Airbnb (Minutes): Believes that the scale of alternative accommodations has at least room to double

The following are the minutes of the 2025Q3 earnings call organized by Dolphin Research. For earnings interpretation, please refer to the article Airbnb: Is it really out of the woods, or just a temporary rebound?

I. Review of Core Financial Information

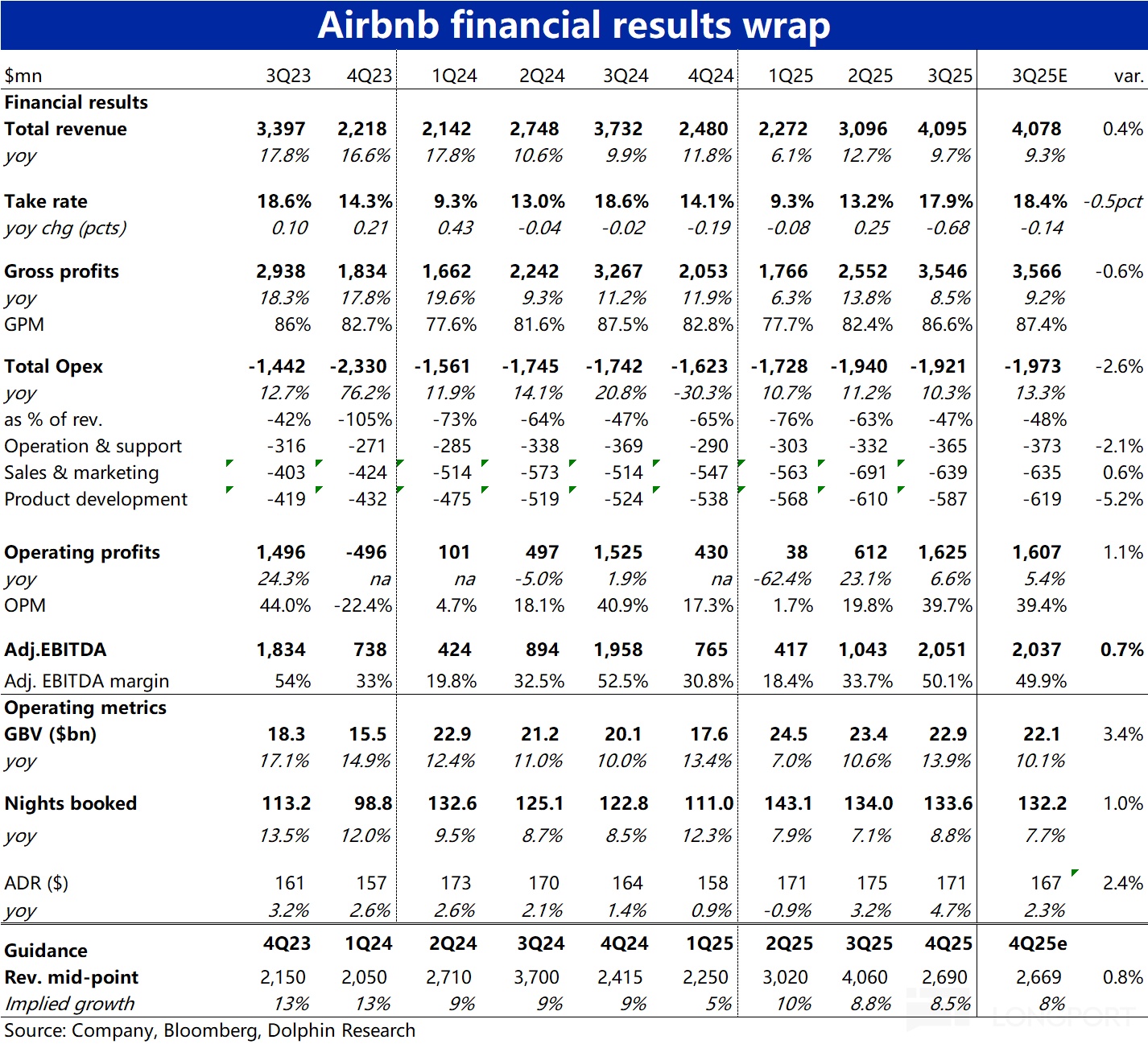

1. The total booking value for this quarter increased by 14% year-on-year to $22.9 billion, driven by both an increase in booking volume and average daily rates. The number of booked nights grew by 9% year-on-year, accelerating by 2 percentage points quarter-on-quarter, with the U.S. market performing particularly well. All major regions saw stable or accelerated growth in booked nights: Latin America grew by approximately 20%, the Asia-Pacific region by about 15%, and North America and EMEA (Europe, Middle East, and Africa) both achieved around 5% growth.

