was not as smooth as imagined (liquidity is a big issue), the company's stock price was not reverted to its original form, and even with the recent sharp decline in virtual currencies, it did not particularly retreat. The current market value is close to $130 billion, only $40 billion short of Charles Schwab. What is the reason for this?

Through the performance of the last two or three quarters, Dolphin Research can clearly see the resonance of four cycles in Robinhood:

First, Product Innovation Cycle: After tasting the sweetness of a stock token conference, Robinhood released some product innovations at the "2025 Robinhood Summit" in September, mainly highlighting real-time trading display and copy trading, transforming itself into a social + trading platform.

This conference, although not as shocking as the previous stock token conference, further solidified Robinhood's brand image as a brokerage that does not follow conventional paths, and it has now become the spokesperson for innovation in the brokerage industry.

Secondly, the company has indeed delivered tangible performance. Dolphin Research summarizes this performance as having several essential driving forces:

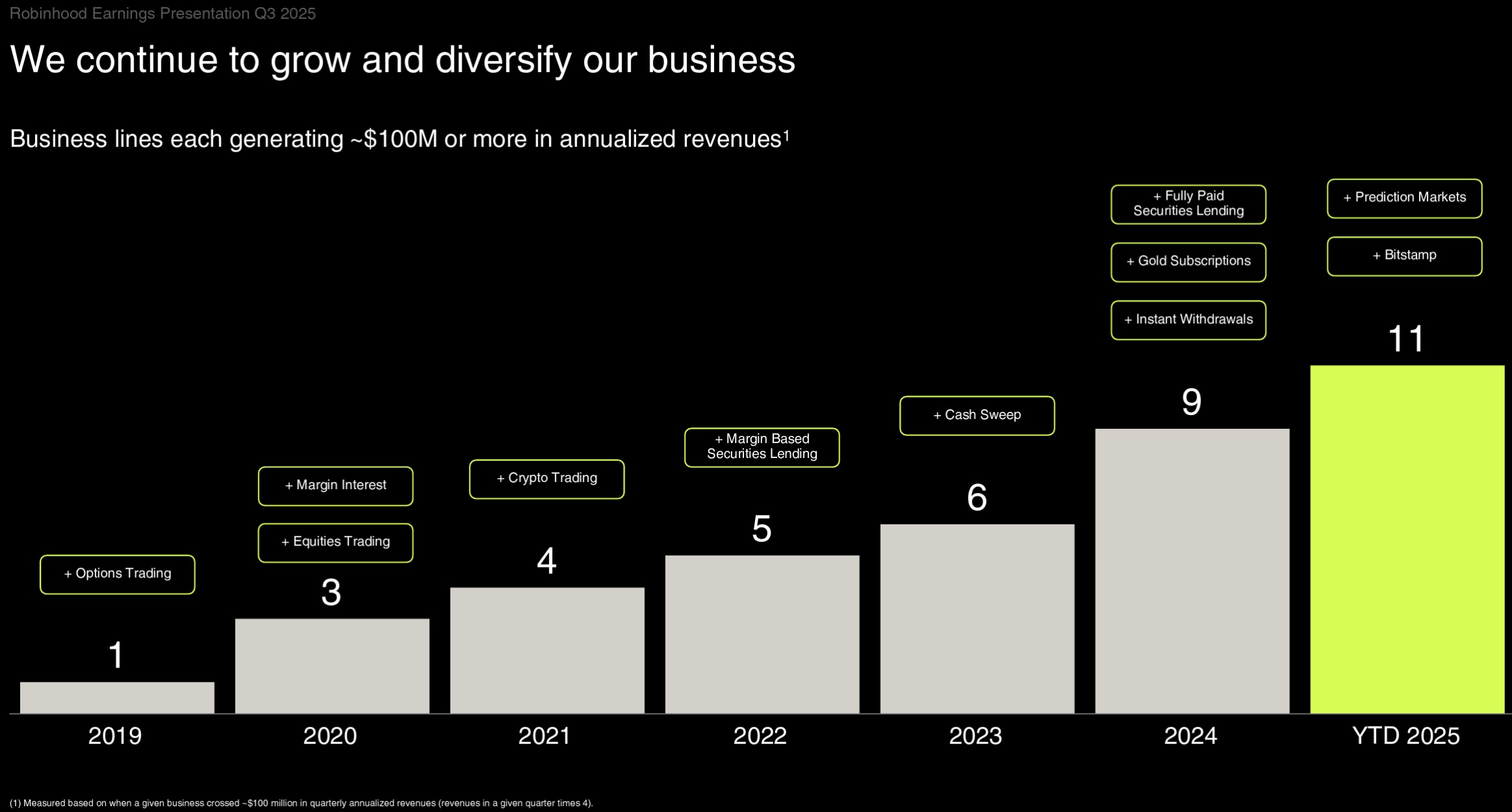

Secondly, M&A Expansion Period: Since the beginning of the year, it has continuously acquired advisory service platform TradePMR and European cryptocurrency exchange Bitstamp. These acquisitions have brought the company not only new customers and new AUM but also importantly, the foundation for business deepening, international expansion, and innovative product launches.

