Robinhood (Minutes): Not only to trade, but also to be the 'origin' of trading ideas

The following are the minutes of the FY25Q3 earnings call for$Robinhood(HOOD.US) compiled by Dolphin Research. For earnings interpretation, please refer to《HOOD: Fourfold in a Year, Is the King of U.S. Retail Investors Really That Strong?》

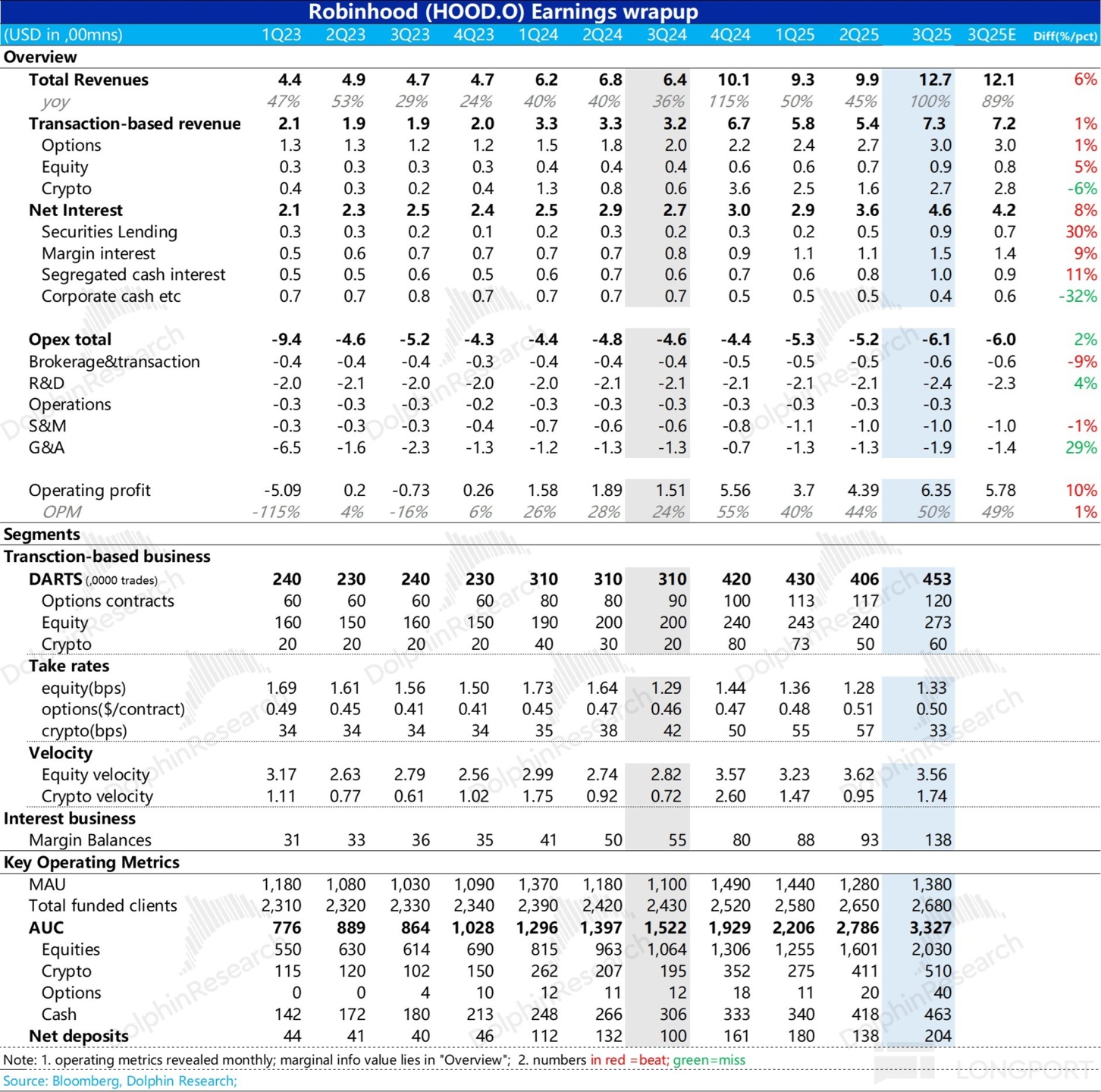

I. Review of Core Financial Information

1. Future Outlook (Q4 and Full Year):

a. Strong start to Q4 (October data): Net deposit momentum continues. Record highs in stocks, options, prediction markets, and margin businesses. Significant rebound in cryptocurrency trading volume.

b. 2025 Full Year Expense Guidance: Expected adjusted operating expenses + equity incentives to be approximately $2.28 billion, potentially higher due to business performance. Reasons for the upward revision include:

- Strong performance year-to-date.