2. Revenue for the quarter reached $4.1 billion, up 10% year-on-year. Adjusted EBITDA was $2.1 billion, setting a new quarterly record, with an EBITDA margin of 50%. Net profit was $1.4 billion, with earnings per share of $2.21, up 4% year-on-year.

Free cash flow reached $1.3 billion, generating a total of $4.5 billion in free cash flow over the past 12 months, with a cumulative free cash flow margin of 38%. The company held $11.7 billion in cash and investments at the end of the period and repurchased $857 million in common stock, with total repurchases over the past 12 months exceeding $3.5 billion, accounting for three-quarters of free cash flow. The company still has $6.6 billion in authorized repurchase capacity.

3. Looking ahead to the fourth quarter, the company expects revenue to be between $2.66 billion and $2.72 billion, representing a year-on-year growth of 7% to 10%, including a slight favorable currency effect. Revenue per available room (GDV) is expected to achieve low double-digit year-on-year growth, driven by moderate increases in average daily rates (due to price increases and currency factors) and continued growth in booked nights and seats.

Booked nights and seats are expected to achieve mid-single-digit year-on-year growth in the fourth quarter. In terms of profitability, the full-year adjusted EBITDA margin is now expected to be around 35%, higher than the previously disclosed 34.5%. Looking ahead to 2026, the focus will be on maintaining strong profit margins while investing in growth areas such as hotels, artificial intelligence, and service experiences, although the scale of investment will be somewhat reduced compared to 2025.

II. Detailed Content of the Earnings Call

2.1 Key Information from Executive Statements

1) The company is advancing iterations around four growth engines: "optimizing service experience, expanding global market coverage, enriching product and service systems, and fully integrating artificial intelligence technology into the app." Since May last year, 65 major improvements have been implemented. Recent optimizations include "Book Now, Pay Later" and map function upgrades (adding landmarks/public transport/restaurants and satellite, street view, and traffic views) to enhance retention and conversion.

2) To enhance the certainty of host earnings and platform efficiency, the company updated its cancellation/modification policies: options include "free cancellation 14 days before check-in" and "free modification within 24 hours of booking for stays longer than 7 days," thereby reducing customer service handling volume and increasing annual bookings.

3) The company is bringing Airbnb to more corners of the world. The international expansion is now in the results release phase: over the past 12 months, the average nightly booking growth rate in expanded markets was twice that of core markets, while driving significant new user growth in key markets; for example, new user bookings in Japan increased by over 20% year-on-year, and nearly 50% in India.

4) Airbnb is driving growth by expanding service content. In May, Airbnb took the first step in upgrading its services by officially launching the "Airbnb Experiences" service. User feedback after the launch was "average rating 4.3/5," with the core accommodation business rating "4.8"; nearly half of the experience users had never booked accommodation on Airbnb before; host applications exceeded 110,000, nearly doubling from the previous quarter; and the social attributes of the experience were enhanced through designs such as "displaying participant information, in-app messaging, and the 'connect' section of personal profiles."

5) This quarter, Airbnb achieved significant breakthroughs in the field of artificial intelligence: on one hand, it launched a new generation of AI customer service systems with smarter response capabilities, supporting direct booking modifications in the messaging interface, which has been launched in the U.S. and reduced the need for human customer service by 15%, and is expected to cover more than 50 languages next year; on the other hand, the company is testing AI-driven search functions, allowing users to obtain personalized travel plans through natural conversations, which will be launched in the app next year.