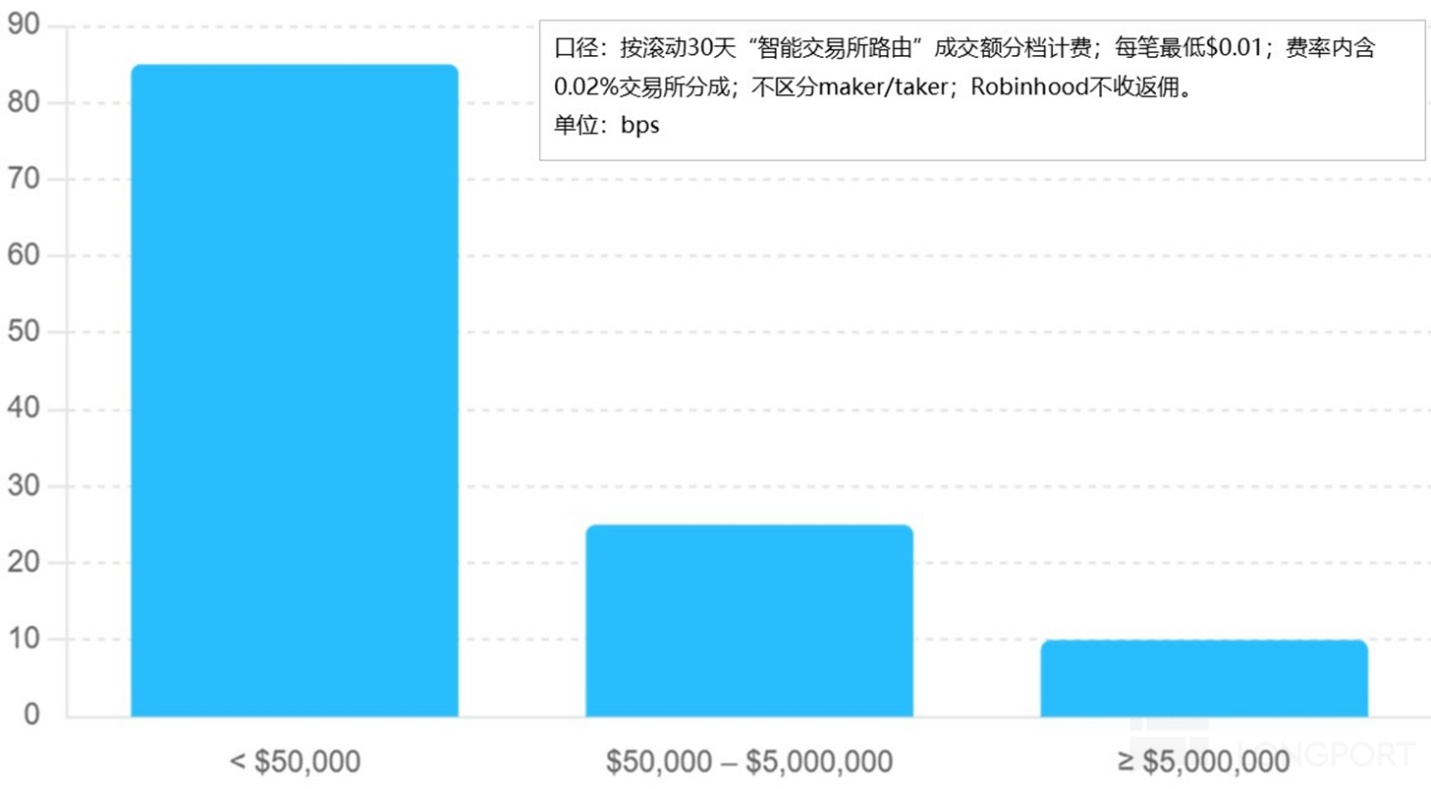

Thirdly, Virtual Asset Monetization Rate Boosting Period: Currently, HOOD's virtual asset monetization has advanced to two paths: a. the original PFOF, approximately 85 basis points, equivalent to invisible charges to users; b. smart order routing: explicit charges to users, a non-order wholesale monetization model that eats order rebates, charging based on users' past 30-day trading volume, priced at 10–85 basis points.

Finally, Alpha in the Beta Bull: In 2025, for U.S. stock investments, whether virtual assets or equity assets, it is undoubtedly a bull market. Through product innovation and brand building, the company has gathered users with extremely high risk preferences. The company amplifies revenue through leverage businesses such as margin and securities lending, and new varieties not available on traditional brokerage platforms such as gambling and virtual asset trading.

In summary, after the quiet of 2024, in 2025, based on the bull market of U.S. stocks itself, Robinhood has run out a super strong Alpha through "rapid product innovation + M&A derivation + monetization boost," consolidating its image as "Robinhood" in the U.S. stock brokerage industry for achieving trading equality for retail investors.

From a valuation perspective, as the strongest Alpha in the U.S. stock Beta bull, if the trend of U.S. stocks + virtual assets continues (bull market continues), then if the revenue in 2026 can reach between $5.5 billion and $6 billion, and the operating profit margin further rises to around 65%.

Then the post-tax operating profit is about $3.4 billion, currently corresponding to a 37x PE for 2026, which seems not very exaggerated given Robinhood's current bullish momentum.

Of course, the basic premise of this valuation premium is: a. its original asset ecosystem's monetization rate is very low, with continuous dividend release; b. the bull market of U.S. stocks must continue, which is difficult to predict. In the case of the continued bull market of U.S. stocks, it remains a strong Alpha in the stock market Beta.

Below is a detailed analysis:

The company almost monthly announces key operational data such as customer acquisition, customer assets, trading volume, financing balance, and securities lending income, and after the announcement, it will communicate with some major banks about revenue and monetization situations.

Therefore, when Robinhood releases quarterly results, only the quantitative monetization rate, detailed revenue, and expense situation are considered as additional small incremental information, and the essence and market expectation gap will not be too large. Dolphin Research also focuses on these aspects to look at the company's business progress and relative expectation differences.

1) Trading Business: Monetization Rate Boosting Dividend Period

For users, Robinhood has always been known for zero commission and low trading fees; but the core logic of the company's current performance release is actually raising users' "fees." Of course, the company is known for zero commission and no fees, and the company's fees are not called fees but "capture rate"—revenue capture rate, which is income obtained from trading volume, mainly concentrated in virtual asset trading volume.

But the release of monetization rate dividends is preceded by the improvement of the business model, from originally eating user order wholesale rebates (this practice raises concerns about whether the company will act in the true interest of users in order execution distribution) to an explicit charging model based on user trading volume to set pricing levels.

The backend is the smart order routing technology itself, which can split orders based on the size of a user's single order to avoid liquidity issues when sending high order volumes to a single trading execution institution, distorting price matching, and achieving optimal trading match for users.

Currently, this charging method is mainly in virtual asset trading volume, and Robinhood has increased the penetration rate of smart order routing from the original full PFOF revenue model. Clearly, from the technology itself, it is fully capable of moving from virtual assets to the currently very low monetization rate stock trading.

