Hesai: Tesla 'Disdain'? Still Growing Wildly Towards the Sun

Overall, $Hesai(HSAI.US) released its Q3 2025 financial report after the Hong Kong stock market closed on November 11, Beijing time. Once again, Hesai delivered an impressive financial report and raised its full-year performance guidance for 2025. Specifically:

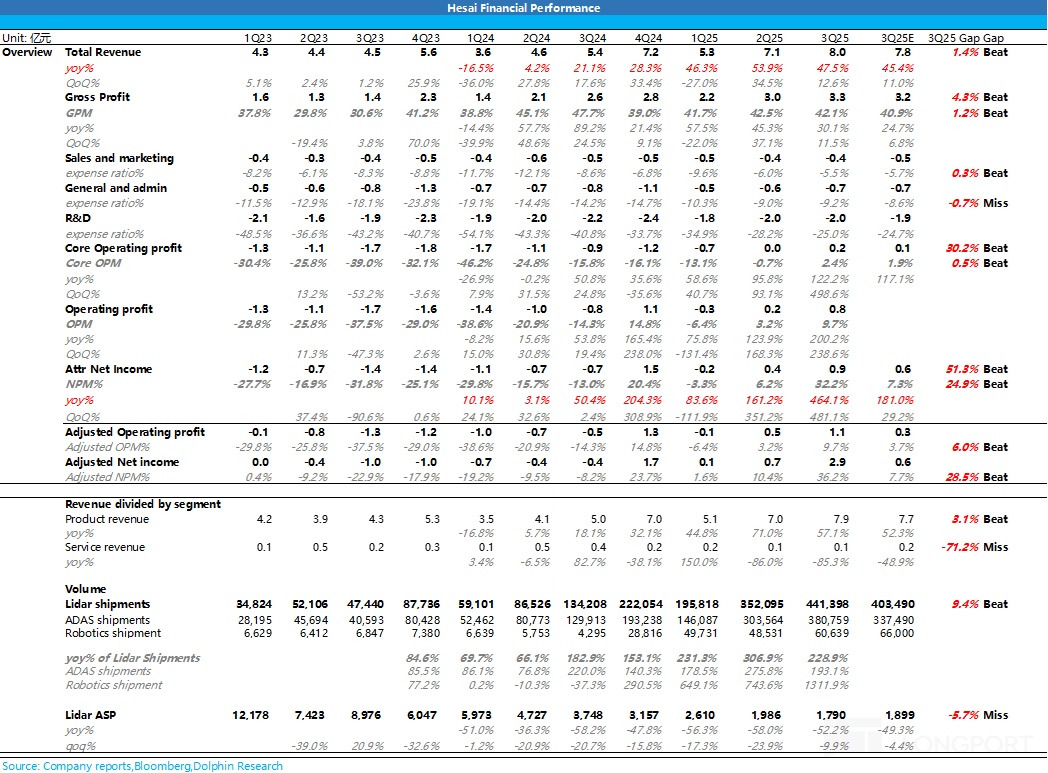

1) Revenue continues to maintain a high year-on-year growth trend, with LiDAR shipments still increasing: Q3 revenue was 800 million yuan, continuing to maintain a high year-on-year growth trend of 47.5%, exceeding the market expectation of 780 million yuan. The key to the revenue exceeding expectations this quarter was the significant increase in LiDAR shipments, mainly driven by the accelerated shipments of Hesai's low-cost ATX passenger car radar.

2) LiDAR shipments in Q3 once again exceeded expectations, mainly driven by the accelerated shipments of the low-cost ATX: This quarter, LiDAR shipments reached 440,000 units, maintaining a high year-on-year growth trend of 229%, also exceeding the market expectation of 400,000 units. The low-cost ATX continued to increase in volume, driving the proportion of passenger car LiDAR in Hesai's shipment structure to 86.3% (Dolphin Research estimates that the proportion of low-cost passenger car radar ATX in the shipment structure will continue to increase to 71% in Q3, becoming the main force of Hesai's shipments).

