Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

JD's 'National Good Car' auctioned at a sky-high price; Alibaba's Quark AI glasses near pre-sale|Today's Important News Recap

1023 | Dolphin Research Focus: 🐬 Macro/Industry 1. Last night, the National Press and Publication Administration announced the approval information for domestic online games in October 2025, issuing ......

Game Boosts Bilibili's Surge; Amazon AWS Services Experience Major Outage | Today's Important News Recap

1021 |Dolphin Research Key Focus: 🐬 Macro/Industry 1. U.S. President Trump and Australian Prime Minister Albanese signed a critical minerals agreement at the White House. The core of the agreement in...

The following are the Minutes of the 3Q25 earnings call of CATL organized by Dolphin Research. For the earnings interpretation, please refer to "Full Capacity Expansion! Has the King of Ning Finally M...

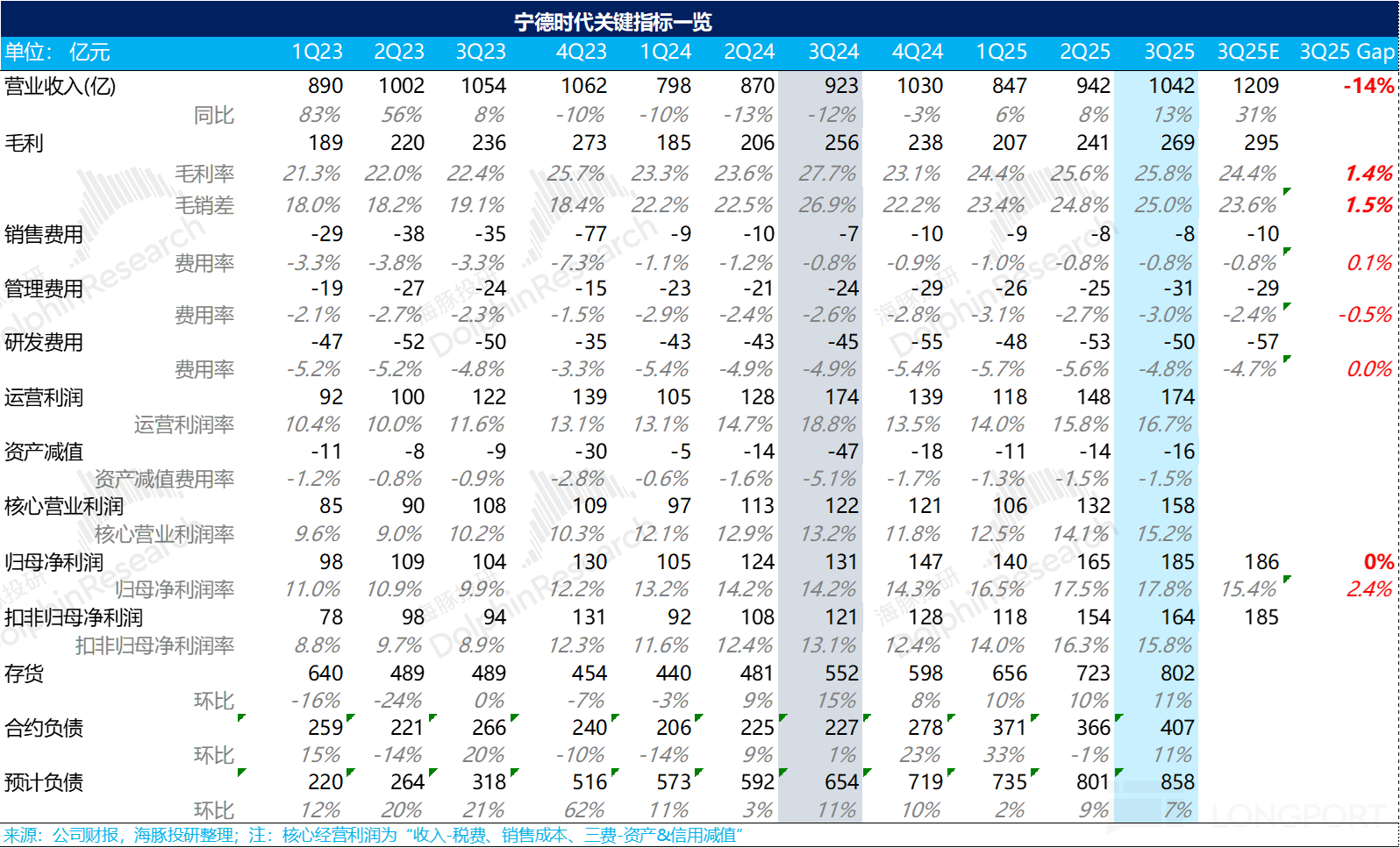