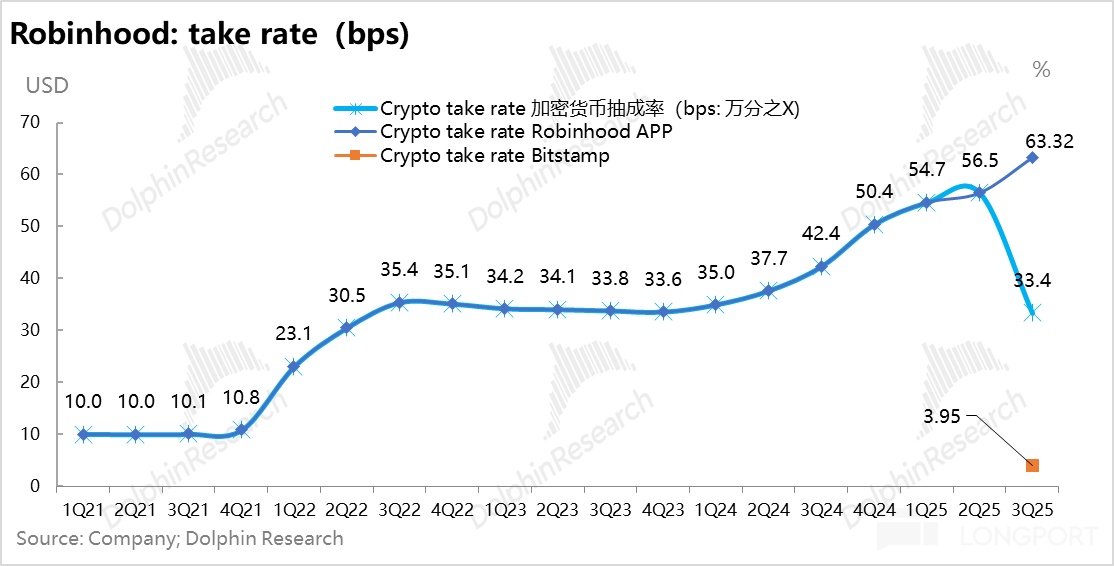

1) Virtual Asset Monetization is Rising, but Not as High as Expected

According to the company's disclosed information, Dolphin Research calculates that the monetization rate of virtual assets in the Robinhood APP business in the third quarter is about 63 basis points, which is far from the monetization ceiling of 150 basis points for virtual asset trading at Coinbase.

But Dolphin Research noticed that some institutions closely tracking Robinhood have actually raised the monetization rate of Robinhood APP trading volume from 56.5 basis points in the second quarter to 67 basis points in the third quarter. From the perspective of expectation difference, this actual result is indeed slightly below the full expectations of major banks.

Additionally, it should be noted that Bitstamp began to fully enter the report in the third quarter: although the trading volume is huge, Bitstamp's third-quarter trading volume was $40.5 billion (90% institutional trading volume, 10% retail trading volume) vs. Robinhood APP's $39.8 billion.

But its revenue was only $16 million, with a monetization rate of only 3.95 basis points (Coinbase's institutional business is about 6 basis points), so the overall monetization rate of Robinhood's virtual asset business was dragged down to 33 basis points.

Clearly, this is not a problem. The acquisition of Bitstamp was partly for the international expansion of the virtual asset business to obtain licenses, and partly for the vertical integration of virtual assets from trading to upstream clearing and settlement.

