Ctrip: Awaiting the Release of Overseas Profits

After the U.S. stock market closed on November 18, $Trip.com(TCOM.US) released its financial report for the third quarter of fiscal year 2025. The performance remained robust, with both revenue and profit slightly exceeding expectations. Specifically:

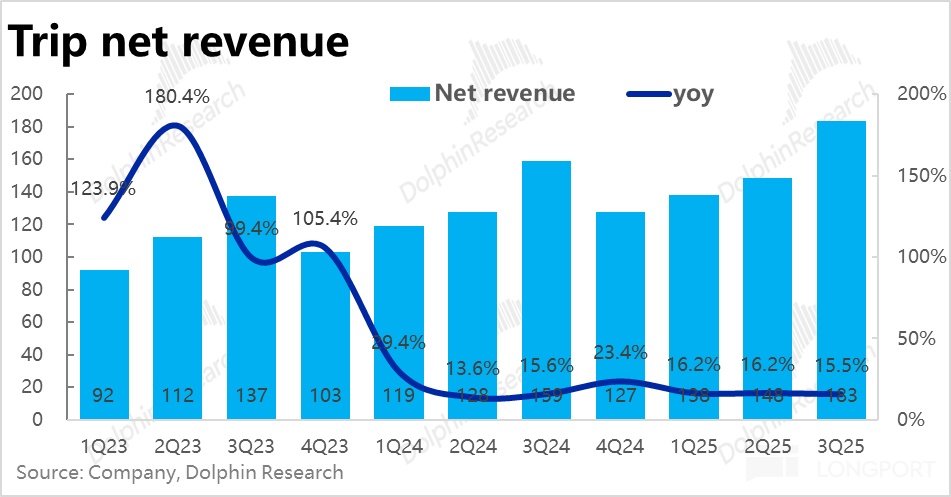

1. Overall performance remains stable: In terms of large numbers, this quarter, Trip.com Group's total net revenue was approximately 18.3 billion yuan (excluding business tax), representing a year-on-year increase of 15.4%, with the growth rate slightly slowing quarter-on-quarter but still slightly above the market expectation of 14.5%, indicating stable growth.

In terms of profit, after adding back stock-based compensation, the adjusted operating profit was 6.2 billion yuan, up 13% year-on-year, slightly higher than the company's guidance of 5.8-5.9 billion yuan. Due to a narrowing gross margin and higher expense growth, profit growth still lagged behind revenue growth, but the trend is gradually improving.

2. Overseas business maintains high growth, outbound tourism recovery accelerates: According to the company's disclosure, inbound tourism bookings this quarter increased by over 100% year-on-year, and pure overseas business bookings increased by 60% year-on-year, consistent with the growth rate disclosed last quarter. Despite entering a high base period, it still maintains impressive growth.

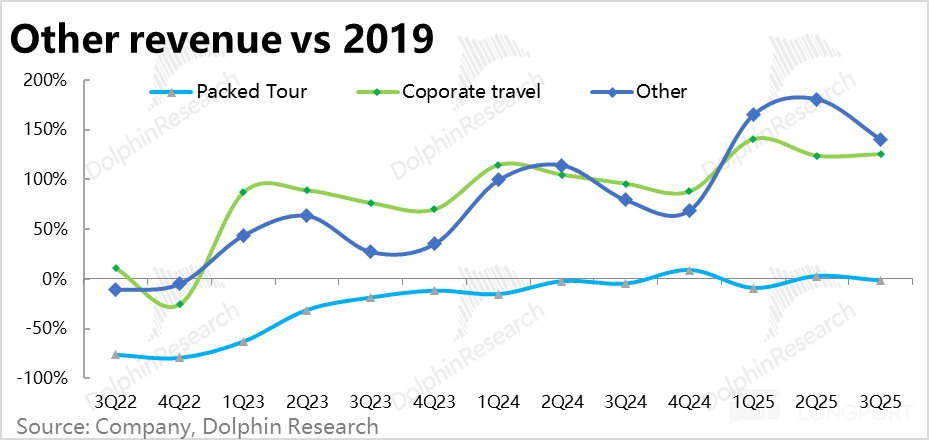

Outbound tourism flight and hotel bookings exceeded 140% of the same period in 2019, up from 120% last quarter, with the increase in international flight supply, outbound tourism further recovered.

