Company Encyclopedia

View More

HESAI-W

02525.HK

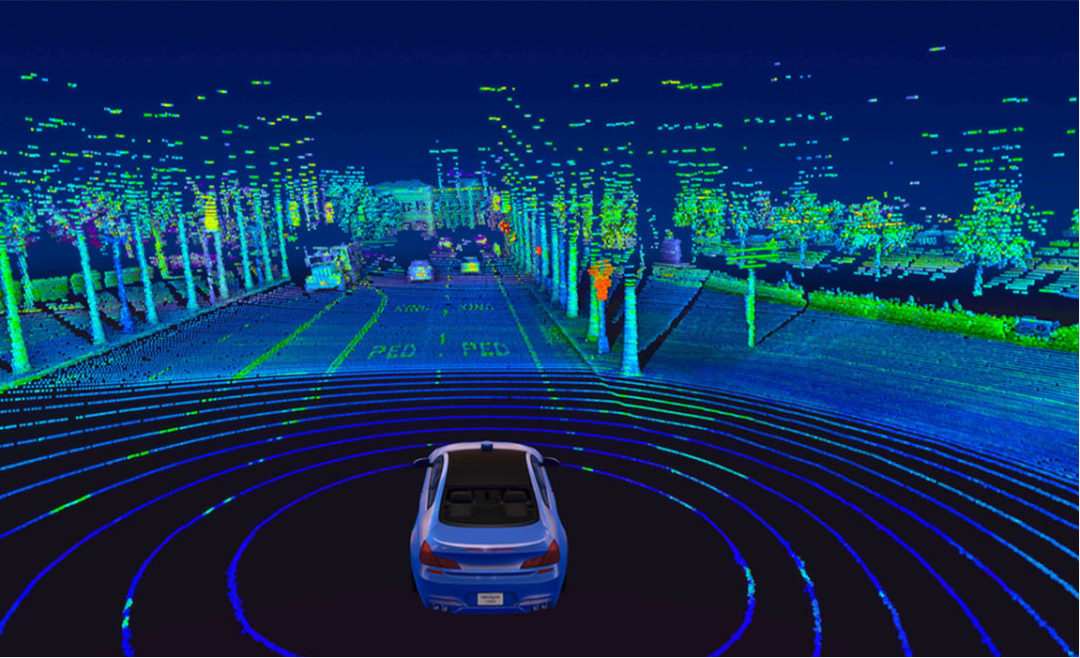

Hesai Group, through with its subsidiaries, engages in the development, manufacture, and sale of three-dimensional light detection and ranging solutions (LiDAR) in Mainland China, Europe, North America, and internationally. The company offers gas detection products, validation services, solution service, and other services, as well as designs and develops engineering products. Its LiDAR products are used in passenger and commercial vehicles with advanced driver assistance systems; autonomous vehicle fleets providing passenger and freight mobility services; and other applications, such as last-mile delivery robots, street sweeping robots, and logistics robots in restricted areas. Hesai Group was founded in 2014 and is headquartered in Shanghai, China.

428.02 B

02525.HKMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

Why do stock prices and performance show opposite trends?