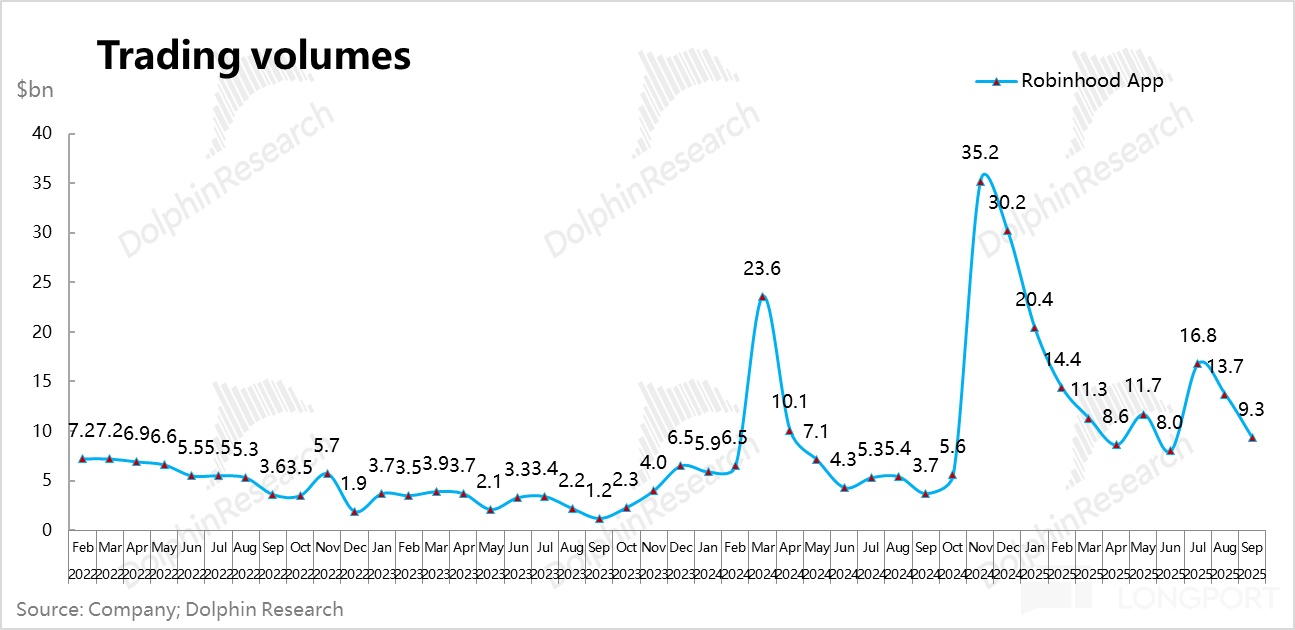

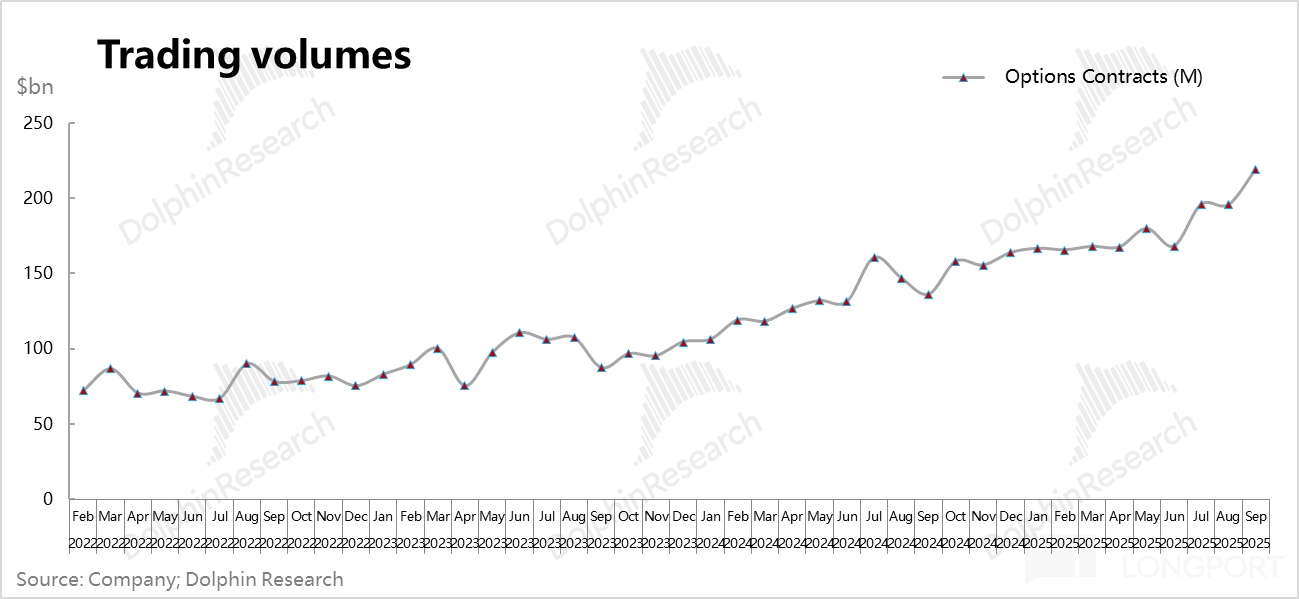

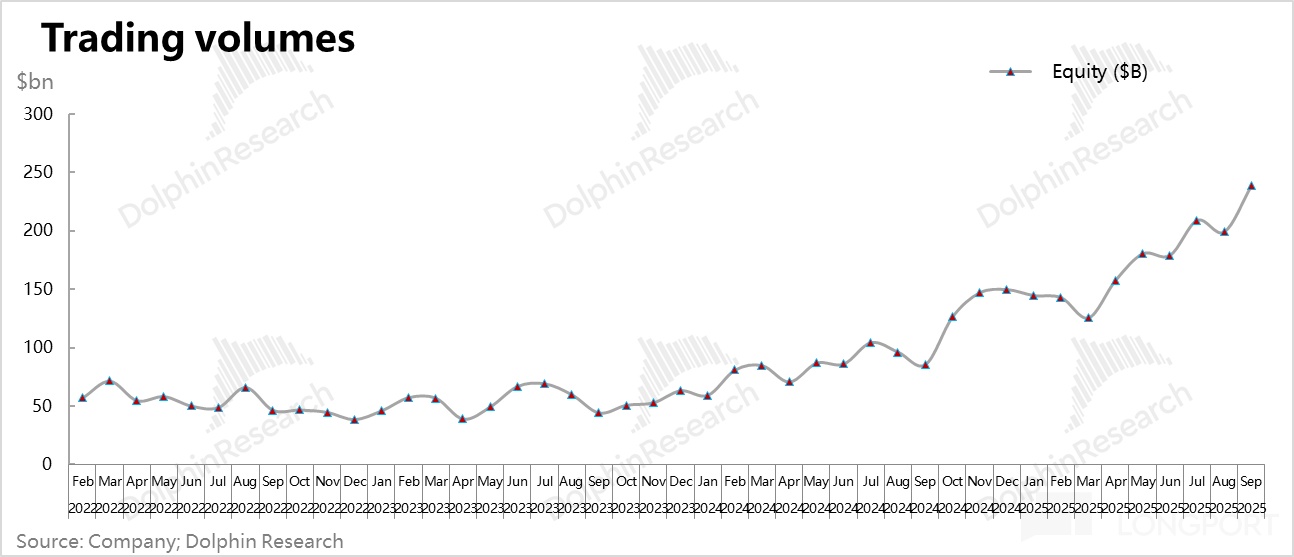

From the perspective of trading volume, in the third quarter, the market value of cryptocurrencies broke new highs again, and trading volume rebounded quarter-on-quarter. The industry's average daily trading volume grew 44% quarter-on-quarter, and Robinhood APP's trading volume grew 41% quarter-on-quarter, basically in line with market growth.

Of course, since October, the virtual asset trend has sharply reversed, which will drag down the company's virtual asset trading revenue performance in the fourth quarter (virtual asset trading revenue contributes nearly 40% of trading revenue).

But currently, the market consensus is that the fiscal and monetary easing of U.S. stocks in 2026 and the new highs of virtual assets are almost certain, and the market views this decline more as a healthy adjustment before a new high.

Under this logic, short-term corrections should be difficult to truly shake Robinhood's long-term growth expectations for its virtual asset business.