- Increased investment in new growth areas such as prediction markets and Robinhood Ventures.

- Inclusion of previously unaccounted CEO market-based performance award costs.

II. Detailed Content of the Earnings Call

2.1 Key Information from Executive Statements

1. Three Strategic Priorities:

a. Becoming the Preferred Platform for Active Traders:

- Goal: To make active traders feel that trading on Robinhood is most advantageous.

- Product Innovation: Announced several updates at the second annual Hood Summit, including short selling, multi-broker accounts, and AI (Cortex)-driven custom indicators.

Launched a new social platform "Robinhood Social", with the first AI event scheduled for December 16, where more information will be shared.

- Stock and Options Trading Business: Q3 trading volume hit a record high, with October setting new daily and monthly records.

- Prediction Market Business: Rapid growth. Since its launch a year ago, trading volume has doubled each quarter. October's monthly trading volume (2.5 billion contracts) exceeded the total for Q3 (2.3 billion contracts). The product has expanded into multiple fields such as economics, politics, and culture.

b. Winning the Next Generation's Wallet Share:

Long-term goal: To seize the $120 trillion intergenerational wealth transfer opportunity and become the financial super app for users. Currently, in terms of total asset size, we have climbed one-third of the way (332.7 billion) towards the trillion-dollar total asset target.

- Retirement: Retirement account assets have exceeded $25 billion, more than doubling year-over-year.

- Robinhood Strategies: Since its launch in March, assets have exceeded $1 billion, making it one of the fastest-growing advisory services.

- Robinhood Gold Card: Over 500,000 cardholders, with an annualized spending amount exceeding $8 billion. The number of cardholders has grown fivefold since the beginning of the year, and the company plans to further accelerate promotion.

- Robinhood Banking: Early customer promotion has begun, with positive feedback. Users are enthusiastic about the feature of earning high interest on checking accounts.

c. Building the World's Leading Financial Ecosystem:

Long-term goal: In 10 years, more than half of the revenue will come from outside the United States. More than half of the business will come from institutional clients (non-retail).

- Tokenization (EU): Stock tokens launched in the EU now cover over 400 listed companies and continue to grow.

- Robinhood Ventures (US): Provides non-accredited retail investors with a channel to invest in private companies, with initial investments completed and plans for a public offering in the coming months.

Dolphin Research Note: This is a closed-end equity fund, but fund shares will be listed on the NYSE for retail trading.

The fund primarily invests in and holds star companies in various industries that are not yet listed, even continuing to hold them post-IPO. The design aims to allow retail investors to indirectly participate in the growth premium of unlisted companies.

- Bitstamp (Global Institutional Virtual Asset Business): Integration is progressing smoothly, with business still accelerating. Q3 trading volume increased by over 60% quarter-over-quarter.

2. Key Financial and Operational Data for the Third Quarter (Q3)

a. Revenue reached a record high of nearly $1.3 billion, more than doubling year-over-year.

b. Net Asset Inflows: Q3 net asset inflows exceeded $20 billion, setting a quarterly record. Year-to-date net asset inflows have surpassed last year's record of $5 billion.

c. Robinhood Gold Subscription Users: Reached a record 3.9 million, with a penetration rate of over 14% among total users and nearly 40% among new users.

d. International Customers: Including Bitstamp, approaching 700,000.

2.2 Q&A

Q: What is the comprehensive rollout plan for Robinhood's private banking business? How quickly do you plan to offer this service to all users?

A: Unlike credit cards, the rollout of private banking will be relatively faster. Credit cards require careful calibration of the economic model between lending and spending, whereas banking is simpler in this regard, with rollout speed mainly depending on customer feedback.

