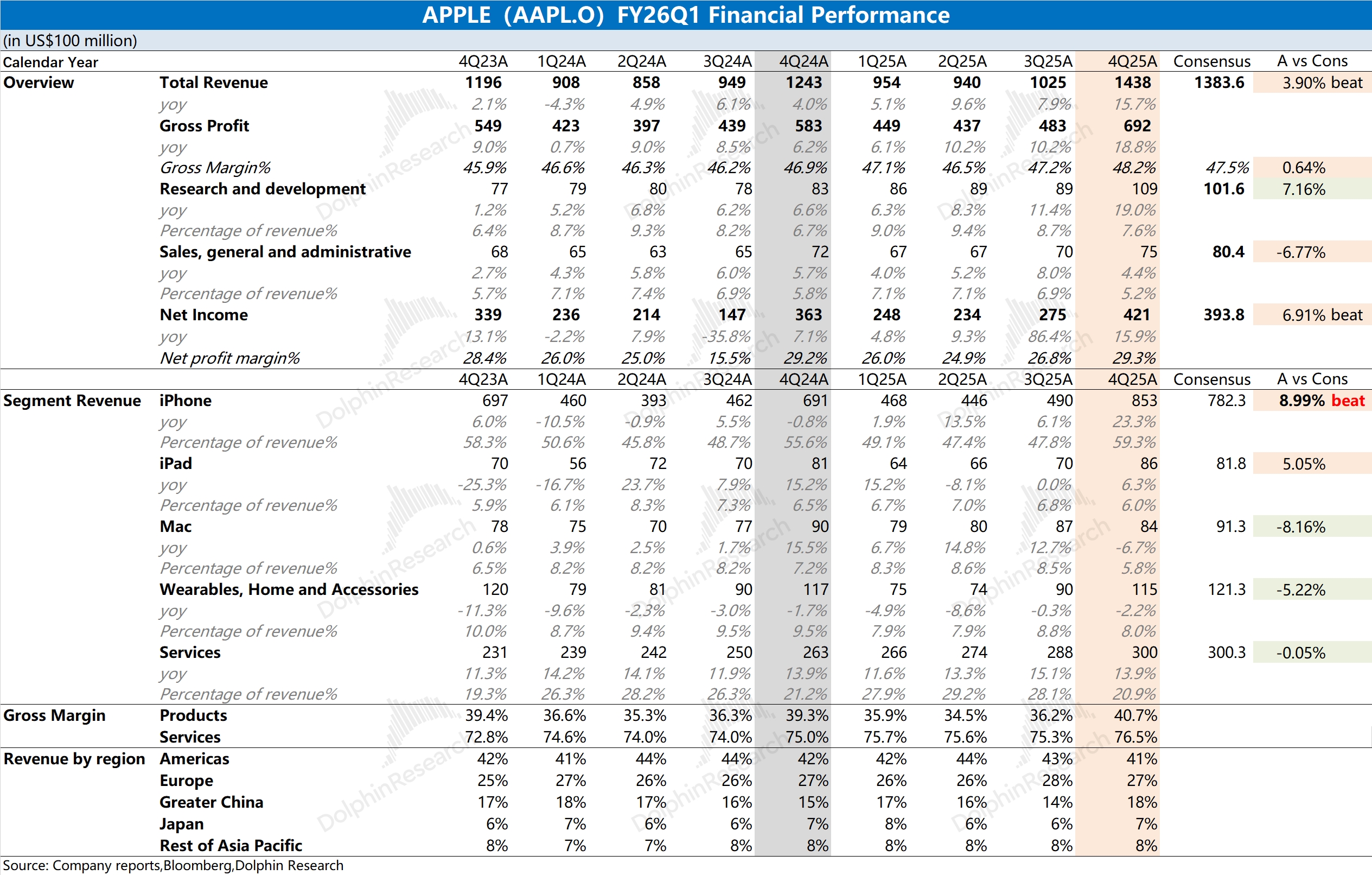

AAPL 4Q25 First Take: Solid quarter with revenue and gross margin beating expectations. Driven mainly by the iPhone 17 launch and a weaker USD.

1) Top-line growth: led by the iPhone 17 series. iPhone revenue rose 23% this quarter, as a spec bump at the same price worked despite limited innovation. Notably, the 256GB iPhone 17 is eligible for state subsidies in Mainland China, driving a significant lift in volumes. Mainland sell-through accelerated.

2) Gross margin up: GM improved despite memory price headwinds, with hardware GM rising again. Helped by lower China tariffs and USD weakness, particularly as tariffs on China-made exports were cut to 10% from 20% this quarter after US–China talks, providing an added tailwind.

Beyond this quarter, mgmt guided next quarter revenue up 13–16% YoY to $107.8–110.6bn; GM at 48–49%, with iPhone remaining the main growth driver. Although memory price hikes will have a larger impact next quarter, GM is still likely to edge higher.

Overall, the print again showcases AAPL’s brand strength and execution. The iPhone 17 series’ spec bump at the same price effectively passes savings to users, delivering double-digit growth against the tide. Even with memory inflation, GM remains on an improving trajectory into next quarter.

Bottom line: AAPL’s core business remains solid. Beyond the core, the market is focused on optionality from the collaboration with Google’s Gemini. With the industry leaning into AI and AAPL’s vast installed base, an upgraded Siri could unlock new growth, which investors are watching. For more details, follow Dolphin Research’s forthcoming deep dive and call Trans. $Apple(AAPL.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.