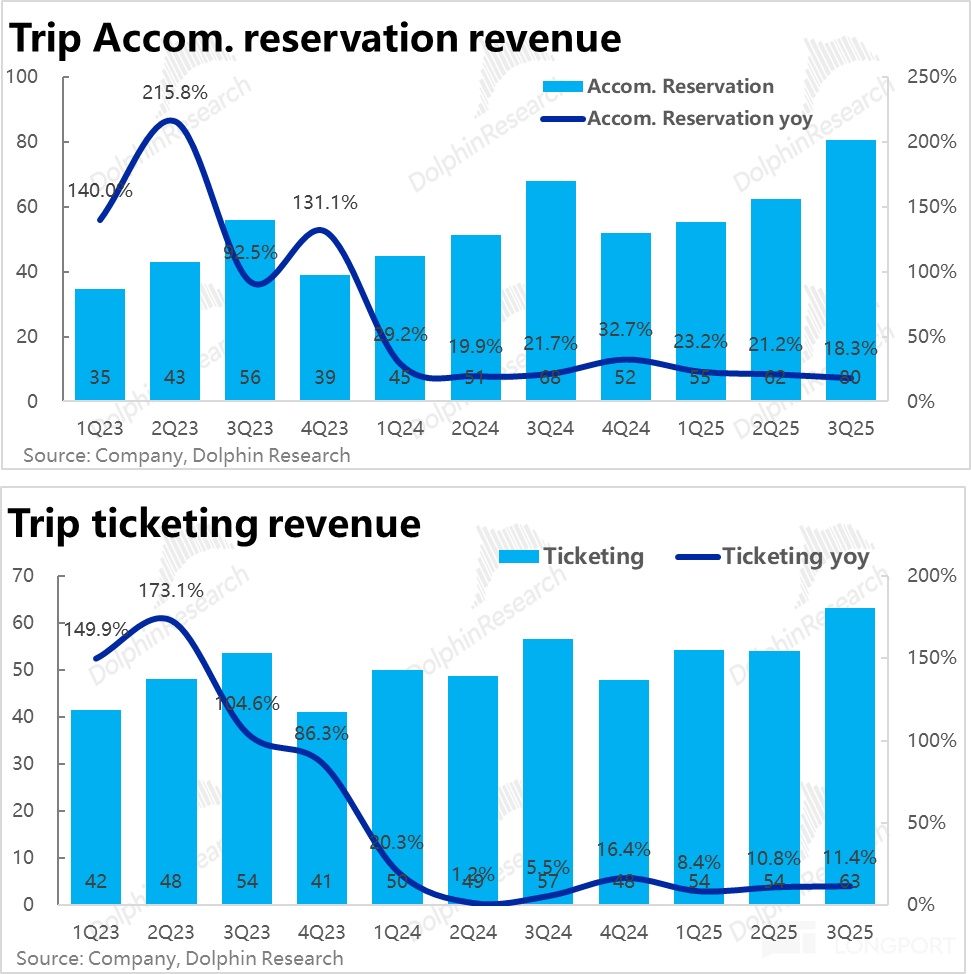

3. Among the two major pillar businesses, this quarter, hotel booking revenue increased by approximately 18% year-on-year, with a continued quarter-on-quarter slowdown of 3 percentage points, approaching the upper end of the company's previous guidance range of 14%-19%. Besides the impact of a high base, the average price per hotel room both domestically and internationally still shows a downward trend, which should also be one of the reasons dragging down revenue growth.

Ticketing revenue this quarter increased by 11.4% year-on-year, with continued acceleration quarter-on-quarter. On one hand, as the impact of reduced bundled sales of air tickets since 2Q last year has passed the base period. Additionally, the strengthening of outbound tourism this quarter should also contribute significantly.

