Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

The recent volatility has been significant. Adjust the position to stocks with more concentrated certainty.$Alphabet(GOOGL.US)$Taiwan Semiconductor(TSM.US)$NVIDIA(NVDA.US)$PDD(PDD.US)

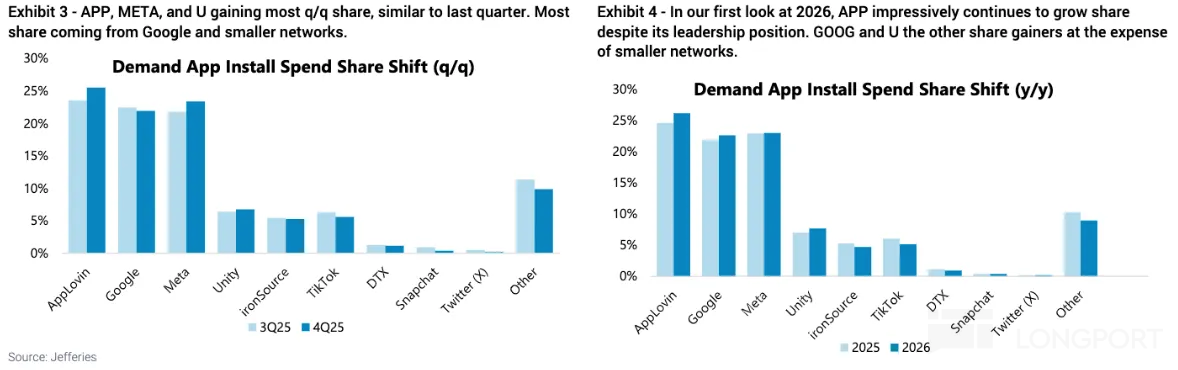

Applovin (Minutes): Currently, the week-over-week growth rate of new user spending on the self-service advertising platform has reached 50%

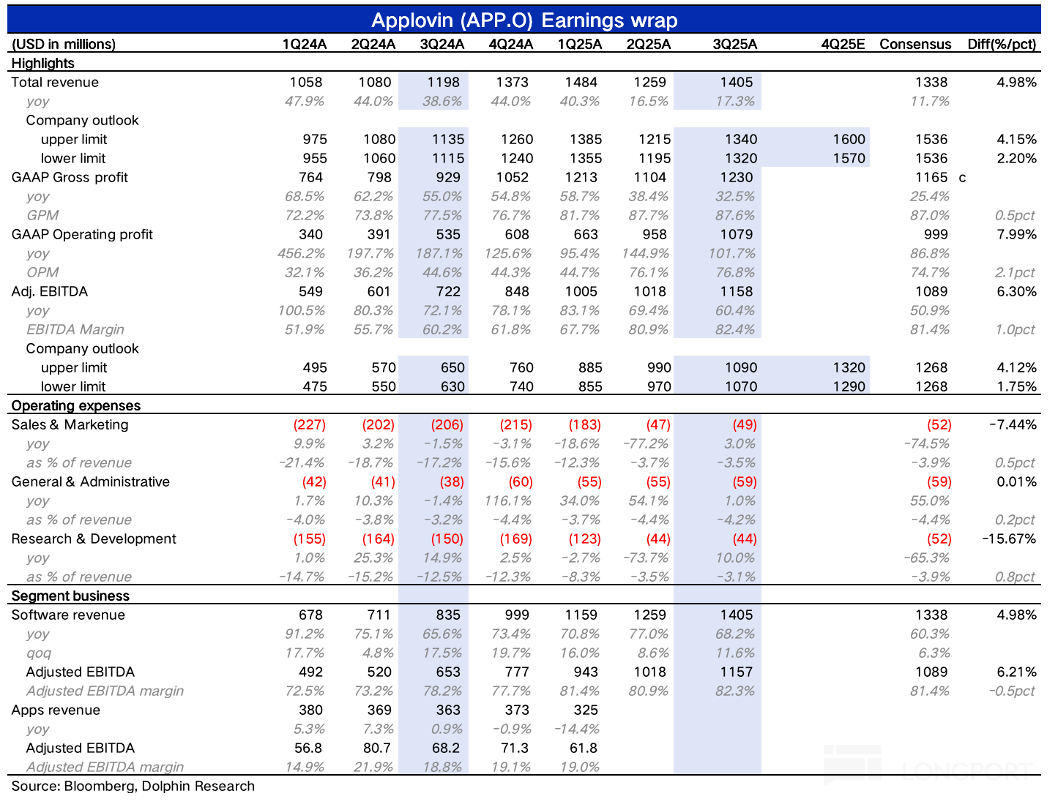

The following is a summary of the 3Q25 earnings call minutes for $AppLovin(APP.US) organized by Dolphin Research. For financial report interpretation, please refer to "Without High Growth and Violent ...