3) LiDAR prices declined quarter-on-quarter: In terms of price, due to the continued increase in the proportion of low-cost ATX (replacing the old AT128), the unit price of LiDAR in Q3 was 1,790 yuan, a quarter-on-quarter decline of 10% (a year-on-year decline of 52%), but overall still follows the logic of "volume increase and price reduction" driven by technological cost reduction and increased penetration rate as previously predicted by Dolphin Research.

4) Continued high gross margin level: Q3 gross margin was 42.1%. The market originally expected that due to the increase in shipments of the low-cost ATX, the gross margin would decline from 42.5% in the previous quarter to 40.9% in Q3. However, despite a reduction in high-margin non-recurring engineering service revenue, Hesai maintained a high gross margin level through technological cost reduction and large-scale shipments (quarter-on-quarter delivery volume increased by 25%).

5) Continued strong cost control ability: In Q3, with a quarter-on-quarter revenue increase of 90 million yuan, the three expenses only increased by 10 million yuan quarter-on-quarter, and the three expense ratios continued to decline by 3.5 percentage points from 43.2% in Q2 to 39.7% in Q3. Hesai once again demonstrated its strong cost control ability.

6) Net profit margin significantly exceeded expectations: In terms of net profit, Hesai's net profit also significantly exceeded expectations this quarter. Q3 net profit reached 260 million yuan, far exceeding the market expectation of 60 million yuan, and the net profit margin increased from 6.2% in the previous quarter to 32.2% this quarter. The significant exceedance of the net profit margin was mainly due to the recognition of a 170 million yuan gain from the sale of equity investments in a startup in Q3. Excluding this one-time impact, the net profit margin in Q3 would be 10.8%, still higher than the market expectation of 7.3%, mainly due to the high gross margin level driven by scale effects and technological cost reduction, as well as strong cost control ability.

Dolphin Research's View:

Overall, Hesai once again delivered an impressive report this quarter, with Q3 performance once again exceeding market expectations, maintaining a high growth trend, and raising its full-year performance guidance:

① Q3 performance continued to maintain a high growth trend, mainly driven by the accelerated shipments of the low-cost ATX:

Both revenue and profit in Q3 exceeded expectations, and this exceedance was still due to the continued increase in volume of the low-cost ATX, becoming the main force of Hesai's revenue and shipment growth (Dolphin Research estimates that the proportion of low-cost passenger car radar ATX in the shipment structure will continue to increase to 71% in Q3). The underlying logic is still the continuous decline in LiDAR unit price driven by technological cost reduction, leading to increased penetration rate and accelerated expansion of application scenarios.

At the same time, due to Hesai's very rigid cost control ability: in Q3, with a year-on-year revenue increase of 47.5%, the three expenses still achieved an 8% year-on-year decline. Even after excluding the one-time recognition of a 170 million yuan gain from the sale of equity investments in a startup, the net profit margin in Q3 still reached 10.8%, achieving a year-on-year increase of 222% in net profit to 90 million yuan this quarter.

② Hesai continues to raise its full-year performance guidance:

Due to the dual exceedance of LiDAR delivery volume and net profit in Q3, Hesai provided Q4 revenue guidance of 1-1.2 billion yuan. If the Q4 shipment unit price is predicted to be flat quarter-on-quarter, the implied Q4 LiDAR shipment volume will reach 550,000-670,000 units, and the full-year 2025 LiDAR delivery volume will reach 1.54-1.66 million units, far exceeding Hesai's previous guidance of 1.2-1.5 million units.

At the same time, due to the better-than-expected net profit performance in Q3, Hesai raised its full-year net profit guidance to 350-450 million yuan (previously 200-350 million yuan), implying Q4 net profit of 70-170 million yuan (Q3 net profit excluding one-time equity gain recognition was 90 million yuan). Based on the midpoint of Q4 revenue and net profit guidance, the Q4 net profit margin will reach 11%, maintaining a very good net profit margin level.

