Hesai 3Q25 Quick Interpretation: Overall, Hesai has once again delivered an impressive report card this quarter. The third-quarter performance exceeded expectations, continuing the high growth trend.

Additionally, Hesai has raised its full-year performance guidance. Specifically:

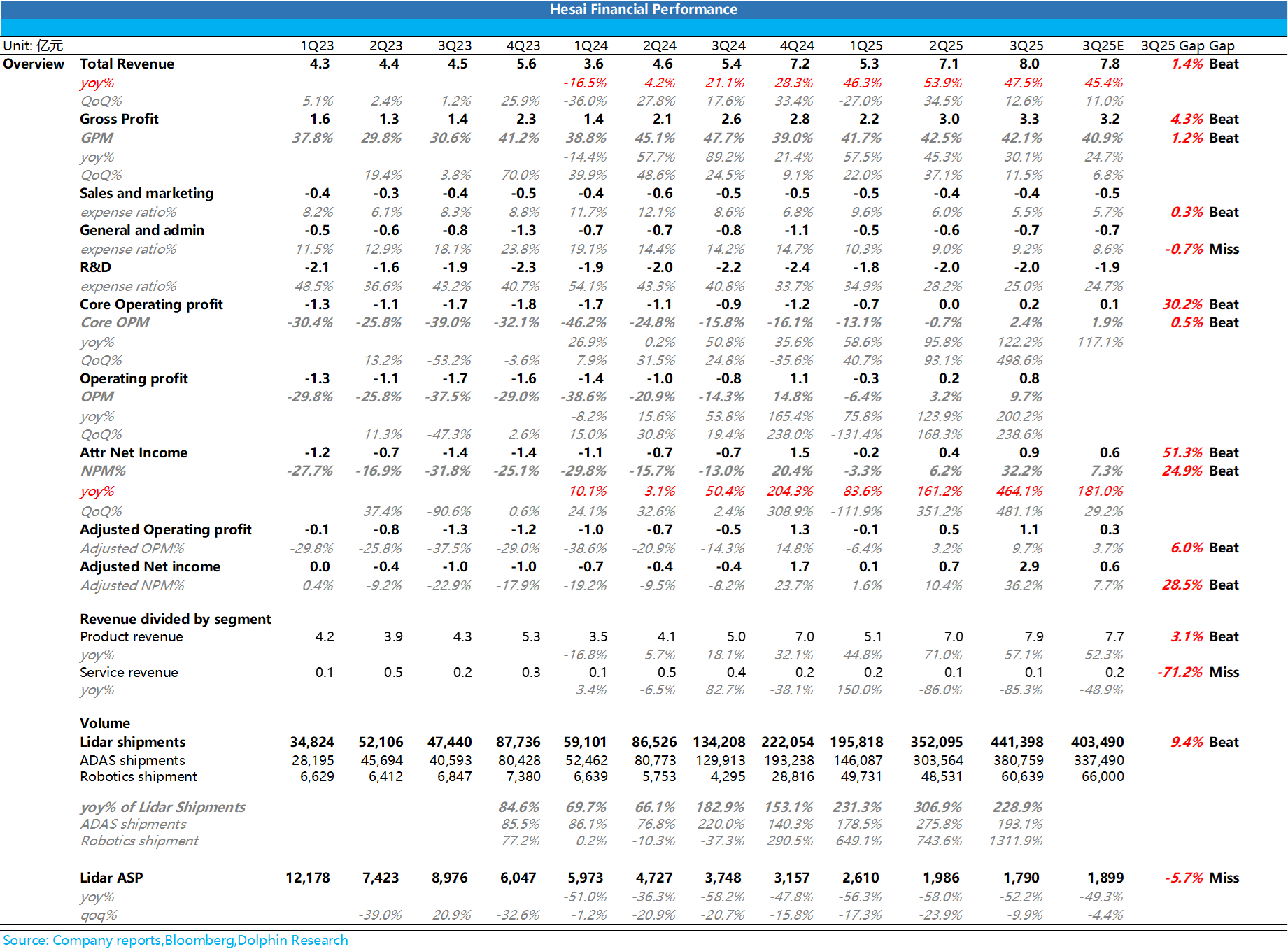

① The third-quarter performance continued the high growth trend, mainly driven by the accelerated shipment of the low-cost ATX:

Third-quarter revenue reached 800 million yuan, maintaining a high growth trend of 47.5% year-on-year, also exceeding the market expectation of 780 million yuan. The key to the revenue exceeding expectations this quarter was the lidar shipment volume significantly surpassing market expectations, primarily driven by the accelerated shipment of Hesai's low-cost ATX passenger car radar.

This quarter, lidar shipments reached 440,000 units, continuing a high growth trend of 229% year-on-year, also exceeding the market expectation of 400,000 units. The low-cost ATX continues to increase in volume, driving the proportion of passenger car lidar in Hesai's shipment structure to 86.3% (Dolphin Research estimates that ATX accounted for 71% in the third quarter).

From the price perspective, the unit price this quarter remained stable quarter-on-quarter. Although the proportion of low-cost ATX continued to rise quarter-on-quarter (replacing the old AT128), it is expected that due to the higher-priced Robotaxi radar starting to increase in volume this quarter, the final lidar unit price was 1,988 yuan, exceeding the market expectation of 1,900 yuan.

From the net profit perspective, Hesai's net profit this quarter also significantly exceeded expectations. Third-quarter net profit reached 260 million yuan, far exceeding the market expectation of 60 million yuan, with the net profit margin increasing from 6.2% in the previous quarter to 32.2% this quarter.

The significantly exceeded net profit margin was mainly due to a 170 million yuan gain from the sale of equity investments in a startup company recognized in the third quarter. Excluding this one-time impact, the third-quarter net profit margin would be 10.8%, also higher than the market expectation of 7.3%, mainly due to:

1) Third-quarter gross margin was 42.1%. The market originally expected the gross margin to decline from 42.5% in the previous quarter to 40.9% in the third quarter due to the increase in low-cost ATX shipments.

Despite the reduction in high-margin non-recurring engineering service revenue, Hesai maintained a high gross margin level through technological cost reduction and large-scale shipments;

2) Continued strong cost control capability, with the three expenses only increasing by 0.1 billion yuan quarter-on-quarter while revenue increased by 0.9 billion yuan quarter-on-quarter. The three expense ratio also continued to decline by 3.5 percentage points quarter-on-quarter from 43.2% in the second quarter to 39.7%.

② Hesai continues to raise full-year performance guidance:

Due to the dual exceedance of expectations in lidar delivery volume and net profit in the third quarter, Hesai provided fourth-quarter revenue guidance of 1-1.2 billion yuan. If the fourth-quarter shipment unit price is predicted to remain flat quarter-on-quarter, it implies that fourth-quarter lidar shipments will reach 500,000-600,000 units, and the full-year 2025 lidar delivery volume will reach 1.49-1.59 million units, exceeding Hesai's previous guidance of 1.2-1.5 million units.

Additionally, due to the third-quarter net profit performance exceeding expectations, Hesai continues to raise full-year net profit guidance to 350-450 million yuan (originally 200-350 million yuan), implying fourth-quarter net profit of 70-170 million yuan (third-quarter net profit excluding one-time equity gain was 90 million yuan). Based on the midpoint of fourth-quarter revenue and net profit guidance, the fourth-quarter net profit margin will reach 11%, continuing to maintain a very good net profit margin level.$Hesai(HSAI.US) $HESAI-W(02525.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.