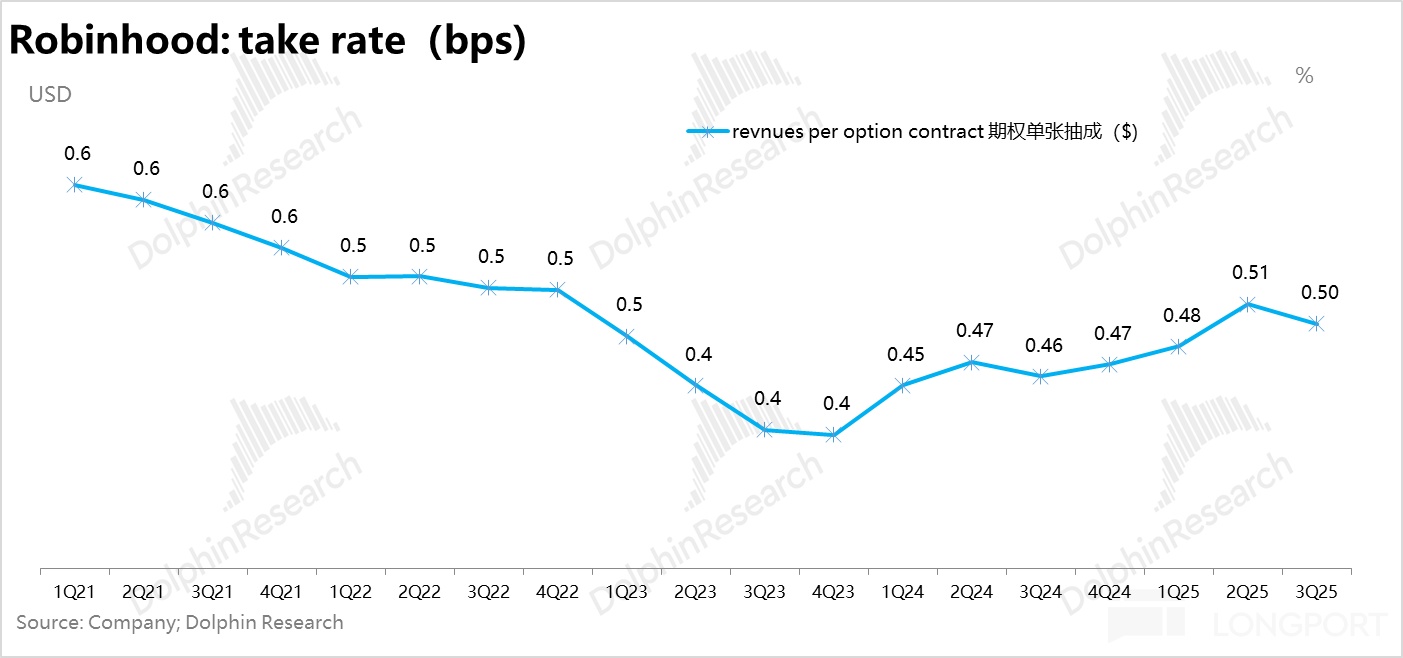

2) Options as a Stabilizing Force: Steady Happiness

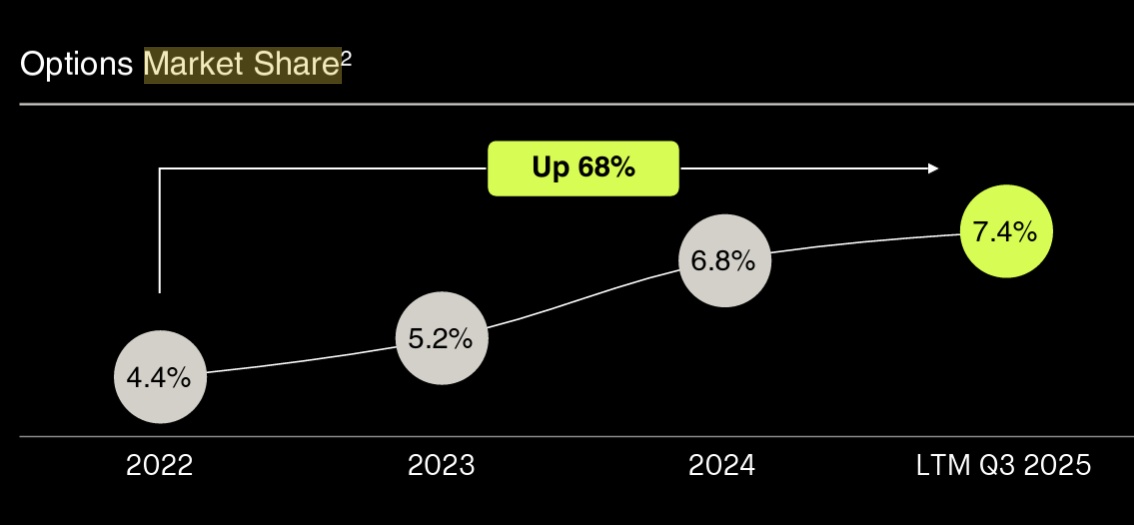

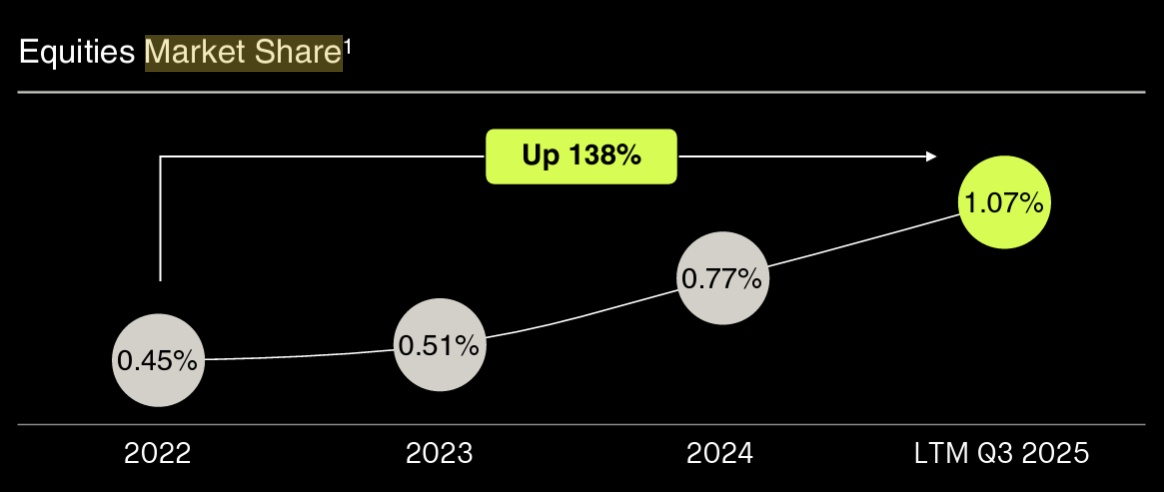

As the largest contributor to trading revenue, the options business brought in $300 million in the third quarter, with a further 15% quarter-on-quarter growth; with known options trading volumes (of course, HOOD's market share in options is still continuously rising), it was completely in line with market expectations.

Revenue per option contract was $0.50, compared to $0.51 in the previous quarter, which is basically stable.

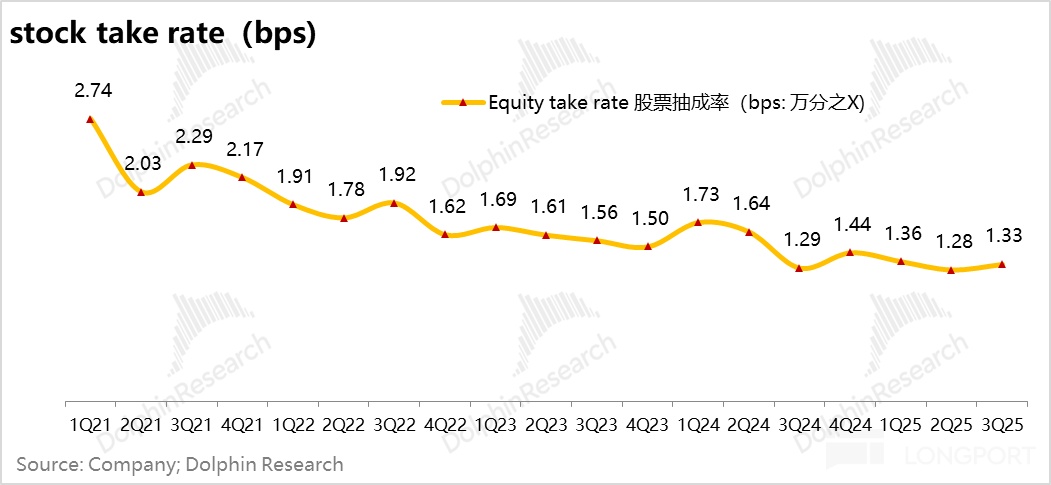

3) Stock Trading: Slight Improvement in Asset Monetization

As an asset category for user asset allocation in trading business, the income earned by Robinhood through the wholesale user order model is still not much, but the monetization rate did slightly improve in the third quarter.

