Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

Reddit (Minutes): There are still user penetration opportunities among specific groups in North America

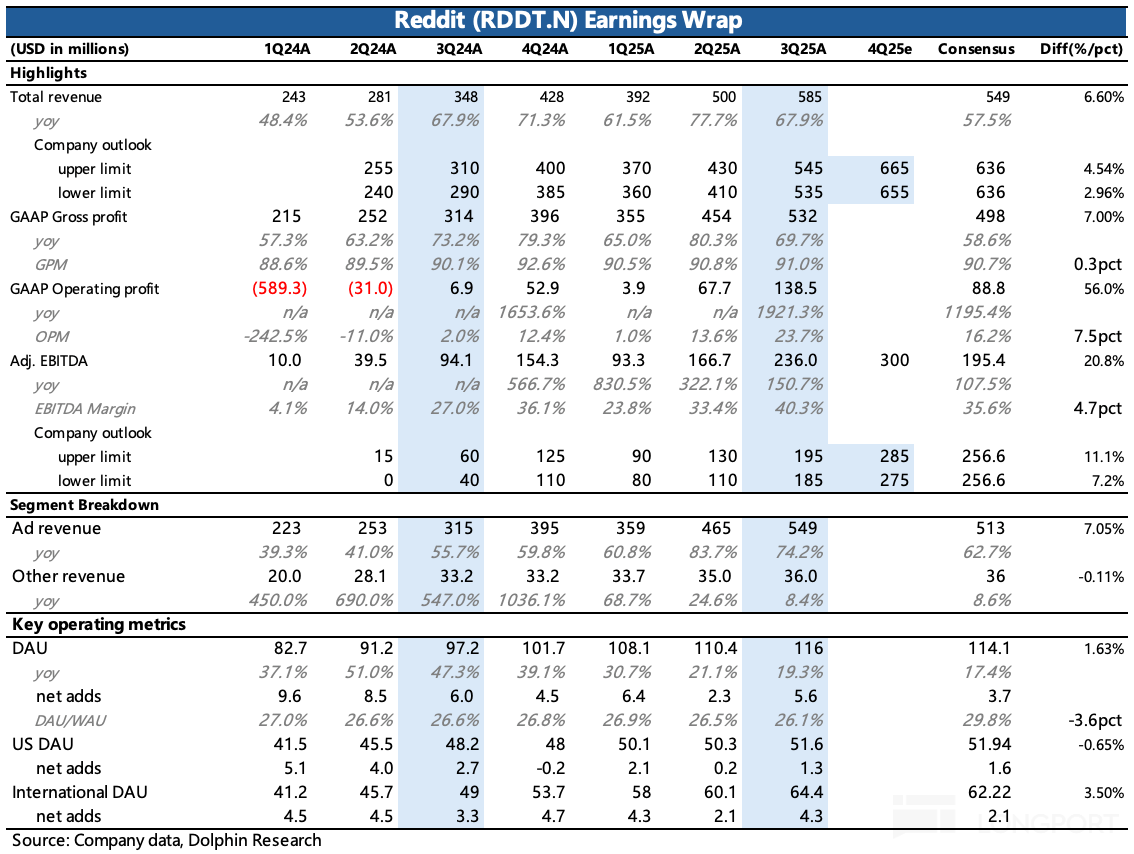

The following are the minutes of the earnings call for $Ryder(R.US)eddit(RDDT.US) FY25Q3 organized by Dolphin Research. For an interpretation of the earnings report, please refer to "Reddit: Another S...

Reddit: Another unexpected surge, how to view the correction of expectation differences before and after the earnings report?

Discussing the third-quarter report of $Reddit(RDDT.US), this time it is actually similar to the situation in the second quarter, also involving a process of expectation correction: 1. Before the earn...

The following are the minutes of the FY25Q2 earnings call for $Reddit(RDDT.US) organized by Dolphin Research. For an interpretation of the earnings report, please refer to "Hugging Google's Thighs, Re...

$Reddit(RDDT.US) surged over 15% after releasing better-than-expected earnings. Is this truly a flawless report card? What are the specific flaws? Dolphin Research will discuss briefly; 1. The point o...

U.S. stocks night session sees 'runaway new king', how to position for tonight's session?