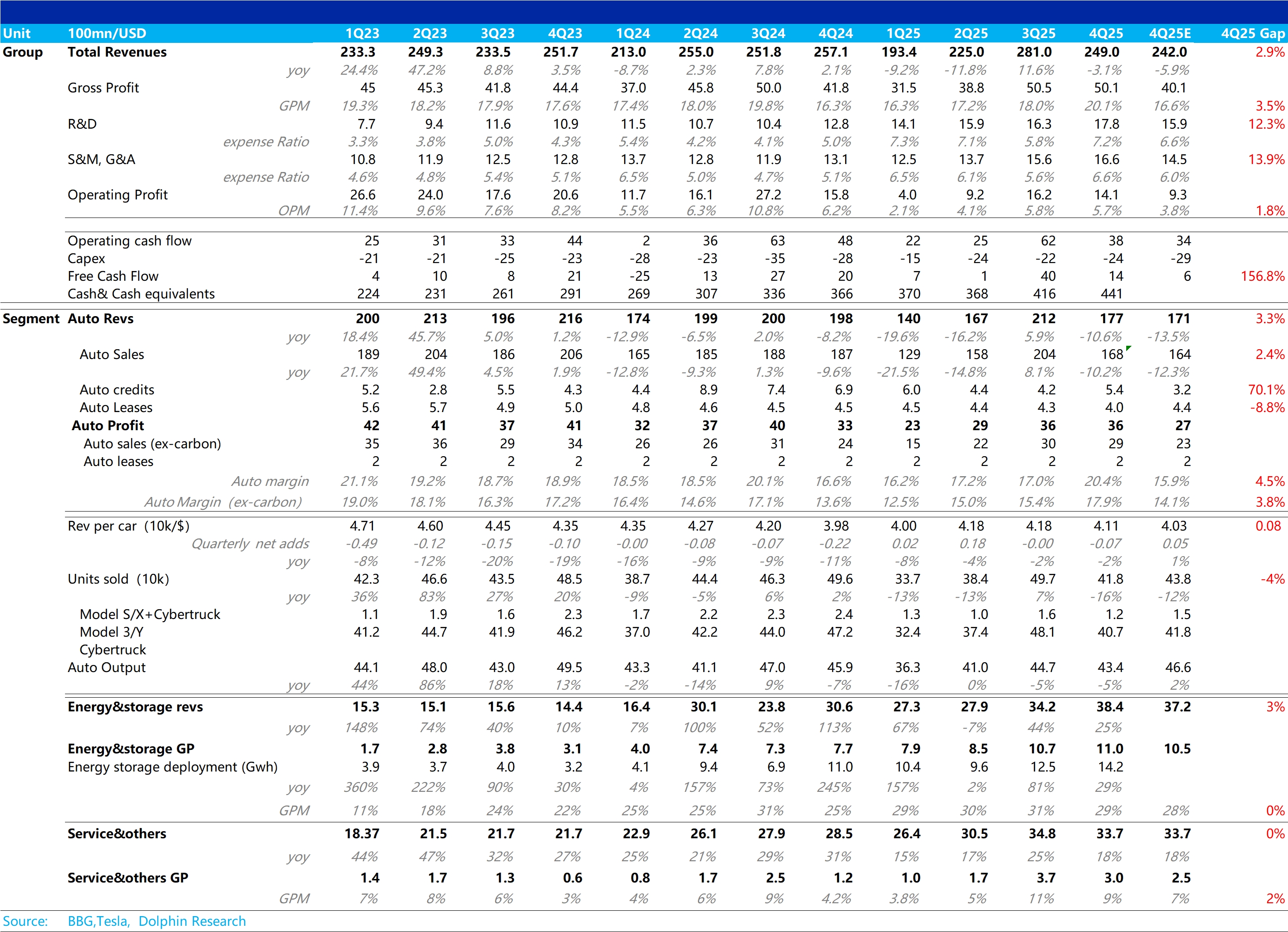

TSLA Earnings First Take: overall a solid print. Contrary to fears that weak Q4 deliveries would sink the P&L. Both revenue and profitability beat.

Auto remains the focus and it surprised to the upside. Despite softer Q4 volumes, automotive GPM rose 340bps QoQ to 20.4%.

Ex-regulatory credits, auto GPM also climbed 250bps QoQ to 17.9%. This beat consensus, which was looking for further deterioration to 14.1%.

Dolphin Research believes this counter-consensus outcome mainly reflects: a) ASP fell only about $700. The Street expected a larger drop as de-contented Model 3/Y trims launched in the U.S. and Europe and promos intensified (loan rate buydowns, financing incentives, inventory discounts).

Offsetting factors likely included the rollout of higher-priced Performance AWD trims for Model 3/Y and higher FSD subscription revenue. FSD subs added roughly 100k to 1.1mn, cushioning ASP pressure.

b) Unit costs declined, lifting auto margin QoQ. While fixed cost per vehicle rose as volumes fell, variable cost per unit dropped sharply, likely as tariff headwinds eased in Q4.

Outside autos, Energy continued to outperform and beat, while Services was broadly in line. Despite higher R&D from AI investments and higher SBC lifting SG&A, the revenue beat ($24.9bn vs. $24.2bn) and a 210bps QoQ increase in total GPM to 20.1% drove a better-than-expected bottom line.

Beyond the print, investors are focused on TSLA's AI progress and roadmap. Dolphin Research will track the call, stay tuned!$Tesla(TSLA.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.