In the third quarter, with high market sentiment and rising market share, Robinhood's order volume grew 25% quarter-on-quarter, while the monetization rate through PFOF slightly rose to 1.33 basis points, driving stock trading revenue to $86 million, slightly exceeding the market expectation of $81 million.

However, because the monetization rate is really low, slight changes are actually difficult to have an effective impact on the company's overall trading revenue.

Thus, the company's total trading revenue for the quarter reached $730 million, slightly more than the market expectation of $720 million. In addition to the slightly exceeding expectations of stock monetization rates, it is also important to mention the company's incubated new business—event prediction, or gambling.

Since its launch, Robinhood's event prediction business has accumulated over 40 billion contract trades, with 20 billion contracts contributed in the third quarter alone, and it will be pushed to more markets in the future. Currently, about 100 prediction events are provided, and some brokerages estimate it can contribute $160 million next year.

This trading revenue is currently included in other trading revenue, which increased significantly from $48 million last quarter to $72 million this quarter. Event prediction has now been classified by the company as a business line with annual revenue exceeding $100 million, indicating that event prediction revenue in the third quarter should have already exceeded $25 million.

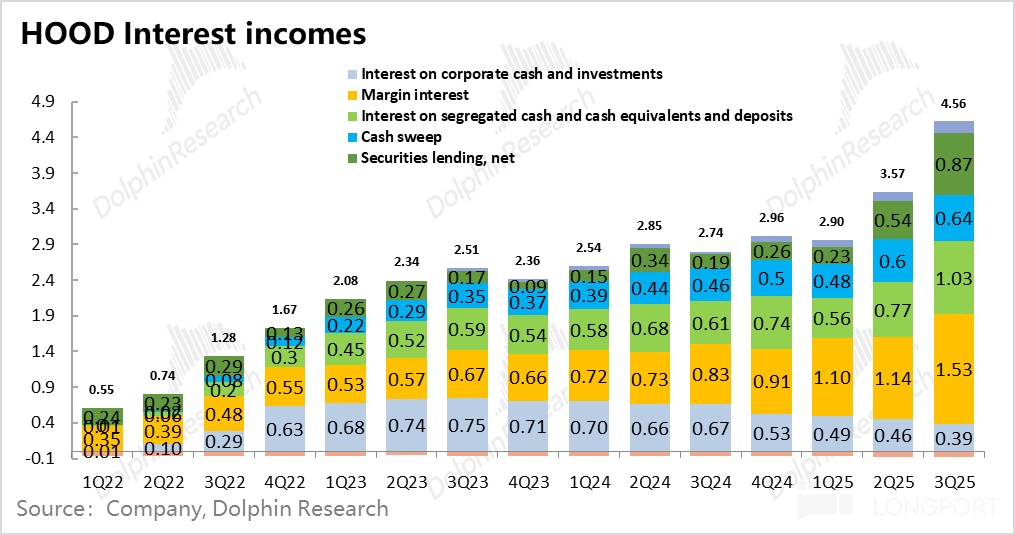

2) Interest-bearing Business: Users' Gambling Nature Fully Displayed, Securities Lending and Financing are Growing Rapidly

Robinhood's interest-bearing business performance in the third quarter was also very good, with income from securities lending, financing, and segregated cash all performing well. These three income streams reflect the higher risk preference of retail investors on the Robinhood platform in a bull market, thereby driving stronger revenue elasticity in a bull market.

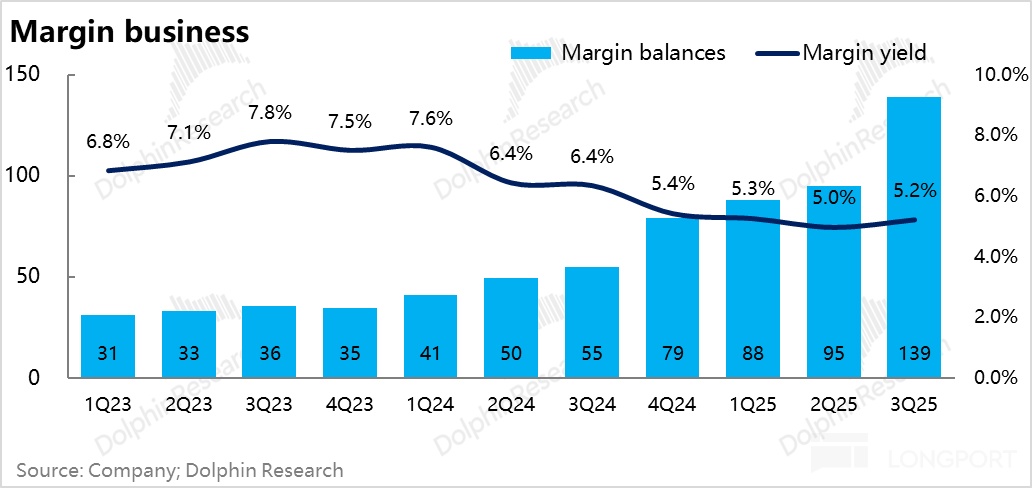

a. Financing Income: $153 million in the third quarter, a quarter-on-quarter increase of 34%, is the single largest interest-bearing business

In a bull market, more and more users use leverage to buy stocks, and the financing business is mainly driven by financing balances (the company announces financing balance data monthly), while the source of funds, before and after listing, Robinhood significantly increased its own funds available for lending through convertible bond financing.

The marginal incremental information in the third quarter is that the yield of Robinhood's financing business even slightly increased to 5.2%, showing very strong monetization.