2.2 Q&A Session

Q: What contribution has the "Book Now, Pay Later" service made to booking growth in the U.S. market? Has there been an increase in cancellation rates? Will more payment tools be introduced to drive growth in the future?

A: This service was launched at the beginning of the third quarter and is available to users booking properties within the U.S. with flexible or moderate cancellation policies. About 70% of eligible users chose this service. Although the cancellation rate has increased, pre-testing and monitoring confirmed that net bookings still achieved growth, contributing positively to the overall business. We will continue to optimize payment tools to promote booking growth in the future.

Q: How should investors view the execution cycle and investment depth required to achieve international market goals over the next two to three years, and how to increase business density outside the current core markets?

A: Airbnb launched its global expansion plan about two to three years ago, adopting a prudent localization strategy to ensure that products and marketing can meet local needs. For example, in Latin America, particularly the Brazilian market, we have been deeply cultivating for many years, currently not only holding a solid market share but also continuing to expand. Since last year, we have also started building a localized team for the Japanese market and have seen initial results. Overall, the progress varies by region, but the company remains committed to steady and continuous investment to ensure substantial growth in key markets.

Q: Has the activities and experiences business contributed to performance so far? Can it improve user retention or platform activity? What are the future expectations?

A: Since its launch in May, we have observed that about half of the experience booking users did not simultaneously book accommodation, with 10% being first-time Airbnb users, helping us attract a new user base. Local demand is also beginning to emerge, for example, 70% of original experiences in Paris are booked by local residents. Although this business is expected to take 3 to 5 years to become a significant part of revenue, it helps drive platform differentiation and increases interest in accommodation bookings by showcasing both listings and experience content in the same ad. Current retention rate data still needs to be validated over a 12-month cycle, but preliminary results show that the experience business has a positive impact on user growth, platform activity, and competitive advantage.

Q: With the accelerated recovery of the U.S. market, does Airbnb plan to re-enter the hotel business, especially in areas it previously exited?

A: The hotel business is a clear future opportunity for the company. We have already piloted hotel resource integration in New York, Los Angeles, and Madrid, particularly in markets with tight supply or regulatory constraints, where hotels can effectively supplement platform supply and attract Airbnb's high-quality customer base without additional demand stimulation. We believe that homestays and hotels are not completely substitutive but complementary choices for different scenarios, such as families or long stays being more suitable for homestays, while business or short trips are more inclined towards hotels. As hotel resources are easy to scale, and the platform itself has strong traffic and conversion capabilities, this business will become an important supplement to the core business in the future.

Q: Beyond filling supply gaps, does Airbnb see a path for hotel commercialization and booking experience expansion beyond supplementary demand? Is there long-term growth potential?

A: We aim to build Airbnb into a top one-stop travel platform, and to become such a travel service provider, we need not only listings, services, and experiences but also a comprehensive product matrix. The hotel business is a key part of this. In the long term, hotels not only supplement areas with insufficient homestay supply but also serve as an important means to meet personalized travel needs. We will focus on integrating boutique and independent hotels worldwide, especially in markets like Europe that are not yet fully covered. With AI-driven personalized recommendations, we will match suitable room types based on travelers' purposes, such as business travelers or short-trip travelers being more likely to get hotel options, while users seeking local immersive experiences are more suited to homestays.

Q: Will there be new billion-dollar products launched in 2026? Will the focus be on hotels, AI, and experience businesses, or are there other plans?

A: Yes, we plan to launch at least one new business each year. This year we have officially launched the experience service, and the hotel business is also in the pilot stage. Both have the potential to grow into billion-dollar businesses. Looking ahead, we will adopt a more flexible incubation model, testing multiple new projects in a few cities rather than requiring global rollout from the start. Currently, we are not only experimenting in the hotel field but also exploring other potential segments such as high-end luxury accommodations. Although details have not been disclosed, it is certain that new businesses will be incubated and gradually launched each year.

Q: How is the AI search function test progressing? Has it changed the Airbnb user experience? Additionally, what are the key milestones for new segments like experiences and hotels over the next three years?

