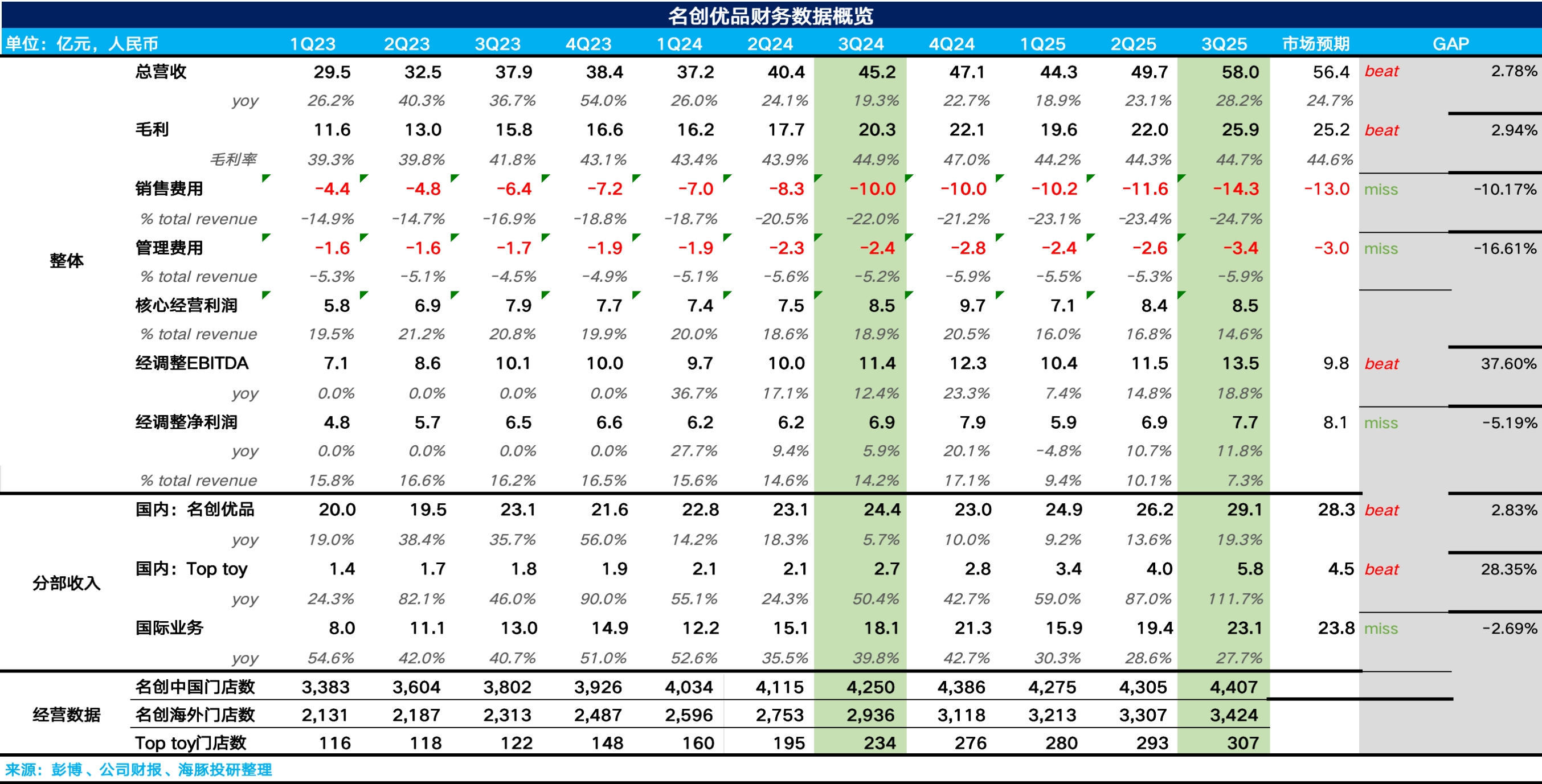

MINISO 3Q25 Quick Interpretation: Overall, MINISO's third-quarter performance was mixed. On the positive side, by closing inefficient small stores and focusing on larger stores, same-store sales growth further expanded after turning positive in the second quarter. However, on the downside, increased marketing and management expenses in the third quarter impacted profit margins.

1. Revenue in line with guidance midpoint: Domestically, by brand, benefiting from the improvement in same-store sales, the main MINISO brand grew by 19% year-on-year, with a trend of acceleration compared to the previous two quarters.

TOP TOY, after an 87% high growth in the previous quarter, continued to perform well with a 112% year-on-year growth in the third quarter. Dolphin Research estimates that the average revenue per TOP TOY store has reached RMB 1.92 million (a 74% year-on-year increase).

Overseas, despite a slowdown in store openings, overall growth slightly declined to 28%. However, the positive aspect is that same-store growth turned positive through focused store locations and localized operations.

Ultimately, the group achieved total revenue of RMB 5.8 billion, a year-on-year increase of 28.2%, slightly exceeding market expectations.

2. Store count continues to rise: In terms of store openings, domestically, after closing a large number of low-efficiency stores in lower-tier cities in the first quarter, the number of stores resumed positive growth in the second quarter, and the pace of store openings slightly accelerated in the third quarter, with growth concentrated in lower-tier markets.

Overseas, similar to the second quarter, the strategy shifted from a dispersed layout to focusing on densely populated areas in the United States (California, Florida, New York, etc.) for cluster store openings, enhancing scale effects through optimized logistics routes.

3. Increased spending on expenses: In terms of profitability, due to the increased proportion of low-margin, high-traffic, high-turnover daily necessities and seasonal promotional items in the third quarter, the gross margin slightly declined year-on-year.

On the expense side, as MINISO is still in the expansion phase overseas (especially in North America), facing significant upfront investments in store openings, personnel recruitment, and brand promotion, both sales and management expense ratios increased in the third quarter.

The adjusted net profit reached RMB 770 million, slightly below market expectations (RMB 810 million). $Miniso(MNSO.US) $MNSO(09896.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.