Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

"International Didi" Uber released its Q3 2025 financial report before the U.S. stock market opened on the evening of November 4. Overall, it showed outstanding performance on the growth side, with ac...

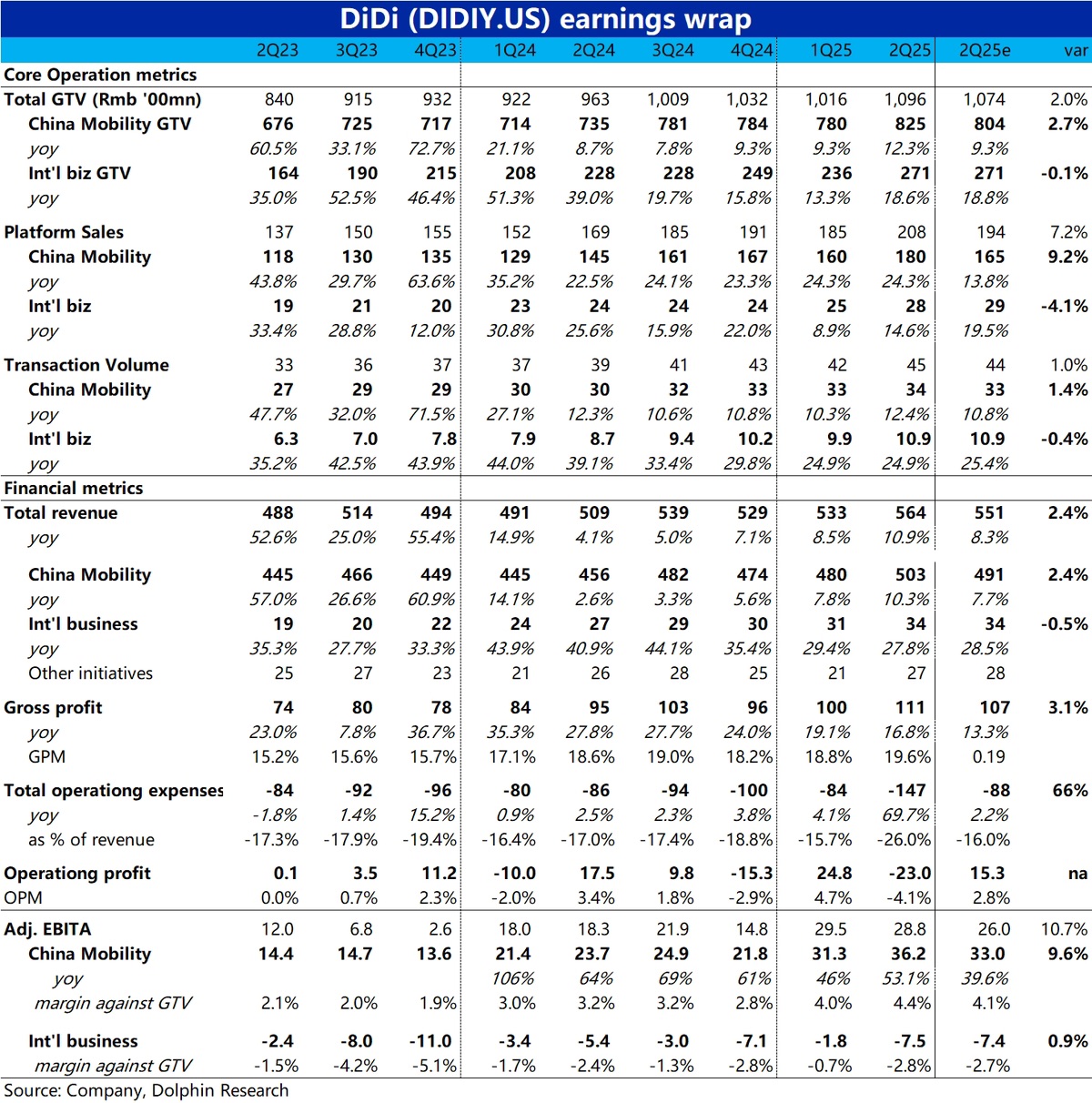

The leading ride-hailing company $DiDi(DIDIY.US) announced its second financial report for 2025 before the U.S. stock market opened on the evening of August 28. The overall performance this season was...

Didi 2Q25 Quick Interpretation: Overall, Didi delivered a decent performance this quarter. Driven by slightly better-than-expected domestic order volume and a continued rise in net monetization rate, ...

With the successful launch of Tesla's Robotaxi, which related players are worth paying attention to?

$Tesla(TSLA.US) rose more than 10% during the session. UBS believes Robotaxi will bring Tesla over $200 billion in annual revenue by 2040. Which players in the autonomous driving industry chain are wo...

China's ride-hailing leader $DiDi(DIDIY.US) released its first quarterly earnings report for 2025 on the evening of June 5. Overall, growth performance was stable and within expectations; profit perfo...