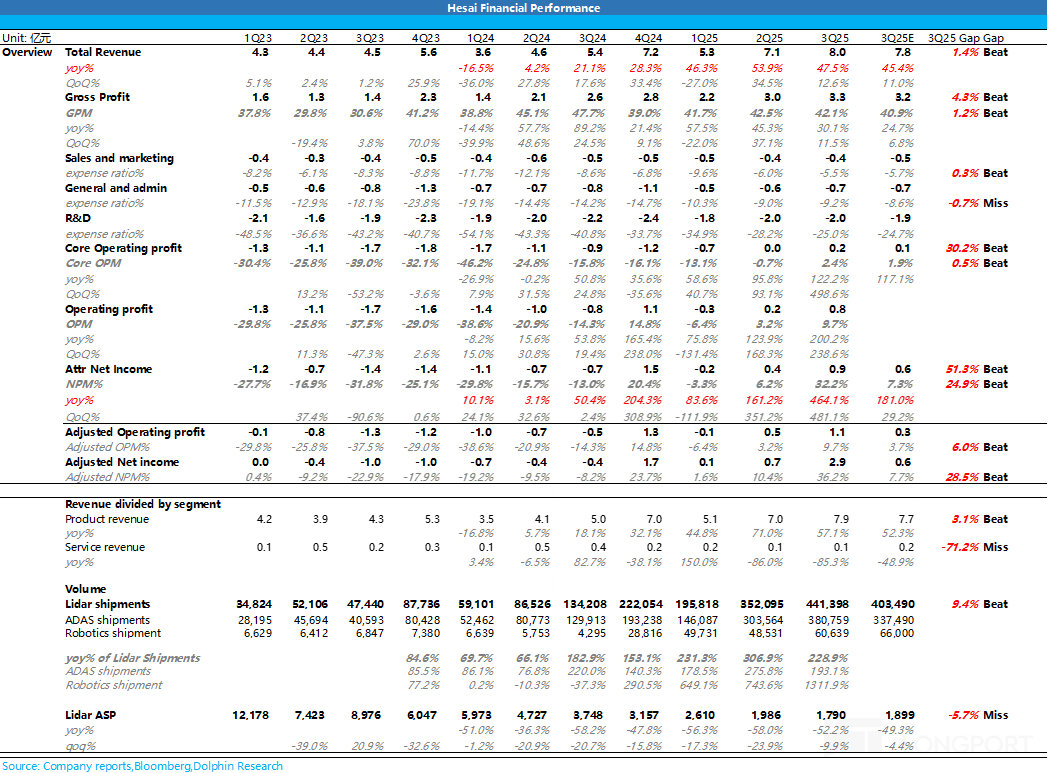

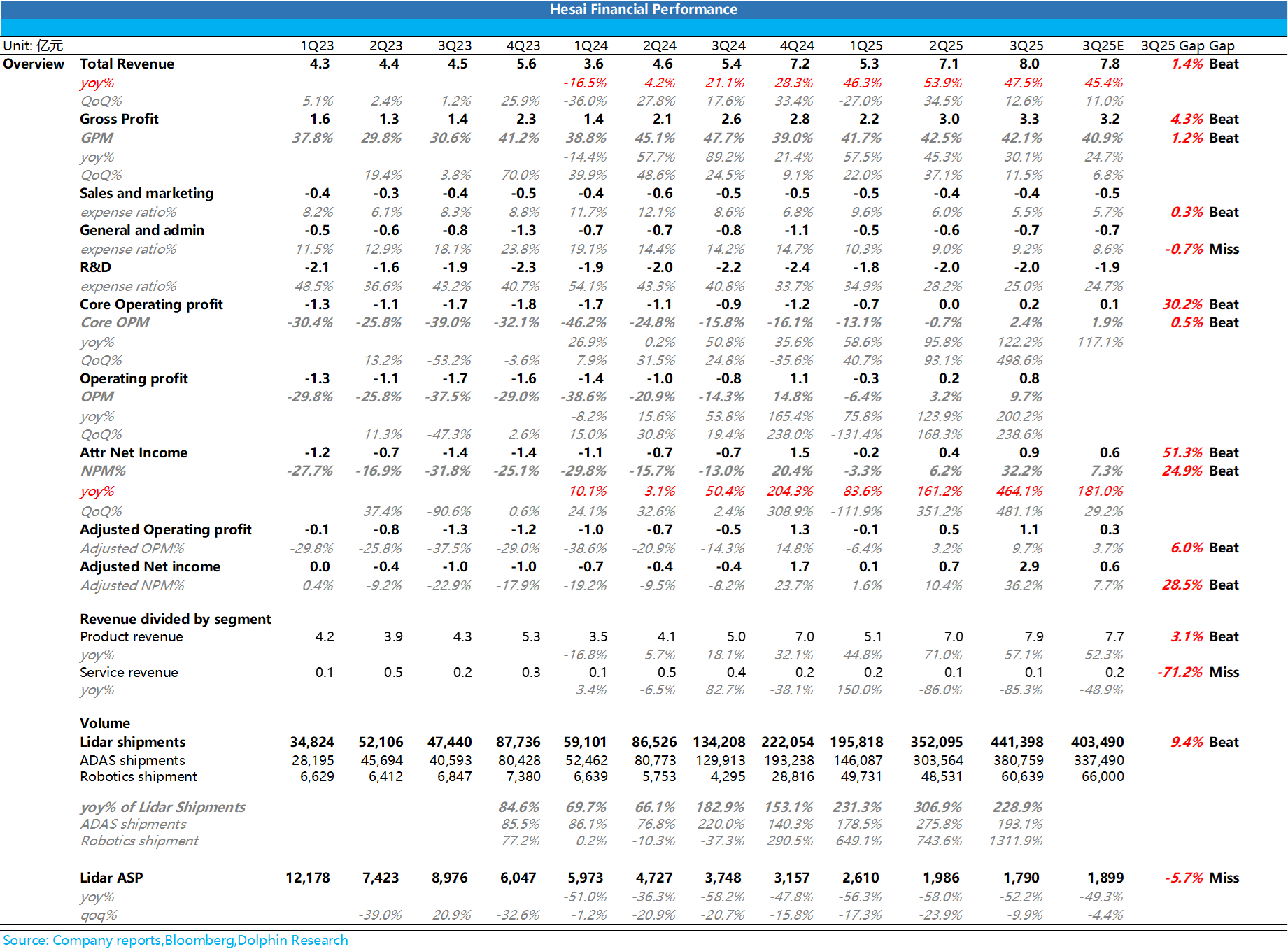

Hesai (3Q25 Minutes): Lidar shipments are expected to reach at least 2 million to 3 million units by 2026

The collaboration with BYD currently covers more than ten models, and more new models will gradually achieve mass production from 2025 to 2026.

ATX continues to increase volume in shipments!

Hesai 3Q25 Quick Interpretation: Overall, Hesai has once again delivered an impressive report card this quarter. The third-quarter performance exceeded expectations, continuing the high growth trend. ...

XPeng surged 17% in a single day; Intel AI Chief jumps ship to OpenAI | Today's Important News Recap

1111 |Dolphin Research Key Focus: 🐬 Macro/Industry 1. The U.S. Senate has passed a temporary spending bill aimed at ending the longest government shutdown in history, which has lasted for 41 days. Th......