Of course, entering the interest rate cut channel, the yield of interest-bearing business should still be affected, and in this case, it can only rely on "stock bull market with interest rate cuts" to achieve volume expansion and compensate with trading revenue.

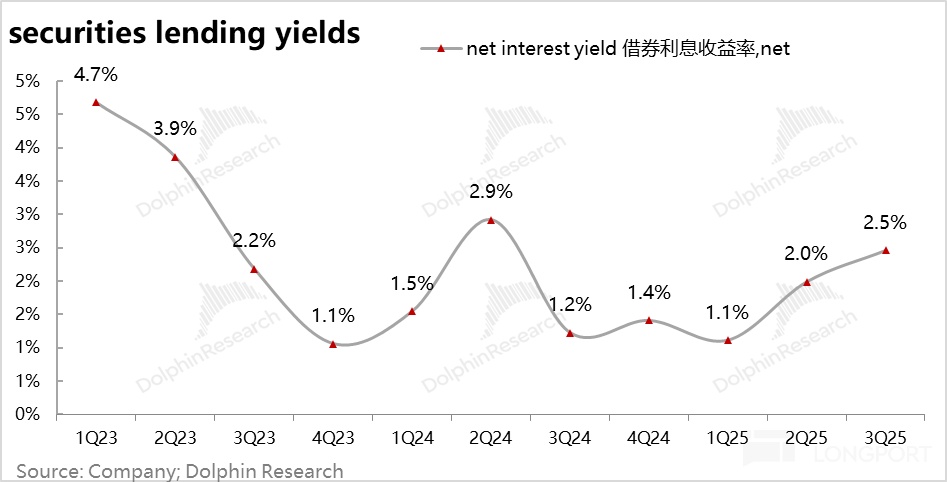

b. Securities Lending Income: $87 million in the third quarter, a quarter-on-quarter increase of 60%, becoming the third largest interest-bearing business

When users borrow securities from Robinhood to sell, they need to provide cash to the platform as collateral, and the borrower needs to deposit cash (segregated cash) into the Robinhood account, so the platform actually earns two parts of income:

a. Earn interest income (segregated cash);

b. Earn additional income based on the tight supply and demand of the lent securities.

The second part of the income is called securities lending income, and the first part is included in segregated cash income by Robinhood.

Dolphin Research calculates that the yield of the securities lending business in the third quarter was 2.5%, compared to the second quarter, there was an improvement; at the same time, the total scale of securities lent by the company also increased by 24% quarter-on-quarter. Volume and price rise drive a significant increase in securities lending income.

c. Segregated Cash Income: This quarter's income was $100 million, the second largest income in interest-bearing business. This interest income mainly includes the interest income from the collateral provided by users under the financing business, as well as specific reserves in clearing institutions. Dolphin Research estimates that this yield is also slightly rising.

The above three income streams, plus cash sweep (users purchase external bank wealth management through the HOOD platform) and interest income from the company's own funds, total nearly $460 million, a quarter-on-quarter growth of over 27%.

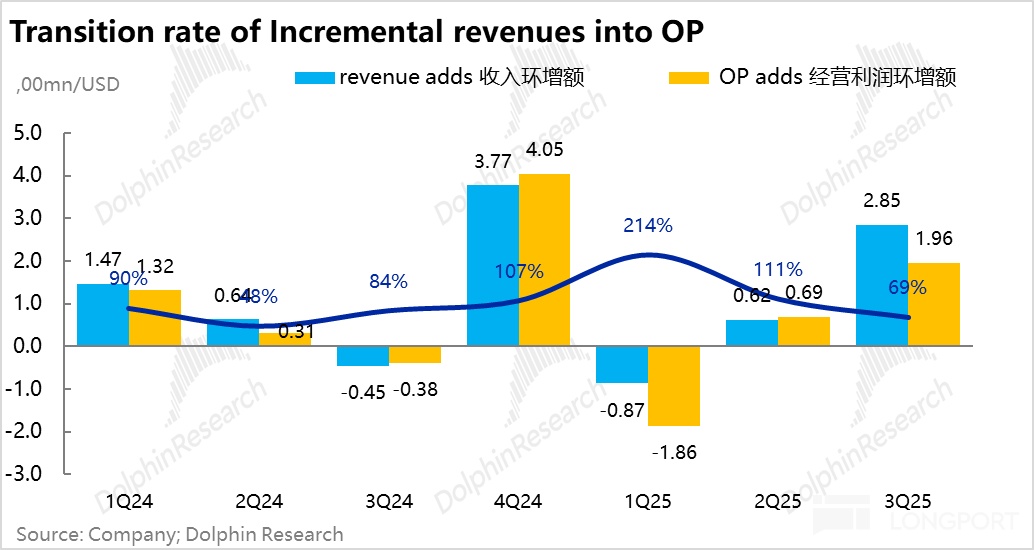

Trading revenue and interest-bearing revenue basically constitute 94% of Robinhood's revenue sources, with a year-on-year growth of 100% and a quarter-on-quarter growth of nearly 30%.

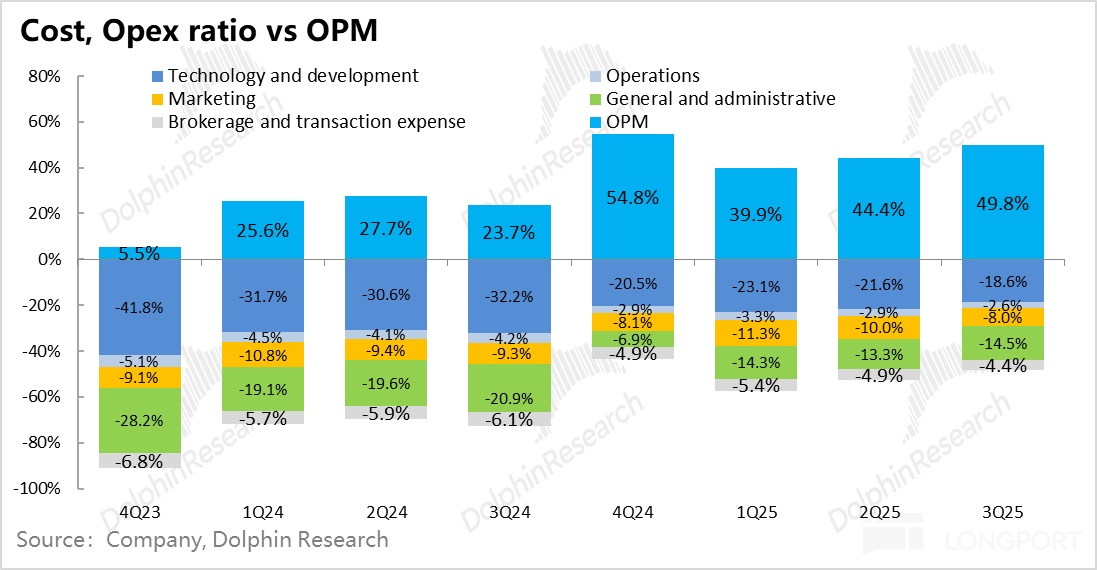

3) Expenditure Side Still in a Restrained State

Since the company cannot predict the market on the revenue side and cannot provide revenue guidance, the company's long-term guidance is fast revenue growth and slow expenditure growth (90% of expenses are basically fixed expenses), and in the process of revenue expansion, it can fully leverage revenue to achieve continuous improvement in profit margins.

