Company Encyclopedia

View More

Certara

CERT.US

Certara, Inc., together with its subsidiaries, provides technology-enabled services and software products for biosimulation in drug discovery, preclinical and clinical research, regulatory submissions, and market access. It offers solutions for model-informed drug development, as well as biosimulation solutions to predict pharmacokinetics and pharmacodynamics; Simcyp simulator, a mechanistic biosimulation platform for physiologically based pharmacokinetic simulation; Simcyp Discovery for scientists working on pre-investigational new drug and translational stages; Simcyp Biopharmaceutics for formulation scientists; and Simcyp Secondary Intelligence that integrates toxicology with quantitative analysis of large networks of molecular and functional biological changes. It also provides Phoenix WinNonlin, a platform for non-compartmental analysis; Phoenix Hosted, that offers a secured and validated Certara Amazon Web Services workspace; Phoenix NLME; and Pirana Modeling Workbench, which provides modelers with a structure to facilitate the iterative processes. In addition, it offers Chemaxon JChem engines; Chemaxon Compound Registration, that supports a streamlined lead optimization process workflow; Chemaxon Design Hub, a design and tracking platform for drug discovery teams and their external collaborators; Certara D360 software, a scientific informatics system for small molecule and biologics discovery research; and Chemaxon Marvin, a chemical drawing tool.

73.65 B

CERT.USMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

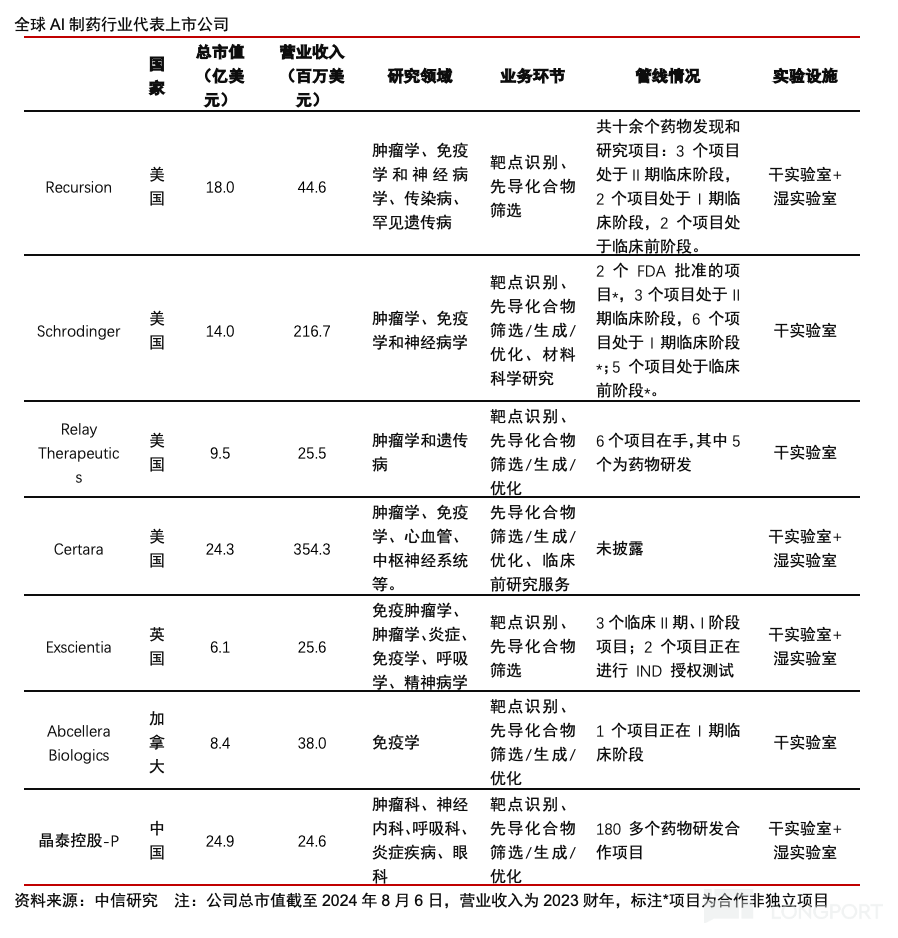

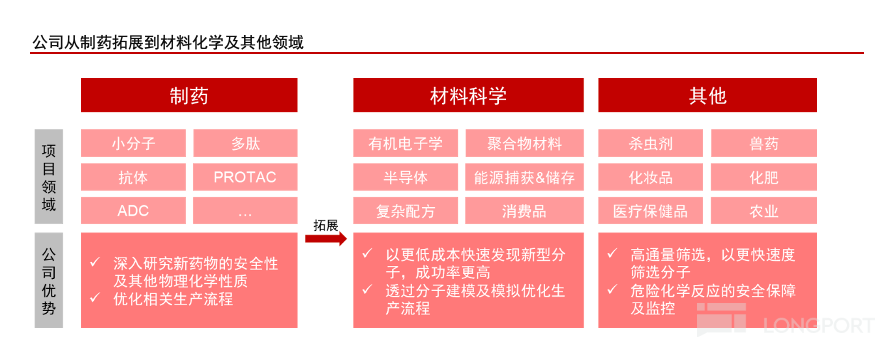

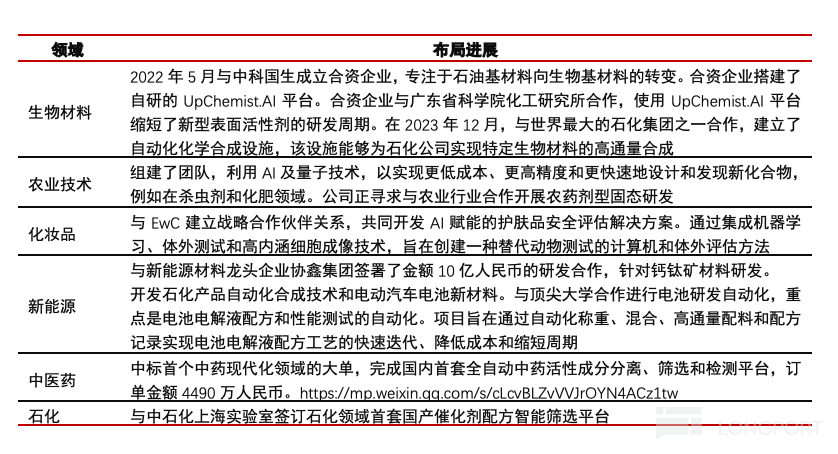

The competition among companies in the US-China gap is concentrated in the European and American markets. Several AI pharmaceutical companies have gone public globally, with representative companies i...