So far, the early results we've seen are very positive, with customers already using services like cash delivery (Note: Unlike users withdrawing money from ATMs, Robinhood delivers the money to its private banking users' homes) in some markets. Therefore, barring any unforeseen circumstances, we expect to roll out to more users very quickly.

Q: There was a recent service disruption related to AWS. What measures are you taking to enhance platform stability and resilience to address such issues?

A: First, the AWS service disruption a few weeks ago did affect us, causing many customers to experience service degradation. However, the good news is that it also demonstrated the significant progress in our system resilience over the past few years.

If we had encountered such a large-scale infrastructure failure a few years ago, our platform might have completely gone down. This time, despite delays and slowdowns, many customers were still able to manage their risks and trade, thanks to our ongoing investments.

We certainly view every such incident (even if caused by third parties) as an opportunity to strengthen our system resilience. We are already working on a review and communicating with all partners to explore how we can do better, as our goal is to be the preferred and most reliable financial account for customers, so platform stability is crucial.

Q: As Robinhood evolves from an investment platform to a "financial super app" for the next generation, how do you view the maturation process of this ecosystem? Among the many products, which one or ones do you think will become the core that connects the entire ecosystem? As the financial situation of the younger generation becomes increasingly complex, where do you see the biggest opportunities?

A: Our vision for the financial super app is clear and predictable. The core is to solve the inflow and outflow of funds. We want Robinhood Banking to be the preferred choice for customers to deposit their salaries, thereby handling the inflow of funds and making it as convenient as possible for customers to transfer money into the platform.

At the same time, we are committed to providing a rich array of products and services to minimize the reasons customers need to withdraw from our ecosystem.

In the future, we will continue to launch innovative product categories like "prediction markets" and leverage our industry-leading user experience and economic advantages to ensure we play a significant role in all customer activities related to funds.

Our strategy is a combination of "breadth" and "depth": on one hand, expanding the range of services horizontally, and on the other hand, selectively deepening in areas where we have a competitive advantage. This strategy is not limited to the United States and will gradually be rolled out globally.

Q: You have become a leader in the prediction market business, but there are many new entrants. What long-term advantages does Robinhood have to maintain its leading position? Currently, you are more of a retail distribution channel for prediction market exchanges. Do you have any strategic considerations about maintaining this position or considering building your own internal exchange through self-development or acquisition?

A: One of our core advantages when entering any market (including prediction markets) is our vast distribution network, with over 26 million existing customers. At the same time, our infrastructure is increasingly robust, capable of supporting multi-asset trading, from mobile to web, including tools like Robinhood Legend, forming a highly integrated financial services ecosystem.

Regarding whether to pursue vertical integration (such as building our own exchange or becoming a market maker), our core consideration is whether it can add value for us and whether the business itself will become commoditized over time.

My personal judgment is that the prediction market field will see a large number of exchanges and competitors, similar to the stock and options markets. This competition will ultimately benefit customers by lowering costs.

Therefore, our strength lies in our distribution capabilities and the platform offering a diverse range of products. Currently, we are the only company that allows traders to trade prediction markets, cryptocurrencies, options, stocks, and futures on the same easy-to-use platform.

Integrating all these products together constitutes a strong advantage, and we will continue to strengthen this. Meanwhile, our product iteration speed is fast and will only get faster in the future.

Q: Regarding the cryptocurrency business, what proportion of the business mix did the "Smart Exchange Routing" feature account for in the third quarter and early fourth quarter? How has it impacted the financial data we are seeing?

A: Our blended take rate in the cryptocurrency business is around the 60+bps range. Entering the fourth quarter, the rate has remained at a similar level, although the specific situation will depend on subsequent business mix changes.

We are very pleased with the performance of the "Smart Exchange Routing" feature, which has been warmly received by customers. We have observed that customers who choose this feature bring more of their trading volume to the Robinhood platform, which gives us confidence in this product.

More importantly, this feature is a significant step towards personalized pricing. In the past, our rates were generally low, unable to offer competitive pricing to active traders with large trading volumes who could leverage advanced exchange features.

The "Smart Exchange Routing" precisely addresses this issue, making Robinhood a "no-brainer choice" for these high-frequency, high-volume customers.