In the third quarter, the company basically fulfilled its promise:

With a nearly 30% quarter-on-quarter revenue growth, expenses only increased by 16%, and this includes the additional salary tax triggered by the rise in stock prices and CEO management incentives. Excluding this factor, Dolphin Research roughly estimates that its expense growth in the third quarter may be only about 6%.

The largest expense—R&D expenses increased by 11% due to intensive iteration of new products and trading functions, reaching $240 million in a single quarter; the total number of employees (excluding acquisitions) also re-entered the growth cycle.

And without significant expansion in R&D, the company released multiple product functions at the "HOOD Summit 2025" on September 10th:

1. Robinhood Social: Positioned as social + trading

Built-in social trading community, displaying verified real-time transactions, allowing users to follow traders and view their historical performance; initially invitation-only, open to some U.S. users early next year, free.

Users' published trades are verified real-time and can be verified, allowing users to see the buy and sell times, view traders' 1-year and daily profit and loss performance data, and directly copy trades in the information flow. Supports following and discussion.

Users can also track public report trades and trading strategies of political figures, hedge funds, and insiders for discussion.

The product covers an integrated social + trading entrance for stocks, options, futures, crypto, and prediction markets.

Launch rhythm: Summit release, initially invitation-only small-scale opening, followed by expansion.

2. Legend Desktop Upgrade:

a. Futures Trading (40+ CME products), Gold member fees as low as $0.50, including real-time level 2 futures data; "ladder" order support for futures, gradually supporting stocks/ETFs/crypto.

b. AI Custom Indicators and Scanning (Cortex-driven): Generate custom technical indicators and market scans using natural language, planned to be fully open to Gold members early next year.

c. Device Linkage: Synchronize mobile and Legend, remote control ladder, online within the year.

d. Short Selling Function: To be gradually opened to mobile and Legend in the coming months.

e. Overnight Index Options: Planned to open night trading early next year (Monday 20:15 ET to Friday 9:25 ET).

f. Others: Multi-account and other basic trading experience improvements.

At the same time, sales expenses highly related to customer acquisition appear quite restrained in a bull market, with only a 3% quarter-on-quarter increase. Only management expenses increased by 40% quarter-on-quarter due to the salary tax issue mentioned earlier, reaching $185 million.

Ultimately, the total revenue of $1.27 billion in the third quarter was converted into an operating profit of $650 million, with a profit margin of 50%. If amortization, depreciation, and stock incentive expenses are excluded, the company's operating profit margin has reached 58%.

If considering that the additional salary tax triggered this time is a one-time expense, then this profit margin can be further raised from 58% to 62%, a solid cash engine.

Overall, from revenue to expenses and finally to profit, it is very clear to see this fact: The company can maintain overall restraint in personnel and expense spending while significantly increasing revenue in a bull market, converting most of the new revenue into operating profit, making it a very reliable company in terms of operational execution.

4) High-quality Upward Customer Acquisition through M&A Innovation

In the third quarter, net asset users increased by 300,000, with a single customer acquisition cost of $193, which also fell in the bull market, showing overall very good performance.

At the same time, new customer funds absorbed $20.4 billion, equivalent to a single customer's AUM rising to $68,000. In other words, its customer acquisition is now beginning to penetrate the traditional so-called "old money" group.

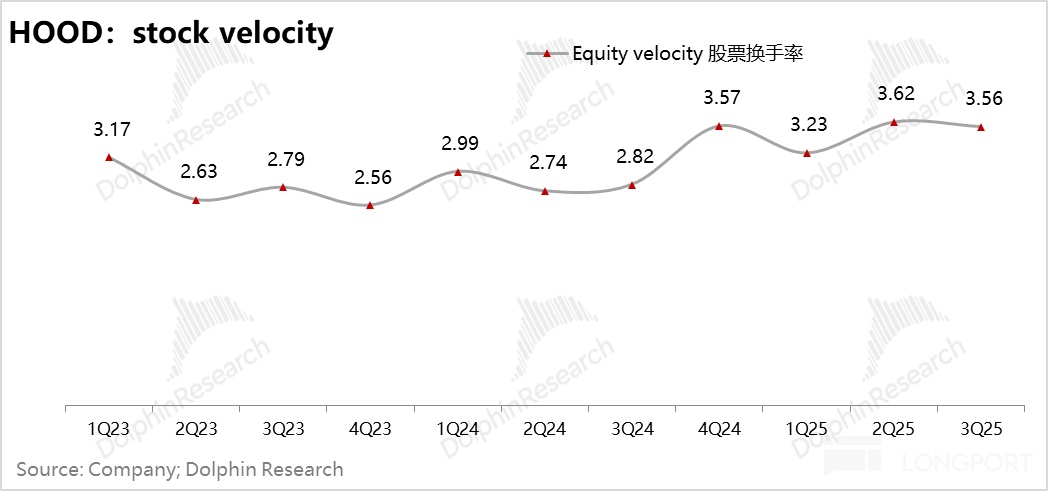

And in the process of penetration, the overall customer funds maintained a relatively high circulation speed, with a turnover rate (stock trading volume/average stock AUM) maintained at over 3.5 times in a single quarter;

<End here>

Dolphin Research's Historical Articles:

"Robinhood: Bright Future for Stock Tokens, Invincible Retail King?"

"Robinhood: Trump's Gift of Rebirth, The Return of the Retail King"

"Robinhood: Born 'Defiant'? Ultimately Falling into the Ordinary?"

"'Retail Boxer' Robinhood: Can One Trick Really Conquer All?"

Risk Disclosure and Statement of this Article:Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.