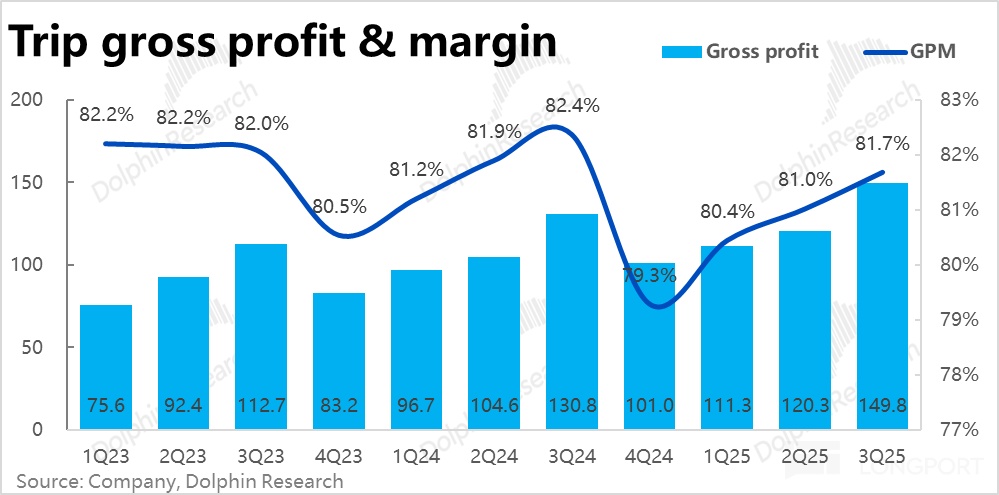

4. Gross margin continues to decline, but the extent narrows: This quarter's gross margin was 81.7%, still shrinking year-on-year, but the decline narrowed from 0.9 percentage points last quarter to 0.7 percentage points this quarter, mainly due to the higher proportion of lower-margin overseas business in the revenue structure. As a result, gross profit increased by 14.5% year-on-year, still slightly below revenue growth, but higher than Bloomberg's expectations.

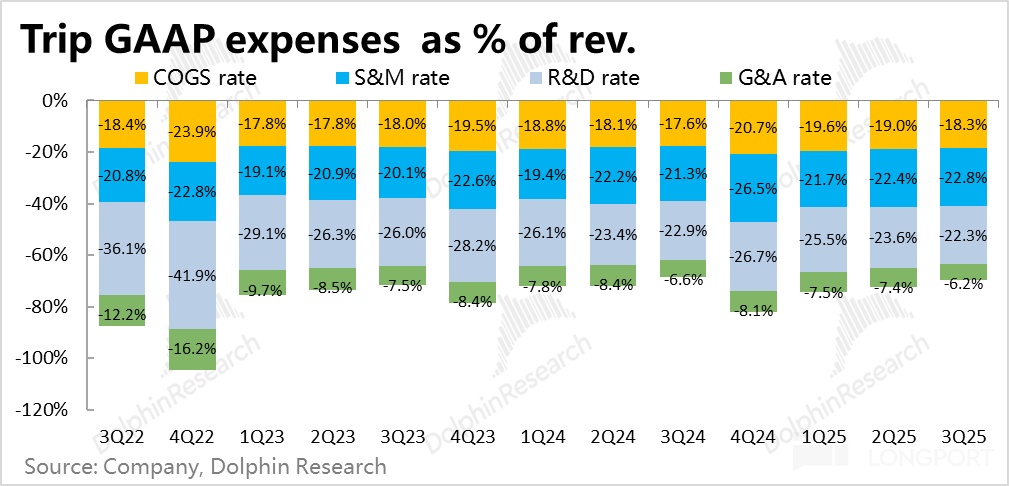

5. Expenses are still in the investment phase: This quarter, Trip.com's total operating expenses increased by nearly 17% year-on-year, significantly higher than the growth rate of revenue and gross profit. To promote the growth of overseas business, the company is still in an expense investment expansion phase. Mainly, marketing expenses increased significantly, up nearly 27% year-on-year, and it cannot be ruled out that domestic customer acquisition pressure is also rising. In terms of other expenses, R&D expenses and management expenses increased by approximately 12% and 9% year-on-year, still slightly below revenue growth.

