Company Encyclopedia

View More

Hyperscale Data

GPUS.US

Hyperscale Data, Inc., together with its subsidiaries, provides crane rental and lifting solutions for oilfield, construction, commercial, and infrastructure markets in North America, Europe, the Middle East, and internationally. It operates through Technology and Finance (Fintech); Sentinum; AGREE; Energy and Infrastructure (Energy); ROI; and TurnOnGreen segments. The company also offers colocation and hosting services; commercial lending, activist investing, and stock trading; and askROI, which operates an AI-driven platform engineered to provide pertinent and unique data insights through integration with business specific data that pushes beyond the conventional uses of existing large language models. In addition, it is involved in Bitcoin mining and data center operations; hotel operations and other commercial real estate holdings; commercial electronics solutions with operations; provision of electric vehicle charging solutions; and operation of a social gaming platform.

614.42 B

GPUS.USMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

how is “we can’t make the GPUs fast enough to sell them” with 74% gross margins a bubble?

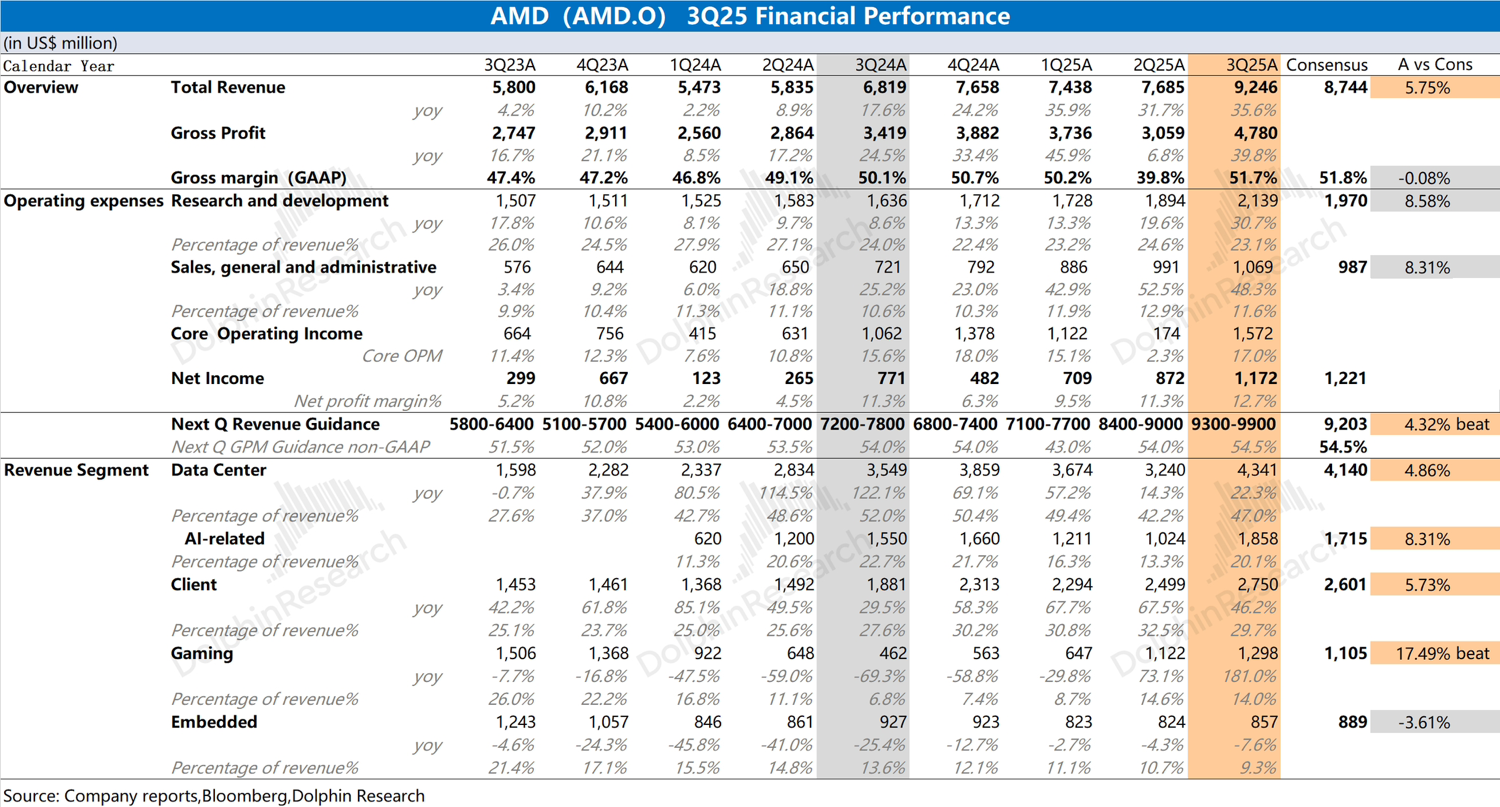

how is an increase of next quarter’s guidance by $4B against street expectations a bubble?at some point we hav.........AMD Quick Interpretation: The company's revenue and gross margin for this quarter exceeded previous guidance expectations, primarily driven by growth in the data center, client, and gaming businesses....

$Oracle(ORCL.US) $Microsoft(MSFT.US) Recently, OpenAI, Oracle, and Vantage Data Centers announced a $15 billion investment to build a large data center campus in the suburbs of Milwaukee, Wisconsin, a...