We are very excited to see that after the feature went live, more and more of these customer groups, which we previously underpenetrated, are starting to choose us.

Q: Considering the company remains private for an extended period, with a lot of value generated before going public, you seem to be in an ideal position to be both a trading hub and help create liquidity in the system, even providing primary capital for the private market. Is there demand from your customer base to participate in private market investments? Do you have plans to do more in this area? Is this related to the trend of tokenization? Considering Morgan Stanley's recent acquisition moves, is entering or expanding the private market business through M&A a reasonable option for you?

A: The private market is a huge opportunity. In the U.S., many great companies remain private for longer, with valuations reaching hundreds of billions of dollars, but ordinary investors cannot participate, which is a major unfairness we hope to address. If you want to invest in cutting-edge fields like AI or space technology, there are very few pure plays in the public market.

The IPO Access product we launched a few years ago was the first step. Initially, we had to work hard to convince companies to open IPO shares to retail investors; now, almost all well-known companies proactively approach us to discuss retail participation strategies when considering going public, proving the rise of retail power. We hope to bring this participation opportunity further forward to earlier stages.

This is the core logic behind Robinhood Ventures. When we communicate with customers, investing in the private market is one of their strongest demands. They want to invest in top tech companies they use and love daily.

Customers' core demands are threefold: daily liquidity, no need for accredited investor certification (currently 85% of Americans are not accredited investors), and a more concentrated investment portfolio. We believe we have found a good way to meet these needs.

We have already filed an application with the SEC for the Robinhood Ventures One fund, currently in a quiet period, so we cannot disclose more details, but we are very excited about this product and future customer demand.

At the same time, we are actively working with private companies to ensure this ecosystem is equally attractive to them. This fund is just Fund 1, merely the beginning, and we have very ambitious plans in this area.

Q: Regarding "Tokenized Equities," when do you expect this technology to truly scale and become widespread? What impact will the widespread adoption of tokenized equities have on Robinhood's revenue model, especially in terms of "PFOF" (Payment for Order Flow)?

A: Regarding tokenized equities, our rollout is divided into three stages. We are currently in the first stage but are rapidly increasing the number of tokens on the platform, now exceeding 400, making our selection among the best in the industry.

The truly interesting part will be the second and third stages: first, enabling secondary market trading on the Bitstamp exchange, and ultimately allowing these tokens to enter the decentralized finance (DeFi) realm. At that point, various possibilities will greatly increase, such as self-custody, collateralized lending, etc., which we believe will be highly disruptive.

In terms of the revenue model, currently, our tokenized equities business in the EU primarily charges a simple foreign exchange conversion fee, with a rate of about 10 basis points (0.1%). We are satisfied with this because the rate is actually slightly higher than the revenue we could get from "payment for order flow" that we have given up.

Q: Over the past few years, Robinhood has made remarkable progress in product execution and iteration speed. What factors have contributed to this positive transformation? How do you plan to maintain or even accelerate this momentum?

A: First, we laid a solid foundation for rapid development over the past few years. Although the company expanded too quickly during the pandemic, we brought in excellent talent and deeply reflected on corporate culture, ultimately establishing the core goal of "delivering products quickly." This preparation in personnel and infrastructure is key to the current improvement in product iteration speed.

Secondly, there are two important catalysts:

First, we started deploying and applying AI technology on a large scale across the company, especially in key areas like customer service and engineering, which greatly improved efficiency and put us in a leading position in the industry.

Second, in terms of organizational structure, we shifted to a "General Manager" model, giving business leaders more autonomy to drive goals, accelerating decision-making speed.

At the same time, we reached a clear consensus across the company on financial criteria such as return on investment (ROI), enabling faster execution once decisions are made.

Q: Are you considering adding Bitcoin or other digital assets to the company's balance sheet as part of corporate treasury reserves?

A: We have spent a lot of time thinking about this issue. As a significant player in the crypto space, we certainly want to align with the crypto community.

Adding Bitcoin and other digital assets to the company's balance sheet has obvious benefits, showcasing our commitment and confidence in the crypto space. However, we must also weigh this from the perspective of shareholder interests. Doing so would tie up company capital, while our shareholders can fully purchase Bitcoin on the Robinhood platform themselves.