6. Net profit exceeded expectations due to the sale of MakeMyTrip equity: This quarter's GAAP net profit reached 19.9 billion yuan, far exceeding the normal level. This was mainly due to the recognition of gains from the sale of approximately 29% equity in the Indian travel OTA platform MakeMyTrip this quarter, resulting in other operating income of 17 billion yuan this quarter.

Dolphin Research's View:

Overall, it can be seen that Trip.com's performance remains quite stable, with revenue growth maintaining around 15% with little fluctuation. On the other hand, due to the higher proportion of low-margin overseas business and the need to maintain high customer acquisition expenses, the profit margin is still in a downward phase, but compared to the previous three quarters, the decline in profit margin has begun to narrow.

As overseas business further matures, with reduced investment and improved profit margins, Trip.com's profit growth is likely to continue to align with revenue growth, or even surpass it.

Looking ahead to the company's future performance trends, 1) According to market research, domestic travel demand is generally stable, and after about two years of decline, the average price per customer has recently shown signs of stabilization. Overall, domestic travel demand should still be stable or slightly slowing.

2) In terms of domestic business, regarding the evolution of the competitive landscape, Dolphin believes that since the supply of travel (especially high-end) is more limited and exclusive compared to goods, Trip.com's business and barriers will not be easily disrupted by traffic advantages. Although it seems to be a light asset business that does not involve fulfillment, the actual requirements for efficiency and service are not low. Therefore, Dolphin does not believe that Trip.com will be easily shaken by JD.com, Alibaba, etc., which have obvious traffic and capital advantages.

At the same time, JD.com, Alibaba, etc., are unlikely to invest too much in the travel business, as the correlation with their core businesses is limited, and low-frequency travel demand does not provide much diversion.

However, potential logical issues arise more from the gradual groupization and membership of domestic hotels, which has some conflict with the underlying OTA business model. Therefore, we are not pessimistic about the potential risks in the short to medium term of domestic business, nor are we overly optimistic about the long-term logic.

3) As the company has fully gone through the damage and benefit period since the COVID-19 pandemic in its domestic travel business, business growth is gradually stabilizing (except for potential incremental competitive pressure from JD.com and Alibaba's Fliggy), the main imagination space for the company's future performance depends more on the steady-state revenue scale and profit margin level of its overseas business (mainly Trip.com). Currently, the growth trend of overseas business is still quite good, with more focus on when the time point for a significant improvement in profit margin will arrive.

However, the information disclosed in Trip.com's financial report is relatively limited, and more important data and guidance on revenue or profit performance by business segment for investment decisions can be found in the management's communication during the conference call, which Dolphin will organize and publish later for judgment.

From a valuation perspective, according to Dolphin's profit estimates (higher than Bloomberg's consensus expectations), Trip.com's current market value corresponds to an estimated multiple of approximately 18x for adjusted operating profit after tax in 2026. The valuation is relatively neutral and generally matches the current revenue and profit growth rates. The main driver of market value or profit is likely to focus on when Trip.com will turn profitable and start releasing valuation.

Below is a detailed commentary:

I. Revenue growth remains stable, overseas continues high growth, outbound tourism also recovers

This quarter, Trip.com Group's total net revenue was approximately 18.3 billion yuan (excluding business tax), representing a year-on-year increase of 15.4%, with the growth rate slightly slowing quarter-on-quarter but still slightly above the market expectation of 14.5%, indicating stable growth.

According to the company's disclosure, inbound tourism bookings this quarter increased by over 100% year-on-year, and pure overseas business bookings increased by 60% year-on-year, consistent with the growth rate disclosed last quarter. Despite entering a high base period, it still maintains high growth.

Outbound tourism flight and hotel bookings exceeded 140% of the same period in 2019, up from 120% last quarter, with the increase in international flight supply, outbound tourism growth is also strengthening.