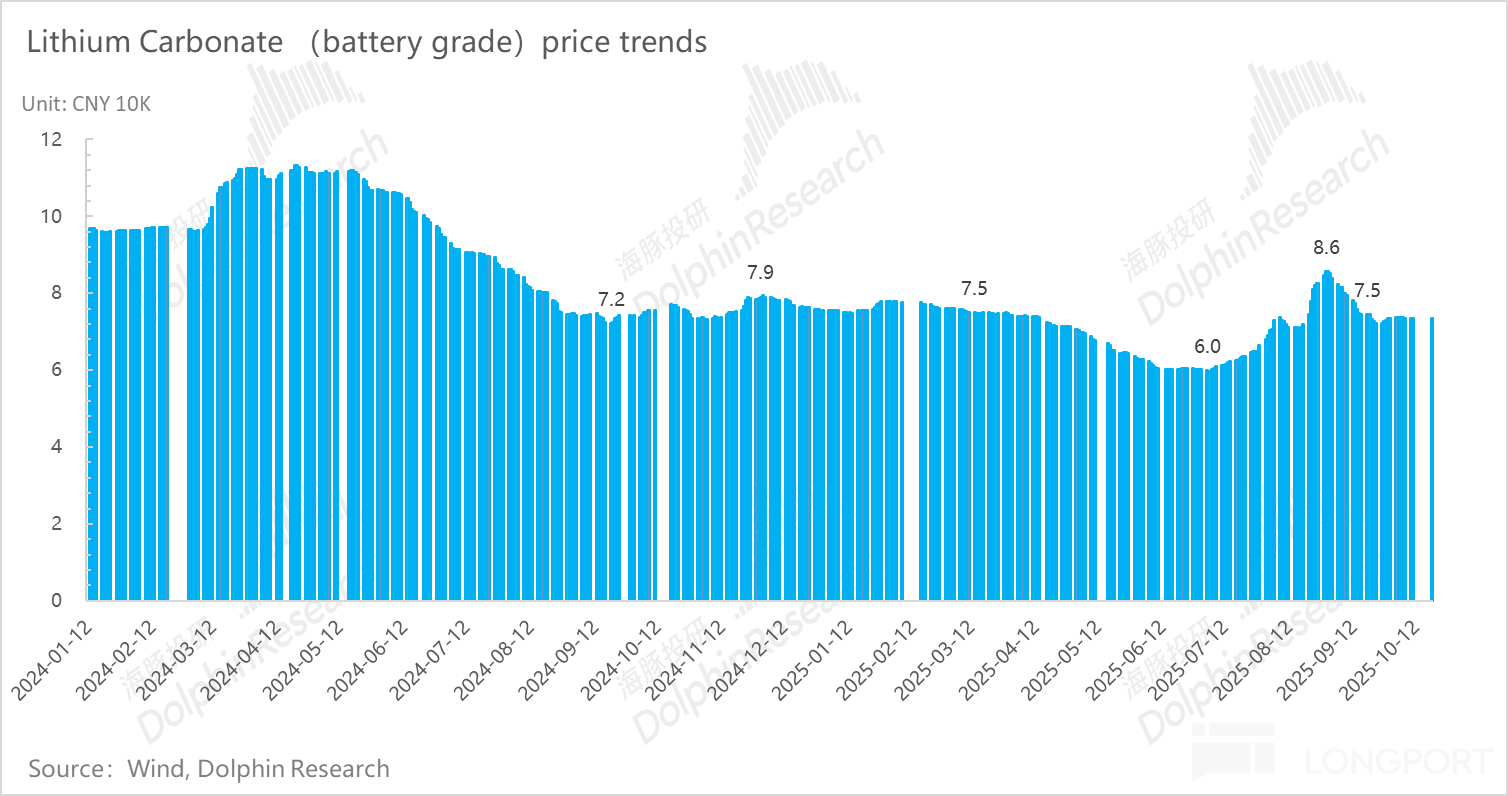

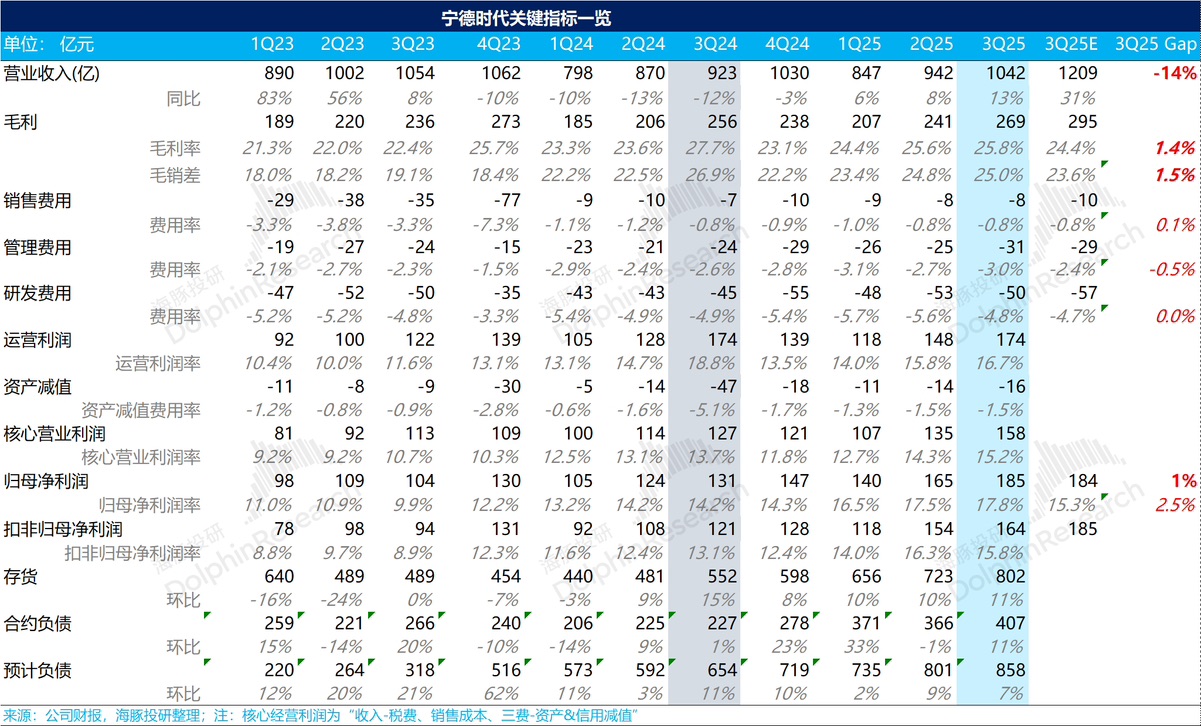

On the evening of October 20, 2025, $CATL(300750.SZ) announced its third-quarter results for 2025. Here are the key points: 1) Did the revenue side significantly miss expectations? In the third quarte......

CATL Quick Interpretation: The third quarter appears very contradictory, evidently because the company does not provide revenue guidance but does guide profit ranges. As a result, third-quarter revenu...