Therefore, we must consider: is it appropriate to make this decision on behalf of shareholders? Is this the best use of company capital? After all, we still need to invest in new product development and technology engineering to drive growth.

We are continuously discussing this issue internally. In short, we are still considering it. This matter has both pros and cons, and we will continue to actively evaluate it.

Q: Could you elaborate on your view of the long-term trend of "intergenerational wealth transfer" and where we currently stand in this trend? From a longer-term perspective (5 to 10 years), how will wealth transfer drive Robinhood's business growth? How should we understand its contribution to growth?

A: We are seizing the enormous opportunity of "intergenerational wealth transfer" from multiple angles.

First, in terms of product strategy, our core idea is to make Robinhood a "family financial center." We believe the more family members there are, the greater the value of the product to users. Specific approaches include:

a. Creating a family product experience: We are designing products like credit cards and bank accounts as family-unit services. Users can easily open accounts for partners, children, or other family members, making Robinhood a unified management platform for family finances.

b. Expanding account types: A few years ago, we only had a single personal brokerage account. Now, we have added retirement accounts (IRA) and up to 10 customizable personal brokerage accounts. In the future, we plan to further introduce trust accounts and custodial accounts to meet customers' needs for diversified asset allocation and inheritance as their wealth grows.

c. Integrating professional advisory services: As customers' financial needs become increasingly complex, we will integrate the Trade PMR platform to provide users with professional financial advisory services.

This "human + digital" model will offer more personalized advice, perfectly complementing our existing digital services.

We believe that this "whole family"-centered design concept is one of our major differentiating advantages, which many competitors have not focused on.

Overall, our goal is to win market share in every segment we participate in. By executing the above vision, we believe we can capture a share far above average in this wave of wealth transfer.

Q: We see Robinhood and other companies launching tokenized stocks, but these products are often built on different blockchains with slightly different structures, leading to a lack of interoperability.

Will this incompatibility lead to fragmented and segmented liquidity in the stock market? How do you foresee this market developing? How do you plan to address interoperability issues to enable tokenized stocks on different platforms to communicate?

A: Regarding the interoperability issue of tokenized stocks, we believe it is only temporary. Currently, our tokenized stocks are indeed still within the "walled garden" of the Robinhood platform, not yet achieving external interoperability. This strategy ensures a good user experience in the early stages, as each transaction is backed by an actual transaction in the traditional stock market.

In the long run, we are not worried about interoperability and liquidity fragmentation. First, we expect interoperability to naturally resolve over time. Just like other assets in the crypto world, even if they are initially distributed on different chains, the community will eventually achieve interoperability through building cross-chain bridges and wrapping protocols, with almost all mainstream tokenized assets ultimately moving towards multi-chain.

Secondly, liquidity fragmentation is not new in financial markets; it is already widespread across major exchanges and asset classes globally, and market makers have mature management solutions for this.

We even believe that crypto technology and blockchain infrastructure can simplify the engineering complexity and cost of cross-platform integration, making it easier to manage fragmented liquidity.

Q: This year's company expenses have been impacted by some specific cost items, some of which seem unlikely to recur next year. Based on this, how should we predict the company's normalized expense level in 2026?

A: We are currently formulating the financial plan for 2026, and while specific numbers are not yet determined, our core guiding principles remain entirely consistent with the past few years: achieving margin expansion while investing in growth. Our strategy is two-pronged:

On one hand, we require existing business units to improve efficiency through internal potential tapping, strictly controlling the growth of the cost base to low single digits or even lower;

On the other hand, we will strategically reinvest the funds saved from this, mainly to increase marketing spending (we are very satisfied with its ROI) and incubate new businesses.

Experience from the past few years has proven that this model allows us to achieve rapid revenue growth while maintaining relatively moderate expense growth. Therefore, when planning for 2026, we will continue to use this proven successful approach.

Q: Recent event prediction trading volume has grown significantly. Did this growth momentum continue in October? Is the growth in trading volume primarily driven by new user influx or more frequent trading by existing users? What is your timeline and initial thoughts on launching new prediction contracts (such as contracts for individual stocks to attract active traders)?

A: We are actively advancing the development of the prediction market. In the past few weeks, we have significantly increased the diversity of contracts, launching many new categories, such as markets in entertainment, culture, and technology, with over 1,000 real-time event contracts currently available.

