Company Encyclopedia

View More

Icon Energy

ICON.US

Icon Energy Corp., a shipping company, provides seaborne transportation services for dry bulk cargoes through its fleet of oceangoing vessels worldwide. Its fleet consists of one Panamax dry bulk vessel with a carrying capacity of approximately 77,326 deadweight tons (dwt); and one Kamsarmax dry bulk vessel with a carrying capacity of approximately 81,448 dwt. The company serves dry bulk operators, commodity traders, and end users. The company was incorporated in 2023 and is based in Athens, Greece.

59.80 B

ICON.USMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

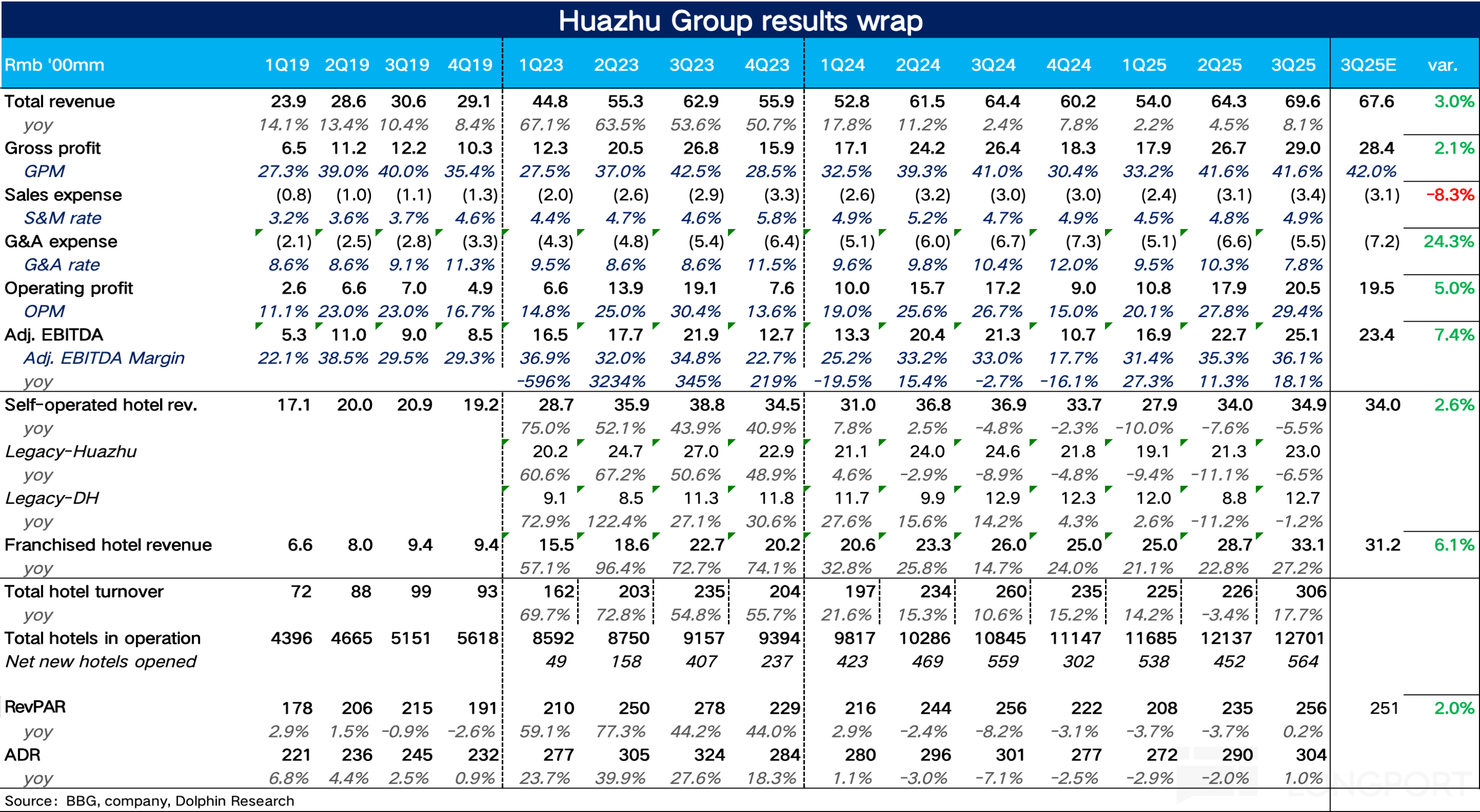

The following are the minutes of Huazhu's 3Q25FY earnings conference call organized by Dolphin Research. For a review of the financial report, please refer to 'Huazhu: Deep Squat and Jump! Huazhu is s...