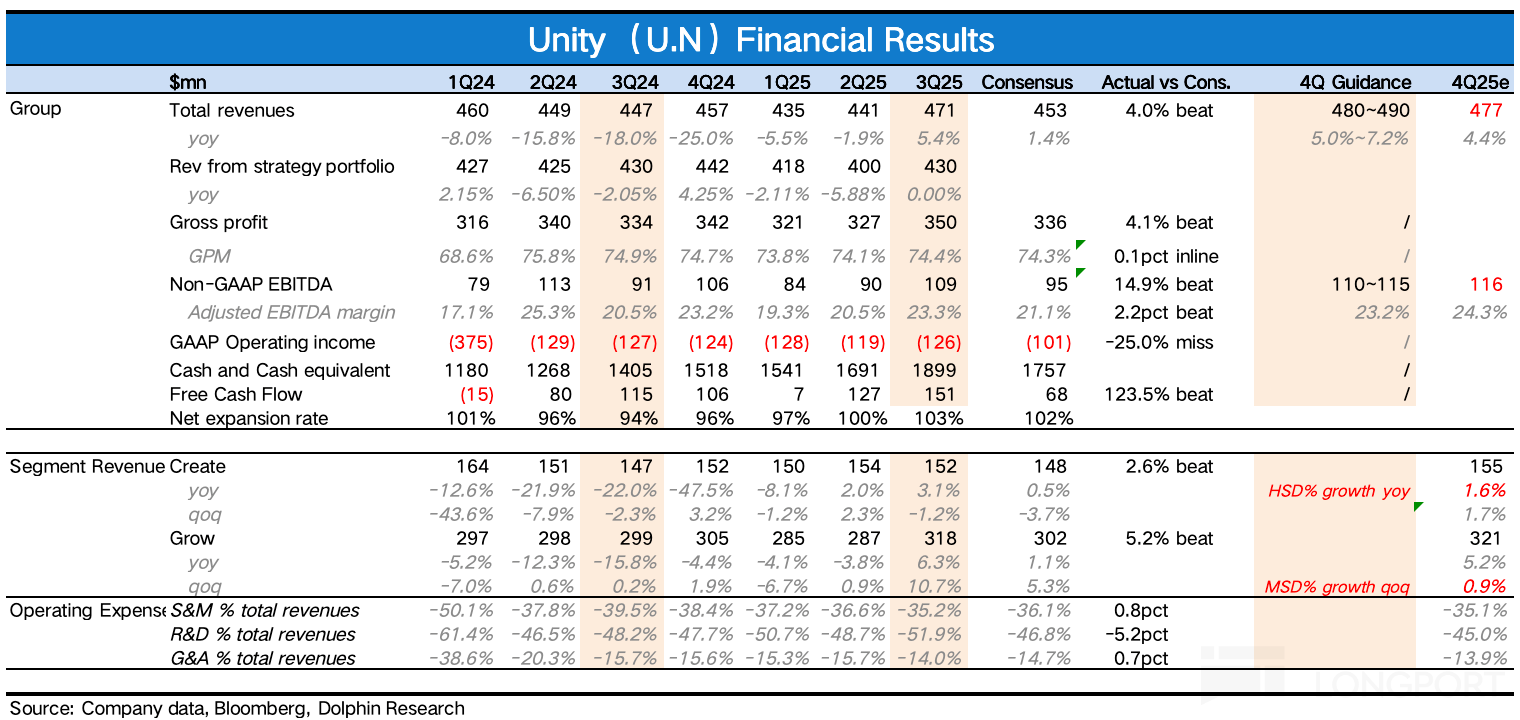

Below is a summary of the FY25Q3 earnings call for $Unity Software(U.US), compiled by Dolphin. For a detailed analysis of the financial results, please refer to ‘Unity: Patience Pays Off as Transforma...