Regarding user growth, we observe two parallel trends: on one hand, thanks to our large existing user base, many old users, especially active traders, are actively participating in the prediction market; on the other hand, we are also attracting many new users specifically for the prediction market.

Currently, the proportion of users participating in the prediction market is still relatively small compared to our total user base, similar to our active trader products. We believe there is still significant growth potential here.

The team is continuously working to improve the overall experience by increasing contract diversity, optimizing the user interface, and enhancing product visibility within the app. You can expect our prediction market products to progress and iterate weekly, attracting more users to participate.

Q: My question is about Robinhood's institutional business. This business grew by over 60% quarter-over-quarter this quarter, performing exceptionally well and appearing to have high strategic significance for the company. Could you elaborate on the long-term strategic importance of this business for Robinhood?

A: We are very excited about Bitstamp's performance and see the enormous opportunities it holds. Just yesterday, we had an in-depth discussion with Bitstamp's engineering and management teams to plan next year's development blueprint. Since the acquisition, despite its tremendous success in trading volume growth and product improvement, we will never be complacent.

Bitstamp is crucial to our long-term strategy, mainly in two aspects:

First, it will be the core of our tokenization vision entering the second stage, where we will rely on it to provide users with truly utility-based real-world asset tokenization products;

Second, as our first institutional business, it allows us to directly serve demanding institutional clients, whose direct and professional feedback is crucial for us to enhance our products and services, helping us become stronger.

In summary, we believe that as long as we continue to successfully build and optimize products, growth in trading volume and market share will naturally follow.

Q: Could you provide more details on the specific features and design of Robinhood Social? When is it expected to officially launch? How do you anticipate users will use this social feature? How and when is it expected to impact the company's financial performance?

A: Precisely predicting the financial impact of Robinhood Social is challenging because we first position it as a new source of information and trading inspiration for users. We aim to build it into a high-quality business and financial discussion community.

Based on past social feature experiments, we found that if executed well, such products can significantly enhance user engagement. Our unique advantage is the ability to verify traders' real holdings, ensuring high-quality content.

Our core goal is to make Robinhood not only a place for executing trading decisions but also the "origin" of trading ideas. If users generate ideas on our platform and complete transactions here, it forms a powerful closed loop, significantly enhancing the platform's network effects.

As we launch more asset classes in the future (such as prediction markets, futures), we will become the only platform offering cross-stock, options, cryptocurrency, prediction market, and futures trading discussions in real-time, verified, which will have great appeal to users interested in business and finance.

In terms of monetization, we currently do not view it as a direct revenue tool but as a "flywheel" driving growth.

The core logic is: attracting more users to the platform through a rich social experience, thereby capturing a larger share of their value in trading and other financial activities.

Q: You mentioned that you hope more than half of your users will come from outside the United States in the future. What role will acquisitions play in this grand international expansion strategy? Will you continue to adopt a market-by-market gradual approach, or consider entering multiple markets simultaneously through a bigger transaction?

A: In the long run, our international expansion strategy may be a combination of multiple approaches. We naturally lean towards organic growth, as exemplified by our progress in the UK market. However, we also have an active corporate development team.

We will not shy away from acquisition opportunities; as long as a deal meets our criteria, such as having an excellent team, advanced technology, and the ability to accelerate our product roadmap, we will actively consider it.

Q: How does the current growth of international business compare to your initial plans? Is it exceeding expectations, meeting expectations, or lagging behind? Are there more measures that can be taken in product deployment and innovation to accelerate international business growth?

A: Our international plans are still in the very early stages, a long-term vision that requires a ten-year perspective. Unlike the U.S. market, we do not have an existing customer base in new markets for cross-selling; everything needs to start from scratch. Nevertheless, we have already seen very positive early signs and are therefore continuing to increase investment.

In the UK and EU regions, we observe that the activity of new user groups is steadily increasing. As revenue increases, the return on investment (ROI) of marketing activities is also beginning to show, prompting us to launch more market promotion plans.

Particularly in the EU, a few months ago, we launched stock tokens in 30 countries through the Catch a Token tokenization event, with enthusiastic market response and rapid growth. However, it is important to emphasize that all this has happened in recent months, and the time is still short.