Since Hesai's listing on the Hong Kong stock market, the stock price has undergone a significant correction. On the one hand, this is due to the release of positive news after the dual listing, and on the other hand, concerns about the 2025 sales of major customers such as Li Auto, Xiaomi, and BYD not meeting expectations, affecting Hesai's achievement of its annual LiDAR shipment target. This better-than-expected financial report and raised full-year guidance have dispelled market doubts.

Dolphin Research believes that Hesai is still a relatively high-certainty target benefiting from the continuous increase in intelligent driving penetration and the expansion of the second curve robot track:

① Hesai still holds the leading position with the shipments of low-cost ATX:

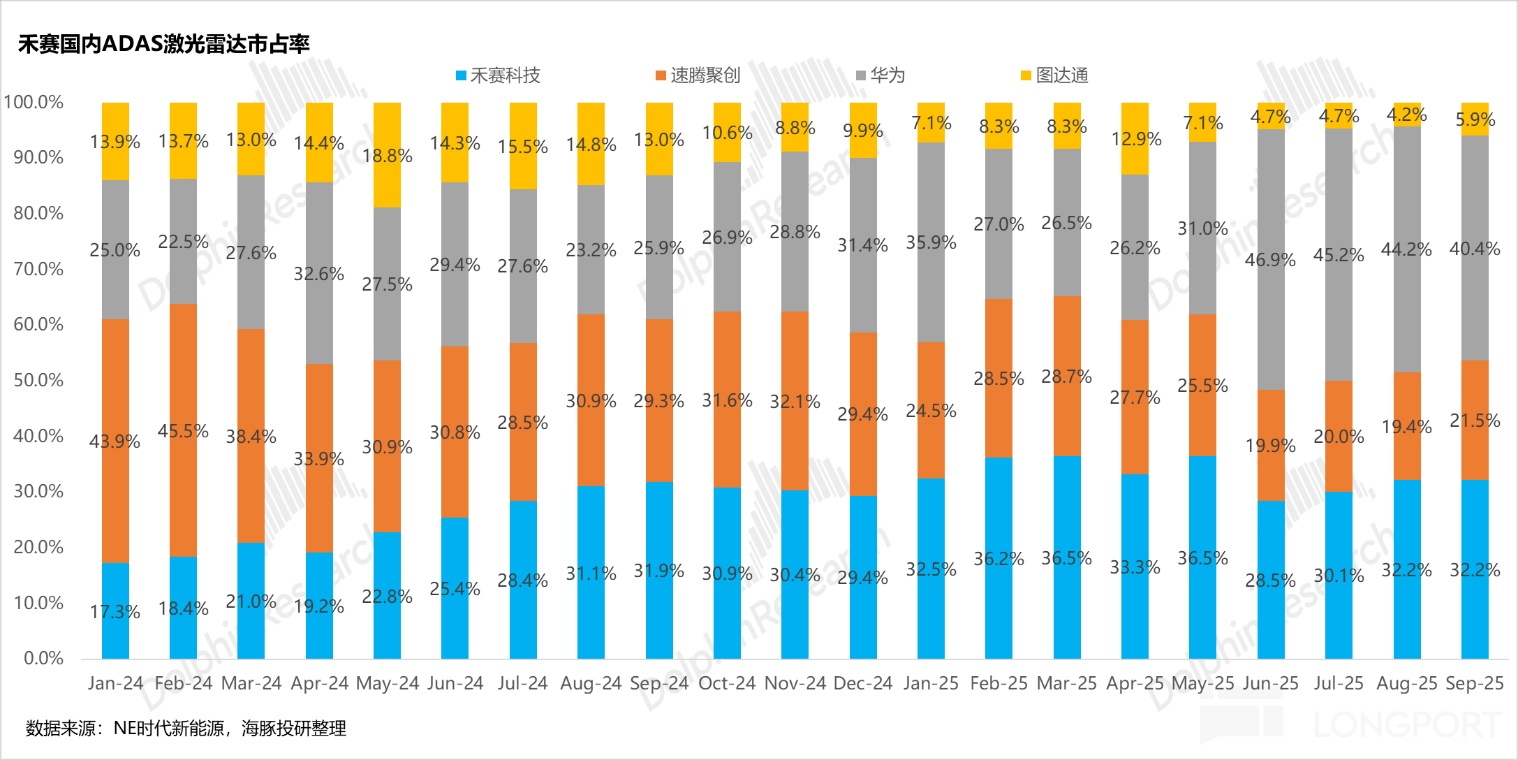

In terms of market share, although Hesai's market share has declined since June, mainly due to the increase in Huawei's market share (driven by the volume of Huawei's blind-spot LiDAR and the ramp-up of the new Aito M8), Huawei's LiDAR is expensive and shipped in an integrated hardware-software package, so the main customers are still those in the intelligent selection car and HI mode. Therefore, the actual competition is still concentrated among Hesai, Suteng, and Tudatong.

Currently, Hesai still holds the leading position in the passenger car track with the shipments of low-cost ATX, with a market share of 31.6% in Q3, 11 percentage points higher than the second-place Suteng.

② Full-year 2025 delivery volume continues to exceed the upper limit of the original guidance, once again confirming the "volume increase and price reduction" logic driven by ATX technological cost reduction:

Hesai previously provided a delivery volume guidance of 1.2-1.5 million units for 2025, including 1-1.3 million units of ADAS LiDAR and 200,000 units of robot radar. This time, Hesai's revenue guidance implies that Q4 LiDAR shipment volume will reach 550,000-670,000 units, and the full-year 2025 LiDAR delivery volume will reach 1.54-1.66 million units, far exceeding Hesai's previous guidance of 1.2-1.5 million units.

③ In 2026, Hesai will continue to benefit from the "democratization of intelligent driving" and the trend of "multiple LiDARs" in advanced intelligent driving:

1) From 2026, ATX has entered the "thousand-yuan machine" era, providing strong support for the "democratization of intelligent driving" trend from the cost side:

Dolphin Research expects that urban NOA will continue to accelerate penetration in the 100,000-200,000 yuan price range. Leapmotor, with its main model price range in the 100,000-200,000 yuan range, plans to achieve urban NOA by the end of the year. XPeng will also bring urban NOA to the 100,000-150,000 yuan model Mona M03. Dolphin Research expects that the popularization of L2-level ADAS in 2026 will still be driven by mass-market car companies such as BYD, Geely, Great Wall, and Changan. Hesai's ATX has entered the "thousand-yuan machine" era, providing strong support for the "democratization of intelligent driving" trend from the cost side.

2) For advanced intelligent driving at L3 and above, the trend of multiple LiDARs is also becoming an industry trend, and the market size is expected to further expand:

On September 12, eight departments jointly issued the "Automobile Industry Growth Stabilization Work Plan (2025-2026)", conditionally approving the production of L3-level models. Models with L3-level autonomous driving capabilities have higher perception requirements, and the number of LiDARs per vehicle is usually more than three. For example, ZEEKR's 9X Glory is equipped with five LiDARs, and the management expects each L3-level vehicle to be equipped with 3-6 LiDARs, with the value of LiDARs per vehicle ranging from $500 to $1,000. The market size of LiDARs is expected to further expand.

Currently, Hesai's main LiDAR ETX + multiple blind-spot radars FTX solution has also been selected for cooperation by the top three new car manufacturers (expected to be Li Auto), with mass production expected by the end of 2026 or early 2027.

From the perspective of Hesai's orders and progress in 2026:

Hesai has already secured cooperation with the top two ADAS customers (expected to be Xiaomi and Li Auto) for all models in 2026, achieving 100% standard configuration of LiDARs. The market is more concerned about the progress of orders from car companies such as BYD and Geely, which may require disclosure from the management during the performance meeting.

In terms of Robotaxi, Hesai has also secured cooperation with Pony.ai, Hello, JD Logistics, Motional, and other Robotaxi and Robovan companies, following the logic of scenario expansion.