According to the revenue breakdown disclosed in the financial report, this quarter, hotel booking revenue increased by approximately 18% year-on-year, with a continued quarter-on-quarter slowdown of 3 percentage points, approaching the upper end of the company's previous guidance range of 14%-19%. Besides the impact of a high base, the average price per hotel room both domestically and internationally still shows a downward trend, which should also be one of the reasons dragging down travel revenue growth.

Ticketing revenue this quarter increased by 11.4% year-on-year, with continued acceleration quarter-on-quarter. As Dolphin mentioned last quarter, as the company entered the low base period caused by the proactive reduction of bundled sales of air tickets last year, ticketing business revenue growth is expected to recover. Additionally, the continued recovery of outbound tourism demand this quarter should also contribute significantly to the ticketing business.

II. Advertising and business travel growth exceed expectations

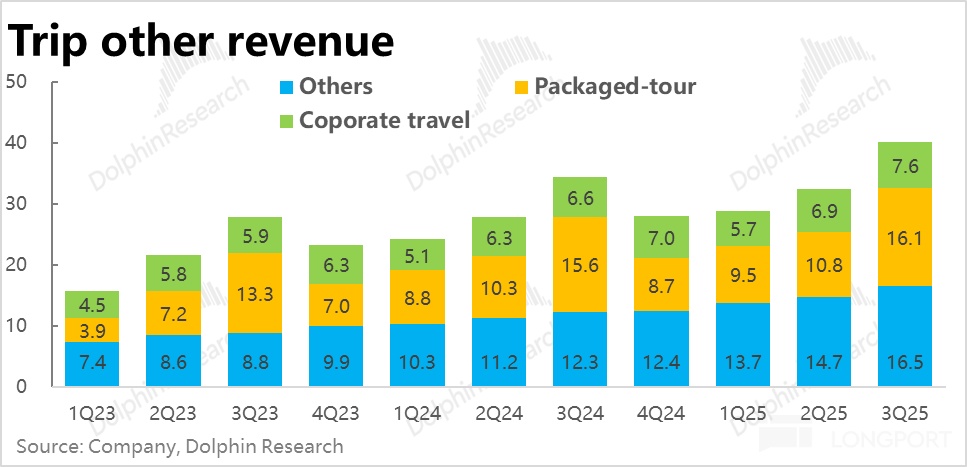

In terms of the performance of the other three small-scale businesses:

1) Business travel revenue was 760 million yuan, up 15% year-on-year, with growth significantly accelerating, also exceeding the upper limit of the company's previous guidance range of 12%. The main reason for the expected increase in business travel growth was seasonal benefits, and it remains to be seen if other trend benefits will be mentioned in the conference call;

2) Packaged tour product revenue was 1.6 billion yuan, up 3% year-on-year, with a significant increase in travelers' preference for independent travel after the pandemic, the growth of packaged tour products remains very poor.

3) Other revenue, mainly from advertising, increased by 34% year-on-year, with growth accelerating by nearly 3 percentage points quarter-on-quarter, showing unexpectedly strong performance. The continued improvement in advertising penetration and the operation of Trip.com's platform in travel community functions such as strategy sharing and personal travelogues should continue to promote good growth in this part of the revenue.

III. Gross margin narrows, expenses expand, profit margin declines but better than expected

This quarter's gross margin was 81.7%, although still shrinking year-on-year, the extent narrowed from 0.9 percentage points last quarter to 0.7 percentage points this quarter. According to the company's explanation, the decline in gross margin is still mainly due to the higher proportion of lower-margin overseas business in the revenue structure. Therefore, gross profit was approximately 15 billion yuan, up 14.5% year-on-year, still slightly below revenue growth.

In terms of expenses, this quarter, Trip.com's total operating expenses increased by nearly 17% year-on-year, significantly higher than the growth rate of revenue and gross profit, indicating that the company is still in an expense investment expansion phase to promote overseas business growth. Mainly, marketing expenses increased significantly, up nearly 27% year-on-year. Besides the need for overseas expansion, it cannot be ruled out that domestic customer acquisition pressure is also rising.

In terms of other expenses, R&D expenses and management expenses increased by approximately 12% and 9% year-on-year, still slightly below revenue growth, partially offsetting the impact of marketing expenses.