Overall, we are satisfied with the early momentum and are continuously increasing investment. It is likely that, as we have experienced in the past, looking back a few years later, we will find that we underestimated the growth potential of this business.

We still have a lot of work to do, such as the tokenization strategy I mentioned, which is currently only in the first stage. I believe that over time, the significant advantages of our international products compared to other competitors will become increasingly clear.

Q: Besides stock tokenization, what is the potential scale of the entire token market? Why do you think "now" is the best time to fully invest in this field? Besides stocks, there are many other assets that can be tokenized. How does Robinhood specifically plan to seize this opportunity in the coming years? What are your thoughts on the prioritization and strategy for tokenizing different assets?

A: We believe tokenization is a very exciting opportunity. Traditional finance and the crypto world have previously been like two separate systems, which is a problem but also an opportunity.

Robinhood's uniqueness lies in our scale in both traditional finance and the crypto field, giving us the ability to be the bridge connecting these two worlds.

Our goal is to enable traditional assets (such as securities) to leverage blockchain technology for on-chain trading. This will bring revolutionary changes: customers can self-custody assets, participate in various decentralized finance protocols (such as collateralized lending), and trade these assets in real-time, 24/7, and in fractional amounts.

We have already conducted some attempts at tokenizing private company assets in the EU market by gifting OpenAI and SpaceX stock tokens, and we are very interested in continuing to advance this.

I am personally excited about the prospects of tokenizing other assets, such as real estate, private credit, and unique collectibles like art. Currently, many alternative assets in high-net-worth individuals' portfolios are inaccessible to ordinary retail investors.

Tokenization technology is expected to solve this problem on a large scale, overcoming the drawbacks of traditionally holding such assets, such as poor liquidity, locked positions, and inability to make fractional investments.

Therefore, both in the U.S. and overseas, we are continuously advancing the tokenization strategy. We are starting with stock assets, which have the greatest potential and are most familiar to us, but you can expect the tokenization business to become increasingly important in the coming years.

Q: Is the trading volume displayed on the platform purely from Robinhood users, or does it mix liquidity from other sources? Is Robinhood considering expanding the prediction market business internationally? Could it even be synchronized with the current trading business expansion, or prioritized over certain regions' trading business expansion?

A: Regarding trading volume, what we display on the Robinhood platform is our own trading volume. Of course, we bring considerable trading activity to our partners, and in fact, a large portion of their trading volume comes from Robinhood.

As for international expansion, we are indeed closely studying it. As mentioned earlier, tokenization and prediction markets are other asset classes with crypto attributes, especially with great potential outside the U.S. Therefore, we are actively exploring the most effective ways to bring this business to international customers.

The specific implementation may vary depending on the regulations of different countries or regions, requiring a case-by-case approach. However, with our dual identity as a large traditional financial platform and a participant in the crypto field, we have multiple options in each market. We are confident in selecting the most suitable solution for the local area and are carefully evaluating this.

Q: Has there been a significant increase in the number of users applying for margin accounts to participate in short selling? How has the early adoption rate and user behavior of this feature been in the initial months?

A: The short selling feature was just announced a few weeks ago at the Hood Summit event, and customer response has been very enthusiastic. However, the feature is still in the final internal employee testing phase and has not yet been officially launched to external customers.

Therefore, we have not yet observed an increase in margin account usage due to anticipated short selling, and it is too early to discuss specific user behavior data. However, the company believes customers will really like this new feature.

Q: How has the cryptocurrency staking business on the Robinhood platform performed so far? Can you share some related data or insights? In the future, do you consider including and disclosing "prediction market" trading volume in monthly operational metrics updates?

A: Regarding the cryptocurrency staking business, our total staking amount at the end of this quarter was approximately $1 billion. Although recent market fluctuations have caused this number to decline slightly, customer response to being able to stake on the platform has been very positive.

As for whether to disclose "prediction market" trading volume in future monthly metrics, we will seriously consider this suggestion. We are always committed to providing investors with as much transparency as possible and continuously seeking ways to increase information disclosure to help everyone better understand our business.

<End Here>

Risk Disclosure and Statement of this Article:Dolphin Research Disclaimer and General Disclosure