$INSILICO(03696.HK) first all in this, then top up $FOREST CABIN(02657.HK)

The Hang Seng Index is approaching its highest level in nearly 3 years, with Chinese brokerage, insurance, and stablecoin concept stocks remaining hot!

On July 11, the three major stock indices in Hong Kong rose together. In terms of sectors, technology stocks rose collectively, and securities and brokerage stocks mostly increased.

【New Stock Highlights】Snow King is here! The entry fee for Mixue Ice City is over 20,000, expensive but worth it?

A cup of milk tea costs 4 yuan, but a share of the Snow King is over 200+! (There’s a little surprise at the end, make sure to read to the end!) MIXUE GROUP, which operates Mixue Ice City, will start ...

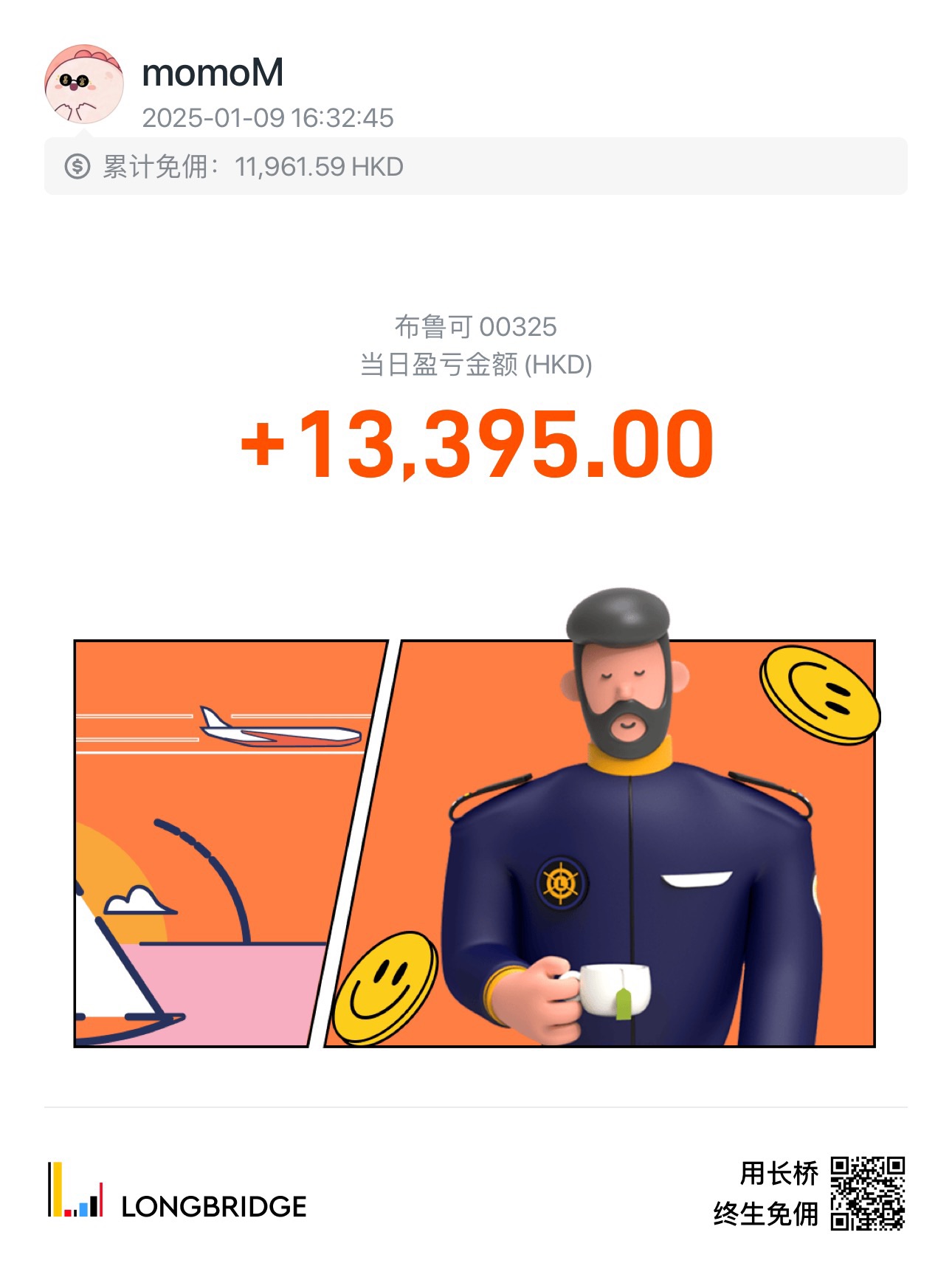

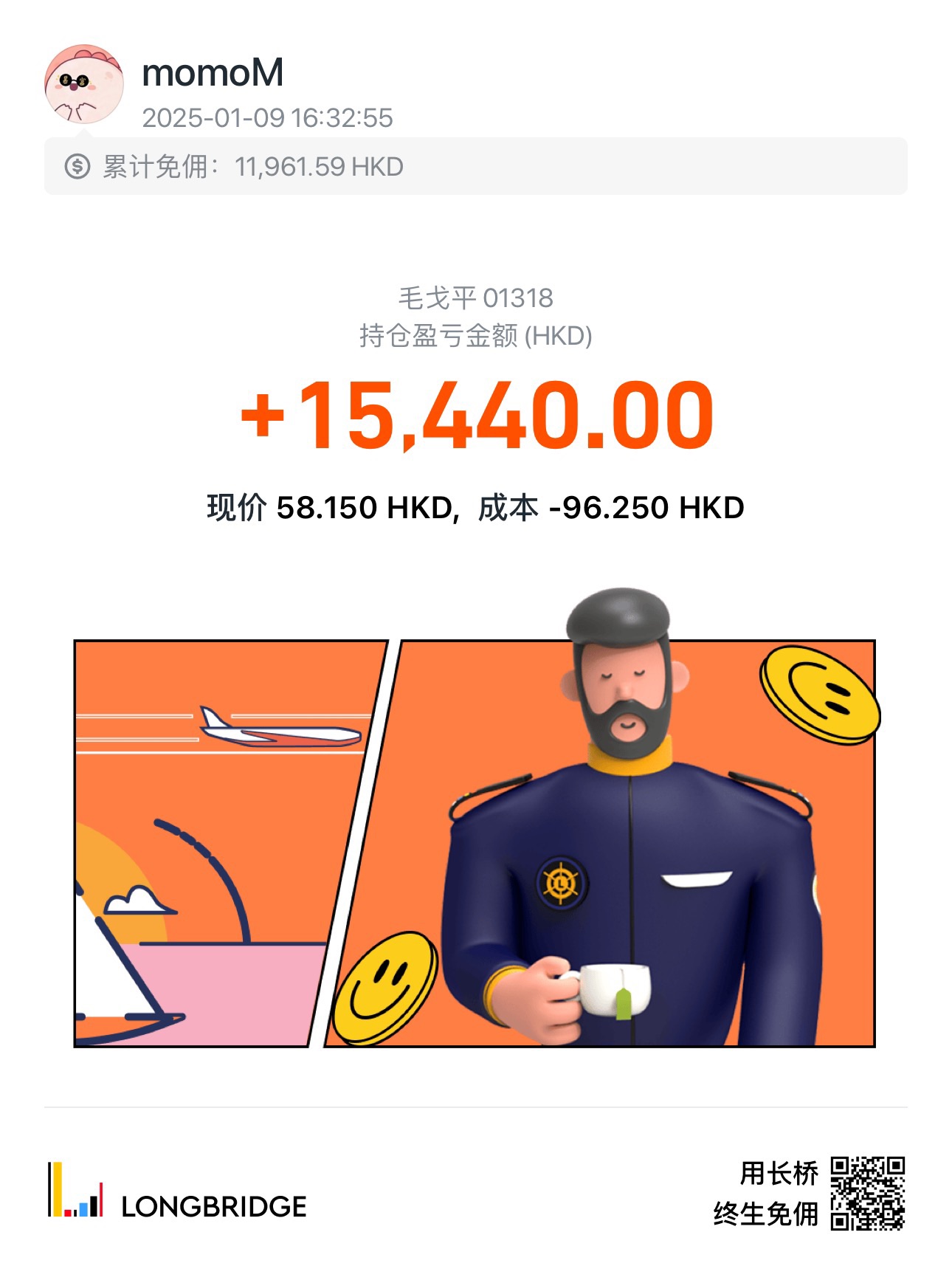

$BLOKS(00325.HK)$MAO GEPING(01318.HK) Thanks again to Longbridge, the IPO was very enjoyable 😆😆😆 There are still two certain opportunities, Mixue Ice City and KAYOU

$HERBS GROUP(02593.HK) After the rebound high in the dark pool, it feels like it's time to sell. Local stocks have a decent gain.