From the perspective of overseas progress: In addition to the previously announced exclusive cooperation with Mercedes-Benz (covering multiple models of both fuel and new energy vehicles, a long-term cooperation project spanning to 2030, with volume expected to increase by the end of 2026 or early 2027), Hesai has also announced strategic cooperation worth tens of millions of dollars with multiple Robotaxi companies in North America, Asia, and Europe, including Motional. Hesai's overseas customer expansion is still progressing smoothly.

From the perspective of Hesai's stock price, the current stock price corresponds to a P/S ratio of 7.9 times for 2025. Although this valuation multiple seems "expensive" in the short term, it requires continued high growth performance to digest the valuation.

Although Hesai has announced orders from Li Auto and Xiaomi for 2026, the market still wants to see orders from major customers such as BYD and Geely (concerns about competition from Suteng) and the ability to provide continued high growth shipment guidance for 2026, bringing a clear volume growth trend in revenue and shipments for 2026 to support the currently "expensive" valuation of Hesai.

However, from a long-term perspective, LiDAR and chip integration can support the continuous evolution of "Moore's efficiency," with rapid technological iteration (achieving significant improvements in point cloud density and cost reduction), strong scale effects, and the ecological binding with OEMs forming the moat of the LiDAR track. Leading players can still achieve the "strong get stronger" effect, and the concentration of the LiDAR track will remain high. Currently, it seems that the competition in the domestic market is mainly between Hesai and Suteng, with Hesai still holding the leading position.

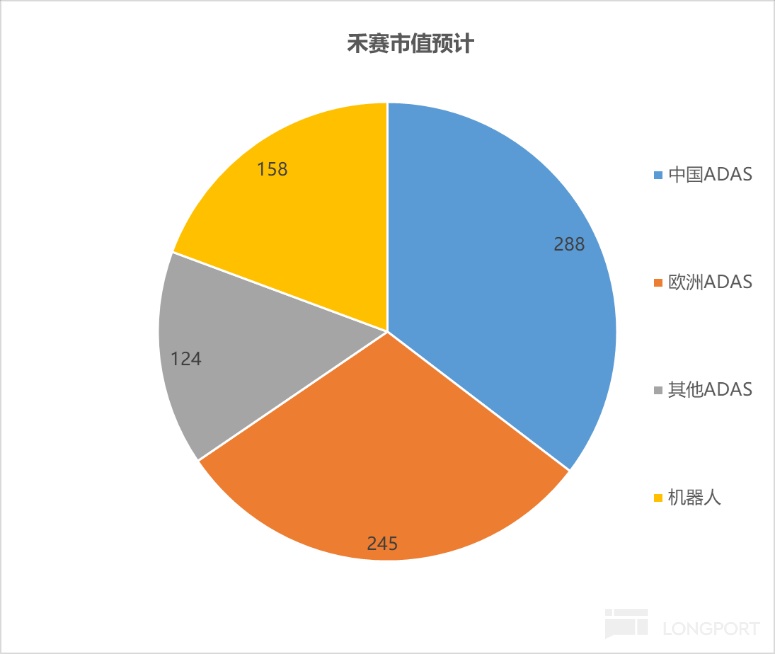

From the perspective of long-term TAM, Hesai's current market value of 25.6 billion yuan only reflects the market value of the domestic passenger car ADAS LiDAR scenario (conservatively estimated at a market size of 40 billion yuan in 2030). However, Hesai's certainty in the overseas market is still very high (almost no substantial competitors overseas, and Hesai continues to receive orders from overseas manufacturers, with the overseas logic continuously strengthening), and the potential upward option attribute of the robot track. Dolphin Research believes that Hesai's current valuation is still not expensive. For specific valuation calculations, please refer to the article "Hesai: Tesla's "Abandoned Child"? Can't Stop the "Gorgeous Comeback" of LiDAR"

Previous Articles:

Hesai In-depth:

""4x" Hesai: Why Did the LiDAR Abandoned by Tesla "Shine" Again?"

"Hesai: Tesla's "Abandoned Child"?Can't Stop the "Gorgeous Comeback" of LiDAR"

Hesai Financial Report

"Hesai: "Eye of Intelligent Driving" High Growth in Shipments, Can It Soar Again?"

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.