A: The AI search function is currently in the testing phase, and we are working to allow users to naturally describe their needs in a conversational manner, with the system generating structured and more personalized results. The goal of this feature is to empower the entire user journey—from search to booking to check-in and review. The progress so far is encouraging. For the experience business, we are conducting in-depth tests in cities like Paris and Los Angeles and have observed strong demand from local users and returning visitors. We are gradually validating product-market fit and expect to build experiences and hotels into scalable new growth engines over the next 3 to 5 years, gradually replicating the city pilot model to more markets.

Q: From the perspective of guests or hosts, what are the most urgent pain points that Airbnb needs to improve?

A: Although we have completed 65 major optimizations, there is still a lot of room for improvement in the future. Current priorities include: continuing to enhance payment flexibility, such as "Book Now, Pay Later" and installment payment options; optimizing cancellation policies and discount mechanisms to enhance user stickiness; strengthening quality management to narrow the gap with hotels in terms of consistent experience; and continuously improving pricing tools to enhance price competitiveness. Additionally, we are optimizing maps and location information as a core competitive advantage of the platform, with all improvements being rapidly and continuously advanced.

Q: Can you further elaborate on the incremental investment plans for 2026? Additionally, what are the reasons for the accelerated maturity of core businesses in some markets over the past few years, and what is the future growth potential?

A: 2025 was a year of significant investment for us, as we launched new businesses such as services and experiences and pushed them into the market to build awareness. Looking ahead to 2026, related business revenue will achieve scale growth, and investment will continue but not at the same massive scale as the first year of launch. We have the ability to undertake these investments while improving core business efficiency, achieving net income growth and margin improvement. Regarding the core accommodation business, we believe the business is far from mature.

Taking our market as an example, for every one person choosing a homestay, about nine people stay in hotels, and we believe the homestay market has the potential to at least double. With improvements in the supply system, pricing tools, and product quality, we see strong growth potential. We have reason to believe that the core business will re-accelerate expansion in more countries in the coming years, especially as the new generation of travelers prefers homestays, which is an important opportunity for us.

Q: Why did Airbnb not participate in the initial integration of the ChatGPT application?

A: We believed that the integration solution at the time was not mature, as users needed to download the app first to use it, which was not convenient. Additionally, we did not want Airbnb to be perceived as a generic data layer or a common product display. We insist on a highly customized integration approach and ensure that users can understand Airbnb's unique value. Future deep cooperation with chat-based products is still possible, but the method must be appropriate.

Q: Can you elaborate on the expectations you mentioned at the Skip Travel conference in September regarding business acceleration?

A: We will start by revitalizing the core business. Currently, for every one person choosing Airbnb, about nine people choose hotels; many people are actually willing to stay in family-style accommodations, but we need to continue improving in "price reasonableness, quality, supporting services, and supply volume." We are pushing more high-quality listings globally, and as supply increases, prices fall, and bookings rise, forming a virtuous cycle, we are confident in restarting core business growth; except for policy restrictions, we have not seen a truly mature global market.

Q: While developing AI search in-house, will you allow third-party applications to build discovery experiences on top of Airbnb? Can they coexist with in-house development?

A: We maintain an open but cautious attitude. About 90% of traffic comes from direct or unpaid channels, and we are confident in providing the best travel search experience on the internet, believing that "specialization" will win in the travel field. We are willing to showcase inventory on other platforms, but it depends on the type of inventory and the value it can bring, taking a case-by-case evaluation for each platform and integration; we expect Airbnb to appear on various platforms and application scenarios in the future.

Q: Will the focus areas and new testing models for the coming year affect the pace of previously mentioned plans, such as the loyalty program or advertising business?

A: These projects can proceed in parallel. For example, the service-oriented hotel business can be implemented city by city, and our new testing model allows for the simultaneous incubation of multiple new businesses before selecting the best ones for expansion. The loyalty program and advertising business are more platform-oriented and are expected to scale faster. We are advancing both, with the loyalty program not being a traditional points model but a customized, unique solution that aligns with community values; the core of the advertising business is to fundamentally reshape the advertising model by combining it with the AI search we are building. We will not disclose specific plans in advance, but more products will be released next year.

<End here>

Risk Disclosure and Statement:Dolphin Research Disclaimer and General Disclosure