Hello everyone, I am Dolphin Research! On November 5th, Eastern Time, before the U.S. stock market opened, the leading game engine company $Unity Software(U.US) released its Q3 2025 financial report. ...

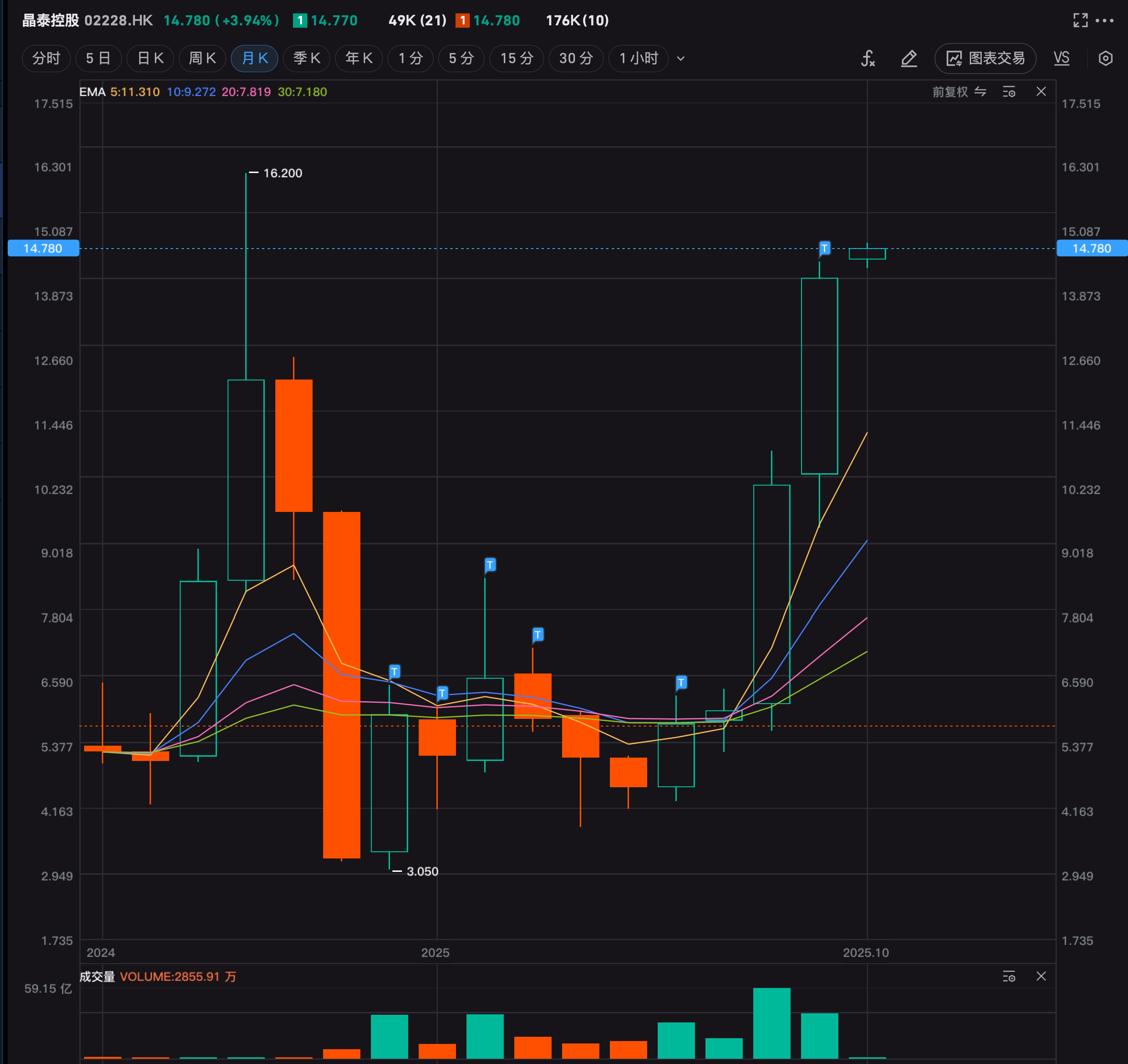

$XTALPI(02228.HK) $TENCENT(00700.HK) Tencent's monthly K-line has reached a historical high at opening. So has Jingtai.