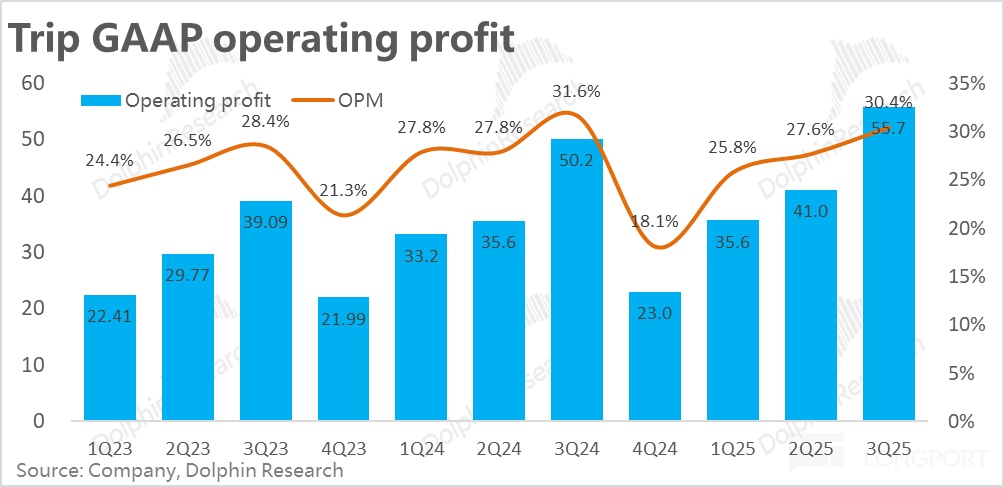

Under GAAP, due to the contraction phase of gross margin and the expansion phase of expenses, this quarter, Trip.com's GAAP operating profit margin narrowed by 1.2 percentage points year-on-year, with operating profit increasing by 11% year-on-year to 5.57 billion yuan.

After adding back stock-based compensation, under Non-GAAP, adjusted operating profit was 6.2 billion yuan, up 13% year-on-year (this quarter's stock-based compensation expenses increased significantly year-on-year, so the profit growth rate under Non-GAAP is slightly higher), slightly higher than the company's guidance of 5.8-5.9 billion yuan. Although this quarter's profit growth still lagged behind revenue growth, it has improved compared to the first two quarters of this year.

<End of text>

Past Dolphin Research [Trip.com] Analysis:

August 28, 2025 Minutes "Trip.com (Minutes): Announced $5 billion open-ended buyback plan"

August 28, 2025 Financial Report Commentary"Unafraid of JD.com's entry, Trip.com remains a top student"

May 20, 2025 Financial Report Commentary"Trip.com: Another revenue increase without profit increase, even top students face challenges?"

May 20, 2025 Minutes "Trip.com (Minutes): Stable travel demand, will continue to increase marketing investment"

February 25, 2025 Financial Report Commentary"Trip.com: Can inbound tourism "turn the tide" under high investment?"

February 25, 2025 Minutes "Trip.com (Minutes): Huge overseas potential, no profit limit in 2025"

November 19, 2024 Financial Report Commentary""Playing out" of the country, Trip.com is still doing well"

November 19, 2024 Conference Call "Trip.com: Any surprises in 2025? (3Q24 Conference Call)"

August 27, 2024 Conference Call "Trip.com: How did the local and inbound/outbound business perform during the summer?"

August 27, 2024 Financial Report Commentary"Trip.com: Between underperformance and madness, finally a normal Chinese concept stock!"

May 21, 2024 Conference Call "Trip.com: Grasping overseas markets and inbound/outbound tourism"

May 21, 2024 Financial Report Commentary "Trip.com: Traveling "high" overseas, but afraid of heights"

February 22, 2024 Conference Call "Trip.com: International business, inbound tourism, AI--3 major strategic directions in 2024"

February 22, 2024 Financial Report Commentary "Trip.com: Can 2024 stabilize domestically, can overseas take over?"

Risk Disclosure and Statement of this Article:Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.